Market Overview:

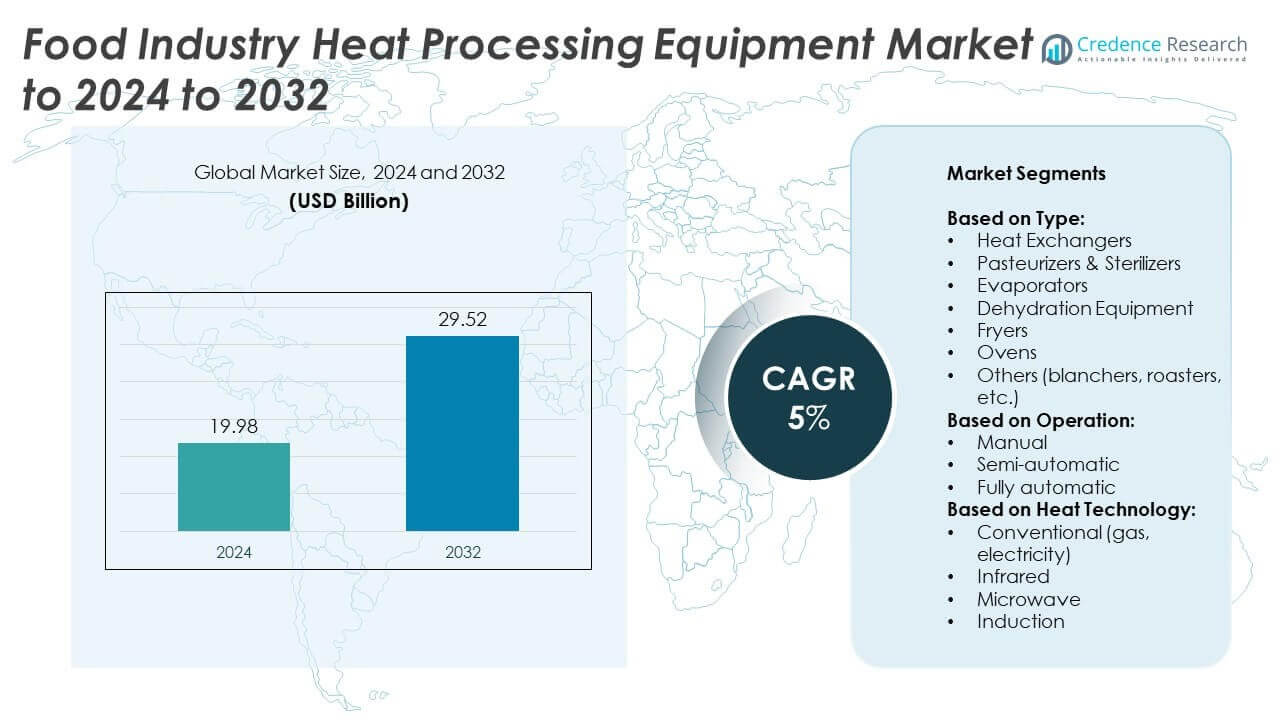

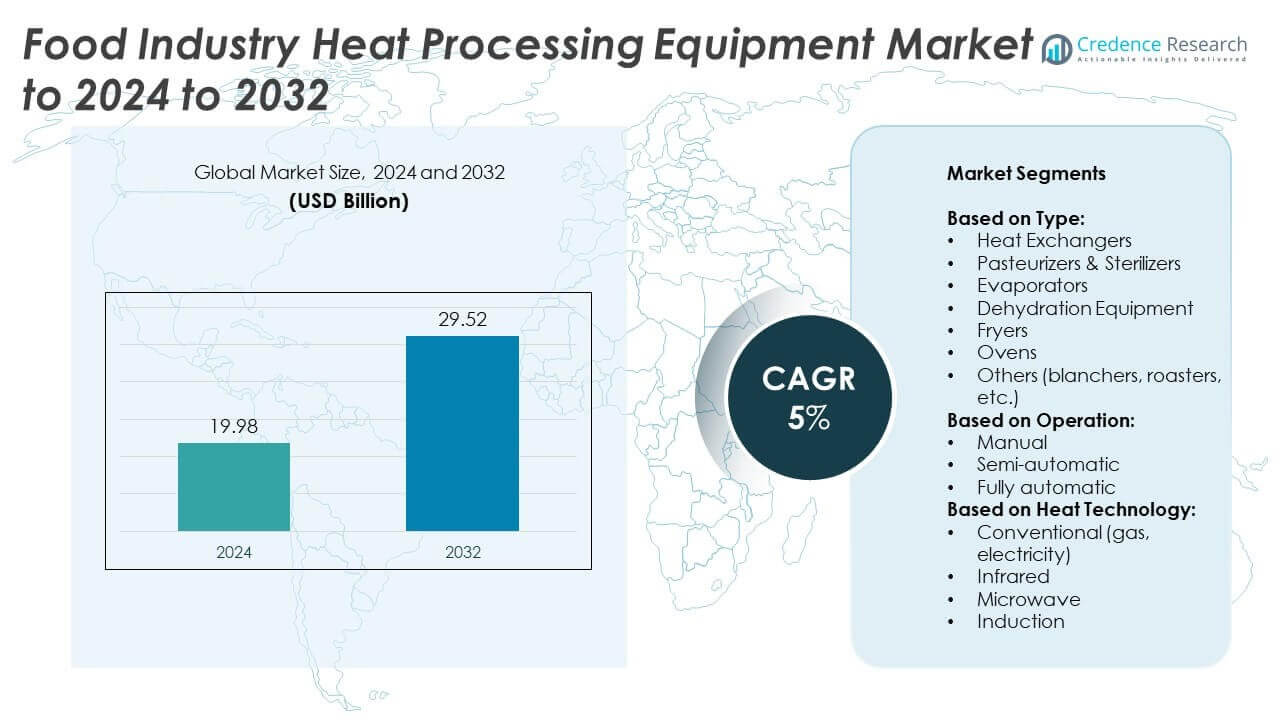

Food Industry Heat Processing Equipment Market size was valued at USD 19.98 Billion in 2024 and is anticipated to reach USD 29.52 Billion by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Industry Heat Processing Equipment Market Size 2024 |

USD 19.98 Billion |

| Food Industry Heat Processing Equipment Market, CAGR |

5% |

| Food Industry Heat Processing Equipment Market Size 2032 |

USD 29.52 Billion |

The Food Industry Heat Processing Equipment market is highly competitive, with top players such as Bühler Group, SPX FLOW, JBT Corporation, Tetra Pak, GEA Group, Marel, Alfa Laval, and Barry-Wehmiller Companies, Inc. driving technological advancements and product innovations. These companies focus on automation, energy-efficient solutions, and compliance with food safety standards to strengthen their global presence. Regional analysis shows that North America led the market with a 34% share in 2024, supported by advanced food processing infrastructure and strict regulatory frameworks. Europe followed with 29% share, driven by strong demand for bakery and dairy products, while Asia Pacific held 24%, emerging as the fastest-growing region due to rapid industrial expansion and rising consumption of processed foods.

Market Insights

- The Food Industry Heat Processing Equipment market was valued at USD 19.98 Billion in 2024 and is projected to reach USD 29.52 Billion by 2032, growing at a CAGR of 5%.

- Rising demand for processed, packaged, and ready-to-eat foods is a major growth driver, supported by stricter food safety regulations and increasing consumer preference for convenience.

- Key trends include the adoption of automation, energy-efficient technologies, and digital monitoring systems, along with growing use of microwave and infrared equipment in ready-meal applications.

- The competitive landscape features global players offering advanced heat exchangers, pasteurizers, ovens, and fryers, with a strong focus on sustainability, product customization, and after-sales service to maintain market leadership.

- North America held the largest share at 34% in 2024, followed by Europe with 29%, Asia Pacific with 24%, Latin America at 8%, and the Middle East & Africa with 5%, reflecting both maturity and growth opportunities across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The food industry heat processing equipment market is segmented into heat exchangers, pasteurizers & sterilizers, evaporators, dehydration equipment, fryers, ovens, and others. Among these, heat exchangers held the dominant share of 28% in 2024, driven by their wide use in dairy, beverages, and processed foods for precise temperature control and energy efficiency. Rising demand for hygienic and continuous food processing, coupled with stricter safety regulations, is boosting adoption. Ovens and fryers are also growing steadily due to expanding bakery and snack industries, while dehydrators gain traction in packaged fruits and vegetables.

- For instance, in 2021, GEA supplied a complete UHT milk processing line to a facility in India with a capacity of 15,000 liters of milk per hour. This demonstrates GEA’s capacity to deliver large-scale equipment for dairy processing.

By Operation

The market is categorized into manual, semi-automatic, and fully automatic equipment. Fully automatic systems accounted for the largest share of 46% in 2024, reflecting the industry’s rapid shift toward automation to improve consistency, reduce labor costs, and enhance productivity. Adoption is particularly high among large-scale food processors who seek continuous, high-throughput production lines. Semi-automatic systems remain relevant for mid-sized enterprises, while manual systems serve niche and small-scale applications. The growth of Industry 4.0, with real-time monitoring and predictive maintenance, further drives demand for fully automated heat processing solutions.

- For instance, Reading Bakery Systems’ Multi-Crisp Baked Snack System produces 250–1,000 kg/hour, depending on oven sections.

By Heat Technology

Heat processing equipment is classified into conventional (gas, electricity), infrared, microwave, and induction technologies. Conventional technology dominated the market with a 54% share in 2024, primarily due to its established use, lower cost, and suitability for a wide range of food applications including bakery and meat processing. However, microwave and infrared systems are gaining adoption in ready-to-eat and packaged foods due to faster heating and improved nutrient retention. Induction technology is emerging in specialized applications, driven by energy efficiency goals and reduced heat loss, aligning with sustainability and decarbonization initiatives in the food sector.

Key Growth Drivers

Rising Demand for Processed and Packaged Foods

A major growth driver is the increasing global consumption of processed and packaged foods. Urbanization, rising disposable incomes, and changing dietary habits are fueling demand for ready-to-eat meals, bakery products, and frozen foods. This shift requires efficient heat processing equipment to ensure safety, extended shelf life, and consistent product quality. Manufacturers are investing in advanced ovens, pasteurizers, and fryers to meet these demands. The strong reliance on reliable thermal systems in large-scale production makes this the leading growth driver in the market.

- For instance, Reading Bakery Systems’ Multi-Crisp system produces 250–1,000 kg/hour, depending on oven sections.

Stringent Food Safety Regulations

Compliance with international and regional food safety regulations is driving investment in advanced heat processing technologies. Governments and regulatory bodies mandate strict guidelines to prevent contamination and ensure microbial safety in food products. Heat exchangers, sterilizers, and pasteurizers are crucial in meeting HACCP and FDA standards. As food exports expand globally, adherence to hygiene and safety protocols becomes a priority for producers. This regulatory push encourages adoption of technologically advanced equipment that can guarantee consistent sterilization and reduce the risk of product recalls.

- For instance, Alfa Laval’s H8 hygienic plate heat exchanger features FDA-compliant gaskets and can be manufactured to meet 3-A sanitary standards for applications requiring high hygiene.

Shift Toward Automation and Industry 4.0

The transition toward automation and digitalized food processing is significantly influencing the market. Fully automated systems equipped with IoT sensors, AI-based monitoring, and predictive maintenance features are being widely adopted. These systems reduce labor dependency, optimize energy use, and enhance output efficiency. Large-scale processors, in particular, are embracing smart ovens, automated fryers, and connected pasteurizers for consistent production. This driver not only increases efficiency but also strengthens food quality assurance, making automation one of the key enablers of market expansion over the forecast period.

Key Trends & Opportunities

Adoption of Energy-Efficient and Sustainable Technologies

One of the key trends is the strong shift toward sustainable food processing solutions. Manufacturers are integrating energy-efficient heat exchangers and induction-based heating systems to reduce carbon footprints and operational costs. The demand is further boosted by government incentives promoting eco-friendly technologies. This transition also creates opportunities for companies to differentiate their offerings by combining sustainability with high-performance designs. As global food processors align with decarbonization targets, sustainability-driven innovation will remain a critical market opportunity.

- For instance, SPX FLOW’s APV Tubular UHT systems recover up to 90% of thermal energy via regenerative heat exchangers.

Expansion of Ready-to-Eat and Functional Foods

The rise of ready-to-eat meals, plant-based alternatives, and functional foods is creating new opportunities. Microwave and infrared technologies are increasingly adopted for faster processing, better nutrient retention, and convenience-focused products. Growing consumer interest in healthier and fortified food options drives equipment upgrades across global production facilities. Companies developing adaptable and high-speed heating systems are well-positioned to benefit. This trend directly supports market growth, as diverse product categories require specialized processing technologies to meet quality and safety standards efficiently.

- For instance, SPX FLOW’s Infusion UHT can heat to 157 °C in 0.09 seconds, enabling shelf stability with minimal thermal damage.

Key Challenges

High Capital Investment Costs

One of the primary challenges is the significant upfront investment required for advanced heat processing systems. Fully automated and digitally enabled equipment comes with high installation and maintenance costs, which small and medium enterprises often find unaffordable. Limited access to financing in developing economies further restricts adoption. While large-scale processors can recover costs through efficiency gains, smaller firms struggle to justify the expense. This cost barrier slows widespread implementation of advanced systems and remains a critical hurdle for market penetration.

Maintenance and Technical Complexity

The technical complexity of advanced heat processing equipment poses another key challenge. Frequent calibration, skilled workforce requirements, and downtime for servicing increase operational burdens. Predictive maintenance systems help, but the reliance on trained technicians raises costs for food processors. In addition, any failure in heat control can result in compromised product quality and safety risks. For smaller operators lacking technical expertise, this challenge limits adoption. The complexity of integrating automated and digitalized solutions adds further strain, particularly in developing markets.

Regional Analysis

North America

North America held the largest share of 34% in the food industry heat processing equipment market in 2024. The region benefits from advanced food processing infrastructure, high automation adoption, and strict food safety regulations. The presence of major food manufacturers in the United States and Canada drives consistent demand for pasteurizers, ovens, and heat exchangers. Growing consumer demand for packaged, frozen, and ready-to-eat meals further supports equipment expansion. Investments in energy-efficient technologies and digitalized processing systems are strengthening the region’s dominance. Rising exports of processed food also enhance the adoption of advanced thermal systems across large-scale facilities.

Europe

Europe accounted for 29% of the food industry heat processing equipment market share in 2024. The region’s dominance is linked to strict food safety standards, advanced technological integration, and strong demand for bakery and dairy products. Germany, France, and the United Kingdom serve as key hubs for equipment innovation and adoption. Growing consumer preference for functional and organic foods is encouraging the use of advanced heat processing systems that ensure safety while retaining nutritional value. Additionally, strong sustainability initiatives across the European Union are accelerating the deployment of energy-efficient and low-emission processing technologies in food production facilities.

Asia Pacific

Asia Pacific captured 24% of the market share in 2024 and is the fastest-growing regional segment. Expanding food processing industries in China, India, and Japan are driving strong equipment demand. Rapid urbanization, rising disposable incomes, and changing dietary preferences are fueling growth in packaged and convenience foods. Regional manufacturers are increasingly adopting automated ovens, fryers, and pasteurizers to meet production demands and safety requirements. Government support for domestic food processing industries further strengthens market expansion. The region’s strong focus on affordable, large-scale production makes Asia Pacific a major growth hub for advanced thermal processing equipment.

Latin America

Latin America represented 8% of the global market share in 2024. The region is witnessing steady growth due to expanding demand for processed meat, dairy, and bakery products. Brazil and Mexico remain leading markets, supported by investments in modernizing food production facilities. Adoption of heat exchangers and sterilizers is increasing as processors focus on meeting international export standards. However, limited capital investment and slower automation adoption compared to developed regions restrain growth. Rising urbanization and the growing middle-class population are expected to create opportunities, encouraging greater reliance on advanced heat processing solutions in the coming years.

Middle East and Africa

The Middle East and Africa accounted for 5% of the food industry heat processing equipment market in 2024. Growth is primarily driven by rising investments in food processing to reduce reliance on imports and meet local consumption demands. Gulf countries, including Saudi Arabia and the UAE, are focusing on advanced processing systems to support domestic food industries. Increasing demand for bakery, dairy, and packaged meals is fueling adoption of ovens and pasteurizers. However, high equipment costs and limited technical expertise hinder widespread implementation. Gradual improvements in food infrastructure are expected to boost regional demand during the forecast period.

Market Segmentations:

By Type:

- Heat Exchangers

- Pasteurizers & Sterilizers

- Evaporators

- Dehydration Equipment

- Fryers

- Ovens

- Others (blanchers, roasters, etc.)

By Operation:

- Manual

- Semi-automatic

- Fully automatic

By Heat Technology:

- Conventional (gas, electricity)

- Infrared

- Microwave

- Induction

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The Food Industry Heat Processing Equipment market is shaped by leading players such as Bühler Group, SPX FLOW, Heat and Control, Inc., JBT Corporation, Tetra Pak, Barry-Wehmiller Companies, Inc., Thermo Fisher Scientific, IDMC Limited, Marel, Scherjon Dairy Equipment, Alfa Laval, GEA Group, TSC Food Processing Equipment, FMT Food Machinery & Technology, and Krones AG. These companies compete through innovation, global presence, and a wide range of processing solutions catering to dairy, bakery, beverages, and ready-to-eat products. The competitive landscape is marked by continuous investments in automation, sustainability, and energy-efficient systems to meet evolving industry standards. Firms are focusing on enhancing operational efficiency and food safety compliance while offering customized solutions to cater to regional demands. Strong after-sales service networks, collaborations with food manufacturers, and expansion into emerging markets further intensify competition. Continuous technological advancements and alignment with regulatory frameworks position these players to maintain their dominance in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bühler Group

- SPX FLOW

- Heat and Control, Inc.

- JBT Corporation

- Tetra Pak

- Barry-Wehmiller Companies, Inc.

- Thermo Fisher Scientific

- IDMC Limited

- Marel

- Scherjon Dairy Equipment

- Alfa Laval

- GEA Group

- TSC Food Processing Equipment

- FMT Food Machinery & Technology

- Krones AG

Recent Developments

- In 2024, JBT Corporation: Announced an intention to launch a voluntary takeover offer for Marel, aiming to combine the two companies’ complementary portfolios to create a leading global food and beverage technology solutions provider.

- In 2024, Heat and Control, Inc.: Partnered with FMT Magazine to showcase new technologies at PACK EXPO Las Vegas.

- In 2023, Bühler Group: Navigated a complex global market, posting a stable turnover and an increase in profitability. The company continued its high investment in R&D, focusing on sustainability with its 50/50/50 goal to reduce energy, waste, and water by 50% in customers’ value chains by 2025.

Report Coverage

The research report offers an in-depth analysis based on Type, Operation, Heat Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for processed and packaged foods.

- Adoption of fully automated systems will increase due to efficiency and consistency needs.

- Energy-efficient and sustainable technologies will gain traction across food processing facilities.

- Microwave and infrared systems will see strong growth in ready-to-eat meal applications.

- Asia Pacific will remain the fastest-growing region with rapid industrial expansion.

- Digital monitoring and predictive maintenance will become standard in advanced equipment.

- Stringent food safety regulations will continue to drive sterilizer and pasteurizer demand.

- Functional and plant-based food categories will boost specialized heat processing adoption.

- Smaller firms may face challenges due to high costs of advanced equipment.

- Partnerships between equipment makers and food processors will drive technology innovation.