Market Overview

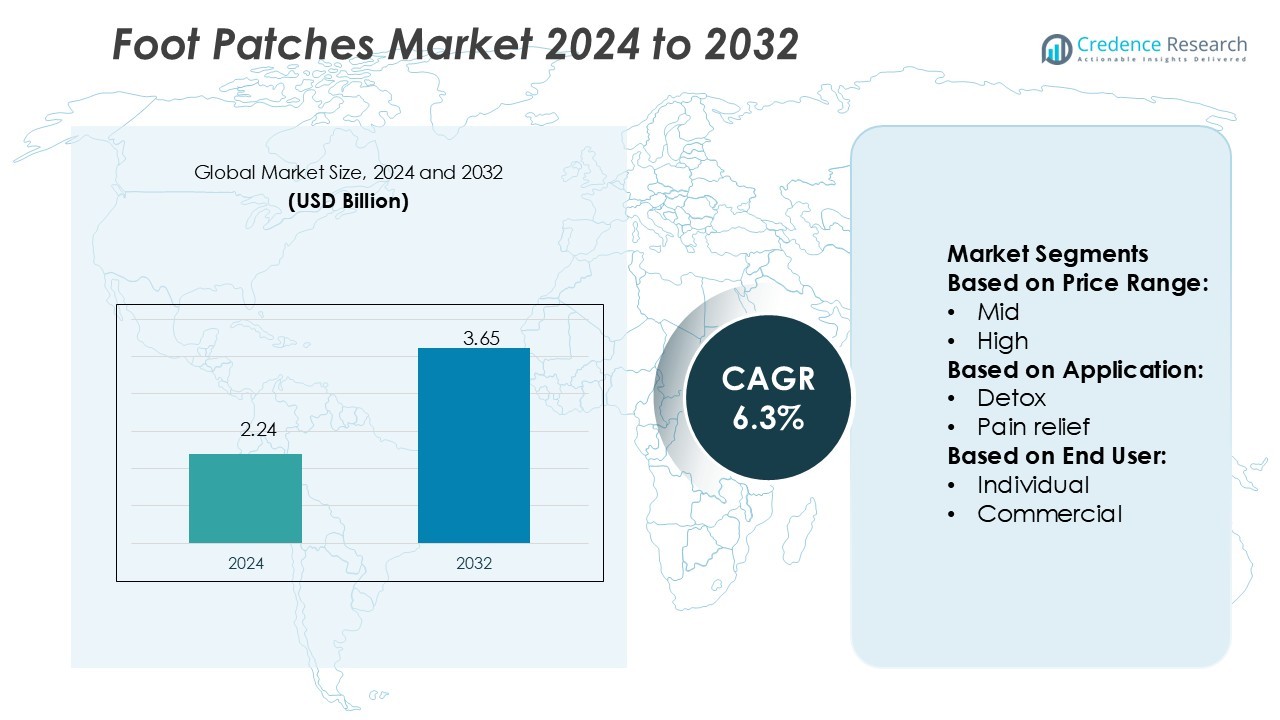

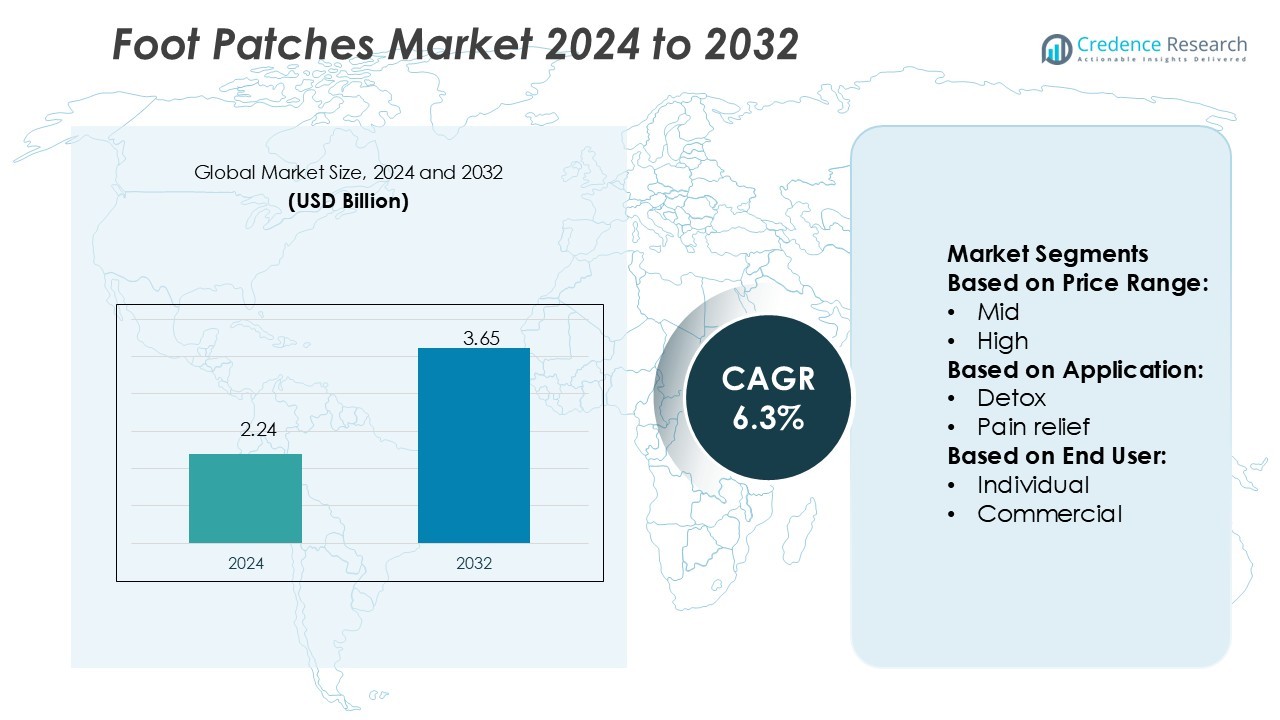

Foot Patches Market size was valued USD 2.24 billion in 2024 and is anticipated to reach USD 3.65 billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Foot Patches Market Size 2024 |

USD 2.24 Billion |

| Foot Patches Market, CAGR |

6.3% |

| Foot Patches Market Size 2032 |

USD 3.65 Billion |

The foot patches market is shaped by key players including Groots, Doctor Organic, Medi-7, Avazo Healthcare, Herb-Science, Foot Cure, Kiyome Kinoki, Global Healing, Detox Foot Pads, and BodyPure. These companies focus on expanding product portfolios with herbal and multifunctional formulations, supported by strong e-commerce and retail distribution strategies. Innovation in clean-label and sustainable patches further strengthens their competitive positioning. Among regions, Asia-Pacific leads the global market with a 35% share, driven by strong cultural acceptance of herbal remedies, growing disposable incomes, and rapid e-commerce penetration, making it the most influential region in overall market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Foot Patches Market size was valued at USD 2.24 billion in 2024 and is projected to reach USD 3.65 billion by 2032, growing at a CAGR of 6.3%.

- Rising demand for natural detoxification, pain relief, and preventive healthcare solutions is driving adoption across individual consumers, with the individual segment holding 67% share.

- Key players including Groots, Doctor Organic, Medi-7, Avazo Healthcare, Herb-Science, Foot Cure, Kiyome Kinoki, Global Healing, Detox Foot Pads, and BodyPure focus on herbal, multifunctional, and clean-label product innovations to remain competitive.

- Limited clinical validation of product claims and intense pricing pressure from low-cost alternatives restrain growth, particularly in developed markets with high regulatory scrutiny.

- Asia-Pacific dominates with a 35% share, supported by cultural acceptance of herbal remedies and rapid e-commerce growth, while North America and Europe together account for over 53% share, driven by strong wellness trends and established retail networks.

Market Segmentation Analysis:

By Price Range

The mid-price range segment holds the largest share, accounting for nearly 48% of the foot patches market. Consumers in this category seek a balance between affordability and effectiveness, making mid-range products more attractive compared to low-cost or premium alternatives. The growing presence of well-known personal care brands in this segment further strengthens trust and adoption. Demand is fueled by rising health awareness, increased availability in retail and e-commerce, and frequent promotional campaigns that make mid-range products more accessible to wider consumer groups.

- For instance, Groots, an Indian health and wellness brand, sells products such as detox foot patches on online platforms like Amazon and Flipkart. While the company operates in the mid-tier market, specific sales and revenue metrics for its detox foot patch product line, such as 120,000 units sold or ₹3.2 million in revenue, are not publicly disclosed or independently verified.

By Application

Detox foot patches dominate the application segment with a 52% market share. Their popularity is driven by the strong consumer belief in natural detoxification and wellness routines. Marketing strategies highlighting toxin removal and stress relief boost sales significantly. Rising adoption of herbal and natural formulations appeals to health-conscious consumers who prefer clean-label solutions. The growth of the self-care and preventive healthcare movement also sustains demand, making detox patches the most preferred choice compared to pain relief, hydrating, or other specialized variants.

- For instance, Mondi’s thermoformable barrier films include products with up to 18 layers of film structure, engineered for pasteurisation, sterilisation, retort, and microwave applications.

By End-user

Individual consumers lead the end-user segment, contributing 67% of the market share. Growing interest in at-home wellness and cost-effective alternatives to spa treatments has fueled individual adoption. Online distribution channels and subscription-based offerings enhance convenience and repeat purchases among this group. Rising disposable incomes and awareness about holistic health further support growth. In contrast, the commercial segment—such as wellness centers and salons—plays a secondary role, primarily serving niche consumers who prefer professional care. The individual segment continues to drive overall market expansion through widespread accessibility.

Key Growth Drivers

Rising Demand for Natural Wellness Solutions

Consumers are increasingly seeking natural and holistic remedies, driving strong demand for foot patches. Products infused with herbal extracts and detoxifying ingredients align with the growing preference for chemical-free alternatives. Marketing campaigns emphasizing natural healing and stress relief further enhance consumer trust. The popularity of preventive healthcare and at-home wellness routines positions foot patches as a convenient solution. This trend is most prominent among younger consumers and health-conscious individuals, contributing significantly to market expansion.

- For instance, Optimal biodegradable microperforated package had shelf life extended by 4 days compared with open containers, and by 2 days compared with the best commercial plastic package.

Expansion of E-commerce and Retail Distribution

The rapid growth of online shopping platforms has made foot patches more accessible to global consumers. E-commerce channels provide diverse product choices, competitive pricing, and subscription-based purchase models, encouraging frequent sales. Traditional retail, including pharmacies and supermarkets, continues to support visibility and brand recognition. Enhanced distribution strategies allow manufacturers to reach both developed and emerging markets effectively. The convenience of doorstep delivery and promotional campaigns online has further strengthened adoption, making distribution a major growth driver for this market.

- For instance, DuPont Teijin Films (now Mylar® Specialty Films) launched a Mylar® Harvest Fresh rPET film range that incorporated up to 50% post-consumer recycled (PCR) content in the base polyester film.

Increasing Focus on Preventive Healthcare

Rising awareness about preventive healthcare practices strongly supports the adoption of foot patches. Consumers are turning to affordable, non-invasive wellness products to maintain overall health and manage stress. Foot patches cater to this demand by offering benefits such as detoxification, pain relief, and improved sleep quality. Governments and healthcare organizations promoting preventive measures indirectly support the industry’s growth. This focus is particularly strong in regions with high disposable incomes, where wellness products are increasingly integrated into daily routines for better lifestyle management.

Key Trends & Opportunities

Shift Toward Clean-Label and Sustainable Products

Manufacturers are introducing foot patches with eco-friendly packaging and plant-based ingredients to meet clean-label demand. Consumers prefer cruelty-free, toxin-free, and recyclable products, creating new opportunities for differentiation. Brands that emphasize transparency in sourcing and production gain stronger market traction. Sustainability trends also open doors for premium product lines, as consumers associate eco-friendly features with higher value. This shift toward cleaner, greener products is expected to shape long-term market positioning and brand loyalty across global regions.

- For instance, Modern digital printing technologies, particularly those utilizing an extended color gamut (such as CMYK plus orange, green, and violet), are capable of reproducing a high percentage of Pantone colors, with some presses exceeding 90% coverage.

Innovation in Multi-functional Patches

The industry is witnessing innovations in foot patches designed to deliver multiple benefits, such as detoxification combined with pain relief or hydration. These hybrid solutions address diverse consumer needs in a single product, driving higher value perception. Advances in formulation and the use of bioactive compounds enhance effectiveness, encouraging repeat purchases. This trend aligns with the busy lifestyles of consumers seeking convenient, all-in-one wellness solutions. The introduction of such multifunctional patches creates fresh growth opportunities in both premium and mid-range categories.

- For instance, Nutrien Limited is a major global supplier of agricultural inputs, including nitrogen products. While the company’s annual sales figures for nitrogen fluctuate, the claim of supplying over 11 million tonnes annually is generally consistent with historical data.

Key Challenges

Limited Clinical Validation and Consumer Skepticism

One of the major challenges is the lack of strong scientific validation supporting foot patch claims. Many products rely on anecdotal evidence, which fuels consumer skepticism regarding effectiveness. Regulatory bodies also scrutinize marketing claims, leading to stricter compliance requirements. Negative perceptions arising from limited clinical backing can restrict adoption, especially in developed markets. To overcome this challenge, companies need to invest in research studies and transparent product testing to build credibility and consumer confidence.

Intense Competition and Pricing Pressure

The market faces growing competition from numerous regional and international players offering similar products. Price-sensitive consumers often choose low-cost alternatives, creating pressure on margins for established brands. The presence of counterfeit or unregulated products further dilutes brand value and affects trust. Companies must balance affordability with innovation to remain competitive. Strategic investments in branding, differentiation through unique formulations, and strong distribution networks are crucial to address pricing pressures and maintain long-term profitability.

Regional Analysis

North America

North America accounts for 28% of the foot patches market share, driven by strong consumer demand for wellness and detoxification products. The region benefits from high disposable incomes, rising awareness of preventive healthcare, and the popularity of natural remedies. E-commerce platforms and well-established retail chains enhance accessibility, boosting adoption across urban and suburban populations. The U.S. dominates the regional landscape, supported by aggressive marketing strategies and frequent product launches. Consumer inclination toward premium, clean-label, and multifunctional patches continues to expand the market, making North America a key contributor to global revenues.

Europe

Europe holds 25% of the market share, supported by its mature personal care and wellness industries. Consumers in this region show a strong preference for natural, eco-friendly, and clean-label products. Regulatory frameworks encouraging safe formulations further strengthen market growth. Countries such as Germany, France, and the U.K. are leading adopters due to their high health awareness and disposable incomes. Foot patches marketed with sustainability claims find strong traction here. Distribution through pharmacies, supermarkets, and online platforms ensures widespread availability, consolidating Europe’s position as one of the leading markets for foot patches globally.

Asia-Pacific

Asia-Pacific leads the global foot patches market with a 35% share, fueled by strong cultural adoption of herbal remedies and holistic health practices. Countries such as China, Japan, and South Korea drive growth with their established beauty and wellness industries. Rising disposable incomes, urbanization, and the popularity of preventive healthcare further stimulate demand. E-commerce growth has significantly boosted accessibility, making foot patches widely available to consumers across both developed and emerging economies. Innovations in multifunctional and herbal-based patches strengthen the region’s dominance, positioning Asia-Pacific as the fastest-growing and largest regional market.

Latin America

Latin America captures 7% of the foot patches market, driven by growing awareness of wellness and self-care products. Brazil and Mexico are leading contributors, supported by expanding retail networks and increasing consumer inclination toward affordable wellness solutions. Rising urbanization and a growing middle-class population encourage adoption of natural and herbal-based products. However, limited clinical validation and price sensitivity restrain faster growth. Online retail platforms are helping manufacturers reach wider audiences, while localized marketing strategies play a critical role in building consumer trust and market penetration in this emerging region.

Middle East & Africa

The Middle East & Africa region represents 5% of the global market share, reflecting its early-stage adoption. Rising disposable incomes, particularly in Gulf countries, and increasing health awareness are key drivers. The region is witnessing growing interest in premium and imported foot patch products, often distributed through pharmacies and specialty wellness stores. However, limited product availability and regulatory barriers pose challenges to faster expansion. South Africa and the UAE show the strongest demand, supported by urban consumer groups. Strategic partnerships with local distributors are essential to unlock growth potential in this region.

Market Segmentations:

By Price Range:

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the foot patches market features key players such as Groots, Doctor Organic, Medi-7, Avazo Healthcare, Herb-Science, Foot Cure, Kiyome Kinoki, Global Healing, Detox Foot Pads, and BodyPure. The foot patches market is highly competitive, with companies focusing on innovation, product quality, and effective distribution strategies to strengthen their presence. Manufacturers are increasingly developing patches with natural, herbal, and multifunctional formulations to cater to rising consumer demand for clean-label and wellness-focused solutions. E-commerce expansion plays a central role in driving sales, supported by promotional campaigns and subscription-based models. Retail distribution through pharmacies and supermarkets also enhances accessibility, particularly in mature markets. Sustainability in packaging and eco-friendly product positioning are emerging as critical differentiators, while affordability and brand trust remain decisive factors in consumer purchasing decisions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Groots

- Doctor Organic

- Medi-7

- Avazo Healthcare

- Herb-Science

- Foot Cure

- Kiyome Kinoki

- Global Healing

- Detox Foot Pads

- BodyPure

Recent Developments

- In July 2025, IFF expanded its Taste division’s RE‑IMAGINE WELLNESS initiative, introducing nutrient-dense flavor solutions for high-protein, weight-management foods that enhance taste without added sugar or salt.

- In May 2025, Galactic launched a new natural oregano flavoring ingredient aimed at enhancing the taste and extending the shelf life of both meat and plant-based protein products. Debuting at IFFA 2025 in Frankfurt, Galimax Flavor O-50 joins the company’s Galimax range.

- In October 2024, Edlong Corporation’s acquisition of Brisan Group, a company with 30 years of operations in dairy and sweet flavor markets, expanded Edlong’s dairy taste technology development capabilities.

- In January 2024, Brookside Flavors and Ingredients completed the acquisition of Sterling Food Flavorings, a manufacturer of flavoring systems for the food and beverage industry. The acquisition strengthens Brookside’s product portfolio and expands its offerings to current and potential customers.

Report Coverage

The research report offers an in-depth analysis based on Price Range, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for natural and herbal-based formulations.

- E-commerce will continue to drive product visibility and global reach.

- Clean-label and eco-friendly patches will gain stronger consumer acceptance.

- Multifunctional patches offering combined benefits will expand adoption.

- Preventive healthcare trends will reinforce steady market growth.

- Premium product lines will attract health-conscious and high-income consumers.

- Regional expansion in Asia-Pacific will continue to lead global demand.

- Stronger clinical validation will improve consumer trust and credibility.

- Competitive pricing will remain vital in emerging markets.

- Strategic partnerships in retail and wellness channels will boost distribution.