Market Overview:

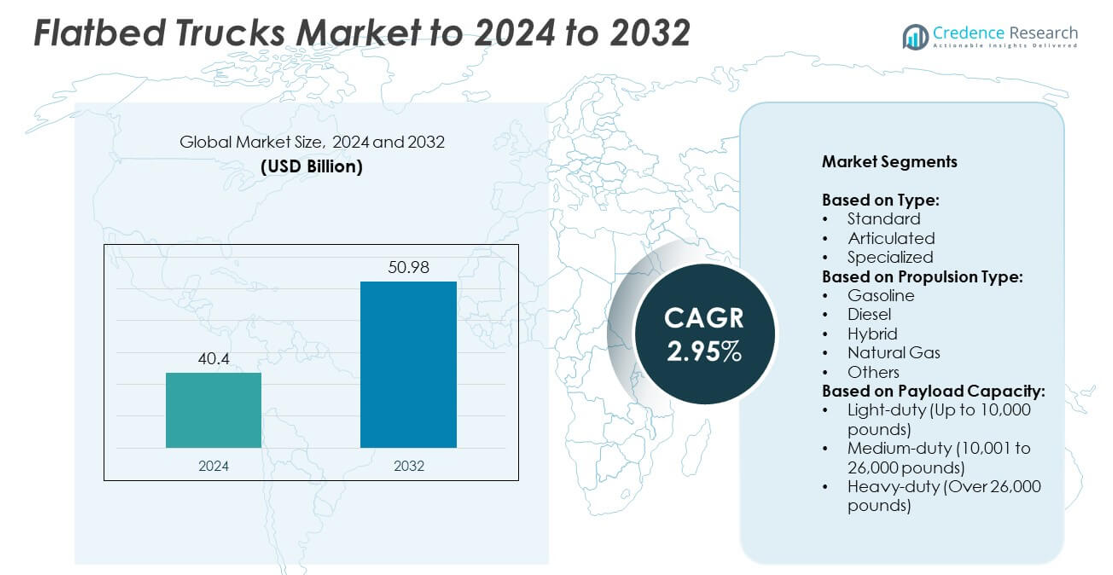

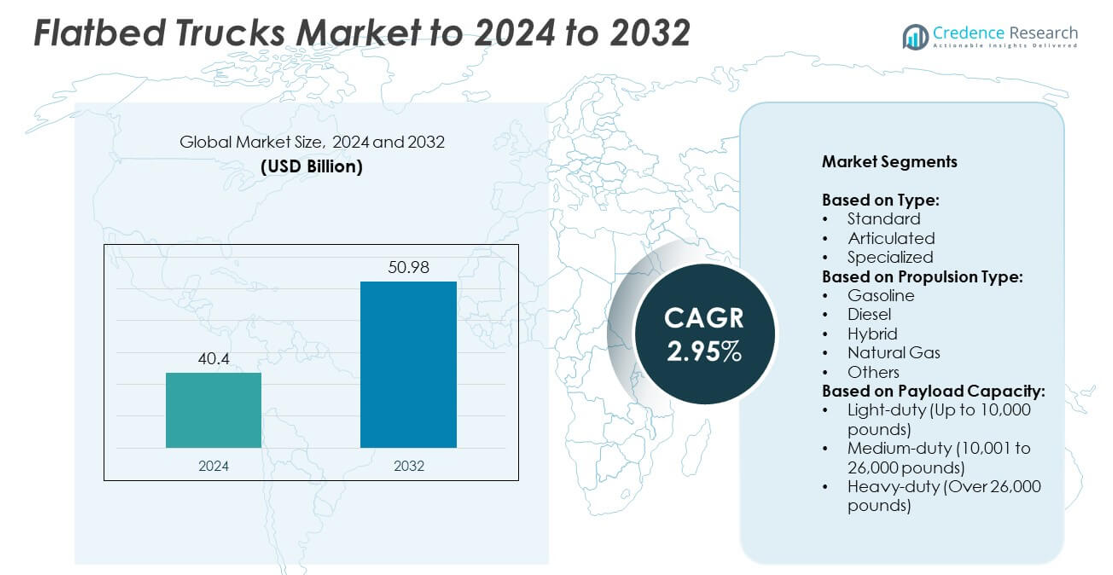

The Flatbed Trucks Market size was valued at USD 40.4 Billion in 2024 and is anticipated to reach USD 50.98 Billion by 2032, at a CAGR of 2.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flatbed Trucks Market Size 2024 |

USD 40.4 Billion |

| Flatbed Trucks Market, CAGR |

2.95% |

| Flatbed Trucks Market Size 2032 |

UUSD 50.98 Billion |

The flatbed trucks market is led by key players including Volvo Group, Tata Motors, Ford Motor Company, Navistar International Corporation, Dongfeng Motor Corporation, Isuzu Motors, Toyota Motor Corporation, International Trucks, Paccar Inc., Daimler AG (Mercedes-Benz), and Hino Motors, Ltd. These companies drive competition through innovation, regional expansion, and advanced product offerings tailored to diverse industrial needs. North America emerged as the leading region in 2024, holding 35% of the global share, supported by large-scale infrastructure projects and a mature logistics sector. Europe followed with 28%, while Asia Pacific accounted for 25%, reflecting strong growth driven by industrialization and urbanization.

Market Insights

- The flatbed trucks market was valued at USD 40.4 billion in 2024 and is projected to reach USD 50.98 billion by 2032, growing at a CAGR of 2.95%.

- Growth is driven by rising infrastructure projects, logistics expansion, and demand for heavy-duty trucks in construction and mining sectors.

- Trends include adoption of alternative fuel vehicles, integration of telematics and fleet management systems, and focus on lightweight materials for efficiency.

- The market is highly competitive, with global players investing in technology upgrades, regional customization, and sustainable product portfolios to strengthen positions.

- North America leads with 35% share due to advanced logistics and infrastructure, Europe follows with 28%, and Asia Pacific accounts for 25% driven by industrialization; by type, standard flatbed trucks dominate with 45% share, while diesel propulsion holds over 55% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The standard flatbed trucks segment held the dominant share of the flatbed trucks market in 2024, accounting for nearly 45% of total sales. Their widespread adoption comes from versatile applications across logistics, construction, and agriculture sectors. Standard models are cost-effective, easy to maintain, and compatible with diverse cargo types, which boosts preference among fleet operators. In contrast, articulated and specialized flatbeds serve niche demands in oversized load transport and specialized industries, but their adoption remains limited compared to the broad utility and affordability of standard flatbed trucks.

- For instance, PACCAR delivered a record production of 204,200 trucks globally in 2023.

By Propulsion Type

Diesel-powered flatbed trucks accounted for more than 55% of the market share in 2024, making them the leading propulsion type. Diesel engines offer higher torque, durability, and better fuel efficiency in long-haul and heavy-duty operations, which makes them the preferred choice among logistics and construction industries. While hybrid and natural gas options are growing, their adoption is slower due to infrastructure and cost barriers. Gasoline-powered flatbeds remain relevant in light-duty applications but lack the performance required for larger payloads, further cementing diesel’s dominance.

- For instance, Daimler Truck AG confirmed that in 2023 it delivered 526,053 vehicles worldwide. The company’s heavy-duty truck portfolio includes brands like Mercedes-Benz, which sold 158,511 units that year, and Freightliner, which helped drive a 4% increase in the Trucks North America segment to 195,014 units.

By Payload Capacity

Heavy-duty flatbed trucks led the market with over 50% share in 2024, driven by demand in construction, mining, and industrial goods transport. These trucks support payloads over 26,000 pounds, making them critical for industries moving heavy equipment and raw materials. Their strong presence is also linked to large infrastructure projects and rising global trade volumes. Medium-duty trucks serve regional logistics and urban freight needs, while light-duty flatbeds remain popular in agriculture and small-scale delivery, but their overall contribution is lower compared to the heavy-duty segment’s wide industrial adoption.

Key Growth Drivers

Infrastructure Expansion and Construction Projects

The surge in global infrastructure development is a primary growth driver for the flatbed trucks market. Large-scale construction projects, including highways, bridges, and urban development, demand reliable transportation of heavy equipment and raw materials. Heavy-duty flatbed trucks are widely used for carrying oversized loads that conventional trucks cannot handle. Governments worldwide are increasing investments in public infrastructure and renewable energy projects, which directly fuel demand. This consistent reliance on flatbed trucks in construction ensures stable growth momentum for the segment throughout the forecast period.

- For instance, Ashok Leyland sold 198,113 commercial vehicles in calendar year 2023. This included sales within India and internationally and represented a record annual volume for the company, surpassing its previous record from 2018.

Growth in Logistics and Freight Movement

The rising need for efficient freight and logistics solutions drives flatbed truck adoption. E-commerce growth and global trade have increased the demand for flexible transportation of goods, including machinery, building materials, and agricultural equipment. Flatbed trucks provide unmatched versatility for oversized and irregular cargo, strengthening their role in logistics chains. Fleet operators are focusing on expanding their heavy-duty truck fleets to meet rising freight demand. This expanding logistics ecosystem, particularly across cross-border and regional transport, continues to accelerate flatbed truck market growth significantly.

- For instance, in 2023, Scania delivered 96,727 vehicles globally, including trucks and buses. The company achieved growth in both sales and profits during that year. In the European market, Scania’s market share for heavy trucks was 15.3% at the end of the third quarter of 2023.

Advancements in Truck Design and Technology

Innovations in flatbed truck design and technology serve as a major growth driver. Manufacturers are focusing on improving fuel efficiency, load-handling capacity, and driver comfort through advanced engineering. Integration of telematics, GPS tracking, and automated safety systems enhances operational efficiency for fleet operators. Additionally, lightweight materials are being adopted to improve payload efficiency and reduce fuel consumption. These technological upgrades not only attract fleet owners seeking cost savings but also meet stringent emission regulations, making innovation a key factor supporting the flatbed truck market’s future expansion.

Key Trends & Opportunities

Rising Demand for Alternative Fuel Trucks

A major trend in the market is the shift toward alternative fuel-powered flatbed trucks. Growing environmental concerns and stricter emission norms are encouraging adoption of hybrid, electric, and natural gas-powered trucks. Fleet operators see alternative propulsion as an opportunity to reduce fuel costs and comply with sustainability targets. Governments are offering subsidies and incentives for cleaner vehicles, which accelerates adoption. Though diesel continues to dominate, the rising demand for eco-friendly options presents a significant opportunity for manufacturers to diversify their offerings and strengthen competitiveness.

- For instance, in 2023, Hyundai Motor Group, which includes the Hyundai and Kia brands, reported 516,000 battery-electric vehicle (BEV) sales globally. Within this total, Hyundai brand BEV sales were estimated to be over 280,000.

Digital Integration and Fleet Management Solutions

Digitalization is shaping the flatbed truck market, creating opportunities for improved efficiency. Advanced telematics, AI-based fleet management systems, and IoT integration allow real-time tracking, predictive maintenance, and route optimization. These technologies reduce downtime, improve safety, and enhance cost-effectiveness for operators managing large fleets. Companies adopting digital solutions are gaining a competitive advantage by offering faster and more reliable services. The growing adoption of connected technologies presents strong opportunities for OEMs and logistics providers to improve performance, customer satisfaction, and overall market value.

- For instance, in November 2023, Iveco announced that around 100,000 of its vehicles were connected to its telematics platform.

Key Challenges

High Operating and Maintenance Costs

One of the major challenges in the flatbed trucks market is high operating and maintenance costs. Fuel expenses, repair costs, and regular maintenance add significant financial pressure for fleet operators. Heavy-duty trucks in particular consume large amounts of fuel and require frequent servicing. Rising prices of spare parts and tires further increase expenses. For smaller fleet owners and logistics startups, these costs can limit adoption. The challenge of balancing affordability with operational efficiency remains a critical hurdle for the long-term growth of the market.

Regulatory Pressure on Emissions Compliance

Stringent emission regulations across key markets pose another challenge for flatbed truck manufacturers and operators. Governments are enforcing stricter standards to curb greenhouse gas emissions, which increases compliance costs. Manufacturers must invest in new technologies, including hybrid engines and cleaner fuel systems, to meet regulations. These compliance requirements raise vehicle prices and restrict adoption, especially in cost-sensitive regions. Fleet operators face additional burdens with mandatory retrofitting and inspections. Navigating these regulatory pressures while maintaining profitability continues to be a major challenge in the flatbed trucks market.

Regional Analysis

North America

North America held the largest share of the flatbed trucks market in 2024, accounting for 35%. Strong demand is driven by infrastructure projects, construction activity, and robust logistics networks. The United States leads the region with heavy investment in highways and energy-related transport, requiring reliable heavy-duty trucks. Canada also contributes with demand in mining and forestry operations. Fleet operators in this region continue to adopt advanced fleet management technologies and fuel-efficient models. The presence of leading manufacturers and a mature logistics ecosystem ensures North America’s dominance in the global flatbed trucks market.

Europe

Europe captured 28% of the global flatbed trucks market in 2024, supported by strong logistics and industrial activity. Germany, France, and the United Kingdom lead with significant adoption in construction, automotive supply chains, and energy projects. Strict emission regulations encourage the use of advanced diesel and hybrid models, driving innovation among manufacturers. Investments in cross-border freight corridors further fuel demand for heavy-duty trucks. While Western Europe dominates the market, Eastern Europe is experiencing steady growth as infrastructure development accelerates. Europe’s focus on sustainability and regulatory compliance continues to shape product development and market expansion.

Asia Pacific

Asia Pacific accounted for 25% of the flatbed trucks market in 2024, making it a high-growth region. China and India are leading contributors, driven by rapid industrialization, urbanization, and infrastructure expansion. Heavy-duty trucks dominate as demand rises for transporting construction materials, machinery, and agricultural produce. Japan and South Korea support growth with advanced truck technologies and innovations in fuel efficiency. Increasing e-commerce activity also fuels light and medium-duty demand. The region benefits from strong domestic manufacturing, making flatbed trucks more accessible. Rising government investments in roads and logistics infrastructure strengthen Asia Pacific’s market position.

Latin America

Latin America represented 7% of the flatbed trucks market in 2024, supported by construction, mining, and agricultural sectors. Brazil and Mexico drive regional demand with large-scale infrastructure projects and exports of raw materials. Flatbed trucks are widely used for transporting steel, cement, and machinery across long distances. The adoption of heavy-duty trucks remains high due to industrial requirements, though light-duty trucks are also growing in agriculture-focused markets. Limited regulatory pressure compared to developed regions allows flexibility in fleet operations. However, economic fluctuations and higher operational costs pose challenges for steady growth in Latin America.

Middle East and Africa

The Middle East and Africa held 5% of the global flatbed trucks market in 2024, led by infrastructure and energy-related projects. Gulf countries, particularly Saudi Arabia and the UAE, drive demand through large-scale construction, oil, and gas projects. In Africa, South Africa and Nigeria contribute with mining and agricultural transportation needs. Heavy-duty flatbed trucks dominate, as industries require reliable vehicles for oversized loads. Investments in logistics and trade corridors are creating new opportunities. However, adoption of advanced propulsion systems remains limited due to high costs and insufficient infrastructure, keeping growth moderate compared to other regions.

Market Segmentations:

By Type:

- Standard

- Articulated

- Specialized

By Propulsion Type:

- Gasoline

- Diesel

- Hybrid

- Natural Gas

- Others

By Payload Capacity:

- Light-duty (Up to 10,000 pounds)

- Medium-duty (10,001 to 26,000 pounds)

- Heavy-duty (Over 26,000 pounds)

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The flatbed trucks market is shaped by leading companies such as Volvo Group, Tata Motors, Ford Motor Company, Navistar International Corporation, Dongfeng Motor Corporation, Isuzu Motors, Toyota Motor Corporation, International Trucks, Paccar Inc., Daimler AG (Mercedes-Benz), and Hino Motors, Ltd. These players compete on the basis of product reliability, payload efficiency, fuel performance, and technological innovation. Market leaders focus heavily on research and development to enhance safety features, integrate telematics, and improve fuel efficiency, while also adapting to emission regulations. Strategic partnerships with logistics providers and construction firms strengthen their global presence. The competitive landscape is marked by strong regional penetration, with companies tailoring product portfolios to suit local infrastructure and regulatory needs. Increasing demand for heavy-duty trucks in construction and mining, combined with the shift toward hybrid and natural gas-powered models, is driving innovation. Overall, competition remains intense, with emphasis on sustainability, cost efficiency, and customer-focused solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Volvo Group

- Tata Motors

- Ford Motor Company

- Navistar International Corporation

- Dongfeng Motor Corporation

- Isuzu Motors

- Toyota Motor Corporation

- International Trucks

- Paccar Inc.

- Daimler AG (Mercedes-Benz)

- Hino Motors, Ltd.

Recent Developments

- In 2025, International Trucks focused on strengthening its core medium-duty lineup, including its MV and CV series, by offering robust and versatile chassis platforms.

- In 2024, Volvo launched the Volvo FH Aero, its most fuel-efficient truck ever, which also became the winner of the 2025 Green Truck award.

- In 2023, Ford announced plans for a second-generation all-electric pickup truck, codenamed “Project T3,” to be built at a new EV plant starting in 2025. The new truck will offer advanced autonomous driving capabilities.

Report Coverage

The research report offers an in-depth analysis based on Type, Propulsion Type, Payload Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The flatbed trucks market will expand steadily with infrastructure and construction investments.

- Heavy-duty flatbed trucks will remain the dominant category due to industrial demand.

- Diesel-powered trucks will continue to lead but alternative fuel adoption will rise.

- Hybrid and natural gas flatbed trucks will gain traction in regulated markets.

- Asia Pacific will emerge as the fastest-growing regional market.

- North America will maintain leadership with advanced logistics and fleet networks.

- Digital fleet management and telematics will drive operational efficiency.

- Rising e-commerce logistics will boost demand for light and medium-duty trucks.

- Manufacturers will invest in lightweight materials to enhance payload efficiency.

- Sustainability initiatives will influence product design and propulsion technologies.