Market Overview

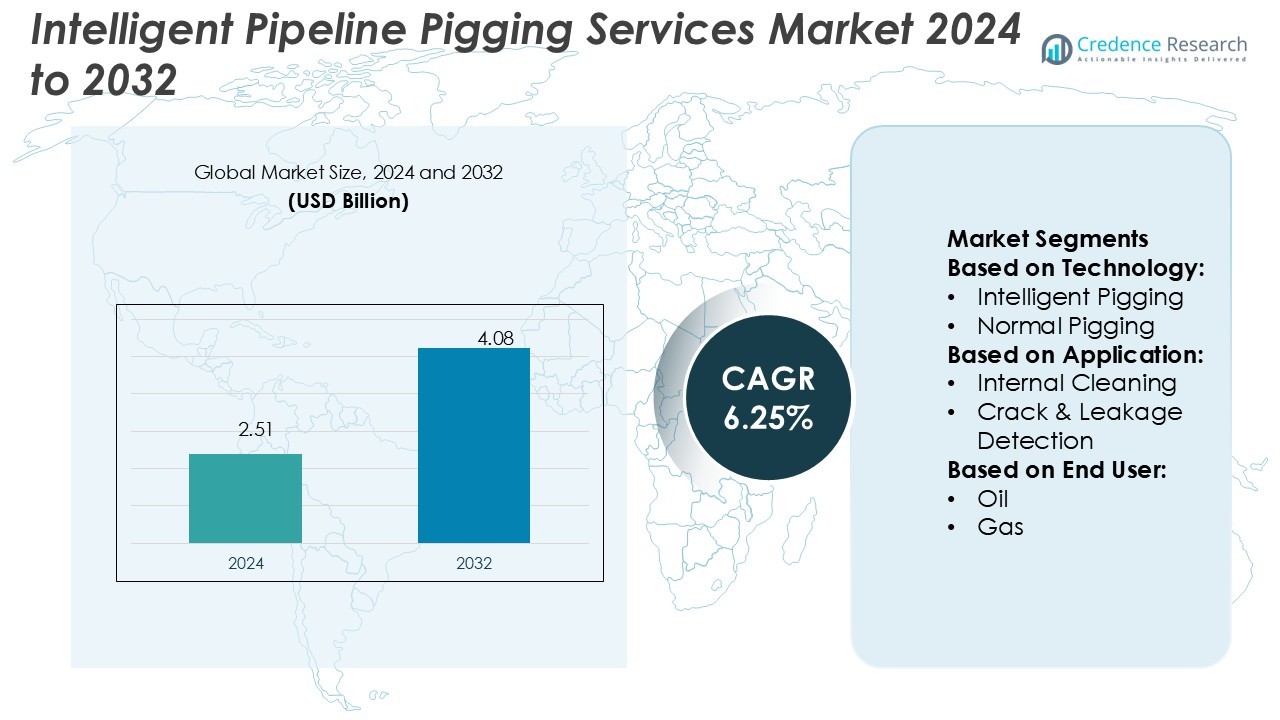

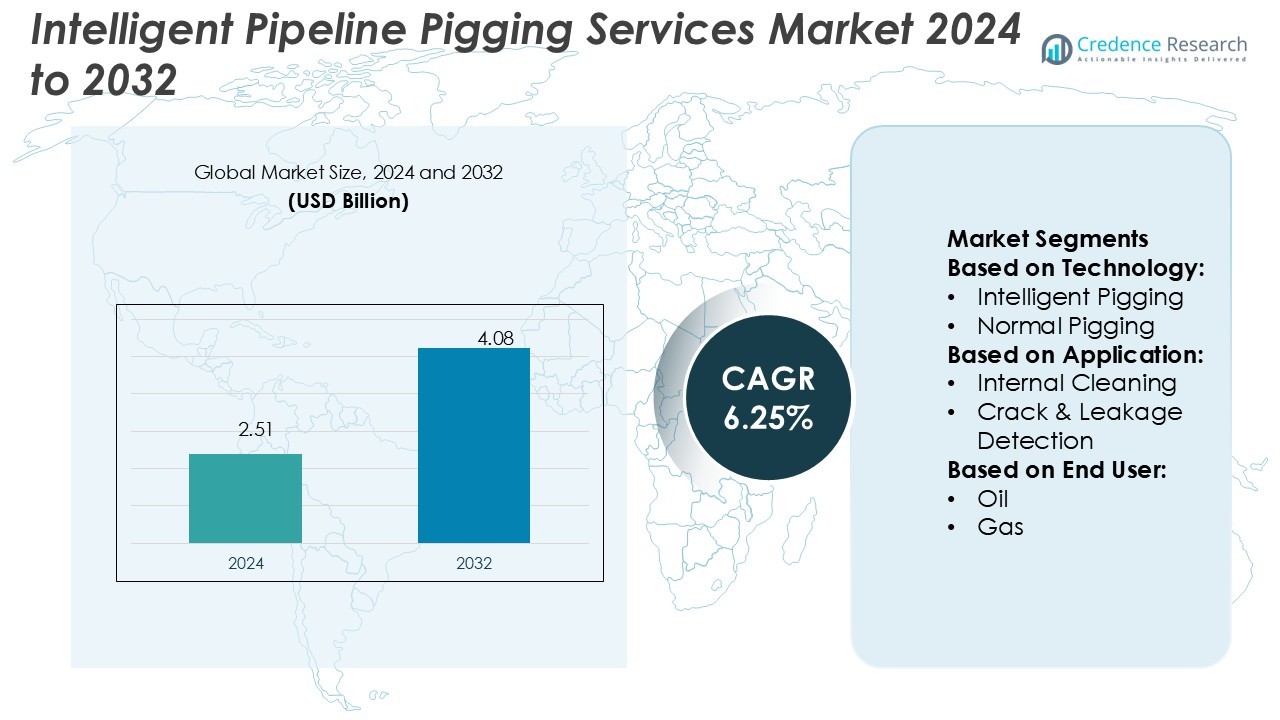

Intelligent Pipeline Pigging Services Market size was valued USD 2.51 billion in 2024 and is anticipated to reach USD 4.08 billion by 2032, at a CAGR of 6.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intelligent Pipeline Pigging Services Market Size 2024 |

USD 2.51 Billion |

| Intelligent Pipeline Pigging Services Market, CAGR |

6.25% |

| Intelligent Pipeline Pigging Services Market Size 2032 |

USD 4.08 Billion |

The intelligent pipeline pigging services market is shaped by top players including LIN SCAN, Altus Intervention, Dacon, T.D. Williamson, Inc., IKM Testing, ROSEN Group, Baker Hughes Company, Applus+, CIRCOR International, Inc., and NDT Global. These companies compete through advanced inspection technologies, global service networks, and strategic partnerships to strengthen market presence. North America leads the market with a 36% share, driven by extensive pipeline infrastructure, stringent regulatory standards, and high adoption of intelligent pigging tools. Strong investments in shale gas and cross-border projects further reinforce the region’s dominance, positioning it as the global hub for pipeline integrity management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The intelligent pipeline pigging services market was valued at USD 2.51 billion in 2024 and is projected to reach USD 4.08 billion by 2032, growing at a CAGR of 6.25%.

- Market growth is driven by rising demand for pipeline safety, regulatory compliance, and predictive maintenance, with intelligent pigging holding a dominant 62% share in technology adoption.

- Key trends include integration of digital technologies, AI-driven analytics, and real-time monitoring, enhancing operational efficiency and supporting the shift toward natural gas infrastructure.

- Competitive dynamics are shaped by players such as ROSEN Group, Baker Hughes, and T.D. Williamson, Inc., with strong focus on advanced inspection tools and global service networks.

- North America leads with a 36% market share, supported by shale gas investments and cross-border pipelines, while Europe follows with 27% due to strict regulations; metal loss and corrosion detection dominate applications with 38% share, reinforcing demand for advanced inspection services.

Market Segmentation Analysis:

By Technology

The technology segment is divided into intelligent pigging and normal pigging. Intelligent pigging holds the dominant share of 62%, driven by its ability to deliver accurate inspection data, including metal loss, crack detection, and geometry analysis. The demand for real-time data and predictive maintenance in oil and gas pipelines strengthens its adoption. Operators increasingly invest in intelligent pigging solutions to ensure compliance with safety regulations, reduce operational risks, and extend pipeline lifespan. Normal pigging remains relevant for cleaning and maintenance but lacks advanced diagnostic capabilities.

- For instance, Dacon offers advanced intelligent pigs with multi-channel ultrasonic testing (UT) capabilities, allowing for high-frequency circumferential sampling of the pipe wall. These tools can inspect pipeline lengths of up to 50 km (optimally shorter) and operate in pipes with smallest bends of 1.5D (i.e., a radius of curvature 1.5 times the pipe diameter).

By Application

The application segment includes metal loss/corrosion detection, internal cleaning, crack and leakage detection, geometry measurement and bend detection, and others. Metal loss/corrosion detection leads with a 38% market share, supported by aging pipeline infrastructure and stricter safety standards. Growing incidents of corrosion-related failures in oil and gas networks push operators to prioritize this application. Advanced intelligent pigging tools enhance early detection, minimizing unplanned shutdowns and environmental risks. While internal cleaning and crack detection remain critical, corrosion monitoring remains the most adopted application across upstream and midstream operators.

- For instance, Advanced Non-Destructive Testing (NDT) services, specifically Phased Array Ultrasonic Testing (PAUT), capable of inspecting pipes as small as 1-inch (approximately 25.4mm) in diameter and 2.77mm in wall thickness to detect internal flaws and ensure structural integrity.

By End User

The end-user segment is categorized into oil and gas industries. Gas dominates with a 55% share, driven by rising investments in natural gas pipeline expansion and distribution networks. The sector requires high-precision inspection and monitoring solutions due to the safety risks associated with leakages and pressure fluctuations. Intelligent pigging services ensure uninterrupted gas delivery while reducing the likelihood of accidents. Although oil pipelines still account for substantial demand, the accelerating shift toward gas as a cleaner fuel source strengthens the dominance of the gas end-user segment in the market.

Key Growth Drivers

Rising Focus on Pipeline Safety and Integrity

The growing emphasis on pipeline safety and regulatory compliance acts as a key growth driver. Governments and industry bodies mandate regular inspections to prevent catastrophic leaks and environmental damage. Intelligent pigging services provide advanced diagnostics that detect corrosion, cracks, and structural weaknesses, reducing risks and downtime. As aging pipeline networks continue to expand globally, operators invest heavily in advanced pigging technologies to ensure uninterrupted supply. This focus on safety and integrity is driving consistent demand across oil and gas sectors.

- For instance, ROSEN’s RoCD EMAT-C Ultra crack inspection tool offers 95 % probability of identification (POD) for radial and longitudinal cracks. Its minimum crack length detection is as low as 20 mm, and it resolves crack depth with ±0.20 t (for wall thicknesses < 10 mm) and ±0.25 t (for ≥ 10 mm).

Expansion of Oil and Gas Pipeline Infrastructure

The expansion of global oil and gas pipeline infrastructure is fueling the adoption of intelligent pigging services. Increasing energy demand, especially in emerging economies, requires new transmission and distribution lines. To maintain efficiency and reduce operational risks, pipeline owners rely on intelligent pigging for accurate inspection and predictive maintenance. Investments in cross-border and subsea pipelines further strengthen market growth, as these high-value assets demand reliable monitoring solutions. This infrastructure expansion directly increases the market’s scope and long-term sustainability.

- For instance, Baker Hughes’s in-line inspection services. In one project, Baker Hughes deployed its MagneScan™ MFL4 tool to inspect a 7 km, 10-inch subsea gas injection pipeline at 430 m water depth.

Advancements in Pigging Technology

Rapid advancements in intelligent pigging technology enhance accuracy, efficiency, and cost-effectiveness. New tools integrate advanced sensors, magnetic flux leakage (MFL), and ultrasonic testing (UT) systems to detect anomalies with higher precision. Artificial intelligence and data analytics enable predictive insights, reducing unplanned downtime. These innovations make pigging services more attractive to operators seeking reliable and scalable inspection methods. As technology adoption grows, intelligent pigging is evolving from a maintenance tool into a strategic enabler of asset integrity management, strengthening its market appeal worldwide.

Key Trends & Opportunities

Integration of Digital Technologies

The integration of digital technologies such as IoT, cloud platforms, and predictive analytics is transforming intelligent pigging services. Operators use real-time data to monitor pipeline performance and optimize maintenance schedules. Predictive insights allow early intervention, minimizing failures and extending asset life. Digital integration also supports remote monitoring, which reduces inspection costs and improves safety in difficult terrains. This trend creates opportunities for service providers to expand offerings by combining pigging with digital asset management solutions.

- For instance, DTI Trekscan operates at an optimum speed of one meter per second (approximately 1.0 m/s or 2.2 mph). The tool is capable of measuring wall thicknesses ranging from 2.8 mm (0.1 inches) up to 50 mm (2.0 inches).

Shift Toward Natural Gas and Renewable Energy Support

The rising demand for natural gas as a cleaner energy source fuels the expansion of gas pipeline infrastructure. Intelligent pigging services benefit from this shift, as gas pipelines require frequent inspection to ensure safety and efficiency. Additionally, the integration of renewable energy projects into existing networks opens opportunities for pipeline monitoring and optimization. This transition toward low-carbon energy increases the relevance of advanced pigging technologies, positioning service providers to capitalize on new infrastructure and sustainability initiatives.

- For instance, Hubbell’s AD1277 wall-switch sensor covers about 1,000 square feet (≈93 m²) and supports load capacities up to 800 W (incandescent) or 1,800 W (fluorescent at 277 V). Its adaptive firmware automatically adjusts the time delay to prevent false-OFF events, providing “install and forget” operation for maintenance-free use.

Key Challenges

High Capital and Operational Costs

The significant costs associated with intelligent pigging equipment and operations remain a major challenge. Advanced tools equipped with sensors, ultrasonic devices, and data systems demand high initial investments. Smaller operators often struggle to justify these costs, limiting adoption in certain markets. Additionally, operational expenses such as deployment, skilled personnel, and data analysis add financial pressure. Balancing cost efficiency with technological reliability poses a key hurdle for widespread market penetration, especially in price-sensitive regions.

Technical Limitations in Complex Pipelines

Complex pipeline structures, including small-diameter, multi-diameter, and older systems, present technical challenges for intelligent pigging. Some pipelines lack pigging facilities or contain sharp bends that restrict tool movement. In such cases, inspections may require costly modifications or alternative methods. These limitations reduce the applicability of intelligent pigging in certain segments and delay adoption in older networks. Overcoming these technical constraints requires continuous innovation, which can slow market growth if not addressed effectively by service providers.

Regional Analysis

North America

North America leads the intelligent pipeline pigging services market with a 36% share, supported by its extensive oil and gas pipeline infrastructure. The U.S. and Canada prioritize safety, regulatory compliance, and advanced inspection technologies, driving strong adoption. Rising shale gas production and cross-border pipeline projects further expand service demand. Intelligent pigging is widely used for corrosion detection and leak prevention in aging networks. High investment levels, along with a strong presence of leading service providers, make the region a mature and technology-driven market that continues to set global standards in pipeline integrity management.

Europe

Europe accounts for 27% of the market, driven by strict regulatory frameworks and a focus on sustainable energy infrastructure. Countries such as Germany, the U.K., and Norway lead adoption, particularly in offshore and subsea pipelines. Intelligent pigging services are critical to ensuring environmental safety and reducing risks associated with aging infrastructure. The region’s push for cleaner energy also increases demand for gas pipeline inspections. Advanced digital integration in inspection processes strengthens efficiency, making Europe a key market where compliance and technological innovation together fuel growth.

Asia-Pacific

Asia-Pacific holds a 22% share, emerging as the fastest-growing region in the intelligent pipeline pigging services market. China, India, and Australia are leading contributors, with rising investments in pipeline construction to meet energy demand. The region’s rapid industrialization and urbanization drive expansion in oil and gas networks, creating strong opportunities for pigging services. Operators increasingly adopt intelligent pigging to minimize operational risks and ensure pipeline reliability. With ongoing infrastructure projects and rising natural gas adoption, Asia-Pacific demonstrates significant growth potential, positioning itself as a future leader in global market expansion.

Latin America

Latin America represents 9% of the market, driven by pipeline expansion projects in Brazil, Mexico, and Argentina. The region’s growing oil and gas production requires reliable inspection and maintenance services to secure pipeline integrity. Intelligent pigging adoption is gradually increasing, supported by modernization programs and foreign investments in energy infrastructure. Corrosion detection and cleaning remain high-demand applications due to aging assets. Although the market is less mature compared to North America and Europe, rising exploration and cross-border projects create growth opportunities, positioning Latin America as a promising emerging market for advanced pigging services.

Middle East & Africa

The Middle East & Africa account for 6% of the market, supported by extensive oil reserves and pipeline projects. Countries such as Saudi Arabia, the UAE, and South Africa are key adopters, investing in intelligent pigging for asset monitoring and corrosion prevention. The region’s heavy reliance on hydrocarbon exports makes pipeline safety and operational efficiency a strategic priority. While adoption is still developing, ongoing infrastructure modernization and large-scale projects drive steady growth. Strong government support for energy sector investment continues to create opportunities for intelligent pigging service providers in this region.

Market Segmentations:

By Technology:

- Intelligent Pigging

- Normal Pigging

By Application:

- Internal Cleaning

- Crack & Leakage Detection

By End User:

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the intelligent pipeline pigging services market features prominent players such as LIN SCAN, Altus Intervention, Dacon, T.D. Williamson, Inc., IKM Testing, ROSEN Group, Baker Hughes Company, Applus+, CIRCOR International, Inc., and NDT Global. The intelligent pipeline pigging services market is defined by continuous technological innovation, expanding service portfolios, and strong focus on pipeline integrity management. Companies are investing in advanced inspection tools that integrate magnetic flux leakage, ultrasonic testing, and digital analytics to enhance precision and reduce operational risks. The market is highly competitive, with service providers differentiating through global presence, regulatory compliance expertise, and customized solutions for complex pipeline networks. Strategic partnerships, mergers, and acquisitions further strengthen market positioning, while digital integration and predictive maintenance capabilities emerge as key differentiators driving long-term growth and competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LIN SCAN

- Altus Intervention

- Dacon

- D. Williamson, Inc.

- IKM Testing

- ROSEN Group

- Baker Hughes Company

- Applus+

- CIRCOR International, Inc.

- NDT Global

Recent Developments

- In September 2024, FLIR launched the TrafiBot Dual AI camera, an advanced multispectral traffic management solution designed to enhance safety and efficiency in interurban environments, particularly in tunnels and on bridges. This innovative technology aims to improve traffic flow while providing critical incident detection capabilities.

- In August 2024, The GMDA is set to further develop the smart traffic signal project by adding 32 junctions in the Gurugram Sector 58 to 115. This is part of the second phase of the smart traffic control project aimed at improving the level of control over vehicle traffic and the safety of pedestrians within the city as it is ongoing.

- In July 2024, LEOTEK announced its successful acquisition of Dialight’s traffic business, a well-known global LED commercial and industrial luminaire company. These further positions them as one of the key suppliers and manufacturers of traffic signals within the Americas region.

- In May 2024, JST Group by launching Pipeline Inspection Tool (PIT). The tool is equipped with ultrasonic measurements to determine the pipeline condition. It has a self-propelled crawler aiming to provide full coverage measurement of the pipe wall.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising investments in oil and gas infrastructure.

- Intelligent pigging adoption will grow due to stricter regulatory compliance requirements.

- Advanced digital technologies will enhance real-time pipeline monitoring capabilities.

- Predictive maintenance will reduce downtime and improve operational efficiency.

- Natural gas pipeline expansion will drive higher demand for inspection services.

- Offshore and subsea pipeline projects will create new service opportunities.

- Service providers will focus on cost-effective solutions for emerging markets.

- Integration of AI and data analytics will strengthen anomaly detection accuracy.

- Demand for corrosion detection services will remain a primary growth driver.

- Strategic collaborations and acquisitions will shape market competitiveness globally.