Market Overview

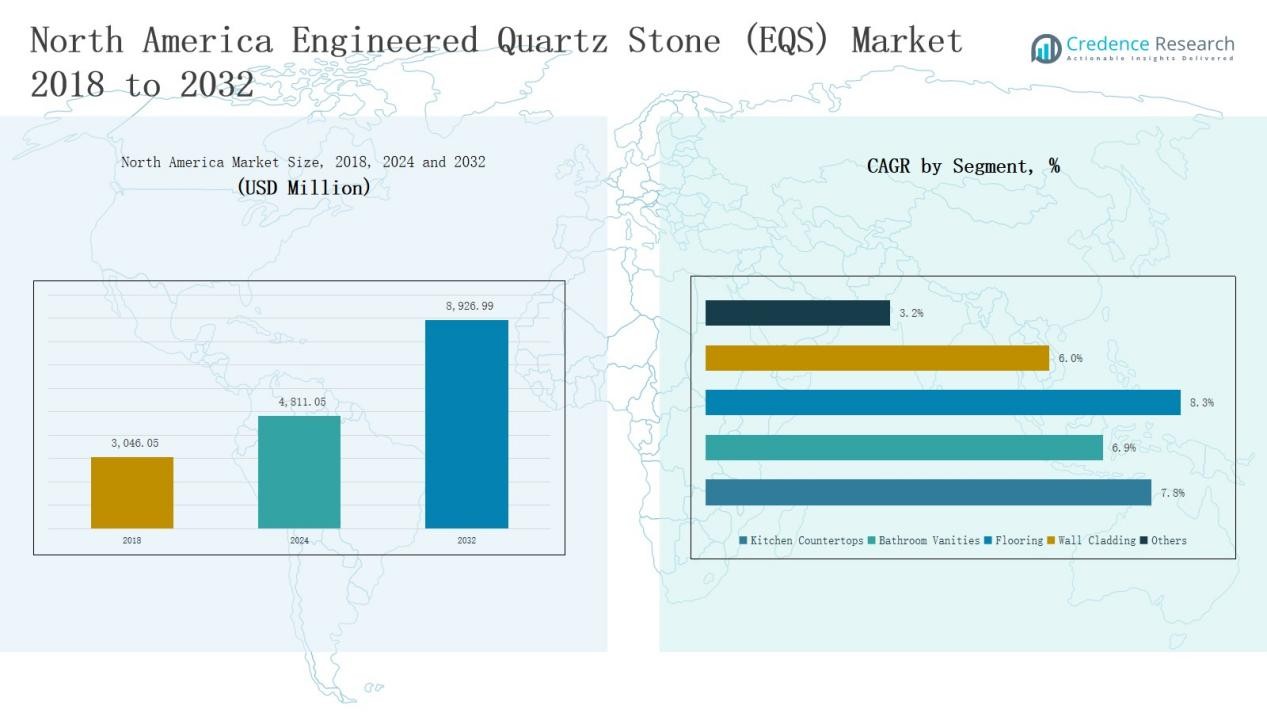

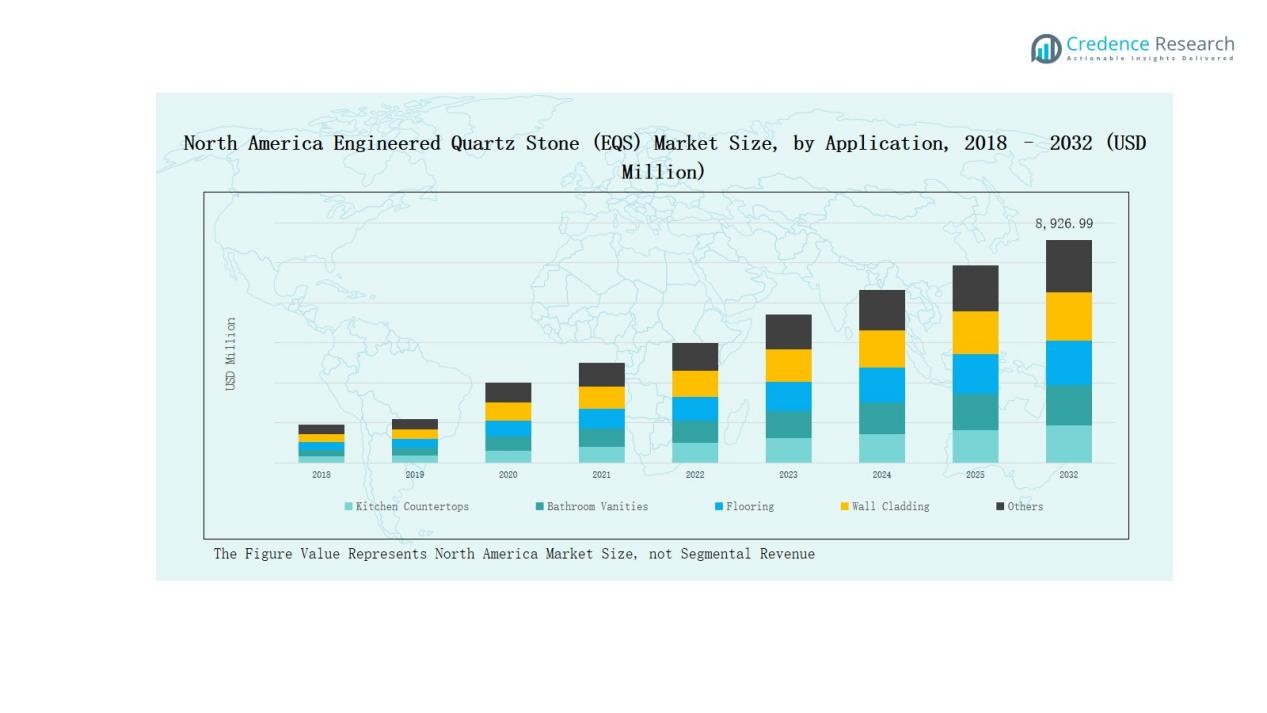

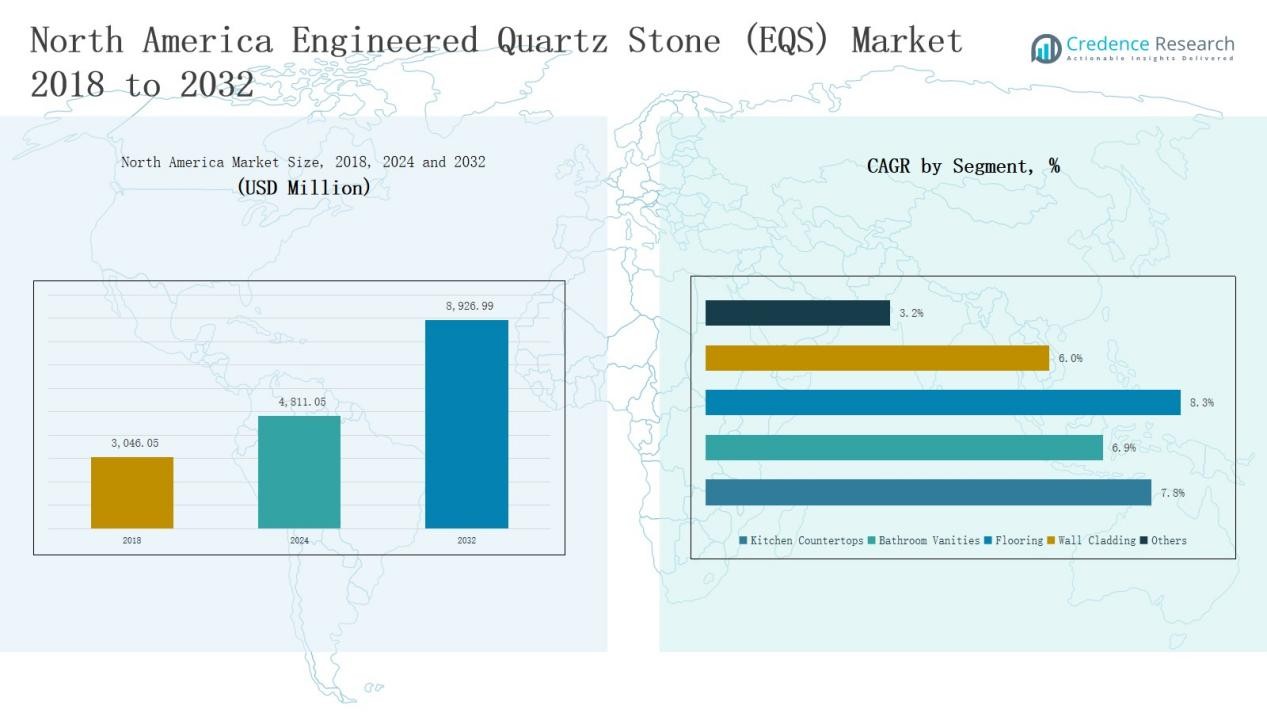

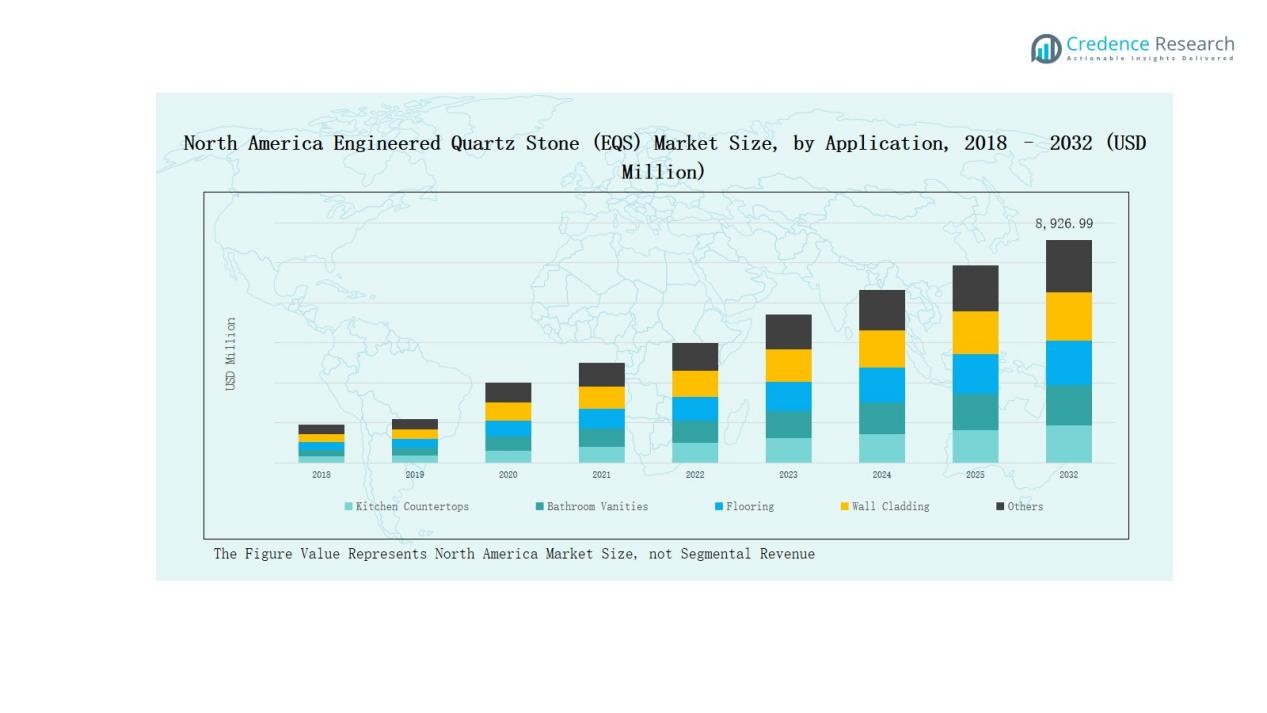

North America Engineered Quartz Stone (EQS) Market size was valued at USD 3,046.05 million in 2018, reached USD 4,811.05 million in 2024, and is anticipated to reach USD 8,926.99 million by 2032, growing at a CAGR of 8.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Engineered Quartz Stone (EQS) Market Size 2024 |

USD 4,811.05 Million |

| North America Engineered Quartz Stone (EQS) Market, CAGR |

8.07% |

| North America Engineered Quartz Stone (EQS) Market Size 2032 |

USD 8,926.99 Million |

The North America Engineered Quartz Stone (EQS) Market is shaped by established players including Cambria, Caesarstone, Cosentino (Silestone), HanStone Quartz, MSI Surfaces, Wilsonart Quartz, DuPont (Corian Quartz), Daltile ONE Quartz, Vicostone, and LG Hausys Viatera. These companies strengthen their competitive positions through innovative product portfolios, sustainable quartz solutions, and extensive distribution networks. Their strategies focus on recycled and silica-free surfaces, premium designs, and partnerships with contractors and retailers to meet rising consumer demand. The United States led the market with a 68% share in 2024, supported by robust remodeling activity, luxury housing projects, and strong adoption in the hospitality sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Engineered Quartz Stone (EQS) Market grew from USD 3,046.05 million in 2018 to USD 4,811.05 million in 2024 and is projected to reach USD 8,926.99 million by 2032 at a CAGR of 8.07%.

- Kitchen Countertops dominated applications with 58% share in 2024, driven by remodeling, luxury housing, and hospitality demand, while bathroom vanities followed as the second-largest segment.

- Distributors/Dealers led distribution channels with 46% share in 2024, supported by strong contractor networks, while home improvement retailers captured 32% due to rising DIY culture.

- The United States commanded 68% share in 2024, driven by remodeling activity, hospitality growth, and sustainability adoption, supported by major retailers like Home Depot and Lowe’s.

- Leading companies include Cambria, Caesarstone, Cosentino (Silestone), HanStone Quartz, MSI Surfaces, Wilsonart Quartz, DuPont (Corian Quartz), Daltile ONE Quartz, Vicostone, and LG Hausys Viatera.

Market Segment Insights

By Application

Kitchen Countertops dominated the North America EQS market in 2024, accounting for nearly 58% share. Demand is driven by rising home remodeling, premium housing projects, and consumer preference for durable, stain-resistant, and low-maintenance surfaces. Increasing adoption in luxury residential kitchens and commercial hospitality spaces further boosts growth. Bathroom vanities follow as the second major sub-segment, supported by rising renovation activity in hotels and residential apartments, while flooring, wall cladding, and others represent niche but steadily expanding applications.

- For instance, Cambria introduced new quartz surface designs tailored for upscale kitchens and hospitality projects, strengthening demand for premium countertops.

By Distribution Channel

Distributors/Dealers held the largest share of about 46% in the North America EQS market in 2024. Their dominance stems from extensive networks, bulk availability, and strong partnerships with architects and contractors. Home improvement retailers contribute significantly, capturing nearly 32% share, supported by DIY culture and consumer accessibility to ready-made products. Direct sales channels remain vital for large projects and premium buyers seeking custom solutions, while other channels, including online platforms, are gradually emerging with growing digital retail adoption.

- For instance, Fastenal strengthened its construction solutions portfolio by integrating digital inventory management tools into its supply chain system, making it easier for contractors to access EQS-related products through hybrid online and direct channels.

Key Growth Drivers

Rising Remodeling and Renovation Activities

The surge in residential and commercial remodeling projects drives EQS demand in North America. Kitchen and bathroom upgrades remain central to this trend, with quartz countertops gaining preference over natural stone due to durability, design variety, and low maintenance. Growing investments in luxury housing and urban apartments further accelerate usage. Homeowners increasingly prioritize modern aesthetics and hygienic surfaces, positioning engineered quartz stone as the material of choice in both premium and mid-range construction projects, boosting long-term market growth.

- For instance, Caesarstone introduced its Pebbles Collection, featuring neutral-toned quartz surfaces designed to cater to modern kitchen and bathroom remodeling demands in the U.S. market.

Increasing Preference for Sustainable Surfaces

Sustainability plays a critical role in shaping consumer demand across the region. Manufacturers are investing in recycled and silica-free engineered quartz to align with stricter regulations and growing eco-consciousness. Consumers prefer surfaces that reduce environmental impact without compromising performance. North America’s green building certifications, such as LEED, encourage the adoption of sustainable quartz products. This shift supports market expansion, as both residential and commercial builders integrate eco-friendly solutions into projects to meet environmental standards and customer expectations.

- For instance, Neolith’s new silica-free surfaces are 100% recyclable, use renewable energy, and incorporate up to 98% recycled raw materials, emphasizing environmental responsibility throughout production.

Expanding Commercial and Hospitality Sector

The hospitality and commercial real estate sectors are increasingly adopting engineered quartz stone for durability and aesthetics. Hotels, restaurants, and office spaces use quartz for countertops, flooring, and wall cladding due to its resistance to stains, scratches, and heavy use. Rising investments in luxury hotels and modern workspaces across North America enhance adoption. With contractors prioritizing long-lasting, stylish surfaces, engineered quartz stone is positioned as a preferred choice, strengthening demand in high-traffic environments beyond residential applications.

Key Trends & Opportunities

Digital Retail Expansion and E-commerce Growth

Digital retail platforms are reshaping distribution strategies in the EQS market. Online channels allow consumers and contractors to explore wide product catalogs, compare finishes, and access design visualization tools. Home improvement retailers and manufacturers are increasingly leveraging e-commerce to target DIY homeowners and small contractors. This shift provides significant opportunities, as online platforms expand brand reach and allow customization at scale. Enhanced digital presence improves customer engagement and purchasing convenience, positioning e-commerce as a major growth enabler.

- For instance, IKEA’s upgraded digital showroom integrates augmented reality features, enabling customers to visualize product finishes and dimensions in real spaces before purchase, significantly improving engagement and purchase confidence.

Innovation in Product Design and Surface Technology

Manufacturers are focusing on product innovation, introducing advanced finishes, textures, and non-porous surfaces. Silica-free and recycled quartz variants are gaining traction as sustainable alternatives. Smart design innovations, such as antibacterial surfaces and enhanced durability, cater to modern consumer demands. Premium offerings with natural stone-like aesthetics strengthen appeal among high-end buyers. These innovations create opportunities for companies to differentiate portfolios, expand into new applications, and capture growing demand across residential, commercial, and hospitality projects in North America.

- For instance, Cambria introduced its Inverness collection featuring intricate debossed veining to replicate natural stone elegance while improving durability

Key Challenges

High Production and Installation Costs

Engineered quartz stone remains costlier than several substitutes, including laminates and ceramic tiles. High production costs, driven by advanced processing and raw material requirements, restrict wider adoption among price-sensitive buyers. Installation costs further add to overall expenses, making EQS more suitable for premium and mid-range projects. This price barrier poses a challenge to market penetration, particularly in budget-conscious residential projects and small-scale renovations, where cheaper alternatives often gain preference over engineered quartz solutions.

Rising Competition from Alternative Materials

The market faces strong competition from natural stones such as granite and marble, alongside emerging surface materials like solid surfaces and sintered stone. Each alternative presents unique advantages, including cost competitiveness or natural appeal. While engineered quartz offers superior durability, the aesthetic value of natural stone continues to influence consumer preference in certain markets. Increasing innovation in substitute materials threatens to limit quartz adoption, forcing manufacturers to strengthen value propositions and differentiate through design and sustainability.

Environmental and Health Concerns

Silica dust exposure during cutting and fabrication of quartz poses health hazards for workers, raising regulatory concerns. Occupational safety regulations in North America are becoming stricter, forcing manufacturers and fabricators to adopt safer processes and alternative materials. This challenge requires heavy investment in dust-control technologies, protective equipment, and safer product innovation. Companies that fail to address environmental and worker safety risks face reputational and legal challenges, making compliance a critical barrier to growth in the EQS market.

Regional Analysis

United States

The United States accounted for 68% share of the North America Engineered Quartz Stone (EQS) Market in 2024. Strong remodeling activity in residential housing drives demand, with kitchen countertops leading adoption. Luxury housing projects and growing investments in hospitality construction support expansion across multiple applications. Consumers prefer engineered quartz over granite and marble due to its durability, low maintenance, and aesthetic flexibility. Home improvement retailers such as Home Depot and Lowe’s enhance accessibility. The country’s strict environmental standards encourage silica-free and recycled quartz adoption. It continues to serve as the region’s largest market, supported by both urban development and suburban housing upgrades.

Canada

Canada represented 19% share of the North America Engineered Quartz Stone (EQS) Market in 2024. Demand is fueled by urban housing projects in Toronto, Vancouver, and Montreal, alongside strong commercial sector growth. Kitchen and bathroom renovations remain a core driver, while office and retail developments expand usage of quartz for flooring and wall cladding. Rising consumer focus on sustainable surfaces supports adoption of recycled quartz solutions. Distributors and specialty retailers play a key role in market expansion. Canada’s emphasis on green building certifications strengthens opportunities for eco-friendly quartz manufacturers. It is positioned as a steadily growing contributor to regional demand.

Mexico

Mexico held 13% share of the North America Engineered Quartz Stone (EQS) Market in 2024. Rising middle-class income levels and expanding urbanization increase demand for affordable yet stylish surface solutions. Kitchen countertops dominate applications, while demand for bathroom vanities is gaining traction in new residential developments. The hospitality sector, particularly hotels and resorts, drives additional growth in commercial usage. Local distributors and dealers remain the main sales channel, supported by rising availability of international brands. Mexico’s lower production costs create opportunities for regional manufacturing expansion. It is expected to grow faster than Canada, driven by urban development and consumer lifestyle shifts.

Market Segmentations:

By Application

- Kitchen Countertops

- Bathroom Vanities

- Flooring

- Wall Cladding

- Others

By Distribution Channel

- Direct Sales

- Distributors/Dealers

- Home Improvement Retailers

- Others

By Region

Competitive Landscape

The North America Engineered Quartz Stone (EQS) Market features strong competition among global leaders and regional specialists focusing on innovation, sustainability, and distribution strength. Key players such as Cambria, Caesarstone, Cosentino (Silestone), HanStone Quartz, MSI Surfaces, Wilsonart Quartz, Vicostone, DuPont (Corian Quartz), Daltile ONE Quartz, and LG Hausys Viatera dominate through extensive product portfolios and strategic partnerships. These companies emphasize eco-friendly surfaces, including recycled and silica-free quartz, to align with regulatory requirements and consumer demand for sustainable materials. Distribution networks play a vital role, with dealers and home improvement retailers driving product reach, while direct sales channels cater to premium projects. Players actively invest in design innovations that replicate natural stone aesthetics and introduce antibacterial, non-porous surfaces to attract high-end residential and commercial buyers. Competition is further shaped by brand recognition, pricing strategies, and digital retail expansion, making differentiation through technology, sustainability, and design excellence crucial for long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cambria

- Daltile ONE Quartz

- DuPont (Corian Quartz)

- HanStone Quartz

- MSI Surfaces

- Silestone by Cosentino

- Caesarstone

- Wilsonart Quar

- Vicostone

- LG Hausys Viatera

Recent Developments

- In February 2025, Caesarstone introduced its Caesarstone ICON™, a crystalline silica-free engineered quartz surface made with around 80% recycled content. The U.S. rollout is scheduled to begin in May 2025.

- In August 2025, Cambria announced an $80 million investment to build a new quartz processing and rail center in Minnesota, shifting some operations from Canada to the United States.

- In March 2025, MSI expanded its Bocage™ collection by adding two new quartz colors, Calacatta Azulean™ and Calacatta Cinela™.

- In August 2025, Wilsonart launched 10 new quartz designs, featuring bold greens and blues to expand its surface portfolio.

Report Coverage

The research report offers an in-depth analysis based on Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for kitchen countertops will continue to dominate residential applications across the region.

- Bathroom vanities are expected to gain traction due to growing hotel and apartment renovations.

- Flooring and wall cladding applications will expand with rising commercial and office projects.

- Sustainable quartz products will see stronger adoption under stricter environmental regulations.

- Silica-free and recycled quartz surfaces will gain popularity among eco-conscious consumers.

- Distributors and dealers will remain the primary channel, supported by strong contractor networks.

- Home improvement retailers will grow further with increasing DIY renovation projects.

- Online platforms will play a greater role in reaching individual buyers and small contractors.

- S. will maintain leadership, while Mexico will grow faster due to urbanization and lifestyle shifts.

- Product innovations in design, texture, and antibacterial surfaces will drive competitive differentiation.