Market Overview

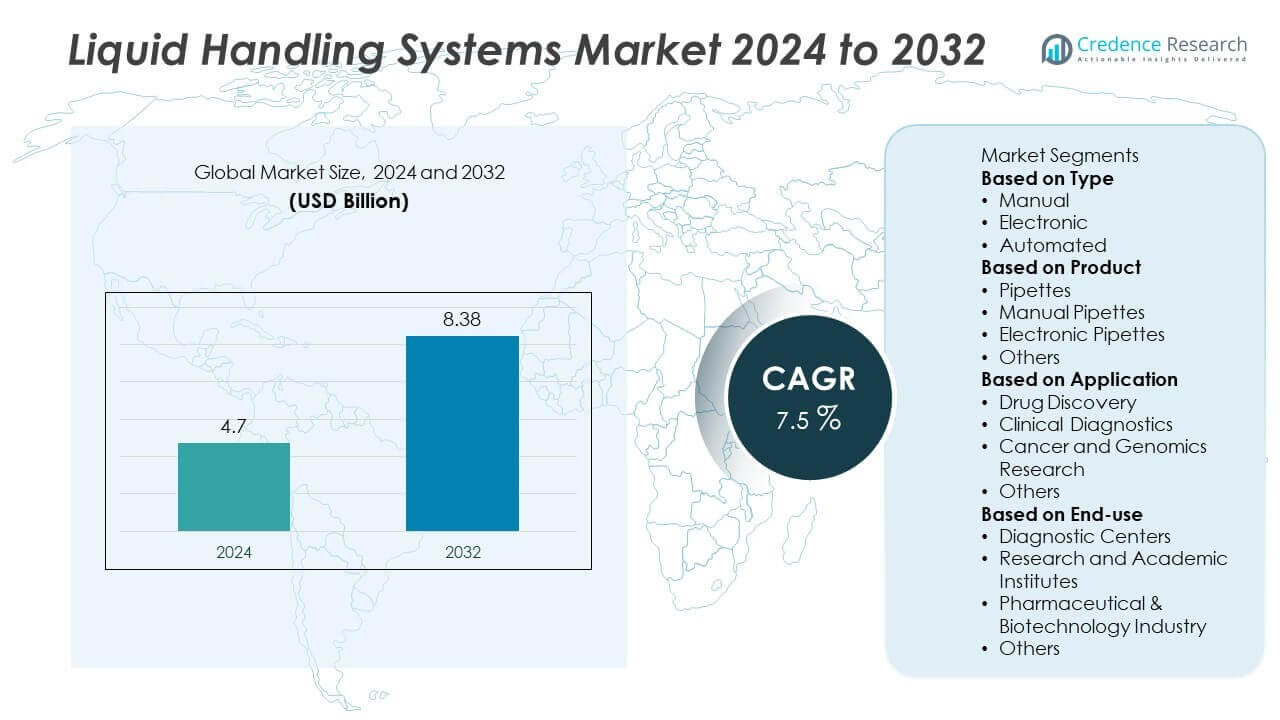

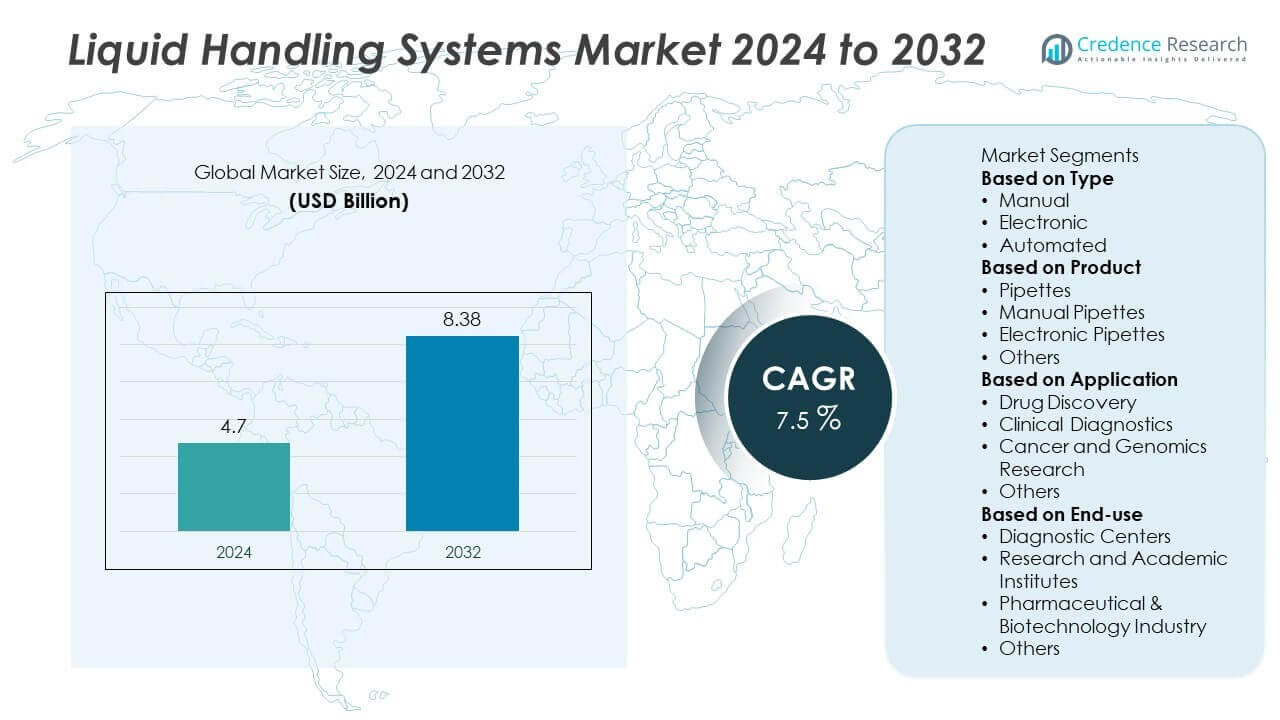

The global Liquid Handling Systems market was valued at USD 4.7 billion in 2024. It is projected to reach USD 8.38 billion by 2032, expanding at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Handling Systems Market Size 2024 |

USD 4.7 Billion |

| Liquid Handling Systems Market, CAGR |

7.5% |

| Liquid Handling Systems Market Size 2032 |

USD 8.38 Billion |

The liquid handling systems market is driven by top players including Thermo Fisher Scientific, Beckman Coulter, Agilent Technologies, Sartorius AG, Aurora Biomed Ltd, Gilson Inc., Hamilton Company, Eppendorf AG, Tecan Group Ltd., and PerkinElmer Inc. These companies lead through automation, robotics integration, and advanced pipetting solutions tailored for pharmaceutical research, genomics, and diagnostics. North America emerged as the leading region in 2024 with 38% market share, supported by strong R&D infrastructure and high adoption of automated systems. Europe followed with 30% share, driven by robust clinical diagnostics and genomics research, while Asia Pacific accounted for 22% share, fueled by growing pharmaceutical investment and expanding healthcare infrastructure.

Market Insights

Market Insights

- The global liquid handling systems market was valued at USD 4.7 billion in 2024 and is projected to reach USD 8.38 billion by 2032, growing at a CAGR of 7.5% during the forecast period.

- Key drivers include rising demand for high-throughput screening in drug discovery and the growing adoption of automation in genomics and cancer research, boosting the automated segment that accounted for over 50% share in 2024.

- Trends highlight increasing integration of robotics and AI, along with miniaturization and microfluidics, enabling higher accuracy and reduced reagent use across pharmaceutical and diagnostic applications.

- The market is highly competitive with players such as Thermo Fisher Scientific, Beckman Coulter, Agilent Technologies, Sartorius AG, Aurora Biomed Ltd, and Gilson Inc., focusing on product innovation, collaborations, and regional expansion.

- Regionally, North America led with 38% share, followed by Europe at 30% and Asia Pacific at 22%, supported by strong R&D infrastructure and expanding healthcare investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The automated segment dominated the liquid handling systems market in 2024 with over 50% share. Demand is driven by high throughput needs in laboratories, rising adoption of robotics, and growing precision requirements in pharmaceutical and biotech workflows. Automated systems reduce manual errors, enhance reproducibility, and streamline processes such as next-generation sequencing and high-throughput screening. Electronic systems followed with notable growth due to their ergonomic design and accuracy in routine tasks. Manual systems maintained a smaller share, largely used in academic labs and cost-sensitive settings.

- For instance, The Gilson PIPETMAN Classic, a durable and highly reliable manual air-displacement pipette, offers a range of volumes up to 10 mL. Its accuracy and robust construction make it a trusted, economical choice for many teaching and research laboratories. In educational settings, it is a staple for demonstrating fundamental liquid handling techniques.

By Product

Pipettes accounted for the largest share in 2024, holding nearly 45% of the market. Within this category, electronic pipettes gained traction due to superior accuracy, reduced hand strain, and suitability for repetitive laboratory tasks. Manual pipettes continued to see widespread use in research institutes and teaching labs where affordability and simplicity are key. The “others” segment, including burettes and dispensers, captured a smaller portion but is expanding steadily. The pipette market’s dominance is supported by consistent demand across life sciences, drug discovery, and clinical applications.

- For instance, Beckman Coulter integrates automated pipetting modules into its Biomek i-Series, capable of handling 96- and 384-well plates for drug screening.

By Application

Drug discovery emerged as the leading application in 2024, representing around 40% market share. Growth is fueled by increased R&D spending from pharmaceutical and biotech companies, alongside the expansion of high-throughput screening platforms. Clinical diagnostics followed as the second-largest segment, benefiting from rising demand for infectious disease testing and automation in clinical labs. Cancer and genomics research contributed a strong share, supported by precision medicine initiatives and sequencing advancements. Other applications, including food safety and forensics, showed steady uptake but remain relatively niche compared to drug discovery.

Key Growth Drivers

Rising Demand for High-Throughput Screening

The growing need for high-throughput screening in drug discovery is a major driver for liquid handling systems. Automated systems allow rapid testing of thousands of compounds, reducing development timelines and increasing efficiency. Pharmaceutical and biotech companies are investing heavily in automation to improve accuracy and productivity. The expansion of clinical trials and personalized medicine programs also supports adoption. As laboratories prioritize throughput and reproducibility, automated liquid handling platforms become critical to accelerate innovation and meet regulatory standards.

- For instance, Beckman Coulter’s Biomek i7 Automated Workstation can process 1,536-well plates in under 10 minutes, supporting compound libraries exceeding 100,000 samples for high-throughput screening programs.

Expansion of Genomics and Cancer Research

Increasing research in genomics and cancer is fueling demand for precision liquid handling solutions. Applications such as PCR, next-generation sequencing, and gene expression analysis require highly accurate pipetting and sample preparation. Laboratories are investing in advanced liquid handling systems to ensure reproducibility and reduce human error. Rising cancer prevalence and government-funded genomics initiatives further drive adoption. These systems support the handling of large sample volumes in oncology studies, enabling breakthroughs in precision medicine, biomarker discovery, and targeted therapies.

- For instance, Tecan’s DreamPrep NGS system automates library preparation for next-generation sequencing, processing up to 96 genomic samples in a single run with high pipetting accuracy and precision, enabling large-scale genomics workflows like cancer genomics.

Growth in Clinical Diagnostics and Personalized Medicine

The clinical diagnostics sector contributes significantly to liquid handling system demand. Automated pipetting and dispensing tools are widely used in infectious disease testing, genetic screening, and molecular diagnostics. The shift toward personalized medicine has created demand for reliable sample preparation in molecular assays. Hospitals and diagnostic centers seek faster turnaround times and reduced error rates, driving adoption of electronic and automated platforms. Rising healthcare spending, coupled with the adoption of automation in clinical labs, continues to strengthen the market growth outlook.

Key Trends & Opportunities

Integration of Robotics and Artificial Intelligence

Robotics and AI are emerging as key trends in liquid handling systems. AI-powered platforms enable predictive maintenance, adaptive workflows, and improved sample tracking. Robotics integration enhances efficiency and supports fully automated labs. The opportunity lies in reducing manual errors, increasing throughput, and enabling advanced workflows in genomics and proteomics. As smart laboratories evolve, companies that offer AI-driven liquid handling systems are well-positioned to capture demand from research organizations, pharmaceutical firms, and diagnostics providers seeking scalable automation solutions.

- For instance, Hamilton Company’s Microlab STAR platform integrates AI-based scheduling and robotic arms capable of handling up to 1,000 samples per day, while maintaining pipetting precision within ±0.5% at volumes as low as 0.5 µL.

Miniaturization and Microfluidics Adoption

The trend toward miniaturization and use of microfluidics is creating new opportunities. Microfluidics allows laboratories to perform assays with minimal reagent volumes, reducing costs and environmental impact. Liquid handling systems that integrate microfluidic technology support point-of-care testing, personalized healthcare, and lab-on-chip applications. This trend benefits industries requiring high sensitivity and precision in sample analysis, such as genomics, proteomics, and diagnostic testing. As microfluidic-based systems advance, they open opportunities for compact, portable, and cost-effective solutions in both research and clinical applications.

- For instance, PerkinElmer’s LabChip GXII Touch system uses microfluidic channels to analyze DNA, RNA, and protein samples with volumes as low as 5 nL, delivering results in under 30 seconds per sample for oncology and genomics applications.

Key Challenges

High Cost of Advanced Systems

The high initial cost of advanced liquid handling systems is a major challenge. Automated platforms require significant investment in hardware, software, and maintenance, limiting adoption among small research laboratories and academic institutions. Budget constraints often drive organizations to continue using manual or semi-automated solutions. The return on investment can be long, especially for labs with limited throughput requirements. Addressing cost barriers through affordable, scalable solutions remains essential for expanding market penetration across diverse research and clinical settings.

Complexity of System Integration and Maintenance

Integrating advanced liquid handling systems into existing laboratory workflows presents another challenge. Compatibility with laboratory information systems, reagent kits, and other instruments can create operational hurdles. Additionally, maintaining calibration, ensuring system reliability, and training staff add to complexity. Downtime from technical issues can disrupt critical workflows in diagnostics and research. Vendors must focus on user-friendly designs, seamless integration, and reliable support services to address these challenges. Overcoming integration and maintenance barriers is vital to fully realizing the benefits of automation.

Regional Analysis

North America

North America held the largest share of the liquid handling systems market in 2024 with 38% share. The region’s leadership is driven by advanced pharmaceutical and biotechnology sectors, strong presence of key market players, and significant investment in drug discovery and clinical research. The United States dominates regional demand, supported by high adoption of automation in laboratories and government funding for genomics and cancer research. Canada also contributes through expanding clinical diagnostic facilities and rising demand for personalized medicine. Continued technological advancements and a mature healthcare infrastructure sustain North America’s leading position in the market.

Europe

Europe accounted for 30% share of the liquid handling systems market in 2024. The region benefits from strong academic research institutions, government-backed genomics programs, and well-established pharmaceutical companies. Countries such as Germany, the United Kingdom, and France lead adoption, supported by initiatives promoting personalized medicine and advanced clinical diagnostics. Demand is further fueled by the integration of automation in drug development and clinical laboratories. Europe’s regulatory framework emphasizes precision and accuracy, encouraging investment in automated systems. Ongoing advancements in cancer research and molecular diagnostics contribute significantly to the region’s steady growth trajectory.

Asia Pacific

Asia Pacific captured 22% share of the liquid handling systems market in 2024. Growth is driven by rising pharmaceutical R&D investment, expanding healthcare infrastructure, and increasing prevalence of cancer and infectious diseases. China, Japan, and India lead regional adoption due to government initiatives supporting genomics and biotechnology research. The region is also witnessing higher adoption of automated liquid handling systems in diagnostic laboratories to improve testing accuracy and efficiency. Expanding clinical trials, cost advantages in manufacturing, and growing demand for precision medicine strengthen Asia Pacific’s role as a high-growth region in the global market.

Latin America

Latin America represented 6% share of the liquid handling systems market in 2024. The region’s growth is supported by increasing adoption of automated diagnostic tools in Brazil, Mexico, and Argentina. Expanding biotechnology research and rising healthcare expenditure contribute to demand. Drug discovery initiatives and efforts to improve clinical diagnostic capabilities also encourage investment in liquid handling systems. However, budget constraints in public healthcare facilities and slower adoption of advanced technologies limit market expansion. Despite these challenges, the region is expected to grow steadily, driven by rising demand for precision diagnostics and pharmaceutical development.

Middle East & Africa

The Middle East & Africa accounted for 4% share of the liquid handling systems market in 2024. Growth is mainly driven by the expansion of healthcare infrastructure in Gulf countries such as Saudi Arabia and the United Arab Emirates. Increasing investments in advanced diagnostic laboratories and biotechnology research initiatives support adoption. South Africa also contributes through growing demand for clinical diagnostics and infectious disease testing. However, limited research budgets and lower penetration of automation present challenges. Despite these hurdles, rising healthcare modernization efforts are expected to create long-term opportunities for liquid handling system providers.

Market Segmentations:

By Type

- Manual

- Electronic

- Automated

By Product

- Pipettes

- Manual Pipettes

- Electronic Pipettes

- Others

By Application

- Drug Discovery

- Clinical Diagnostics

- Cancer and Genomics Research

- Others

By End-use

- Diagnostic Centers

- Research and Academic Institutes

- Pharmaceutical & Biotechnology Industry

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the liquid handling systems market is shaped by leading players such as Thermo Fisher Scientific, Aurora Biomed Ltd, Sartorius AG, Gilson Inc., Beckman Coulter, Agilent Technologies, Hamilton Company, Eppendorf AG, Tecan Group Ltd., and PerkinElmer Inc. These companies focus on technological innovation, portfolio expansion, and strategic collaborations to strengthen their market presence. Automation, robotics integration, and AI-driven platforms remain central to their R&D investments, catering to high-throughput screening, genomics, and diagnostics applications. Partnerships with pharmaceutical firms, diagnostic centers, and academic institutions support product adoption and global expansion. North America and Europe serve as strongholds for established players, while Asia Pacific is emerging as a key growth region, attracting investment and localized manufacturing. Intense competition drives continuous product upgrades, emphasizing precision, scalability, and cost-effectiveness. Companies also adopt mergers, acquisitions, and strategic alliances to expand their capabilities and meet rising demand across drug discovery, clinical diagnostics, and cancer research.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Ingersoll Rand acquired Lead Fluid, boosting its life science fluid handling capacity.

- In March 2025, HighRes Biosolutions acquired Let’s Go Robotics, enhancing its low-volume dispensing capabilities.

- In 2025, Merck KGaA is also highlighted in reports as a major participant in liquid handling systems markets.

- In 2025, Eppendorf’s presence in liquid handling remains strong, with its broad portfolio of automated pipetting and handling systems.

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automated liquid handling systems will see wider adoption across pharmaceutical and biotechnology research.

- Integration of robotics and AI will improve accuracy, efficiency, and workflow scalability in laboratories.

- Growth in genomics and cancer research will boost demand for high-precision liquid handling tools.

- Clinical diagnostics will remain a strong application area, driven by molecular and genetic testing needs.

- Miniaturization and microfluidic innovations will lower reagent costs and enable portable solutions.

- Asia Pacific will emerge as the fastest-growing region with expanding healthcare and research investments.

- North America will maintain leadership due to strong R&D funding and advanced infrastructure.

- Key players will focus on partnerships, acquisitions, and product innovations to strengthen presence.

- High equipment cost and integration complexity will remain challenges for smaller laboratories.

- Sustainable and energy-efficient designs will gain traction as laboratories adopt greener practices.

Market Insights

Market Insights