Market Overview:

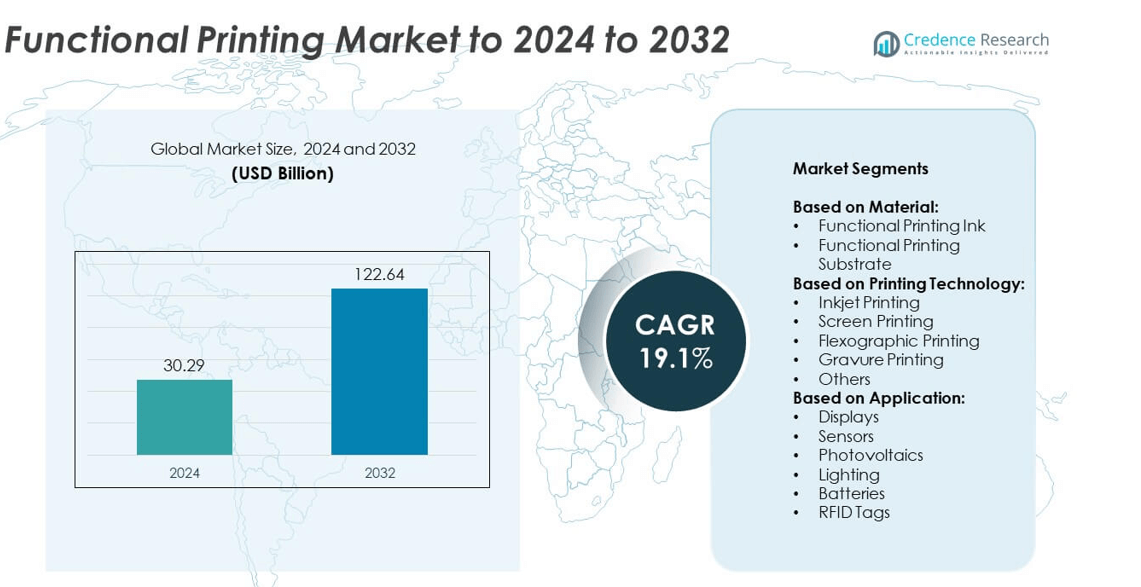

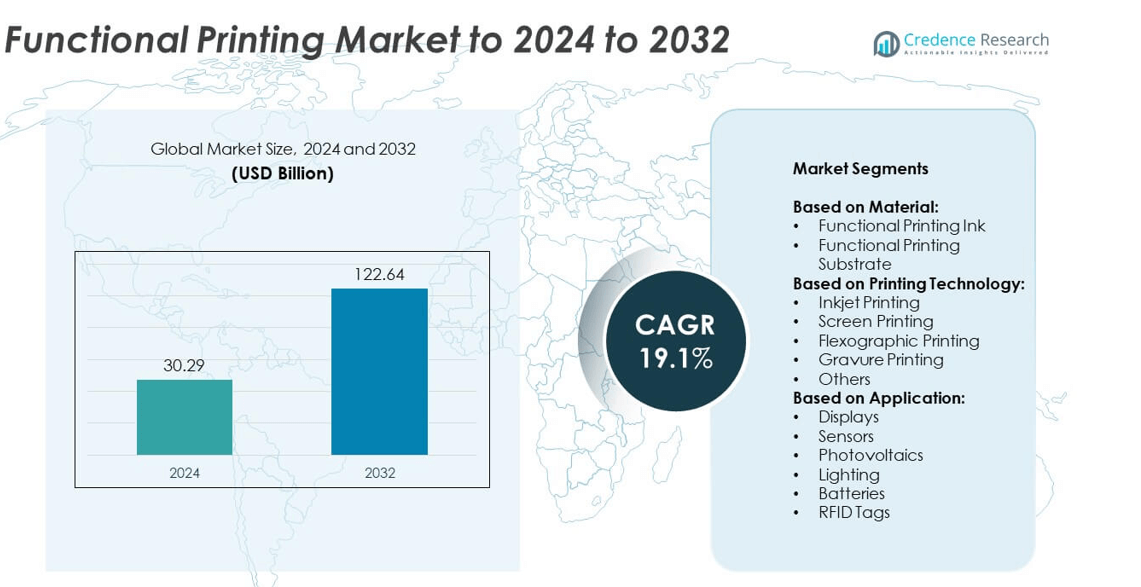

Functional Printing Market size was valued USD 30.29 Billion in 2024 and is anticipated to reach USD 122.64 Billion by 2032, at a CAGR of 19.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Functional Printing Market Size 2024 |

USD 30.29 Billion |

| Functional Printing Market, CAGR |

19.1% |

| Functional Printing Market Size 2032 |

USD 122.64 Billion |

The functional printing market features prominent players including NovaCentrix, Merck KGaA, GSI Technologies LLC, E Ink Holdings Inc., Blue Spark Technologies, Eastman Kodak Company Ltd., Avery Dennison Corporation, Enfucell Oy, Quantica, BASF SE, and Isorg. These companies drive innovation through advancements in conductive inks, substrates, and scalable printing technologies, enabling applications across displays, sensors, photovoltaics, and smart packaging. North America led the market with a 36% share in 2024, supported by strong adoption in consumer electronics and renewable energy. Europe followed with 28% share, driven by automotive electronics and sustainable solutions, while Asia Pacific held 24%, fueled by large-scale display and semiconductor production.

Market Insights

- The functional printing market was valued at USD 30.29 billion in 2024 and is projected to reach USD 122.64 billion by 2032, growing at a CAGR of 19.1%.

- Growth is driven by rising demand in consumer electronics, renewable energy, and smart packaging, with displays holding the largest segment share of over 40% in 2024.

- Key trends include advancements in inkjet printing, development of conductive inks, and expansion of flexible and wearable devices supported by increasing adoption in healthcare and IoT.

- Competition is marked by global players focusing on R&D, collaborations, and product diversification to address challenges of high production costs and lack of standardization in durability and scalability.

- Regionally, North America led with 36% share in 2024, Europe accounted for 28%, and Asia Pacific captured 24%, while Latin America and Middle East & Africa together contributed 12%, reflecting growing adoption in emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Functional printing ink dominated the market in 2024, accounting for more than 65% share. Its leadership stems from high demand in electronics, photovoltaics, and sensor applications where conductive, dielectric, and biological inks are critical for device performance. Growth is supported by rapid developments in nanoparticle-based and conductive polymer inks, enabling cost-effective and flexible manufacturing. Substrates like plastic films and paper also play a growing role, especially in wearable devices and packaging, but inks remain the key driver due to their indispensable role in functional layer deposition.

- For instance, DIC Corporation (via Sun Chemical, its subsidiary) states it supplies conductive IME silver inks optimized for 3D formability and circuit stacks.

By Printing Technology

Inkjet printing held the dominant share of over 45% in 2024, driven by its precision and versatility in electronics and display manufacturing. The technology enables material efficiency, non-contact deposition, and compatibility with various substrates, making it ideal for low-volume, high-value applications such as RFID tags and sensors. Screen printing remains vital in high-volume production, especially for photovoltaic cells, but inkjet’s ability to reduce waste and support complex circuit designs ensures faster adoption in industrial manufacturing, particularly as miniaturization and customization trends strengthen.

- For instance, Heidelberger Druckmaschinen’s Jetfire 50 inkjet press demonstrated speeds of 9,120 SRA3 sheets per hour (equivalent to ~18,000 A4 pages per hour) in production grade mode.

By Application

Displays led the market with a share exceeding 40% in 2024, supported by strong demand in flexible, OLED, and e-paper displays across consumer electronics. Functional printing enables thinner, lighter, and cost-efficient display panels, driving its adoption in smartphones, wearables, and automotive dashboards. Photovoltaics and sensors also represent high-growth areas, with rising investment in renewable energy and IoT solutions. However, displays remain the largest application, driven by continuous innovation in flexible display manufacturing, rising consumer preference for advanced screens, and ongoing collaboration between electronics firms and printing technology providers.

Key Growth Drivers

Rising Adoption in Consumer Electronics

The demand for functional printing is rapidly expanding in consumer electronics, where displays, sensors, and RFID tags are widely integrated into smartphones, wearables, and smart home devices. Flexible printing technologies enable lightweight and compact designs that enhance product functionality and user experience. The increasing trend toward miniaturization and multifunctionality in electronics further accelerates adoption. This segment stands as the key growth driver, as major manufacturers increasingly invest in printed electronics to meet growing consumer expectations for advanced, energy-efficient, and cost-effective devices.

- For instance, Medidata launched its new Sensor Cloud platform in February 2021. This was announced against a backdrop of increasing sensor and wearable use in clinical trials. A 2018 estimate by Kaiser Associates and Intel had projected that 70% of clinical trials would incorporate wearables by 2025.

Advancements in Printing Technologies

Ongoing innovations in inkjet, screen, and gravure printing technologies have enhanced precision, scalability, and substrate compatibility. Inkjet printing, in particular, supports non-contact deposition, material efficiency, and design flexibility, enabling applications in high-resolution displays and advanced sensors. Such advancements reduce manufacturing costs and allow wider customization across industries. The continuous evolution of conductive inks and nanomaterials further improves performance, making functional printing more attractive for electronics, energy, and medical sectors. These technology improvements act as a strong driver for mass adoption across multiple applications.

- For instance, in 2025, researchers demonstrated that 2D cadmium (Cd) metal contacts fabricated via low-temperature van der Waals epitaxy on two-dimensional materials resulted in field-effect transistors with mobilities up to 160 cm²/V·s and on/off ratios exceeding \(10^{8}\).

Growing Renewable Energy Applications

Functional printing plays a crucial role in the production of photovoltaic cells, energy storage devices, and lightweight batteries. The global focus on renewable energy generation has significantly increased the demand for low-cost and scalable printed photovoltaic solutions. Flexible printed solar panels are being adopted in portable electronics, building-integrated photovoltaics, and off-grid applications. This segment is fueled by government policies promoting clean energy and growing investment in sustainable technologies. The ability of functional printing to deliver high efficiency at reduced cost drives growth in the renewable energy sector.

Key Trends & Opportunities

Shift Toward Flexible and Wearable Devices

The rise of flexible and wearable devices creates strong opportunities for functional printing technologies. Manufacturers are increasingly integrating printed sensors, batteries, and displays into health monitoring wearables, fitness trackers, and medical patches. These devices require lightweight, flexible, and durable printed components, which functional printing delivers effectively. The trend is supported by consumer demand for personalized healthcare solutions and digital lifestyle products. As the wearable electronics market continues to expand, functional printing will remain central to enabling innovation and mass adoption in this field.

- For instance, in Q3 2023, Xiaomi shipped 11.6 million wearable devices globally, achieving the highest year-over-year growth among the top 5 vendors with a 36.0% increase.

Expansion in Smart Packaging Solutions

Smart packaging is emerging as a significant opportunity for the functional printing market. Printed RFID tags, sensors, and indicators enhance supply chain transparency, product authentication, and customer engagement. Companies are adopting these solutions to combat counterfeiting, reduce losses, and meet sustainability targets. The increasing demand for connected packaging in food, healthcare, and retail industries drives this trend. As brands focus on adding value through interactive packaging and real-time product tracking, functional printing provides a scalable and cost-efficient solution to support this growing demand.

- For instance, As of 2023, Tageos announced an annual production capacity of more than 7 billion RFID inlays, supported by the opening of new manufacturing sites in the U.S. and China. By October 2024, the company’s annual global capacity had increased to over 9 billion inlays to support smart packaging and IoT supply chains.

Key Challenges

High Production Costs and Scalability Issues

Despite advancements, high production costs and scalability challenges continue to limit widespread adoption of functional printing. Advanced materials like conductive inks and nanomaterials are often expensive, raising overall manufacturing costs. Additionally, scaling laboratory-level innovations to industrial production remains a hurdle due to technical complexities and equipment limitations. Small- and medium-sized enterprises face difficulties adopting these technologies at scale. Overcoming cost barriers and developing standardized, cost-efficient processes is necessary to expand the reach of functional printing into broader industrial applications.

Limited Standardization and Durability Concerns

The lack of standardized processes and durability concerns poses a significant challenge for the functional printing market. Printed electronics and components often face issues with long-term reliability, particularly under extreme environmental conditions such as heat and humidity. Variations in materials and technologies further complicate interoperability across industries. Without standardized benchmarks, large-scale integration into mission-critical applications such as automotive or aerospace remains limited. Addressing these concerns through material innovation and the creation of international standards will be key to ensuring consistent performance and wider adoption.

Regional Analysis

North America

North America held the largest share of 36% in the functional printing market in 2024, driven by strong adoption in consumer electronics, healthcare devices, and renewable energy applications. The presence of major technology firms and research institutions supports innovation in inkjet and screen printing technologies. Government incentives for renewable energy also boost demand for printed photovoltaics and batteries. High investments in IoT-enabled devices and advanced packaging further strengthen regional growth. The United States dominates this market, while Canada contributes through expanding adoption of smart packaging and sustainable printing solutions across retail and logistics industries.

Europe

Europe accounted for 28% of the functional printing market in 2024, supported by high adoption in automotive electronics, healthcare, and smart packaging industries. The region benefits from strong R&D investments and regulatory frameworks promoting renewable energy and sustainability. Germany, France, and the United Kingdom lead in advanced printing technology adoption, particularly in flexible electronics and photovoltaic applications. European firms are also at the forefront of developing conductive inks and substrates for printed electronics. With rising demand for eco-friendly solutions and innovation in industrial printing, Europe continues to expand its presence in global functional printing applications.

Asia Pacific

Asia Pacific represented 24% of the functional printing market in 2024, with rapid growth driven by consumer electronics, displays, and photovoltaic applications. Countries such as China, Japan, and South Korea dominate due to strong manufacturing bases and advanced semiconductor and display industries. Rising investments in renewable energy and expansion of flexible display production fuel growth. The region’s cost-effective production capabilities attract global companies to establish partnerships and facilities. Increasing adoption of RFID tags and printed sensors in logistics and retail also contributes significantly to expansion, positioning Asia Pacific as a rapidly advancing regional market.

Latin America captured a 7% share of the functional printing market in 2024, supported by growing demand for renewable energy technologies, especially in Brazil and Mexico. The region is gradually adopting printed photovoltaics and smart packaging solutions to improve supply chain efficiency and consumer engagement. Investment in consumer electronics and healthcare devices also contributes to market expansion. However, high costs and limited access to advanced manufacturing technologies remain challenges. Despite these hurdles, increasing focus on sustainability and digital transformation provides new opportunities for functional printing adoption across industries in the region.

Middle East and Africa

The Middle East and Africa accounted for 5% of the functional printing market in 2024, with adoption driven by renewable energy projects and rising investment in advanced packaging. Countries like the United Arab Emirates and Saudi Arabia are investing in solar technologies where printed photovoltaics play a role in large-scale renewable initiatives. Africa is witnessing growing interest in RFID tags and smart packaging to support retail and logistics development. Although adoption is still at an early stage, rising government initiatives and international collaborations are expected to accelerate functional printing adoption in the coming years.

Market Segmentations:

By Material:

- Functional Printing Ink

- Functional Printing Substrate

By Printing Technology:

- Inkjet Printing

- Screen Printing

- Flexographic Printing

- Gravure Printing

- Others

By Application:

- Displays

- Sensors

- Photovoltaics

- Lighting

- Batteries

- RFID Tags

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The functional printing market is shaped by key players such as NovaCentrix, Merck KGaA, GSI Technologies LLC, E Ink Holdings Inc., Blue Spark Technologies, Eastman Kodak Company Ltd., Avery Dennison Corporation, Enfucell Oy, Quantica, BASF SE, and Isorg. These companies focus on advancing printing inks, substrates, and technologies to support diverse applications including displays, sensors, photovoltaics, and RFID tags. Continuous investment in research and development drives innovations in conductive inks, nanomaterials, and scalable printing methods. Strategic collaborations with electronics manufacturers and renewable energy firms strengthen their global footprint. Expanding portfolios in flexible and wearable devices, along with growth in smart packaging, reflect the market’s evolving direction. Firms are also emphasizing cost-efficient solutions and standardization to overcome production and durability challenges. With competition intensifying, players prioritize expanding manufacturing capabilities and establishing partnerships to address rising demand from industries such as consumer electronics, automotive, healthcare, and renewable energy worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NovaCentrix

- Merck KGaA

- GSI Technologies LLC

- E Ink Holdings Inc.

- Blue Spark Technologies

- Eastman Kodak Company Ltd.

- Avery Dennison Corporation

- Enfucell Oy

- Quantica

- BASF SE

- Isorg

Recent Developments

- In 2024, NovaCentrix Introduced the Metalon Ultra line of inks, beginning with the Metalon HPS-U11. This advanced silver nanoparticle ink was developed to provide high performance at a more economical price.

- In 2024, Merck KGaA Acquired Unity-SC, a company specializing in high-precision metrology instruments. These tools are used to improve the quality and production yield of microchips, many of which use functional printing techniques.

- In 2024, Quantica Collaborated with ImageXpert to integrate its NovoJet printheads with ImageXpert’s JetXpert systems.

Report Coverage

The research report offers an in-depth analysis based on Material, Printing Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The functional printing market will grow steadily, driven by rising adoption in consumer electronics.

- Flexible and wearable devices will remain a strong focus for manufacturers.

- Inkjet printing will continue to dominate due to precision and material efficiency.

- Printed photovoltaics will see rising demand from renewable energy initiatives worldwide.

- Smart packaging will expand with wider use of RFID tags and sensors.

- Conductive inks and nanomaterials will enhance performance across printed electronics applications.

- Asia Pacific will emerge as the fastest-growing region with strong manufacturing support.

- Cost reduction and scalable production methods will become key industry priorities.

- Standardization and durability improvements will accelerate adoption in critical industries.

- Collaborations between technology firms and material developers will shape future innovations.