Market Overview:

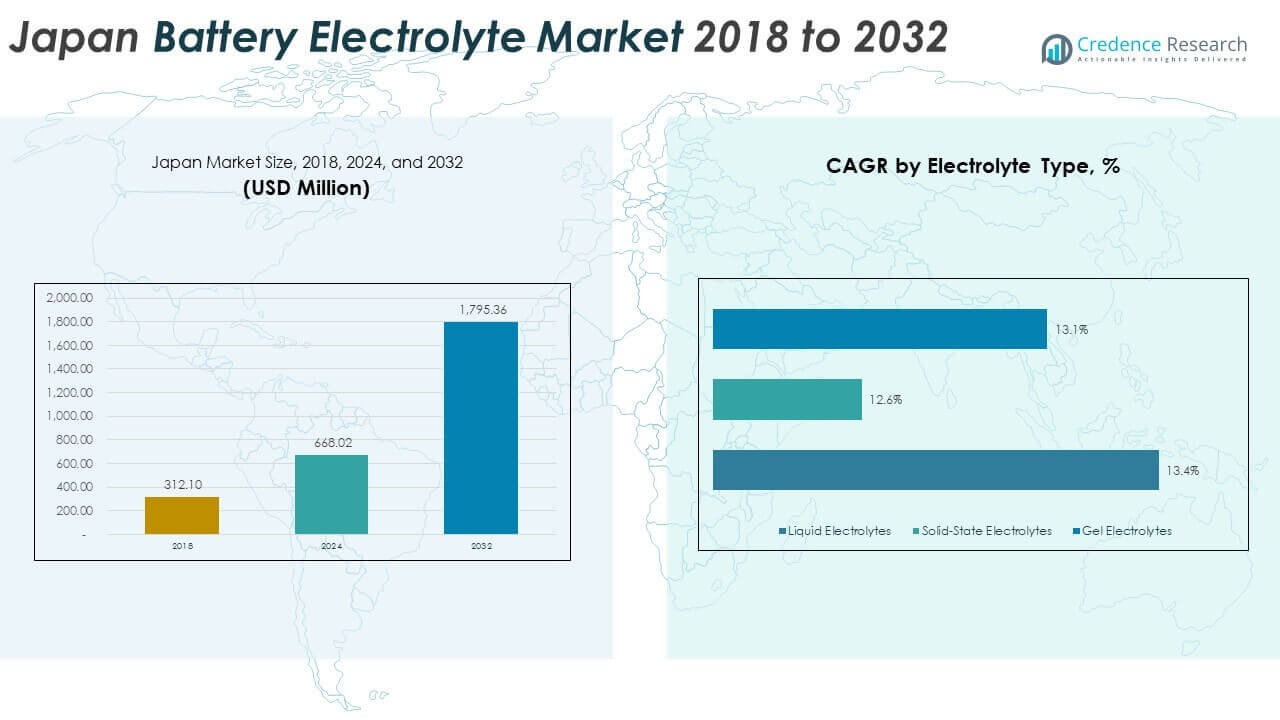

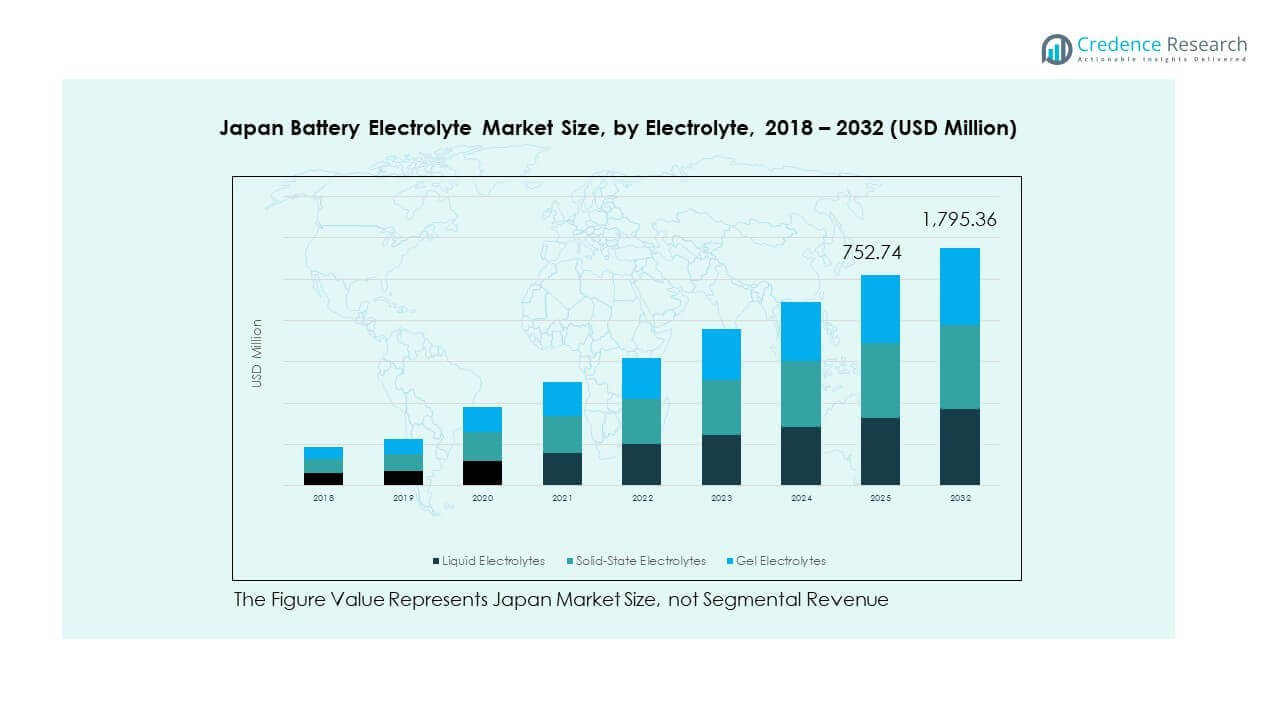

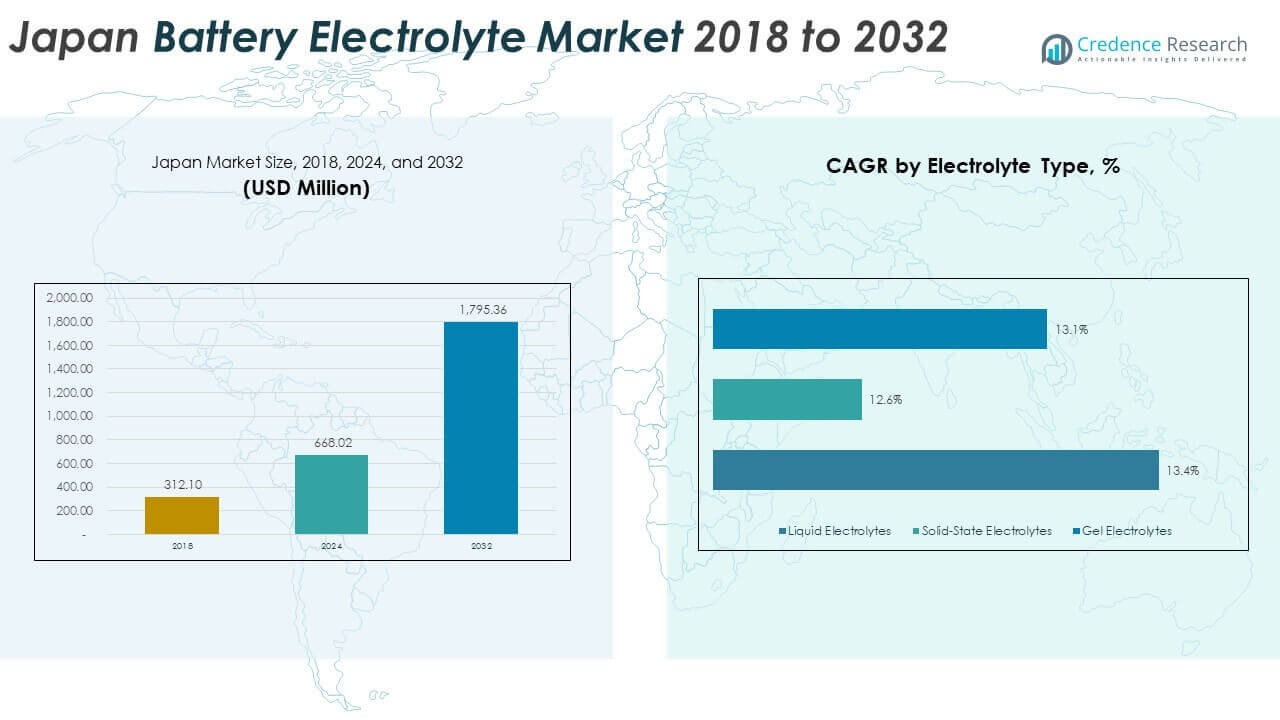

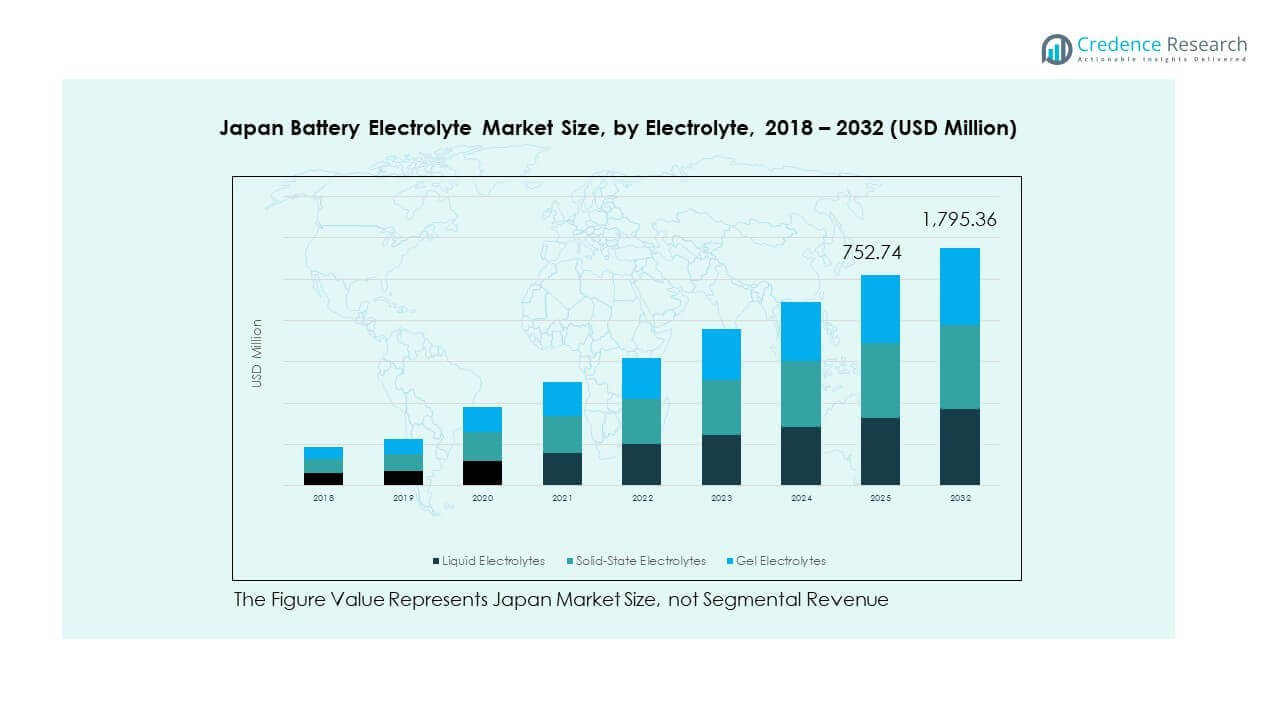

The Japan Battery Electrolyte Market size was valued at USD 312.1 million in 2018 to USD 668.02 million in 2024 and is anticipated to reach USD 1,795.36 million by 2032, at a CAGR of 13.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Battery Electrolyte Market Size 2024 |

USD 668.02 Million |

| Germany Battery Electrolyte Market, CAGR |

13.15% |

| Germany Battery Electrolyte Market Size 2032 |

USD 1,795.36 Million |

Growth in the Japan Battery Electrolyte Market is driven by rapid adoption of electric vehicles, strong government support for renewable energy, and rising demand for advanced energy storage. Expanding consumer electronics production and growing investments in lithium-ion technology also fuel the market. Companies are innovating with safer and more efficient electrolytes to improve performance, reduce charging times, and extend battery life. This focus on innovation strengthens competitiveness and ensures alignment with sustainability goals, positioning Japan as a leader in battery technology development.

Japan dominates the battery electrolyte landscape due to its advanced automotive industry, technological expertise, and strong presence of leading battery manufacturers. Neighboring countries like South Korea and China are emerging with expanding production capacities and government-backed initiatives. Southeast Asia is also witnessing rising demand as local industries adopt electrification and renewable energy. Japan maintains a leadership role through its innovation-driven ecosystem, while emerging regions create opportunities for global expansion and collaboration in the market.

Market Insights:

Market Insights:

- The Japan Battery Electrolyte Market was valued at USD 312.1 million in 2018, reached USD 668.02 million in 2024, and is anticipated to reach USD 1,795.36 million by 2032, growing at a CAGR of 13.15%.

- Eastern Japan led with 42% share in 2024, supported by strong automotive and electronics hubs; Western Japan followed with 34% share due to industrial clusters and renewable energy projects; Northern and Southern regions collectively held 24% share, backed by manufacturing and storage demand.

- Northern Japan, with part of the 24% share, is the fastest-growing region, driven by renewable energy storage expansion and investments in wind and solar power capacity.

- Liquid electrolytes contributed the largest share at over 55%, reflecting their widespread use in lithium-ion and lead-acid batteries.

- Solid-state electrolytes captured nearly 30% share and showed the strongest growth momentum, supported by R&D focus on safety and EV commercialization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Electric Vehicles and Government Support

Japan’s aggressive move toward electrification is fueling electrolyte demand at an unprecedented pace. The country’s automotive industry continues to push hybrid and electric vehicles into mainstream markets. Government incentives for EV adoption reinforce growth and motivate battery advancements. The Japan Battery Electrolyte Market benefits from strong collaboration between automakers and energy firms. It is witnessing rapid investments in charging infrastructure and large-scale production. These actions build momentum for efficient battery technology. Strong consumer adoption in domestic markets creates further pressure on supply chains. Rising exports of Japanese EVs strengthen the role of the nation in global markets.

- For instance, while Japan produced nearly 9 million motor vehicles in 2023, its sales of purely electric vehicles (EVs) were only about 140,000 units. In contrast to the statement, hybrid-electric vehicles (HEVs) remain significantly more popular in the domestic market, and Japan’s significant automotive exports are not predominantly electric.

Expansion of Renewable Energy Storage and Grid Integration

The transition to renewable energy is increasing storage requirements across Japan’s power systems. Energy companies are investing in advanced battery solutions to stabilize grids. Rising solar and wind adoption drives demand for high-performance electrolytes. The Japan Battery Electrolyte Market responds with innovations in lithium-ion and next-generation chemistries. It is positioned as a critical enabler for balancing intermittent energy sources. Strong regulatory support is shaping utility-scale storage initiatives nationwide. Grid operators rely on efficient battery electrolytes to reduce risks of instability. Long-term energy strategies emphasize resilience and sustainability. This creates consistent growth potential for the sector.

- For instance, Renova Inc secured financing in early 2025 for three battery storage projects totaling 215 MW capacity, directly supporting grid stability and renewable integration efforts.

Growing Consumer Electronics Sector and Portable Device Adoption

Japan’s global reputation for consumer electronics adds a steady growth factor to electrolyte consumption. Smartphones, laptops, and wearable devices rely on durable and safe batteries. Innovation in small-format cells drives ongoing improvements in electrolyte performance. The Japan Battery Electrolyte Market thrives from rising exports of electronic devices. It is supported by strong domestic production of advanced semiconductors. Continuous product miniaturization requires more compact and energy-dense batteries. Manufacturers invest heavily in research to extend device life and efficiency. These efforts position Japanese electronics as global leaders in battery safety.

Market Trends:

Market Trends:

Shift Toward Solid-State and Advanced Electrolyte Materials

The battery industry in Japan is moving toward solid-state and advanced electrolyte chemistries. These innovations aim to enhance safety, energy density, and cycle life. The Japan Battery Electrolyte Market is seeing rapid adoption of solid-state batteries in R&D and pilot lines. It is supported by strong partnerships between material suppliers and automakers. Solid-state designs reduce risks of flammability, a key concern in mobility applications. Global interest in Japanese innovation fuels export opportunities in advanced batteries. This trend enhances Japan’s competitive edge in the global market. Large investments are reinforcing the move toward next-generation electrolytes.

- For instance, Toyota holds over 1,000 solid-state battery patents and plans to mass-produce solid-state batteries by 2027-2028, helping Japan maintain leadership in this technology.

Integration of Automation and Smart Manufacturing in Battery Production

Automation in manufacturing is transforming the efficiency of electrolyte production processes. Robotic systems and smart technologies are reducing operational costs and enhancing consistency. The Japan Battery Electrolyte Market benefits from precision-driven output, critical for high-performance batteries. It is aligned with the country’s leadership in factory automation and robotics. Smart analytics ensure quality control across large-scale production facilities. Japanese firms are adopting digital twins and AI-driven monitoring systems. These improvements accelerate time-to-market for advanced battery technologies. Strong integration of smart manufacturing creates higher resilience against supply disruptions.

- For instance, companies like Gurīn Energy have integrated lithium-ion Battery Energy Storage Systems with AI-driven monitoring to optimize performance and reliability in Japan’s energy storage projects.

Growing Focus on Recycling and Circular Economy Practices

Recycling of electrolytes and batteries is gaining momentum as sustainability becomes a priority. Japan is building advanced recycling plants to recover valuable battery components. The Japan Battery Electrolyte Market reflects this trend with innovations in closed-loop supply chains. It is increasingly shaped by policies targeting reduced raw material imports. Circular economy models reduce dependency on international supply and strengthen domestic resilience. Research centers focus on improving electrolyte recovery and purification processes. Growing awareness among consumers and industries fuels adoption of recycled solutions. This movement creates a balanced growth path between innovation and sustainability.

Strategic Collaborations Between Automakers and Energy Firms

Automakers and energy firms are building alliances to secure supply of advanced electrolytes. Partnerships ensure stable access to critical components for EV and storage systems. The Japan Battery Electrolyte Market is supported by joint ventures across the energy ecosystem. It is enabling technology transfer and shared expertise between major industry leaders. Strategic cooperation reduces risks tied to raw material fluctuations. Firms gain opportunities to expand capacity faster with shared infrastructure. International collaborations also strengthen export competitiveness of Japanese electrolyte solutions. These partnerships act as a foundation for innovation and supply chain resilience.

Market Challenges Analysis:

High Production Costs and Raw Material Volatility Impacting Market Growth

The cost of producing advanced electrolytes remains high, limiting scalability across applications. Raw material prices for lithium salts, solvents, and additives show frequent volatility. The Japan Battery Electrolyte Market faces difficulties in maintaining consistent margins. It is challenged by global competition offering lower-cost alternatives. Price instability raises risks for automakers and storage developers relying on steady supply. Firms must balance innovation with affordability in order to capture wider adoption. Currency fluctuations and import reliance further complicate raw material procurement. These challenges create uncertainty for both investors and manufacturers.

Safety Concerns and Technological Barriers in Electrolyte Innovation

Electrolytes must meet strict safety and performance standards, creating barriers for new technologies. Solid-state and next-generation electrolytes face scalability challenges in large-scale production. The Japan Battery Electrolyte Market experiences delays in commercialization due to complex testing needs. It is constrained by the risks of thermal runaway in conventional liquid electrolytes. Regulatory approval processes extend product development timelines. Industry players are investing in research to overcome stability and compatibility issues. Consumer safety demands drive stricter performance benchmarks across all battery formats. The industry must resolve these barriers to achieve broader deployment.

Market Opportunities:

Expanding Export Potential Through Global EV and Energy Storage Adoption

Japan holds a strong reputation in advanced battery manufacturing, opening doors for export expansion. The Japan Battery Electrolyte Market gains advantage from rising EV and renewable energy adoption worldwide. It is positioned to supply high-performance electrolytes to global automakers and storage developers. Demand from Europe and North America offers long-term growth prospects. International trade agreements provide additional opportunities for expanding Japanese supply chains. Companies with innovative electrolyte technologies can secure premium positions in foreign markets. Export expansion also reinforces Japan’s strategic role in the global battery ecosystem.

R&D Investment and Next-Generation Technology Development Driving Innovation

Continuous research is unlocking opportunities for breakthrough technologies in electrolytes. The Japan Battery Electrolyte Market benefits from government-backed R&D programs. It is supported by universities and industrial collaborations pushing solid-state and hybrid designs. Funding for pilot plants accelerates the path from lab to large-scale production. Global firms are investing in joint research with Japanese companies. These activities strengthen leadership in next-generation battery solutions. Growth in R&D-driven innovation ensures Japan maintains its technological edge. The market is well-positioned to capture opportunities in emerging sectors like aerospace and robotics.

Market Segmentation Analysis:

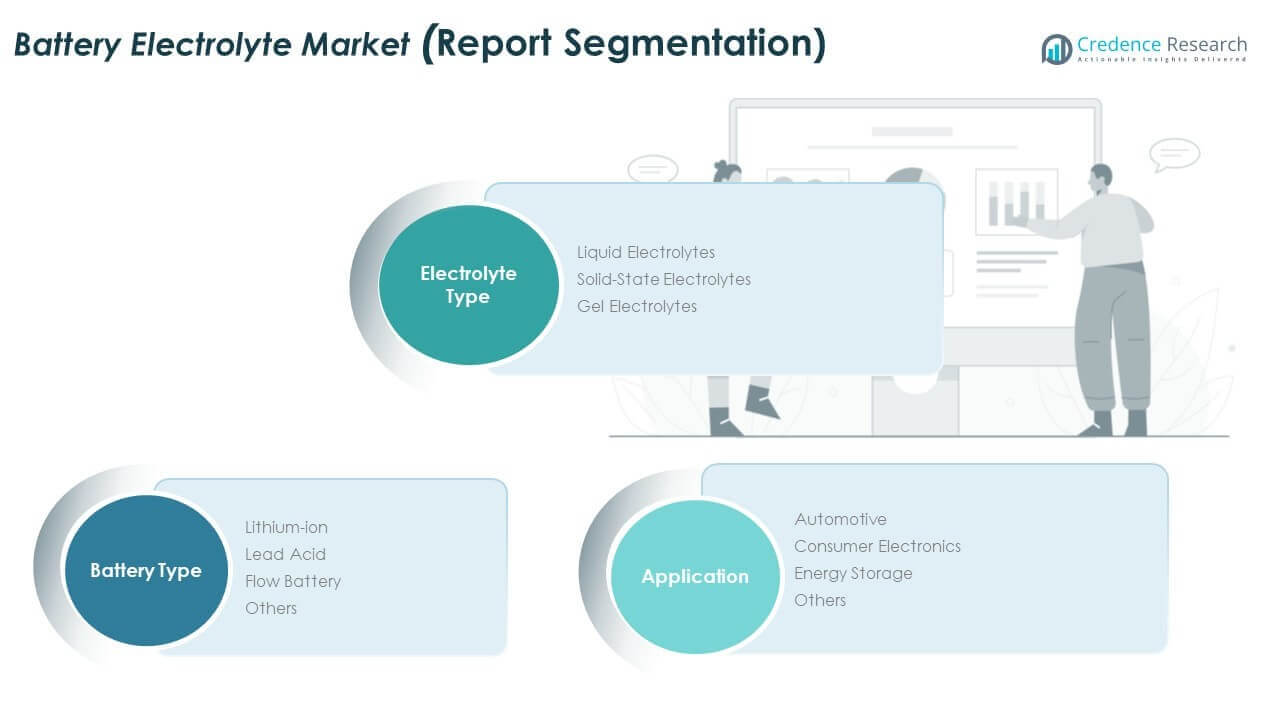

By Electrolyte Type

Liquid electrolytes dominate the Japan Battery Electrolyte Market due to their established use in lithium-ion and lead-acid batteries. They offer high conductivity and are widely adopted in automotive and electronics. Solid-state electrolytes are gaining momentum with improved safety and higher energy density, attracting investments in EVs and next-generation storage. Gel electrolytes hold niche demand where flexibility and leak resistance are critical, creating opportunities in specialized devices. It reflects strong innovation across all electrolyte types, balancing performance and safety needs.

- For instance, while liquid electrolytes remain prevalent in most lithium-ion batteries used in Toyota’s electric models for now, Japan has lagged behind other developed economies in widespread EV adoption. Japan’s slower EV transition is primarily due to its automakers’ long-standing focus on hybrid technology, consumer preferences for hybrids, and a less developed charging infrastructure, rather than being driven by Toyota’s battery choices. In fact, the shift towards full EVs is relatively recent in Japan.

By Battery Type

Lithium-ion batteries remain the largest segment, driven by Japan’s leadership in EV production and electronics. They deliver superior efficiency and energy density, aligning with market demand for high-performance systems. Lead-acid batteries maintain steady adoption in industrial and backup applications due to cost advantages. Flow batteries are emerging as long-duration storage solutions, supporting renewable integration. Other formats find limited but growing use in specialized industries. The Japan Battery Electrolyte Market adapts across these types to meet diverse energy needs.

By Application

Automotive leads the application landscape, supported by Japan’s advanced EV ecosystem and government policies. Consumer electronics form the second-largest segment, reflecting strong domestic and export-driven demand. Energy storage is expanding quickly, supported by renewable energy projects and grid modernization. Other applications, including robotics and niche devices, add incremental growth potential. It highlights how the market benefits from a balanced mix of established and emerging applications.

Segmentation:

Segmentation:

By Electrolyte Type

- Liquid Electrolytes

- Solid-State Electrolytes

- Gel Electrolytes

By Battery Type

- Lithium-ion

- Lead Acid

- Flow Battery

- Others

By Application

- Automotive

- Consumer Electronics

- Energy Storage

- Others

Regional Analysis:

Dominance of Eastern Japan

Eastern Japan holds the largest share of the Japan Battery Electrolyte Market, accounting for nearly 42% in 2024. The region benefits from the strong concentration of automotive manufacturers, advanced electronics companies, and leading research institutions. Tokyo and Kanagawa act as industrial hubs, driving demand for high-performance electrolytes. It remains a center for innovation with multiple R&D facilities supporting solid-state battery development. The presence of global and domestic leaders ensures consistent investment inflows. Strong infrastructure and government-backed policies further strengthen Eastern Japan’s position in this market.

Growth Momentum in Western Japan

Western Japan represents around 34% of the market share, supported by its industrial base in Osaka, Kyoto, and Hiroshima. The area focuses heavily on renewable energy projects and energy storage solutions, which boosts electrolyte demand. It benefits from proximity to manufacturing clusters that produce both consumer electronics and automotive parts. The Japan Battery Electrolyte Market in this region is expanding with collaborations between local universities and corporations. It also serves as a gateway for exports to neighboring Asian countries due to its port infrastructure. Continuous development of next-generation battery technologies reinforces its growth momentum.

Emerging Opportunities in Northern and Southern Japan

Northern and Southern Japan collectively account for nearly 24% of the market share, with steady growth projections. Northern Japan is investing in renewable energy storage due to its favorable wind and solar conditions. It also supports industrial applications through local mining and chemical facilities. Southern Japan contributes through its shipbuilding, aerospace, and industrial manufacturing sectors that require advanced energy systems. The Japan Battery Electrolyte Market sees these regions as emerging opportunities with untapped potential. It is gaining traction here through regional incentives and increased demand for localized energy solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Neogen Chemical

- Mitsubishi Chemical Group

- 3M

- Asahi Kasei

- UBE Corporation

- NEI Corporation

- Central Glass Co., Ltd.

- Solvay SA

- Tokyo Chemical Industry Co. Ltd.

- TOMIYAMA PURE CHEMICAL INDUSTRIES, LTD

- Sumitomo Corporation

Competitive Analysis:

The Japan Battery Electrolyte Market is highly competitive with a mix of global leaders and domestic innovators. Established companies such as Mitsubishi Chemical Group, Asahi Kasei, UBE Corporation, and Central Glass Co., Ltd. dominate due to their extensive portfolios and R&D investments. It is also shaped by international firms like 3M and Solvay SA that provide specialized electrolyte solutions. Smaller players, including Tokyo Chemical Industry Co. Ltd. and TOMIYAMA PURE CHEMICAL INDUSTRIES, strengthen competition with niche offerings. The market shows strong emphasis on product innovation, cost optimization, and safety advancements. Strategic partnerships, mergers, and capacity expansions remain common approaches to gain market share.

Recent Developments:

- In August 2025, Neogen Chemical’s wholly-owned subsidiary, Neogen Ionics Limited, entered into a joint venture agreement with Japan’s Morita Investment Limited, a subsidiary of Morita Chemicals Industries Co. Ltd. This partnership, forming Neogen Morita New Materials Limited, will focus on the production, development, and sale of solid LiPF6 salt, a critical electrolyte component for lithium-ion batteries.

- Mitsubishi Chemical Group Corporation remains a key player in the Japan battery electrolyte market, actively scaling production capacities and enhancing R&D efforts in next-generation electrolyte technologies. Their ongoing focus is on high-performance, safe, and environmentally friendly electrolyte materials to meet rising demand driven by the electric vehicle (EV) and energy storage sectors.

- Asahi Kasei is recognized for its contributions to battery materials, including electrolyte components, and maintains ongoing innovation and supply relationships in the lithium-ion battery sector, supporting the dynamic growth in Japan’s market.

- UBE Corporation has a strategic footprint in electrolyte materials, engaging in production and development activities aligned with the expanding battery electrolyte demand globally, including Japan.

Report Coverage:

The research report offers an in-depth analysis based on electrolyte type, battery type, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising EV adoption will expand demand for advanced electrolytes in domestic and export markets.

- Solid-state electrolyte innovation will accelerate commercialization across automotive and storage applications.

- Government initiatives will drive higher investment in clean energy battery technologies.

- Consumer electronics will sustain electrolyte demand through portable and miniaturized devices.

- Recycling and circular economy models will reshape electrolyte supply chains.

- Strategic collaborations between chemical companies and automakers will intensify.

- Western Japan will strengthen its role through renewable energy projects and industrial clusters.

- Flow battery electrolytes will gain traction in long-duration grid storage.

- Safety-focused designs will remain a key differentiator in product innovation.

- Japan’s strong R&D ecosystem will keep it competitive in next-generation battery markets.

Market Insights:

Market Insights: Market Trends:

Market Trends: Segmentation:

Segmentation: