Market Overview

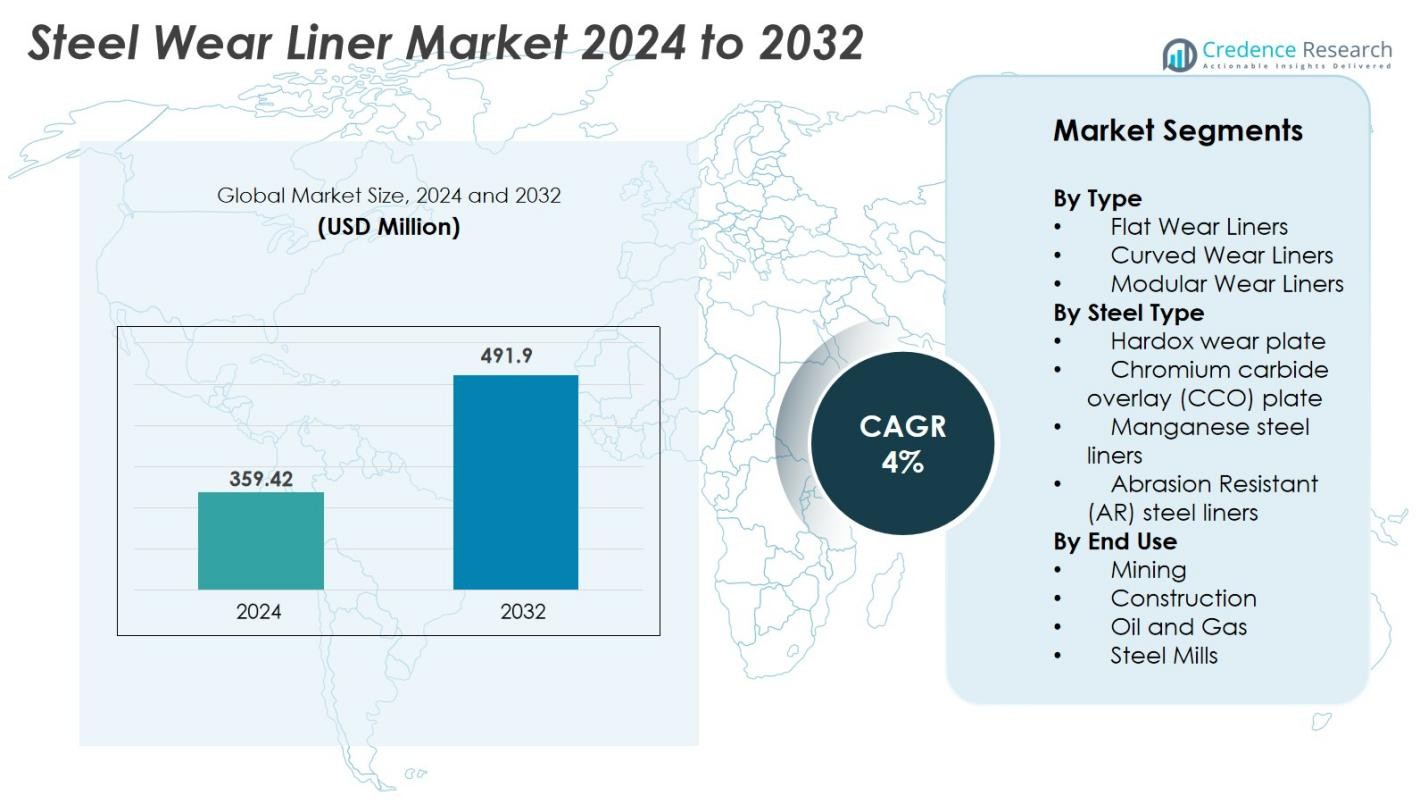

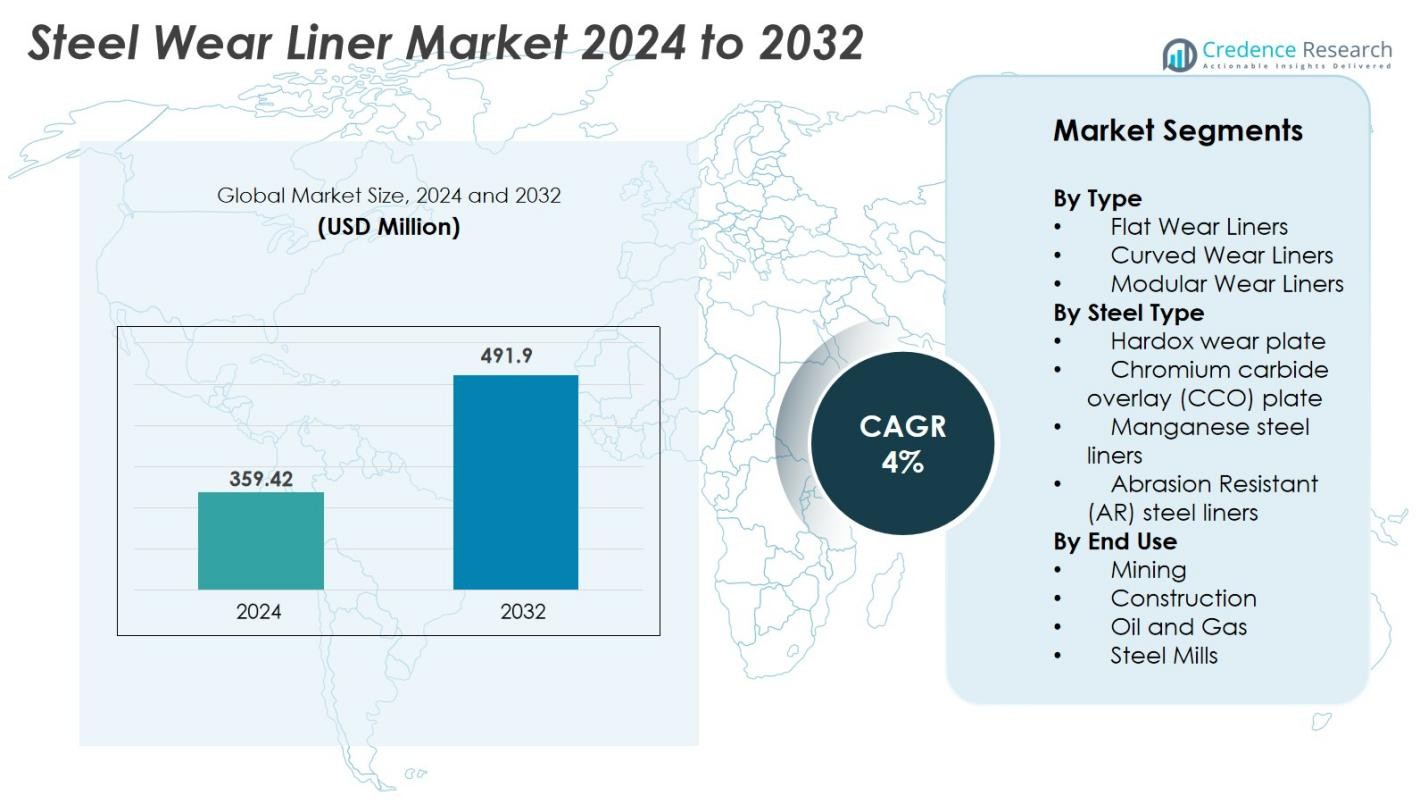

The Steel Wear Liner Market size was valued at USD 359.42 million in 2024 and is anticipated to reach USD 491.9 million by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Steel Wear Liner Market Size 2024 |

USD 359.42 Million |

| Steel Wear Liner Market, CAGR |

4% |

| Steel Wear Liner Market Size 2032 |

USD 491.9 Million |

The Steel Wear Liner Market is driven by a strong lineup of global and regional players specializing in advanced wear-resistant solutions for mining, construction, and heavy processing industries. Key companies include Magotteaux, Bradken, Metso Outotec, FLSmidth, SSAB (Duroxite), JADCO Manufacturing Inc., Columbia Steel Casting Co., Inc., H-E Parts International, CME (Crusher Wear Parts), and L&H Industrial. These players compete through product innovation, material advancements such as chromium carbide overlays, and customized liner systems. Asia-Pacific leads the market with a 38% share, driven by extensive mining activity and industrial expansion, followed by North America at 28% and Europe at 22%, supported by strong aftermarket services and technological advancements.

Market Insights

- The Steel Wear Liner Market was valued at USD 359.42 million in 2024 and is expected to reach USD 491.9 million by 2032, registering a CAGR of 4% during the forecast period.

- Increasing demand from the mining industry drives market growth, as operators seek durable wear solutions to improve equipment life and reduce downtime in abrasive environments.

- Key trends include the adoption of chromium carbide overlay (CCO) liners and the integration of predictive maintenance technologies for improved wear tracking and cost optimization.

- The market is competitive, with major players like Magotteaux, Bradken, Metso Outotec, FLSmidth, and SSAB (Duroxite) investing in advanced materials, modular liner systems, and digital solutions to maintain leadership.

- Asia-Pacific holds a 38% share, North America 28%, and Europe 22%, while Flat Wear Liners account for 45% of the type segment, demonstrating strong demand for versatile solutions across mining, construction, and heavy industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Steel Wear Liner market includes Flat Wear Liners, Curved Wear Liners, and Modular Wear Liners, each offering unique performance characteristics. Flat Wear Liners dominate the segment with approximately 45% market share due to their widespread use in conveyor systems, chutes, and bins across mining and processing operations. Their ease of installation and compatibility with large flat surfaces drive adoption. Modular Wear Liners are gaining traction for their flexibility and reduced maintenance downtime, while Curved Wear Liners are preferred for cylindrical equipment. Growth drivers include rising demand for cost-efficient maintenance and reduced equipment wear.

- For instance, Metso Outotec’s recent mill‑lining rubber product achieved wear‑life extension of 25 % compared to its predecessor in highly abrasive ore processing applications.

By Steel Type

This segment comprises Hardox wear plate, Chromium Carbide Overlay (CCO) plate, Manganese steel liners, and Abrasion Resistant (AR) steel liners. Chromium Carbide Overlay (CCO) plates lead the segment with about 40% market share, favored for their superior abrasion resistance and extended service life in high-impact environments. Hardox plates follow closely due to their blend of toughness and durability in heavy-duty applications. Manganese steel liners remain essential for high-impact crusher applications. Increasing focus on reducing operational downtime and enhancing equipment longevity is driving greater adoption of engineered steel wear solutions.

- For instance, SSAB’s Hardox 600 delivers surface hardness up to 600 HBW, supporting extended wear cycles in heavy-load applications.

By End Use

The key end-use industries for steel wear liners include Mining, Construction, Oil & Gas, and Steel Mills, where abrasive material handling and harsh operating conditions are commonplace. Mining accounts for over 50% of the market share, thanks to extensive use in crushers, screens, and conveyor systems. Rising global mineral output and investments in mine expansion drive this dominance. Construction and oil & gas sectors also leverage wear liners for heavy equipment protection. Steel mills utilize liners for material handling and furnace operations, with growing demand linked to increasing global steel production.

Key Growth Drivers

Rising Demand from Mining and Quarrying Industries

The mining and quarrying sectors remain the largest consumers of steel wear liners due to the abrasive nature of material handling processes like crushing, screening, and conveying. As global demand for minerals such as iron ore, copper, coal, and aggregates increases, operators are expanding production capacities, leading to a surge in equipment usage. This directly boosts the need for wear liners designed to withstand heavy abrasion and impact. The ongoing push toward deeper mining operations and the need to extend equipment life in harsh operating environments further drive the adoption of high-performance liners. Increased investment in automated mining systems and predictive maintenance technologies is also contributing to higher demand for wear-optimized materials and smart liner systems. Furthermore, expansions in developing regions like Asia-Pacific and Africa present lucrative growth opportunities, as these regions invest in large-scale resource extraction and infrastructure development.

- For instance, Metso Outotec reported that at Tata Steel TISCO their mill‑lining optimisation extended the wear life of the liner by 36%, significantly reducing unscheduled downtime in mining operations.

Technological Advancements in Materials and Manufacturing

Progress in metallurgy and fabrication techniques is significantly enhancing the performance and durability of steel wear liners, making them more attractive for demanding applications. Innovations such as chromium carbide overlay (CCO) plates, ultra-hard coated steels, and composite wear-resistant materials have improved abrasion resistance and extended service life. Advanced coatings, heat treatment processes, and welding techniques enable liners to withstand higher wear, reducing maintenance downtime for end users in mining, construction, and processing industries. Furthermore, the integration of digital tools like wear monitoring sensors and predictive analytics allows for preventive maintenance, optimizing replacement cycles. These technological advancements reduce total cost of ownership and align with industry demands for higher productivity and lower operational disruptions. Manufacturers who invest in R&D for next-generation wear plates and modular wear solutions are gaining a competitive edge due to their ability to offer tailored, cost-efficient solutions across diverse applications.

- For instance, SSAB’s Hardox® 500 Tuf wear plate has achieved a 50% improvement in wear resistance compared to 450 HBW AR steel in mining and quarrying applications, resulting in fewer replacements and reduced maintenance intervals. When compared to a typical 400 HBW AR steel, the wear plate can offer up to double the service life.

Growth in Construction and Infrastructure Projects

The boom in global infrastructure and construction projects, especially in emerging markets, is bolstering demand for heavy-duty equipment that relies on wear liners for protection. Activities such as road building, urban development, tunneling, and demolition require material handling equipment like crushers, grinders, and conveyors that are routinely subjected to abrasion and impact. Steel wear liners provide critical protection, extending equipment life and improving operational efficiency. As nations like India, China, Indonesia, and African economies invest in large-scale infrastructure expansion, the demand for high-strength, abrasion-resistant liners is expected to rise. In developed regions, refurbishment of aging infrastructure also fuels demand for wear-resistant components. Additionally, the growth of the demolition and recycling industry requires efficient material processing systems, creating opportunities for modular and replaceable wear liner systems. This trend will continue to drive market expansion, especially as construction equipment manufacturers integrate advanced wear-resistant materials to enhance product durability and performance.

Key Trends & Opportunities

Shift Toward Sustainable and Recyclable Steel Solutions

Sustainability is becoming a major trend in the steel wear liner market, driven by regulatory pressure and corporate commitments toward circular economy practices. Manufacturers are increasingly adopting eco-friendly production methods that reduce CO₂ emissions and resource usage. Additionally, recyclable and longer-lasting steel grades, such as Hardox and CCO plates, offer customers a more sustainable option while delivering superior performance. This shift also includes initiatives aimed at improving wear liner lifecycle and supporting recycling programs at end-of-life. Companies that prioritize sustainability in their product lines, manufacturing processes, and supply chains are expected to gain approval from environmentally conscious customers and regulatory bodies. The ability to provide certified, low-carbon steel liners is emerging as a competitive advantage, particularly in industries like mining and construction where environmental impact is closely scrutinized.

- For example, SSAB reports that Hardox wear plates retain 100% recyclability without degradation in structural properties, allowing them to be reused in new steel production, thus supporting a closed-loop recycling model.

Integration of Smart Monitoring and Predictive Maintenance Systems

The adoption of Industry 4.0 and smart mining practices is creating new opportunities for digital wear monitoring and predictive maintenance in steel wear liner applications. Advanced wear liners are increasingly being fitted with embedded sensors to track wear rates, temperature deviations, and stress points in real-time. This data enables proactive replacement planning, minimizing downtime and improving operational efficiency. AI-driven analytics provides insights to optimize liner lifecycles and performance under varying operational conditions. The rise of remote monitoring and automation technologies in mining and heavy industries further fuels adoption. Manufacturers offering integrated solutions with digital tracking capabilities are well-positioned to capitalize on this trend, especially as end-users seek to streamline maintenance and reduce unscheduled stoppages. The digitization of wear management opens new service-based revenue models for suppliers, enhancing customer value and building long-term partnerships.

- For instance, Bridon-Bekaert has integrated digital inspection services, such as their VisionTek™ optical measurement technology, for predictive critical rope performance in mining. This creates a service-based revenue stream that optimizes wear parts usage and drives customer loyalty through enhanced uptime management, often as part of collaborations with partners like ABB.

Key Challenges

High Cost of High-Performance Wear Liners

Despite their long-term benefits, high-performance wear liners made from advanced materials like chromium carbide or composite overlays come with significant upfront costs. This is a barrier for small and mid-sized operators, particularly in price-sensitive markets. High-grade liners often require complex manufacturing and machining processes, resulting in higher procurement costs. Furthermore, frequent price fluctuations in steel and alloying materials add to pricing instability. End-users may opt for cheaper alternatives with shorter lifespans to reduce immediate expenditure, slowing the adoption of premium liners. The challenge for manufacturers is to balance high-performance material innovations with cost competitiveness. Value-added service offerings, such as wear liner optimization programs or leasing models, may help offset these barriers, but overall, price sensitivity remains a limiting factor in widespread adoption, especially in developing economies.

Operational Downtime and Replacement Complexity

Another major challenge is the operational downtime associated with replacing or installing steel wear liners, particularly in large mining and processing operations. Liner replacement often demands equipment shutdown, skilled labor, and safety measures, leading to lost productivity and increased maintenance costs. The mounting complexity of modern equipment also necessitates precise installation techniques to ensure performance optimization, which not all operators are equipped to handle. Additionally, accessibility issues in remote sites and harsh environments further complicate maintenance schedules. Manufacturers are increasingly working on modular and easy-to-install liner systems, but the transition remains gradual. The challenge lies in designing wear liners that are not only durable but also easy to replace without compromising efficiency. Improving liner accessibility, reducing replacement time, and offering on-site support or training are critical measures to address this pain point.

Regional Analysis

North America

North America holds a prominent share of the Steel Wear Liner market, accounting for approximately 28% of global revenue. The region benefits from advanced mining operations in the U.S. and Canada, where demand for high-performance wear solutions is driven by increasing equipment automation and aggressive extraction activities. The oil and gas sector further fuels adoption, particularly in shale operations where abrasion resistance is crucial. Manufacturers are focusing on digital wear monitoring and predictive maintenance solutions to enhance equipment lifecycle. Continued investments in mining modernization, infrastructure rehabilitation, and steel production sustain growth, although price sensitivity can influence adoption rates in smaller operations.

Europe

Europe represents around 22% of the global Steel Wear Liner market, primarily driven by demand from the steel manufacturing, construction, and mining industries. The region places strong emphasis on sustainable manufacturing and high-quality materials that meet stringent EU standards. Countries such as Germany, Sweden, and the UK lead the adoption of advanced wear-resistant technologies, including Hardox and chromium carbide overlays. Growth is also supported by refurbishment programs in aging industrial facilities and the integration of smart materials. However, market expansion is tempered by high costs and regulatory compliance requirements, prompting local manufacturers to innovate with recyclable liner solutions and improved operational efficiency.

Asia-Pacific

Asia-Pacific dominates the Steel Wear Liner market with a market share exceeding 38%, driven by extensive mining, steel production, construction, and infrastructure development in countries like China, India, and Indonesia. The rapid growth of the mining sector combined with massive investment in industrial expansion fuels sustained demand for abrasion-resistant components. The region also benefits from local manufacturing capabilities that provide cost-effective steel liner products. Furthermore, rising foreign direct investments in heavy industries and energy sectors expand application scope. Emerging technologies, such as modular liners and predictive maintenance systems, are gradually being adopted, especially among large mining operators seeking operational efficiencies.

Latin America

Latin America holds approximately 7% of the global market, supported by robust mining activities in countries such as Brazil, Chile, and Peru. The region’s significant mineral reserves, especially in copper, iron ore, and lithium, drive demand for wear liners used in conveyors, crushers, and grinding mills. Equipment modernization and expansion projects in mining accelerate adoption, while local steel production also contributes. However, supply chain challenges and fluctuating raw material costs pose risks to steady growth. Increasing foreign investment and partnerships with global liner manufacturers are expected to boost technology adoption, enabling growth in predictive maintenance and wear optimization in the region.

Middle East & Africa (MEA)

The Middle East and Africa account for nearly 5% of the Steel Wear Liner market, with growth led by expanding mining, cement production, and construction sectors. Countries like South Africa, Ghana, and Saudi Arabia are key contributors, benefiting from increased mineral exploration and infrastructure projects. In oil-rich regions, wear liners are also used in heavy machinery for drilling and processing. However, the market is challenged by limited local production capabilities, resulting in heavy imports. As mining operations expand and modernization initiatives gain traction, opportunities emerge for suppliers offering durable, cost-efficient wear liner systems tailored to challenging environments.

Market Segmentations

By Type

- Flat Wear Liners

- Curved Wear Liners

- Modular Wear Liners

By Steel Type

- Hardox wear plate

- Chromium carbide overlay (CCO) plate

- Manganese steel liners

- Abrasion Resistant (AR) steel liners

By End User

- Mining

- Construction

- Oil and Gas

- Steel Mills

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Steel Wear Liner market is moderately consolidated, with a mix of global manufacturers and regional specialists competing based on product durability, material innovation, and customized liner solutions. Key players such as Magotteaux, Metso Outotec, Bradken, and FLSmidth lead with advanced steel liner systems and broad geographic presence, offering solutions tailored for mining, processing, and heavy industrial applications. Companies like SSAB (Duroxite) and JADCO Manufacturing Inc. excel in producing high-performance overlay and abrasion-resistant plates, while Columbia Steel Casting Co., Inc. and H-E Parts International provide engineered designs for crushers and wear-prone equipment. Emerging providers such as CME (Crusher Wear Parts) and L&H Industrial are gaining market share through aftermarket services and high-strength liner materials. Innovation in overlay technology, digital wear monitoring, and modular liner systems is key to competitive differentiation, while partnerships, supply chain optimization, and expansion into emerging markets define strategic priorities for leading manufacturers.

Key Player Analysis

- Magotteaux

- Columbia Steel Casting Co., Inc.

- L&H Industrial

- Bradken

- FLSmidth

- JADCO Manufacturing Inc.

- CME (Crusher Wear Parts)

- Metso Outotec

- Duroxite by SSAB

- H-E Parts International

Recent Developments

- In June 2025, Metso entered into a three‑year supply agreement with BHP Group to provide metallic liners (including cast wear liners and XAlloy™ metallic liners) for chute‑lining solutions in BHP’s Western Australia iron‑ore operations.

- In July 2025, Metso Corp. announced the acquisition of the recycling operations and induction‑heating technology development capabilities of Finland‑based TL Solution, aimed at enhancing its mill‑lining recycling technology and customer service offerings

- In September 2025, Tega Industries Limited, in consortium with Apollo Global Management affiliates, announced plans to acquire Molycop for about USD 1.5 billion. The acquisition is intended to combine Molycop’s grinding‑media portfolio with Tega’s wear‑resistant liners and material‑handling solutions to create an end‑to‑end offering in the mining consumables space.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Steel Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-performance wear liners will grow as mining and construction sectors expand and modernize globally.

- Adoption of advanced wear-resistant materials like chromium carbide overlay and composite liners will rise.

- Digital wear monitoring and predictive maintenance solutions will become standard, reducing unplanned equipment downtime.

- Modular liner systems designed for faster installation and replacement will gain widespread adoption.

- Sustainability and recyclability of steel liners will drive innovation and influence purchasing decisions.

- Emerging markets in Asia-Pacific and Africa will create new growth opportunities for manufacturers.

- Integration of AI and IoT for real-time wear analysis will enhance maintenance planning and operational efficiency.

- Manufacturers will focus more on aftermarket services and lifecycle support to build customer loyalty.

- Hybrid and custom liner solutions will be in demand for specific heavy-duty applications.

- Strategic partnerships and regional expansions will shape competitive positioning in the global market.