Market Overview

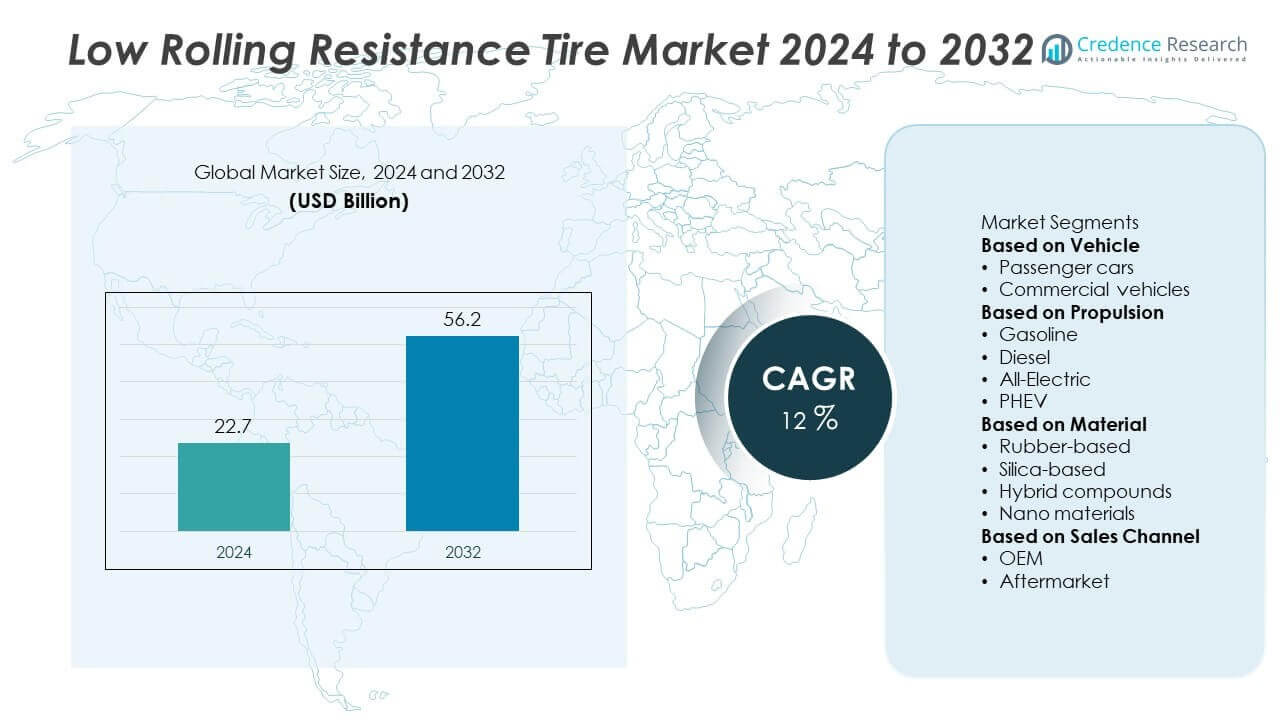

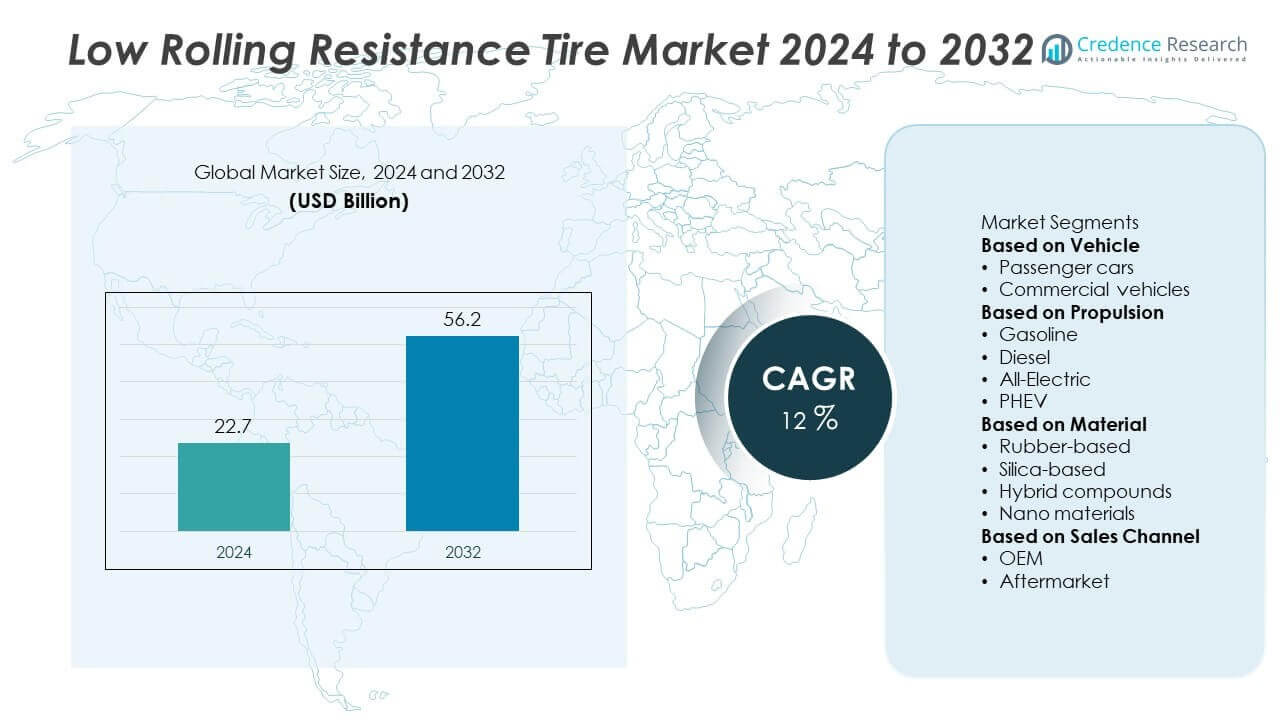

The Low Rolling Resistance Tire Market was valued at USD 22.7 billion in 2024 and is projected to reach USD 56.2 billion by 2032, growing at a CAGR of 12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Rolling Resistance Tire Market Size 2024 |

USD 22.7 Billion |

| Low Rolling Resistance Tire Market, CAGR |

12% |

| Low Rolling Resistance Tire Market Size 2032 |

USD 56.2 Billion |

The low rolling resistance (LRR) tire market is led by key players including Hankook Tire & Technology, Yokohama Rubber, Michelin, Apollo, Pirelli & C. S., Sumitomo Rubber Industries, Continental, The Goodyear Tire & Rubber Company, Bridgestone, and Cheng Shin Rubber Industry. These companies dominate through advanced compound development, strategic partnerships with automakers, and investments in sustainable tire technologies. Regionally, Asia-Pacific leads the market with a 34% share in 2024, driven by large-scale automotive production and rapid EV adoption. Europe follows with 30% share, supported by strict emission regulations and strong EV penetration, while North America holds 28% share, reflecting regulatory mandates and rising consumer demand for fuel-efficient mobility solutions.

Market Insights

Market Insights

- The low rolling resistance (LRR) tire market was valued at USD 22.7 billion in 2024 and is projected to reach USD 56.2 billion by 2032, expanding at a CAGR of 12% during the forecast period.

- Rising fuel efficiency demands and strict emission regulations drive adoption, with passenger cars holding over 60% share in 2024, supported by cost savings and compliance with fuel economy standards.

- Growing electric vehicle penetration and advancements in silica-based compounds, which accounted for 50% share, highlight key trends, alongside opportunities in smart tire integration.

- The market is highly competitive with major players including Hankook, Michelin, Bridgestone, Continental, Goodyear, Yokohama, Pirelli, Apollo, Sumitomo, and Cheng Shin Rubber Industry, focusing on R&D and sustainable materials to strengthen positions.

- Regionally, Asia-Pacific leads with 34% share, followed by Europe at 30% and North America at 28%, while Latin America and Middle East & Africa hold smaller shares of 5% and 3% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle

Passenger cars dominated the low rolling resistance (LRR) tire market in 2024, accounting for over 60% share. Their leadership is supported by rising demand for fuel efficiency, stricter emission norms, and the widespread adoption of eco-friendly vehicles. Passenger vehicle manufacturers integrate LRR tires to meet corporate average fuel economy (CAFE) standards and reduce carbon footprints. Expanding urban mobility and growing consumer awareness of cost savings through improved mileage strengthen this segment’s position. Meanwhile, commercial vehicles show gradual adoption, driven by logistics fleet operators aiming to cut fuel expenses.

- For instance, Michelin has reported that its e·PRIMACY tires, designed for passenger cars, can deliver an average fuel saving of approximately 0.21 litres per 100 kilometers compared to competitors within its category. This adds up to potential savings over the lifetime of the tire, benefiting many drivers globally.

By Propulsion

Gasoline vehicles held the largest share of the LRR tire market in 2024, with nearly 45% share. The dominance is attributed to the high global fleet of gasoline-powered cars, particularly in emerging economies. Manufacturers favor LRR tires in this category due to their proven benefits in reducing fuel use and emissions. However, the all-electric and plug-in hybrid electric vehicle (PHEV) segments are expanding rapidly. Electric vehicles demand tires with lower rolling resistance to extend driving range, making this a crucial growth driver in the coming years.

- For instance, Bridgestone developed Low-Rolling-Resistance (LRR) tires using its ENLITEN technology specifically for electric vehicles, which have been shown in company tests to extend driving range by minimizing energy loss.

By Material

Silica-based tires led the market in 2024, capturing around 50% share within the material segment. Their dominance stems from superior energy efficiency, enhanced wet grip, and reduced heat generation compared to conventional rubber-based tires. Automakers increasingly adopt silica-based formulations to balance performance with sustainability goals. Hybrid compounds and nano materials are emerging as innovation-driven categories, offering durability and lower wear rates. However, silica-based materials remain the preferred choice for mass adoption, driven by their established supply chains and compliance with stringent energy-saving tire regulations worldwide.

Key Growth Drivers

Rising Focus on Fuel Efficiency and Emission Reduction

Governments worldwide enforce strict fuel economy and emission regulations, pushing automakers to adopt energy-efficient technologies. Low rolling resistance (LRR) tires reduce fuel consumption by up to 6%, making them vital in meeting regulatory targets. Passenger car manufacturers particularly prioritize these tires to comply with corporate average fuel economy (CAFE) standards. Rising consumer demand for cost savings through reduced fuel use further boosts adoption. This regulatory push, combined with consumer awareness, positions LRR tires as a key solution for sustainable mobility growth.

- For instance, Continental’s Conti EfficientPro Gen3+ LRR tire line for trucks reduced rolling resistance by 9% compared to its predecessor, contributing to fuel savings and CO2 emission reduction for fleets. A medium-sized fleet with 500 vehicles could save approximately €300,000 annually and reduce CO2 emissions by up to 465 metric tons compared with its predecessor.

Rapid Expansion of Electric Vehicle Adoption

The global shift toward electric vehicles (EVs) strongly supports LRR tire market growth. EVs rely heavily on energy-efficient tires to extend driving range and improve battery performance. Automakers are investing in specialized LRR tires that minimize energy loss and support heavy battery loads. In 2024, the surge in EV sales, particularly across Europe, China, and North America, intensified demand for such tires. As EV adoption accelerates, the LRR tire segment will remain a strategic priority for manufacturers to enhance performance and customer satisfaction.

- For instance, Pirelli has developed its ELECT™ line of tires specifically for electric vehicles, which feature reinforced structures to handle the extra battery weight. The P Zero E tire has achieved an “A-A-A” rating on the EU label, signifying ultra-low energy consumption.

Technological Advancements in Tire Materials

Continuous innovation in tire materials enhances the durability and performance of LRR tires. Silica-based and hybrid compounds dominate the market due to superior rolling efficiency, wet grip, and lower heat generation. Research in nano materials is creating opportunities for stronger, lighter, and more eco-friendly tire solutions. Major manufacturers focus on developing advanced tread designs and compound blends that extend tire life while ensuring regulatory compliance. These material advancements not only improve performance but also provide differentiation in a highly competitive tire market.

Key Trends and Opportunities

Growing Adoption of Sustainable Tire Solutions

Sustainability is shaping purchasing decisions across the automotive industry. Consumers and regulators prefer eco-friendly tire options, encouraging manufacturers to invest in recyclable and bio-based materials for LRR tires. Companies are integrating circular economy practices by designing tires with extended life cycles and reduced carbon footprints. This trend creates opportunities for premium sustainable tire lines, appealing to environmentally conscious buyers. Collaborations between automakers and tire producers on green mobility solutions will further accelerate this transition toward sustainable LRR tire technologies.

- For instance, Continental AG introduced the UltraContact NXT, its most sustainable series tire to date, incorporating up to 65% renewable, recycled, and ISCC PLUS mass-balance-certified materials, combining high mileage with maximum safety and performance.

Integration of Smart Tire Technologies

The rise of connected vehicles opens opportunities for smart LRR tire adoption. Manufacturers are embedding sensors in LRR tires to monitor pressure, wear, and rolling resistance in real time. These features improve safety, extend tire life, and enhance fuel efficiency. Fleet operators benefit by reducing operational costs through predictive maintenance. The integration of smart technology aligns with broader Industry 4.0 and IoT trends, creating a new value proposition for automakers and tire suppliers focused on next-generation mobility solutions.

- For instance, Bridgestone’s smart tire systems and integrated Fleet Care portfolio, equipped with embedded sensors, provide real-time alerts on tire pressure and tread depth, helping managed fleets to improve vehicle safety, reduce premature tire wear, and increase overall efficiency.

Key Challenges

High Production Costs of Advanced Materials

Despite strong demand, high costs of silica and nano material-based compounds challenge LRR tire affordability. These advanced materials require sophisticated manufacturing processes, raising production expenses. Manufacturers struggle to balance performance benefits with cost competitiveness, especially in price-sensitive markets across Asia and Latin America. This cost barrier restricts mass adoption and limits availability to premium vehicle categories. Without economies of scale and broader supply chain efficiencies, high material costs remain a hurdle for widespread LRR tire penetration.

Performance Trade-Offs in Durability and Grip

While LRR tires improve fuel efficiency, some designs compromise on durability and traction. Reducing rolling resistance often lowers tread depth, leading to faster wear and limited performance in extreme driving conditions. Concerns over reduced grip on wet or icy surfaces also impact consumer confidence. Fleet operators and commercial users hesitate to switch fully due to potential safety and maintenance challenges. Balancing efficiency with consistent performance remains a critical issue that tire makers must address to expand adoption globally.

Regional Analysis

North America

North America accounted for 28% share of the low rolling resistance (LRR) tire market in 2024. The region’s growth is driven by stringent Corporate Average Fuel Economy (CAFE) standards and rising adoption of electric vehicles across the United States and Canada. Passenger cars dominate demand, with increasing emphasis on fuel savings and emission control. Commercial fleets are also adopting LRR tires to reduce operating costs in logistics and transportation. Strong investments by leading tire manufacturers and government support for sustainable mobility further enhance market penetration, reinforcing North America’s position as a major revenue contributor.

Europe

Europe held a 30% share of the LRR tire market in 2024, leading global adoption. The dominance is fueled by strict European Union emission regulations, strong EV sales, and consumer preference for sustainable mobility solutions. Automakers in Germany, France, and the United Kingdom widely integrate silica-based LRR tires to meet efficiency goals. Strong demand from premium passenger cars and expanding EV fleets further strengthens the region’s leadership. Tire manufacturers collaborate with automakers to develop advanced compounds, boosting innovation. Government-backed decarbonization initiatives and incentives for eco-friendly vehicles ensure Europe maintains a robust position in this market.

Asia-Pacific

Asia-Pacific captured the largest 34% share of the LRR tire market in 2024. The region’s dominance stems from its large automotive manufacturing base in China, Japan, South Korea, and India. Expanding passenger vehicle ownership and rapid electrification trends accelerate demand for LRR tires. Government mandates on emission reduction and fuel efficiency add momentum to adoption. Rising disposable incomes and urban mobility growth enhance consumer preference for fuel-saving technologies. Major tire companies invest in advanced production facilities across the region, strengthening supply chains. Asia-Pacific’s expanding EV sector and cost-driven manufacturing capabilities ensure it remains the fastest-growing market.

Latin America

Latin America accounted for 5% share of the LRR tire market in 2024. The region’s adoption is supported by gradual enforcement of fuel efficiency regulations and rising consumer awareness of fuel cost savings. Brazil and Mexico lead demand, with growing passenger car sales and a gradual shift toward sustainable vehicle technologies. Commercial vehicle fleets are beginning to adopt LRR tires to manage fuel expenses. However, limited local manufacturing capacity and higher costs of advanced materials restrict faster market penetration. Partnerships with global tire manufacturers and rising EV interest will create moderate growth opportunities in the coming years.

Middle East & Africa

The Middle East & Africa represented 3% share of the LRR tire market in 2024. Market adoption is in the early stage, influenced by expanding urban mobility and rising fuel prices that drive consumer interest in cost-saving technologies. South Africa and Gulf countries lead adoption, supported by growing premium car sales. Commercial fleet operators are exploring LRR tires to improve fuel economy in logistics. However, low consumer awareness and limited distribution networks restrict large-scale penetration. As governments introduce efficiency standards and sustainable transport initiatives, opportunities for LRR tire adoption are expected to gradually increase across the region.

Market Segmentations:

By Vehicle

- Passenger cars

- Commercial vehicles

By Propulsion

- Gasoline

- Diesel

- All-Electric

- PHEV

By Material

- Rubber-based

- Silica-based

- Hybrid compounds

- Nano materials

By Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the low rolling resistance (LRR) tire market features leading players such as Hankook Tire & Technology, Yokohama Rubber, Michelin, Apollo, Pirelli & C. S., Sumitomo Rubber Industries, Continental, The Goodyear Tire & Rubber Company, Bridgestone, and Cheng Shin Rubber Industry. These companies focus on developing advanced tire technologies using silica-based and hybrid compounds to enhance fuel efficiency, durability, and wet grip performance. Strong investments in research and development enable continuous innovation in nano materials and smart tire technologies. Strategic collaborations with automakers support integration of LRR tires in both conventional and electric vehicles. Expansions in manufacturing facilities across Asia-Pacific and Europe strengthen global supply chains, while sustainability initiatives drive the adoption of eco-friendly materials. Competition remains intense, with companies emphasizing regulatory compliance, performance differentiation, and premium product portfolios to gain market share in a rapidly evolving automotive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hankook Tire & Technology

- Yokohama Rubber

- Michelin

- Apollo

- Pirelli & C. S.

- Sumitomo Rubber Industries

- Continental

- The Goodyear Tire & Rubber Company

- Bridgestone

- Cheng Shin Rubber Industry

Recent Developments

- In July 2025, Continental launched an awareness campaign for fleet customers on benefits of rolling resistance–optimized tires, including cost and emissions savings.

- In April 2025, Continental introduced the Conti HDL 3 EP commercial tire for long-haul trucks, combining high-structure carbon black + silica to deliver up to 10 % better rolling resistance.

- In February 2025, Continental AG expanded its EcoContact 7 line, adding a variant tuned for EVs and plug-in hybrids with adaptive tread stiffness to maintain low resistance under aggressive driving.

- In 2025, Michelin launched the e.Primacy All-Season tire, claiming up to 25 % better efficiency vs two leading competitors.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Propulsion, Material, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for fuel-efficient mobility solutions.

- Electric vehicle adoption will strongly boost the need for low rolling resistance tires.

- Advanced silica and hybrid compounds will dominate future material development.

- Smart tire technologies with sensors will become an integrated feature.

- Sustainability goals will push manufacturers toward recyclable and eco-friendly materials.

- Passenger cars will remain the leading segment, supported by emission regulations.

- Commercial fleets will increasingly adopt LRR tires to reduce operating costs.

- Asia-Pacific will maintain its leadership with rapid vehicle production and EV growth.

- Europe will strengthen its position with strict emission norms and premium vehicles.

- Competitive intensity will increase as companies invest in innovation and global expansion.

Market Insights

Market Insights