Market overview

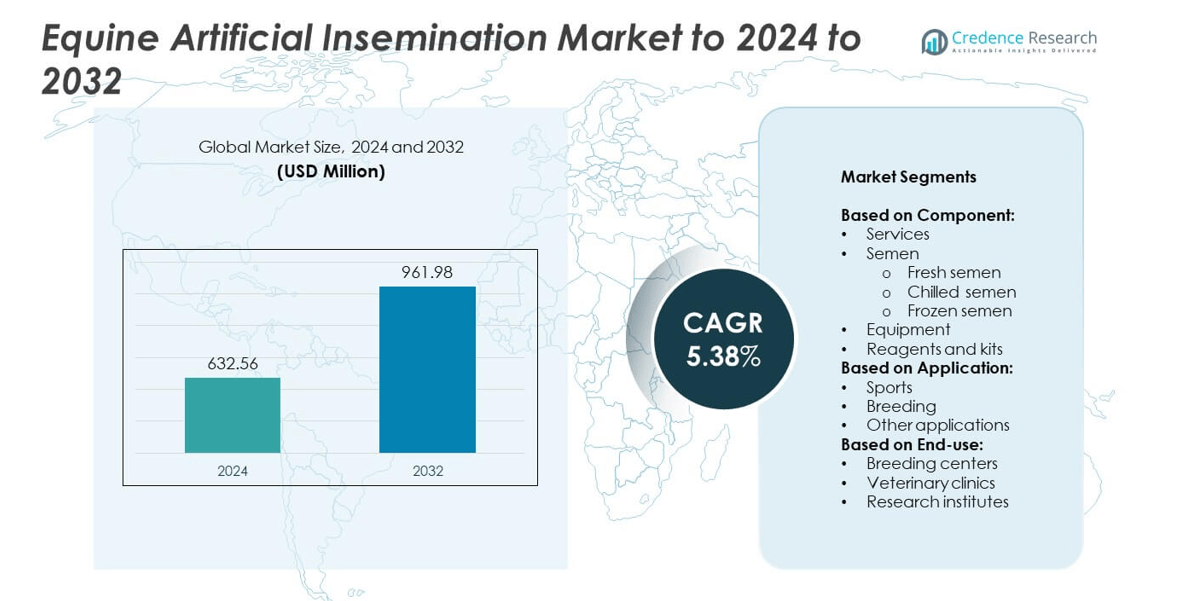

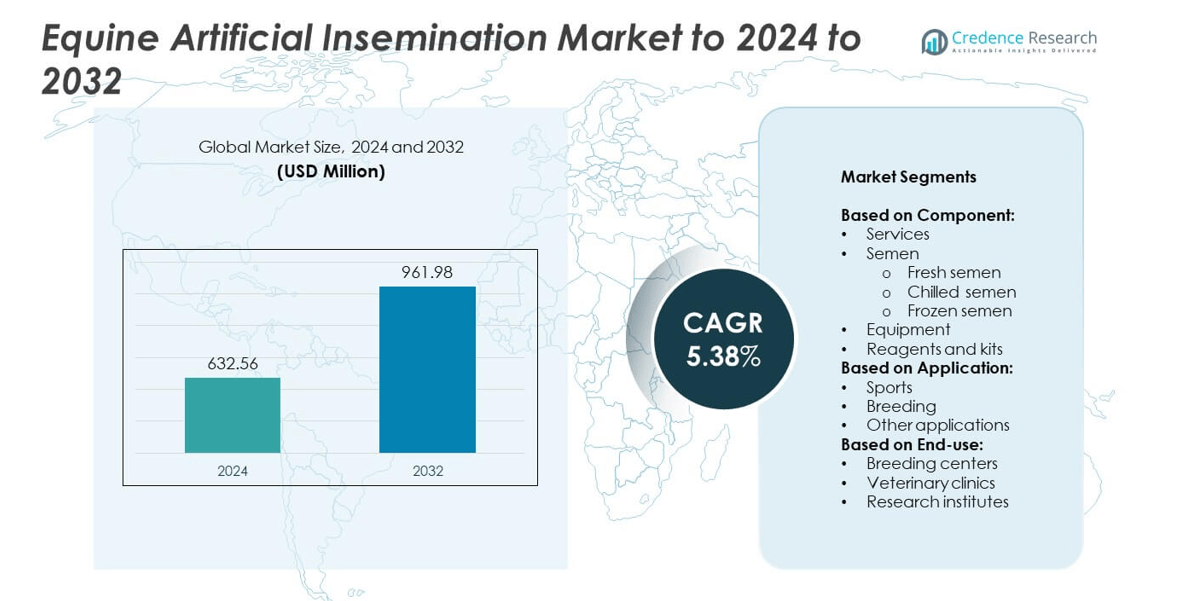

The Equine Artificial Insemination Market size was valued at USD 632.56 million in 2024 and is anticipated to reach USD 961.98 million by 2032, at a CAGR of 5.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Equine Artificial Insemination Market Size 2024 |

USD 632.56 million |

| Equine Artificial Insemination Market, CAGR |

5.38% |

| Equine Artificial Insemination Market Size 2032 |

USD 961.98 million |

The equine artificial insemination market is shaped by leading players such as Stallion AI Services, Zoetis Inc., MINITÜB GMBH, IMV Technologies, Zerlotti Genetics, Dairymac, and Spervital B.V., along with specialized breeding centers and veterinary service providers. These companies focus on advanced cryopreservation, semen storage solutions, and digital monitoring technologies to improve breeding efficiency and genetic diversity. Strategic collaborations and service expansion further strengthen their global presence. North America dominated the market in 2024 with a 38% share, supported by established breeding programs and veterinary infrastructure, while Europe followed with 30%, driven by strong equestrian traditions and cross-border breeding activities.

Market Insights

- The equine artificial insemination market was valued at USD 632.56 million in 2024 and is projected to reach USD 961.98 million by 2032, growing at a CAGR of 5.38%.

- Rising demand for genetic improvement in breeding programs and wider access to advanced veterinary infrastructure are the key drivers fueling market expansion.

- Frozen semen dominates the market due to its longer shelf life and global trade advantages, while digital and IoT-based monitoring tools are emerging as notable trends.

- The market is competitive with players focusing on cryopreservation technologies, specialized breeding services, and international collaborations to strengthen their positions.

- North America led the market with a 38% share in 2024, followed by Europe at 30%; the semen segment accounted for the largest component share, particularly frozen semen, while breeding centers remained the leading end-use segment across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The semen segment accounted for the largest share of the equine artificial insemination market in 2024, representing over 45% of revenue. Within semen, frozen semen dominated due to its extended shelf life, ease of global transport, and ability to preserve high-value genetics for longer periods. Growing demand for genetic diversity in competitive horse breeding programs strongly drives this segment. Services and reagents also expanded steadily, supported by rising veterinary expertise and increasing adoption of AI techniques in commercial breeding. Equipment uptake is growing with advanced insemination tools enhancing precision and success rates.

- For instance, Stallion AI Services prepares 500 million motile sperm per fresh dose and 1,000 million for chilled; one frozen dose equals 6 straws.

By Application

Breeding emerged as the dominant application segment, holding more than 55% of the total market share in 2024. This dominance is attributed to rising investments in thoroughbred and sport horse breeding programs across Europe and North America. Increasing preference for controlled breeding to improve lineage quality and genetic advancement is fueling demand. Sports applications, particularly equestrian events and racing, also contributed significantly, supported by the need for high-performance horses. Other applications such as conservation projects are gaining traction but remain niche compared to large-scale breeding operations.

- For instance, Coolmore’s stallion Order Of St George covered 311 mares in 2024, reflecting intense breeding demand.

By End-use

Breeding centers led the market with the highest share, exceeding 50% in 2024. These centers benefit from their capacity to manage large-scale semen storage, advanced reproductive technologies, and high demand for premium stallions. Veterinary clinics followed closely, driven by rising adoption of AI for routine reproduction management and expanding access to trained veterinarians. Research institutes play a smaller role but continue to grow steadily, supported by advancements in equine reproductive biology and genetic research. The central role of breeding centers in commercializing semen and providing specialized services secures their leadership in the end-use landscape.

Key Growth Drivers

Rising Demand for Genetic Improvement

The equine artificial insemination market is primarily driven by the increasing demand for genetic improvement in horse breeding. Breeders and owners seek superior lineage to enhance performance in racing, sports, and show events. Frozen semen enables access to top stallions globally, ensuring diverse genetic pools and improved offspring quality. This demand for elite genetics, combined with advancements in reproductive technologies, positions genetic improvement as the leading driver. The ability to enhance desirable traits while maintaining breed standards ensures continuous market expansion.

- For instance, Spendthrift Farm’s Into Mischief covered 193 mares in 2024, showing strong selection for elite genetics.

Expansion of Breeding Programs

Large-scale breeding programs across North America and Europe significantly boost market growth. Breeding centers are investing heavily in AI technologies to support commercial breeding for both sports and recreational horses. Thoroughbred and warmblood programs highlight the rising role of artificial insemination in maintaining high-value herds. Government support for livestock and horse breeding initiatives further strengthens adoption. The scalability of AI techniques in meeting growing breeding demands underpins its importance as a core driver of market development.

- For instance, Juddmonte reports 152 mares visiting Kingman in 2024, supporting scaled, planned matings.

Increasing Veterinary Expertise and Infrastructure

The growth of specialized veterinary clinics and advanced reproductive centers is enhancing AI adoption rates. Veterinarians are increasingly trained in handling semen preparation, insemination procedures, and post-insemination care, improving success outcomes. Rising availability of advanced equipment, reagents, and diagnostic kits further supports the integration of AI in equine health. Infrastructure improvements in rural and urban areas make AI accessible to more breeders. This improved veterinary ecosystem ensures greater awareness, efficiency, and reliability, cementing its role as a major growth driver.

Key Trends and Opportunities

Adoption of Advanced Cryopreservation Techniques

One of the key trends is the increasing adoption of advanced cryopreservation technologies for frozen semen. These techniques extend semen viability, allowing global trade of equine genetics and reducing geographical barriers. The demand for international breeding collaborations has grown, enabling breeders to access high-quality genetics from top-performing stallions without relocation. This trend not only promotes genetic diversity but also offers strong commercial opportunities for semen banks and breeding centers that specialize in long-term storage solutions.

- For instance, Asymptote’s Stirling Cycle freezer (EF600) froze horse semen in 0.25 mL straws and 15 mL bags.

Integration of Digital and IoT-Based Solutions

Digitalization is creating new opportunities in equine artificial insemination through IoT-enabled equipment and software platforms. Breeding centers and clinics are adopting digital monitoring systems for semen quality, ovulation cycles, and insemination outcomes. These solutions improve accuracy, optimize timing, and enhance pregnancy success rates. Cloud-based platforms are further enabling remote consultations and global coordination between breeders and veterinarians. This integration of digital technologies represents a major opportunity for players offering advanced AI-related services and tools, aligning with the broader trend of smart animal healthcare.

- For instance, Merck Animal Health’s Bio-Thermo microchips integrate with EquiTrace; USTA logged 50,000 microchips for enhanced temperature tracking and records.

Key Challenges

High Costs of AI Procedures and Equipment

The high cost of equine artificial insemination procedures and specialized equipment remains a significant barrier to adoption. Many smaller breeders and horse owners face financial constraints in accessing premium semen, advanced diagnostic kits, or veterinary expertise. Frozen semen storage and transport also add to overall expenses, limiting widespread use in emerging regions. These cost pressures reduce affordability and slow penetration in cost-sensitive markets. Addressing pricing through affordable service models and wider infrastructure support remains a pressing challenge for industry stakeholders.

Regulatory and Ethical Concerns

Regulatory restrictions and ethical concerns over animal welfare pose challenges to market growth. Different countries enforce varying laws regarding semen collection, storage, and transport, complicating international trade. Additionally, ethical debates over overbreeding and the genetic manipulation of horses sometimes lead to stricter oversight. Breeding practices must balance commercial goals with animal health and welfare, requiring stricter compliance measures. Navigating these regulations while ensuring responsible practices remains a key challenge for companies and breeders aiming for long-term success.

Regional Analysis

North America

North America held the largest share of the equine artificial insemination market in 2024, accounting for 38%. The region benefits from well-established breeding programs, advanced veterinary infrastructure, and strong investments in equestrian sports. High demand for thoroughbred and warmblood horses in the United States and Canada further supports adoption. Frozen semen usage is widespread due to international collaborations and genetic diversity requirements. Strong presence of breeding centers and advanced laboratories ensures access to specialized reproductive services. Continued growth in equestrian events and recreational horse ownership sustains North America’s leadership position in the global market.

Europe

Europe captured 30% of the global market share in 2024, making it the second-largest regional segment. Countries such as Germany, the United Kingdom, and France are prominent contributors, supported by strong equestrian traditions and organized horse breeding programs. Frozen and chilled semen dominate due to extensive cross-border trade and advanced cryopreservation technologies. The European Union’s supportive regulations for animal breeding practices further strengthen adoption. High-value equestrian sports, including show jumping and dressage, also drive demand. Breeding centers in the region maintain large-scale operations, ensuring Europe’s continued significance in the equine artificial insemination market.

Asia Pacific

sia Pacific accounted for 18% of the equine artificial insemination market in 2024, driven by rising adoption in China, Japan, and Australia. Growing interest in equestrian sports, coupled with expanding investments in horse breeding, supports steady growth. Veterinary clinics in the region are increasingly adopting advanced reproductive technologies to meet demand. Frozen semen imports are gaining traction, particularly in China, where breeders seek access to superior genetics from Europe and North America. Rising disposable incomes and expanding horse ownership in emerging economies ensure strong growth potential, positioning Asia Pacific as a fast-growing market segment.

Latin America

Latin America represented 8% of the equine artificial insemination market share in 2024. Argentina and Brazil lead the region, supported by strong horse breeding traditions and participation in competitive equestrian events. Breeding programs in the region are steadily adopting AI to improve genetic quality and increase international competitiveness. Veterinary clinics and breeding centers are investing in equipment and reagents to enhance insemination success rates. While cost constraints remain a challenge in rural areas, expanding infrastructure in urban hubs is driving adoption. Latin America shows strong potential as demand for equestrian sports and commercial breeding expands.

Middle East and Africa

The Middle East and Africa accounted for 6% of the global equine artificial insemination market share in 2024. The Middle East dominates within the region, supported by significant investments in Arabian horse breeding and equestrian culture. Wealthy owners and breeding centers in countries such as the UAE and Saudi Arabia drive demand for frozen semen and advanced reproductive services. In Africa, adoption is limited but gradually expanding through government-supported veterinary programs and training initiatives. Although infrastructure challenges persist, the region is expected to show steady growth due to cultural significance and rising interest in premium breeds.

Market Segmentations:

By Component:

- Services

- Semen

- Fresh semen

- Chilled semen

- Frozen semen

- Equipment

- Reagents and kits

By Application:

- Sports

- Breeding

- Other applications

By End-use:

- Breeding centers

- Veterinary clinics

- Research institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The equine artificial insemination market features a diverse competitive landscape shaped by global and regional players such as Stallion AI Services, Dairymac, Spervital B.V., Zoetis Inc., Shotter & Byers Equine Vets, Agtech Inc, Zerlotti Genetics, Sussex Equine Hospital, MINITÜB GMBH, HOFFMAN A.I. Breeders Inc., Semen Tanks, ICAR-National Research Centre, Scone Equine Group, IMV Technologies, and Girovet. The competition is defined by continuous advancements in reproductive technologies, wider adoption of frozen semen solutions, and digital platforms supporting accurate breeding cycles. Companies are focusing on strengthening their service portfolios through improved veterinary infrastructure, semen cryopreservation, and specialized breeding programs. Strategic collaborations between breeding centers and veterinary clinics are enhancing accessibility, while investments in equipment, reagents, and training contribute to higher insemination success rates. Regional players are expanding their market reach by adopting cost-effective solutions, whereas larger global companies are leveraging innovation, scalability, and international partnerships to secure stronger positions in the growing equine artificial insemination market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Stallion AI Services

- Dairymac

- Spervital B.V.

- Zoetis Inc.

- Shotter & Byers Equine Vets

- Agtech Inc

- Zerlotti Genetics

- Sussex Equine Hospital

- MINITÜB GMBH

- HOFFMAN A.I. BREEDERS INC.

- Semen Tanks

- ICAR-National Research Centre

- Scone Equine Group

- IMV Technologies

- Girovet

Recent Developments

- In 2025, Scone Equine Group announced a partnership with the Altano Group. This collaboration aims to improve foal survival rates and care standards through knowledge exchange and innovation.

- In 2024, IMV Technologies Acquired UD-Vet B.V., a veterinary equipment and imaging supplier in the Benelux region, to strengthen its market presence and service capabilities in Europe.

- In 2023, ICAR-National Research Centre on Equines (ICAR-NRCE) Successfully produced the first Marwari horse foal in India using embryo transfer technology, demonstrating the potential of AI to conserve and improve indigenous horse breeds.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for genetic diversity in horse breeding.

- Frozen semen will remain the preferred choice due to longer storage life and global trade benefits.

- Breeding centers will continue leading adoption with large-scale use of advanced reproductive technologies.

- Veterinary clinics will increase their role as more equine practitioners adopt AI techniques.

- Digital tools and IoT-based monitoring will improve insemination success and efficiency.

- Europe and North America will maintain dominance, while Asia Pacific will emerge as the fastest-growing region.

- Equestrian sports demand will strengthen the use of AI for performance-focused breeding.

- Research institutes will advance cryopreservation and reproductive technologies for improved outcomes.

- Ethical and regulatory standards will shape breeding practices and ensure responsible adoption.

- Cost reduction and wider accessibility will be crucial for market expansion in developing regions.