Market Overview

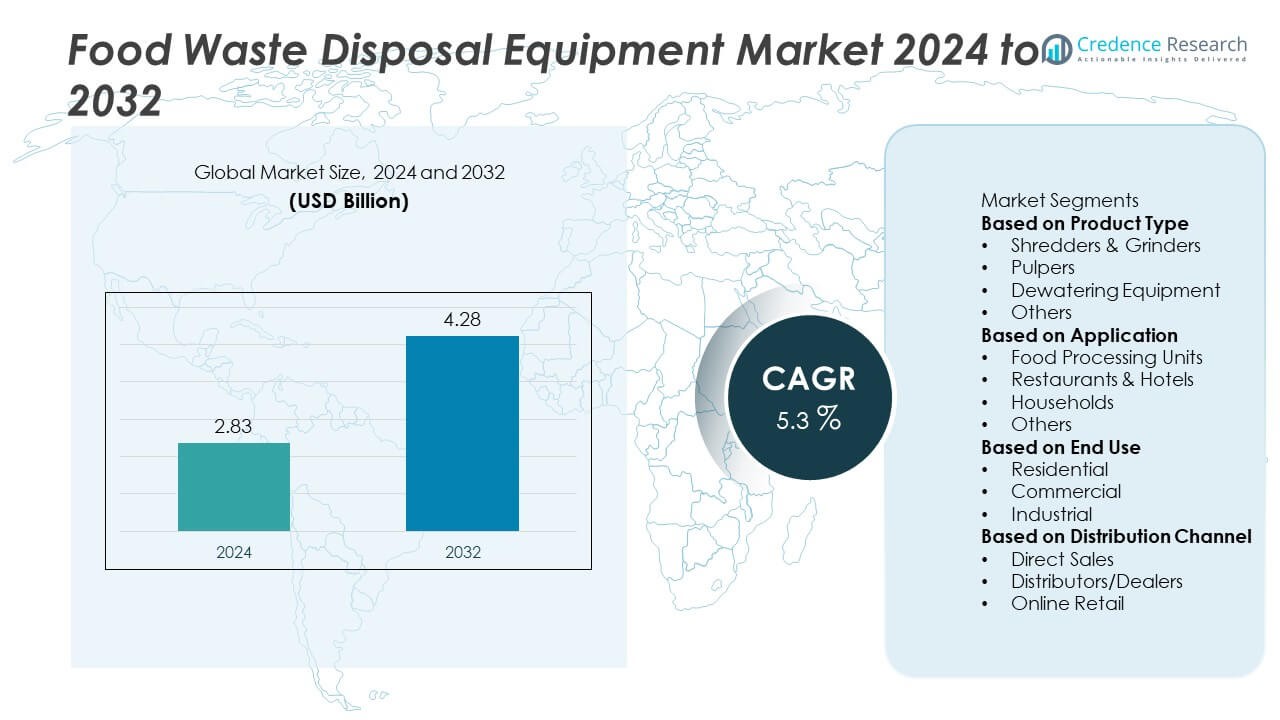

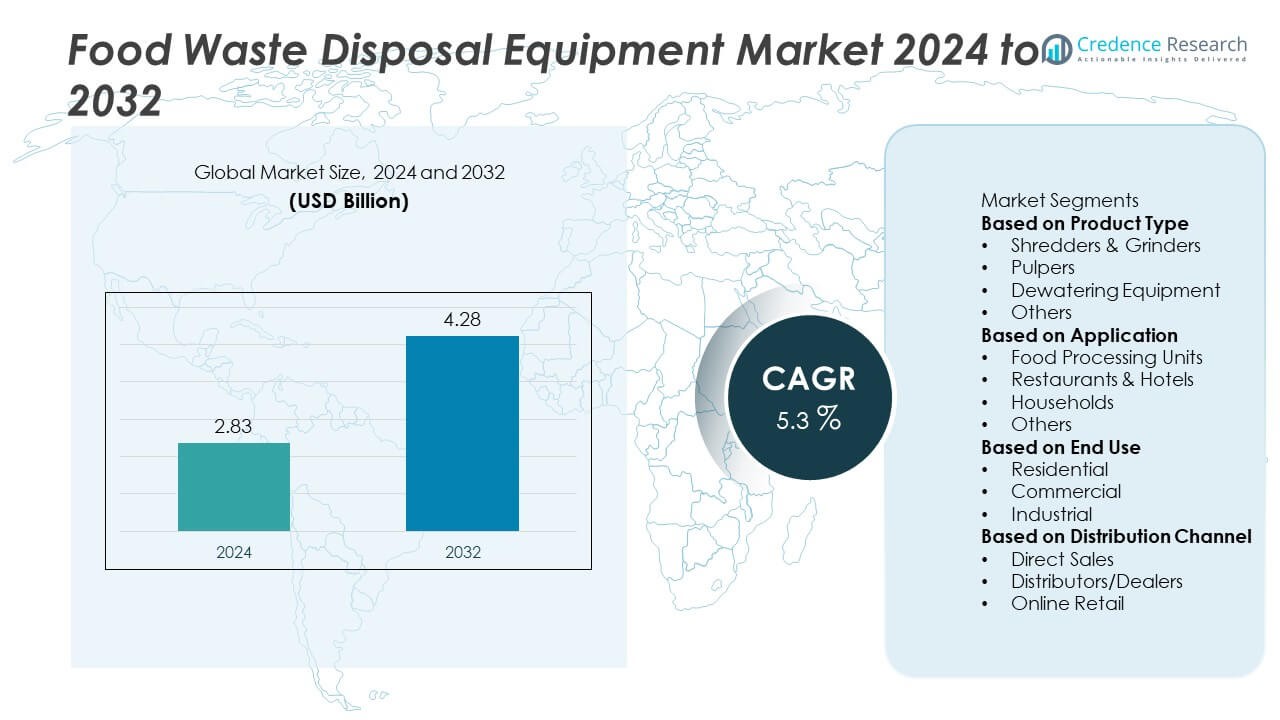

The Food Waste Disposal Equipment Market was valued at USD 2.83 billion in 2024 and is projected to reach USD 4.28 billion by 2032, expanding at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Waste Disposal Equipment Market Size 2024 |

USD 2.83 Billion |

| Food Waste Disposal Equipment Market, CAGR |

5.3% |

| Food Waste Disposal Equipment Market Size 2032 |

USD 4.28 Billion |

The food waste disposal equipment market is led by key players such as InSinkErator, Franke Group, Hobart, Salvajor Company, Emerson Electric Co., Somat Company, Haier Group Corporation, BEAM Manufacturing, Fello Waste Systems, and The Home Depot, Inc. These companies drive market growth through advanced shredders, pulpers, and dewatering systems designed to support sustainability and regulatory compliance. Regionally, North America held the largest share at 36% in 2024, supported by strong adoption in residential and commercial sectors. Europe accounted for 28% share, driven by strict environmental regulations, while Asia-Pacific followed with 27% share, fueled by rapid urbanization and growing foodservice demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The food waste disposal equipment market was valued at USD 2.83 billion in 2024 and is projected to reach USD 4.28 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

- Rising demand is driven by stricter waste management regulations and growing adoption in food processing units, restaurants, and hotels, with the commercial sector holding 41% share in 2024.

- Market trends highlight increasing adoption of energy-efficient shredders and pulpers, along with smart, automated systems for foodservice industries and households.

- The competitive landscape includes major players such as InSinkErator, Franke Group, Hobart, Salvajor Company, and Emerson Electric Co., focusing on innovation, global expansion, and sustainability-based product lines.

- Regionally, North America led with 36% share in 2024, followed by Europe at 28% and Asia-Pacific at 27%, while Latin America and the Middle East & Africa accounted for 5% and 4% shares, respectively, showing steady adoption in emerging markets.

Market Segmentation Analysis:

By Product Type

In 2024, shredders and grinders dominated the food waste disposal equipment market with a 38% share. Their leadership stems from widespread use in food processing facilities, restaurants, and institutional kitchens, where large volumes of food waste require quick and efficient handling. Shredders and grinders reduce waste volume and prepare it for further processing, such as composting or energy recovery. The growing demand for cost-efficient, high-capacity solutions in commercial kitchens continues to drive adoption, while biogas equipment is gaining traction as sustainable energy recovery initiatives expand.

- For instance, Hobart’s Ecolo pulper system is capable of processing up to 7.5 kilograms of leftovers per minute, significantly reducing organic waste volume and supporting downstream composting operations in institutional kitchens.

By Application

The commercial segment accounted for the largest application share in 2024, representing 41% of the market. Restaurants, hotels, and catering services generate significant amounts of food waste, driving adoption of disposal equipment that ensures hygiene, reduces operational costs, and meets regulatory compliance standards. Rising food service industry growth, combined with stricter municipal waste management norms, reinforces dominance of this segment. Household adoption is increasing steadily, especially in developed markets, but commercial applications remain the leading driver due to higher food waste generation volumes.

- For instance, InSinkErator offers commercial-grade disposers like the powerful SS-1000 with a 10 HP motor, designed for continuous operation in locations such as large restaurants, hotels, and cafeterias, which can handle substantial food waste streams.

By End Use

The industrial sector led the market in 2024 with a 44% share, reflecting strong adoption in food processing units and large-scale manufacturing facilities. These environments rely on shredders, pulpers, and dewatering systems to manage high food waste volumes effectively. Strict regulations on food waste disposal and sustainability targets further strengthen demand in industrial applications. The residential sector is witnessing notable growth due to rising consumer awareness of eco-friendly disposal solutions, while the commercial sector continues to support steady adoption. Industrial usage remains dominant, as large-scale waste streams demand advanced and automated equipment solutions.

Key Growth Drivers

Rising Food Waste Generation Globally

Growing food waste volumes from households, restaurants, and processing industries strongly drive market demand. According to FAO, nearly one-third of global food production is wasted annually, creating environmental and economic challenges. This rising waste has increased reliance on shredders, pulpers, and dewatering systems to improve disposal efficiency. Governments and businesses are prioritizing waste reduction and recycling, pushing facilities to adopt advanced equipment. The need to reduce landfill burdens and greenhouse gas emissions is a significant force behind sustained demand growth.

- For instance, Somat Company has installed numerous pulper and dewatering systems in large institutions, including U.S. military bases. These units are capable of processing varying amounts of food waste per hour, with some models handling up to 1,250 pounds (about 567 kilograms).

Government Regulations and Sustainability Policies

Stringent waste management regulations implemented by governments are accelerating equipment adoption. Regulations banning food waste from landfills in regions such as Europe and North America have compelled commercial and industrial users to adopt disposal technologies. Subsidies and incentives for composting and energy recovery solutions also boost uptake. Sustainability-focused frameworks, such as circular economy initiatives, encourage the use of food waste to generate renewable energy. These supportive policies continue to drive investments in advanced food waste management infrastructure worldwide.

- For instance, on-site aerobic digesters are available that process up to 1,090 kilograms of food waste per day, converting it into gray water and supporting compliance with landfill diversion mandates. This technology is currently offered by various companies, including the firm TraQiQ, which acquired the digester business from Renovare Environmental (formerly BioHiTech Global) in early 2023.

Growth of the Foodservice and Hospitality Industry

The rapid expansion of restaurants, hotels, and catering services has amplified demand for food waste disposal systems. Commercial kitchens generate significant volumes of waste daily and require efficient, hygienic, and cost-effective solutions. Rising consumer dining trends, urbanization, and tourism growth further add to this demand. With stricter hygiene standards in foodservice operations, adoption of grinders, pulpers, and composting units has surged. The strong correlation between foodservice growth and waste volumes ensures steady market expansion in this segment.

Key Trends & Opportunities

Integration of Smart Waste Management Technologies

The adoption of smart and IoT-enabled disposal equipment is a rising trend. Automated monitoring systems now track waste volumes, energy use, and performance efficiency in real time. These technologies improve operational efficiency, reduce downtime, and help businesses optimize waste management. Smart solutions also align with digital transformation goals in hospitality and industrial facilities. This integration creates strong opportunities for manufacturers to offer advanced, data-driven waste disposal systems that enhance compliance and sustainability efforts.

- For instance, Hobart’s BiVaTec PV vacuum system reduces organic waste volume by up to 80% across institutional kitchens. It is a hygienic and automated system that disposes of various organic wastes, including food residues and expired food, directly at the source.

Expansion of Energy Recovery Solutions

The growing emphasis on converting food waste into energy presents a major opportunity. Biogas digesters and waste-to-energy equipment are gaining traction as sustainable solutions to reduce reliance on landfills. Governments and industries are investing in technologies that generate renewable energy from organic waste, promoting circular economy practices. This shift is especially strong in Europe and Asia-Pacific, where energy recovery policies are expanding. Manufacturers focusing on integrated waste-to-energy solutions stand to gain significant market share.

- For instance, Veolia operates more than 130 anaerobic digestion facilities worldwide, with a combined capacity exceeding 6 million metric tons of organic waste annually, generating renewable biogas for electricity and heat production.

Key Challenges

High Installation and Maintenance Costs

The cost of advanced food waste disposal equipment remains a challenge for adoption, especially in small-scale businesses and residential sectors. Shredders, pulpers, and biogas systems involve high upfront investments, along with recurring maintenance expenses. Many small restaurants and households prefer cheaper alternatives, limiting widespread adoption. Unless manufacturers introduce cost-effective and scalable solutions, this price barrier will continue to restrain market growth, particularly in developing economies.

Lack of Awareness in Developing Regions

In emerging markets, awareness of food waste management solutions is still limited. Many households and businesses rely on traditional disposal practices due to lack of knowledge and affordability. Weak enforcement of waste disposal regulations in some countries further slows adoption. Inconsistent infrastructure, coupled with limited access to advanced technologies, restricts market expansion in these regions. Educating consumers and businesses, along with improving availability, is critical to overcoming this challenge.

Regional Analysis

North America

North America held the largest share of the food waste disposal equipment market in 2024, accounting for 34%. The region benefits from strong regulatory enforcement on food waste management and landfill reduction, particularly in the United States and Canada. High adoption of disposers in residential kitchens, restaurants, and commercial foodservice facilities supports market growth. Technological innovations such as smart grinders and energy recovery systems further drive adoption. Strong awareness of sustainability practices and government-backed initiatives for waste reduction ensure that North America maintains its leadership position throughout the forecast period.

Europe

Europe accounted for 28% of the market share in 2024, supported by stringent EU regulations banning food waste disposal in landfills and promoting recycling. Countries such as Germany, France, and the UK lead adoption with advanced composting systems, biogas plants, and waste-to-energy technologies. Strong focus on circular economy models drives investment in high-capacity shredders and pulpers across commercial and industrial sectors. Rising demand in residential applications also contributes to growth. Sustainability goals and government policies ensure continuous expansion, reinforcing Europe’s role as a key hub for innovative waste disposal solutions.

Asia-Pacific

Asia-Pacific captured 27% share of the food waste disposal equipment market in 2024, emerging as the fastest-growing region. Rapid urbanization, population growth, and rising disposable incomes are driving demand for modern waste management solutions. Countries like China, India, and Japan are investing heavily in advanced disposal infrastructure, supported by government initiatives for sustainable cities. Expanding foodservice industries and growing residential adoption of compact disposal units further boost the market. With rising environmental concerns and increasing investments in waste-to-energy technologies, Asia-Pacific is positioned as a major driver of future growth.

Latin America

Latin America accounted for 6% share of the food waste disposal equipment market in 2024, with Brazil and Mexico leading adoption. The region is experiencing rising urbanization and expansion in the foodservice industry, driving demand for grinders, pulpers, and composting systems. Government-backed initiatives to reduce landfill usage are gradually promoting modern disposal methods. However, limited awareness and high equipment costs continue to restrict broader adoption across smaller businesses and residential users. Despite these challenges, improving infrastructure and sustainability programs are expected to enhance long-term opportunities for growth.

Middle East & Africa

The Middle East & Africa held 5% share of the food waste disposal equipment market in 2024, driven by rapid infrastructure development in Saudi Arabia, the UAE, and South Africa. Demand is fueled by the expansion of hospitality and foodservice industries, particularly in urban centers. Governments are promoting waste reduction and sustainable disposal practices through new regulatory frameworks. However, reliance on imports and high installation costs present challenges. Ongoing smart city projects and rising investment in waste-to-energy solutions are expected to create long-term opportunities, supporting gradual growth across the region.

Market Segmentations:

By Product Type

- Shredders & Grinders

- Pulpers

- Dewatering Equipment

- Others

By Application

- Food Processing Units

- Restaurants & Hotels

- Households

- Others

By End Use

- Residential

- Commercial

- Industrial

By Distribution Channel

- Direct Sales

- Distributors/Dealers

- Online Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the food waste disposal equipment market is shaped by leading players including InSinkErator, Franke Group, Hobart, Salvajor Company, Emerson Electric Co., Somat Company, Haier Group Corporation, BEAM Manufacturing, Fello Waste Systems, and The Home Depot, Inc. These companies focus on developing efficient, durable, and energy-saving equipment to address rising demand from residential, commercial, and industrial sectors. Innovation in shredders, pulpers, and dewatering systems is a key strategy, alongside expanding smart disposal technologies integrated with IoT for monitoring and control. Partnerships with hospitality chains and food processors further enhance product reach. Companies also emphasize compliance with waste management regulations and sustainability initiatives by offering eco-friendly and water-saving designs. Market leaders are strengthening global distribution networks and investing in after-sales services to build customer loyalty. Intense competition fosters continuous product upgrades, positioning these players to capture growth opportunities as waste reduction becomes a critical priority worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- InSinkErator (a Whirlpool Corporation brand)

- Franke Group

- Hobart (ITW Food Equipment Group)

- Salvajor Company

- Emerson Electric Co.

- Somat Company

- Haier Group Corporation

- BEAM Manufacturing

- Fello Waste Systems

- The Home Depot, Inc.

Recent Developments

- In July 2024, Franke released a redesigned line of slimline waste disposals—models Slim 50, Slim 75, Slim 100, Slim 125—each with a more compact footprint to better fit under kitchen sinks.

- In January 2023, Kitchen Aid rolled out the Red Batch Feed Food Waste Disposer, targeting a swift and easy replacement of its predecessor for efficient food waste disposal.

- In September 2023, InSinkErator introduced a next-generation garbage disposal line that produces finer waste particles to ease flow in household plumbing.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for food waste disposal equipment will rise with stricter global waste management policies.

- Energy-efficient and smart disposal systems will gain wider adoption across commercial facilities.

- Residential use of compact and cost-effective equipment will expand steadily in urban areas.

- Growth in food processing industries will continue driving large-scale equipment demand.

- Asia-Pacific will emerge as the fastest-growing region with rapid urbanization and industrial growth.

- North America and Europe will maintain strong shares due to regulatory compliance and advanced infrastructure.

- Manufacturers will focus on sustainable solutions aligned with circular economy initiatives.

- Technological innovations will improve operational efficiency and reduce energy consumption.

- Partnerships between governments and private players will enhance adoption in public waste systems.

- Increasing awareness of food waste reduction will strengthen long-term opportunities across both developed and emerging markets.