Market Overview:

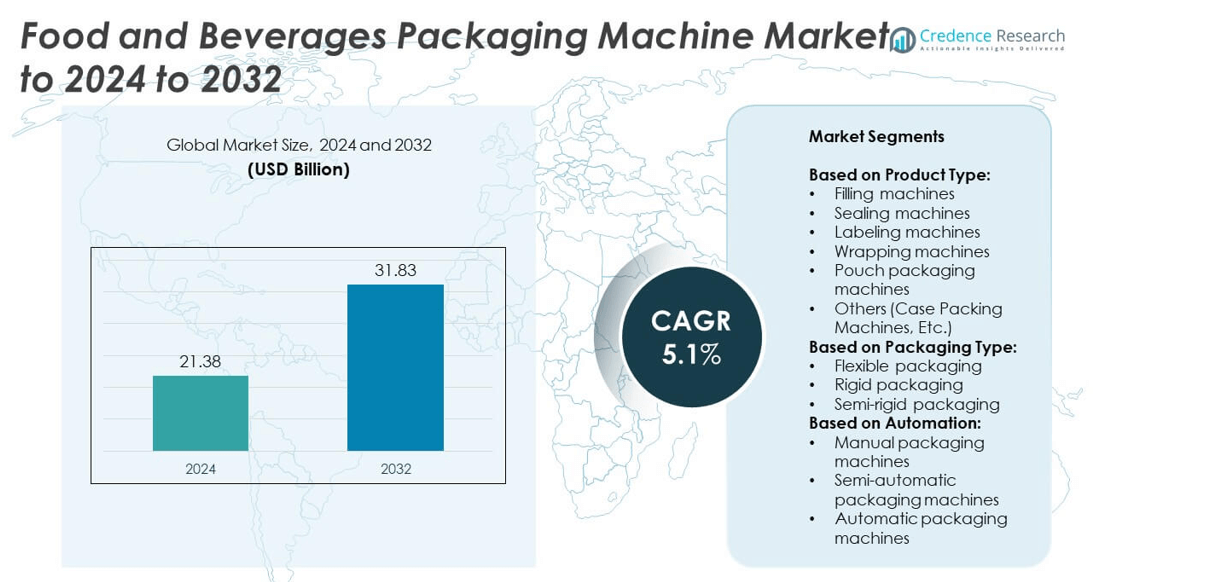

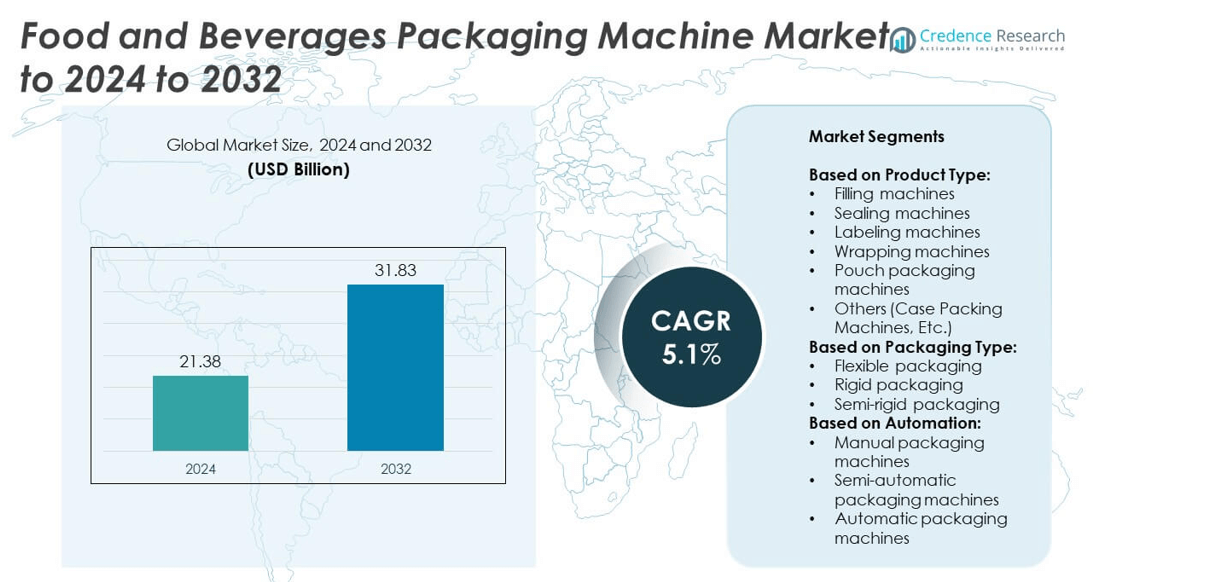

Food and Beverages Packaging Machine Market size was valued USD 21.38 Billion in 2024 and is anticipated to reach USD 31.83 Billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food and Beverages Packaging Machine Market Size 2024 |

USD 21.38 Billion |

| Food and Beverages Packaging Machine Market, CAGR |

5.1% |

| Food and Beverages Packaging Machine Market Size 2032 |

USD 31.83 Billion |

The food and beverages packaging machine market is led by prominent players such as ProMach, Nestlé, Mitsubishi Heavy Industries, GEA Group, Multivac, Bosch Packaging, Coesia, Schubert, Tetra Pak, Marel, IMA Group, Sidel, Shibaura Machine, Krones, and FLSmidth. These companies focus on automation, sustainability, and technological innovation to strengthen their global presence. In 2024, North America dominated the market with a 32% share, supported by advanced manufacturing infrastructure and strict food safety regulations. Europe followed with 28%, driven by strong sustainability initiatives, while Asia Pacific held 26%, benefiting from rapid urbanization and rising consumer demand for packaged foods.

Market Insights

- The food and beverages packaging machine market was valued at USD 21.38 Billion in 2024 and is projected to reach USD 31.83 Billion by 2032, growing at a CAGR of 5.1%.

- Rising demand for processed and packaged foods, along with growing automation in production facilities, is driving steady adoption of advanced packaging machines worldwide.

- Flexible packaging leads the market with over 40% share, supported by consumer preference for lightweight, convenient formats, while filling machines dominate equipment demand with 32% share.

- Competition is intense, with global players investing in automation, IoT-enabled systems, and sustainability-focused machinery to enhance efficiency and align with environmental regulations.

- North America leads with 32% share, followed by Europe at 28% and Asia Pacific at 26%, while Latin America and the Middle East & Africa account for smaller but growing shares, reflecting modernization of food processing industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Filling machines dominated the product type segment, capturing over 32% share in 2024. Their leadership stems from widespread application in bottling, dairy, and liquid food processing, where precision and hygiene are critical. These machines enable high-speed operations, minimize spillage, and extend product shelf life, making them vital in large-scale beverage and dairy plants. Growing demand for bottled water, ready-to-drink juices, and dairy-based drinks continues to reinforce their adoption. Technological upgrades, such as servo-driven systems and smart controls, further enhance efficiency, ensuring filling machines maintain their dominant position within the product type segment.

- For instance, Krones’ Modulfill VFJ filler fills up to 78,000 containers per hour in PET juice lines.

By Packaging Type

Flexible packaging held the largest share, accounting for more than 40% in 2024. Its strong market position is supported by rising consumer preference for portable, lightweight, and resealable packs. Flexible formats, including pouches and sachets, lower material and logistics costs while offering high visual appeal. Sustainability initiatives, such as recyclable films and bio-based laminates, are driving greater adoption in snacks, beverages, and dairy packaging. Manufacturers are increasingly favoring flexible options to meet evolving consumer lifestyles and reduce their carbon footprint, ensuring this segment remains the dominant choice across diverse food and beverage applications.

- For instance, Syntegon’s SVX Compact machine reaches up to 300 cycles per minute when sealing flexible snack pouches.

By Automation

Automatic packaging machines led the automation segment with nearly 55% market share in 2024. Their dominance is driven by efficiency, precision, and cost-effectiveness, particularly in high-volume operations. These machines reduce dependency on manual labor while ensuring compliance with hygiene and safety regulations. Integration of robotics, IoT-enabled monitoring, and smart sensors has improved throughput and reduced downtime, making them indispensable in modern food and beverage plants. Growing investments in Industry 4.0 and the rising need for consistent, high-speed packaging solutions will continue to support the strong growth of automatic machines over manual and semi-automatic systems.

Key Growth Drivers

Rising Demand for Processed and Packaged Foods

The growing consumption of processed and convenience foods is a key growth driver for the food and beverages packaging machine market. Busy lifestyles, urbanization, and changing dietary patterns have increased reliance on ready-to-eat products. This has created strong demand for efficient filling, sealing, and labeling solutions to ensure hygiene, extended shelf life, and large-scale production. Manufacturers are investing in high-speed machines to meet volume needs, particularly in beverages, dairy, and snack foods. This factor significantly accelerates the market’s expansion across developed and emerging economies.

- For instance, KHS’s Innofill PET DRV filler can reach 90,000 PET bottles per hour to match growing beverage demand.

Technological Advancements in Packaging Automation

Technological progress in automation is another major growth driver for the market. Advanced machines equipped with robotics, IoT connectivity, and smart sensors enhance productivity, reduce downtime, and ensure compliance with food safety standards. Automation also minimizes labor dependency while enabling precision packaging at higher speeds. These advancements are especially critical in addressing growing regulatory pressures on food safety and efficiency. Manufacturers adopting these technologies gain a competitive edge, supporting rapid industry growth and fueling widespread adoption across high-volume food and beverage facilities.

- For instance, KHS reports that its automated filling and packaging lines can significantly reduce changeover times, boosting line flexibility and efficiency. The company’s InnoPET iflex automation concept for PET lines can save up to 70% of the time needed for manual changeovers. In addition, automation of packaging and palletizing equipment can save up to 30 minutes and 20 minutes per format changeover, respectively.

Focus on Sustainability and Eco-Friendly Packaging

The global emphasis on sustainability is a key growth driver shaping the packaging machinery industry. With rising concerns about plastic waste and carbon emissions, companies are shifting toward recyclable, compostable, and bio-based packaging materials. Packaging machines are being adapted to handle these innovative materials without compromising efficiency. This aligns with government regulations and consumer preferences for eco-friendly packaging. Firms investing in flexible, sustainable packaging machinery are witnessing stronger adoption, as environmental awareness continues to drive innovation and create opportunities for sustainable packaging equipment worldwide.

Key Trends & Opportunities

Expansion of Flexible Packaging Solutions

A key trend in the market is the rising preference for flexible packaging formats such as pouches and sachets. These options are lightweight, cost-effective, and align with consumer demand for portability and convenience. Flexible packaging also allows advanced printing options that enhance brand visibility. Additionally, its compatibility with eco-friendly films and laminates offers new opportunities for sustainability-focused companies. This trend is encouraging machinery manufacturers to innovate and design equipment specifically suited for flexible packaging, ensuring strong future growth within this segment.

- For instance, Syntegon launched its Pack 103 flow wrapper with output rates up to 175 packs per minute, boosting flexibility for small-to-mid size operations.

Integration of Smart and IoT-Enabled Packaging Machines

The integration of IoT-enabled and smart packaging machines represents a major opportunity in the market. Real-time monitoring, predictive maintenance, and data analytics improve machine efficiency and reduce downtime. IoT-enabled systems also ensure compliance with hygiene and safety regulations through automated tracking and quality control. As food and beverage producers prioritize operational efficiency, this integration offers significant cost savings. The growing adoption of Industry 4.0 solutions is expected to expand further, opening opportunities for companies providing advanced, connected packaging machinery.

- For instance, Snack Connection adopted Syntegon’s Elematic 2001 WA case packer, achieving speeds up to 40 cases per minute and faster format changeovers.

Key Challenges

High Initial Investment and Maintenance Costs

One of the major challenges is the high capital investment required for advanced packaging machines. Automation, robotics, and IoT-equipped systems involve significant upfront costs, making adoption difficult for small and medium-sized enterprises. Additionally, ongoing maintenance and technical expertise add to the financial burden. This restricts widespread adoption in cost-sensitive markets. While large players benefit from productivity gains, smaller manufacturers often hesitate, which slows down the overall penetration of modern packaging machinery in emerging economies.

Complexity in Handling Diverse Packaging Materials

Another key challenge lies in adapting machines to handle diverse and sustainable packaging materials. With the growing demand for bio-based and recyclable materials, machinery often requires redesigns or upgrades to ensure efficiency. Many machines designed for traditional plastics struggle with new substrates, leading to operational inefficiencies. This complexity increases production costs and requires continuous R&D investment. As sustainability becomes a priority, manufacturers face challenges in balancing cost, compatibility, and performance while meeting evolving packaging material requirements.

Regional Analysis

North America

North America held the largest share of the food and beverages packaging machine market in 2024, accounting for 32%. The region benefits from advanced manufacturing infrastructure, strong adoption of automation, and strict food safety regulations. High demand for packaged dairy, beverages, and processed foods continues to drive investments in efficient packaging systems. The United States dominates regional demand due to large-scale production facilities and high consumer spending. Additionally, technological innovation, coupled with the rising focus on sustainable packaging solutions, further strengthens the market’s growth, ensuring North America maintains its leading position during the forecast period.

Europe

Europe accounted for 28% of the food and beverages packaging machine market share in 2024. The region is driven by strong regulatory frameworks supporting food safety, traceability, and eco-friendly packaging. Countries such as Germany, Italy, and France serve as manufacturing hubs for advanced packaging technologies. Demand for flexible and recyclable packaging continues to increase, aligned with the European Union’s sustainability goals. Growing consumption of convenience foods and beverages adds to market expansion. European manufacturers are also investing heavily in automation and robotics, reinforcing the region’s competitiveness and ensuring steady growth within the global packaging machinery industry.

Asia Pacific

Asia Pacific captured 26% of the market share in 2024, making it a rapidly expanding region in the food and beverages packaging machine market. Rising urbanization, population growth, and increasing disposable incomes are fueling demand for packaged food and beverages. China, India, and Japan are leading contributors, with strong investments in large-scale manufacturing. The shift toward flexible packaging formats, combined with a growing middle-class consumer base, supports further growth. Additionally, local governments’ initiatives to promote modernized food processing facilities enhance machine adoption, positioning Asia Pacific as one of the most dynamic markets with high long-term growth potential.

Latin America

Latin America held an 8% market share in 2024, supported by growing investments in food processing and beverage production industries. Brazil and Mexico lead demand, driven by rising urban populations and increasing consumption of packaged snacks and ready-to-drink beverages. While the market is smaller compared to North America and Europe, modernization of packaging facilities is gaining traction. The adoption of flexible packaging and automatic machines is increasing steadily. However, economic volatility and cost sensitivity present some constraints, yet steady demand for efficient and sustainable packaging systems continues to provide growth opportunities across the region.

Middle East and Africa

The Middle East and Africa accounted for 6% of the global market share in 2024. Growth in this region is supported by expanding retail chains, rising demand for packaged dairy, and processed food products. Countries like Saudi Arabia, South Africa, and the United Arab Emirates are witnessing increasing investments in food manufacturing and packaging infrastructure. Adoption of automatic packaging machines is rising to meet hygiene and efficiency standards. Despite challenges such as high costs and limited local production capacity, the region shows potential, with gradual modernization fueling market opportunities over the forecast period.

Market Segmentations:

By Product Type:

- Filling machines

- Sealing machines

- Labeling machines

- Wrapping machines

- Pouch packaging machines

- Others (Case Packing Machines, Etc.)

By Packaging Type:

- Flexible packaging

- Rigid packaging

- Semi-rigid packaging

By Automation:

- Manual packaging machines

- Semi-automatic packaging machines

- Automatic packaging machines

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The food and beverages packaging machine market is characterized by the presence of leading players such as ProMach, Inc., Nestlé S.A., Mitsubishi Heavy Industries Ltd., GEA Group AG, Multivac Sepp Haggenmüller SE & Co. KG, Bosch Packaging Technology, Coesia S.p.A., Schubert GmbH, Tetra Pak International S.A., Marel hf., IMA Group S.p.A., Sidel Group S.A.S., Shibaura Machine Co., Ltd., Krones AG, and FLSmidth A/S. The market is highly competitive, with companies focusing on innovation, automation, and sustainable solutions to gain an edge. Strategic partnerships, acquisitions, and technological upgrades are common approaches to strengthen global presence and expand product portfolios. Rising demand for smart, IoT-enabled machinery and flexible packaging solutions has intensified competition. Global leaders invest heavily in R&D to enhance production speed, precision, and adaptability to eco-friendly packaging materials. The competitive landscape is expected to remain dynamic, driven by continuous advancements and the need to cater to diverse industry requirements across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ProMach, Inc.

- Nestlé S.A.

- Mitsubishi Heavy Industries Ltd.

- GEA Group AG

- Multivac Sepp Haggenmüller SE & Co. KG

- Bosch Packaging Technology

- Coesia S.p.A.

- Schubert GmbH

- Tetra Pak International S.A.

- Marel hf.

- IMA Group S.p.A.

- Sidel Group S.A.S.

- Shibaura Machine Co., Ltd.

- Krones AG

- FLSmidth A/S

Recent Developments

- In 2024, ProMach, Inc.: Completed its acquisition of Italian filling, seaming, and pasteurization systems company Zacmi. ProMach later acquired HMC Products in October, further expanding its flexible packaging portfolio.

- In 2024, Tetra Pak International S.A.: Launched the Tetra Pak® E3/Speed Hyper, a high-speed filling machine that uses eBeam technology to reduce energy, water, and chemical consumption.

- In 2023, Multivac Sepp Haggenmüller SE & Co. KG: Opened a new production and sales facility in India in December, aiming to improve supply for the region’s food and medical device companies.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Packaging Type, Automation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, supported by rising global demand for packaged foods.

- Automatic packaging machines will gain dominance due to efficiency and labor cost reduction.

- Flexible packaging will continue to lead, driven by convenience and sustainability benefits.

- IoT-enabled and smart machines will see rapid adoption for predictive maintenance and monitoring.

- Sustainability regulations will push machinery adaptation to eco-friendly packaging materials.

- Asia Pacific will witness the fastest growth with urbanization and rising disposable incomes.

- Robotics and AI integration will enhance accuracy and speed in large-scale production.

- Demand for hygienic and safe packaging will increase with stricter food safety standards.

- High initial investment will remain a barrier for small and medium manufacturers.

- Innovation in recyclable and bio-based packaging formats will create new opportunities for machinery suppliers.