Market Overview

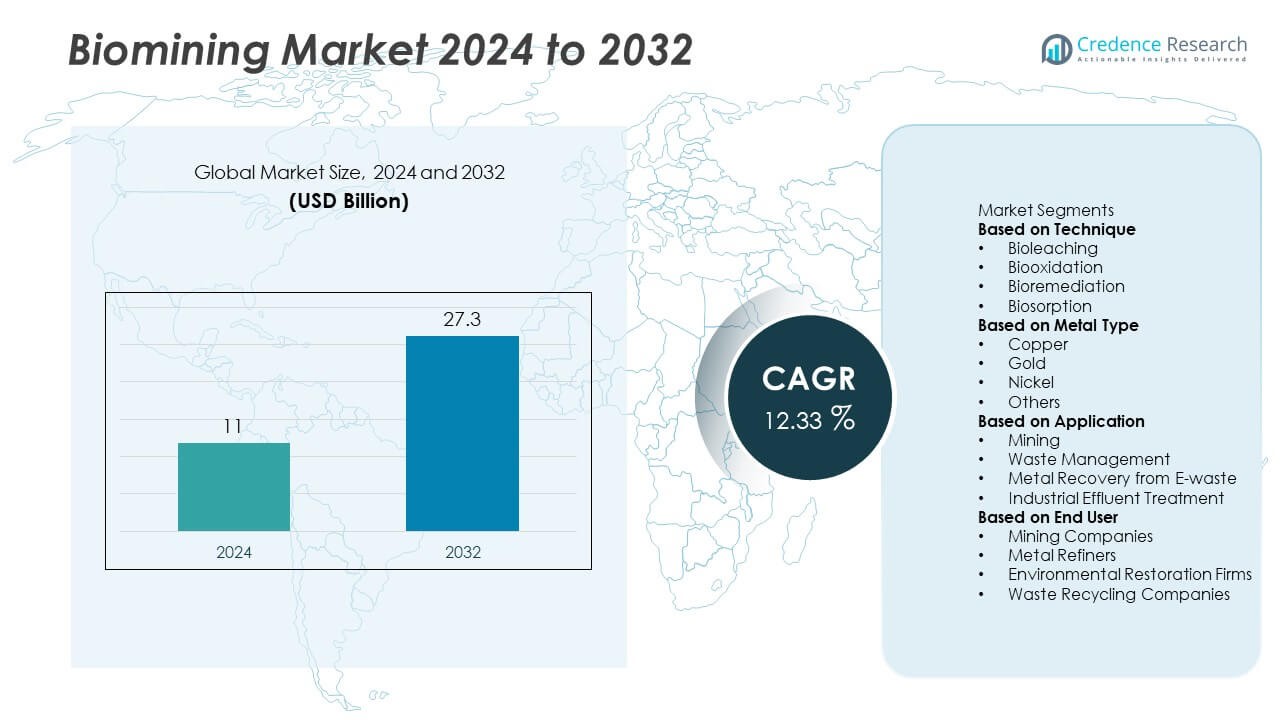

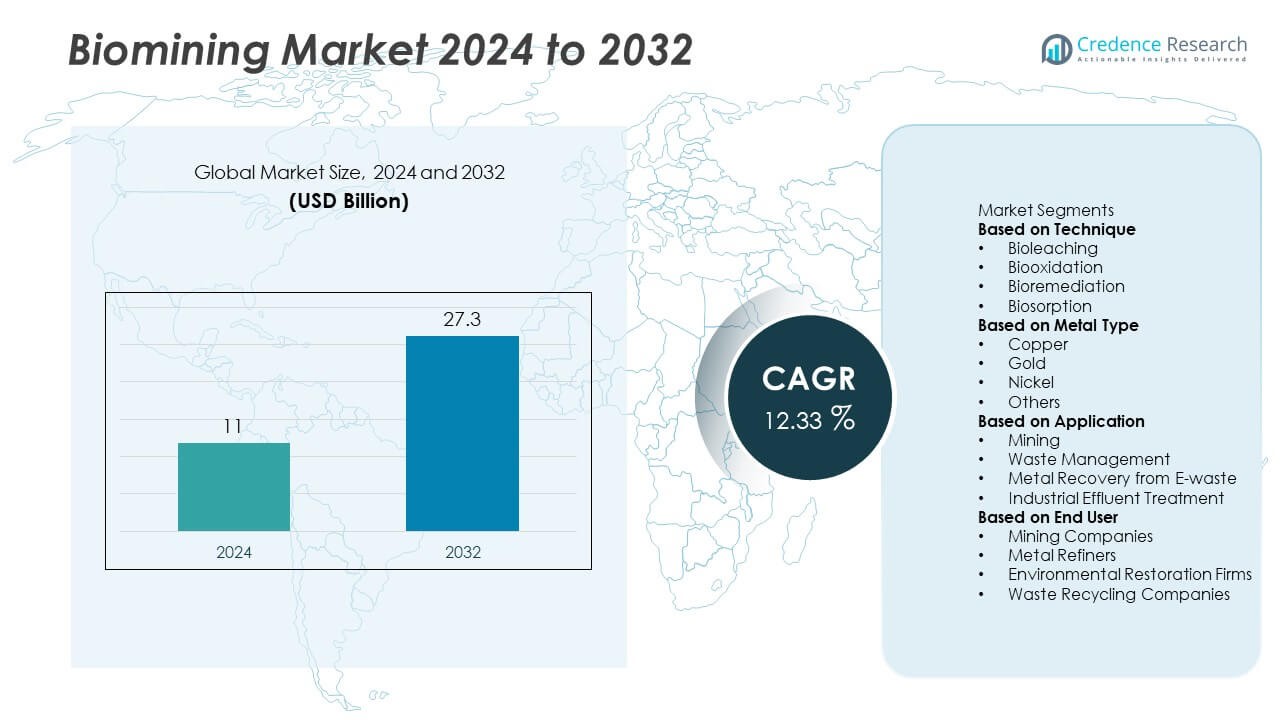

The Biomining Market was valued at USD 11 billion in 2024 and is projected to reach USD 27.3 billion by 2032, growing at a 12.33% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biomining Market Size 2024 |

USD 11 Billion |

| Biomining Market, CAGR |

12.33% |

| Biomining Market Size 2032 |

USD 27.3 Billion |

Top players in the Biomining market include Biomine USA, Rio Tinto, BHP Group, Freeport-McMoRan, Glencore, Anglo American, Metso Outotec, Barrick Gold Corporation, Denison Mines, and BioteQ Environmental Technologies. These companies strengthen their positions by adopting advanced bioleaching and biooxidation technologies to recover metals from low-grade ores, mining waste, and e-waste streams while reducing environmental impact. Their focus on microbial optimization, bioreactor efficiency, and sustainable processing helps drive market expansion. North America leads the market with a 33% share, supported by strong mining infrastructure and high adoption of eco-friendly extraction methods, followed by Asia Pacific and Europe with growing biomining applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Biomining market reached USD 11 billion in 2024 and will grow at a 12.33% CAGR through the forecast period.

- Demand rises as mining companies adopt eco-friendly extraction methods, using bioleaching and biooxidation to process low-grade ores while meeting strict environmental regulations.

- Key trends include rapid growth of microbial metal recovery from e-waste and strong advancement in engineered microorganisms, with bioleaching leading the technique segment at a 46% share.

- Competition intensifies as major players expand bioreactor capabilities and invest in microbial engineering, though slow processing rates and limited effectiveness for certain ore types remain restraints.

- North America leads regional adoption with a 33% share, followed by Asia Pacific at 28% and Europe at 27%, supported by strong mining investment, sustainability initiatives, and rising demand for battery and critical metals.

Market Segmentation Analysis:

By Technique

Bioleaching dominates the technique segment with a market share of 46%, driven by its efficiency in extracting metals from low-grade ores while reducing energy use and chemical dependence. This method supports sustainable mining by lowering emissions and minimizing waste generation. Biooxidation gains traction in gold and refractory ore processing, while bioremediation plays a key role in restoring contaminated soils and mine tailings. Biosorption expands across industrial effluent treatment. Growing demand for environmentally sound extraction practices continues to strengthen bioleaching’s leadership in large-scale mining operations.

- For instance, companies like Rio Tinto utilize bioleaching in their operations to extract copper from low-grade ores, significantly reducing energy consumption by up to 30% compared to traditional methods.

By Metal Type

Copper leads the metal type segment with a market share of 41%, supported by extensive adoption of bioleaching for low-grade copper sulfide ores. The process lowers operational costs and enables extraction from deposits unsuitable for conventional methods. Gold follows, driven by rising use of biooxidation to improve recovery from refractory ores. Nickel gains momentum as demand rises for battery-grade materials. Other metals, including cobalt and rare earth elements, show growing potential. Increasing need for sustainable metal recovery reinforces copper’s dominant position in biomining applications.

- For instance, Freeport-McMoRan uses bioleaching at its Morenci mine, extracting copper from ore with lower grades that would otherwise be unprofitable to mine, thus enhancing operational efficiency.

By Application

Mining holds the dominant share in the application segment with a market share of 52%, as companies use biomining to improve extraction efficiency and reduce environmental impact. The method offers strong benefits for processing low-grade ores and reducing waste volumes. Waste management applications grow due to rising need for bioremediation of contaminated mining zones. Metal recovery from e-waste expands quickly as industries seek cost-effective, eco-friendly extraction of copper, gold, and rare elements. Industrial effluent treatment also advances, supported by biosorption technologies. Mining’s strong operational suitability keeps it the leading application.

Key Growth Drivers

Growing Need for Eco-Friendly Metal Extraction

Demand for sustainable extraction methods drives strong adoption of biomining across global mining operations. Companies seek alternatives to energy-intensive smelting and chemical-heavy leaching to reduce emissions and environmental damage. Bioleaching and biooxidation offer lower operating costs, reduced waste generation, and improved efficiency for low-grade ores, making them suitable for large-scale use. Rising global pressure to adopt greener technologies strengthens the shift toward biological metal recovery, especially as mining firms commit to decarbonization and environmentally responsible extraction practices.

- For instance, the Zijinshan mine in China, operated by Zijin Mining Industry Co., uses commercial bioleaching to treat low-grade copper ore, achieving an estimated 80% recovery of copper with the process also reportedly leading to energy savings and a reduction in greenhouse gas emissions compared to conventional smelting.

Rising Demand for Critical and Battery Metals

The increasing demand for copper, nickel, cobalt, and rare earth elements fuels the growth of biomining as conventional reserves decline and ore grades drop. Biomining techniques help extract metals from complex, refractory, or low-grade ore bodies that traditional methods cannot exploit economically. The expansion of electric vehicles, renewable energy systems, and electronics accelerates the need for sustainable metal recovery. Biomining supports long-term supply security by enabling extraction from unconventional deposits while maintaining lower environmental impact.

- For instance, Vale S.A. has partnered with the Mining Innovation, Rehabilitation, and Applied Research Corporation (MIRARCO) on an industrial research program to develop, pilot, and work towards commercializing bioleaching processes for recovering nickel and cobalt from mine waste and low-grade pyrrhotite tailings in Ontario, Canada, improving the potential recovery of metals from materials that would otherwise be considered waste.

Expansion of Bioremediation and Waste Recovery Applications

The market grows as industries adopt biomining technologies to treat contaminated soils, tailings, and metal-laden effluents. Bioremediation and biosorption provide cost-effective solutions for cleaning mining waste, recovering valuable metals, and reducing long-term environmental liabilities. Growing regulations on waste disposal, water contamination, and land restoration strengthen adoption across mining, industrial processing, and waste management sectors. Rising interest in circular economy practices further boosts the use of microbial recovery systems to extract metals from e-waste and industrial residues.

Key Trends & Opportunities

Growth of E-Waste Metal Recovery Using Microbial Processes

A major trend involves expanding biomining applications in e-waste recycling to recover gold, copper, nickel, and rare earth elements from discarded electronics. Microbial processes offer safer alternatives to hazardous chemical methods and improve recovery yields from complex waste streams. This trend creates opportunities for scalable, low-energy recycling plants in regions experiencing rapid electronic waste generation. The shift toward sustainable urban mining strengthens the role of biomining as a key technology in metal recovery from secondary sources.

- For instance, Umicore, a global leader in materials technology, uses a unique pyro-hydrometallurgical process in their electronic waste and battery recycling facilities, combining high-temperature smelting with subsequent chemical treatment, which enables high recovery rates for precious metals like gold and valuable battery metals such as cobalt, nickel, and copper.

Advancements in Microbial Engineering and Bio-Reactors

Technological progress in microbial engineering, genetic modification, and controlled bioreactor systems is improving extraction speeds, metal recovery rates, and process stability. Engineered microbes enhance tolerance to extreme conditions and increase efficiency for multiple metals. Advanced reactors allow precise control of temperature, aeration, and nutrient conditions, enabling continuous and high-yield operations. These developments open opportunities for commercializing biomining in large-scale industrial operations and expanding use across diverse metal categories.

- For instance, BASF has developed a chemical product called LixTRA™, a novel leaching aid that enhances bioleaching efficiency for copper recovery by increasing the wettability of ore particles.

Rising Adoption of Low-Carbon Mining Technologies

Mining companies increasingly adopt biomining to align with global decarbonization goals and ESG commitments. Bio-based extraction methods help reduce carbon emissions, energy use, and chemical discharge. This trend strengthens opportunities for biomining companies to partner with large mining firms seeking cleaner operations and regulatory compliance. Growing investments in green mining facilities and government incentives for sustainable technologies further support market expansion.

Key Challenges

Slow Processing Rates Compared to Conventional Methods

Biomining processes often operate more slowly than traditional chemical leaching or smelting, creating challenges for high-volume production environments. Operators may require longer extraction cycles to achieve desired metal recovery levels, limiting adoption in mines with tight production schedules. This constraint intensifies when handling complex ores or operating in colder climates. Companies must balance sustainability advantages with operational efficiency, and many continue investing in microbial optimization to address speed limitations.

Limited Effectiveness Across Certain Ore Types

Biomining performs well with sulfide ores but is less effective for oxide ores or materials with limited microbial accessibility. This restricts its use across broader mineral deposits and limits adoption among mining firms dependent on conventional extraction routes. Variability in ore composition, metal concentration, and mineral structure affects microbial activity and recovery rates. As a result, biomining companies must invest in research to improve compatibility with diverse ore types while addressing technical barriers that constrain full-scale implementation.

Regional Analysis

North America

North America holds a market share of 33%, driven by strong investment in sustainable mining technologies and advanced research capabilities in bioleaching and bioremediation. The region benefits from large copper and gold mining operations that increasingly adopt biomining to reduce environmental impact and process low-grade ores. Growing e-waste recycling initiatives also support market expansion. Government regulations promoting cleaner extraction methods and reduced chemical use further encourage adoption. Strong collaboration between mining companies, biotechnology firms, and research institutions positions North America as a leading market for commercial biomining applications.

Europe

Europe accounts for a market share of 27%, supported by stringent environmental regulations, strong focus on circular economy principles, and rising demand for low-carbon extraction technologies. The region invests heavily in microbial-based metal recovery to reduce reliance on imported critical minerals. Biomining is also used in soil restoration, waste management, and industrial effluent treatment. Growing interest in recovering metals from e-waste enhances market activity, especially in technologically advanced countries. Europe’s commitment to sustainable resource management and research-driven innovation strengthens its position in the global biomining landscape.

Asia Pacific

Asia Pacific holds a market share of 28%, driven by rapid industrialization, expanding mining activities, and rising metal consumption in electronics, construction, and renewable energy. Countries with large mineral reserves adopt biomining to process low-grade copper, gold, and nickel ores while reducing environmental damage. The region also witnesses strong growth in e-waste recycling, creating new opportunities for microbial extraction technologies. Government initiatives promoting sustainable mining practices and rising investments in biotechnology accelerate adoption. Asia Pacific’s strong mining output and growing research capabilities support its rising global influence.

Latin America

Latin America captures a market share of 8%, supported by abundant copper, gold, and nickel reserves and increasing use of bioleaching in large-scale mining operations. Countries with strong mineral industries adopt biomining to process low-grade ores and reduce energy-intensive smelting. Environmental concerns and community pressures encourage mining companies to integrate microbial technologies for tailings treatment and land restoration. The region also sees expanding interest in metal recovery from mining waste as governments promote sustainable extraction practices. Growing foreign investment and partnerships with global biotechnology firms support steady growth.

Middle East & Africa

The Middle East & Africa region holds a market share of 4%, driven by growing interest in sustainable mining practices across countries with significant mineral resources. The region adopts biomining to enhance extraction efficiency and manage environmental impact in copper, gold, and uranium deposits. Limited water resources encourage the use of bio-based methods that require fewer chemicals and less energy. Emerging mining projects and rising investment in resource development create new opportunities. Although adoption remains gradual, increasing focus on responsible mining and technology partnerships supports market expansion across select countries.

Market Segmentations:

By Technique

- Bioleaching

- Biooxidation

- Bioremediation

- Biosorption

By Metal Type

- Copper

- Gold

- Nickel

- Others

By Application

- Mining

- Waste Management

- Metal Recovery from E-waste

- Industrial Effluent Treatment

By End User

- Mining Companies

- Metal Refiners

- Environmental Restoration Firms

- Waste Recycling Companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major players such as Biomine USA, Rio Tinto, BHP Group, Freeport-McMoRan, Glencore, Anglo American, Metso Outotec, Barrick Gold Corporation, Denison Mines, and BioteQ Environmental Technologies. These companies strengthen their positions by integrating advanced bioleaching, biooxidation, and bioremediation technologies into mining and waste recovery operations. Their strategies focus on improving metal recovery rates from low-grade ores, expanding microbial processing capabilities, and reducing environmental impact. Many invest in R&D partnerships with biotechnology institutes to accelerate microbial strain development and optimize bio-reactor performance. Technological advancements in microbial engineering, controlled leaching environments, and real-time monitoring enhance operational efficiency. Companies also expand biomining applications into e-waste recycling and contaminated site restoration to meet rising sustainability demands. Strengthening ESG commitments, reducing chemical usage, and lowering energy consumption remain key priorities that help these players maintain competitive advantage in the global biomining market.

Key Player Analysis

- Biomine USA

- Rio Tinto

- BHP Group

- Freeport-McMoRan

- Glencore

- Anglo American

- Metso Outotec

- Barrick Gold Corporation

- Denison Mines Corp.

- BioteQ Environmental Technologies

Recent Developments

- In June 2025, Rio Tinto reported that its Mining Microbiome Analytics Platform (“M‑MAP”) project collected over 2,500 rock, water, soil and tailings samples and developed one of the largest mine‑site microbial databases in the industry.

- In 2024, Rio Tinto filed a patent application for a microbial‑assisted heap leaching process targeting copper‑containing sulfidic ores and waste materials.

- In August 2023, the BHP Group, the majority owner (57.5%) and operator of the Escondida copper mine, announced that it would complete strategic studies on options including the application of its proprietary Full SaL (Simple Approach to Leaching) technology at the mine.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technique, Metal Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of bioleaching and biooxidation will increase as mining firms target low-impact extraction.

- Demand for battery metals will accelerate biomining use in copper, nickel, and cobalt recovery.

- Engineered microorganisms will improve metal recovery rates and processing efficiency.

- E-waste recycling will emerge as a major growth area for microbial metal extraction.

- Bioremediation technologies will expand to support mine-site restoration and soil cleanup.

- Mining companies will invest more in bioreactors and controlled microbial processing systems.

- ESG commitments will drive faster replacement of chemical-heavy extraction methods.

- Governments will promote biomining through green mining policies and sustainability incentives.

- Partnerships between mining firms and biotech companies will strengthen technological innovation.

- Biomining will become a key solution for accessing metals from complex and low-grade ores.