Market Overview

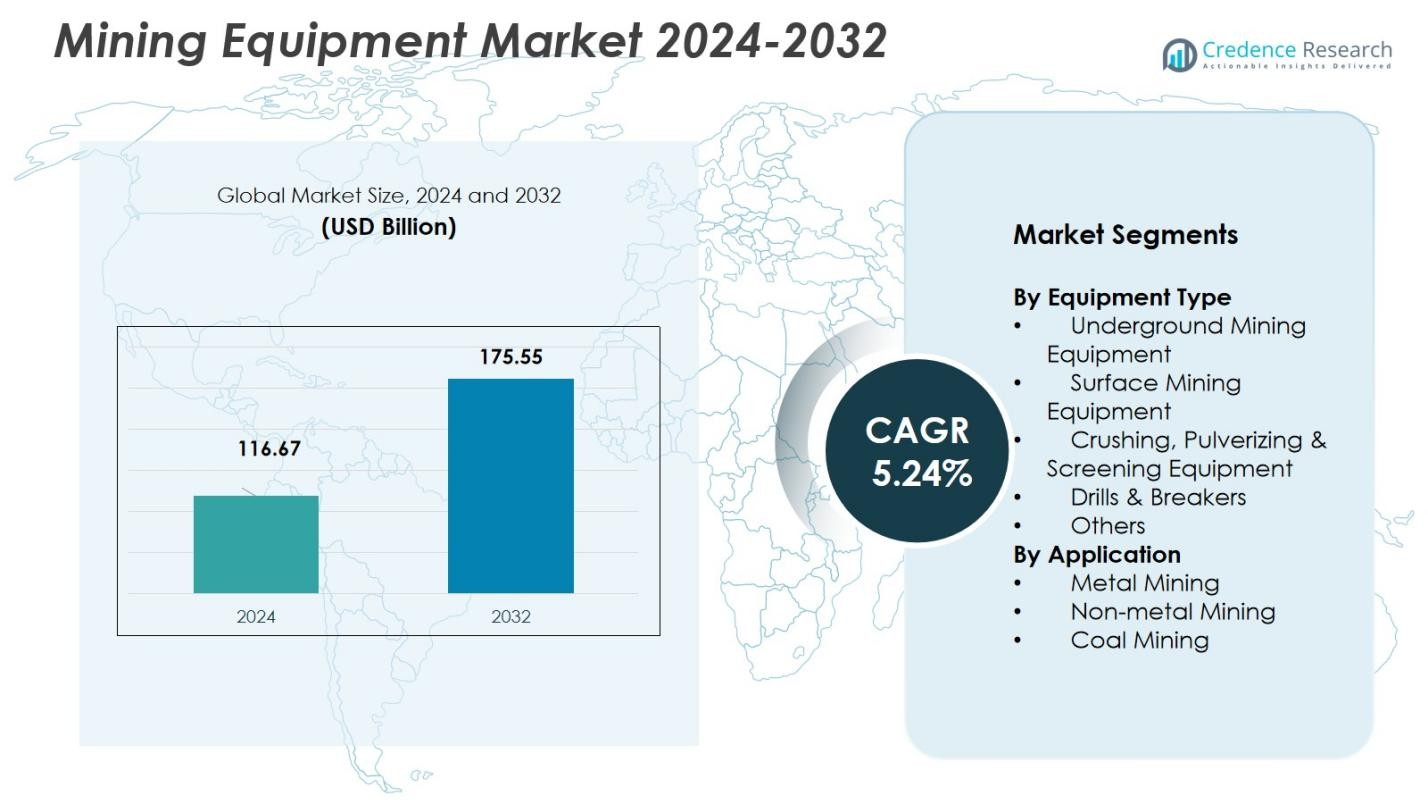

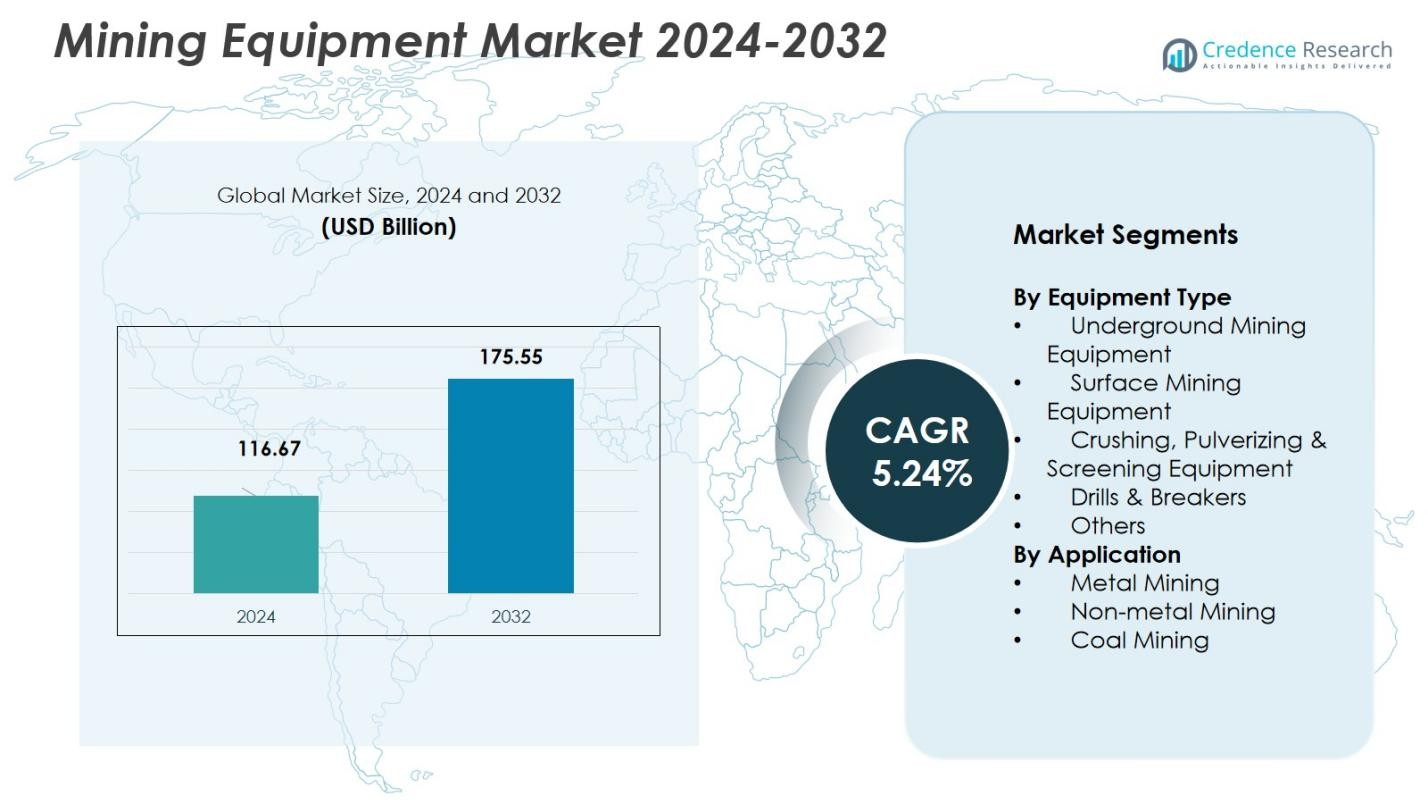

Mining Equipment Market size was valued at USD 116.67 Billion in 2024 and is anticipated to reach USD 175.55 Billion by 2032, at a CAGR of 5.24 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mining Equipment Market Size 2024 |

USD 116.67 Billion |

| Mining Equipment Market, CAGR |

5.24 % |

| Mining Equipment Market Size 2032 |

USD 175.55 Billion |

Mining Equipment Market exhibits strong leadership from major suppliers such as Caterpillar Inc., Komatsu Ltd., Epiroc AB, Sandvik AB, and Liebherr Group, which together command a significant portion of global demand. These firms supply a wide array of mining machinery from surface and underground excavators to drilling rigs, crushing systems, and material‑handling equipment enabling them to meet the varied needs of metal, coal, and non‑metal mining operations worldwide. The market’s largest region is Asia‑Pacific, holding a 61.9% share in 2024, as robust industrial growth, resource exploration, and infrastructure development across China, India, and Southeast Asia drive heavy investment in modern mining fleets. North America and Europe also contribute substantially, although at lower regional shares, while emerging regions offer growing potential for expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mining Equipment Market was valued at USD 116.67 Billion in 2024 and is projected to reach USD 175.55 Billion by 2032, growing at a CAGR of 5.24% during the forecast period.

- The demand for mining equipment is primarily driven by the increasing need for critical minerals such as copper, gold, and lithium, driven by industrialization, renewable energy transition, and technological advancements in mining operations.

- Key trends in the market include the rise of automation and AI-powered equipment, which improve operational efficiency, safety, and reduce costs. Additionally, there is a growing focus on eco-friendly and energy-efficient mining technologies.

- The market faces challenges such as high initial capital investments and strict regulatory compliance, which can limit the adoption of new technologies and equipment.

- Asia-Pacific dominates the market with a share of 61.9% in 2024, followed by North America at 18.2%. Surface Mining Equipment holds the largest share in the equipment type segment at 47.3%.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Equipment Type

The Mining Equipment Market is segmented by equipment type into Underground Mining Equipment, Surface Mining Equipment, Crushing, Pulverizing & Screening Equipment, Drills & Breakers, and Others. Among these, Surface Mining Equipment dominates the market with a share of 47.3% in 2024. This dominance is driven by the increasing demand for minerals such as coal, copper, and iron, which are predominantly extracted through surface mining methods. The growing need for efficient mining operations, combined with technological advancements in surface mining machinery, supports the segment’s expansion.

- For instance, Sandvik’s LH621 underground loader, though designed for underground mining, incorporates technology that has influenced improvements in surface equipment automation, contributing to efficiency gains across mining operations.

By Application

The Mining Equipment Market is also segmented by application into Metal Mining, Non-metal Mining, and Coal Mining. The Metal Mining segment holds the largest market share at 42.6% in 2024. This is primarily driven by the rising demand for metals like copper, gold, and aluminum, which are essential for industrial and technological applications. The continuous advancements in mining technology, particularly in equipment for extracting metals, along with growing investments in metal mining operations, contribute significantly to the growth of this segment.

- For instance, Komatsu’s PC3000-11 hydraulic excavator has been adopted widely in copper mines for its high digging power and durability.

Key Growth Drivers

Increasing Demand for Minerals

The global demand for minerals, particularly metals such as copper, gold, and coal, is a significant driver of the Mining Equipment Market. The expansion of industrial activities, particularly in the construction, automotive, and electronics sectors, has led to a surge in the need for these materials. As industries continue to grow, mining operations require more efficient and specialized equipment, driving investments in advanced mining machinery. This trend is expected to continue as countries focus on securing raw materials for their industrial growth, propelling the market forward.

- For instance, Vedanta’s investment in the Konkola Copper Mine supports increased underground development and operational efficiency.

Technological Advancements in Mining Equipment

Advancements in mining technology, such as automation, digitalization, and remote monitoring, are crucial growth drivers in the Mining Equipment Market. Automation technologies, including autonomous haul trucks and robotic drilling systems, enhance operational efficiency and reduce labor costs. Additionally, innovations in equipment design, such as energy-efficient and eco-friendly machines, support sustainable mining practices. The growing adoption of Internet of Things (IoT) and AI technologies for predictive maintenance further increases the demand for advanced mining equipment, contributing to market growth.

- For instance, Rio Tinto reached a milestone in Western Australia’s Pilbara region by moving 100 million tonnes using autonomous haul trucks, enhancing efficiency, reducing costs, and improving safety and environmental performance.

Government Initiatives and Investments

Government initiatives aimed at improving mining productivity and environmental sustainability play a vital role in driving the Mining Equipment Market. Several governments worldwide are investing heavily in upgrading their mining infrastructure and promoting sustainable practices, including resource-efficient equipment. Programs supporting the development of renewable energy and decarbonization in mining operations are expected to boost demand for advanced equipment. These initiatives not only foster technological innovation but also provide financial incentives, creating a conducive environment for the growth of the mining equipment sector.

Key Trends & Opportunities

Rise of Automation and Remote Operations

Automation is a key trend transforming the Mining Equipment Market, with the increasing integration of autonomous vehicles, robotic systems, and AI-powered equipment. This shift towards automated mining operations improves operational efficiency, reduces human errors, and enhances safety, especially in hazardous environments. The adoption of remote operation technologies allows mining companies to manage equipment from off-site locations, leading to cost savings and operational flexibility. As automation technology continues to evolve, it presents significant opportunities for growth in the market, especially in remote and complex mining environments.

- For instance, Yunnan Jinding Zinc Co., Ltd. in China employs autonomous driving trucks alongside remotely controlled excavators for open-pit mining, enhancing operational flexibility and reducing human risk in challenging terrain.

Sustainability and Eco-friendly Mining Practices

Sustainability is becoming a critical focus in the mining industry, with mining companies increasingly adopting eco-friendly technologies. The growing emphasis on reducing carbon footprints, minimizing water usage, and improving waste management has created opportunities for innovation in mining equipment. Manufacturers are now designing machinery that is energy-efficient, uses renewable energy sources, and minimizes environmental impact. As environmental regulations tighten and the demand for sustainable practices rises, there is a strong opportunity for growth in the development of green mining technologies, positioning the market for long-term expansion.

- For instance, Coal India Limited (CIL) and other public sector undertakings have integrated advanced technologies like surface miners, continuous miners, and dust control systems to reduce environmental damage and improve waste management.

Key Challenges

High Initial Capital Investment

One of the major challenges in the Mining Equipment Market is the high initial capital investment required for advanced machinery. While mining equipment is essential for operations, the upfront costs of purchasing, maintaining, and upgrading equipment can be prohibitively expensive for many companies, particularly smaller operations. These high costs limit the ability of some players to invest in the latest technologies, hindering their competitive position and slowing market growth in certain regions. As a result, the high capital expenditure remains a significant barrier to entry for new and smaller companies in the market.

Regulatory and Environmental Compliance

The mining industry is heavily regulated, with strict environmental and safety standards that equipment manufacturers and operators must adhere to. Compliance with these regulations can be challenging, particularly as governments worldwide continue to tighten environmental laws. Mining companies are under pressure to adopt equipment that meets these standards, often requiring costly modifications or replacements. Additionally, the implementation of regulations focused on reducing environmental impacts, such as carbon emissions and water usage, may require substantial investments in new equipment and technologies, creating an ongoing challenge for market participants.

Regional Analysis

Asia‑Pacific

Asia‑Pacific leads the global mining equipment market, holding a market share of 61.9% in 2024. Rapid industrialization, extensive mineral exploration, and large‑scale infrastructure development across countries such as China, India, and Indonesia drive demand. High demand for coal, metals, and rare‑earth minerals needed for electronics, construction, and energy sectors fuels investment in modern mining fleets. The region also benefits from concerted efforts toward mechanization and adoption of advanced, efficient, and safety‑compliant equipment, reinforcing its dominant position. As the largest market, Asia‑Pacific will continue to dominate the sector during the forecast period.

North America

North America ranks as the second largest region in the mining equipment market, with a market share of 18.2% in 2024. The region sees steady demand thanks to ongoing exploration, stable regulatory frameworks, and early adoption of automation and advanced mining technologies. Mining companies in the U.S. and Canada increasingly invest in modern equipment to boost productivity and meet environmental and safety standards. Strong demand for base metals and coal, coupled with modernization of existing mines, ensures sustained need for updated equipment across mining segments.

Europe

Europe contributes a meaningful portion of global mining equipment demand, holding a market share of 9.3% in 2024. Supported by mature mining operations and growing regulatory pressure for safety and environmental compliance, the region continues to experience steady demand. Although mining activity in some sub‑regions has declined, demand persists for specialized and modern underground as well as surface mining equipment to mine base metals and remnant mineral deposits. Equipment upgrades for safety, reduced emissions, and enhanced efficiency drive demand in parts of Eastern and Western Europe.

Latin America

Latin America accounted for a notable share of global mining equipment demand in 2024, with the regional market registering a market share of 7.1%. Growth in Latin America is driven by expanding metal mining activities particularly copper and gold in countries such as Chile, Peru, and Brazil along with increased mechanization and modernization of mining fleets. Adoption of automated and efficient mining equipment to meet environmental, social, and governance (ESG) norms and improve productivity offers significant growth potential across the region.

Middle East & Africa

The Middle East & Africa region is emerging as a growth frontier for mining equipment demand, holding a market share of 3.5% in 2024. Driven by resource exploration and increasing investments in mining infrastructure, demand for mining equipment for the extraction of minerals, base metals, and precious metals is rising across the region. With growing interest in sustainable practices, there is an increased preference for modern, energy-efficient equipment, which is expected to propel demand in the coming years. The region’s market share is expected to grow further as mining operations expand.

Market Segmentations:

By Equipment Type

- Underground Mining Equipment

- Surface Mining Equipment

- Crushing, Pulverizing & Screening Equipment

- Drills & Breakers

- Others

By Application

- Metal Mining

- Non-metal Mining

- Coal Mining

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Mining Equipment Market is dominated by key players such as Caterpillar Inc., Komatsu Ltd., Epiroc AB, Sandvik AB, and Liebherr Group, which hold substantial market shares through their extensive product offerings and global reach. These companies lead in various segments, including surface and underground mining equipment, drilling, and crushing technologies. Their competitive advantage is driven by continuous innovation, particularly in automation, energy efficiency, and advanced safety features, responding to the growing demand for more sustainable and cost-effective mining solutions. With automation and eco-friendly equipment becoming increasingly important, these players are focusing on integrating electric and autonomous machines into their portfolios. However, they face competition from emerging players in Asia-Pacific and other regions, who offer lower-cost alternatives, thus intensifying market rivalry. As a result, industry leaders are under constant pressure to innovate while maintaining operational efficiency to sustain their market positions.

Key Player Analysis

- Caterpillar Inc

- Komatsu Ltd

- Boart Longyear Ltd

- China Coal Energy Group Co. Ltd

- Henan Baichy Machinery Equipment Co. Ltd

- Vipeak Mining Machinery Co. Ltd

- Epiroc

- Guangdong Leimeng Intelligent Equipment Group Co. Ltd

- Metso Qutotec

- Liebherr

Recent Developments

- In November 2025, Epiroc launched the new Scooptram ST4, a 4‑tonne underground loader designed for narrow‑vein mining, enhancing productivity for compact underground operations.

- In August 2025, Liebherr formed a strategic partnership with Glencore to deliver 17 advanced excavators across Australian coal operations through 2026, underlining ongoing demand for modern fleets in coal mining regions.

- In June 2025, Komatsu also acquired Core Machinery to expand its dealership network in the southwestern United States, particularly covering Arizona and southern California, to better serve strategic mining customers in that region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global shift toward electrification and battery-powered mining equipment will accelerate adoption of zero-emission fleets.

- Growing demand for critical minerals (e.g., copper, lithium, rare earths) required for EVs, renewable energy, and high-tech industries will drive sustained investment in mining equipment.

- Increased adoption of automation, remote operations, and AI-enabled systems will improve safety, reduce human exposure to hazardous conditions, and enhance productivity.

- Pressure from stricter environmental regulations and ESG commitments will encourage mining companies to replace legacy diesel-powered fleets with cleaner, more efficient machinery.

- Demand from developing economies driven by urbanization, infrastructure expansion, and industrialization will sustain demand growth for mining equipment globally.

- Surge in metal mining (copper, lithium, critical metals) led by green energy transition and high-tech demand will shift demand share in favor of equipment for metal extraction.

- Retrofit and upgrade cycles in mature mines, especially in developed regions, will renew demand for modern, high-efficiency equipment including automated loaders, drills, and crushers.

- Growing investments in exploration of deeper and previously inaccessible deposits will spur demand for advanced underground mining equipment and robotics.

- Integration of digital services asset-management platforms, remote monitoring, predictive maintenance will add value and promote demand for “smart” mining equipment.

- Rising interest among mining companies to improve total cost of ownership through fuel efficiency, reduced downtime, and lower labor costs will favor long-term equipment investments and replacement cycles.

Market Segmentation Analysis:

Market Segmentation Analysis: