Market Overview:

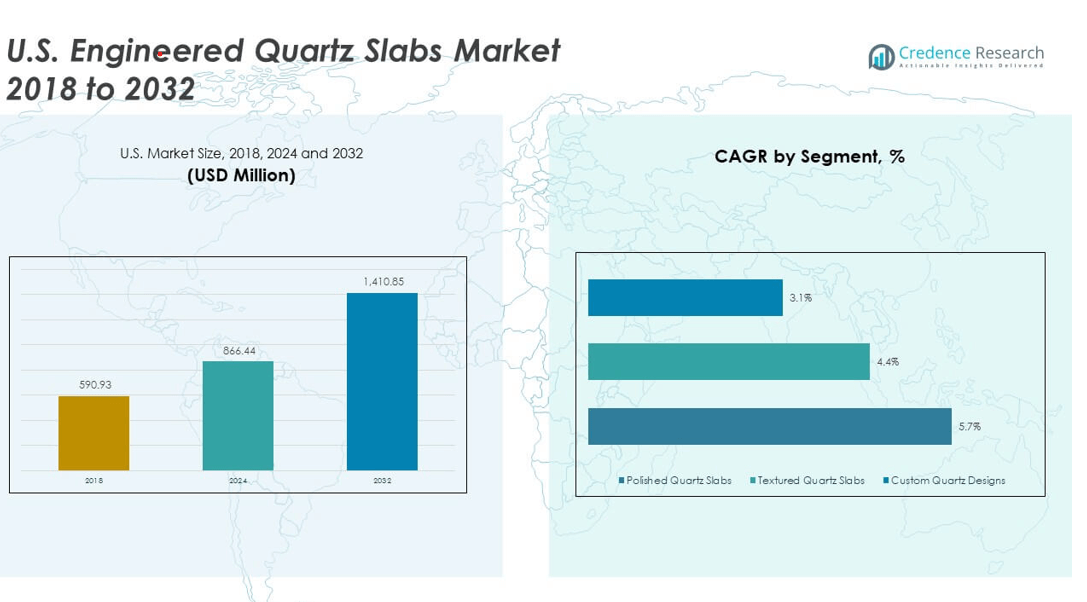

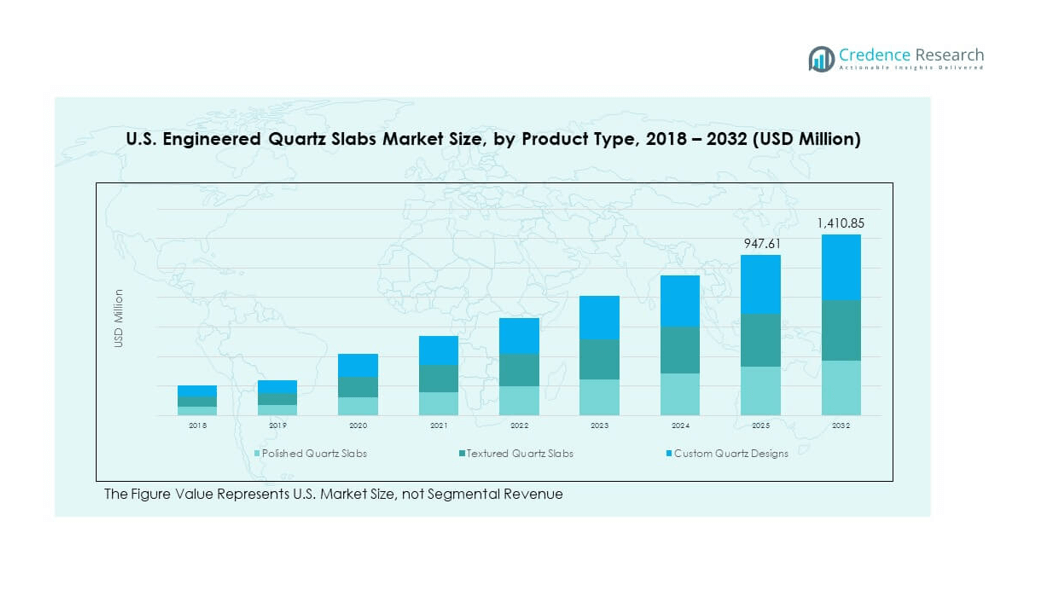

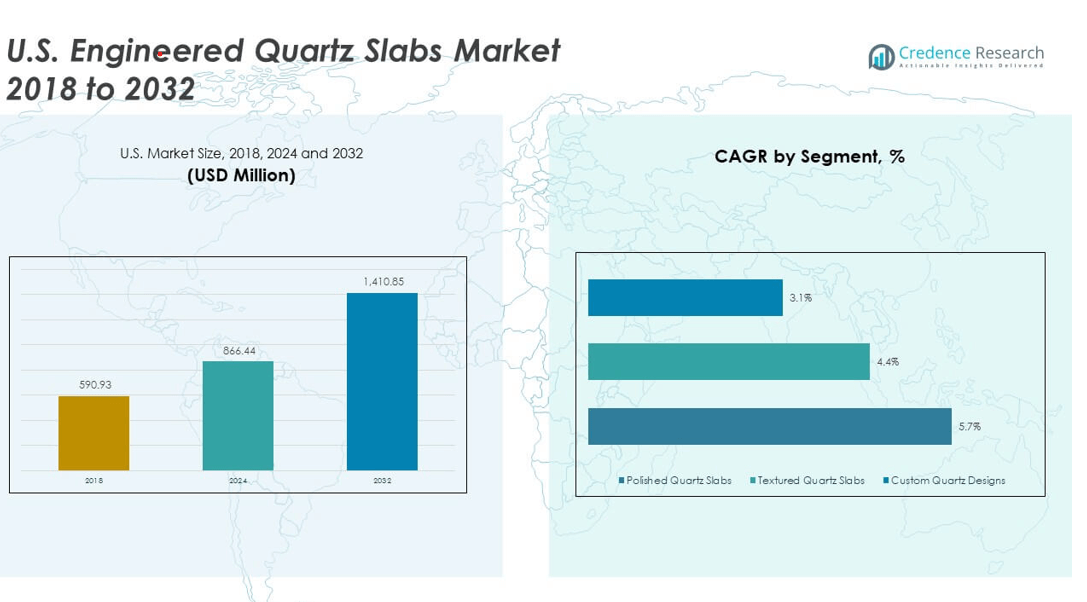

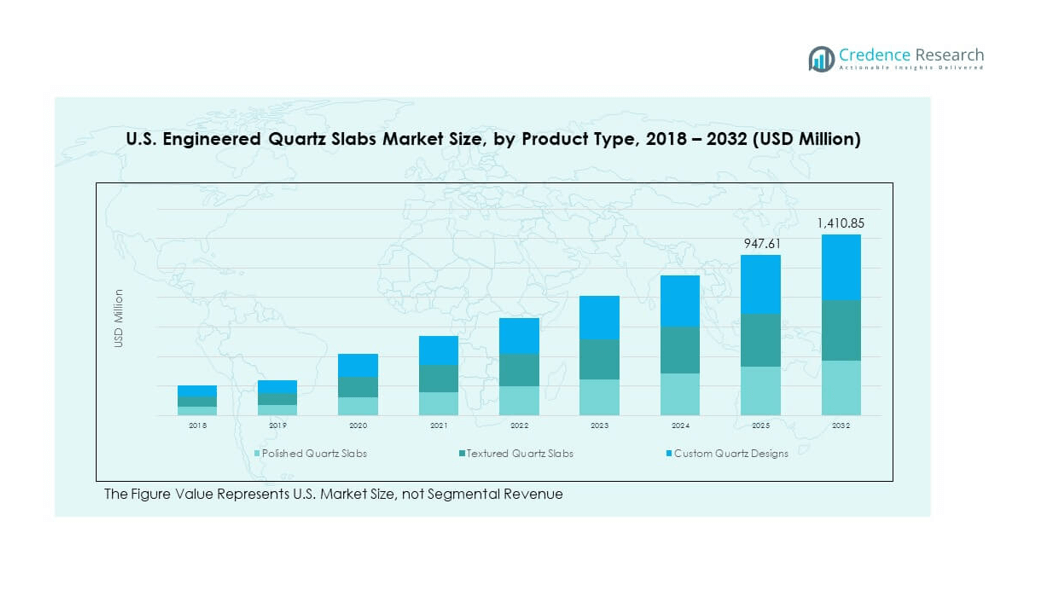

The U.S. Engineered Quartz Slabs Market size was valued at USD 590.93 million in 2018 to USD 866.44 million in 2024 and is anticipated to reach USD 1,410.85 million by 2032, at a CAGR of 5.85% during the forecast period. The market continues to expand due to rising adoption in residential and commercial projects, supported by strong consumer demand for durable and stylish surface solutions.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Engineered Quartz Slabs Market Size 2024 |

USD 866.44 million |

| U.S. Engineered Quartz Slabs Markett, CAGR |

5.85% |

| U.S. Engineered Quartz Slabs Market Size 2032 |

USD 1,410.85 million |

Growing urbanization, home remodeling activities, and the preference for non-porous, low-maintenance surfaces drive demand across the country. Consumers are increasingly shifting toward engineered quartz slabs due to their durability, wide design choices, and resistance to stains and scratches. The market also benefits from rising awareness about sustainable materials, with manufacturers offering eco-friendly options to align with green building standards. Demand from hospitality, healthcare, and corporate infrastructure projects further enhances the growth outlook.

The U.S. leads the market due to high disposable incomes, advanced construction practices, and a strong inclination toward premium interior solutions. Emerging demand is notable in suburban and semi-urban areas, where new housing projects are rising. Growth in coastal states is driven by luxury real estate development, while the Midwest and South are witnessing momentum from large-scale infrastructure and residential expansion. This geographic diversity highlights the market’s broad base and future potential across multiple U.S. regions.

Market Insights:

- The U.S. Engineered Quartz Slabs Market was valued at USD 590.93 million in 2018, reached USD 866.44 million in 2024, and is projected to hit USD 1,410.85 million by 2032, growing at a CAGR of 5.85%.

- The Northeast holds about 25% of the market share, driven by high-end residential remodeling and commercial infrastructure projects, while the West Coast follows with nearly 20% share, supported by luxury real estate and sustainability-focused construction.

- The Midwest contributes around 25% share, ranking among the top three regions, with strong adoption in family housing and urban redevelopment initiatives across key cities.

- The South is the fastest-growing region, holding nearly 20% of the U.S. Engineered Quartz Slabs Market, with demand fueled by suburban housing expansion and large-scale urbanization.

- By product segmentation, polished quartz slabs account for nearly 55% of the share in 2024, while textured quartz slabs and custom quartz designs together contribute close to 45%, reflecting growing consumer interest in diverse finishes and design flexibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Residential Construction and Remodeling Activities

The U.S. Engineered Quartz Slabs Market is strongly driven by rapid growth in residential construction and renovation projects across urban and suburban areas. Rising disposable incomes and consumer preference for premium interiors fuel demand for quartz slabs as a superior alternative to traditional granite and marble. Homeowners prefer quartz for its durability, non-porous nature, and wide range of designs that enhance kitchens and bathrooms. Remodeling activities, especially in upscale housing projects, support consistent adoption of quartz surfaces. It benefits from increasing homeownership and lifestyle upgrades that focus on aesthetics and convenience. The popularity of open kitchens and luxury finishes further reinforces its usage in countertops and flooring. Architects and contractors also recommend engineered quartz due to its consistent quality and long-term performance, creating lasting growth prospects.

- For instance, Caesarstone launched its nature-inspired Pebbles Collection at KBIS 2022, with five new designs featuring durable, nonporous quartz surface technology and a palette of warm monochromes, available nationwide in summer 2022 for U.S. residential interiors.

Expanding Applications in Commercial Infrastructure and Public Spaces

The market gains momentum from growing installations in commercial infrastructure such as hotels, offices, restaurants, and healthcare facilities. Quartz slabs are increasingly chosen in high-traffic areas because of their resilience, stain resistance, and ability to retain color and texture over time. The hospitality sector favors quartz for lobby spaces, bars, and dining areas, where visual appeal and durability are essential. The U.S. Engineered Quartz Slabs Market benefits from healthcare and corporate infrastructure adopting hygienic, low-maintenance materials. It caters to large-scale commercial developments that demand both performance and design flexibility. Rapid urbanization further increases adoption in malls, airports, and institutions. Interior designers highlight quartz as an affordable luxury solution, offering broad creative scope while maintaining reliability. Continuous commercial expansion across metropolitan regions sustains demand across the market.

- For instance, Cambria quartz surfaces, which are manufactured in the United States and known for high-impact resistance and lasting performance, are frequently considered for commercial and hospitality projects.

Consumer Shift Toward Sustainable and Eco-Friendly Building Materials

Growing awareness about sustainability and environmentally responsible practices shapes market demand. Consumers increasingly prefer products with recycled content, energy-efficient production processes, and certifications aligned with green building standards. The U.S. Engineered Quartz Slabs Market responds by incorporating eco-friendly manufacturing and sourcing practices. It benefits from the demand for materials that support LEED-certified projects and sustainable construction initiatives. Manufacturers develop slabs with reduced carbon footprints to meet evolving consumer values. Government incentives for sustainable construction also support adoption. Buyers are motivated by long-term cost savings linked to durability and reduced maintenance. This shift strengthens the market’s alignment with both environmental goals and consumer lifestyle expectations.

Technological Advancements Enhancing Product Quality and Design Versatility

Innovation in manufacturing technologies plays a key role in shaping the market. Advanced production methods allow slabs to replicate the look of natural stone while offering higher consistency and customization options. The U.S. Engineered Quartz Slabs Market benefits from improved color palettes, textures, and surface finishes that appeal to evolving design preferences. It supports both modern and traditional interior applications with versatile options. Technology also improves scratch resistance, heat endurance, and ease of maintenance. Automation in production enhances efficiency and reduces costs, making premium slabs more accessible. Growing use of digital printing technologies creates unique patterns that expand consumer choices. These advancements drive wider acceptance in both residential and commercial projects across the U.S.

Market Trends:

Growing Popularity of Customized and Aesthetic Interior Solutions

Consumers are increasingly drawn to personalized interior solutions that reflect unique style preferences. The U.S. Engineered Quartz Slabs Market benefits from demand for customizable colors, patterns, and finishes. It provides designers and homeowners with the flexibility to create spaces that balance functionality and aesthetics. Quartz slabs offer a wide selection of looks that mimic marble, granite, or modern minimalist styles. Homeowners favor these materials in open kitchens, luxury bathrooms, and accent walls. This trend also supports premium housing and luxury real estate projects. Growing interest in personalization continues to push the adoption of engineered quartz in diverse applications.

- For instance, Cosentino’s Silestone Ethereal Collection, expanded in the U.S. in 2023, uses HybriQ+ technology for marble-like quartz surfaces, combining 100% renewable energy with at least 20% recycled materials, and offers four distinct custom finish options designed for premium interiors.

Expansion of Distribution Through Online and Specialty Retail Channels

The distribution landscape is evolving with the rise of digital and specialized retail networks. Manufacturers are strengthening partnerships with e-commerce platforms and specialty outlets to increase accessibility. The U.S. Engineered Quartz Slabs Market is experiencing strong traction from consumers who prefer direct, convenient purchasing channels. It helps smaller contractors and independent designers gain faster access to material supplies. Online platforms also allow buyers to explore extensive design catalogs before purchasing. Specialty retailers enhance market growth by offering expert advice and showcasing samples in showrooms. This trend widens consumer choice and supports steady adoption across regions.

- For instance, MSI Surfaces significantly expanded its Q Premium Natural Quartz online offerings in 2021, providing more options for homeowners and builders through its digital retail network and dealers like Build.com. As part of this expansion, a large number of engineered quartz designs were made available for purchase and nationwide shipping.

Integration of Smart Surfaces and Functional Innovations

Technological integration is redefining the use of quartz surfaces in modern interiors. Manufacturers are experimenting with slabs that feature antibacterial coatings, enhanced heat resistance, and even embedded lighting effects. The U.S. Engineered Quartz Slabs Market leverages these innovations to appeal to design-forward and health-conscious consumers. It addresses changing needs in sectors like healthcare, hospitality, and luxury retail. Smart surfaces improve hygiene while delivering a futuristic appearance. Designers embrace these products for high-end projects seeking unique value propositions. Continued R&D investment is expected to expand the range of functional innovations available in the market.

Adoption in Outdoor and Non-Traditional Applications

Engineered quartz is expanding beyond indoor countertops into outdoor and creative applications. The U.S. Engineered Quartz Slabs Market witnesses rising use in outdoor kitchens, patios, and commercial landscapes. It benefits from improved UV resistance and durability, making quartz suitable for exterior environments. Architects explore quartz slabs for furniture, wall cladding, and large-scale decorative projects. This shift diversifies the product’s application base and reduces reliance on traditional indoor usage. Luxury designers integrate quartz into custom furniture and architectural accents. Broader applications support continued growth by unlocking new revenue streams for manufacturers. This trend strengthens the material’s position across residential and commercial design landscapes.

Market Challenges Analysis:

Intense Competition from Alternative Surface Materials

The U.S. Engineered Quartz Slabs Market faces strong competition from natural stone, porcelain, and solid-surface materials. It struggles to differentiate itself in a crowded landscape where each material has unique appeal. Granite and marble maintain a loyal consumer base due to their natural look, while porcelain slabs attract attention for affordability and thin profiles. Consumer perception that quartz is less exclusive than natural stone can slow adoption in luxury projects. Price-sensitive buyers also favor laminates and ceramic options. Intense competition pressures manufacturers to innovate continuously in design and marketing. It increases the importance of product differentiation, branding, and customer education.

High Production Costs and Regulatory Compliance Barriers

The market also faces challenges related to high production costs and compliance with safety standards. Quartz manufacturing involves significant capital investment, energy consumption, and reliance on imported raw materials. The U.S. Engineered Quartz Slabs Market must adapt to rising costs of labor and transportation. It also faces regulatory scrutiny over crystalline silica exposure during fabrication and installation. Compliance with health and environmental standards requires investment in advanced machinery and protective measures. These added costs limit profitability for smaller players and raise end-user prices. Fluctuations in raw material availability further impact stability. Managing compliance while maintaining cost competitiveness remains a key challenge for manufacturers.

Market Opportunities:

Rising Adoption in Luxury Real Estate and Commercial Spaces

The U.S. Engineered Quartz Slabs Market is positioned to benefit from growing demand in luxury residential and premium commercial spaces. It gains momentum from expanding real estate investments in metropolitan and coastal areas. High-end property developers choose quartz for its elegance, durability, and ability to replicate natural stone. It supports upscale kitchens, spa-inspired bathrooms, and designer lobbies that appeal to affluent buyers. The hospitality sector also creates opportunities through hotels and resorts adopting quartz for high-traffic spaces. This sustained adoption enhances visibility and strengthens long-term market potential.

Innovation in Eco-Friendly and Advanced Product Lines

Manufacturers have opportunities to expand their market share by focusing on sustainable and advanced designs. The U.S. Engineered Quartz Slabs Market can benefit from slabs made with recycled materials, lower emissions, and energy-efficient processes. It also gains from innovations such as antimicrobial surfaces, lightweight slabs, and digitally printed textures. Consumers seeking modern, health-conscious, and environmentally responsible products drive this opportunity forward. Smart partnerships with construction firms and architects can accelerate adoption. These innovations allow brands to differentiate themselves and appeal to both residential and commercial segments.

Market Segmentation Analysis:

By Product Type

Polished quartz slabs dominate demand due to their sleek appearance, durability, and ease of maintenance, making them the preferred choice in residential and commercial spaces. Textured quartz slabs are gaining traction among designers seeking unique finishes and natural stone aesthetics. Custom quartz designs cater to high-end projects where personalization and exclusivity are central, driving growth in premium markets. The U.S. Engineered Quartz Slabs Market benefits from all three categories, with polished slabs leading overall revenue.

- For instance, HanStone Odina polished quartz slabs (130″ x 65″ x 2 cm) were launched in 2023 with Calacatta-inspired veining and high-gloss finish, specifically engineered for luxury U.S. interiors requiring large slab sizes and a natural aesthetic.

By Application

Residential construction remains the largest application segment, supported by remodeling trends, new housing projects, and consumer preference for modern kitchens and bathrooms. Commercial construction, including offices, hotels, and healthcare facilities, is also expanding its use of quartz slabs due to durability and hygiene standards. Kitchen and bathroom design contributes significantly, with quartz countertops considered a premium choice. Interior design applications highlight decorative walls and furniture, while other niche uses broaden the scope. It benefits from diversified demand across both residential and commercial domains.

- For instance, Viatera quartz countertops by LX Hausys (formerly LG Hausys) are crafted with up to 93% natural quartz, offering nonporous, scratch-resistant surfaces, and are widely adopted in modern residential and commercial settings, confirmed by official product launches and showrooms across Texas as of 2025.

Segmentation:

By Product Type

- Polished Quartz Slabs

- Textured Quartz Slabs

- Custom Quartz Designs

By Application

- Residential Construction

- Commercial Construction

- Kitchen & Bathroom Design

- Interior Design

- Others

By Country Analysis (within U.S. scope)

- Country-wise overview

- Revenue by Product Type

- Revenue by Application

Regional Analysis:

Northeast and West Coast Leadership

The Northeast and West Coast together account for over 45% of the U.S. Engineered Quartz Slabs Market share, driven by luxury real estate projects, high-income households, and strong demand for premium kitchen and bathroom installations. States such as New York, California, and Massachusetts lead adoption due to urban development and design-focused consumer bases. The West Coast benefits from a strong remodeling culture and the influence of sustainability-driven construction practices. The Northeast is characterized by demand from both residential upgrades and commercial developments, including hospitality and corporate infrastructure. It reflects a preference for polished quartz slabs and custom designs tailored to upscale living spaces. Both regions also benefit from established distribution networks and higher brand penetration.

Midwest Expansion and Growing Adoption in South

The Midwest holds nearly 25% of the market share, supported by robust housing projects and rising investments in urban redevelopment. Consumers in this region increasingly favor quartz for durability and low maintenance in family homes. Commercial projects such as healthcare facilities and retail centers also strengthen demand. The South contributes about 20% of the U.S. Engineered Quartz Slabs Market, with rapid urbanization and expanding housing developments driving adoption. It demonstrates strong growth in residential construction, especially in suburban areas experiencing population influx. Both regions show a shift toward textured slabs, aligning with evolving design preferences. It highlights untapped opportunities for expansion in mid-tier and emerging cities.

Regional Momentum in Emerging States

Emerging states across the Mountain West and smaller southern markets collectively represent close to 10% of the national share but are projected to grow faster than mature markets. Rising demand comes from new housing projects, expanding hospitality infrastructure, and the influence of nationwide retail chains introducing premium finishes. It benefits from increasing awareness of quartz as a cost-effective and stylish alternative to natural stone. Smaller states are also witnessing growing participation of local distributors and specialty retailers. Investment in logistics and distribution infrastructure enhances accessibility, enabling manufacturers to penetrate underserved markets. This expansion strengthens overall market stability and ensures broad geographic coverage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cambria

- Caesarstone

- MSI Surfaces (Q Premium Quartz)

- Silestone (Cosentino)

- HanStone Quartz

- Wilsonart Quartz

- Viatera (LG Hausys)

- PentalQuartz

- Corian Quartz (DuPont)

- Imperial Vanities

Competitive Analysis:

The U.S. Engineered Quartz Slabs Market is highly competitive, with a mix of global brands and regional suppliers driving innovation and market share. It is characterized by intense rivalry among players such as Cambria, Caesarstone, MSI Surfaces, Silestone (Cosentino), and HanStone Quartz, each focusing on product quality, distribution strength, and design variety. Companies compete by offering a wide selection of colors, textures, and custom designs, while also investing in eco-friendly and technologically advanced slabs. Strategic partnerships with builders, retailers, and designers enhance their reach and customer loyalty. Product differentiation and innovation remain key levers for sustaining growth and positioning within this evolving market.

Recent Developments:

- In August 2025, Cambria unveiled four new quartz designs that emphasize elegance and advanced innovation to cater to contemporary interior trends within the U.S. engineered quartz slabs market.

- In July 2025, Caesarstone launched its ICON™ Advanced Fusion surface, a next-generation silica-free quartz product containing roughly 80% recycled materials—addressing growing concerns around indoor air quality and sustainable design.

- In January 2025, HanStone Quartz was associated with the acquisition of Midwest Specialty Products, LLC by Richelieu Hardware. While not a direct product launch, this acquisition expands the distribution network for HanStone quartz surfaces and others in key U.S. states.

- August 2025 saw Wilsonart Quartz launch a new line incorporating bold, nature-inspired colorways and textures. This release pushed boundaries in engineered quartz design for both residential and commercial interior applications. Around the same time, Wilsonart also acquired Virginia Tile’s woodworking division, further enhancing its distribution reach and product offerings in the U.S. market.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and country-level segmentation. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption in luxury residential projects will continue to drive demand.

- Expanding commercial infrastructure will enhance opportunities across hospitality and corporate spaces.

- Sustainable quartz slabs will gain traction due to eco-friendly initiatives.

- Technological innovations will improve customization and design options.

- Growth in suburban housing will create steady demand for polished slabs.

- E-commerce and specialty retail channels will strengthen distribution reach.

- Emerging states will contribute to market growth through expanding real estate.

- Strategic collaborations with designers and builders will improve brand penetration.

- Investments in silica-safe manufacturing will address compliance challenges.

- Increasing consumer awareness will push preference for durable, low-maintenance surfaces.