Market Overview

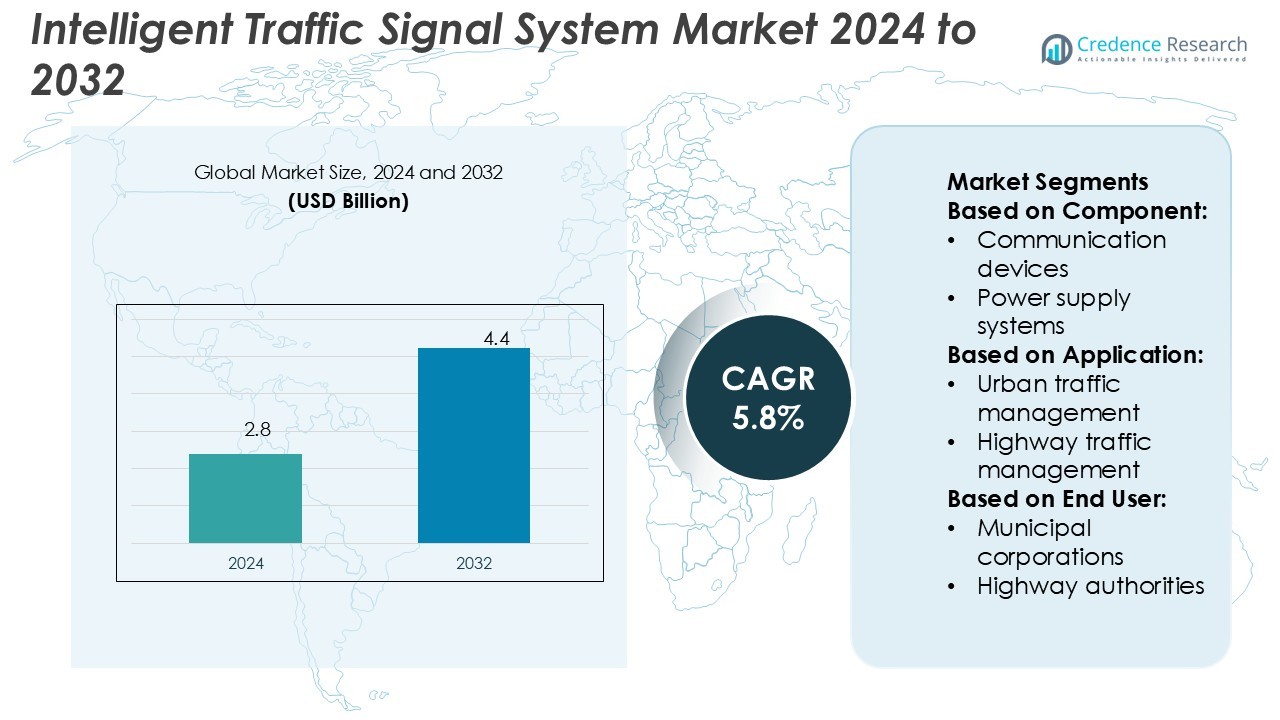

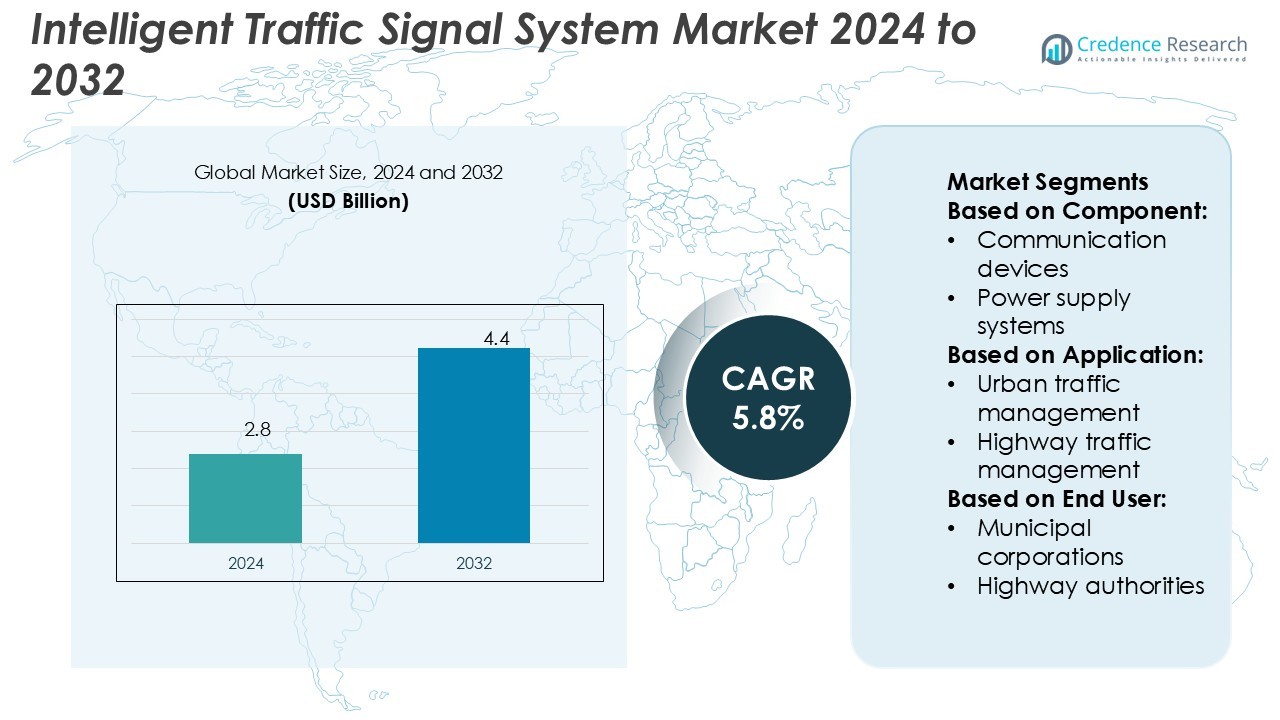

Intelligent Traffic Signal System Market size was valued USD 2.8 billion in 2024 and is anticipated to reach USD 4.4 billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intelligent Traffic Signal System Market Size 2024 |

USD 2.8 Billion |

| Intelligent Traffic Signal System Market, CAGR |

5.8% |

| Intelligent Traffic Signal System Market Size 2032 |

USD 4.4 Billion |

The Intelligent Traffic Signal System Market is shaped by top players including Iteris Inc, Cubic, Parsons, LG CNS, Dynniq, AECOM, LITE-ON Technology, Intelligent Traffic Systems, Kapsch, and Econolite. These companies compete through advanced solutions integrating AI, IoT, and cloud technologies to improve urban mobility and safety. Iteris Inc and Econolite focus on adaptive traffic control systems, while Kapsch and Cubic emphasize connected vehicle communication. Parsons and AECOM leverage expertise in large-scale infrastructure, and LG CNS drives digital transformation initiatives. Regionally, Asia-Pacific leads the market with a 34% share, driven by rapid urbanization, government-led smart city projects, and large-scale adoption of intelligent transportation solutions across China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Intelligent Traffic Signal System Market was valued at USD 2.8 billion in 2024 and is expected to reach USD 4.4 billion by 2032, growing at a CAGR of 5.8%.

- Rising traffic congestion, sustainability goals, and government-led smart city initiatives drive strong demand for adaptive traffic control and connected infrastructure solutions.

- Key trends include the integration of AI, IoT, and cloud platforms, with increasing focus on vehicle-to-infrastructure communication and predictive analytics to enhance efficiency and safety.

- Competitive dynamics are shaped by top players such as Iteris Inc, Cubic, Parsons, LG CNS, Dynniq, AECOM, LITE-ON Technology, Intelligent Traffic Systems, Kapsch, and Econolite, each advancing technology leadership and partnerships.

- Asia-Pacific dominates with a 34% market share, supported by rapid urbanization and large-scale deployments in China, India, and Japan, while North America holds 32% and Europe 28%, highlighting strong adoption across leading regions.

Market Segmentation Analysis:

By Component

The Intelligent Traffic Signal System market is segmented into hardware, software, and services. Hardware holds the dominant share at 47%, led by traffic signal controllers that ensure reliable real-time operations. Growth is driven by rising adoption of advanced sensors, IoT-enabled communication devices, and stable power supply systems that support uninterrupted functionality. Software accounts for strong demand through traffic management platforms and cloud-based analytics, while services like installation and maintenance ensure system integration and lifecycle support. The combination of controllers and sensors reinforces hardware’s leadership due to its central role in system performance.

- For instance, Iteris’ Vantage Apex hybrid sensor monitors vehicle presence up to 600 feet downstream of the stop bar. Software accounts for strong demand through traffic management platforms and cloud-based analytics, while services like installation and maintenance ensure system integration and lifecycle support.

By Application

Urban traffic management dominates with a 42% share, as cities prioritize congestion control and safety. Intelligent systems optimize traffic flow, reduce delays, and enhance pedestrian safety through adaptive signaling. Highway traffic management is expanding as smart corridors emerge to handle freight and long-distance mobility. Smart city initiatives and public transportation management create opportunities for integrated mobility solutions, while emergency vehicle management ensures priority passage. The rise of connected infrastructure and population growth in metropolitan areas sustains urban management as the key driver within this segment.

- For instance, Parsons announced that its updated iNET ingests data streams every 5 seconds to recalibrate signal timing dynamically.In New Jersey, Parsons deployed iNET as a statewide Advanced Traffic Management System (ATMS), replacing legacy systems across 21,000+ ITS devices and coordinating responses across 21 transportation districts.

By End User

Government transportation departments lead with a 38% share, driven by large-scale infrastructure investments and public safety mandates. Municipal corporations and highway authorities follow, focusing on reducing congestion and enhancing commuter convenience. Public transit agencies increasingly deploy these systems to improve scheduling and passenger movement efficiency. Smart city developers and private infrastructure companies contribute to growth by adopting intelligent solutions in urban expansion projects. The dominance of government agencies stems from funding capacity, policy enforcement, and long-term contracts that secure adoption of advanced traffic management systems.

Key Growth Drivers

Rising Urban Traffic Congestion

Increasing vehicle ownership in urban areas drives the adoption of intelligent traffic signal systems. These systems reduce congestion by using adaptive signal control and real-time monitoring. Governments prioritize them to improve mobility and decrease economic losses caused by delays. The adoption rate is highest in megacities where road density is critical. Smart intersections with AI-based algorithms help cut travel times and improve fuel efficiency. As urbanization accelerates globally, demand for optimized traffic management solutions continues to expand rapidly.

- For instance, Dynniq reports that in the Netherlands, 1,000 out of 5,000 traffic light controllers (TLCs) are already smart i-TLCs under its “Talking Traffic” initiative. Its GreenFlow module permits vehicles to request signal priority and receive “time-to-green” data along with speed advice to catch a green wave.

Government Initiatives and Smart City Programs

Governments worldwide are investing heavily in smart city infrastructure, with traffic management as a core focus. Intelligent traffic signal systems align with sustainability goals by lowering emissions and improving road safety. Public funding, coupled with partnerships with technology providers, accelerates deployment across metropolitan areas. Several cities have introduced pilot programs integrating AI, IoT, and cloud platforms into traffic operations. These initiatives enhance public transportation flow and emergency vehicle access. Policy-driven momentum positions government initiatives as a key driver of market growth.

- For instance, AECOM has delivered transportation management center (TMC) operations for more than 40 facilities worldwide, managing real-time data across signals, CCTV, and dynamic message systems.

Integration of AI and IoT in Traffic Management

The integration of AI, IoT, and cloud platforms enhances traffic control efficiency and scalability. AI-enabled predictive analytics allows signals to adjust dynamically to vehicle patterns. IoT sensors deliver real-time data on traffic density, accidents, and weather conditions. Cloud-based traffic platforms support centralized control and seamless interconnection between multiple intersections. This integration significantly reduces waiting times and improves safety for both vehicles and pedestrians. As digital transformation accelerates in infrastructure, intelligent traffic systems become essential for future-ready cities.

Key Trends & Opportunities

Adoption of Connected Vehicle Technologies

The growth of connected and autonomous vehicles creates new opportunities for intelligent signal systems. Vehicle-to-infrastructure (V2I) communication enables smoother traffic flow and supports advanced driver assistance systems. Automakers and infrastructure developers collaborate to create unified platforms that enhance road safety. This trend also supports faster emergency response by prioritizing emergency vehicles through intelligent signals. Expansion of connected vehicle ecosystems presents long-term growth opportunities for system providers.

- For instance, a recent research paper describes a distributed acoustic sensor approach using fiber optics in ITS applications—achieving 92% vehicle classification accuracy and 92–97% accuracy in occupancy detection under controlled conditions.

Shift Toward Sustainability and Green Mobility

Environmental sustainability is shaping investments in intelligent traffic systems. Smart signals reduce idle time, cutting vehicle emissions significantly in congested areas. Cities with climate action plans are adopting these solutions to meet carbon reduction targets. Energy-efficient signal controllers and renewable-powered systems are gaining traction. Sustainability goals encourage partnerships between governments and technology companies, creating fresh market opportunities. As urban areas prioritize green mobility, intelligent signals serve as a critical enabler.

- For instance, Econolite has deployed over 160,000 traffic controllers across more than 60,000 intersections globally. Its newly introduced EPIQ RADAR™ detection solution offers a 110-degree field of view, covers up to 900 feet, and can track 128 objects from 512 detections, integrating lane-by-lane classification and ETA computation.

Key Challenges

High Implementation and Maintenance Costs

Intelligent traffic signal systems require significant upfront investment in hardware, software, and integration. Many municipalities face budget limitations that slow deployment. Ongoing maintenance costs, including sensor calibration and software updates, add financial strain. Smaller cities often struggle to justify the cost against limited budgets. Despite long-term benefits, high expenses remain a major barrier to widespread adoption.

Integration Complexity with Legacy Infrastructure

Many cities still operate traditional traffic control systems that are difficult to integrate with new technologies. Legacy hardware often lacks compatibility with IoT sensors and AI-driven platforms. Upgrading requires extensive infrastructure modifications, which delay adoption timelines. Technical challenges arise in ensuring interoperability between multiple vendors’ solutions. The complexity of transitioning from conventional to intelligent systems continues to hinder seamless deployment in many regions.

Regional Analysis

North America

North America holds a 32% market share, driven by strong adoption of advanced traffic management systems. The United States leads with heavy investments in smart city projects and highway modernization. Federal and state funding supports large-scale deployments, particularly in metropolitan areas with high congestion. Integration of AI-based adaptive traffic control and vehicle-to-infrastructure communication further boosts growth. Canada contributes through sustainability-focused projects, emphasizing reduced emissions and safety improvements. The presence of leading technology providers and robust infrastructure makes North America a pioneer in intelligent traffic solutions.

Europe

Europe accounts for 28% of the global market, with Germany, the UK, and France as frontrunners. The region benefits from well-established transportation infrastructure and strong regulatory focus on road safety and emissions reduction. EU-funded smart mobility initiatives support widespread adoption of intelligent traffic systems. Cities like London and Berlin deploy adaptive signal control to enhance urban mobility and meet sustainability goals. Ongoing development of connected vehicle ecosystems also fuels demand. With its strong emphasis on innovation and policy-driven transformation, Europe maintains a significant position in the market.

Asia-Pacific

Asia-Pacific leads the market with a 34% share, fueled by rapid urbanization and high vehicle ownership. China, India, and Japan drive demand through large-scale smart city programs and infrastructure upgrades. Governments invest heavily in IoT-enabled and AI-powered traffic solutions to address congestion and pollution. Mega cities like Beijing, Tokyo, and Mumbai implement intelligent traffic lights to improve efficiency and safety. Rising focus on green mobility initiatives further strengthens adoption. With expanding urban populations and continuous investments, Asia-Pacific dominates as the fastest-growing region in the market.

Latin America

Latin America captures a 4% market share, with Brazil and Mexico as the leading adopters. Growing urbanization and rising traffic congestion in major cities drive the need for intelligent systems. Governments are gradually investing in modernizing outdated traffic infrastructure to improve road safety and reduce economic losses from delays. Pilot programs introducing adaptive signal control in São Paulo and Mexico City highlight progress. However, limited funding and high implementation costs slow widespread deployment. Despite these challenges, growing smart city initiatives provide strong growth opportunities across the region.

Middle East & Africa

The Middle East & Africa hold a 2% share, representing an emerging market for intelligent traffic solutions. Gulf countries like the UAE and Saudi Arabia invest in smart city initiatives aligned with Vision 2030 programs. Intelligent traffic signals are being integrated into large infrastructure projects, particularly in Dubai and Riyadh. Africa’s adoption remains limited, with South Africa leading due to urban safety concerns. Budgetary constraints and limited technical infrastructure slow adoption across several nations. Nonetheless, ongoing government-led projects and private investments signal steady growth potential in the region.

Market Segmentations:

By Component:

- Communication devices

- Power supply systems

By Application:

- Urban traffic management

- Highway traffic management

By End User:

- Municipal corporations

- Highway authorities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Intelligent Traffic Signal System Market features leading players such as Iteris Inc, Cubic, Parsons, LG CNS, Dynniq, AECOM, LITE-ON Technology, Intelligent Traffic Systems, Kapsch, and Econolite. The Intelligent Traffic Signal System Market is defined by rapid technological advancements and strong demand for smart mobility solutions. Companies focus on integrating artificial intelligence, IoT, and cloud-based platforms to deliver adaptive traffic control and predictive analytics. Strategic investments in research and development drive innovations such as connected vehicle communication and real-time monitoring systems. Government collaborations and public-private partnerships play a vital role in large-scale deployments, particularly in smart city initiatives. Market competition centers on offering scalable, energy-efficient, and cost-effective solutions that enhance traffic flow, reduce emissions, and improve overall road safety.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Iteris Inc

- Cubic

- Parsons

- LG CNS

- Dynniq

- AECOM

- LITE-ON Technology

- Intelligent Traffic Systems

- Kapsch

- Econolite

Recent Developments

- In September 2024, FLIR launched the TrafiBot Dual AI camera, an advanced multispectral traffic management solution designed to enhance safety and efficiency in interurban environments, particularly in tunnels and on bridges. This innovative technology aims to improve traffic flow while providing critical incident detection capabilities.

- In August 2024, The GMDA is set to further develop the smart traffic signal project by adding 32 junctions in the Gurugram Sector 58 to 115. This is part of the second phase of the smart traffic control project aimed at improving the level of control over vehicle traffic and the safety of pedestrians within the city as it is ongoing.

- In July 2024, LEOTEK announced its successful acquisition of Dialight’s traffic business, a well-known global LED commercial and industrial luminaire company. These further positions them as one of the key suppliers and manufacturers of traffic signals within the Americas region.

- In December 2023, Yunex Traffic has launched advanced traffic management system (ATMS), a cloud based Traffic Studios, in the U.S. The system is designed to address traffic management challenges quickly, efficiently, and safely with high-quality tools for planning, monitoring, and optimization.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing investments in smart city infrastructure worldwide.

- Adoption of AI-driven adaptive traffic control will enhance efficiency across urban intersections.

- IoT-enabled sensors will gain prominence for real-time monitoring and congestion management.

- Vehicle-to-infrastructure communication will strengthen integration with connected and autonomous vehicles.

- Sustainability goals will drive demand for energy-efficient and eco-friendly traffic signal solutions.

- Cloud-based platforms will support centralized control and scalability in large cities.

- Governments will prioritize intelligent systems to reduce emissions and improve road safety.

- Private-public partnerships will accelerate deployments in developing and emerging economies.

- Data analytics will play a key role in predictive traffic management strategies.

- The market will see stronger competition through innovations and technology collaborations.