Market Overview

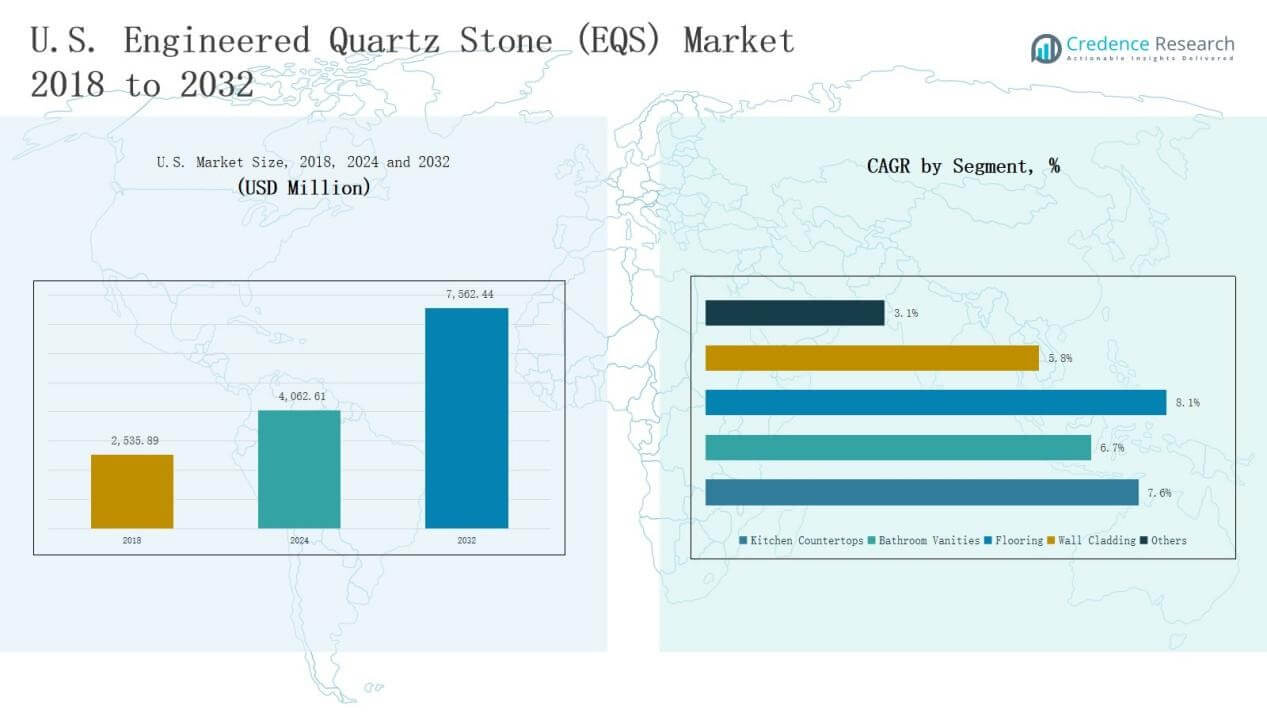

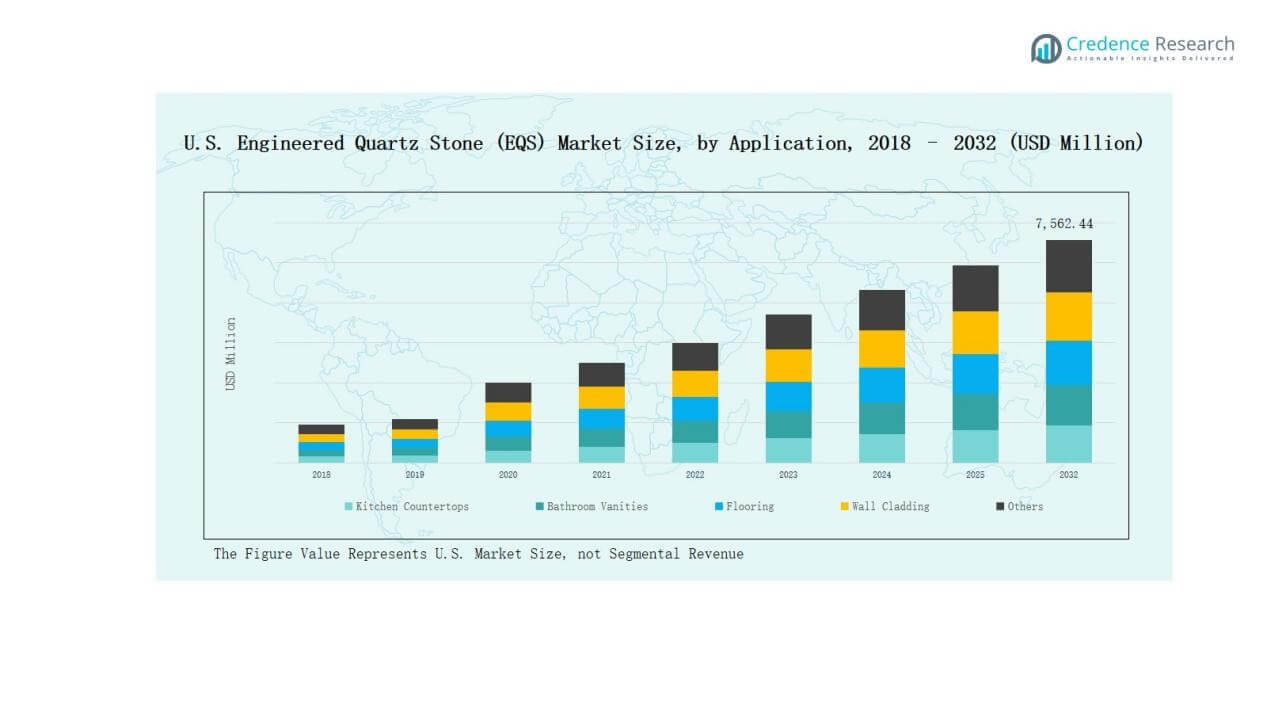

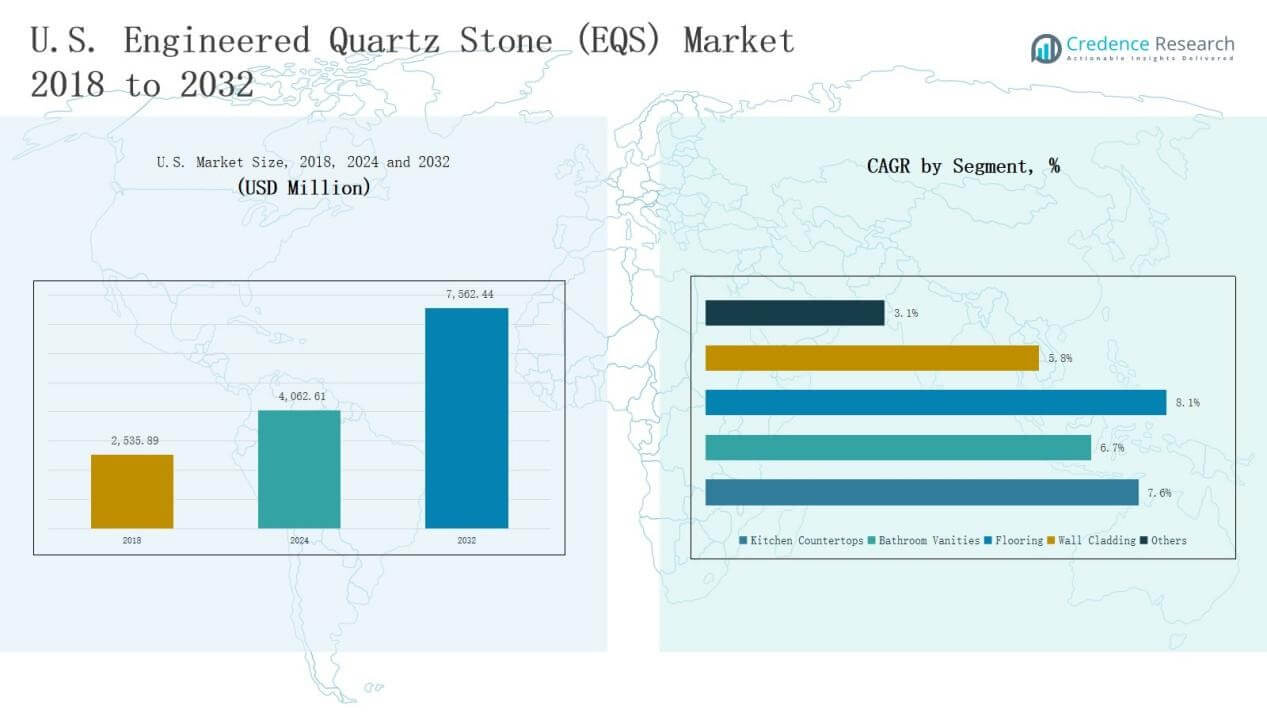

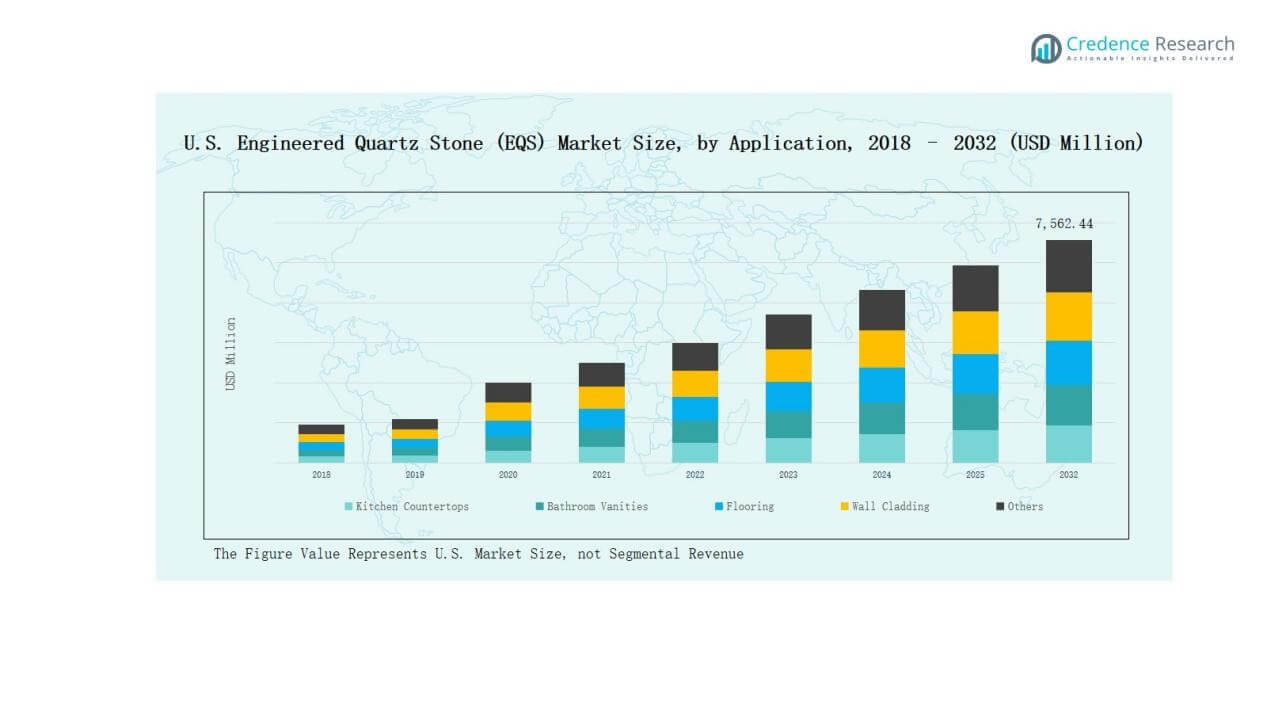

U.S. Engineered Quartz Stone (EQS) Market size was valued at USD 2,535.89 million in 2018, reached USD 4,062.61 million in 2024, and is anticipated to reach USD 7,562.44 million by 2032, at a CAGR of 7.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Engineered Quartz Stone (EQS) Market Size 2024 |

USD 4,062.61 Billion |

| U.S. Engineered Quartz Stone (EQS) Market, CAGR |

7.52% |

| U.S. Engineered Quartz Stone (EQS) Market Size 2032 |

USD 7,562.44 Billion |

The U.S. Engineered Quartz Stone (EQS) Market is shaped by leading companies including Cambria, Caesarstone, Silestone, MSI Surfaces, HanStone Quartz, Corian Quartz by DuPont, Daltile ONE Quartz, Wilsonart Quartz, Vicostone, and LX Hausys Viatera. These players compete through product innovation, advanced finishes, sustainable solutions, and extensive distribution networks. They focus on expanding customization, eco-friendly designs, and partnerships with contractors and retailers to strengthen market presence. Regionally, the South led with 36% share in 2024, driven by rapid urban expansion, strong residential construction, and commercial development.

Market Insights

Market Insights

- The U.S. Engineered Quartz Stone (EQS) Market grew from USD 2,535.89 million in 2018 to USD 4,062.61 million in 2024 and is expected to reach USD 7,562.44 million by 2032, growing at 7.52%.

- Kitchen countertops led applications with 47% share in 2024, followed by bathroom vanities at 23%, flooring at 15%, wall cladding at 9%, and others at 6%.

- Distributors and dealers dominated distribution channels with 41% share in 2024, while direct sales captured 28%, home improvement retailers 19%, and others including online platforms 12%.

- Regionally, the South held the largest share with 36% in 2024, while the Northeast contributed 24%, the West 22%, and the Midwest 18%.

- Key players include Cambria, Caesarstone, Silestone, MSI Surfaces, HanStone Quartz, Corian Quartz by DuPont, Daltile ONE Quartz, Wilsonart Quartz, Vicostone, and LX Hausys Viatera.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Application

In the U.S. Engineered Quartz Stone (EQS) Market, kitchen countertops dominated with 47% share in 2024, supported by high demand for durable, stain-resistant, and versatile surfaces in modern homes and remodeling projects. Bathroom vanities followed with 23% share, driven by resistance to moisture and growing preference for spa-like interiors. Flooring accounted for 15%, favored in commercial spaces for its durability, while wall cladding held 9%, mainly in luxury interiors. The “Others” category, including backsplashes and tabletops, represented 6%, offering niche growth opportunities.

For instance, Caesarstone introduced its Porcelain collection in the U.S., expanding options for countertops and wall applications with high heat and scratch resistance.

By Distribution Channel

Distributors and dealers led the market with 41% share in 2024, supported by broad networks that ensure accessibility across U.S. regions. Direct sales captured 28%, strengthened by bulk contracts with builders and contractors. Home improvement retailers held 19%, benefiting from DIY culture and consumer renovations, while the “Others” category, including online platforms and specialty outlets, accounted for 12%. These varied channels highlight the market’s strong reliance on both traditional distribution and emerging digital pathways for expansion.

For instance, Builders FirstSource expanded its distribution footprint by opening a new distribution yard in Sanford, Florida, aimed at improving material access for residential and commercial contractors.

Key Growth Drivers

Rising Demand for Residential Remodeling

The U.S. EQS market is strongly driven by increasing residential remodeling activities. Homeowners are upgrading kitchens and bathrooms with durable, non-porous, and low-maintenance surfaces. Engineered quartz meets consumer demand for style flexibility, offering designs that replicate marble and granite without the maintenance challenges. The surge in home improvement projects post-pandemic, combined with rising disposable incomes, has reinforced demand. Builders and contractors actively promote quartz over natural stone, citing its superior durability, consistent quality, and long-term cost advantages in residential installations.

For instance, Cosentino expanded its Silestone Ethereal line, offering new colors with HybriQ+ technology that integrates recycled materials and reduces silica content, directly targeting eco-conscious residential renovators.

Expansion of Commercial Infrastructure

Growing investment in commercial spaces such as hotels, offices, and retail outlets supports EQS adoption. Architects and contractors increasingly specify quartz for countertops, flooring, and reception areas due to its longevity and aesthetic consistency. The material’s resistance to heavy traffic, stains, and bacteria aligns with strict commercial standards. The hospitality and office sector’s focus on modern and sustainable interior designs strengthens demand. This infrastructure expansion, coupled with urban development initiatives, positions EQS as a preferred material for large-scale commercial projects across the U.S.

Shift Toward Sustainable Surfaces

Environmental awareness is boosting demand for sustainable materials, making engineered quartz attractive. Manufacturers increasingly integrate recycled glass, silica-free compositions, and eco-friendly resins to align with green building standards. Consumers prefer quartz surfaces due to their long lifespan, which reduces replacement frequency and waste generation. LEED-certified projects also encourage use of engineered quartz for energy-efficient and eco-compliant construction. This sustainability-driven demand enhances market growth, as suppliers innovate with new product lines featuring reduced water use, minimal emissions, and responsible sourcing practices.

For instance, Silestone by Cosentino rolled out its Sunlit Days series, the first carbon-neutral quartz collection, achieved through renewable energy use and certified offset programs.

Key Trends & Opportunities

Key Trends & Opportunities

Growing DIY and Retail Segment

The rise of do-it-yourself culture in the U.S. presents opportunities for engineered quartz. Homeowners increasingly purchase ready-to-install quartz surfaces from home improvement retailers and online channels. Retail penetration offers consumers direct access to varied designs at competitive prices. Easy availability of mid-range options has expanded market reach, particularly among younger homeowners investing in first-time renovations. This trend supports growth for suppliers catering to the retail and online segment, making quartz more accessible and creating new sales pathways beyond dealer networks.

For instance, IKEA U.S. partnered with Caesarstone to supply durable quartz countertops in modular kitchen packages, giving customers customizable options tailored for self-installation.

Product Innovation and Customization

Product innovation continues to create opportunities in the U.S. EQS market. Manufacturers invest in advanced finishes, large-format slabs, and customizable edge profiles to appeal to premium buyers and designers. Color palettes inspired by natural stone, metallic finishes, and minimalist aesthetics are expanding adoption in both residential and commercial spaces. Customization enables alignment with evolving consumer preferences for unique interiors. Companies introducing crystalline silica-free and recycled-content surfaces strengthen their market positioning, catering to the dual demands of safety and sustainability.

For instance, Caesarstone launched a new crystalline silica-free quartz surface under its Mineral Surfaces Collection, engineered with sustainable materials to reduce health risks in fabrication.

Key Challenges

High Competition from Alternatives

The market faces challenges from substitute materials such as granite, marble, and solid surface composites. While engineered quartz offers advantages, natural stones maintain strong appeal in luxury projects due to their exclusivity and unique patterns. Solid surfaces and laminates also attract cost-sensitive buyers. This competitive landscape requires EQS suppliers to differentiate through pricing, design innovation, and sustainability features. Without strong marketing and awareness campaigns, quartz adoption may be restricted in certain customer segments favoring traditional or cheaper alternatives.

Supply Chain and Raw Material Costs

Volatility in raw material availability and pricing challenges market stability. Engineered quartz production relies on quartz aggregates, resins, and pigments, which are subject to global supply fluctuations. Rising energy and transportation costs further elevate production expenses. These factors pressure manufacturers to balance pricing with profitability. Disruptions, such as trade restrictions or shipping delays, can impact timely product delivery. Companies must adopt resilient supply chain strategies and explore local sourcing to mitigate risks and sustain competitive positioning in the U.S. market.

Regulatory and Environmental Compliance

Stringent regulations around crystalline silica exposure in manufacturing present challenges for EQS producers. Compliance with Occupational Safety and Health Administration (OSHA) standards requires significant investment in dust control, worker safety equipment, and updated processes. Non-compliance can result in penalties, reputational risks, and restrictions on market access. In addition, growing consumer awareness of health and environmental impacts forces companies to innovate toward silica-free and eco-friendly alternatives. Balancing compliance costs while maintaining profitability remains a major obstacle for market participants.

Regional Analysis

Northeast

The Northeast held 24% share in 2024 in the U.S. Engineered Quartz Stone (EQS) Market. It benefits from dense urban housing, premium kitchen remodeling, and strong adoption of luxury interiors in cities like New York and Boston. Demand is also supported by high disposable incomes and preference for durable, low-maintenance countertops. Architects and contractors promote quartz in multifamily housing and office projects. The region continues to lead in design-forward trends, making it a strong market for premium and customized surfaces.

Midwest

The Midwest accounted for 18% share in 2024, driven by steady residential construction and renovation projects across suburban areas. Engineered quartz is increasingly replacing laminate and solid surface materials due to its durability and cost efficiency. Growing awareness of sustainability and modern interior trends supports its use in mid-range housing projects. Commercial adoption also rises in hospitality and retail. The Midwest remains price-sensitive, yet it offers stable growth potential supported by its balanced mix of urban and suburban markets.

South

The South dominated with 36% share in 2024, establishing itself as the largest regional market. Strong population growth, urban expansion, and extensive new housing projects drive quartz demand. Kitchen countertops and bathroom vanities remain core applications, fueled by rising homeownership and large-scale residential developments. Builders and distributors play a vital role in promoting quartz as a standard in mid to high-end housing. Commercial growth in cities such as Atlanta, Dallas, and Miami further strengthens adoption, ensuring continued leadership.

West

The West contributed 22% share in 2024, shaped by strong consumer demand for sustainable and stylish surfaces. States like California emphasize eco-friendly building materials, giving quartz an edge over natural stone. High renovation spending and preference for premium interiors fuel adoption in both residential and commercial spaces. Quartz dominates kitchen countertop demand in urban areas, while growth in hospitality and tech-driven office projects adds momentum. The West continues to attract premium buyers, strengthening its importance in the national market.

Market Segmentations:

Market Segmentations:

By Application

- Kitchen Countertops

- Bathroom Vanities

- Flooring

- Wall Cladding

- Others

By Distribution Channel

- Direct Sales

- Distributors/Dealers

- Home Improvement Retailers

- Others

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. Engineered Quartz Stone (EQS) Market is highly competitive, with both domestic manufacturers and global brands shaping its growth. Leading players such as Cambria, Caesarstone, Silestone, MSI Surfaces, and HanStone Quartz maintain strong positions through extensive product portfolios, advanced finishes, and premium design offerings. Companies like Corian Quartz by DuPont, Daltile ONE Quartz, Wilsonart Quartz, Vicostone, and LX Hausys Viatera strengthen market presence through dealer networks, retail partnerships, and innovation in sustainable product lines. Competition is driven by design variety, durability, pricing strategies, and alignment with green building practices. Product differentiation through large-format slabs, crystalline silica-free solutions, and recycled-content materials is increasingly critical. Distributors and retailers further shape market dynamics by expanding access to diverse consumer groups. With rising demand from residential and commercial sectors, leading players continue to invest in customization, branding, and technological upgrades to secure long-term market advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In May 2025, LOTTE Chemical partnered with EKO Stone to distribute Radianz Quartz across the U.S. Midwest.

- In August 2024, Vadara Quartz Surfaces launched four new distribution partnerships to expand its reach in the U.S. East Coast market.

- In April 2025, Cosentino introduced Silestone’s new “Hybrid Quartz,” blending minerals with recycled materials.

- In July 2025, Vicostone launched 10 new quartz colors for its Fall 2025 collection.

Report Coverage

The research report offers an in-depth analysis based on Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Kitchen countertops will continue to lead demand due to durability and design flexibility.

- Bathroom vanities will grow steadily with rising home renovation and wellness-focused interiors.

- Flooring applications will expand in commercial projects requiring long-lasting surfaces.

- Wall cladding will gain traction in luxury residential and hospitality developments.

- Distributors and dealers will remain the primary sales channel, ensuring wide market access.

- Home improvement retailers will grow with the rising do-it-yourself and retail renovation culture.

- Direct sales will strengthen through long-term partnerships with large builders and contractors.

- Sustainability-focused quartz products will gain preference in eco-conscious construction projects.

- Product innovation with customizable finishes and large slabs will drive premium adoption.

- Competitive pressure will increase as brands invest in branding, design variety, and safety features.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: