Market Overview:

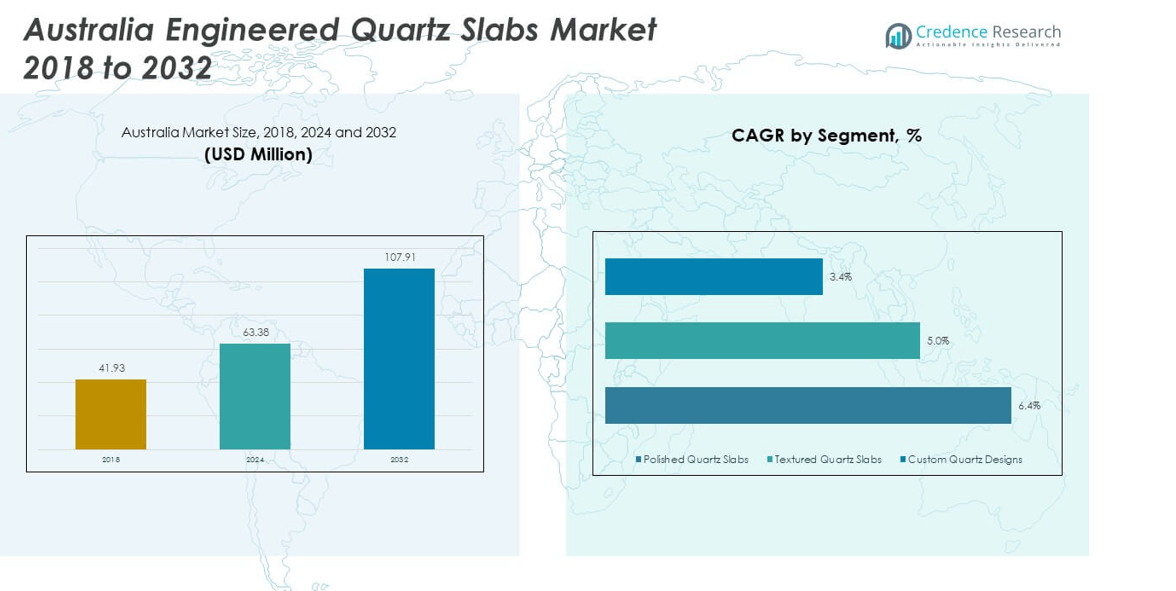

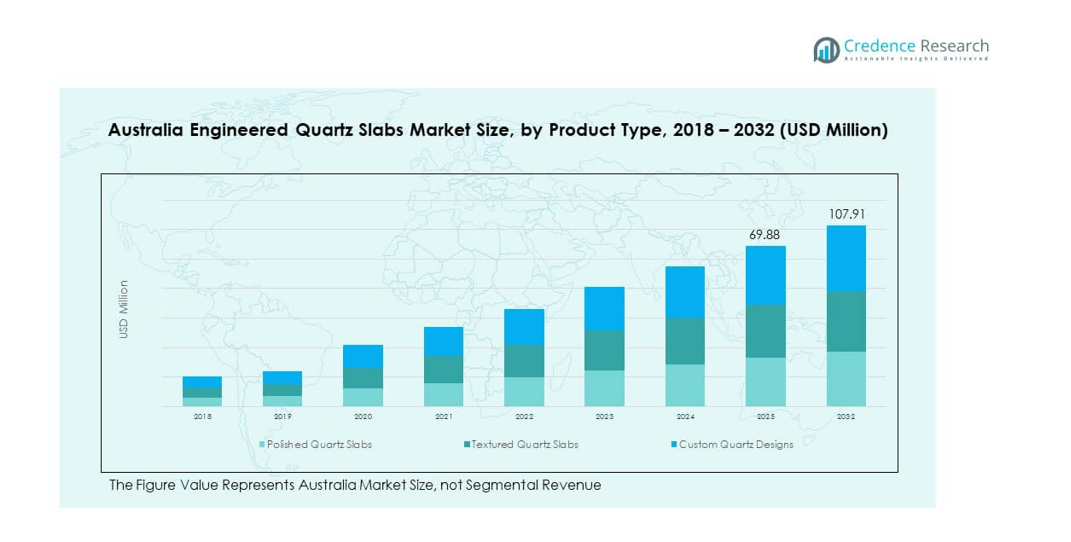

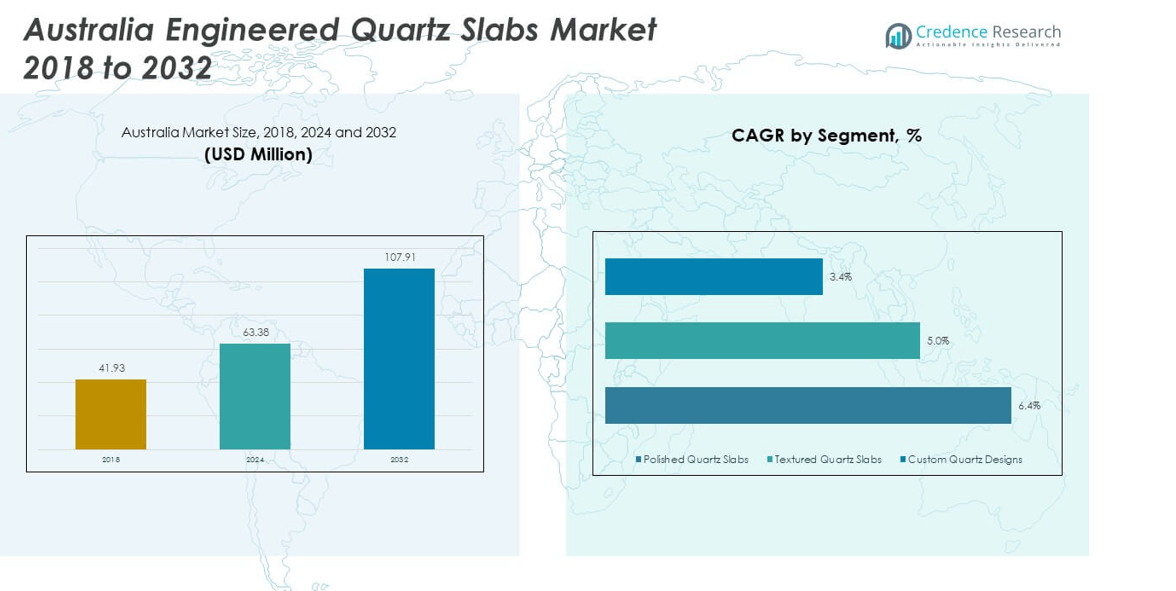

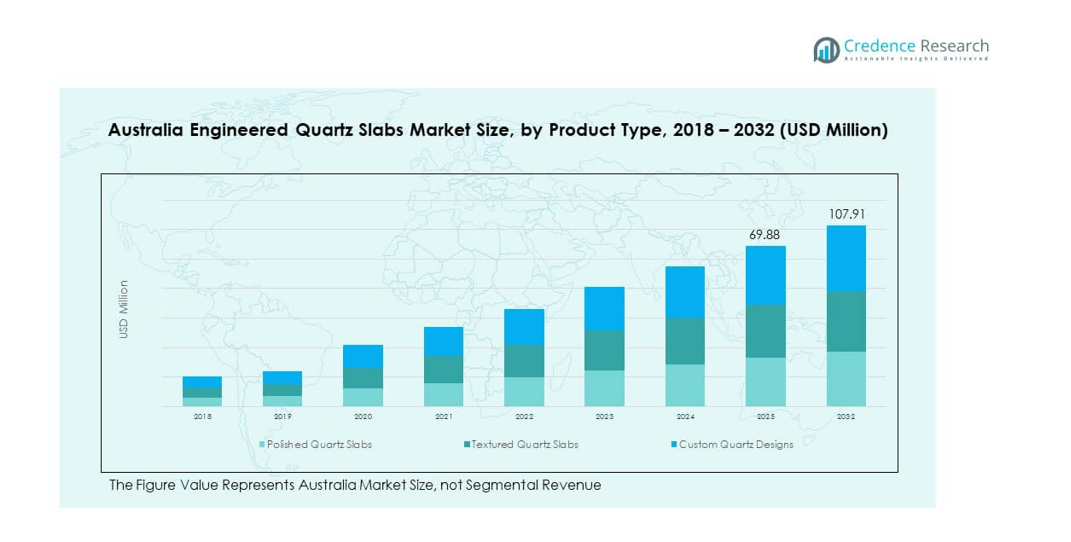

The Australia Engineered Quartz Slabs Market size was valued at USD 41.93 million in 2018 to USD 63.38 million in 2024 and is anticipated to reach USD 107.91 million by 2032, at a CAGR of 6.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Engineered Quartz Slabs Market Size 2024 |

USD 63.38 million |

| Australia Engineered Quartz Slabs Market, CAGR |

6.40% |

| Australia Engineered Quartz Slabs Market Size 2032 |

USD 107.91 million |

Growing demand for durable, non-porous, and low-maintenance surfaces drives market expansion. Rising consumer preference for modern kitchen and bathroom aesthetics has increased quartz slab adoption in residential projects. Commercial sectors, such as hotels and offices, also contribute to demand due to quartz’s resilience and design flexibility. Advancements in engineered stone production and wider availability of customizable colors and finishes strengthen adoption across multiple applications. Sustainability trends and awareness of eco-friendly alternatives further accelerate growth in the country’s construction and renovation activities.

Geographically, urban regions in Australia lead the market, particularly areas with high construction activity and modern housing projects. Rising disposable incomes and strong real estate investments in metropolitan cities support demand growth. Emerging opportunities are visible in semi-urban and regional areas as infrastructure development expands. The market’s concentration in developed zones stems from better consumer awareness, while evolving design preferences and ongoing housing upgrades foster broader adoption across new regions.

Market Insights:

- The Australia Engineered Quartz Slabs Market was valued at USD 41.93 million in 2018, reached USD 63.38 million in 2024, and is projected to attain USD 107.91 million by 2032, expanding at a CAGR of 6.40%.

- Eastern Australia held the largest share at 45% in 2024, supported by high urbanization and strong real estate investments, followed by Western Australia at 25% and Southern Australia at 18%.

- Northern Australia is projected to be the fastest-growing region with nearly 12% share in 2024, driven by infrastructure projects and expanding residential activity.

- By product type, polished quartz slabs accounted for around 52% of the market in 2024, making them the leading category due to their versatility and aesthetic appeal.

- Textured quartz slabs represented 30% of the 2024 share, while custom quartz designs held about 18%, reflecting growing demand for personalized and premium finishes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Residential Construction and Renovation Activities

The Australia Engineered Quartz Slabs Market benefits from robust residential construction and renovation projects. Growing urbanization fuels demand for modern kitchens and bathrooms that highlight sleek quartz surfaces. Homeowners favor quartz for its durability, non-porous nature, and minimal upkeep compared to natural stone. The material offers both design appeal and longevity, making it a preferred choice for contemporary living spaces. Government-backed housing initiatives also enhance market penetration in urban and semi-urban areas. Rising disposable incomes increase consumer willingness to invest in premium home interiors. Renovation projects contribute significantly to repeat demand for engineered slabs. This segment remains a leading driver for market expansion.

- For instance, Caesarstone was prominently featured in the 2025 season of ‘Selling Houses Australia,’ highlighting large-scale kitchen and bathroom renovations using Caesarstone ICON™ surfaces, which are crystalline silica-free and promote enhanced indoor air quality for residential projects.

Growing Commercial Sector Demand for Durable Surfaces

Commercial spaces such as offices, hotels, and retail outlets are turning to engineered quartz slabs for their strength and versatility. These slabs offer uniform appearance and long-lasting performance under heavy usage. Hospitality establishments value their resistance to stains and scratches, ensuring lower maintenance costs. The Australia Engineered Quartz Slabs Market sees consistent demand from large-scale projects in urban centers. Architects and designers incorporate quartz slabs into projects for aesthetic appeal and structural benefits. The growing trend of open-space offices and premium interiors boosts usage further. Developers see quartz as a cost-efficient material offering quality and style. It secures steady momentum in commercial adoption.

- For instance, Smartstone’s quartz surfaces, known for certified durability and a 15-year limited warranty, have been installed in multiple award-winning hotel and high-traffic office projects, as documented by Houzz user reviews and project portfolios for 2022-2025 installations.

Technological Advancements in Manufacturing Processes

Innovations in production processes are broadening the appeal of engineered quartz slabs. Advanced technology enables improved finishing, enhanced durability, and a wider range of textures. Local manufacturers invest in R&D to create unique designs that mimic marble and granite. The Australia Engineered Quartz Slabs Market gains from these advancements through higher consumer acceptance. Production improvements also allow better customization for specific client needs. Digital design tools streamline slab fabrication, reducing waste and costs. Manufacturers offering eco-friendly processes position themselves competitively in the marketplace. Such technological progress sustains industry growth and product appeal.

Increasing Awareness of Sustainable and Eco-Friendly Materials

Sustainability plays a major role in shaping preferences for quartz slabs in Australia. Growing environmental awareness drives demand for materials produced with eco-friendly practices. The Australia Engineered Quartz Slabs Market benefits from companies that highlight recycled content and low-emission processes. Architects and developers align with sustainability goals by choosing quartz over alternatives requiring greater resource use. Consumer demand for products supporting health and environmental safety increases adoption. Manufacturers responding to green certifications gain a competitive edge in project approvals. Stronger regulations on environmental standards further push adoption of engineered quartz. This focus on sustainability strengthens long-term market growth.

Market Trends:

Expanding Use of Digital Tools for Design and Customization

Digital design platforms are transforming how customers select and customize quartz slabs. Consumers and architects use 3D modelling and visualization tools to match slabs with interiors. The Australia Engineered Quartz Slabs Market gains traction as digital previews reduce design uncertainty. Fabricators also leverage automated cutting and finishing equipment to improve efficiency. This integration of technology enhances the buyer experience and boosts confidence in purchase decisions. Custom color blends and surface textures created through digital innovation expand design possibilities. Manufacturers adopting these tools strengthen relationships with premium clients. The trend positions quartz slabs as a highly adaptable product.

- For instance, WK Stone (Australia), supplier of Quantum Porcelain and other engineered surfaces, has expanded to include crystalline silica-free options and offers digital visualization for customers, allowing selection and preview of slabs for personalized projects as of May 2025.

Rising Preference for Minimalist and Modern Aesthetic Surfaces

Design preferences in Australia are shifting toward minimalist, modern interiors featuring clean lines and neutral tones. Engineered quartz slabs meet these demands with their sleek, uniform surfaces. The Australia Engineered Quartz Slabs Market benefits from the alignment between design trends and product features. Homeowners prefer slabs that complement open-plan living and light-filled spaces. Architects recommend quartz for projects that emphasize contemporary styling. The versatility of slabs in matching cabinetry and flooring enhances adoption. Demand for polished finishes with subtle veining patterns continues to rise. The trend strengthens quartz as a go-to material in modern interior design.

- For instance, Cosentino’s Silestone Ethereal collection, launched with HybriQ+ technology, provides marble-like veining and has been prominently chosen for high-end duplex renovations for its aesthetic versatility and environmental sustainability, as of August 2025.

Integration of Quartz Slabs in Outdoor and Specialty Applications

Engineered quartz is extending beyond kitchens and bathrooms into outdoor and specialty applications. Advances in UV-resistant formulations allow quartz to be used in patios, outdoor kitchens, and facades. The Australia Engineered Quartz Slabs Market benefits from this expansion into non-traditional spaces. Builders and designers view quartz as a versatile solution for both functionality and style. Outdoor living culture in Australia supports demand for durable yet aesthetic surfaces. Specialty applications like reception desks and retail counters highlight its adaptability. Designers showcase slabs as statement pieces in commercial environments. This trend broadens the scope of quartz usage across industries.

Growing Influence of Health and Hygiene Considerations in Material Choice

Consumers place higher value on materials that promote hygiene and safety in living spaces. Non-porous quartz surfaces prevent bacterial growth and resist stains. The Australia Engineered Quartz Slabs Market leverages these features to address consumer health concerns. Commercial sectors, including healthcare and food service, recognize quartz as a safer alternative to porous materials. Public demand for hygienic environments after health crises supports adoption. Architects highlight quartz surfaces in projects requiring strict cleanliness standards. Increased marketing of health-related benefits strengthens consumer trust. The trend drives wider adoption across both residential and commercial sectors.

Market Challenges Analysis:

High Competition from Natural Stones and Alternative Materials

The Australia Engineered Quartz Slabs Market faces competition from natural stones such as granite and marble, as well as emerging substitutes like porcelain and solid surfaces. These materials often attract consumers due to lower cost or perceived prestige in luxury projects. Strong brand presence of natural stone suppliers challenges quartz adoption in traditional applications. Limited consumer awareness in regional areas further slows penetration of engineered slabs. Architects loyal to granite or marble often resist switching to quartz. This creates pricing pressure on manufacturers trying to compete in cost-sensitive markets. Intense rivalry forces quartz producers to invest heavily in differentiation. Such competitive dynamics limit overall growth potential.

High Production Costs and Limited Domestic Manufacturing Capabilities

Quartz slab production requires advanced technology, significant energy use, and raw material sourcing challenges. The Australia Engineered Quartz Slabs Market struggles with high operational costs compared to imports from large-scale producers abroad. Local manufacturers face barriers in achieving economies of scale due to smaller production volumes. Currency fluctuations also raise costs for imported machinery and raw quartz. Rising energy prices compound the issue, directly impacting profitability. Smaller players lack resources to invest in automation or sustainability-focused equipment. This weakens their ability to compete with established global brands. Such constraints make local market players vulnerable in price-driven segments.

Market Opportunities:

Rising Demand for Premium Interiors in Residential and Commercial Spaces

Growing consumer interest in high-end interiors creates strong opportunities for engineered quartz slabs. The Australia Engineered Quartz Slabs Market benefits as homeowners and developers prioritize durability and style. Rising urbanization and lifestyle upgrades increase adoption across luxury homes and modern office spaces. Hotels and retail environments also prefer quartz for its design flexibility and longevity. Rising tourism boosts hospitality construction, enhancing product penetration. Companies offering unique patterns and high customization options gain competitive advantage. Targeting this demand for premium interiors ensures long-term revenue growth.

Expansion into Export Markets and Niche Applications

Opportunities extend beyond domestic demand, with potential growth in exports and niche applications. The Australia Engineered Quartz Slabs Market can leverage its reputation for quality to access nearby Asia-Pacific markets. Expanding into specialized uses such as laboratory surfaces, healthcare facilities, and educational institutions further supports growth. Rising demand for eco-certified products abroad creates openings for sustainable local players. Partnerships with international distributors expand visibility and reach. Targeting export demand reduces reliance on domestic cycles and broadens revenue streams. This creates resilience and sustainability for industry players in the long run.

Market Segmentation Analysis:

By Product Type

The Australia Engineered Quartz Slabs Market demonstrates strong demand for polished slabs, driven by their durability and modern aesthetic appeal in residential and commercial projects. Textured quartz slabs gain traction for premium interiors, reflecting consumer preference for natural finishes. Custom quartz designs address niche requirements in high-end applications, positioning them as a growth-oriented category.

By Application

Residential construction remains the largest consumer of engineered quartz slabs due to rising home renovation and kitchen remodeling trends. Commercial construction contributes significantly with demand from offices, hotels, and retail spaces. Kitchen and bathroom design represent key application drivers, supported by consumer focus on aesthetics and functionality. Interior design uses quartz slabs in furniture and decorative spaces, while other applications extend adoption into innovative uses.

- For instance, Smartstone and Caesarstone quartz products are specified in a wide array of hospitality and commercial projects in Australia for kitchens, bathrooms, and reception surfaces due to their high stain resistance and certification for direct food contact, as confirmed across recent project showcases and supplier documentation.

By Country (Australia Focus)

The market in Australia shows notable regional concentration, with urban hubs leading consumption due to high construction activity. It reflects a diverse revenue footprint across product type and application segments, underlining growth in both residential and commercial domains. Country-wise revenue distribution highlights strong adoption of polished slabs, while application-wise insights confirm dominance of kitchen and bathroom installations.

Segmentation:

By Product Type

- Polished Quartz Slabs

- Textured Quartz Slabs

- Custom Quartz Designs

By Application

- Residential Construction

- Commercial Construction

- Kitchen & Bathroom Design

- Interior Design

- Others

By Country (Australia Focus)

- Country-wise Revenue Share

- Revenue by Product Type

- Revenue by Application

Regional Analysis:

Eastern Australia

Eastern Australia holds the largest share of the Australia Engineered Quartz Slabs Market, accounting for nearly 45% of total revenue. High urbanization in Sydney, Melbourne, and Brisbane drives sustained demand from both residential and commercial construction. Renovation activity in metropolitan households supports growth, especially in kitchen and bathroom applications. Large-scale commercial projects, including hotels and office complexes, further strengthen adoption of premium quartz slabs. Consumers in this region show a preference for polished and custom designs, aligning with higher disposable incomes and design-conscious trends. It maintains its lead through continuous infrastructure development and evolving interior design preferences.

Western Australia

Western Australia contributes close to 25% of the market, driven by robust construction activity in Perth and surrounding urban centers. Mining-led economic growth supports disposable income, which encourages investment in modern housing and high-end interiors. Residential construction remains dominant, but commercial applications such as retail and hospitality projects show growing importance. Textured slabs are gaining appeal due to their natural finish, suited for upscale housing projects. Western Australia shows strong imports of engineered quartz products, reflecting a reliance on premium international suppliers. It continues to expand its market presence with rising demand from both urban and suburban construction sectors.

Northern & Southern Australia

Northern and Southern regions collectively account for around 30% of the market share. In Northern Australia, demand stems largely from government-backed infrastructure projects and modest residential development. Southern Australia, led by Adelaide, shows consistent consumption of quartz slabs in both new construction and renovations. Residential kitchens and bathrooms are the leading application areas, while commercial adoption remains steady in retail and education facilities. Polished slabs dominate, though custom designs are gaining traction in luxury housing developments. The Australia Engineered Quartz Slabs Market benefits from a balanced distribution across these regions, ensuring diversified growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Caesarstone

- Silestone

- Smartstone

- Quantum Quartz

- Stone Ambassador

- Compac

- Technistone

- Quarella

- Cambria

Competitive Analysis:

The Australia Engineered Quartz Slabs Market features a competitive landscape shaped by global and domestic players. Caesarstone, Silestone, and Smartstone dominate with strong brand presence and premium product portfolios. Quantum Quartz and Stone Ambassador reinforce competition with tailored offerings for residential and commercial projects. It shows intense rivalry driven by product differentiation, design innovation, and regional expansion strategies. Companies invest in distribution networks and partnerships to strengthen accessibility in urban and suburban markets. Custom quartz designs are becoming a critical differentiator, attracting niche customers seeking personalization. The market remains highly dynamic with competitors leveraging sustainability and innovation to secure growth.

Recent Developments:

- In June 2025, Caesarstone launched the ICON™ Crystalline Silica-Free (CSF) Advanced Fusion surface, marking a breakthrough innovation aimed at safer surfacing solutions. This launch was part of Caesarstone’s commitment to address industry-wide silica regulations and represents the latest addition to its advanced material portfolio for the Australian market.

- In November 2023, Silestone by Cosentino partnered with luxury designer Elie Saab to unveil an exclusive quartz collection, infusing high-fashion elements into engineered surfaces. This collaboration shows Silestone’s dedication to creative partnerships and expanding premium offerings in Australia.

- In March 2024, Smartstone officially introduced the Sintered Collection, a range of 24 sintered stone surfaces fully compliant with Australia’s updated government legislation regarding crystalline silica. This collection, available nationwide, was designed specifically to help industry stakeholders transition from traditional engineered stone to safer, innovative alternatives.

- In March 2025, WK Stone launched Quantum Zero, a crystalline silica-free, recycled surface collection. This new offering replaced the Quantum Quartz line and directly responded to the government’s July 2024 ban on engineered stone containing more than 1% crystalline silica. Quantum Zero positions WK Stone at the forefront of sustainable and safe surface design in Australia.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and country-level segmentation. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising renovation and remodeling trends will support steady demand across residential projects.

- Commercial construction will expand consumption, especially in hospitality and retail sectors.

- Polished slabs will remain dominant due to their versatility and aesthetic appeal.

- Textured and custom designs will gain momentum in premium and luxury markets.

- Sustainability and eco-friendly production practices will shape product innovation.

- Imports will continue to play a role in meeting demand for premium finishes.

- Distribution networks will expand, strengthening access in suburban and regional areas.

- Regional hubs in Eastern Australia will lead consumption supported by high urbanization.

- Competitive intensity will remain strong, with companies focusing on design differentiation.

- Technological advancements in slab production will drive efficiency and broaden applications.