Market Overview:

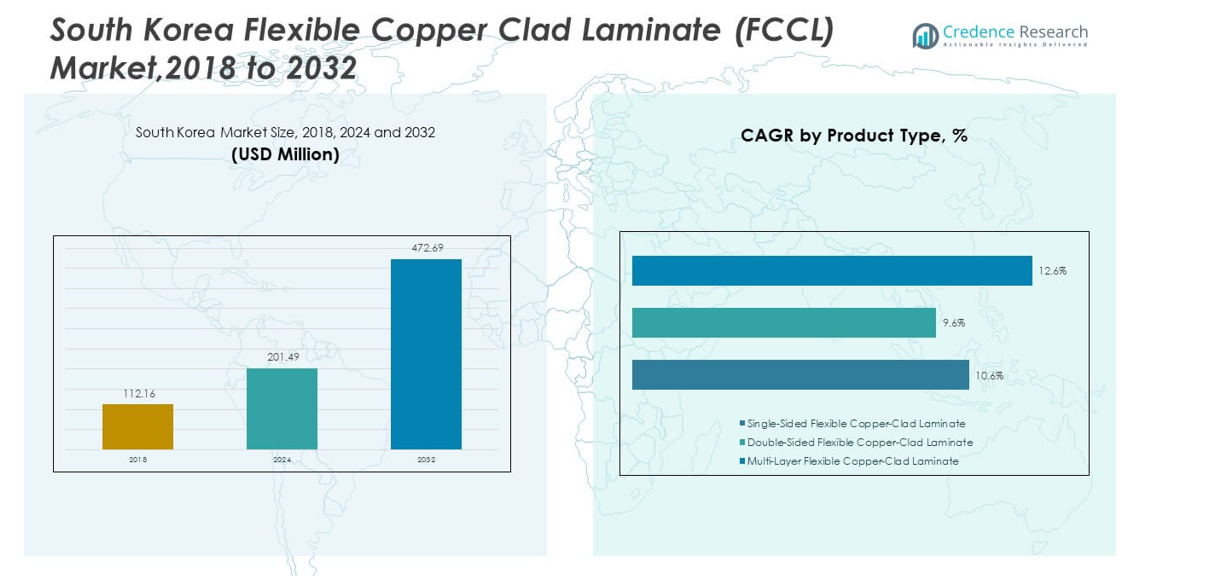

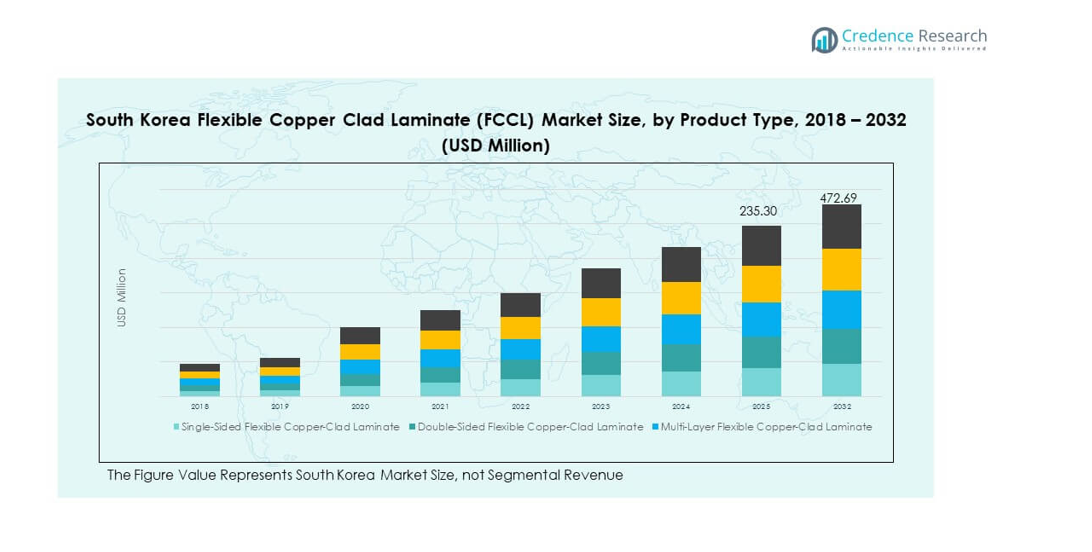

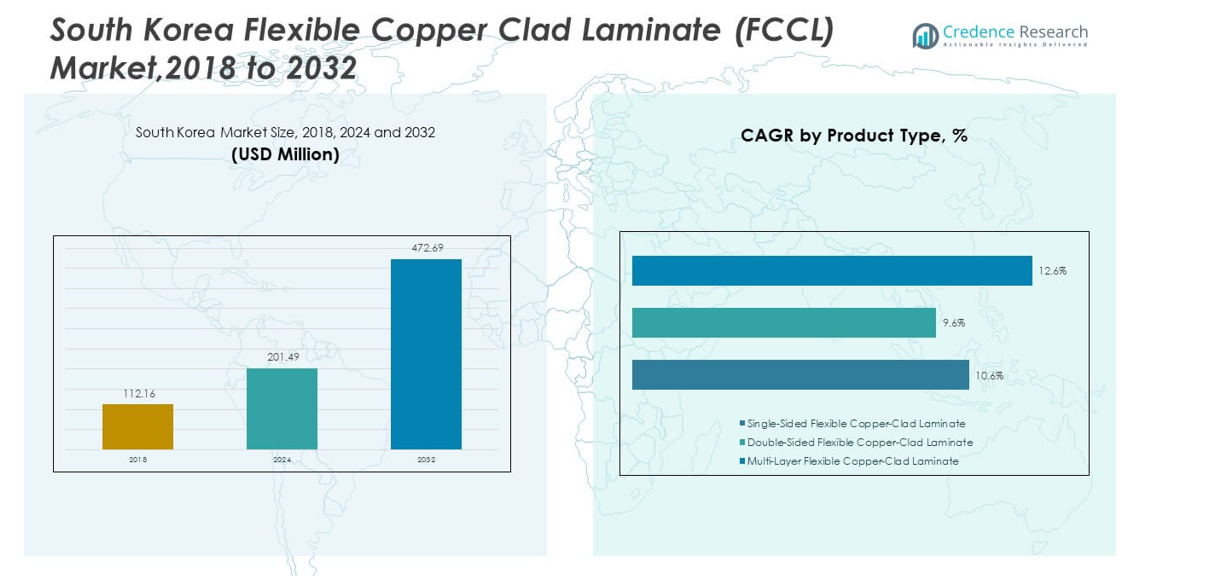

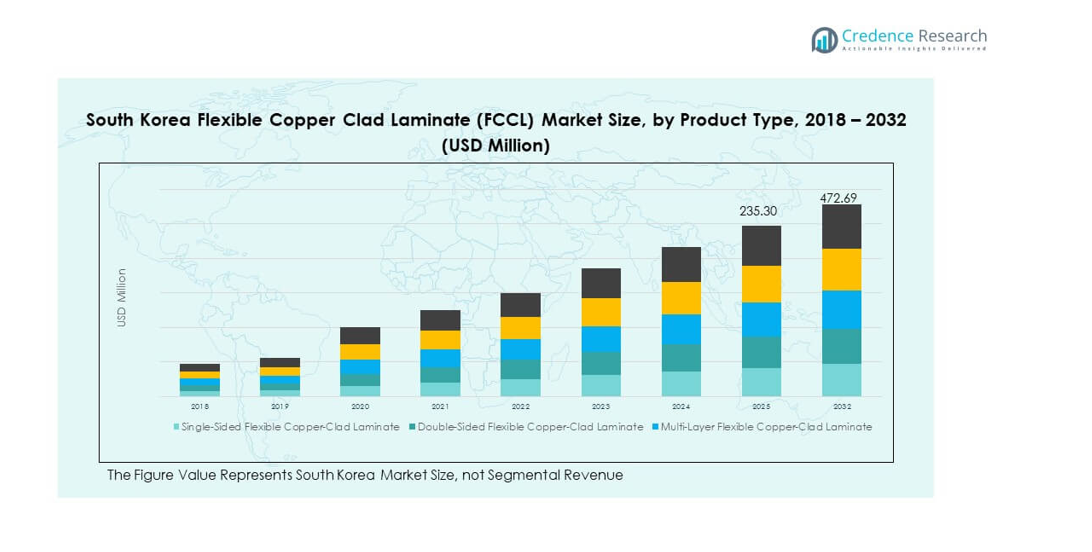

The South Korea Flexible Copper Clad Laminate (FCCL) Market size was valued at USD 112.16 million in 2018, increased to USD 201.49 million in 2024, and is anticipated to reach USD 472.69 million by 2032, at a CAGR of 10.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Flexible Copper Clad Laminate (FCCL) Market Size 2024 |

USD 201.49 million |

| South Korea Flexible Copper Clad Laminate (FCCL) Market, CAGR |

10.48% |

| South Korea Flexible Copper Clad Laminate (FCCL) Market Size 2032 |

USD 472.69 million |

Strong demand for lightweight electronic materials drives steady expansion in the South Korea Flexible Copper Clad Laminate (FCCL) Market. Makers of flexible PCBs prefer thin, stable laminates that support bending without performance loss. The rise of 5G devices boosts the need for high-frequency-compatible FCCL grades across major fabrication sites. EV battery modules integrate flexible circuits that rely on heat-resistant laminate structures. Display makers adopt FCCL for high-density interconnect layers used in OLED and foldable screens. Supply upgrades improve quality levels that match tight device specifications. Strong R&D activity strengthens material innovation.

The South Korea Flexible Copper Clad Laminate (FCCL) Market shows strong regional ties with Asia Pacific due to its advanced electronics clusters. South Korea leads adoption because of its dense network of semiconductor, smartphone, and display manufacturers. China maintains a broad production base and attracts PCB suppliers seeking scale benefits. Taiwan remains a stable contributor through its robust IC substrate and PCB ecosystem. Japan shows strong growth through premium FCCL innovations focused on reliability and low signal loss. Southeast Asian countries start emerging due to new electronics assembly hubs and rising investment.

Market Insights:

- The South Korea Flexible Copper Clad Laminate (FCCL) Market grew from USD 112.16 million in 2018 to USD 201.49 million in 2024 and is projected to reach USD 472.69 million by 2032, expanding at a CAGR of 10.48%, driven by strong electronics, display, and semiconductor manufacturing activity.

- The Seoul Capital Area holds the largest share at 45–50%, supported by advanced semiconductor clusters and strong device manufacturing; the Gyeongsang region follows with 25–30% driven by automotive electronics and export-linked facilities; the Jeolla–Chungcheong regions hold 15–20% due to expanding PCB and IoT assembly infrastructure.

- The fastest-growing region is the Jeolla–Chungcheong zone, holding 15–20% share, supported by rising investments in flexible PCB fabrication, IoT devices, and regional industrial parks focused on digital component production.

- Segment distribution from the chart shows single-sided FCCL contributing roughly 25–30% share, supported by widespread use in compact flexible circuits across mainstream consumer electronics.

- Double-sided and multi-layer FCCL together account for about 70–75% share, reflecting higher adoption in smartphones, foldable displays, and advanced interconnect structures that dominate Korean electronics production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Use Of FCCL In Advanced Consumer Electronics

The South Korea Flexible Copper Clad Laminate (FCCL) Market gains strong momentum from higher device output across major hubs. Producers upgrade thin laminate grades to meet compact designs in smartphones and wearables. It supports bending stability that improves flexible circuit reliability during mass production cycles. Display makers adopt premium FCCL to boost signal control in OLED and foldable products. High-frequency performance needs shape material selection across dense interconnect layers. R&D upgrades help local firms maintain quality benchmarks demanded by global device leaders. Strong electronics expansion keeps demand steady across long-term supply programs.

- For instance, Panasonic’s FELIOS™ polyimide FCCL uses a 12.5 μm PI film that supports high flex endurance used widely in foldable displays.

Rising Integration Of FCCL In EVs And Automotive Electronics

Electric vehicles create fresh need for heat-resistant FCCL in compact circuit modules.Battery control systems depend on flexible circuits that reduce weight in tight layouts.

It helps designers achieve stable electrical performance during harsh thermal events.OEMs push suppliers to deliver laminates with tighter dimensional control for safety parts.Advanced driver systems require stable signal integrity under continuous load patterns.Tier-one suppliers boost orders as they expand smart component production lines.Strong automotive electrification creates consistent volume gains across many plants.

- For instance, SK Nexilis manufactures ultra-thin 4 μm copper foil used in flexible battery circuits, improving thermal reliability in EV control units.

Shift Toward High-Density PCB Manufacturing Capacity

High-density interconnect production strengthens FCCL demand across strategic Korean sites.

Fabricators need low-loss laminates to support rapid signal flow inside compact boards. It enables tighter layer spacing that enhances output in premium device categories. Producers invest in new lamination lines to improve consistency at higher yields. Local PCB firms respond to global supply shifts by expanding technology clusters. Rising chip packaging activity increases the need for durable FCCL stacks. Capacity upgrades help firms secure long contracts across advanced electronics.

Strong Growth In Semiconductor And Display Ecosystems

Semiconductor expansion fuels wider FCCL use in chip packaging and testing modules. It enhances stability across circuits that manage heat around advanced chipsets. Display makers prefer flexible laminates for thin interconnects inside next-generation panels. Material suppliers introduce cleaner copper surfaces to improve etching results. High-speed data devices require FCCL with stable dielectric strength at peak loads. Production synergies across clusters shorten lead times for top manufacturers. A strong ecosystem ensures sustained FCCL integration across many premium devices.

Market Trends:

Adoption Of Ultra-Thin FCCL Grades For Compact System Designs

Thin and lightweight materials define a strong trend in the South Korea Flexible Copper Clad Laminate (FCCL) Market. Producers supply ultra-thin layers that meet miniaturization goals in top-tier devices. It improves circuit flexibility without reducing electrical stability across bending points. Wearable makers choose thin FCCL to deliver slim and durable product structures.Foldable screens push the need for higher flex endurance under repeated motion. Producers modify resin blends to enhance peel strength in narrow bonding zones. Trend intensity rises with fast rollouts of compact smart equipment across many sectors.

- For instance, Nippon Mektron’s flexible circuits support more than 200,000 bend cycles at a small radius, enabling durable wearable and foldable device designs.

Shift Toward High-Frequency-Compatible FCCL For 5G And RF Devices

5G expansion drives upgrades in FCCL used in RF front-end circuits across Korea. Engineers require laminate grades with low dielectric loss at high signal speeds. It supports accurate routing in antennas and filters inside compact device formats. Network equipment manufacturers invest in stable FCCL for multi-band operations. R&D groups test new substrates for better heat handling during peak transfer events. Demand rises for precision-controlled copper surfaces tailored for RF layouts. This trend gains pace as more 5G and Wi-Fi modules enter consumer and industrial devices.

- For instance, DuPont’s Pyralux® AP FCCL features a dielectric constant of 3.4 and loss tangent of 0.004, making it suitable for high-frequency 5G modules.

Increased Automation In FCCL Manufacturing Lines

Producers integrate automated optical inspection and handling tools across new FCCL plants.Automation improves defect detection accuracy in thin laminate structures. It reduces material waste during large-scale output cycles across many grades. Robotic support strengthens alignment control during multi-stage lamination tasks. Smart production improves traceability and speeds up operator decision cycles. Suppliers use data-driven tools to maintain consistency during frequent batch shifts. Automation trends rise with stronger export commitments to major electronics makers.

Growing Use Of Eco-Efficient FCCL Materials

Sustainability drives wider acceptance of eco-efficient FCCL across large OEM networks.It encourages producers to supply halogen-free resin systems with better heat stability.Device brands seek materials that strengthen safety while reducing emissions during processing.Recyclability goals shape laminate design across flexible circuits used in many devices.Several plants invest in cleaner energy lines to meet corporate footprint targets.Global buyers prefer suppliers aligned with long-term sustainability guidelines.This trend accelerates with stronger environmental goals across consumer electronics.

Market Challenges Analysis:

High Technical Barriers And Complex Production Requirements

The South Korea Flexible Copper Clad Laminate (FCCL) Market faces difficulty due to strict technical benchmarks across device ecosystems.It requires precise copper adhesion control that demands advanced surface treatment lines.Ultra-thin films increase defect risk during lamination and etching steps.Producers must maintain uniform dielectric properties while scaling volumes.High-frequency devices introduce tighter requirements for loss stability and heat behavior.Supply gaps emerge when plants face yield fluctuations in sensitive grades. These barriers limit entry for smaller firms that lack deep capital or R&D strength.

Intense Competition And Raw Material Sensitivities

Producers face cost pressure linked to pricing shifts for copper foil and specialty resins.It challenges margins when global demand tightens across PCB and semiconductor segments.

Competitors from China and Taiwan introduce high-volume grades at aggressive pricing.Local firms must differentiate through quality rather than cost advantages.Regulatory pressure on chemicals used in resin systems increases compliance costs.OEMs push for faster lead times that strain existing production cycles.These factors combine to create sustained competitive and operational risk.

Market Opportunities:

Expansion Of FCCL In Emerging Mobility And Smart Device Platforms

The South Korea Flexible Copper Clad Laminate (FCCL) Market gains new opportunities from rising EV architectures and smart modules.It supports designers seeking lightweight circuits that replace rigid structures in tight spaces.Wearable growth increases demand for FCCL with higher flex endurance.Robotics and IoT devices require compact laminates with stable heat control.Advanced displays boost need for premium interconnect materials across thin panels.Local suppliers can expand export offerings to growing Asian assembly hubs.

These segments create long-term openings for firms with strong innovation pipelines.

Growth Potential In High-Frequency, Low-Loss FCCL Technologies

High-speed electronics open opportunities for FCCL tailored for RF, AI, and 5G systems.It encourages suppliers to invest in resin reforms that reduce loss at peak loads.Chip packaging firms demand reliable materials for dense signal paths.Thermal stability improvements help meet strict performance rules in advanced boards.Producers with strong R&D capacity can secure design wins from global OEMs.Upgraded capability strengthens Korea’s position in premium electronics supply chains.This opportunity expands with rising global interest in high-performance digital systems.

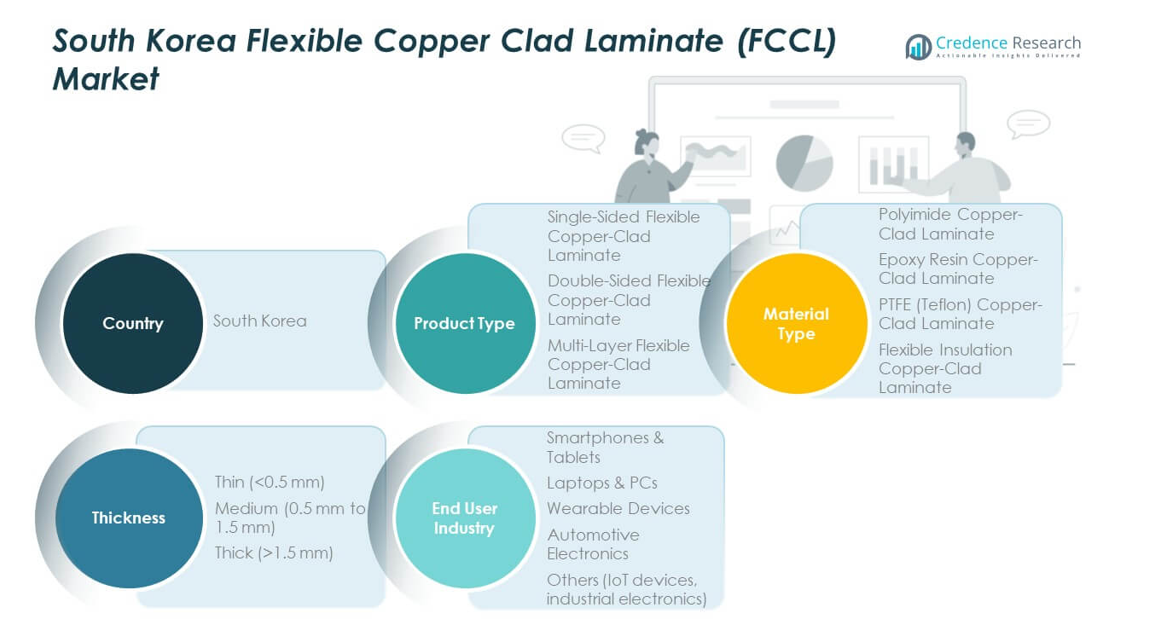

Market Segmentation Analysis:

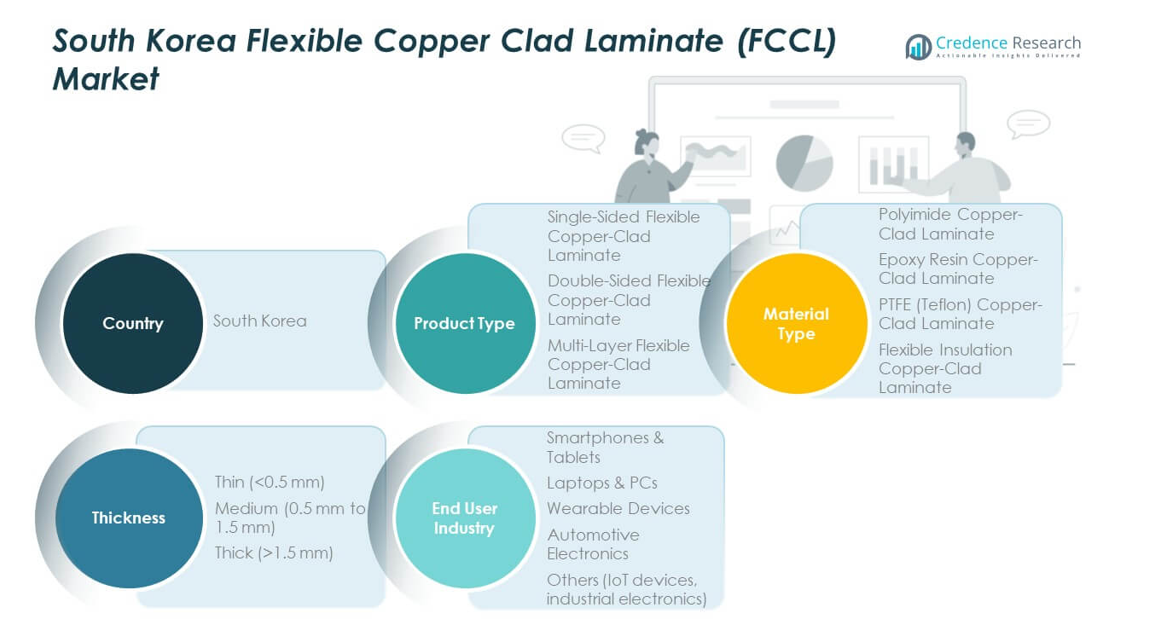

By Product Type

The South Korea Flexible Copper Clad Laminate (FCCL) Market shows strong adoption across all product categories. Single-sided FCCL secures steady use in flexible printed circuits for compact devices. Double-sided FCCL gains wide preference for mid-range consumer electronics that need higher routing density. Multi-layer FCCL strengthens its position in advanced displays and high-performance modules where reliability and signal accuracy matter. Demand rises as makers shift toward thinner interconnect structures for premium products. Each product type supports a defined manufacturing workflow that aligns with evolving device architecture. Growth momentum stays firm across expanding electronics clusters.

- For instance, LG Innotek’s multilayer FCCL structures support fine-pitch circuit formation down to 20 μm lines/20 μm spacing, enabling dense smartphone interconnects.

By Material Type

Polyimide-based laminates lead due to heat stability and superior flex endurance. Epoxy resin laminates support mass-market devices where cost and durability must align with production goals. PTFE laminates gain interest in high-frequency modules used in communication systems that need low dielectric loss. Flexible insulation laminates serve broader applications that require moderate performance at stable pricing. Material selection shifts with device complexity and thermal requirements across Korean production hubs.

- For instance, Toray’s polyimide films withstand continuous temperatures near 400°C, supporting FCCL structures for demanding semiconductor and aerospace circuits.

By Thickness

Thin laminates hold strong relevance for wearables, foldable screens, and space-limited circuits. Medium thickness grades support mainstream electronics with balanced rigidity and heat tolerance. Thick laminates retain value in automotive electronics and industrial systems where durability is critical.

By End User Industry

Smartphones and tablets dominate demand due to high output cycles. Laptops and PCs maintain stable consumption for internal interconnect layers. Wearables expand at a quick pace with rising multifunction device use. Automotive electronics gain traction through EV adoption. Other segments, including IoT and industrial electronics, add consistent growth pathways.

Segmentation:

By Product Type

- Single-Sided Flexible Copper-Clad Laminate

- Double-Sided Flexible Copper-Clad Laminate

- Multi-Layer Flexible Copper-Clad Laminate

By Material Type

- Polyimide Copper-Clad Laminate

- Epoxy Resin Copper-Clad Laminate

- PTFE (Teflon) Copper-Clad Laminate

- Flexible Insulation Copper-Clad Laminate

By Thickness

- Thin (<0.5 mm)

- Medium (0.5 mm to 1.5 mm)

- Thick (>1.5 mm)

By End User Industry

- Smartphones & Tablets

- Laptops & PCs

- Wearable Devices

- Automotive Electronics

- Others (IoT devices, industrial electronics)

Regional Analysis:

Seoul Capital Area – Dominant Electronics Hub

The South Korea Flexible Copper Clad Laminate (FCCL) Market shows its highest concentration of demand in the Seoul Capital Area, which holds the largest market share among domestic regions. It benefits from the presence of major semiconductor, display, and electronics manufacturers that rely on advanced FCCL grades. The area leads innovation cycles through strong R&D activity and early adoption of premium interconnect materials. It drives procurement volumes for flexible circuits used in smartphones, foldable screens, and high-density devices. Supply chains remain firmly integrated around major industrial clusters near Seoul and Incheon. The region’s strong infrastructure supports efficient distribution and rapid technology uptake. It continues to set the growth pace for nationwide FCCL demand.

Gyeongsang Region – Expanding Manufacturing Base

The Gyeongsang region holds a moderate share of the South Korea Flexible Copper Clad Laminate (FCCL) Market due to its expanding electronics and automotive production bases. It benefits from strong industrial facilities that use FCCL in power modules, infotainment units, and smart mobility systems. Busan and Ulsan contribute through active component manufacturing for export-driven segments. Demand rises as suppliers scale output for EV electronics and high-performance computing parts. The region supports steady procurement for mid- to high-end FCCL thickness categories. Manufacturing networks in this area strengthen product diversification across industrial electronics. It remains a key contributor to national FCCL growth momentum.

Jeolla and Chungcheong Regions – Emerging Growth Zones

The Jeolla and Chungcheong regions hold a smaller but fast-expanding share of the South Korea Flexible Copper Clad Laminate (FCCL) Market. These regions gain traction through rising investments in PCB fabrication, IoT assembly lines, and precision electronics. Emerging industrial parks upgrade production capacity to attract suppliers that need reliable FCCL sourcing. Local demand strengthens as factories align with national goals for advanced materials and digital components. These regions support flexible insulation laminates and mid-range material types used in diversified electronics. Growth potential increases with regional efforts to enhance manufacturing capabilities. It positions these zones as important future contributors to FCCL supply and innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- NexFlex

- Doosan Corporation (Electro-Materials)

- SKC

- Samsung Electro-Mechanics

- LG Innotek

- BH Flex

- SI Flex

- Interflex

- Daeduck Electronics

- LS Cable & System

Competitive Analysis:

The South Korea Flexible Copper Clad Laminate (FCCL) Market features a highly competitive structure driven by strong domestic electronics and semiconductor ecosystems. It includes established players that invest in advanced resin systems, ultra-thin laminates, and precision copper treatments to secure long-term contracts. Firms compete through material quality, flex endurance, signal stability, and supply reliability for high-density circuits. It sees rising differentiation as companies focus on premium FCCL grades for smartphones, wearables, and automotive electronics. Competitive momentum stays strong due to active R&D programs. Several suppliers leverage strategic partnerships to strengthen export reach. Market share shifts align with innovation capability, production scale, and customer integration.

Recent Developments:

- In November 2025, Samsung Electro-Mechanics signed a memorandum of understanding (MOU) with Sumitomo Chemical Group to establish a joint venture for manufacturing ‘Glass Core,’ a key material for next-generation semiconductor package substrates. Samsung Electro-Mechanics is currently producing glass package substrate prototypes at its Sejong plant pilot line, with mass production planned to begin after 2027. The Glass Core technology reduces thickness by approximately 40 percent compared to conventional substrates while improving warpage control and signal performance in large-area substrates.

- In September 2025, Samsung Electro-Mechanics showcased advanced next-generation package substrate technologies at the KPCA Show 2025. The company displayed AI and server FCBGA substrates currently in mass production, including newly introduced substrates that are over 10 times larger in area and feature more than triple the number of internal layers compared to standard FCBGAs. Samsung Electro-Mechanics became the first company in Korea to successfully mass-produce AI and server FCBGA substrates in October 2022 and continues to be the only Korean manufacturer in mass-producing server FCBGAs.

- In June 2025, LG Innotek unveiled its groundbreaking copper post (Cu-Post) technology for semiconductor substrates, which the company began developing in 2021. This innovative technology reduces semiconductor substrate size by up to 20 percent while maintaining performance levels and enables denser circuit layouts. The Cu-Post method employs copper pillars instead of conventional solder balls, significantly improving thermal dissipation with copper’s thermal conductivity being over seven times higher than traditional solder. LG Innotek has secured approximately 40 patents related to this technology and plans to apply it to RF-SiP and FC-CSP substrates, aiming to grow its semiconductor component business to 3 trillion won ($2.2 billion) in annual revenue by 2030.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material Type, Thickness, and End User Industry segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand increases for high-frequency FCCL tailored for 5G, RF, and advanced computing needs.

- Material innovation accelerates through new resin systems that improve signal and thermal performance.

- Suppliers expand thin-film FCCL production to support growth in wearables and foldable devices.

- Automotive electronics adoption rises with stronger EV integration and sensor module expansion.

- Export volume grows as domestic producers target Asian and global PCB assembly hubs.

- Manufacturing automation strengthens yield control in ultra-thin laminate categories.

- Smart factories use data-driven tools to optimize copper adhesion and dielectric stability.

- Local firms invest in premium FCCL lines that enhance global competitiveness.

- Sustainability goals drive wider use of halogen-free and eco-efficient laminate structures.

- Industry partnerships deepen to support rapid product cycles across leading electronics brands.