Market Overview

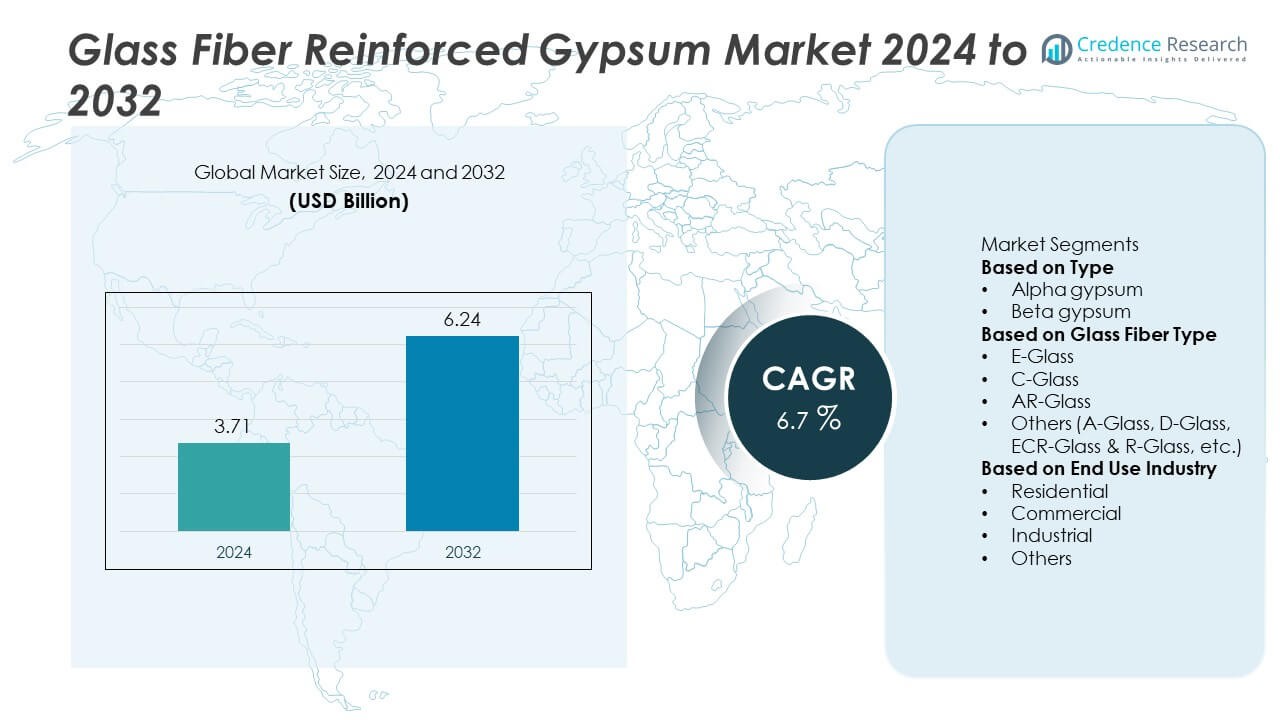

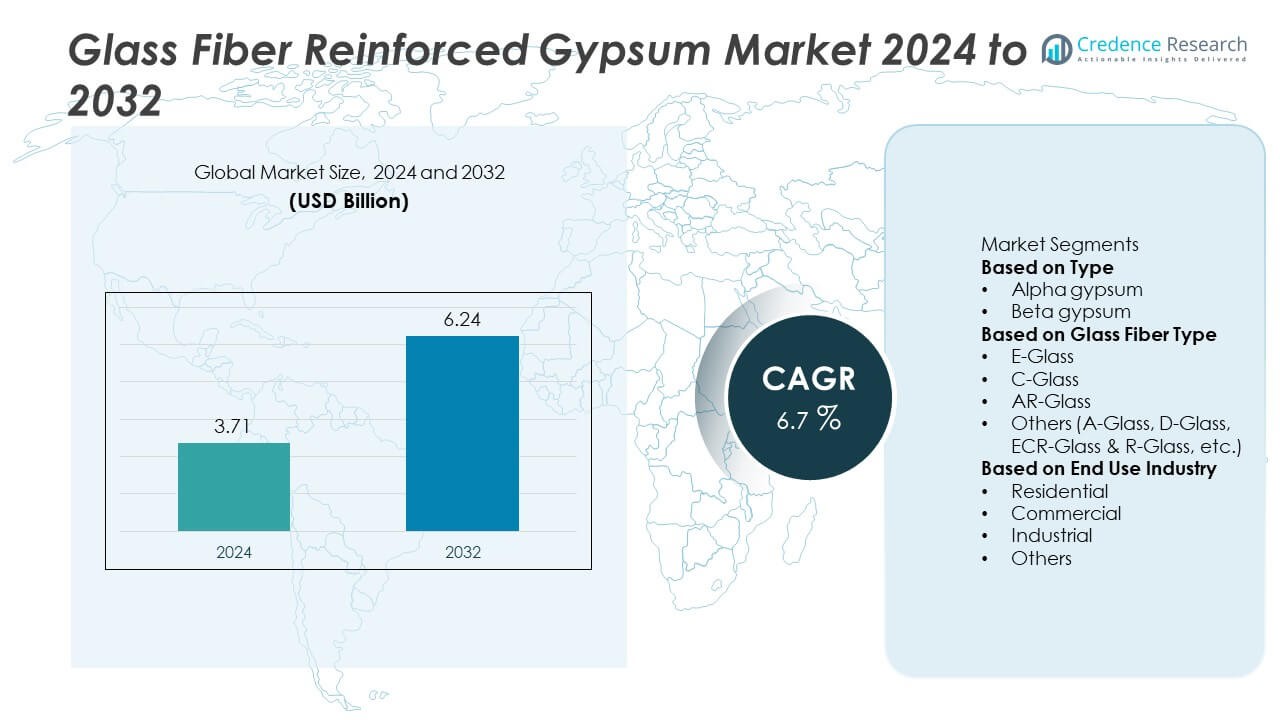

The Glass Fiber Reinforced Gypsum (GFRG) Market was valued at USD 3.71 billion in 2024 and is projected to reach USD 6.24 billion by 2032, expanding at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glass Fiber Reinforced Gypsum Market Size 2024 |

USD 3.71 Billion |

| Glass Fiber Reinforced Gypsum Market, CAGR |

6.7% |

| Glass Fiber Reinforced Gypsum Market Size 2032 |

USD 6.24 Billion |

The top players in the Glass Fiber Reinforced Gypsum (GFRG) market include Stromberg Architectural, GC Products, Inc., Saint-Gobain Formula GmbH, Formglas Products Ltd, Yingchuang Building Technique Co. Ltd., USG Corporation, AWI Licensing LLC, Knauf Danoline A/S, Georgia-Pacific LLC, and BACE India. These companies strengthen their market presence through innovative product designs, sustainable GFRG panels, and prefabricated construction solutions. Regionally, Asia-Pacific led with a 30% share in 2024, supported by rapid urbanization and large-scale infrastructure projects, while North America held 32% share, driven by strong adoption in commercial and residential sectors. Europe accounted for 28% share, driven by strict environmental standards and sustainable building practices. Latin America and the Middle East & Africa contributed 6% and 4% shares, respectively, reflecting steady but growing adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Glass Fiber Reinforced Gypsum (GFRG) market was valued at USD 3.71 billion in 2024 and is projected to reach USD 6.24 billion by 2032, growing at a CAGR of 6.7% during the forecast period.

- Growth is driven by rising demand for lightweight, sustainable, and fire-resistant construction materials, with alpha gypsum leading the market by type at 58% share in 2024 due to its strength and durability.

- Key trends include the adoption of prefabricated and modular construction methods, along with increasing innovation in GFRG-based decorative and specialty applications.

- The competitive landscape features players such as Stromberg Architectural, Saint-Gobain Formula GmbH, Formglas Products Ltd, USG Corporation, Knauf Danoline A/S, and Georgia-Pacific LLC, focusing on sustainable solutions, R&D investments, and expansion in emerging economies.

- Regionally, North America held 32% share, followed by Asia-Pacific at 30% and Europe at 28%, while Latin America and Middle East & Africa accounted for 6% and 4% shares, respectively.

Market Segmentation Analysis:

By Type

Alpha gypsum dominated the GFRG market in 2024 with a 58% share, driven by its superior strength, density, and durability compared to beta gypsum. Its higher mechanical properties make it the preferred choice for construction applications, particularly in high-strength panels, ceilings, and decorative interiors. Beta gypsum continues to serve cost-sensitive applications but lacks the strength required for structural components. Growing demand for lightweight, sustainable, and fire-resistant building materials ensures strong adoption of alpha gypsum, positioning it as the leading product type across residential and commercial construction projects worldwide.

- For instance, Saint-Gobain Formula produces high-purity alpha gypsum from its European plants, supplying reinforced gypsum panels and interior architectural components for global construction projects.

By Glass Fiber Type

E-glass held the largest share of the GFRG market in 2024, accounting for 46% share, owing to its excellent tensile strength, cost-effectiveness, and resistance to moisture. E-glass is widely used in panels, partitions, and ceiling applications due to its high compatibility with gypsum. AR-glass follows with growing adoption in construction projects requiring alkali resistance, especially in harsh environments. C-glass and other specialty glass types serve niche applications but contribute a smaller portion of demand. The strength-to-cost ratio of E-glass ensures its continued dominance across large-scale building projects.

- For instance, Owens Corning uses its specialized, corrosion-resistant Advantex® glass non-woven solutions to reinforce gypsum boards, ensuring increased durability and moisture resistance in commercial installations.

By End Use Industry

The commercial sector led the GFRG market in 2024 with a 41% share, driven by rising demand in office complexes, shopping malls, hospitals, and hotels. The sector benefits from the material’s aesthetic flexibility, fire resistance, and cost efficiency in large construction projects. Residential usage also grew steadily, supported by lightweight panels and modular construction trends. Industrial and other applications, though smaller in share, utilize GFRG for partitions and non-load-bearing walls. The commercial sector’s emphasis on sustainability and modern design ensures its leadership, reinforcing GFRG as a preferred material in global urban development projects.

Key Growth Drivers

Rising Demand for Lightweight and Sustainable Materials

The GFRG market is expanding as construction industries prioritize lightweight and eco-friendly alternatives to traditional building materials. GFRG panels offer superior strength-to-weight ratios, reduced carbon footprint, and faster installation times, making them highly suitable for sustainable building projects. Increasing government initiatives promoting green construction and energy-efficient infrastructure support adoption. Demand is further strengthened by the material’s recyclability and lower environmental impact compared to conventional options. These factors position GFRG as a key material in achieving sustainability goals across global residential and commercial projects.

- For instance, Yingchuang Building Technique (Winsun) has used 3D printing with a special “ink” composed of recycled construction and industrial waste, along with cement, for large-scale projects, including multi-story buildings. This process has been noted to significantly reduce waste and construction time.

Expansion of Commercial and Urban Infrastructure

Rapid growth in commercial infrastructure, including offices, hotels, malls, and healthcare facilities, is a major driver for the GFRG market. Developers prefer GFRG due to its flexibility, fire resistance, and cost-effectiveness for large-scale projects. The material’s ability to deliver superior surface finish and complex architectural designs enhances its adoption in modern urban developments. With expanding urban populations and increasing investments in smart cities, GFRG continues to play a critical role in meeting design, safety, and efficiency requirements across global construction markets.

- For instance, Glass Fibre Reinforced Gypsum (GFRG) panels are a modern, rapid building technology suitable for mass housing. They are known for their scalability and are used for load-bearing and non-load-bearing applications in residential and multi-story buildings.

Technological Advancements in Manufacturing

Innovation in gypsum processing and glass fiber technology is enhancing the performance and versatility of GFRG products. Advances in automated production systems and improved fiber reinforcement techniques have increased durability, fire resistance, and thermal insulation properties. Manufacturers are investing in R&D to create panels suitable for both structural and non-structural applications. These innovations enable broader application across diverse industries, including residential, commercial, and industrial sectors. Technological improvements reduce costs and strengthen market competitiveness, positioning GFRG as a high-performance alternative in modern construction practices.

Key Trends & Opportunities

Shift Toward Prefabricated and Modular Construction

The growing trend of prefabricated and modular construction is creating significant opportunities for GFRG adoption. GFRG panels are lightweight, easy to transport, and quick to install, making them highly compatible with off-site construction methods. This aligns with rising demand for faster, cost-effective, and sustainable building solutions in urban areas. Developers are increasingly integrating GFRG in modular housing, educational buildings, and commercial facilities, driving strong market potential.

- For instance, BACE India has been involved in projects using GFRG wall panels, which are prefabricated and can significantly reduce construction time. BACE India focuses on various types of construction, including affordable housing.

Innovation in Specialty GFRG Applications

Manufacturers are exploring specialty applications such as GFRG-based false ceilings, partitions, and architectural elements to expand market scope. The versatility of GFRG allows intricate designs while maintaining fire resistance and durability, meeting both functional and aesthetic requirements. Opportunities exist in luxury residential projects and high-end commercial spaces where modern design and sustainability are equally valued. This innovation-driven expansion creates new revenue streams and strengthens the role of GFRG in advanced construction.

- For instance, Stromberg Architectural has delivered custom GFRG domes, columns, and ornate ceilings for luxury hotels and casinos in Las Vegas, including Caesars Palace and the Orleans Casino, demonstrating the scalability of GFRG in specialty architectural applications.

Key Challenges

High Installation and Labor Costs

Despite its benefits, GFRG adoption faces challenges due to relatively high installation and skilled labor costs. Handling and installing large panels often require specialized training and equipment, increasing project expenses compared to conventional materials. In cost-sensitive markets, these factors limit widespread usage, particularly in smaller residential projects. Reducing installation complexity and labor costs remains a critical area for improvement.

Limited Awareness in Emerging Markets

Awareness of GFRG’s benefits remains limited in several developing regions, where traditional construction materials dominate. Lack of familiarity among contractors, architects, and builders hinders adoption despite the material’s advantages. Additionally, inconsistent supply chains and limited local manufacturing facilities restrict availability. Overcoming these challenges requires education campaigns, regional production expansion, and stronger distribution networks to boost market penetration in emerging economies.

Regional Analysis

North America

North America accounted for a 32% share of the GFRG market in 2024, supported by strong demand in commercial construction, including office complexes, malls, and institutional buildings. The region benefits from advanced manufacturing technologies, high awareness of sustainable construction, and government-backed initiatives promoting eco-friendly building materials. The United States leads adoption, driven by modern infrastructure projects and preference for prefabricated solutions. Canada also contributes significantly, with demand for lightweight and energy-efficient materials in residential and public sector projects. North America’s strong regulatory environment and innovation in modular construction sustain its leadership.

Europe

Europe held a 28% share of the GFRG market in 2024, driven by stringent environmental regulations and strong emphasis on sustainable construction practices. Countries such as Germany, France, and the UK are leading adopters, particularly in commercial and residential projects that demand fire resistance and durability. The region also shows significant growth in modular and prefabricated construction, aligning with EU sustainability targets. Rising investments in urban housing and green building certifications continue to support demand. Europe’s mature construction industry and focus on high-quality architectural finishes position it as a strong market for GFRG adoption.

Asia-Pacific

Asia-Pacific captured a 30% share of the GFRG market in 2024, making it the fastest-growing region. Rapid urbanization, industrialization, and population growth in countries such as China, India, and Japan are driving large-scale demand. Government-backed initiatives to promote sustainable housing and infrastructure development further support adoption. Prefabricated construction methods are gaining traction in urban centers, where GFRG panels are favored for cost efficiency, durability, and quick installation. The rising middle class and demand for affordable, energy-efficient housing ensure continuous growth. Asia-Pacific’s expanding construction industry positions it as a critical engine for GFRG market expansion.

Latin America

Latin America accounted for a 6% share of the GFRG market in 2024, with Brazil and Mexico serving as the largest contributors. Growth is supported by urban development projects, rising investments in commercial construction, and demand for cost-effective building materials. However, limited local manufacturing capacity and lower awareness among builders pose challenges. Adoption is growing in high-rise residential and public sector projects where GFRG’s lightweight and fire-resistant qualities provide added benefits. With increasing foreign investment in infrastructure and gradual adoption of sustainable building practices, Latin America presents steady growth potential for GFRG applications.

Middle East & Africa

The Middle East & Africa region held a 4% share of the GFRG market in 2024, supported by ongoing construction booms in the UAE, Saudi Arabia, and South Africa. Rapid infrastructure development, including hotels, commercial complexes, and residential towers, fuels demand for modern, lightweight, and fire-resistant materials. The region also shows rising interest in sustainable construction, aligning with government initiatives for energy-efficient buildings. Limited local production and high import reliance pose challenges but also create opportunities for global suppliers. With increasing investments in urban projects, the region is set to offer long-term growth prospects for GFRG adoption.

Market Segmentations:

By Type

By Glass Fiber Type

- E-Glass

- C-Glass

- AR-Glass

- Others (A-Glass, D-Glass, ECR-Glass & R-Glass, etc.)

By End Use Industry

- Residential

- Commercial

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Glass Fiber Reinforced Gypsum (GFRG) market is shaped by key players such as Stromberg Architectural, GC Products, Inc., Saint-Gobain Formula GmbH, Formglas Products Ltd, Yingchuang Building Technique Co. Ltd., USG Corporation, AWI Licensing LLC, Knauf Danoline A/S, Georgia-Pacific LLC, and BACE India. These companies focus on strengthening their portfolios with advanced GFRG panels, prefabricated solutions, and decorative architectural products to meet growing demand in residential and commercial construction. Strategic investments in R&D and manufacturing technologies enable them to enhance durability, fire resistance, and sustainability of GFRG offerings. Global expansion through partnerships, acquisitions, and local production facilities helps improve supply chains and address demand in emerging economies. Sustainability initiatives and compliance with green building certifications are becoming central to competition, as players align with stricter regulations and consumer demand for eco-friendly materials. Intense competition fosters continuous innovation, positioning these companies to capture growth opportunities in modern construction markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Stromberg Architectural

- GC Products, Inc.

- Saint-Gobain Formula GmbH

- Formglas Products Ltd

- Yingchuang Building Technique Co. Ltd.

- USG Corporation

- AWI Licensing LLC

- Knauf Danoline A/S

- Georgia-Pacific LLC

- BACE India

Recent Developments

- In May 2023, USG Corporation (via its Canadian arm, CGC) announced a CAD 104 million investment to relaunch a gypsum quarry in Nova Scotia, aiming to strengthen raw gypsum supply capabilities for its wallboard and related products.

- In May 2023, Formglas Products Ltd. highlighted that its large GFRG panels weigh only 2–3 pounds per square foot (10–15 kg/m²), enabling easier installation.

- In 2023, GC Products, Inc. specified that its standard GFRG panels achieve a flexural strength of at least 2,500 psi, ensuring high structural reliability.

Report Coverage

The research report offers an in-depth analysis based on Type, Glass Fiber Type, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for GFRG will increase with growing adoption of sustainable and lightweight construction materials.

- Alpha gypsum will continue to dominate due to its strength and durability in structural applications.

- Prefabricated and modular construction will create strong opportunities for GFRG panel adoption.

- Innovation in decorative and specialty GFRG products will expand applications in commercial projects.

- Asia-Pacific will emerge as the fastest-growing region driven by urbanization and infrastructure development.

- North America and Europe will sustain strong demand supported by strict environmental regulations.

- Companies will invest in R&D to improve durability, fire resistance, and design flexibility of GFRG.

- Green building certifications will encourage higher adoption of eco-friendly GFRG solutions.

- Strategic partnerships and regional manufacturing expansions will enhance supply chain efficiency.

- Rising demand in residential and commercial sectors will ensure long-term market growth.