Market Overview:

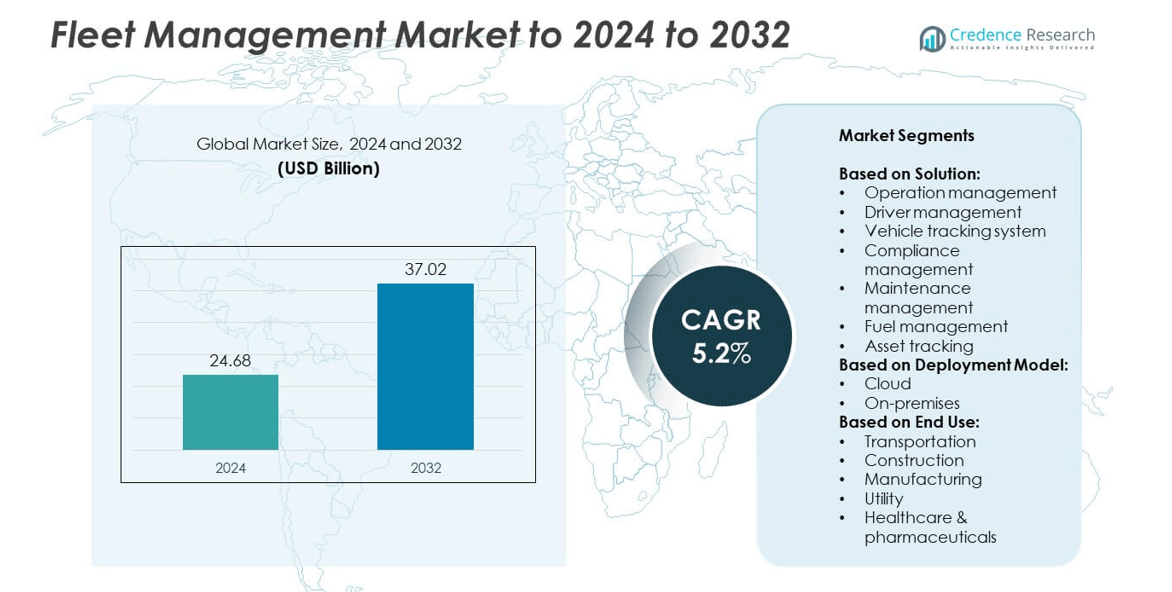

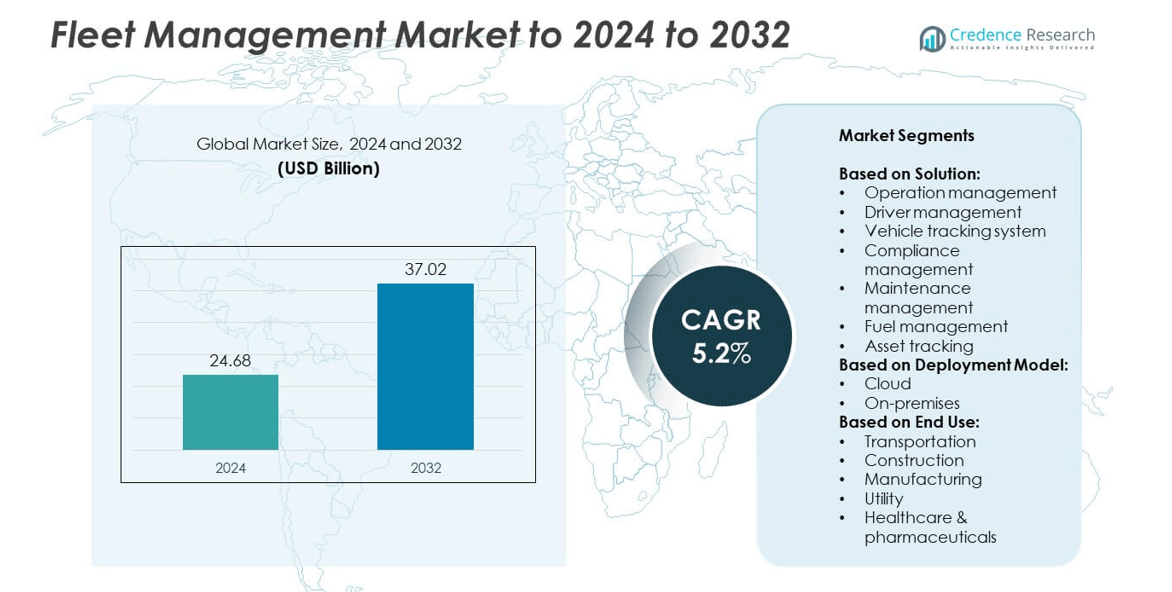

Fleet Management Market size was valued USD 24.68 Billion in 2024 and is anticipated to reach USD 37.02 Billion by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fleet Management Market Size 2024 |

USD 24.68 Billion |

| Fleet Management Market, CAGR |

5.2% |

| Fleet Management Market Size 2032 |

USD 37.02 Billion |

The fleet management market is led by major players including Trimble, Verizon Connect, Omnitracs, Geotab, Donlen, Samsara, Teletrac Navman, Arval-Element, and ARI Fleet Management. These companies focus on advanced telematics, real-time vehicle tracking, and cloud-based platforms to enhance operational efficiency, compliance, and cost reduction across industries such as transportation, construction, utilities, and healthcare. Strategic emphasis on sustainability and electric fleet integration is further strengthening their competitiveness. Regionally, North America dominated the market in 2024 with a 34% share, driven by regulatory mandates, strong e-commerce logistics, and widespread adoption of digital fleet solutions, positioning it as the global leader.

Market Insights

- The fleet management market was valued at USD 24.68 Billion in 2024 and is projected to reach USD 37.02 Billion by 2032, growing at a CAGR of 5.2%.

- Rising demand for real-time vehicle tracking, predictive maintenance, and fuel efficiency is driving adoption across transportation, construction, and utility sectors.

- Trends such as integration of AI, IoT, and cloud platforms are shaping smarter fleet operations, while electric and hybrid fleets create new opportunities for advanced management solutions.

- The market is highly competitive, with players focusing on telematics innovation, cloud-based deployment, and partnerships to expand global presence and strengthen service portfolios.

- North America led with 34% share in 2024, followed by Europe at 29% and Asia Pacific at 24%, while the vehicle tracking system segment accounted for over 32%, highlighting strong regional and segmental growth drivers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solution

The vehicle tracking system segment held the largest share of the fleet management market in 2024, accounting for over 32% of the total revenue. Its dominance is driven by rising demand for real-time vehicle monitoring, route optimization, and theft prevention. Companies increasingly adopt GPS-enabled systems to cut fuel costs, improve driver safety, and enhance delivery accuracy. Compliance pressures and government mandates on vehicle tracking in logistics further strengthen adoption. Operation management and maintenance management also grow steadily as firms focus on cost efficiency and predictive maintenance practices.

- For instance, MICHELIN Connected Fleet (which previously operated as Masternaut) reported tracking over 684,000 vehicles in over 20 countries, improving fleet management and safety.

By Deployment Model

The cloud deployment model dominated the fleet management market in 2024 with nearly 65% share. Cloud solutions attract enterprises due to scalability, lower upfront costs, and ease of integration with IoT platforms. Remote accessibility enables managers to monitor fleets in real time, improving decision-making and operational agility. Rising adoption of SaaS platforms across logistics and transportation boosts cloud preference. On-premises deployment retains significance among large organizations prioritizing data control and regulatory compliance, but its share is shrinking due to higher infrastructure and maintenance costs compared with cloud models.

- For instance, According to Lytx, its 2024 “State of the Data” report indicated its platform added 40 billion miles in 2023, reaching a cumulative 261 billion miles. By June 2025, Lytx announced in its “Road Safety Report” that its database had grown to over 300 billion miles.

By End Use

The transportation sector commanded the largest share of the fleet management market in 2024, representing over 40% of demand. Growth is fueled by e-commerce expansion, cross-border logistics, and the need for efficient last-mile delivery. Fleet operators in this sector leverage telematics, fuel management, and compliance tools to cut costs and meet tight delivery timelines. Construction and utility sectors also show notable adoption, as they require asset tracking and maintenance management for heavy equipment. Healthcare and pharmaceuticals are emerging users, focusing on cold-chain monitoring and compliance-driven fleet safety.

Key Growth Drivers

Rising Demand for Real-Time Tracking

The growing need for real-time vehicle monitoring is a key growth driver for the fleet management market. Logistics and transportation operators increasingly adopt GPS-enabled tracking systems to optimize routes, improve delivery timelines, and reduce fuel costs. Governments mandating vehicle tracking in sectors like public transport further accelerate adoption. Real-time tracking also strengthens security against theft and unauthorized use, enhancing operational control. This widespread demand ensures continuous investment in telematics and IoT-based tracking solutions across industries, solidifying its role as a primary market driver.

- For instance, In a July 1, 2025 press release, ORBCOMM, a provider of industrial IoT solutions, and HARMAN International announced a strategic partnership to enhance ORBCOMM’s asset intelligence technology. In the press release, ORBCOMM’s standard company description mentioned it was a global leader with more than 2.4 million connected devices. These telematics solutions are designed to provide real-time data for compliance, fleet safety, and theft prevention.

Expansion of E-Commerce and Last-Mile Delivery

The rapid growth of e-commerce is another key driver, creating immense pressure on logistics networks for timely deliveries. Fleet management solutions are vital in supporting route optimization, vehicle utilization, and driver performance monitoring to meet tight delivery schedules. Rising urbanization and consumer demand for same-day and next-day services push logistics companies to expand fleets and adopt advanced management systems. Integration of telematics and cloud platforms helps address delivery efficiency challenges. This structural shift in retail dynamics is fueling large-scale adoption of fleet management technologies.

- For instance, DHL’s 2023 financial reports indicated its Post & Parcel Germany division handled approximately 1.2 billion parcels in 2023, while its global eCommerce business continued to expand.

Focus on Fuel Efficiency and Cost Reduction

Rising fuel costs and increasing competition make cost efficiency a key growth driver. Fleet management solutions allow companies to monitor fuel consumption, reduce idle time, and implement predictive maintenance strategies to avoid breakdowns. Advanced analytics provide insights into driver behavior and vehicle performance, directly lowering operational costs. As organizations seek sustainable and eco-friendly transport solutions, optimizing fuel efficiency aligns with both cost savings and environmental regulations. This dual benefit strongly accelerates the adoption of fleet management systems across sectors.

Key Trends & Opportunities

Integration of AI and IoT Technologies

The integration of artificial intelligence and IoT is a key trend shaping fleet management. AI-powered analytics enhance predictive maintenance, optimize driver schedules, and support intelligent routing. IoT devices provide continuous data streams on vehicle health, fuel consumption, and compliance metrics, improving decision-making. This convergence enables automation of fleet operations, reduces downtime, and boosts efficiency. With rising adoption of connected vehicles, opportunities for AI-driven platforms are expanding, offering vendors growth potential in delivering smarter, more adaptive fleet management systems.

- For instance, In an early September 2025 press release reporting its Q2 fiscal year 2026 earnings, Samsara confirmed it was processing approximately 20 trillion data points annually.

Shift Toward Electric and Sustainable Fleets

The rising adoption of electric vehicles (EVs) presents a major opportunity for fleet management providers. Businesses transitioning to sustainable fleets require advanced systems for EV battery monitoring, charging optimization, and lifecycle management. Governments’ incentives for EV adoption further accelerate this trend, especially in logistics and public transport. Fleet management platforms capable of integrating EV-specific analytics gain competitive advantage, addressing both operational efficiency and carbon reduction goals. This shift creates a fast-growing opportunity for providers specializing in sustainable mobility solutions.

- For instance, According to its 2023 Commercial Vehicle Sustainable Development Report, BYD’s commercial vehicle sales reached 11,511 units in 2023.

Key Challenges

High Implementation and Integration Costs

The high upfront costs of deploying fleet management systems remain a key challenge, particularly for small and medium enterprises. Expenses include hardware installation, software licensing, training, and integration with existing IT systems. Although cloud deployment reduces some costs, many organizations still face budget constraints. The return on investment is long-term, which discourages smaller fleets from adopting these technologies. This barrier slows widespread adoption in cost-sensitive markets, limiting penetration despite the proven operational benefits of fleet management solutions.

Data Privacy and Cybersecurity Concerns

Rising digitalization exposes fleet management systems to cybersecurity threats, making this a key challenge. Connected vehicles and IoT-enabled platforms generate large amounts of sensitive data, including real-time location and driver behavior. Breaches can lead to data misuse, financial losses, and reputational damage. Ensuring compliance with data protection regulations adds to the complexity for providers. Vendors must invest heavily in advanced encryption and cybersecurity frameworks, which increases operational costs. These risks act as restraints, slowing adoption among firms concerned about data vulnerabilities.

Regional Analysis

North America

North America held the largest share of the fleet management market in 2024, accounting for 34%. Growth is supported by strong adoption of telematics, advanced driver management, and compliance systems driven by stringent regulatory frameworks such as ELD mandates in the United States. The presence of major technology providers and large-scale logistics operators further enhances the market. Expanding e-commerce and last-mile delivery services also fuel demand for fleet tracking and route optimization. Increasing investment in electric fleet adoption strengthens the region’s position, making North America the dominant contributor to global revenues.

Europe

Europe captured 29% of the fleet management market in 2024, supported by strict emission regulations and sustainability initiatives. Countries such as Germany, the UK, and France lead adoption of vehicle tracking and fuel management solutions. The rise of electric and hybrid vehicle fleets provides further opportunities for integrated fleet platforms. Compliance with EU transport safety standards and carbon reduction goals accelerates investment in telematics and predictive maintenance technologies. The region also benefits from widespread digitalization in logistics and public transport, making Europe a key hub for sustainable fleet innovations.

Asia Pacific

Asia Pacific accounted for 24% of the fleet management market in 2024, driven by rapid industrialization and expansion of e-commerce logistics networks. China, India, and Japan lead regional growth due to increasing demand for vehicle tracking, route optimization, and driver safety solutions. Governments in the region encourage adoption of telematics and digital monitoring to improve road safety and reduce emissions. Growing investment in smart city projects further expands opportunities for fleet management systems. Rising use of electric vehicles in commercial fleets also supports the region’s strong long-term growth outlook.

Latin America

Latin America held a 7% share of the fleet management market in 2024, supported by increasing adoption of vehicle tracking and fuel management solutions in countries like Brazil and Mexico. Rising demand for logistics services across urban and rural areas drives the need for efficient fleet operations. However, cost sensitivity and high implementation expenses limit adoption among small and medium enterprises. The market benefits from gradual government support for digital transport infrastructure. Growing security concerns, including vehicle theft, further push adoption of advanced telematics and asset tracking systems across the region.

Middle East & Africa

The Middle East & Africa region accounted for 6% of the fleet management market in 2024, with growth primarily led by the Gulf countries and South Africa. Expanding construction and oil and gas sectors drive demand for asset tracking and compliance management. Governments invest in digital infrastructure to modernize transport and logistics operations, creating new opportunities. However, market penetration remains limited due to high upfront costs and fragmented adoption across smaller enterprises. Rising focus on smart city projects and adoption of electric vehicles is expected to boost fleet management deployment in the coming years.

Market Segmentations:

By Solution:

- Operation management

- Driver management

- Vehicle tracking system

- Compliance management

- Maintenance management

- Fuel management

- Asset tracking

By Deployment Model:

By End Use:

- Transportation

- Construction

- Manufacturing

- Utility

- Healthcare & pharmaceuticals

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the fleet management market is shaped by leading companies such as Trimble, Verizon Connect, Omnitracs, Geotab, Donlen, Samsara, Teletrac Navman, Arval-Element, and ARI Fleet Management. These players focus on delivering advanced telematics, vehicle tracking, and predictive maintenance solutions to support diverse industries including transportation, construction, utilities, and healthcare. Innovation in cloud-based deployment, integration of IoT devices, and artificial intelligence capabilities strengthens their service portfolios, enabling greater efficiency and compliance. Strategic investments in sustainability, particularly in managing electric and hybrid fleets, highlight their long-term growth approach. Partnerships with logistics operators, government bodies, and technology providers further enhance their global presence and customer reach. Rising competition drives continuous upgrades in user-friendly platforms and mobile applications, allowing better monitoring and analytics for fleet operations. The emphasis on cost efficiency, data security, and digital transformation is positioning these companies to expand their influence across developed and emerging markets worldwide.\

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Arval-Element Outlined its strategy for the year, focusing on continued support for fleet electrification and expansion through partnerships.

- In 2023, Geotab Launched a beta project to enhance its data experience by leveraging generative AI models within its platform.

- In 2023, Teletrac Navman featured a “Santa’s Sleigh” case study in December, highlighting the use of modern telematics to manage and optimize delivery fleet operations for a fictional business.

Report Coverage

The research report offers an in-depth analysis based on Solution, Deployment Model, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The fleet management market will grow steadily with increasing adoption of telematics solutions.

- Real-time tracking and route optimization will remain central to operational efficiency.

- Cloud-based deployment will expand further, reducing reliance on on-premises systems.

- Electric and hybrid fleets will create new demand for battery and charging management.

- Artificial intelligence and IoT will enhance predictive maintenance and driver performance analytics.

- Regulatory mandates on safety and compliance will accelerate system adoption.

- E-commerce and last-mile delivery growth will continue to fuel demand.

- Data security and privacy will remain critical challenges for providers.

- Small and medium enterprises will gradually adopt cost-effective SaaS platforms.

- Emerging markets in Asia Pacific and Latin America will drive future growth opportunities.