Market Overview:

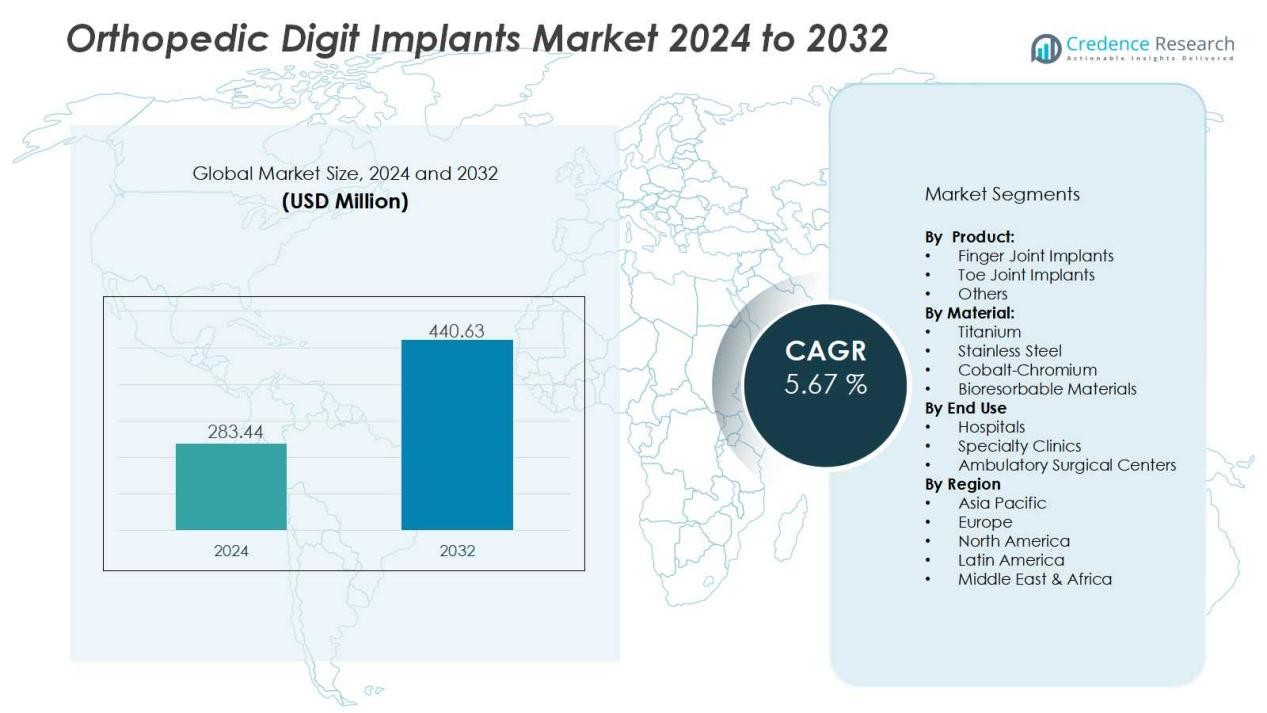

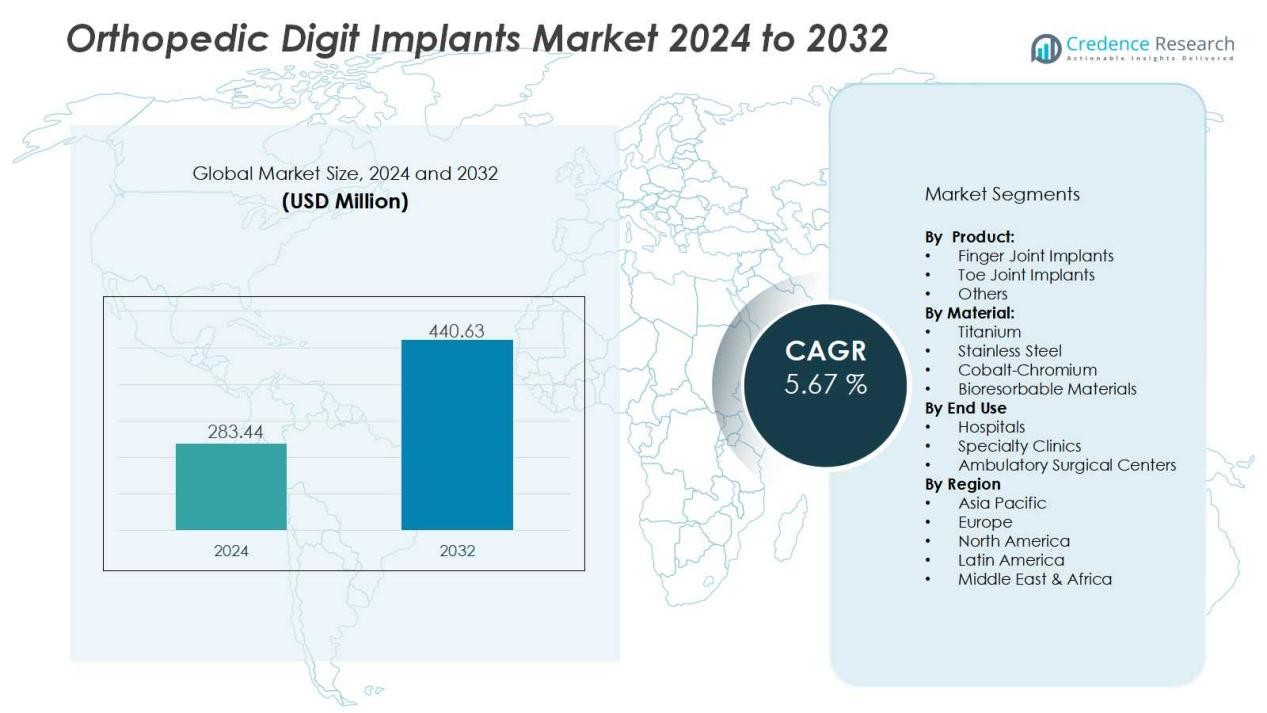

The orthopedic digit implants market size was valued at USD 283.44 million in 2024 and is anticipated to reach USD 440.63 million by 2032, at a CAGR of 5.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthopedic Digit Implants Market Size 2024 |

USD 283.44 Million |

| Orthopedic Digit Implants Market, CAGR |

5.67% |

| Orthopedic Digit Implants Market Size 2032 |

USD 440.63 Million |

Key drivers include the growing geriatric population, which is more prone to degenerative joint conditions, and the rising number of sports and workplace injuries. Technological advancements, such as customized 3D-printed implants and bioresorbable materials, are fueling demand. Increased awareness among patients and improved healthcare infrastructure in both developed and emerging economies are also contributing to higher procedure volumes, creating favorable conditions for market expansion.

Regionally, North America leads due to advanced healthcare systems, high patient awareness, and strong presence of key manufacturers. Europe follows closely, supported by widespread adoption of modern orthopedic treatments and favorable reimbursement policies. Asia-Pacific is projected to grow at the fastest rate, driven by rising healthcare investments, growing middle-class populations, and increasing demand for cost-effective implant solutions, especially in countries such as China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The orthopedic digit implants market was valued at USD 283.44 million in 2024 and is projected to reach USD 440.63 million by 2032 at a CAGR of 5.67%.

- Rising prevalence of arthritis, trauma, and joint deformities continues to drive strong demand for implant solutions worldwide.

- Technological advancements, including bioresorbable materials, titanium-based implants, and 3D printing, enhance performance and patient outcomes.

- The growing geriatric population contributes significantly, with rising surgical procedures addressing degenerative joint conditions and mobility restoration.

- High cost of implants and restrictive reimbursement policies remain barriers to adoption, particularly in developing economies.

- North America leads with 42% share, supported by advanced healthcare systems, patient awareness, and strong manufacturer presence.

- Asia-Pacific records 20% share with the fastest growth outlook, driven by healthcare investments, growing awareness, and rising surgical volumes.

Market Drivers:

Rising Prevalence of Degenerative Joint Disorders and Injuries:

The orthopedic digit implants market benefits from the increasing number of patients suffering from arthritis, trauma, and joint deformities. These conditions often lead to pain, restricted mobility, and functional limitations, creating strong demand for implant solutions. It offers effective restoration of motion and relief from discomfort, making it a preferred choice for patients. The rising incidence of sports-related injuries and workplace accidents also fuels implant adoption worldwide.

- For Instance, Stryker continued the global expansion of its MAKO SmartRobotics™ platform, used for joint restoration surgeries, contributing to a total of over 1.5 million Mako procedures performed to date across more than 45 countries.

Technological Advancements in Implant Materials and Design:

Continuous innovation in biomaterials and implant design significantly drives growth in the orthopedic digit implants market. Manufacturers are developing bioresorbable, titanium-based, and 3D-printed implants that provide greater strength, compatibility, and customization. It supports faster healing and improves patient outcomes by reducing implant rejection risks. Advanced design solutions also enable minimally invasive procedures, which are increasingly preferred by patients and surgeons alike.

- For instance, Bioretec’s RemeOs bioabsorbable metal alloy demonstrates 90% of patients achieving full ossification within 6 weeks and complete fracture consolidation by 12 weeks. It supports faster healing and improves patient outcomes by reducing implant rejection risks.

Growing Geriatric Population and Rising Surgical Procedures:

The growing elderly population drives consistent demand for digit implants due to age-related joint degeneration. Osteoarthritis and reduced bone density among older adults increase the need for surgical interventions. The orthopedic digit implants market gains momentum from the rising acceptance of elective surgeries that improve quality of life. It reflects broader trends in healthcare that prioritize mobility restoration and long-term patient wellness.

Expanding Healthcare Infrastructure and Patient Awareness:

Improved healthcare facilities and increasing access to specialized surgical care enhance adoption of digit implants. Governments and private providers are investing in modern operating rooms and advanced surgical tools across emerging markets. The orthopedic digit implants market benefits from rising patient awareness about treatment effectiveness and long-term benefits. It encourages individuals to seek corrective surgeries earlier, thereby driving consistent growth across regions.

Market Trends:

Integration of Advanced Technologies and Customized Implant Solutions:

The orthopedic digit implants market is witnessing a strong trend toward advanced materials and patient-specific implant solutions. Manufacturers are increasingly investing in 3D printing and computer-aided design to create customized implants that match individual anatomy. It allows surgeons to achieve better alignment, improved comfort, and faster recovery rates for patients. The adoption of bioresorbable and titanium-based implants continues to rise due to their durability and biocompatibility. Companies are also focusing on coatings and surface modifications that reduce infection risks and improve bone integration. These advancements are strengthening patient trust and encouraging healthcare providers to adopt innovative solutions.

- For instance, the zinc finger-inspired peptide-metal-phenolic nanocoating developed by researchers demonstrates enhanced binding strength of 6 times and functional connectivity improvements of 1.5-3 times in implant osseointegration studies, showcasing significant technological progress in surface modification technologies.

Shift Toward Minimally Invasive Procedures and Expanding Global Access:

A major trend in the orthopedic digit implants market is the growing preference for minimally invasive surgical techniques. Patients and surgeons favor procedures with smaller incisions, reduced hospital stays, and quicker rehabilitation times. It aligns with the broader healthcare shift toward efficiency and improved patient experiences. Global access to advanced surgical care is expanding, particularly in Asia-Pacific and Latin America, where investments in healthcare infrastructure are accelerating. Rising awareness campaigns are also improving patient knowledge about treatment options and long-term benefits. This combination of technological adoption and wider accessibility is driving consistent growth across multiple regions.

- For Instance, Stryker launched its PROstep MIS Lapidus system, an internal fixation system for treating bunions. The procedure, which uses a minimally invasive approach to fuse a foot joint, has shown a 2.5% decrease in recurrence compared to traditional surgery.

Market Challenges Analysis:

High Cost of Implants and Limited Reimbursement Policies:

The orthopedic digit implants market faces significant challenges due to the high cost of surgical procedures and implants. Advanced materials, customization, and specialized surgical tools increase overall treatment expenses, limiting accessibility for patients in low- and middle-income regions. It becomes more difficult for healthcare systems to ensure affordability when reimbursement policies remain restrictive. Insurance coverage often excludes or partially covers elective procedures, creating financial burdens for patients. This cost barrier slows adoption, particularly in emerging markets where awareness is rising but purchasing power is constrained.

Risk of Complications and Shortage of Skilled Surgeons:

Another challenge for the orthopedic digit implants market is the risk of post-surgical complications, such as infection, implant rejection, or limited joint mobility. It discourages some patients from undergoing corrective surgery, even when clinical outcomes are promising. The shortage of skilled orthopedic surgeons trained in advanced implant procedures further adds to the problem. Many healthcare facilities lack access to modern surgical equipment, leading to inconsistent treatment quality across regions. Regulatory hurdles and lengthy approval processes for new devices also slow innovation. These challenges collectively hinder faster market expansion despite growing demand.

Market Opportunities:

Expansion of Advanced Implant Technologies and Customization:

The orthopedic digit implants market holds strong opportunities with the growing adoption of advanced technologies such as 3D printing and bioresorbable materials. These innovations allow the development of patient-specific implants that improve surgical precision and recovery outcomes. It enables surgeons to provide solutions tailored to individual anatomy, increasing acceptance and satisfaction. Rising demand for minimally invasive options also creates space for next-generation implants that reduce recovery times. Manufacturers focusing on material science and surface modifications can differentiate their products in a competitive market. The shift toward personalized medicine positions this sector for sustained innovation and growth.

Rising Demand in Emerging Economies and Expanding Healthcare Access:

The orthopedic digit implants market is also supported by rapid growth in emerging regions, particularly Asia-Pacific and Latin America. Expanding healthcare infrastructure and government investments in advanced surgical facilities drive wider adoption of implant procedures. It creates opportunities for manufacturers to introduce cost-effective products tailored for local needs. Rising disposable incomes and growing awareness about corrective surgeries are encouraging more patients to seek treatment. Training programs and collaborations with local healthcare providers further strengthen market entry strategies. This expanding demand across developing economies highlights a strong growth pathway for global players.

Market Segmentation Analysis:

By Product:

The orthopedic digit implants market is segmented into finger joint implants, toe joint implants, and others. Finger joint implants hold a significant share due to the rising number of patients with rheumatoid arthritis and trauma-related injuries. Toe joint implants are gaining traction with the growing prevalence of hallux rigidus and degenerative conditions. It supports better mobility and pain management, making these implants widely accepted by surgeons and patients. The segment continues to expand with new designs and minimally invasive solutions.

- For Instance, In a 2-year prospective study comparing the Avanta metacarpophalangeal implant to silicone spacers, the Avanta implants produced a 7° greater increase in range of motion when comparing individual implants.

By Material:

Material choice plays a critical role in implant performance, with the market segmented into titanium, stainless steel, cobalt-chromium, and bioresorbable materials. Titanium dominates due to its superior biocompatibility, durability, and low rejection rates. Stainless steel and cobalt-chromium alloys are used in cost-sensitive settings while providing reliable outcomes. Bioresorbable materials represent an emerging area, offering flexibility in post-surgical recovery and reducing complications. It enables surgeons to address patient-specific needs with greater precision.

- For Instance, A 2014 clinical review of the NexGen® LPS Mobile Bearing implant reported a 98.4% survivorship rate at 10 years, with a subset of patients showing a 97.5% rate. This is not the same as the LPS-Flex, and the review was published earlier than 2024

By End Use:

Hospitals, specialty clinics, and ambulatory surgical centers form the key end-use segments of the orthopedic digit implants market. Hospitals lead adoption due to their access to advanced surgical equipment and skilled orthopedic surgeons. Specialty clinics are expanding their role with focused treatment options and personalized care. Ambulatory surgical centers are growing quickly, offering cost-efficient alternatives and shorter recovery times. It reflects the increasing preference for accessible and patient-centered orthopedic care.

Segmentations:

By Product:

- Finger Joint Implants

- Toe Joint Implants

- Others

By Material:

- Titanium

- Stainless Steel

- Cobalt-Chromium

- Bioresorbable Materials

By End Use:

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America accounts for 42% share of the orthopedic digit implants market, leading globally. The region benefits from advanced healthcare infrastructure, high patient awareness, and strong presence of key manufacturers. It is further supported by favorable reimbursement policies that encourage adoption of implant procedures. Rising incidence of sports injuries and arthritis cases among the elderly population also drives demand. Investments in research and development continue to deliver innovative implant solutions with improved performance. Growing emphasis on minimally invasive surgeries enhances the region’s leadership in the global market.

Europe:

Europe holds 30% share of the orthopedic digit implants market, ranking second after North America. The region demonstrates strong adoption of advanced implants due to favorable clinical outcomes and high-quality healthcare systems. It benefits from established regulatory frameworks that ensure patient safety and device performance. Aging demographics and the rising burden of degenerative joint disorders continue to drive demand. Hospitals and specialty clinics are expanding their surgical capabilities with modern tools and training. It creates a favorable environment for growth while encouraging collaborations between manufacturers and healthcare providers.

Asia-Pacific:

Asia-Pacific represents 20% share of the orthopedic digit implants market, with the fastest growth outlook. Rising healthcare expenditure and expanding hospital infrastructure support stronger adoption of implant procedures. It is further driven by growing awareness of surgical solutions and improving access to specialized care. Increasing cases of trauma injuries and degenerative conditions among aging populations add to demand. Government initiatives to expand healthcare access create favorable conditions for market penetration. Global manufacturers are entering partnerships with regional providers to expand their footprint. This dynamic growth positions Asia-Pacific as a key region for future expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The orthopedic digit implants market is highly competitive with strong participation from global and regional players. Key companies include Extremity Medical LLC, Stryker, Zimmer, Smith & Nephew, Depuy, Arthrex Inc, Acumed LLC, and Anika Therapeutics, Inc. These firms focus on innovation, product diversification, and expansion into high-growth regions to strengthen their market presence. It emphasizes advanced materials, minimally invasive designs, and patient-specific solutions to meet evolving clinical needs. Strategic collaborations with healthcare providers and continuous investment in research and development enhance their competitive edge. Companies are also adopting mergers, acquisitions, and partnerships to expand their portfolios and geographic reach. The competitive landscape is defined by continuous technological upgrades and strong emphasis on improving surgical outcomes.

Recent Developments:

- In January 2025, Stryker entered a definitive agreement to sell its U.S. spinal implants business to Viscogliosi Brothers, resulting in the creation of VB Spine and a new strategic partnership for spinal technologies.

- In July 2025, Zimmer Biomet announced the acquisition of Monogram Technologies, a robotics company, for $177 million to strengthen its robotic surgery portfolio.

Report Coverage:

The research report offers an in-depth analysis based on Product, Material, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The orthopedic digit implants market will witness sustained growth driven by rising cases of arthritis and trauma injuries.

- Technological advancements in 3D printing and bioresorbable materials will create new product opportunities.

- It will benefit from the growing demand for minimally invasive surgeries that reduce recovery times.

- North America will maintain leadership due to strong healthcare infrastructure and high adoption rates.

- Europe will strengthen its position with favorable regulations and increasing surgical volumes.

- Asia-Pacific will emerge as the fastest-growing region due to expanding healthcare access and rising awareness.

- It will see rising collaborations between global manufacturers and regional healthcare providers for market penetration.

- Customization of implants tailored to patient anatomy will become a major differentiator in the industry.

- Rising geriatric population will continue to drive procedures addressing degenerative joint disorders.

- Sustained focus on affordability and broader insurance coverage will improve accessibility and accelerate adoption worldwide.