Market Overview

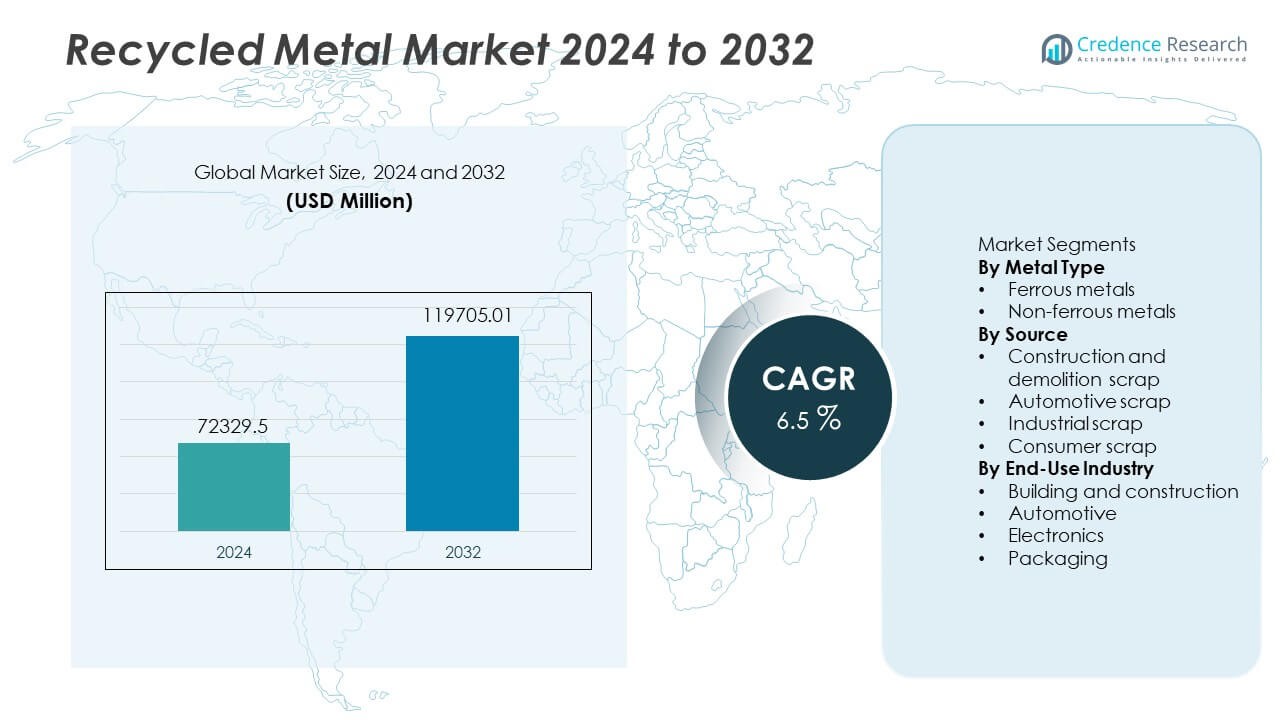

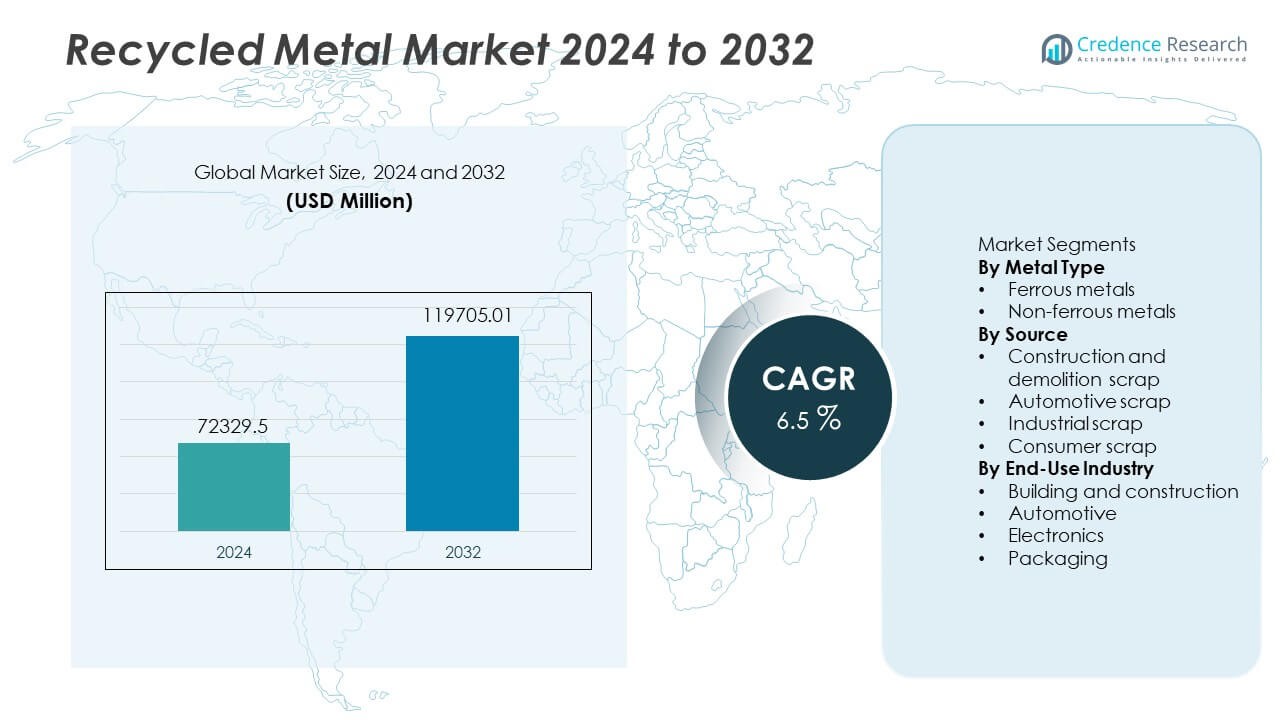

The Recycled Metal Market reached USD 72,329.5 million in 2024. The sector is projected to hit USD 119,705.01 million by 2032, reflecting a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Recycled Metal Market Size 2024 |

USD 72,329.5 Million |

| Recycled Metal Market, CAGR |

6.5% |

| Recycled Metal Market Size 2032 |

USD 119,705.01 Million |

Top players in the recycled metal market include ArcelorMittal, Nucor Corporation, Sims Limited, Schnitzer Steel Industries, Commercial Metals Company, Steel Dynamics Inc., Tata Steel, Aurubis AG, Novelis Inc., and European Metal Recycling. These companies invest in advanced scrap-processing and electric-arc furnace technologies to expand recycled output and support decarbonization goals. Asia Pacific remains the leading regional market with 45 % share, driven by large construction volumes and strong industrial demand in China, India, and Japan. Europe ranks next due to strict circular-economy regulations, while North America follows with high recycling rates across ferrous and non-ferrous segments supported by mature scrap-collection systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Recycled Metal market reached USD 72,329.5 million in 2024 and is set to hit USD 119,705.01 million by 2032 at a 6.5 % CAGR, driven by rising sustainability investment across major industries.

- Growing demand for green materials in construction and automotive boosts consumption, while public policies encourage recycling programs and higher scrap recovery from end-of-life vehicles and industrial segments.

- Key trends include wider adoption of advanced sorting systems, sensor-based separation, and electric-arc furnaces, supporting higher recycled ratios for ferrous metals, which hold nearly 62 % share within the segment mix.

- Competition intensifies as global players expand scrap networks, acquire regional recyclers, and invest in automation and low-carbon steel solutions, although fluctuating scrap quality and contamination restrain wider adoption in precision applications.

- Asia Pacific leads global demand with 45 % share, followed by Europe at 25 % and North America at 20 %, reflecting strong construction activity, regulatory pressure, and established collection systems across these regions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Metal Type

In 2024, ferrous metals account for roughly 62 % of the recycled metal market, making them the dominant sub-segment. Demand remains strong because steel—mainly from iron and ferrous alloys-serves as the backbone of infrastructure and construction materials worldwide. Recycling firms favor ferrous scrap due to its high availability from old buildings, railways, and industrial machinery. Lower processing costs and stable demand support its lead over non-ferrous metals, whose share hovers around 38 %. Rising infrastructure projects and steel-intensive construction keep driving ferrous metal recycling volumes upward.

- For instance, worldwide scrap-based steel production used around 650 million tonnes of scrap per year vs about 1,869 million tonnes of total crude steel production.

By Source

The automotive scrap sub-segment leads the recycled-metal supply chain, contributing about 45 % of total scrap volume. End-of-life vehicles yield large quantities of steel, aluminum, and other metals that recyclers reclaim at scale. Regulatory pressure for sustainable disposal and incentives for metal recovery further boost automotive-scrap recycling. Construction and demolition scrap follow closely, but automotive scrap remains the most consistent feedstock. The reliable inflow, high metal concentration, and established scrap-collection networks make it the dominant source sub-segment in the market.

- For instance, typical passenger cars contain about 800 kg of steel, making them a rich source of recycled metal when dismantled at end-of-life.

By End-Use Industry

In the end-use breakdown, the building and construction sector commands roughly 50 % of recycled metal consumption. Recycled steel re-enters as structural beams, rebar, and reinforcement materials in residential and commercial projects. Urbanization, infrastructure upgrades, and green-building standards drive this high demand. The automotive industry ranks next, followed by electronics and packaging. Still, construction’s sheer scale and continuous demand give it the dominant position. As sustainable construction practices grow, demand for recycled metal in this sector is likely to strengthen further.

Key Growth Drivers

Growing Demand for Sustainable Materials

Recycled metals support lower carbon emissions and help cut energy use during production. Many governments promote metal-recycling targets through regulations and green incentives. Manufacturers in construction, automotive, and packaging prefer recycled inputs due to sustainability goals and lower raw-material volatility. Companies report lower lifecycle costs after shifting toward secondary metals. Growing public focus on resource preservation also raises awareness across heavy industries. These factors encourage higher collection efforts, better sorting systems, and industrial partnerships. Increasing global investments in circular economy programs continue to push recycled-metal adoption in both emerging and developed regions.

- For instance, a major steel producer using electric-arc-furnace (EAF) technology emits less than one-third of greenhouse-gas intensity compared to conventional blast-furnace steelmaking when using scrap as feedstock.

Expansion in Construction and Infrastructure Projects

Large public infrastructure plans in Asia Pacific, North America, and Europe increase recycled-steel usage in bridges, roads, and commercial buildings. Construction firms use recycled rebar and beams to meet green certification requirements. Infrastructure modernization projects produce significant ferrous scrap, which returns to the supply cycle. Government-funded housing and urban redevelopment improve demand visibility. Building codes gradually encourage material recycling to cut landfill pressure. Increased steel intensity in infrastructure projects also makes recycled metal a reliable option. Growing urban construction in developing countries further strengthens market growth during the forecast period across global regions.

- For instance, when producing one tonne of steel via the EAF route (using recycled scrap), energy consumption drops to about 9–12.5 GJ per tonne, compared to 28–31 GJ per tonne for traditional blast-furnace methods.

Increasing Metal Recovery from End-of-Life Vehicles

Automotive-scrap flows rise because modern vehicles contain more lightweight metals such as aluminum. Strict vehicle-scrappage rules push organized recycling and regulated dismantling centers. Recovered metals feed back into automotive, machinery, and industrial supply chains. Growing electric-vehicle fleets are expected to produce new streams of copper and aluminum. Many automotive manufacturers integrate recycled metals to reduce environmental scores and support closed-loop systems. Higher end-of-life recovery rates also reduce land waste and lower mining dependency. Improved vehicle dismantling, better sorting technology, and regulatory support continue to drive automotive-scrap recycling across global markets.

Key Trends and Opportunities

Rising Use of Advanced Sorting and Sensor Technologies

Automated sorting systems, including optical, magnetic, and sensor-based equipment, improve metal separation accuracy and raise yield rates. Investment in AI-enabled sorting helps recyclers detect alloys and contaminants with higher precision. Better recovery rates improve supply consistency for steel and non-ferrous segments. Technology upgrades lower processing losses and increase the quality of recycled metal. Many recycling plants adopt robotics for safe handling of end-of-life vehicles and demolition scrap. These tools reduce manual labor risks and enhance operational speed. Growing digitalization opens opportunities for technology providers and specialized recycling machinery suppliers worldwide.

- For instance, a global recycling-equipment company reports its optical/sensor-based sorting lines consistently recover up to 98 % of marketable non-ferrous metals from mixed scrap loads greatly reducing waste and improving purity.

Emerging Opportunities in Green Steel Production

Steelmakers invest in lower-emission furnaces that use recycled scrap rather than iron ore. Policies supporting green steel encourage scrap-based steelmaking through emission-reduction targets. Global automakers and construction firms seek low-carbon steel to meet sustainability guidelines. This preference increases demand for recycled metallic feedstock. Scrap-based electric-arc furnaces offer significant emission savings compared to traditional blast furnaces. Countries investing in green infrastructure create new demand centers for recycled metals. These initiatives provide long-term opportunities for recycling stakeholders, furnace manufacturers, and steel producers seeking sustainability-linked procurement standards.

- For instance, a large U.S.-based steelmaker used scrap-based electric-arc furnaces to produce about 18.5 million tonnes of steel in 2024, recycling roughly 18 million tonnes of scrap metal the same year.

Key Challenges

Quality Variability and Contamination Issues

Scrap-quality differences reduce production efficiency and limit recycled-metal use in precision applications. Contamination from coatings, plastics, and mixed alloys requires advanced sorting and pre-processing. Many recycling plants face technical barriers when dealing with composite materials, electronic scrap, and complex automotive structures. These issues increase processing time and operational costs. Limited standardization across scrap collection also affects material visibility. Some industries require stricter purity standards that recycled metals struggle to meet consistently. Quality concerns continue to slow adoption in high-performance sectors such as aerospace and advanced electronics manufacturing across major regions.

Fluctuating Raw-Material Prices and Collection Gaps

Metal-price volatility affects collection economics and recycling margins. During periods of low primary-metal pricing, recycling becomes less profitable and discourages investment. Collection gaps remain visible in developing countries because of weak infrastructure and informal scrap-collection networks. Limited awareness restricts household scrap return rates. Rising operational and labor costs also impact profitability in fragmented scrap markets. Uneven global regulations cause supply inconsistencies, increasing risk for recycling firms. These factors restrict continuous feedstock supply and raise uncertainty in long-term capacity planning for recyclers and downstream industries worldwide.

Regional Analysis

North America

North America holds 20 % of the recycled metal market on strong industrial recycling systems and well-established scrap collection networks. The United States leads due to high steel consumption in construction and automotive activities. Rising sustainability rules encourage recycled steel in public infrastructure and green building projects. Major steelmakers expand electric-arc furnace capacity to increase scrap usage and reduce emissions. Canada contributes sizable ferrous scrap from industrial hubs, while cross-border scrap trade supports supply balance. Ongoing plant modernization and higher end-of-life vehicle recovery continue to support regional demand for recycled metals during the forecast period.

Europe

Europe commands 25 % share driven by strong circular-economy policies and strict environmental rules. Recycling targets under EU frameworks push metal recovery from automotive, construction, and industrial waste streams. Germany and Italy operate large steel-recycling plants that adopt high scrap ratios in electric-arc furnaces. Automotive OEMs integrate recycled aluminum and steel in vehicle platforms under emission-reduction targets. Growing adoption of low-carbon steel in infrastructure helps expand ferrous scrap consumption. Rising electronic-waste collection enhances non-ferrous metal recovery. European markets maintain high quality standards that encourage investments in sorting technology and automated recycling equipment.

Asia Pacific

Asia Pacific leads the global recycled metal market with 45 % share supported by massive construction activities, rapid industrialization, and strong manufacturing bases. China operates large ferrous recycling capacity and encourages scrap-based steelmaking to reduce emissions. India expands organized scrap-processing zones to replace informal recycling practices. Japan grows non-ferrous recovery from advanced automotive and electronics markets. Urbanization, public infrastructure spending, and electric-vehicle adoption generate high demand for recycled iron, steel, copper, and aluminum. Strong government support and expanding electric-arc furnace installations further strengthen regional leadership in recycled metal consumption across major economies.

Latin America

Latin America represents 6 % of the recycled metal market backed by industrial scrap from mining, construction, and automotive activities in Mexico and Brazil. Growth remains tied to steel demand in urban infrastructure and housing projects. Scrap collection systems are improving with support from local metal processors and regional industry programs. Automotive recycling expands with end-of-life vehicle rules in key countries. Investment in modern shredding and sorting equipment enhances metal recovery and export supply. Continued industrialization, urban construction demand, and sustainability initiatives help drive recycled metal usage across emerging Latin American economies.

Middle East and Africa

Middle East and Africa account for 4 % share driven by growing construction and energy-sector projects that generate sizable ferrous scrap. Gulf countries expand infrastructure spending linked with industrial diversification and green-building plans. Scrap collection capacity improves across United Arab Emirates and Saudi Arabia as steelmakers integrate higher scrap ratios in local furnaces. Africa increases metal recycling from mining and automotive sectors, although informal collection remains common. Rising interest in circular-economy regulation and industrial reform helps expand future opportunities. Demand for low-emission materials is likely to grow with large regional infrastructure plans.

Market Segmentations:

By Metal Type

- Ferrous metals

- Non-ferrous metals

By Source

- Construction and demolition scrap

- Automotive scrap

- Industrial scrap

- Consumer scrap

By End-Use Industry

- Building and construction

- Automotive

- Electronics

- Packaging

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape includes ArcelorMittal, Nucor Corporation, Sims Limited, Schnitzer Steel Industries, Commercial Metals Company, Steel Dynamics Inc., Tata Steel, Aurubis AG, Novelis Inc., and European Metal Recycling. Leading companies expand scrap-processing capacity and adopt electric-arc furnace technology to increase recycled content and lower emissions. Many players invest in automation, robotics, and advanced sorting lines to improve scrap yield and quality. Partnerships with automotive makers and construction firms help secure long-term scrap supply and support sustainability goals. Global leaders also acquire regional recyclers to strengthen collection networks and optimize feedstock sourcing. Growing focus on low-carbon steel and green-material certification pushes companies toward emission-reduction commitments. Strategic initiatives increasingly focus on circular-economy standards, especially in Europe and North America, where policy support remains strong.

Key Player Analysis

- ArcelorMittal

- Nucor Corporation

- Sims Limited

- Schnitzer Steel Industries

- Commercial Metals Company

- Steel Dynamics Inc.

- Tata Steel

- Aurubis AG

- Novelis Inc.

- European Metal Recycling (EMR)

Recent Developments

- In October 2023, Nucor Corporation expanded River Metals Recycling through the Garden Street Iron & Metal deal. The network rose to 19 recycling facilities.

- In July 2023, Commercial Metals Company received a key permit for its West Virginia micro mill. The site is expected to start up in 2025.

- In March 2023, Commercial Metals Company (CMC) acquired Roane Metals Group LLC, a metal recycling company. This acquisition is expected to enhance the security and supply of competitively priced inputs to CMC’s steelmaking operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Metal Type, Source, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as industries shift toward low-emission raw materials.

- Green construction rules will increase recycled steel consumption in buildings.

- Electric-arc furnace adoption will support higher scrap usage in steelmaking plants.

- End-of-life vehicle programs will strengthen automotive scrap supply.

- Digital sorting systems will raise recovery rates for mixed metal streams.

- Circular-economy policies will encourage formal scrap-collection networks.

- Green-steel certification will create new procurement standards in major sectors.

- Recycling of electronics and batteries will expand non-ferrous supply pools.

- Global players will invest in advanced recycling capacity across emerging markets.

- Regional sustainability goals will keep recycled metal demand on a long-term growth path.

Market Segmentation Analysis:

Market Segmentation Analysis: