Market Overview

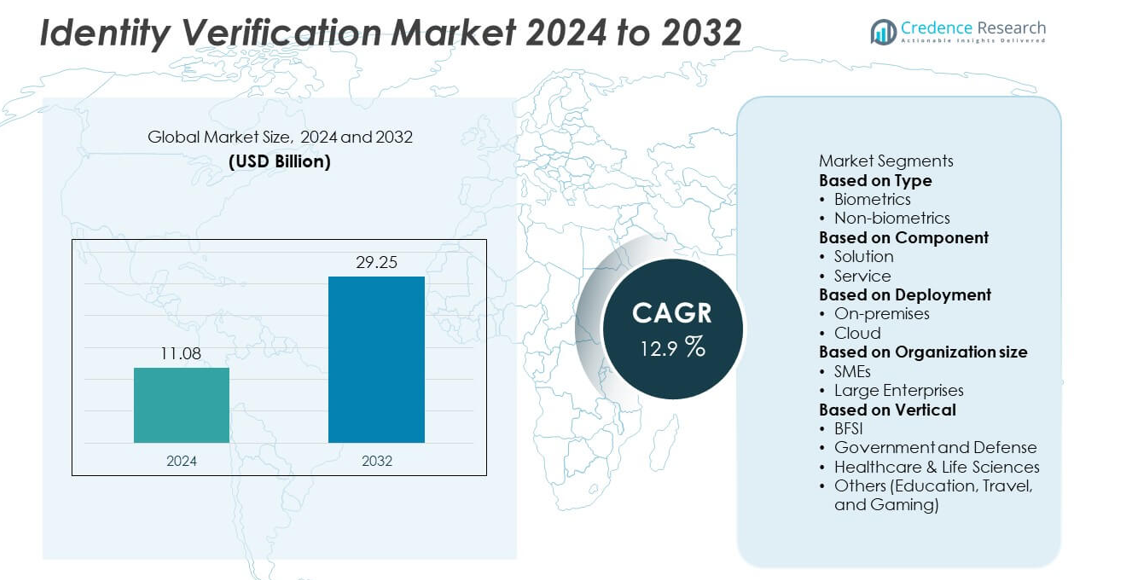

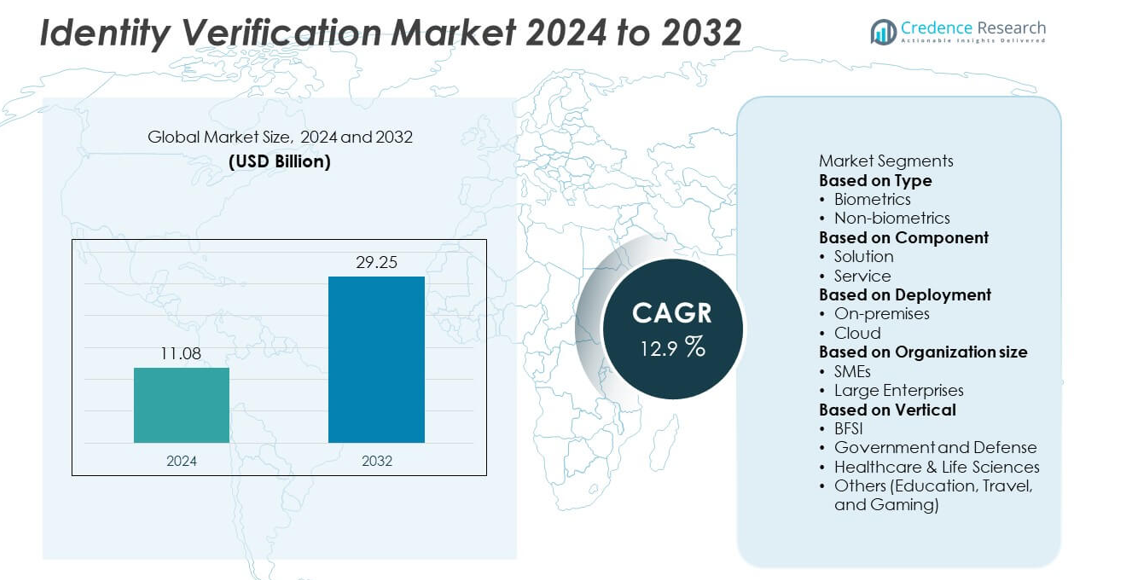

The global identity verification market was valued at USD 11.08 billion in 2024 and is projected to reach USD 29.25 billion by 2032, growing at a CAGR of 12.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Identity Verification Market Size 2024 |

USD 11.08 billion |

| Identity Verification Market, CAGR |

12.9% |

| Identity Verification Market Size 2032 |

USD 29.25 billion |

The identity verification market is led by major players including TransUnion LLC, IDEMIA, Mitek Systems, Inc., Equifax, Inc., GB Group PLC, Acuant, Inc., Thales Group S.A., Experian Plc, Nuance Communications Inc., and Intellicheck Inc. These companies drive growth through biometric innovations, AI-based fraud detection, and scalable cloud verification solutions catering to banking, government, telecom, and e-commerce sectors. Regionally, North America held the largest share at 35% in 2024, supported by strict compliance requirements and advanced digital infrastructure. Europe followed with 29% share, driven by GDPR and eIDAS frameworks, while Asia-Pacific accounted for 26% share, emerging as the fastest-growing region due to digital banking expansion and government-backed identity programs in China and India.

Market Insights

- The global identity verification market was valued at USD 11.08 billion in 2024 and is projected to reach USD 29.25 billion by 2032, growing at a CAGR of 12.9% during the forecast period.

- Rising incidents of identity fraud and stricter KYC and AML regulations drive demand, with the biometrics segment leading at 61% share due to higher accuracy and security.

- Key trends include the integration of AI and machine learning for real-time fraud detection, along with growing adoption of mobile and cloud-based identity verification solutions.

- Leading players such as TransUnion, IDEMIA, Mitek Systems, Equifax, and Thales compete through innovation in biometric technology, cloud platforms, and global expansion strategies, though high implementation costs and data privacy concerns remain significant restraints.

- Regionally, North America leads with 35% share, Europe follows with 29%, and Asia-Pacific holds 26% driven by fintech growth and government initiatives, while Latin America (6%) and Middle East & Africa (4%) show steady adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In 2024, the biometrics segment dominated the market with 61% share, driven by the rising adoption of fingerprint, facial, and iris recognition technologies. Biometrics provides a higher level of accuracy and security compared to traditional methods, making it the preferred choice for banking, financial services, government, and border control applications. Increasing demand for frictionless and secure user experiences in digital platforms also fuels adoption. Non-biometrics, including knowledge-based and document verification systems, remain relevant but are being increasingly complemented or replaced by biometric solutions due to advancements in AI and sensor technology.

- For instance, IDEMIA’s MorphoWave contactless fingerprint scanners enable identity verification throughput of up to 60 users per minute with four-finger scans. They have been deployed for staff access control at dozens of airports worldwide, and the technology has been installed at over 15,000 gates for corporate and border control projects.

By Component

The solution segment held 68% share in 2024, emerging as the leading category in the identity verification market. Comprehensive identity verification solutions, including biometric authentication, document scanning, and database validation, are widely deployed across banking, telecom, e-commerce, and government sectors. Their ability to prevent fraud, ensure compliance, and enhance customer onboarding drives strong demand. The service segment, covering managed and professional services, supports implementation and maintenance but remains secondary. The growing regulatory landscape, such as KYC and AML requirements, ensures sustained growth for solutions as enterprises seek scalable and secure verification systems.

- For instance, Mitek Systems provides AI-powered identity verification solutions for banking and fintech platforms, which are trusted by over 7,000 organizations worldwide. In its preliminary fiscal year 2023 financial results, the company’s identity revenue grew 18% year over year. Additionally, Mitek’s AI-based tools are used to combat sophisticated fraud tactics, including deepfakes.

By Deployment

In 2024, the cloud-based deployment segment accounted for 59% share, overtaking on-premises systems due to its scalability, cost-effectiveness, and flexibility. Organizations across financial services, retail, and IT sectors increasingly prefer cloud platforms for faster integration with digital applications and real-time identity validation. Cloud adoption is also strengthened by AI-driven analytics and improved cybersecurity frameworks. On-premises systems continue to serve industries with strict data sovereignty requirements but face slower growth. With the rise of remote work, digital onboarding, and mobile-first transactions, cloud deployment remains the dominant and fastest-growing segment in the identity verification market.

Key Growth Drivers

Rising Incidents of Identity Fraud

The surge in digital transactions and online services has increased cases of identity theft and fraud, driving the demand for reliable verification solutions. Financial institutions, telecom operators, and e-commerce platforms rely heavily on identity verification to secure transactions and protect customer data. Advanced biometric and AI-driven solutions help detect anomalies and prevent unauthorized access. With fraud-related financial losses rising globally, enterprises are investing in robust identity verification systems to ensure security, maintain customer trust, and meet compliance obligations across industries.

- For instance, Intellicheck’s platform validates around 100 million identities each year, providing a seamless, invisible ID verification with 99.975% decisioning in under a second.

Stringent Regulatory Requirements

Governments and regulatory bodies worldwide are enforcing stricter KYC (Know Your Customer) and AML (Anti-Money Laundering) norms. Organizations across banking, fintech, and insurance sectors are mandated to adopt secure identity verification systems to prevent illicit activities. Regulations like GDPR in Europe and CCPA in the U.S. further emphasize data protection, pushing enterprises to invest in advanced solutions. This regulatory pressure ensures consistent demand for both biometric and non-biometric verification systems, creating strong growth opportunities for vendors offering compliant, scalable, and efficient verification technologies.

- For instance, Experian’s CrossCore platform is used by banks and fintech firms to manage fraud and identity checks for KYC and AML compliance. A 2023 report from KuppingerCole recognized Experian as a market leader in fraud prevention for its CrossCore platform, which helps organizations maintain compliance with regulatory requirements.

Expansion of Digital Banking and E-commerce

The rapid growth of digital banking, e-commerce, and fintech platforms is a major driver of the identity verification market. Online onboarding, remote account opening, and digital payments demand secure and seamless verification processes. Biometric technologies such as facial recognition and fingerprint scanning enhance user experience while ensuring security. E-commerce platforms also adopt verification tools to reduce fraud during transactions and protect customer data. With consumers increasingly preferring digital channels, identity verification has become a critical component for businesses seeking to balance convenience with robust security.

Key Trends & Opportunities

Adoption of AI and Machine Learning

AI and machine learning are transforming identity verification by enabling real-time fraud detection and reducing false positives. These technologies enhance document verification, facial recognition, and risk scoring, providing higher accuracy and faster decision-making. Businesses are leveraging AI-driven analytics to streamline onboarding and improve customer experiences. As digital platforms expand, the adoption of AI in identity verification will create new opportunities for innovation, allowing enterprises to stay ahead of evolving fraud tactics while reducing operational costs.

- For instance, Thales provides biometric authentication solutions for large-scale government and banking projects, with specific implementations showing high accuracy rates.

Growing Use of Mobile and Remote Verification

The rise of remote work and mobile-first digital services is accelerating demand for mobile-based identity verification. Smartphone-integrated biometrics, such as facial recognition and fingerprint authentication, are becoming standard for banking apps, payment platforms, and government services. Remote verification allows businesses to expand services across geographies while maintaining compliance and security. This trend also benefits sectors such as healthcare and education, where secure digital onboarding is increasingly important. The shift toward mobile and remote verification opens significant opportunities for solution providers.

- For instance, IDEMIA’s mobile ID solutions are deployed in many US states, enabling citizens to use a secure, smartphone-based digital identity credential for accessing services like travel, online verification, and age-restricted purchases.

Key Challenges

High Implementation and Integration Costs

The deployment of advanced identity verification systems, particularly biometric and AI-enabled solutions, involves significant investment. Smaller enterprises and organizations in developing economies often find the high upfront and maintenance costs prohibitive. Integration with existing IT infrastructure adds complexity, further slowing adoption. Despite clear security benefits, cost remains a key restraint, limiting penetration among SMEs. Vendors are increasingly focusing on offering cost-effective, subscription-based, and cloud-based models to address this challenge and broaden their customer base.

Privacy Concerns and Data Security Risks

While identity verification enhances security, it also raises concerns around privacy and misuse of personal data. Biometric data storage and processing pose potential risks if systems are breached. Stringent data protection laws require companies to maintain transparency and compliance, which can increase operational complexity. Consumer skepticism about sharing sensitive information may also limit adoption in some markets. Overcoming these concerns requires strong encryption, secure storage practices, and transparent communication to build user confidence and ensure regulatory alignment.

Regional Analysis

North America

North America held the largest share of the identity verification market in 2024, accounting for 35%. The region’s leadership is driven by advanced digital infrastructure, widespread adoption of online banking, and strong regulatory frameworks such as KYC and AML requirements. The U.S. dominates due to heavy investment in biometric systems, AI-driven fraud detection, and digital onboarding solutions across financial and government sectors. Growing cases of cybercrime and identity theft further push enterprises to adopt advanced solutions. The presence of leading solution providers and rapid adoption in fintech and e-commerce strengthen North America’s position.

Europe

Europe captured 29% share of the identity verification market in 2024, supported by strict regulations such as GDPR and eIDAS, which mandate secure digital identity management. Countries like Germany, the U.K., and France are leading adopters, with strong demand in banking, insurance, and government services. Rapid expansion of digital commerce and cross-border transactions also fuels the need for secure verification systems. The European Union’s emphasis on digital identity frameworks and data protection continues to drive innovation and adoption, ensuring Europe remains a strong and mature market for identity verification solutions.

Asia-Pacific

Asia-Pacific accounted for 26% share of the identity verification market in 2024, emerging as the fastest-growing region. High population density, rapid digitization, and expansion of fintech platforms in China, India, and Southeast Asia are key drivers. Governments are actively promoting digital identity initiatives to improve financial inclusion and support secure e-governance. The rise of mobile payments, e-commerce platforms, and remote onboarding creates strong demand for biometric and cloud-based verification solutions. With increasing smartphone penetration and regulatory reforms, Asia-Pacific continues to witness rapid adoption, making it a critical growth engine for the global market.

Latin America

Latin America held 6% share of the identity verification market in 2024, with Brazil and Mexico leading adoption. Rising digital banking usage, coupled with efforts to combat fraud and cybercrime, drives demand for verification solutions. The region is experiencing growing adoption of biometric systems in financial institutions and government programs aimed at enhancing digital identity infrastructure. However, high implementation costs and limited digital infrastructure in some countries restrain faster growth. Despite challenges, increasing investments in fintech and regulatory support for stronger KYC compliance are expected to drive steady market expansion in Latin America.

Middle East & Africa

The Middle East & Africa represented 4% share of the identity verification market in 2024, reflecting emerging adoption trends. GCC nations, particularly the UAE and Saudi Arabia, are investing heavily in biometric identity programs and digital government services to strengthen security. In Africa, initiatives to improve financial inclusion and expand mobile banking drive gradual adoption of verification solutions. Infrastructure limitations and cost barriers remain challenges, but growing digital penetration and government-backed identity projects provide long-term opportunities. Rising demand in financial services and telecom sectors positions the region for gradual but steady growth.

Market Segmentations:

By Type

- Biometrics

- Non-biometrics

By Component

By Deployment

By Organization size

By Vertical

- BFSI

- Government and Defense

- Healthcare & Life Sciences

- Others (Education, Travel, and Gaming)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the identity verification market is shaped by leading players such as TransUnion LLC, IDEMIA, Mitek Systems, Inc., Equifax, Inc., GB Group PLC, Acuant, Inc., Thales Group S.A., Experian Plc, Nuance Communications Inc., and Intellicheck Inc. These companies compete by offering advanced verification solutions including biometric authentication, document verification, and AI-driven fraud detection to serve financial institutions, governments, telecom providers, and e-commerce platforms. Continuous investment in research and development enables them to enhance accuracy, speed, and scalability of their platforms while meeting stringent regulatory requirements. Cloud-based and mobile-first identity verification solutions are a key focus, addressing the needs of digital banking and remote onboarding. Strategic collaborations, acquisitions, and global expansion are common strategies to broaden market reach and strengthen technological capabilities. With rising fraud threats and stricter compliance standards, competition is intensifying, driving innovation and pushing vendors to deliver secure, user-friendly, and cost-effective solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TransUnion LLC

- IDEMIA

- Mitek Systems, Inc.

- Equifax, Inc.

- GB Group PLC

- Acuant, Inc.

- Thales Group S.A.

- Experian Plc

- Nuance Communications Inc.

- Intellicheck Inc.

Recent Developments

- In September 2025, Equifax launched Identity Proofing within its Kount® 360 platform to authenticate customer-provided identities, combining document verification and facial biometrics.

- In September 2025, Experian rolled out a UK solution for continuous KYC monitoring that flags changes in customer data to detect risk in real time.

- In January 2024, Intellicheck upgraded its platform to simplify digital identity verification: integration via two web hooks, auto snap/focus image capture, barcode scanning, guided ID capture.

- In 2024, Experian’s Ascend Fraud Sandbox won the Platinum Award for Identity Verification Innovation after analyzing over 10 billion identity and fraud events to detect new fraud patterns

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Deployment, Organization size, Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with increasing digital transactions across industries.

- Biometric verification will remain the dominant type due to high security and accuracy.

- Non-biometric methods will continue supporting multi-factor authentication systems.

- AI and machine learning will enhance fraud detection and reduce false positives.

- Cloud-based deployment will gain further traction for scalability and cost efficiency.

- Mobile-based verification will rise with growth in digital banking and e-commerce.

- North America and Europe will maintain strong demand driven by regulatory compliance.

- Asia-Pacific will emerge as the fastest-growing region with government-backed digital identity programs.

- Data privacy and compliance with global regulations will shape solution development.

- Partnerships and acquisitions will intensify as companies expand global market presence.