Market Overview:

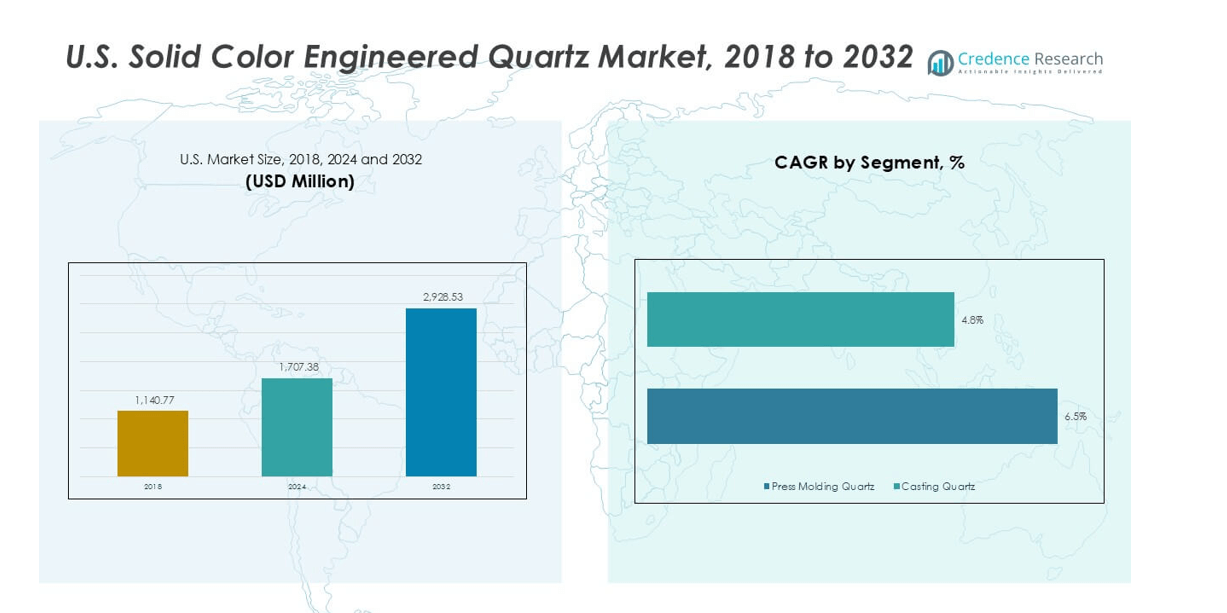

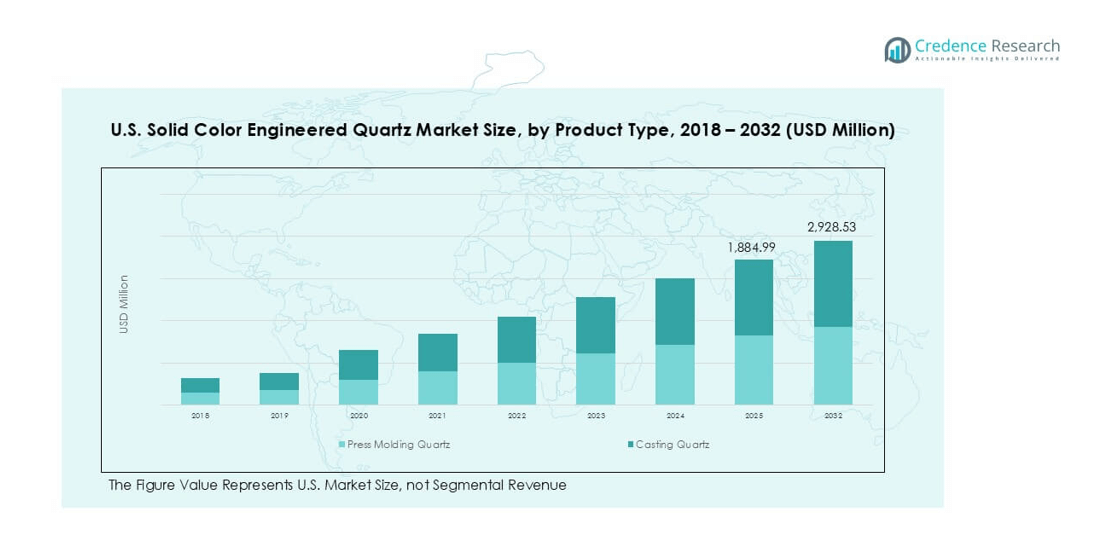

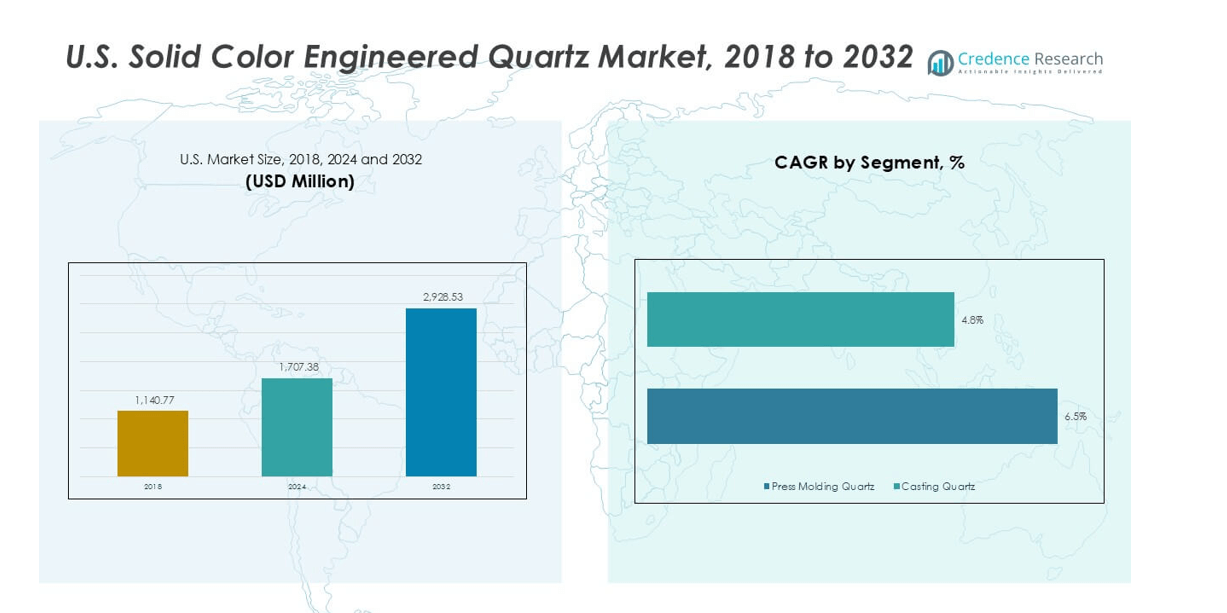

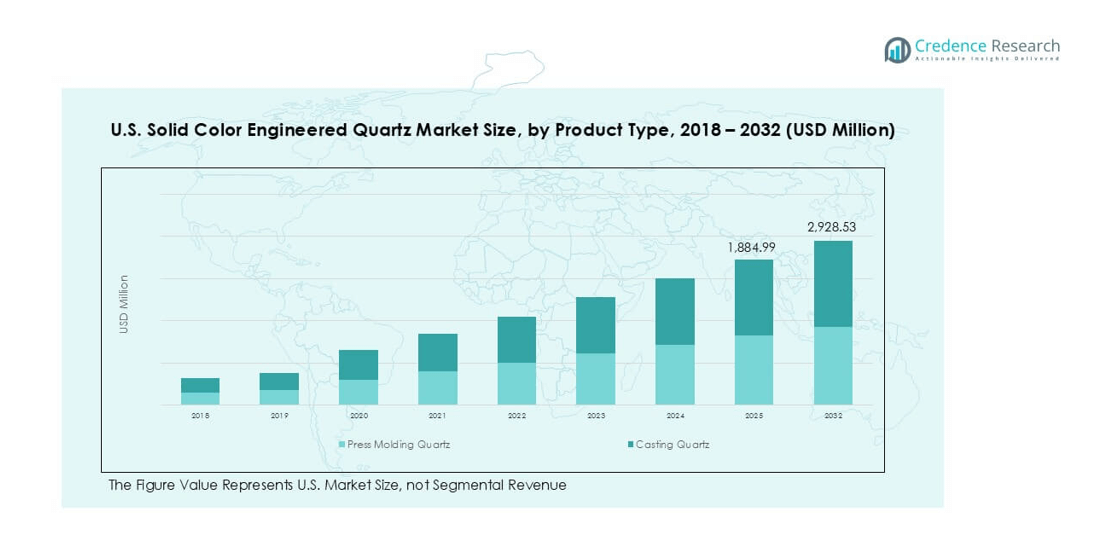

U.S. Solid Color Engineered Quartz market size was valued at USD 1,140.77 million in 2018 and reached USD 1,707.38 million in 2024. It is anticipated to reach USD 2,928.53 million by 2032, growing at a CAGR of 6.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Solid Color Engineered Quartz Market Size 2024 |

USD 1,707.38 million |

| U.S. Solid Color Engineered Quartz Market, CAGR |

6.50% |

| U.S. Solid Color Engineered Quartz Market Size 2032 |

USD 2,928.53 million |

The U.S. solid color engineered quartz market is led by key players such as Cambria, Caesarstone, HanStone Quartz, MSI Surfaces, Silestone by Cosentino, Wilsonart Quartz, Vicostone, Daltile, Meta Surfaces, and LX Hausys Viatera. These companies hold strong positions through extensive product portfolios, innovative surface designs, and broad distribution networks. The South region leads the market with a 34% share in 2024, driven by robust residential demand and large-scale commercial construction. The Northeast follows with 28%, supported by luxury remodeling projects, while the Midwest holds 22%, reflecting stable residential growth. The West accounts for 16%, driven by sustainability-focused demand in states like California.

Market Insights

- The U.S. solid color engineered quartz market was valued at USD 1,707.38 million in 2024 and is projected to reach USD 2,928.53 million by 2032, registering a CAGR of 6.50%.

- Rising residential renovations and premium kitchen demand drive adoption, with countertops dominating application share at 55%, supported by durability and modern aesthetics.

- Minimalist design preferences, eco-friendly production, and technological advancements in press molding sustain growth trends, while manufacturers expand portfolios to align with sustainability goals.

- The market is competitive, with leading players including Cambria, Caesarstone, HanStone Quartz, MSI Surfaces, Silestone by Cosentino, Wilsonart Quartz, Vicostone, Daltile, Meta Surfaces, and LX Hausys Viatera focusing on innovation and brand positioning.

- Regionally, the South leads with 34% share, followed by the Northeast at 28%, the Midwest at 22%, and the West at 16%, reflecting strong adoption across both residential and commercial end-user segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

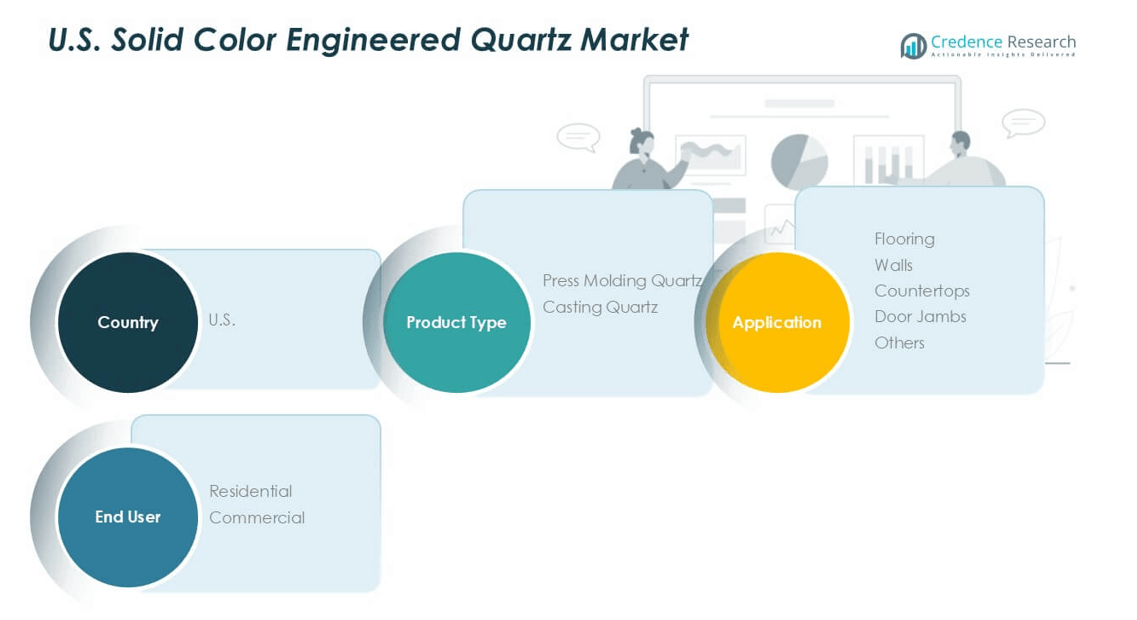

By Product Type

In 2024, press molding quartz dominated the U.S. solid color engineered quartz market, accounting for over 65% share. Its leadership is driven by superior durability, uniform surface finish, and cost-effective mass production that appeals to large-scale applications. The ability to maintain consistent patterns and resist stains makes it the preferred choice for residential and commercial projects. Casting quartz, though smaller in share, is growing steadily due to its flexibility in producing intricate shapes and designs, supporting demand in customized architectural applications.

- For instance, Caesarstone’s primary production facilities are in Israel (two plants) and India. It also sources products from third-party manufacturers in China. A U.S. facility in Richmond Hill, Georgia, was closed in mid-January 2024 as part of a restructuring plan.

By Application

Countertops held the largest share of over 55% in 2024 within the U.S. market. Their dominance stems from high adoption across kitchens and bathrooms, where aesthetics, durability, and resistance to heat and scratches are critical. Consumer preference for modern, minimal designs further strengthens demand for solid color engineered quartz countertops. Flooring applications follow, supported by growing interest in seamless, low-maintenance surfaces in residential and commercial interiors. Meanwhile, walls, door jambs, and other niche uses continue to expand as designers emphasize uniformity in interior finishes.

- For instance, Vicostone, one of the world’s leading suppliers of engineered quartz, has a manufacturing facility in the Hoa Lac Hi-Tech Park in Hanoi, Vietnam, which utilizes Breton manufacturing lines.

By End User

The residential sector led the U.S. solid color engineered quartz market in 2024 with a share of nearly 60%. Rising home renovations, demand for premium kitchen solutions, and the shift toward long-lasting materials underpin this dominance. Consumers increasingly prefer quartz surfaces for their balance of affordability and high-end appeal compared to natural stone. The commercial segment, while smaller, is gaining momentum in office spaces, retail outlets, and hospitality projects. Its growth is driven by developers seeking durable, stylish, and easy-to-maintain surfaces that align with modern design trends.

Key Growth Drivers

Rising Demand for Premium Residential Interiors

The growing preference for high-quality and durable interior materials is a key driver in the U.S. solid color engineered quartz market. Homeowners increasingly favor quartz for its resistance to stains, scratches, and heat, making it ideal for kitchens and bathrooms. Unlike natural stone, quartz offers a more uniform appearance and requires minimal maintenance, aligning with modern lifestyles. The U.S. home renovation sector, valued at over USD 500 billion annually, continues to expand, further fueling demand for quartz surfaces. Solid color designs are gaining popularity in contemporary homes where minimalism and sleek aesthetics dominate consumer choices. This trend strongly supports growth in the residential segment.

- For instance, in 2023, Caesarstone, like many companies in the home remodeling sector, faced a challenging market environment with global economic headwinds affecting demand. As a result, the company focused on restructuring and optimizing its manufacturing footprint by closing facilities in Richmond Hill, Georgia, and Sdot-Yam, Israel, to improve its overall profitability.

Expansion of Commercial Construction Projects

Rising investments in commercial spaces, including offices, hospitality, and retail establishments, significantly support the adoption of solid color engineered quartz. Developers and architects prefer quartz surfaces for their durability, cost efficiency, and ability to deliver modern, professional finishes. The U.S. commercial construction sector has rebounded in recent years, with emphasis on sustainable and long-lasting materials. Quartz countertops, flooring, and wall applications fit well with these requirements due to their longevity and ease of cleaning. Demand is also being boosted by the hospitality sector, where hotels and restaurants prioritize stylish, easy-to-maintain surfaces. This expansion ensures steady consumption across commercial end users, reinforcing market growth.

- For instance, Caesarstone Ltd. closed its manufacturing facility in Richmond Hill, Georgia, in January 2024, as part of a strategic restructuring to optimize its global production footprint. The company now relies on a network of global partners to serve its North American markets and other regions.

Advancements in Manufacturing Technologies

Technological improvements in engineered quartz production have emerged as a major growth driver. Press molding and advanced casting technologies enable manufacturers to achieve higher consistency, better finishes, and improved durability in solid color quartz products. Enhanced automation and digital design integration also reduce production costs, allowing suppliers to scale efficiently. The availability of eco-friendly resins and recycled raw materials aligns with sustainability goals, appealing to environmentally conscious buyers. U.S. manufacturers increasingly focus on energy-efficient processes and waste reduction strategies to meet regulatory requirements and green certifications. These advancements not only enhance product quality but also expand the range of applications, creating new opportunities in both residential and commercial markets.

Key Trends and Opportunities

Shift Toward Sustainable and Eco-Friendly Materials

Sustainability is a defining trend in the U.S. solid color engineered quartz market. Consumers and businesses alike demand environmentally responsible products, driving manufacturers to adopt recycled raw materials and eco-resins in production. Certifications such as LEED and GREENGUARD are becoming critical in influencing purchase decisions. The trend toward green construction and renovation projects strengthens this momentum, especially as federal and state regulations emphasize energy efficiency and reduced carbon footprints. This creates a clear opportunity for producers that can market quartz surfaces as sustainable alternatives to natural stone, positioning themselves as leaders in eco-conscious design.

- For instance, Cosentino’s Silestone Sunlit Days collection uses HybriQ+ technology, incorporating at least 20% recycled glass and 99% reused water in manufacturing, while the company confirms that 100% of its electricity used in quartz surface production is sourced from renewable energy.

Growing Popularity of Minimalist and Modern Aesthetics

Design trends are shifting toward clean, minimalist interiors where solid color quartz surfaces align perfectly. Architects and homeowners prefer uniformity and simplicity over heavily patterned surfaces, increasing adoption in kitchens, bathrooms, and commercial spaces. Solid color engineered quartz provides flexibility for modern, seamless designs while maintaining high durability. The rise of open-plan living spaces and luxury renovations further amplifies demand for neutral-colored quartz products. This aesthetic-driven trend opens opportunities for manufacturers to introduce wider color palettes and textures that cater to evolving consumer preferences, reinforcing quartz as a premium surface material.

Key Challenges

High Competition from Alternative Surface Materials

Despite its strong growth, the U.S. solid color engineered quartz market faces intense competition from granite, marble, and emerging solid surface materials. Many consumers still perceive natural stone as more prestigious, limiting quartz adoption in certain premium projects. Additionally, engineered surfaces such as porcelain slabs and sintered stones are gaining market attention due to their durability and unique finishes. Price sensitivity in some consumer segments also drives demand toward lower-cost alternatives like laminates. To counter this challenge, quartz manufacturers must invest in branding, education, and product innovation to highlight performance benefits and value.

Volatility in Raw Material Costs and Supply Chains

The production of engineered quartz depends heavily on raw materials such as quartz crystals, resins, and pigments, which are subject to price fluctuations. Global supply chain disruptions, rising energy costs, and resin shortages can significantly impact manufacturing expenses and profit margins. The U.S. market is also exposed to import-related uncertainties, as a large portion of quartz is sourced from overseas producers. Trade policies and tariffs further compound risks for suppliers. These challenges make it crucial for companies to diversify sourcing strategies, invest in local manufacturing, and explore recycled inputs to stabilize operations and reduce dependence on volatile supply chains.

Regional Analysis

Northeast

The Northeast accounted for nearly 28% of the U.S. solid color engineered quartz market in 2024, driven by strong demand in urban centers such as New York, Boston, and Philadelphia. High levels of residential remodeling and luxury apartment construction fuel adoption of quartz countertops and flooring. The region’s established commercial infrastructure, including office spaces and hospitality projects, also supports growth. Consumers prefer modern, low-maintenance surfaces, aligning with quartz’s properties. Rising sustainability initiatives in states like New York and Massachusetts further boost demand for eco-friendly quartz products, consolidating the region’s importance in both residential and commercial applications.

Midwest

The Midwest captured about 22% market share in 2024, supported by a growing residential construction sector and steady demand in mid-sized cities like Chicago, Minneapolis, and Detroit. Rising home renovation activities, particularly in kitchens and bathrooms, strengthen adoption of quartz countertops and walls. Commercial growth, including office and retail expansions, adds to demand. Affordability plays a critical role in this region, where consumers seek durable, cost-effective alternatives to natural stone. The Midwest also benefits from increasing awareness of quartz’s performance in harsh climates, where low-maintenance and durable materials are valued, ensuring stable market expansion.

South

The South led the U.S. solid color engineered quartz market in 2024 with a 34% share, making it the dominant region. High population growth, strong housing demand, and large-scale commercial development in states like Texas, Florida, and Georgia underpin this leadership. Homeowners increasingly adopt quartz for countertops and flooring, driven by rising disposable incomes and preference for modern finishes. The region’s robust hospitality and retail sectors further amplify usage in commercial interiors. Favorable construction activity, coupled with quartz’s resilience in humid climates, secures the South’s position as the largest consumer of engineered quartz surfaces.

West

The West held nearly 16% of the U.S. market in 2024, supported by high demand in California and other coastal states. Strong renovation activity in upscale homes, combined with strict sustainability standards, drives preference for eco-friendly quartz products. California’s focus on green building regulations, alongside a thriving luxury housing market, accelerates adoption of solid color quartz. The region’s commercial demand, particularly in tech-driven urban centers like San Francisco and Seattle, supports growth in office and hospitality interiors. Increasing consumer preference for sleek, minimalist aesthetics further fuels adoption, making the West an important market segment despite higher competition.

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Quartz

By Application

- Flooring

- Walls

- Countertops

- Door Jambs

- Others

By End User

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. solid color engineered quartz market is highly competitive, with both domestic and international players shaping the landscape. Leading companies such as Cambria, Caesarstone, HanStone Quartz, MSI Surfaces, and Silestone by Cosentino dominate through strong brand recognition, diverse product portfolios, and extensive distribution networks. These firms focus on innovation, introducing eco-friendly resins, recycled inputs, and advanced surface designs to align with sustainability trends. Regional players like Wilsonart Quartz, Vicostone, Daltile, Meta Surfaces, and LX Hausys Viatera contribute significantly by offering cost-effective and customizable solutions. Competition intensifies as manufacturers invest in technology-driven production, expanding color palettes, and partnerships with architects and builders to capture a broader customer base. Pricing strategies, quality assurance, and marketing campaigns emphasizing durability and design aesthetics remain critical differentiators. Overall, the market reflects a balance between premium offerings and value-based alternatives, with players positioning themselves to meet rising demand across residential and commercial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cambria

- Caesarstone

- HanStone Quartz

- MSI Surfaces

- Silestone by Cosentino

- Meta Surfaces

- Wilsonart Quartz

- Vicostone

- Daltile

- LX Hausys Viatera

Recent Developments

- In July 2025, Caesarstone launched ICON™, a revolutionary crystalline silica-free solid surface (less than 1% silica) with approximately 80% recycled content, prioritizing both safety for fabricators and sustainability for consumers.

- In July 2025, Vicostone launched 10 new quartz colors for the fall season, focusing on inspirations from natural elements and aesthetics.

- In May 2025, RAK Ceramics commissioned its new next-generation slab production facility using Continua+ PCR 2180 technology, marking a significant technological leap in large-format engineered quartz and ceramic surfaces.

- In May 2024, WK Stone partnered with Eight Homes to offer Quantum Zero, a recycled surface as a safe alternative to high-silica engineered stone.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, driven by strong demand in residential renovations.

- Countertops will remain the dominant application due to durability and modern appeal.

- Commercial adoption will increase as developers seek long-lasting and stylish surfaces.

- Press molding quartz will continue to hold the largest product share.

- Sustainable and eco-friendly quartz production will gain higher consumer preference.

- Minimalist and uniform designs will shape future product innovations.

- Leading players will expand portfolios with new colors and textures.

- Regional dominance will remain with the South leading the market.

- Supply chain optimization and local production will reduce dependency on imports.

- Technology-driven manufacturing will improve product quality and expand applications.