Market Overview

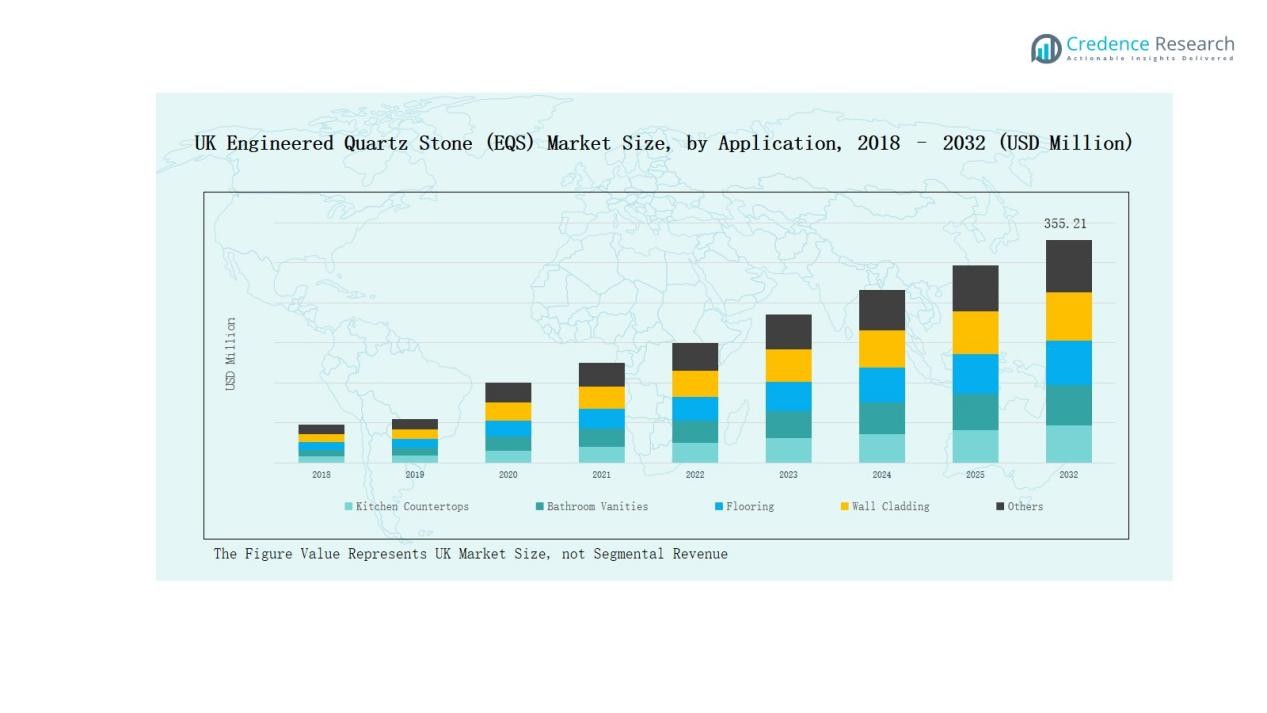

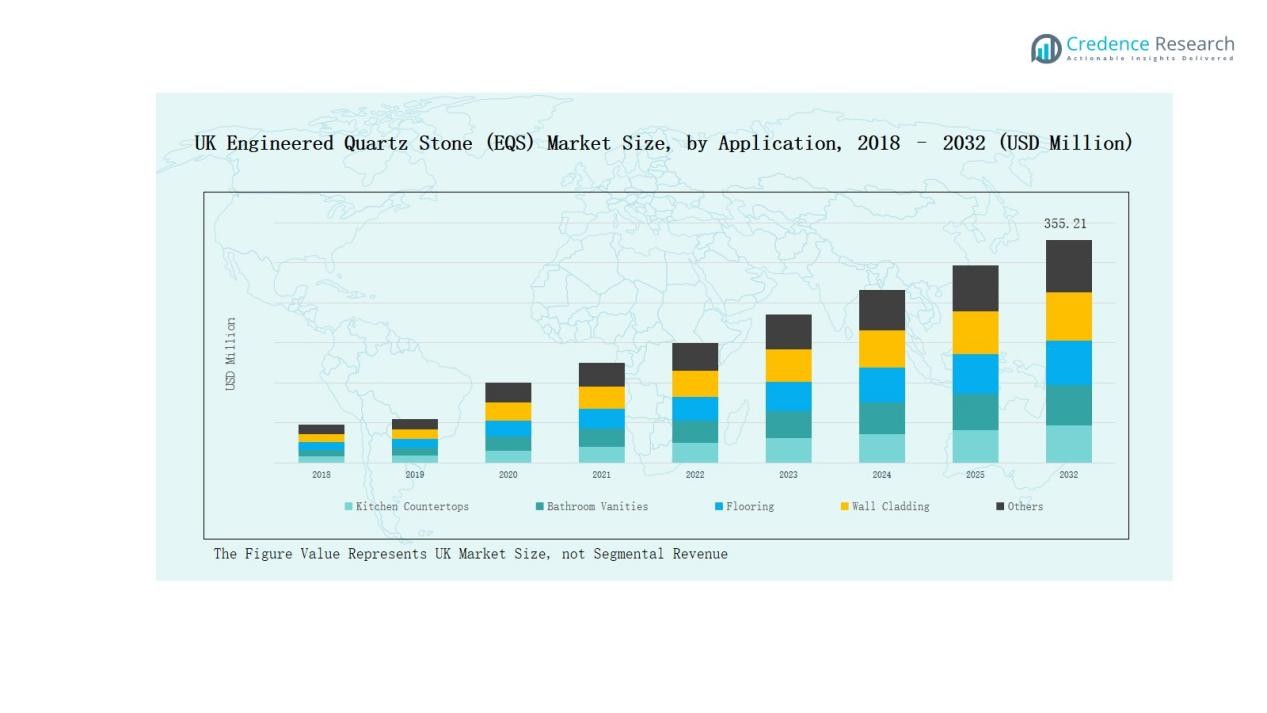

The UK Engineered Quartz Stone (EQS) Market size was valued at USD 138.03 million in 2018, reached USD 208.63 million in 2024, and is anticipated to reach USD 355.21 million by 2032, at a CAGR of 6.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Engineered Quartz Stone (EQS) Market Size 2024 |

USD 208.63 Million |

| UK Engineered Quartz Stone (EQS) Market, CAGR |

6.40% |

| UK Engineered Quartz Stone (EQS) Market Size 2032 |

USD 355.21 Million |

The UK Engineered Quartz Stone (EQS) Market is shaped by leading players including Caesarstone, Silestone, COMPAC, Unistone UK, Cosentino, Stone Italiana, Cambria UK, Wilsonart, Cimstone UK, and Quartzforms UK. These companies drive growth through extensive product portfolios, innovative finishes, and sustainable manufacturing practices, strengthening their positions across both residential and commercial applications. Their strategies focus on customization, eco-friendly solutions, and strong partnerships with distributors and builders to enhance market penetration. Northern UK led the market with 34% share in 2024, supported by rapid urban housing projects, commercial infrastructure development, and strong consumer demand for durable, stylish interiors.

Market Insights

Market Insights

- The UK Engineered Quartz Stone (EQS) Market grew from USD 138.03 million in 2018 to USD 208.63 million in 2024 and will reach USD 355.21 million by 2032.

- Kitchen countertops led applications with 47% share in 2024, followed by bathroom vanities at 24%, flooring and wall cladding at 21%, and other uses at 8%.

- Distributors and dealers dominated distribution with 40% share, while direct sales captured 29%, home improvement retailers held 19%, and other channels including online platforms accounted for 12%.

- Northern UK led the market with 34% share in 2024, supported by urban housing, commercial developments, and strong distributor networks driving higher adoption of engineered quartz surfaces.

- Key players include Caesarstone, Silestone, COMPAC, Unistone UK, Cosentino, Stone Italiana, Cambria UK, Wilsonart, Cimstone UK, and Quartzforms UK, focusing on innovation and sustainability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Application

Kitchen countertops dominated the UK Engineered Quartz Stone (EQS) Market with 47% share in 2024. This leadership is driven by increasing residential renovations and consumer preference for durable and stylish surfaces. Bathroom vanities followed with 24% share, supported by growth in premium housing projects and remodeling activities. Flooring and wall cladding together accounted for 21%, reflecting adoption in commercial and upscale interiors. The remaining 8% share came from other uses, including furniture and niche decorative applications.

For instance, Silestone by Cosentino introduced Sunlit Days surfaces featuring high durability and stain resistance, widely adopted in premium kitchen and vanity installations across London.

By Distribution Channel

Distributors and dealers led the UK EQS market with 40% share in 2024, supported by wide networks ensuring consistent product availability across regions. Direct sales captured 29%, driven by partnerships with contractors and large-scale builders. Home improvement retailers held 19% share, reflecting rising consumer adoption through DIY projects and retail availability. The remaining 12% was contributed by other channels, including online platforms and specialty outlets, which are expanding as digital retail and e-commerce strengthen customer accessibility.

For instance, Schneider Electric relies on its national distributor base to stock and deliver its power-quality products quickly across the UK.

Key Growth Drivers

Expanding Residential Renovation Projects

The UK Engineered Quartz Stone (EQS) Market is strongly driven by rising residential renovation and remodeling activities. Homeowners increasingly choose engineered quartz for kitchen countertops and bathroom vanities due to its durability, resistance to stains, and modern aesthetics. Higher disposable income, demand for stylish interiors, and growing property upgrades contribute significantly. The government’s focus on improving housing quality and energy efficiency also supports adoption. Together, these factors ensure steady demand across residential projects, making this segment a consistent growth driver for the industry.

For instance, Caesarstone introduced its Porcelain Collection in the UK, offering surfaces designed for kitchen renovations with enhanced durability and stain resistance, appealing to homeowners upgrading interiors.

Growth in Commercial Real Estate Development

Expanding commercial construction across offices, hotels, and retail spaces boosts demand for engineered quartz in the UK. Builders and architects prefer quartz for high-traffic areas due to its durability, easy maintenance, and ability to replicate natural stone designs. Increased investment in urban commercial infrastructure projects, particularly in metropolitan areas like London and Manchester, strengthens adoption. The hospitality sector, with its focus on aesthetics and long product lifecycle, also contributes to growth. This trend positions commercial construction as a major driver of market expansion.

For instance, Quantum Quartz supplied custom slabs that replicate natural stone, favored for long-lasting surfaces in busy retail environments.

Shift Toward Sustainable Building Materials

Sustainability is becoming a central growth driver in the UK EQS market. Engineered quartz production increasingly incorporates recycled content, lower emissions, and water-saving processes. With stricter regulations on carbon footprint and rising consumer awareness, demand for eco-friendly materials is accelerating. Developers and contractors are prioritizing products that align with green building certifications. Leading manufacturers emphasize innovation in sustainable finishes and production methods to meet environmental standards. This alignment of consumer preference and regulation ensures sustainability remains a key factor supporting long-term industry growth.

Key Trends & Opportunities

Key Trends & Opportunities

Innovation in Design and Customization

The market is witnessing a strong trend toward innovative designs, finishes, and customization options. Consumers increasingly seek engineered quartz that mimics natural stone with improved durability. Manufacturers are focusing on matte, textured, and large-format slabs to meet evolving tastes. The growing preference for unique and luxurious surfaces in both residential and commercial spaces creates opportunities for premium offerings. By investing in product differentiation, companies can expand their customer base and strengthen competitiveness in the evolving UK EQS market landscape.

For instance, Cosentino’s Dekton Trillium stone, a large-format slab with a sleek matte finish, is used in premium kitchen designs in Blackheath, London, where the company leverages innovative shapes and textures to maximize functionality and aesthetics.

Expansion of Online and Retail Distribution

E-commerce platforms and home improvement retailers are creating new growth opportunities for engineered quartz in the UK. Digital channels provide easy product access and enable visualization tools for design selection, enhancing customer engagement. Rising consumer preference for convenient, research-driven purchasing further accelerates this trend. Home improvement retailers also expand reach by catering to do-it-yourself buyers. As digital transformation reshapes construction material sales, online and retail distribution will become critical in improving accessibility and capturing broader consumer segments.

For instance, Caesarstone introduced a virtual tour of its London showroom, letting shoppers view 2.8-metre-high slab displays online from anywhere in the UK.

Key Challenges

High Market Competition and Price Sensitivity

The UK EQS market is highly competitive, with international and domestic brands vying for share. Intense rivalry pressures companies to compete on pricing, reducing profitability. Customers often compare quartz with alternatives such as granite, marble, and ceramics, challenging premium pricing strategies. While high-end buyers prioritize quality and design, cost-sensitive consumers may choose cheaper substitutes. This competitive environment forces players to focus on differentiation, innovation, and efficiency, but price sensitivity continues to pose a major obstacle for sustained growth.

Supply Chain and Raw Material Volatility

Fluctuations in raw material prices and global supply chain disruptions present significant challenges. Quartz aggregates and resin, key inputs, often depend on imports, making the UK market vulnerable to international trade restrictions and currency variations. Rising transportation costs further increase production expenses, impacting profitability. Unpredictable supply also creates planning difficulties for manufacturers and distributors. Companies must develop stronger supplier relationships and diversify sourcing strategies to mitigate these risks, ensuring stable production and delivery across the UK market.

Regulatory Compliance and Environmental Costs

Strict environmental regulations in the UK require significant investment in sustainable production practices. Compliance with emission controls, waste management standards, and workplace safety rules increases operational costs. Small and mid-sized companies face challenges in maintaining profitability while meeting these requirements. Larger firms adapt through advanced technology and eco-friendly processes, but the financial burden can be high. While these regulations drive long-term sustainability and demand, they create short-term pressures on manufacturers, limiting flexibility and raising barriers for smaller players.

Regional Analysis

Northern UK

Northern UK held the leading position in the UK Engineered Quartz Stone (EQS) Market with 34% share in 2024. Strong demand in cities like Manchester and Leeds is driven by ongoing residential renovations and urban housing projects. It benefits from large-scale commercial developments where quartz is widely used for countertops and flooring. Distributors and dealers maintain strong networks across the region, ensuring consistent product availability. It also reflects growth from hospitality investments, where quartz is favored for aesthetics and durability.

Southern UK

Southern UK accounted for 28% share in 2024, supported by extensive luxury housing projects and retail expansions. London remains a key growth hub, with high adoption in both residential and commercial applications. Kitchen countertops dominate demand, driven by affluent consumers seeking modern and durable interiors. Commercial spaces, including offices and hotels, also rely on quartz for its long lifecycle and low maintenance. It benefits from the presence of premium players and advanced distribution channels catering to large-scale projects.

Western UK

Western UK captured 21% share in 2024, driven by steady growth in residential remodeling and regional infrastructure upgrades. Coastal developments and mid-sized housing projects contribute to expanding quartz adoption in flooring and wall cladding. Distributors play a significant role in ensuring product availability across urban and semi-urban markets. Consumers value quartz for its versatility and modern design features, boosting demand in lifestyle-focused renovations. It shows consistent performance with opportunities emerging from sustainable construction initiatives in regional cities.

Eastern UK

Eastern UK represented 17% share in 2024, supported by industrial development and steady commercial expansion. Offices, retail outlets, and small-scale housing projects drive demand for engineered quartz applications. Bathroom vanities and kitchen countertops remain the core segments, while adoption in flooring is growing. Regional distributors expand market reach by serving smaller cities and towns. It reflects reliable growth through ongoing construction projects and the rising preference for durable, design-oriented surfaces across both residential and commercial spaces.

Market Segmentations:

Market Segmentations:

By Application

- Kitchen Countertops

- Bathroom Vanities

- Flooring

- Wall Cladding

- Others

By Distribution Channel

- Direct Sales

- Distributors/Dealers

- Home Improvement Retailers

- Others

By Region

- Nortehrn UK

- Western UK

- Southern UK

- Eastern UK

Competitive Landscape

The UK Engineered Quartz Stone (EQS) Market is moderately consolidated, with international and regional players competing to capture demand across residential and commercial applications. Leading companies such as Caesarstone, Silestone, COMPAC, Unistone UK, Cosentino, Stone Italiana, Cambria UK, Wilsonart, Cimstone UK, and Quartzforms UK drive competition through extensive product portfolios, strong brand recognition, and distribution partnerships. These players emphasize innovation in colors, textures, and finishes to differentiate from natural stone alternatives and attract premium customers. Sustainability also plays a central role, with major firms adopting recycled content and eco-friendly production methods to align with regulatory standards. While larger players dominate premium segments, regional companies focus on affordability and localized networks to reach cost-sensitive buyers. Growing emphasis on digital presence, e-commerce platforms, and collaboration with builders and designers further intensifies competition. The market remains dynamic, shaped by innovation, sustainability, and the ability to meet evolving consumer preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Caesarstone

- Silestone

- COMPAC

- Unistone UK

- Cosentino

- Stone Italiana

- Cambria UK

- Wilsonart

- Cimstone UK

- Quartzforms UK

Recent Developments

- In January 2025, Vadara Quartz Surfaces expanded into the UK through a distribution partnership with The Thomas Group.

- In February 2025, Brachot introduced Unistone UniQ, a crystalline silica–free quartz slab for the market.

- In April 2024, NMR Stone Limited strengthened its UK presence by acquiring Chichester Stoneworks.

Report Coverage

The research report offers an in-depth analysis based on Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will expand with rising home renovation and remodeling projects across major UK cities.

- Kitchen countertops will remain the leading application, supported by consumer preference for durable and stylish interiors.

- Bathroom vanities will gain momentum, driven by growth in premium housing and modern design trends.

- Commercial adoption will rise in hotels, offices, and retail spaces due to long lifecycle benefits.

- Sustainable and recycled quartz products will see stronger demand under stricter environmental regulations.

- Northern UK will continue leading the market, supported by urban development and housing upgrades.

- Online retail platforms and visualization tools will strengthen consumer engagement and widen accessibility.

- Innovation in colors, finishes, and large-format slabs will drive growth in premium offerings.

- Partnerships between manufacturers and builders will improve distribution efficiency and project-based adoption.

- Competition will intensify as domestic and international players expand with new product portfolios.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: