Market Overview:

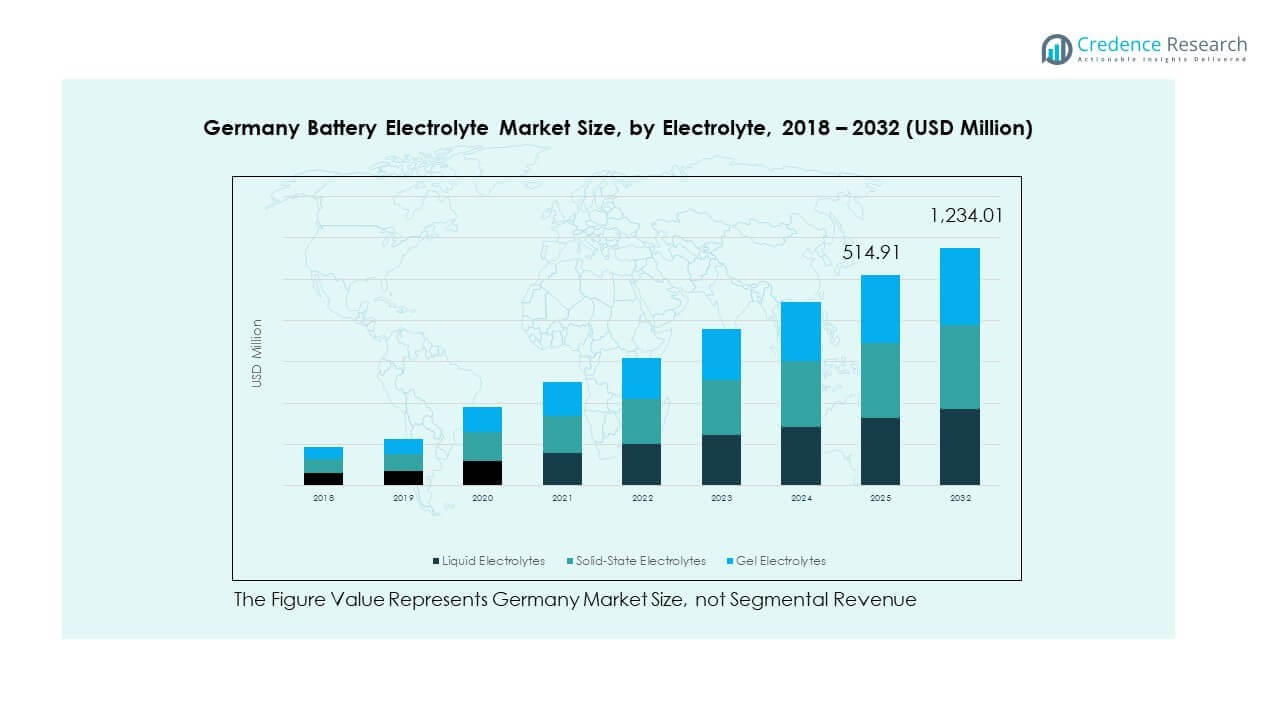

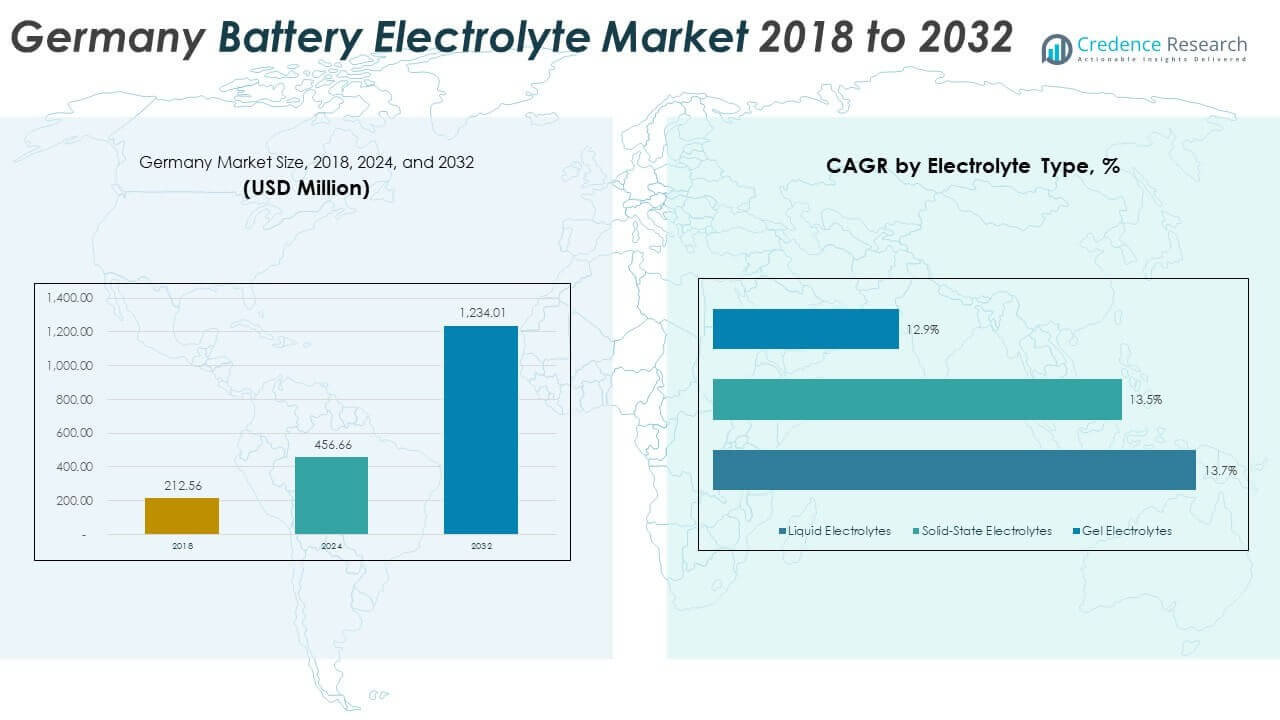

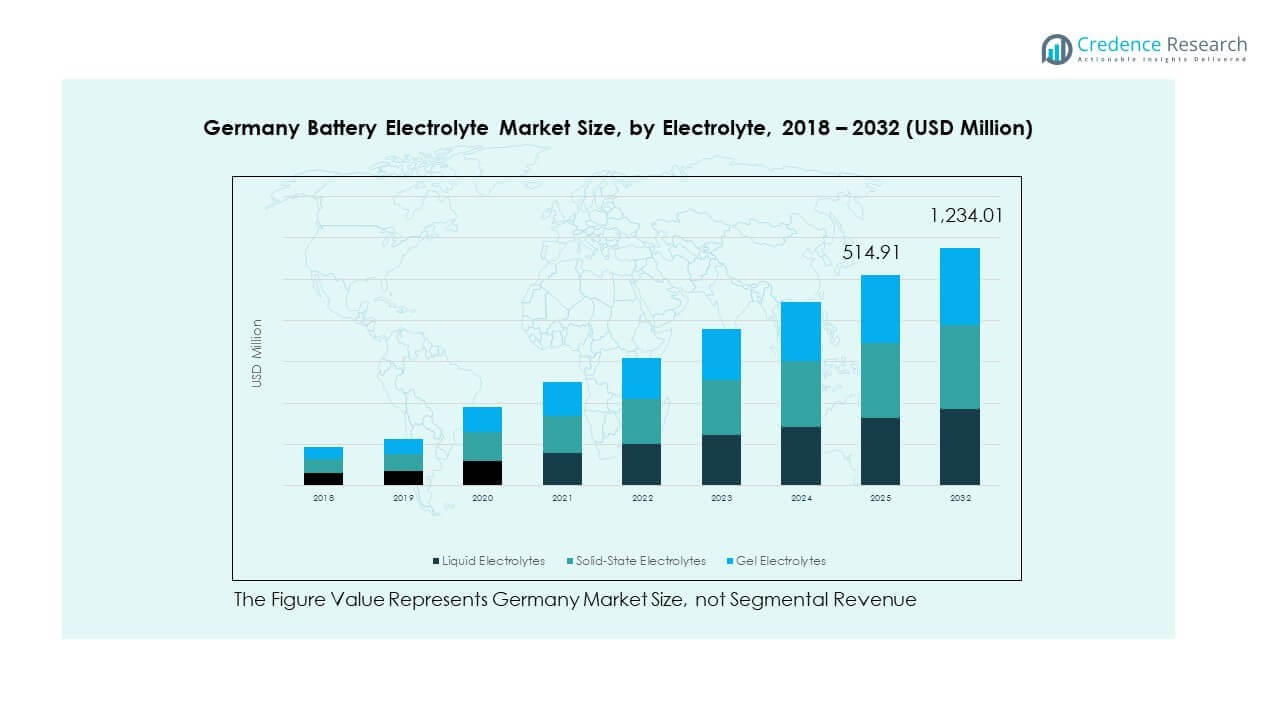

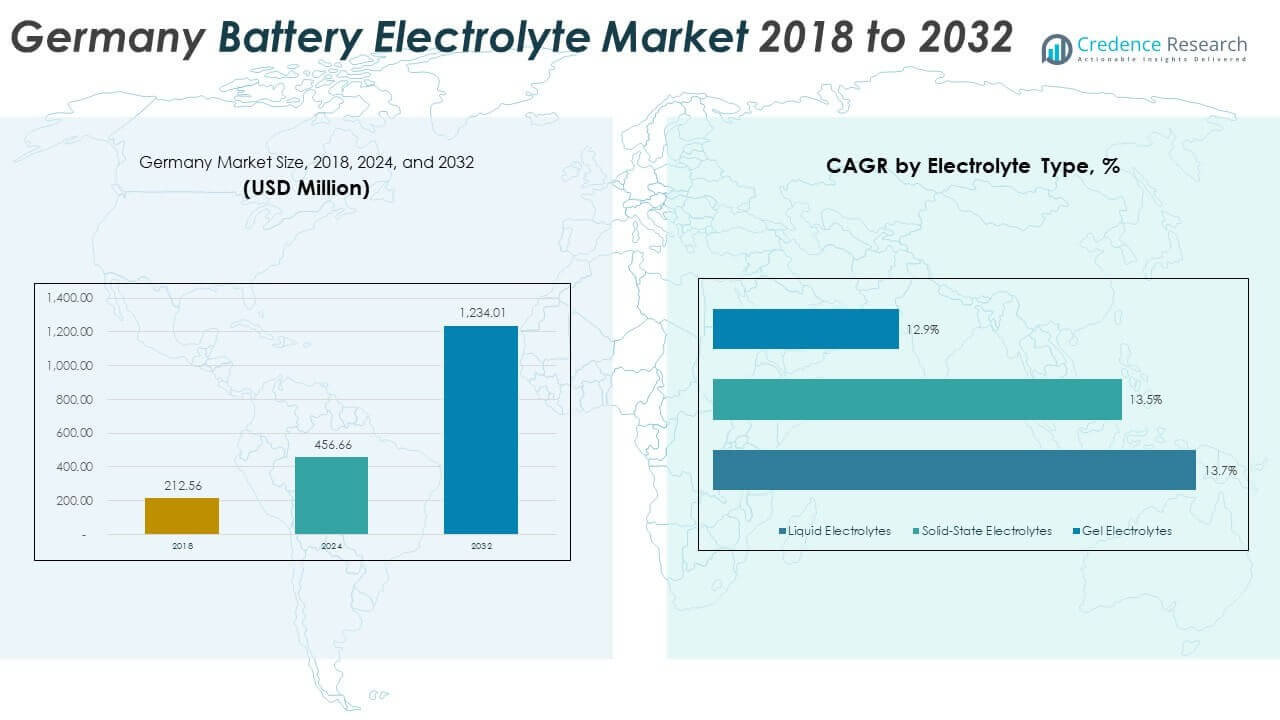

The Germany Battery Electrolyte Market size was valued at USD 212.56 million in 2018 to USD 456.66 million in 2024 and is anticipated to reach USD 1,234.01 million by 2032, at a CAGR of 13.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Battery Electrolyte Market Size 2024 |

USD 456.66 Million |

| Germany Battery Electrolyte Market, CAGR |

13.23% |

| Germany Battery Electrolyte Market Size 2032 |

USD 1,234.01 Million |

The Germany Battery Electrolyte Market is witnessing strong growth driven by the rising demand for electric vehicles, renewable energy storage, and portable electronics. Increasing government incentives for clean mobility and strict carbon emission regulations are encouraging adoption of advanced battery technologies. Continuous innovations in electrolyte formulations to improve battery efficiency, lifespan, and safety are also strengthening demand. The expansion of energy storage systems for grid stability, coupled with rapid digitalization, further accelerates the market’s growth trajectory across diverse industries.

Germany’s strong automotive industry and advanced manufacturing ecosystem make it a leading hub for electrolyte adoption. Neighboring European countries, particularly France and the Netherlands, are emerging players as they expand EV production and renewable energy storage capacities. Eastern Europe is also showing growth potential, supported by rising industrial activity and investments in clean energy infrastructure. Together, these regional dynamics position Germany as both a core market and a gateway to broader European battery advancements.

Market Insights:

- The Germany Battery Electrolyte Market was valued at USD 212.56 million in 2018, reached USD 456.66 million in 2024, and is anticipated to hit USD 1,234.01 million by 2032, growing at a CAGR of 13.23%.

- Northern Germany held 39% share in 2024, driven by automotive hubs and renewable projects. Southern Germany followed with 28%, supported by strong R&D and industrial bases, while Western Germany accounted for 21% due to its established chemical industry.

- Eastern Germany, with 12% share, is the fastest-growing region, supported by renewable energy investments and rising industrial capacity, positioning it as an emerging growth frontier.

- By electrolyte type, liquid electrolytes accounted for around 55% share in 2024, solid-state electrolytes captured nearly 30%, showing fast growth, while gel electrolytes made up the remaining 15%.

- Gel electrolytes, though smaller at 15%, are gaining traction in portable and specialized applications, broadening market adoption across niche segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Electric Vehicle Adoption Supported By Stringent Emission Regulations

The Germany Battery Electrolyte Market is fueled by rapid adoption of electric vehicles. Government policies favoring clean transportation and strict carbon emission norms push automakers toward battery-powered solutions. Consumers are also shifting preferences to EVs due to environmental awareness and rising fuel costs. Growing investments in charging infrastructure encourage EV adoption across urban and rural areas. Leading automotive manufacturers in Germany are expanding battery research and production capacity. This transition creates consistent demand for advanced electrolytes with improved performance. It establishes a sustainable growth pathway for electrolyte suppliers.

- For instance, in 2023, Germany produced approximately 955,000 battery electric vehicles and 315,000 plug-in hybrids. The total of 1.27 million battery electric and plug-in hybrid vehicles were made in Germany in 2023. This production, combined with other factors, contributed to Europe’s total estimated EV battery demand of 110 GWh in 2023. Key manufacturers like CATL were ramping up their production capacity, with their German plant targeting a capacity of 24 GWh per annum by mid-2023 to meet growing battery cell needs.

Increasing Renewable Energy Integration Across Power Grids And Industrial Systems

Expanding renewable energy projects across Germany drive large-scale energy storage deployment. Wind and solar power require efficient storage systems to stabilize electricity supply. Electrolytes play a critical role in batteries supporting renewable integration. Energy storage is becoming essential for industrial operations, commercial facilities, and residential grids. Market participants invest in tailored electrolyte chemistries to support long-duration storage. Government focus on energy transition further strengthens this demand shift. It aligns with the country’s long-term sustainability objectives. The Germany Battery Electrolyte Market benefits from consistent investment in renewable-focused storage applications.

- For example, in the first half of 2025, Germany added nearly 2 GW of new battery storage power capacity and 3.55 GWh of energy storage, with projects such as RWE’s large-scale lithium-ion battery installations in North Rhine-Westphalia contributing to grid stabilization and renewable energy balance.

Rapid Technological Advancements In Battery Chemistry And Electrolyte Formulation

Research initiatives in Germany accelerate innovation in electrolyte technologies. Manufacturers aim to improve energy density, safety, and cycle life of batteries. Solid-state electrolytes are emerging as a key focus area. Universities and private firms collaborate to strengthen material science capabilities. Funding programs support development of high-performance lithium-ion and alternative chemistries. These innovations aim to meet the requirements of EVs, portable devices, and large storage systems. It allows companies to remain competitive in a fast-evolving landscape. The Germany Battery Electrolyte Market thrives on technological leadership and continuous research efforts.

Growing Consumer Electronics Sector Driving Demand For Efficient Power Sources

Germany’s consumer electronics market continues to expand with rising digital lifestyles. Smartphones, laptops, wearables, and smart home devices depend on reliable battery technologies. Electrolyte producers benefit from this surge in portable electronics demand. Companies design lightweight, high-capacity batteries to enhance user experience. Manufacturers are scaling production to serve growing domestic and export markets. Advances in 5G and IoT applications increase energy requirements across devices. It makes battery efficiency and longevity critical factors. The Germany Battery Electrolyte Market experiences strong support from consumer electronics expansion.

Market Trends:

Market Trends:

Shift Toward Solid-State Electrolytes For Enhanced Safety And Performance

The Germany Battery Electrolyte Market is witnessing a transition toward solid-state solutions. Solid-state electrolytes offer higher energy density and reduced risks of leakage or combustion. Companies are prioritizing these materials to meet safety requirements in electric vehicles. Research centers and start-ups are actively collaborating to advance scalability and cost-efficiency. Automotive leaders in Germany are testing these electrolytes for mass adoption in EV platforms. Consumer electronics manufacturers are also evaluating solid-state designs for compact devices. It positions Germany as a leader in next-generation battery innovations. The momentum reflects long-term transformation of energy storage solutions.

- For instance, BMW is testing large-format all-solid-state battery cells from Solid Power in its BMW i7 test vehicle, which promises higher energy density and advanced safety, with ongoing prototype testing in Munich since early 2025.

Growing Investment In Recycling Technologies To Recover Battery Materials Efficiently

Recycling is emerging as a central theme in the battery industry across Germany. Electrolyte recovery and reuse reduce dependency on scarce raw materials. Policymakers encourage circular economy practices through recycling-focused regulations and incentives. Companies are developing technologies to safely extract and repurpose electrolyte materials. Large battery producers integrate recycling into their production cycles to ensure sustainability. Industrial-scale facilities for lithium-ion battery recycling are expanding capacity. It creates opportunities for reducing environmental impact and production costs. The Germany Battery Electrolyte Market integrates recycling into its long-term sustainability model.

- For instance, Rock Tech Lithium’s lithium refinery in Guben aims to produce about 24,000 tonnes of lithium hydroxide annually from recycled materials starting in 2026, supporting electrolyte raw material sustainability and reducing environmental footprint.

Expansion Of Localized Supply Chains Strengthening Energy Security And Market Stability

Germany is focusing on building secure and localized supply chains for battery components. Global supply disruptions highlighted the risk of heavy import dependence. Companies are investing in local production facilities for electrolytes and related inputs. Government support is reinforcing supply chain resilience through funding and infrastructure programs. Regional collaborations across Europe strengthen shared capabilities in material production. Firms are targeting faster delivery timelines and reduced transportation costs with localized setups. It ensures a reliable flow of critical materials for automotive and energy applications. The Germany Battery Electrolyte Market benefits from this proactive regional strategy.

Rising Demand For High-Performance Electrolytes In Aerospace And Defense Applications

Beyond automotive and consumer electronics, aerospace and defense industries are adopting advanced electrolytes. High-performance batteries are needed for drones, satellites, and defense equipment. Electrolytes supporting extreme temperatures and durability are becoming critical in these sectors. Research institutions and defense agencies partner with manufacturers to develop specialized chemistries. Germany’s focus on advanced technology adoption supports integration of these innovations. Market participants are diversifying product portfolios to target aerospace demand. It highlights the versatility of electrolytes across high-value applications. The Germany Battery Electrolyte Market finds growth opportunities in strategic defense and aerospace projects.

Market Challenges Analysis:

High Cost Of Advanced Electrolyte Materials And Manufacturing Complexity

The Germany Battery Electrolyte Market faces challenges from the high cost of advanced materials. Electrolytes with improved energy density and safety often require expensive raw inputs. Complex production processes also add to operational costs for manufacturers. Small and medium enterprises struggle to compete with large-scale producers due to these barriers. Price sensitivity in end-user markets like consumer electronics limits immediate adoption of premium formulations. Supply chain disruptions can further inflate costs, slowing consistent production cycles. It creates pressure on companies to balance affordability with innovation. Long-term cost reduction strategies remain critical for sustained market competitiveness.

Environmental Concerns And Stringent Regulations On Chemical Handling

Environmental issues pose a major challenge to electrolyte manufacturers in Germany. Electrolytes often contain hazardous chemicals that require strict handling and disposal measures. Regulators enforce compliance standards to minimize environmental risks during production and recycling. Meeting these regulations increases operational costs and slows product rollouts. Companies must invest in safer formulations without compromising performance. Public awareness about sustainability also raises scrutiny over chemical-intensive processes. It demands more innovation in eco-friendly electrolytes and greener production technologies. The Germany Battery Electrolyte Market must navigate these pressures while sustaining growth momentum.

Market Opportunities:

Expansion Of Energy Storage Solutions For Renewable Integration And Grid Stability

The Germany Battery Electrolyte Market presents strong opportunities in renewable integration. Electrolytes are essential for batteries supporting wind and solar energy storage. Expanding renewable projects require reliable storage solutions for grid stability. Industrial, commercial, and residential installations are accelerating demand for scalable battery systems. Companies that develop electrolytes tailored to long-duration storage will capture significant growth. It aligns with national policies on energy transition and carbon neutrality. This creates consistent opportunities across both domestic and export markets.

Innovation In Electrolyte Chemistries To Enable Next-Generation Battery Technologies

Electrolyte innovation opens opportunities for capturing new applications across industries. Solid-state and hybrid electrolyte technologies are under focus for safety and performance. Research partnerships with universities and global technology firms expand innovation pipelines. Applications in aerospace, defense, and high-performance electronics require advanced chemistries. Companies investing in R&D gain competitive advantages in specialized markets. It creates room for niche players alongside large-scale producers. The Germany Battery Electrolyte Market is positioned to leverage this innovation-driven opportunity.

Market Segmentation Analysis:

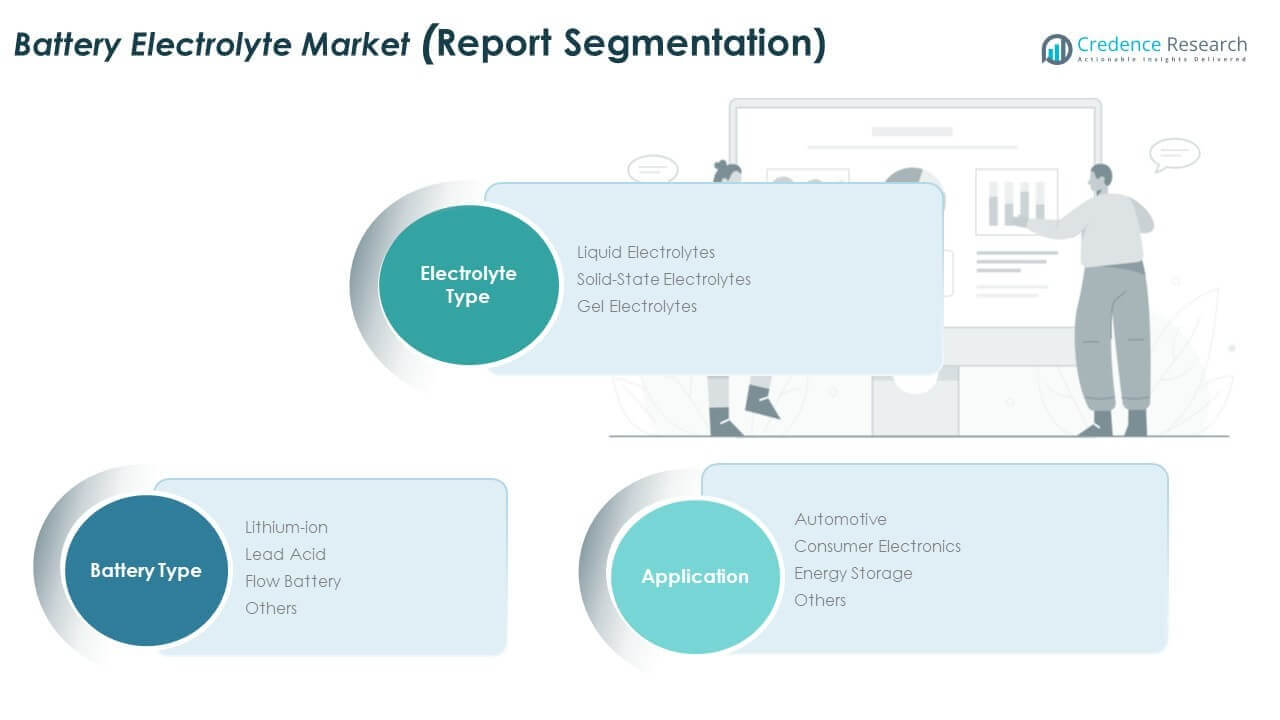

By Electrolyte Type

The Germany Battery Electrolyte Market is segmented into liquid, solid-state, and gel electrolytes. Liquid electrolytes hold a significant share due to their established use in lithium-ion and lead acid batteries. Solid-state electrolytes are gaining traction for their safety and high energy density, making them suitable for electric vehicles and advanced electronics. Gel electrolytes provide balance between stability and flexibility, creating niche adoption in portable applications. It reflects growing diversification of electrolyte formulations tailored to performance and safety needs across industries.

- For example, lithium-ion liquid electrolytes remain dominant, with approximately 2.1 GW lithium-ion battery capacity installed in Germany by mid-2025, while solid-state electrolyte development gains momentum driven by automotive stakeholders like Mercedes-Benz and VW focusing on commercial viability by 2027–2028.

By Battery Type

Lithium-ion batteries dominate demand for electrolytes, supported by wide adoption in electric vehicles and consumer electronics. Lead acid batteries maintain relevance in backup power and industrial systems. Flow batteries are emerging for renewable integration and large-scale energy storage projects. Other chemistries contribute smaller shares but indicate steady technological experimentation. It highlights a balanced market landscape with both traditional and next-generation battery chemistries shaping growth.

By Application

Automotive represents the largest application, with rising electric vehicle production in Germany driving electrolyte demand. Consumer electronics follow closely, supported by growing sales of smartphones, laptops, and connected devices. Energy storage applications are expanding rapidly as renewable projects require scalable solutions. Other applications, including aerospace and industrial equipment, add diversification. It strengthens the role of electrolytes in supporting both mainstream and specialized applications.

Segmentation:

By Electrolyte Type

- Liquid Electrolytes

- Solid-State Electrolytes

- Gel Electrolytes

By Battery Type

- Lithium-ion

- Lead Acid

- Flow Battery

- Others

By Application

- Automotive

- Consumer Electronics

- Energy Storage

- Others

Regional Analysis:

Northern Germany – Industrial and Automotive Stronghold

Northern Germany holds the largest share of the Germany Battery Electrolyte Market with nearly 39% in 2024. The region benefits from advanced automotive clusters, strong industrial bases, and leading battery research institutions. It is supported by heavy investment in electric vehicle production and related supply chains. Northern Germany also hosts several renewable energy projects, increasing demand for grid storage solutions. Electrolyte suppliers align with these needs by expanding production capacity in the region. The concentration of skilled workforce and advanced infrastructure enhances growth momentum. It positions Northern Germany as the primary hub for large-scale adoption and innovation.

Southern Germany – Technology and Research Driven Growth

Southern Germany accounts for around 28% of the Germany Battery Electrolyte Market, driven by its strong technology ecosystem. The region is home to major automotive OEMs and advanced research universities collaborating on solid-state and hybrid electrolyte technologies. Energy companies in the south are investing in large storage projects to support clean energy initiatives. Consumer electronics demand is also notable, driven by high-tech manufacturing bases. It provides suppliers with opportunities to serve both industrial and consumer-focused sectors. Strong R&D activity ensures continuous innovation in battery chemistry. Southern Germany is expected to sustain robust growth with its technology-driven approach.

Western and Eastern Germany – Emerging Markets with Expanding Potential

Western Germany contributes nearly 21% of the Germany Battery Electrolyte Market, supported by established chemical industries and export-driven manufacturing. The presence of global chemical companies provides a strong foundation for electrolyte production. Eastern Germany, with about 12% share, is emerging as a growth frontier with rising industrial activity and renewable energy projects. Regional governments encourage investments in energy transition projects, strengthening demand for storage solutions. It is gradually attracting interest from international battery producers. Both western and eastern regions complement national growth by providing balance between traditional industries and emerging energy solutions. Their evolving roles underline the geographic diversity of electrolyte adoption in Germany.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF

- Mitsubishi Chemical Group

- 3M

- Targray Industries Inc

- Evonik Industries AG

- NEI Corporation

- E-Lyte

- Solvay SA

- Ilika plc

- LiNa Energy

- Koura

Competitive Analysis:

The Germany Battery Electrolyte Market is highly competitive with the presence of global chemical giants, specialized electrolyte innovators, and emerging startups. Companies such as BASF, Evonik Industries AG, and Solvay SA lead through strong portfolios and established chemical expertise. Niche players like E-Lyte and Ilika plc are strengthening their positions with advanced formulations, particularly in solid-state electrolytes. Competition is shaped by R&D investments, partnerships with automotive OEMs, and renewable energy storage projects. It is also influenced by regional expansion strategies and efforts to secure raw material supply chains. The market reflects a blend of scale advantages from established firms and agility from specialized innovators.

Recent Developments:

- In May 2025, BASF showcased a comprehensive range of innovative technologies for electromobility, including battery materials designed to enhance the performance of electrified powertrains, at The Battery Show Europe in Stuttgart, Germany. BASF’s offerings prominently feature tailor-made cathode active materials for high-performance batteries and battery recycling solutions, reinforcing its strong position in the market.

- In June 2025, BASF commissioned a new battery recycling plant in Schwarzheide, Germany, capable of processing up to 15,000 tonnes of lithium-ion batteries annually. This plant produces black mass, a key precursor material for cathode production, supporting sustainable battery material supply in line with EU regulations.

- In September 2025, BASF delivered the first mass-produced cathode active materials for semi-solid-state batteries to Chinese battery developer Beijing WELION New Energy Technology. This collaboration marks significant progress toward industrializing solid-state batteries with enhanced energy density, cycle stability, and safety, moving rapidly from concept to mass production within one year.

Report Coverage:

The research report offers an in-depth analysis based on electrolyte type, battery type, and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising EV adoption will keep driving demand for advanced electrolytes.

- Solid-state electrolytes will gain wider adoption across automotive and electronics.

- Renewable energy integration will strengthen demand for large-scale energy storage solutions.

- Consumer electronics will continue contributing significant growth opportunities.

- Recycling technologies will emerge as a critical part of the value chain.

- Localized supply chains will improve resilience against global disruptions.

- Collaborations between OEMs and chemical companies will intensify.

- R&D investments in high-performance chemistries will expand.

- Aerospace and defense applications will create niche opportunities.

- Regulatory focus on sustainable production will shape product innovation.

Market Trends:

Market Trends: