Market Overview:

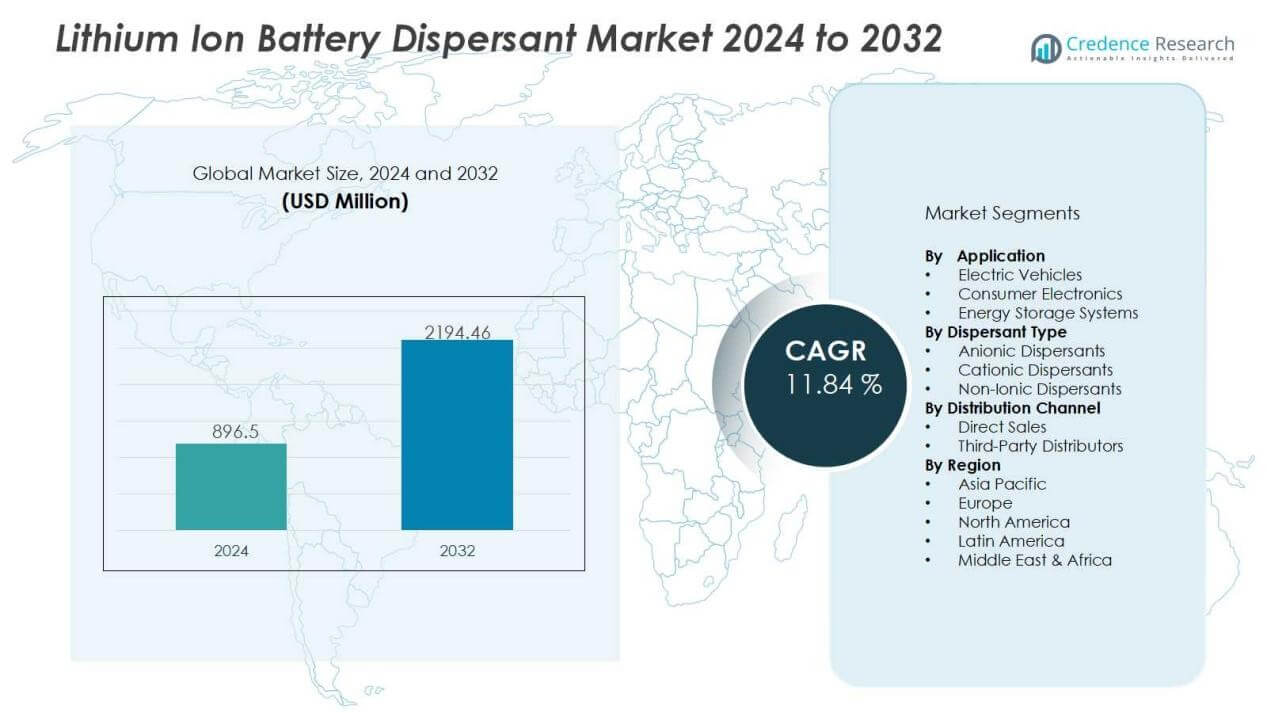

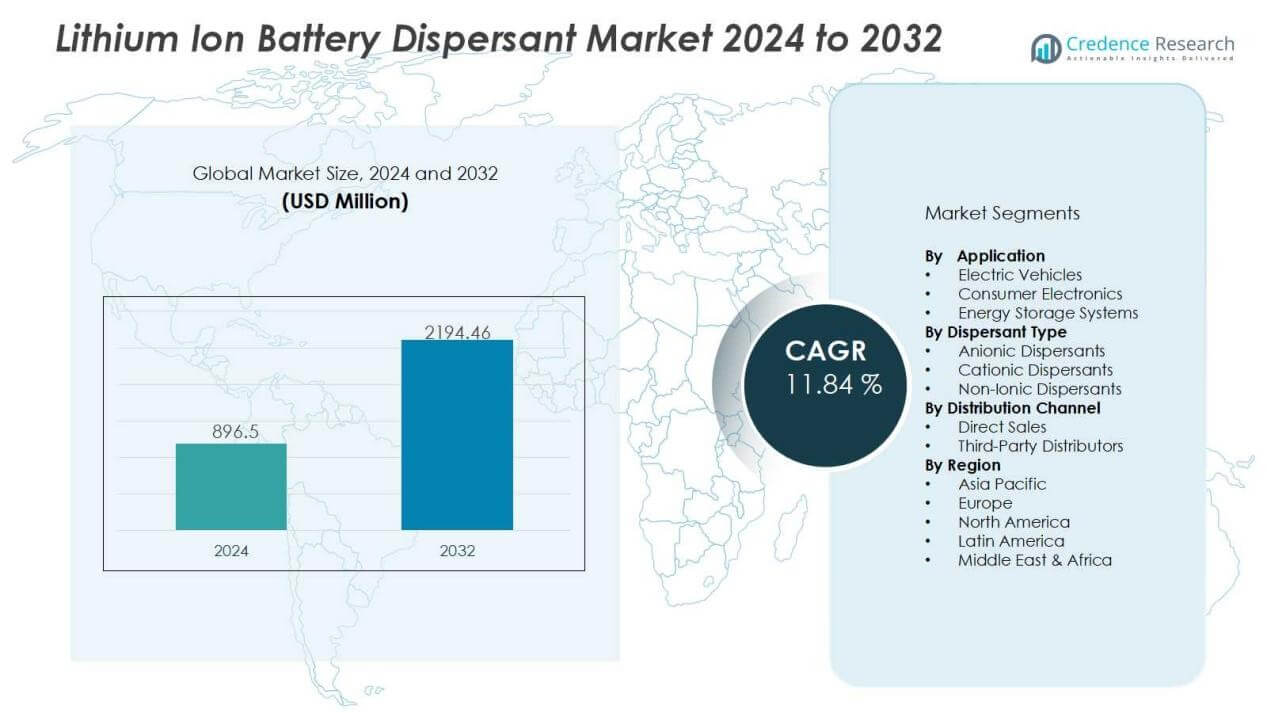

The lithium ion battery dispersant market size was valued at USD 896.5 million in 2024 and is anticipated to reach USD 2194.46 million by 2032, at a CAGR of 11.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium Ion Battery Dispersant Market Size 2024 |

USD 896.5 Million |

| Lithium Ion Battery Dispersant Market, CAGR |

11.84% |

| Lithium Ion Battery Dispersant Market Size 2032 |

USD 2194.46 Million |

Strong growth drivers include the global shift toward electric vehicles, growing adoption of renewable energy storage solutions, and continuous improvements in battery technologies. Dispersants enhance conductivity, optimize electrode slurry uniformity, and extend battery life, making them critical in advancing performance standards. Moreover, increasing investments in sustainable energy projects, paired with government incentives for EV adoption, further boost demand for high-quality dispersants tailored to next-generation lithium-ion batteries.

Regionally, Asia-Pacific dominates the lithium-ion battery dispersant market, holding the largest share due to high EV production, extensive electronics manufacturing, and strong government support for energy transition in countries like China, Japan, and South Korea. North America follows, fueled by EV adoption, grid storage expansion, and technological innovation, while Europe shows steady growth supported by strict emission targets and clean energy initiatives. Emerging markets in Latin America and the Middle East are also presenting new opportunities through renewable energy investments.

Market Insights:

Market Insights:

- The lithium ion battery dispersant market was valued at USD 896.5 million in 2024 and is projected to reach USD 2,194.46 million by 2032, growing at a CAGR of 11.84% during the forecast period.

- Strong growth is driven by the global shift toward electric vehicles, rising adoption of renewable energy storage, and continuous improvements in battery technologies.

- Dispersants enhance conductivity, ensure uniform electrode slurry, and extend battery life, making them critical for performance optimization.

- Investments in sustainable energy projects, coupled with government incentives for EV adoption, further boost demand for high-quality dispersants tailored to next-generation lithium-ion batteries.

- Regionally, Asia-Pacific dominates with 53% market share due to high EV production, electronics manufacturing, and government support in China, Japan, and South Korea.

- North America follows with 22% share, supported by EV adoption, grid storage expansion, and technological innovation, while Europe holds 18% share with growth driven by emission targets and clean energy initiatives.

- Emerging markets in Latin America and the Middle East present new opportunities through renewable energy investments and expanding energy infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Electric Vehicles Driving Large-Scale Adoption:

The rapid growth of electric vehicles has created strong demand for advanced battery technologies. The lithium ion battery dispersant market benefits from this shift, as dispersants enhance battery efficiency and extend operational life. Automakers focus on high-performance batteries to meet emission targets and consumer expectations. Strong government incentives and expanding charging infrastructure further reinforce the need for advanced dispersants.

- For Instance, the Hyundai IONIQ 5 received a battery upgrade from 77.4 kWh to 84.0 kWh, resulting in an improved EPA-estimated driving range of up to 318 miles for the single-motor rear-wheel-drive model

Expanding Renewable Energy Storage Applications Strengthening Market Growth:

Renewable energy adoption continues to accelerate globally, creating new requirements for energy storage systems. The lithium ion battery dispersant market supports this transition by improving electrode stability and conductivity in large-scale storage units. Utilities invest in grid stabilization and peak load management, fueling consistent demand. Energy projects in solar and wind rely on efficient storage solutions that require high-quality dispersants.

- For Instance, CATL introduced the TENER Stack battery system for large-scale energy storage, which can achieve a cycle life of 12,000 cycles. Deploying 800 MWh of storage using TENER Stack requires one-third fewer containers compared to traditional systems. Read more at CATL.

Advancements in Battery Technology Enhancing Product Efficiency:

Ongoing research and development efforts have significantly improved lithium-ion battery performance. The lithium ion battery dispersant market benefits from these innovations, as dispersants are essential to achieving consistent electrode dispersion and uniform coatings. Advances in cathode and anode materials require tailored dispersant formulations. It strengthens overall reliability, safety, and cycle life of batteries used across diverse applications.

Growing Consumer Electronics Industry Supporting Continuous Utilization:

Consumer demand for smartphones, laptops, and wearables remains a major growth driver. The lithium ion battery dispersant market gains from this trend, since dispersants play a key role in ensuring compact yet powerful battery performance. Manufacturers emphasize fast charging, longer runtime, and device safety, making dispersants indispensable. Expanding production in Asia-Pacific further boosts consumption of dispersants across high-volume electronics manufacturing hubs.

Market Trends:

Integration of Sustainable and Eco-Friendly Dispersant Solutions Across Industries:

Sustainability has become a central trend shaping the lithium ion battery dispersant market. Manufacturers are introducing eco-friendly dispersants that reduce environmental impact while maintaining high performance standards. The trend aligns with stricter environmental regulations and the growing preference for green technologies across industries. Companies focus on bio-based and solvent-free formulations to meet demand from automotive and electronics sectors. It creates opportunities for innovation in product development while supporting global decarbonization goals. This trend also enhances the competitive positioning of suppliers that prioritize cleaner production methods.

- For Instance, BASF offers CGPS 277B, a dispersing agent for lithium iron phosphate (LFP) cathode slurries, which improves viscosity reduction and allows for higher solid content.

Rising Focus on High-Performance Dispersants for Advanced Battery Applications:

The lithium ion battery dispersant market is witnessing increasing demand for products tailored to high-performance energy storage. Manufacturers emphasize dispersants that improve slurry uniformity, enhance conductivity, and extend cycle life. It reflects the industry’s focus on meeting the requirements of electric vehicles, renewable energy storage, and fast-charging consumer devices. Customization of dispersants for next-generation cathode and anode materials has emerged as a key strategy. Leading players invest in research partnerships and pilot projects to accelerate product testing and commercialization. This trend reinforces the market’s role in supporting the evolution of advanced lithium-ion battery technologies.

- For Instance, BASF Shanshan Battery Materials (BSBM), a BASF joint venture, delivered the first batches of mass-produced cathode active materials (CAM) for semi-solid-state batteries in collaboration with Beijing WELION New Energy Technology Co., Ltd..

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes Limiting Growth:

The lithium ion battery dispersant market faces challenges due to high production costs and complex processing requirements. Developing advanced dispersants involves specialized raw materials and precise formulation techniques, which increase expenses. It creates difficulties for smaller manufacturers competing against established players with stronger resources. The need for consistent quality and performance further raises barriers in scaling operations. Limited availability of cost-effective raw materials also restricts expansion opportunities. These factors collectively slow the pace of widespread adoption in cost-sensitive applications.

Stringent Environmental Regulations and Supply Chain Vulnerabilities Impacting Stability;

Tightening global environmental regulations present significant challenges for dispersant producers. The lithium ion battery dispersant market must adapt to stricter compliance standards related to chemical usage and waste management. It places pressure on companies to reformulate products while maintaining efficiency and safety. Supply chain disruptions, driven by geopolitical tensions and resource scarcity, further complicate market stability. Inconsistent access to critical materials delays production schedules and raises costs. These challenges highlight the need for strategic sourcing, innovation, and stronger regulatory alignment to sustain growth.

Market Opportunities:

Expanding Electric Vehicle and Renewable Energy Sectors Creating Long-Term Opportunities:

The lithium ion battery dispersant market is well-positioned to benefit from the rapid expansion of electric vehicles and renewable energy projects. Growing consumer adoption of EVs and government incentives for clean transportation drive strong demand for advanced dispersants. It enables better electrode stability and higher energy density, which are essential for vehicle range and efficiency. Large-scale renewable energy storage projects also depend on reliable dispersants to maintain consistent battery performance. The growing integration of wind and solar energy into grids creates sustained opportunities for suppliers. These sectors together provide a strong foundation for long-term market growth.

Innovation in Advanced Materials and Sustainable Formulations Driving New Potential:

Opportunities arise from continuous innovation in advanced dispersant formulations tailored to evolving battery technologies. The lithium ion battery dispersant market benefits from research into eco-friendly, solvent-free, and bio-based dispersants. It supports both regulatory compliance and growing customer demand for sustainable solutions. Customization for next-generation cathode and anode materials opens doors for specialized applications. Collaborations between manufacturers, research institutions, and battery producers further accelerate product development. These innovations create new avenues for differentiation and competitiveness in global markets.

Market Segmentation Analysis:

By Dispersant Type:

The lithium ion battery dispersant market by dispersant type is segmented into anionic, cationic, and non-ionic categories. Anionic dispersants dominate due to their strong performance in stabilizing electrode slurries and ensuring consistent dispersion of active materials. Cationic dispersants serve niche applications where higher compatibility with specific electrode chemistries is required. Non-ionic dispersants are gaining traction in eco-friendly formulations, offering balanced stability and reduced environmental impact. It continues to evolve as manufacturers explore advanced blends that combine high efficiency with regulatory compliance.

By Application:

The market by application covers electric vehicles, consumer electronics, and energy storage systems. Electric vehicles lead this segment, driven by increasing global adoption and demand for longer battery life. Consumer electronics follow, with dispersants supporting compact designs and fast-charging features in devices such as smartphones and laptops. Energy storage systems represent a growing area, with dispersants ensuring stability in large-capacity batteries for renewable integration. It supports diverse application needs by offering tailored dispersant solutions for performance optimization.

- For Instance, Hyundai and LG Energy Solution’s existing partnership enabled the production of the long-range IONIQ 6, which offers over 600 km of driving range per charge

By Distribution Channel:

The distribution channel segment includes direct sales and third-party distributors. Direct sales dominate as major producers maintain close partnerships with battery manufacturers to ensure consistent supply and technical support. Third-party distributors play a critical role in reaching smaller firms and emerging markets. The growing emphasis on regional supply chain efficiency strengthens direct engagement between suppliers and end users. It highlights the importance of flexible distribution strategies that address both large-scale and localized demand.

- For instance, in July 2025, Panasonic Energy strengthened its distribution strategy by partnering with Tesla’s Gigafactory Nevada, facilitating direct supply of over 13 million battery cells annually to support the automaker’s advanced EV production line.

Segmentations:

By Dispersant Type:

- Anionic Dispersants

- Cationic Dispersants

- Non-Ionic Dispersants

By Application:

- Electric Vehicles

- Consumer Electronics

- Energy Storage Systems

By Distribution Channel:

- Direct Sales

- Third-Party Distributors

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific held 53% market share in 2024, making it the dominant region in the lithium ion battery dispersant market. China, Japan, and South Korea drive this leadership through large-scale battery manufacturing, rapid EV adoption, and strong electronics production. It benefits from government policies that support clean energy transition and industrial innovation. Regional suppliers focus on expanding production capacity to meet the rising demand from domestic and international clients. Strong investments in renewable energy storage further reinforce market strength. Asia-Pacific is expected to maintain leadership due to its integrated supply chains and strong export capabilities.

North America:

North America accounted for 22% market share in 2024, positioning it as the second-largest regional market. The lithium ion battery dispersant market in this region is supported by robust EV adoption and continuous innovation in energy storage technologies. The United States leads with strong R&D investments, government incentives, and advanced manufacturing capacity. It benefits from rising demand in both automotive and grid storage sectors. Canada also contributes with renewable projects that drive storage applications. Expanding collaborations between dispersant manufacturers and battery producers strengthen the region’s global competitiveness.

Europe:

Europe captured 18% market share in 2024, reflecting its commitment to clean energy and sustainable technologies. The lithium ion battery dispersant market grows in this region due to strict emission reduction targets and supportive policies for electric mobility. Germany and France lead with advanced automotive industries and strong renewable adoption. It is also supported by European Union funding programs for next-generation battery technologies. Regional manufacturers focus on eco-friendly formulations that align with regulatory requirements. Europe continues to expand its role as a key hub for sustainable energy storage innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Akzo Nobel N.V.

- BASF SE

- Ashland Global Holdings Inc.

- Clariant AG

- Dow Chemical Company

- Evonik Industries AG

- Croda International Plc

- Huntsman Corporation

- Mitsubishi Chemical Corporation

- Lubrizol Corporation

- Nouryon

Competitive Analysis:

The lithium ion battery dispersant market is highly competitive, driven by innovation, product quality, and strategic partnerships. Leading companies such as Akzo Nobel N.V., BASF SE, Ashland Global Holdings Inc., Clariant AG, Dow Chemical Company, Evonik Industries AG, and Croda International Plc dominate through extensive product portfolios and global distribution networks. It focuses on developing advanced dispersants that enhance electrode performance, improve battery stability, and extend cycle life. Companies invest in research and development to create eco-friendly formulations, meet regulatory requirements, and address the growing demand from electric vehicles, consumer electronics, and energy storage systems. Strategic collaborations with battery manufacturers strengthen market presence and enable faster commercialization of new products. Competitive pricing, technical support, and supply chain efficiency also play key roles in maintaining market share. Continuous innovation and expansion into emerging regions ensure that these players remain at the forefront of the global market.

Recent Developments:

- In September 2025, AkzoNobel launched a new powder coating product within the Interpon A1000 range, co-developed with Chinese EV-maker NIO, which won the Altair Enlighten Award for sustainable automotive innovation.

- In September 2025 , BASF SE announced a partnership with AkzoNobel and Arkema to lower the carbon footprint of architectural powder coatings by utilizing BASF’s NPG ZeroPCF bio-attributed raw material.

Report Coverage:

The research report offers an in-depth analysis based on Dispersant Type, Application, Distribution Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The lithium ion battery dispersant market is expected to expand with rising global EV adoption.

- Manufacturers will invest in advanced dispersants that improve conductivity and extend battery cycle life.

- Sustainable and bio-based dispersant formulations will gain traction due to tightening environmental regulations.

- Research collaborations between battery producers and chemical companies will accelerate product innovation.

- High-performance dispersants tailored to next-generation cathode and anode materials will drive demand.

- The market will benefit from growing renewable energy storage projects requiring efficient large-scale batteries.

- Asia-Pacific will maintain leadership due to integrated supply chains and high EV production.

- North America will grow steadily, supported by strong R&D and government energy policies.

- Europe will emphasize eco-friendly formulations aligned with strict emission targets and sustainability goals.

- Emerging markets in Latin America and the Middle East will create new opportunities through energy investments.

Market Insights:

Market Insights: