Market Overview:

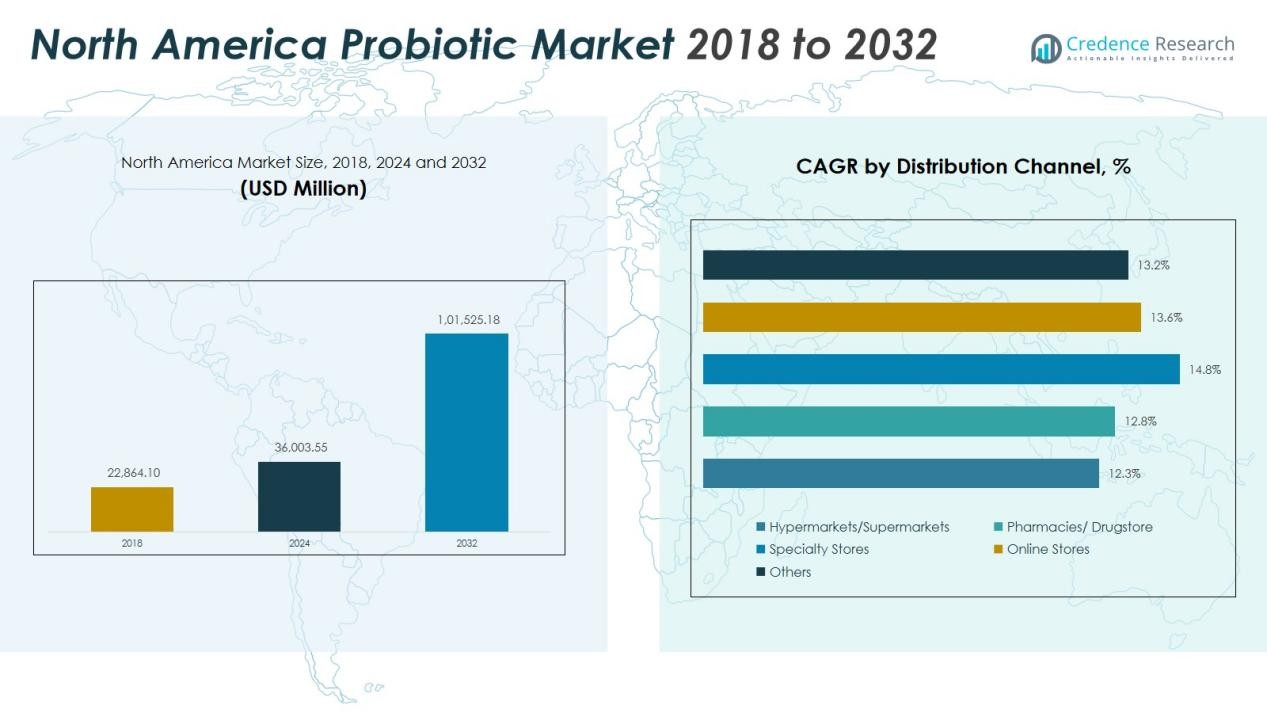

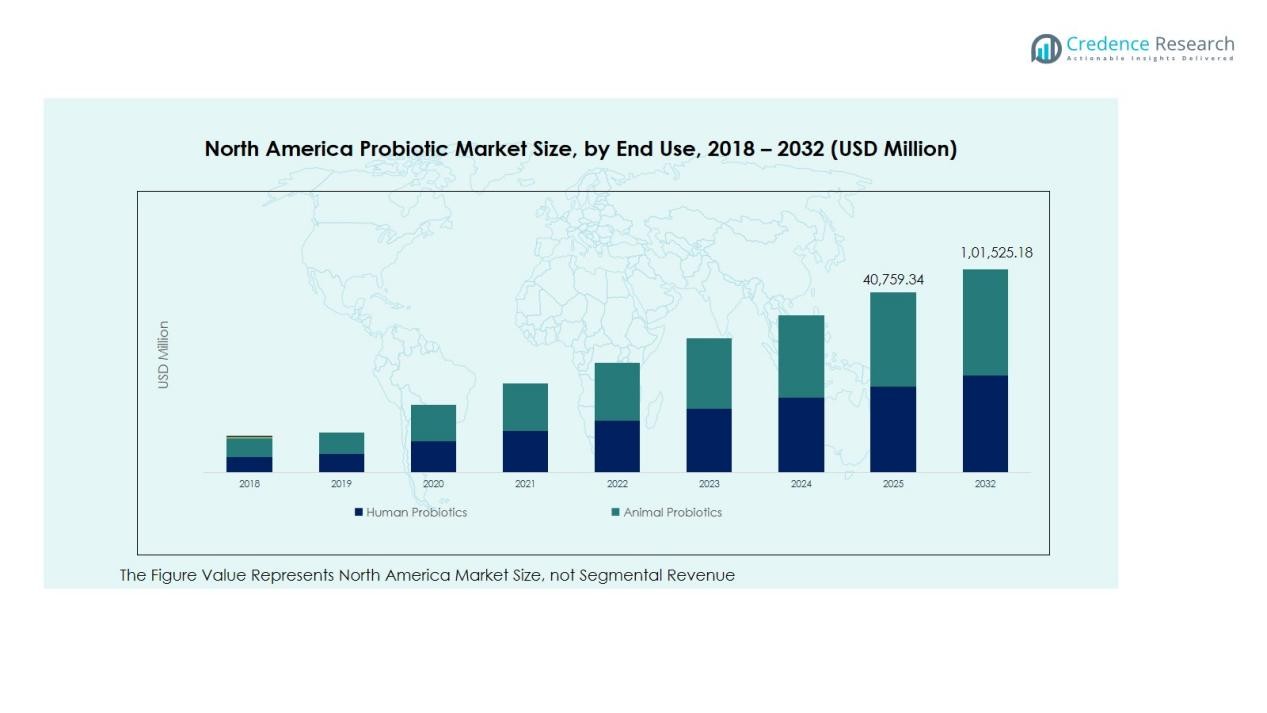

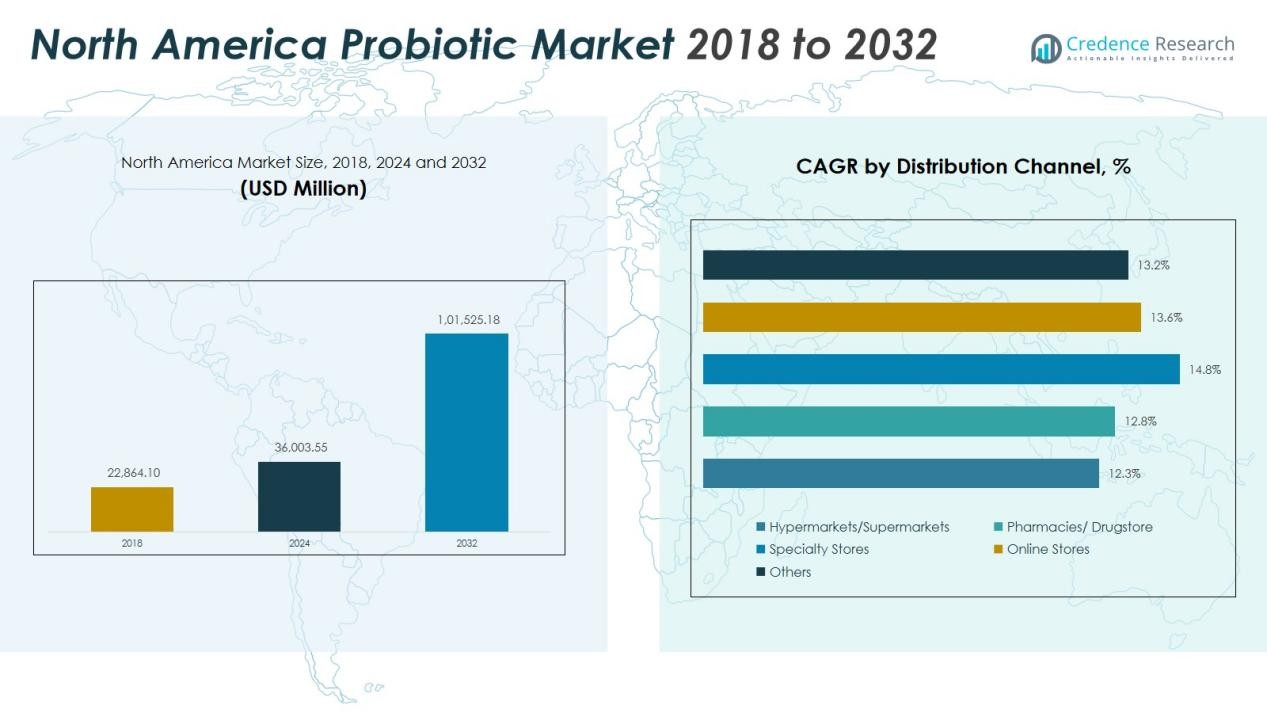

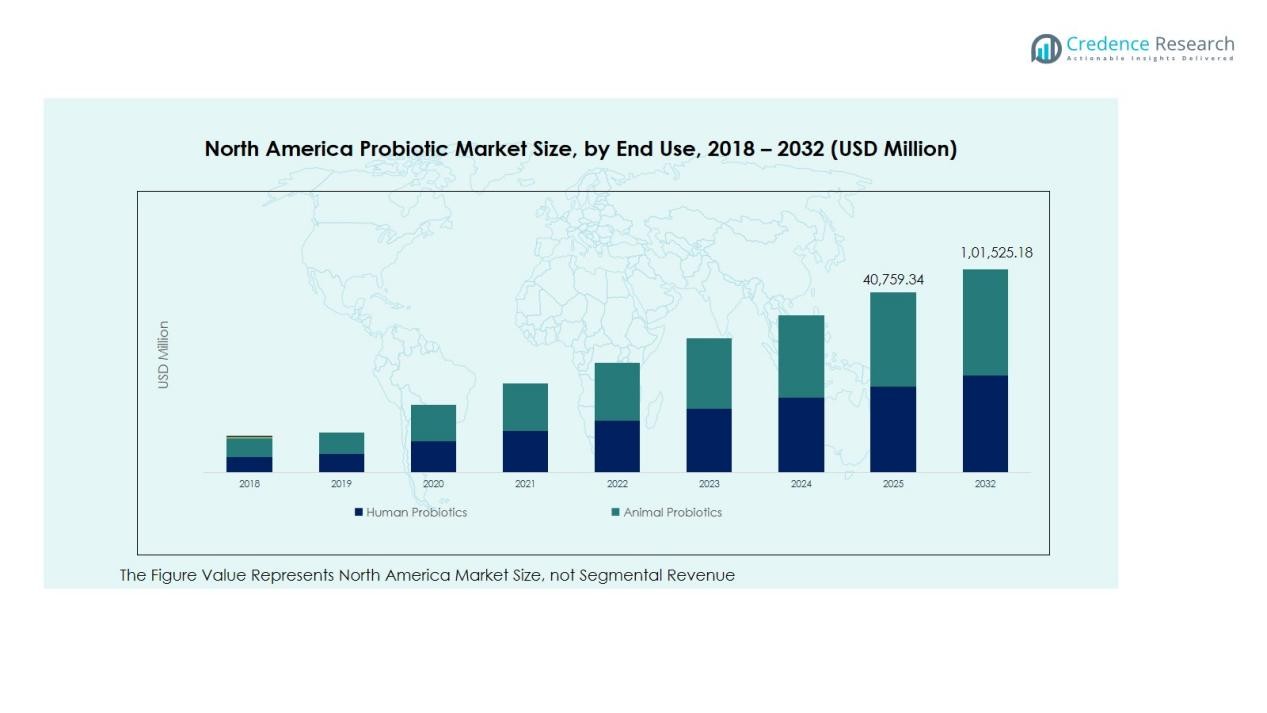

The North America Probiotic Market size was valued at USD 22,864.10 million in 2018 to USD 36,003.55 million in 2024 and is anticipated to reach USD 1,01,525.18 million by 2032, at a CAGR of 11.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Probiotic Market Size 2024 |

USD 36,003.55 Million |

| North America Probiotic Market, CAGR |

11.55% |

| North America Probiotic Market Size 2032 |

USD 1,01,525.18 Million |

The North America Probiotic Market is driven by growing health consciousness and a shift toward preventive healthcare solutions. Strong demand for functional foods, along with a preference for clean-label and natural ingredients, is stimulating product innovation. The growing elderly population and rising digestive health issues are also fueling adoption across both retail and online distribution channels.

Regionally, the United States dominates the North America Probiotic Market with over 75% share in 2024, driven by a mature functional food sector and advanced clinical research. Canada is showing strong growth supported by expanding retail availability of probiotic dairy and supplements. Mexico is emerging as a promising market, supported by increasing disposable incomes and wider acceptance of fortified food products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- Rising health awareness and preventive healthcare are driving strong probiotic adoption across North America.

- Consumers are increasingly choosing probiotic-enriched foods and beverages to support digestive and immune health.

- Functional dairy, yogurt, and fermented beverages remain leading categories fueling consistent product demand.

- Technological innovation in strain encapsulation is improving shelf life, stability, and therapeutic efficiency.

- Regulatory challenges related to labeling and strain validation continue to slow market entry and product launches.

- The United States leads the regional market with advanced research facilities and high consumer awareness.

- Canada and Mexico show steady and emerging growth respectively, supported by expanding retail presence and rising disposable incomes.

Market Drivers:

Rising Health Awareness and Preventive Healthcare Focus

Consumers are becoming more conscious of digestive and immune health, fueling demand for probiotics. The growing preference for preventive healthcare over curative treatments supports steady adoption. Functional foods and beverages fortified with probiotic strains are gaining traction across retail platforms. The North America Probiotic Market benefits from increasing consumer trust in natural solutions that enhance overall wellness.

- For Instance, The number of Colony Forming Units (CFUs) of Lacticaseibacillus casei Shirota in a 65 mL bottle of Yakult varies by region. The UK version contains at least 20 billion CFUs, while the standard formulas in markets like India and Australia contain at least 6.5 billion CFUs.

Expansion of Functional Food and Beverage Segment

The rapid expansion of functional dairy, yogurt, and fermented beverages drives the regional probiotic demand. Manufacturers are launching new products with clinically tested strains to attract health-focused consumers. It is supported by growing supermarket penetration and strong marketing emphasizing digestive balance and immunity benefits. The integration of probiotics into everyday food products is strengthening brand loyalty and consumer engagement.

- For instance, in August 2025, Danone’s Activia introduced its Proactive Yogurt line in the U.S., formulated with billions of live probiotics and 3 grams of prebiotic fiber per serving, alongside a 25% reduction in sugar content to enhance digestive health and consumer appeal.

Technological Advancements and Product Innovation

Advances in strain isolation and encapsulation technologies are improving product shelf life and effectiveness. Companies are investing in research partnerships to develop targeted probiotic formulations for different health needs. It enables better strain delivery and higher survival rates through gastrointestinal passage. These technological innovations are helping brands expand into new applications such as nutraceuticals, infant nutrition, and sports supplements.

Rising Geriatric Population and Lifestyle-Related Disorders

An aging population with higher rates of digestive issues and metabolic disorders supports market expansion. Probiotic supplements are increasingly used to manage gut imbalance and enhance nutrient absorption. The growing incidence of obesity, stress-related digestive problems, and antibiotic use also contributes to demand. The North America Probiotic Market is gaining strong traction among adults seeking daily digestive and immune support solutions.

Market Trends:

Growing Shift Toward Non-Dairy and Plant-Based Probiotic Products

Consumers are showing stronger demand for non-dairy probiotic options due to rising lactose intolerance and vegan preferences. Companies are responding with plant-based formulations made from soy, oats, almonds, and coconut. It supports broader accessibility among consumers seeking sustainable and allergen-free products. Non-dairy probiotic beverages, gummies, and powders are gaining popularity across supermarkets and online platforms. Manufacturers are expanding product portfolios with natural flavors and organic ingredients to attract health-conscious buyers. The North America Probiotic Market is moving toward inclusivity, appealing to both vegan and flexitarian consumers through diversified product innovation.

- For Instance, Israeli agrifoodtech startup Wonder Veggies received its first granted patent for technology to infuse probiotics into fresh produce. The technology enables viable endophytic bacteria to survive throughout the shelf life of the produce, which the company claims can be up to 14 days in leafy greens.

Integration of Personalized Nutrition and Digital Health Solutions

Personalized nutrition is becoming a major trend shaping the probiotic industry in North America. Digital platforms now offer microbiome testing and customized probiotic recommendations, creating higher consumer engagement. It reflects a transition from generic supplementation to tailored wellness strategies. Technology-driven solutions are helping brands deliver specific formulations that target gut, immune, and mental health needs. Collaborations between biotech firms and nutrition companies are strengthening this personalized approach. The growing integration of health apps, e-commerce, and data-driven formulations is transforming how consumers interact with probiotic products and track their health outcomes.

- For instance, in June 2025, The Vitamin Shoppe partnered with GenoPalate to launch an at-home DNA nutrition kit that analyzes over 400 genetic markers to curate personalized probiotic and vitamin regimens based on the user’s microbiome and genetic traits.

Market Challenges Analysis:

Complex Regulatory Framework and Labeling Inconsistencies

Regulatory variations across the United States, Canada, and Mexico pose challenges for probiotic manufacturers. Companies face difficulty in obtaining approvals and maintaining label claims that comply with regional health authorities. It limits product launches and delays innovation cycles. The absence of standardized guidelines for probiotic strain efficacy and dosage reduces consumer trust. Manufacturers must invest in rigorous clinical validation and documentation to maintain credibility. The North America Probiotic Market faces pressure to align scientific evidence with evolving health and safety regulations.

High Product Sensitivity and Supply Chain Constraints

Probiotics are living organisms that require strict temperature control and stable packaging during storage and transport. Small deviations in handling conditions can reduce product viability and potency. It creates added cost burdens for producers and distributors. Limited availability of high-quality raw materials and strain-specific cultures further complicates supply consistency. Shelf life issues in fermented and supplement-based probiotics restrict market penetration in remote regions. These operational and logistical challenges continue to affect profitability and scalability for several market participants.

Market Opportunities:

Expanding Applications Beyond Digestive Health

Probiotics are gaining recognition for benefits beyond gut wellness, including immunity, skin health, and mental well-being. Scientific research continues to uncover links between gut microbiota and mood regulation, creating new opportunities for functional supplements. It encourages companies to introduce multi-benefit formulations addressing stress, metabolism, and skincare. The North America Probiotic Market is witnessing increasing collaborations between nutraceutical and pharmaceutical sectors to explore these diversified applications. Such innovation broadens consumer reach and strengthens long-term growth prospects across emerging health categories.

Rising Demand for E-Commerce and Customized Nutrition Solutions

E-commerce platforms are becoming a key growth driver for probiotic brands targeting tech-savvy consumers. Online sales enable direct-to-consumer engagement and flexible subscription-based distribution models. It provides opportunities for personalization through microbiome testing and tailored probiotic blends. Companies leveraging digital health tools and data-driven insights are gaining a competitive edge. Strategic partnerships with wellness apps and digital pharmacies support brand visibility and consumer trust. Growing digital adoption continues to open new channels for targeted marketing and product expansion in the regional market.

Market Segmentation Analysis:

By Type

Probiotic food and beverages dominate the North America Probiotic Market, driven by strong demand for functional dairy, fermented drinks, and non-dairy alternatives. Yogurt, kefir, and fortified beverages remain key revenue contributors. It benefits from consumer preference for convenient and natural digestive health solutions. Dietary supplements such as capsules, gummies, and powders are expanding rapidly, supported by clinical validation and online retail growth. The animal feed segment continues to grow steadily, driven by rising awareness of gut health and productivity in livestock.

- For Instance, Danone North America launched Activia Proactive, a new line of low-fat yogurt with simpler ingredients and 25% less sugar than its classic low-fat version. Activia Proactive also contains billions of live probiotics and prebiotic fiber to support digestive health.

By Ingredient

Bacteria-based probiotics hold the largest market share due to their proven health benefits and widespread application in food and dietary supplements. Strains such as Lactobacillus and Bifidobacterium are widely used for improving immunity and digestion. It continues to attract significant research and investment for strain-specific functionality. Yeast-based probiotics, primarily Saccharomyces boulardii, are gaining popularity for their role in gastrointestinal health and antibiotic resistance support.

- For instance, Yakult’s Original fermented milk drink sold in the UK and Europe delivers at least 20 billion CFUs of Lacticaseibacillus casei Shirota in each 65 mL bottle, ensuring consistent probiotic intake per serving

By End-Use

Human probiotics lead the market with strong consumer adoption in functional foods, supplements, and fortified beverages. Growing awareness of gut-brain and gut-skin connections supports their integration into wellness routines. It shows consistent demand across adult and elderly populations. Animal probiotics, though smaller in share, are expanding with rising adoption in poultry, swine, and cattle feed to enhance immunity and growth efficiency.

Segmentations:

By Type

Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

By Ingredient

By End-Use

- Human Probiotics

- Animal Probiotics

By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacies/Drugstores

- Specialty Stores

- Online Stores

- Others

By Country

- United States

- Canada

- Mexico

Regional Analysis:

United States Dominating the Regional Market Landscape

The United States accounts for the largest share of the regional probiotic industry, driven by strong consumer awareness and a mature health supplements market. Robust demand for probiotic yogurt, functional beverages, and dietary capsules fuels consistent revenue growth. It benefits from advanced research capabilities, high disposable income, and widespread retail availability. Key manufacturers focus on strain innovation and product diversification to meet growing wellness trends. The North America Probiotic Market gains significant momentum in the U.S. due to strong distribution networks and supportive clinical studies that validate probiotic efficacy.

Canada Demonstrating Steady Market Growth

Canada exhibits steady growth supported by rising healthcare spending and interest in preventive nutrition. Expanding supermarket and pharmacy chains have improved product accessibility across urban and suburban regions. It experiences increasing acceptance of probiotic-enriched dairy, gummies, and supplements among younger consumers. Government emphasis on food safety and clear labeling standards promotes trust in branded probiotic products. The country’s focus on clean-label and organic formulations continues to strengthen its probiotic market position.

Mexico Emerging as a High-Potential Market

Mexico shows promising potential driven by improving income levels and growing urbanization. Probiotic beverages and fortified foods are gaining traction among consumers seeking digestive support and immune balance. It benefits from expanding awareness campaigns and wider distribution through modern retail formats. Local manufacturers are partnering with global brands to enhance product quality and strain diversity. Rapid adoption of affordable probiotic solutions positions Mexico as a key contributor to regional expansion and future demand growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Yakult Honsha Co. Ltd

- Danone S.A.

- Nestlé S.A.

- Hansen Holding A/S

- BioGaia AB

- Probi AB

- General Mills, Inc.

- Lallemand Inc.

- Kerry Group plc

- Lifeway Foods, Inc.

- Archer Daniels Midland Company (ADM)

- UAS Laboratories

- i-Health, Inc. (Culturelle)

- Seed Health

- DuPont (IFF – International Flavors & Fragrances)

- NOW Foods

Competitive Analysis:

The North America Probiotic Market is highly competitive with several global and regional players operating across multiple product categories. Leading companies such as Yakult Honsha Co. Ltd, Danone S.A., Nestlé S.A., Chr. Hansen Holding A/S, BioGaia AB, Probi AB, General Mills, Inc., Lallemand Inc., Kerry Group plc, and Lifeway Foods, Inc. dominate the landscape through extensive product portfolios and strong distribution networks. It is characterized by continuous product innovation, partnerships, and acquisitions aimed at expanding probiotic applications beyond digestive health. Major players are focusing on developing strain-specific formulations and functional beverages that address immunity and mental wellness. Investments in research, clinical validation, and clean-label formulations are intensifying competition, while digital retail channels and personalized nutrition trends create new growth opportunities across the region.

Recent Developments:

- In July, 2025, Danone completed the acquisition of a majority stake in Kate Farms, a U.S.-based plant-based nutrition company, enhancing its specialized nutrition portfolio.

- In October 2025, BioGaia announced the publication of a scientific study on its new patented probiotic strain Lactobacillus reuteri BG-R46® in the journal Beneficial Microbes, highlighting its role in gut and immune health.

Report Coverage:

The research report offers an in-depth analysis based on Type, Ingredient, End-Use, Distribution Channel and Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North America Probiotic Market is expected to expand steadily driven by increasing consumer awareness of preventive healthcare.

- Growing focus on gut health and immunity will continue to influence product innovation across the food and supplement sectors.

- It will witness greater adoption of non-dairy and plant-based probiotic products, appealing to vegan and lactose-intolerant consumers.

- Advancements in microbiome research will support the development of targeted and clinically validated probiotic strains.

- Personalized nutrition and microbiome testing will shape product customization and marketing strategies.

- E-commerce and direct-to-consumer platforms will strengthen brand reach and customer engagement across the region.

- Collaborations between biotech and food companies will accelerate product diversification and regulatory compliance.

- It will experience higher demand for probiotics addressing skin health, mood balance, and metabolic wellness.

- Sustainable sourcing, clean-label formulations, and transparent labeling will remain key consumer priorities.

- Increasing adoption in animal feed will contribute to improved livestock productivity and overall market expansion.