Market Overview

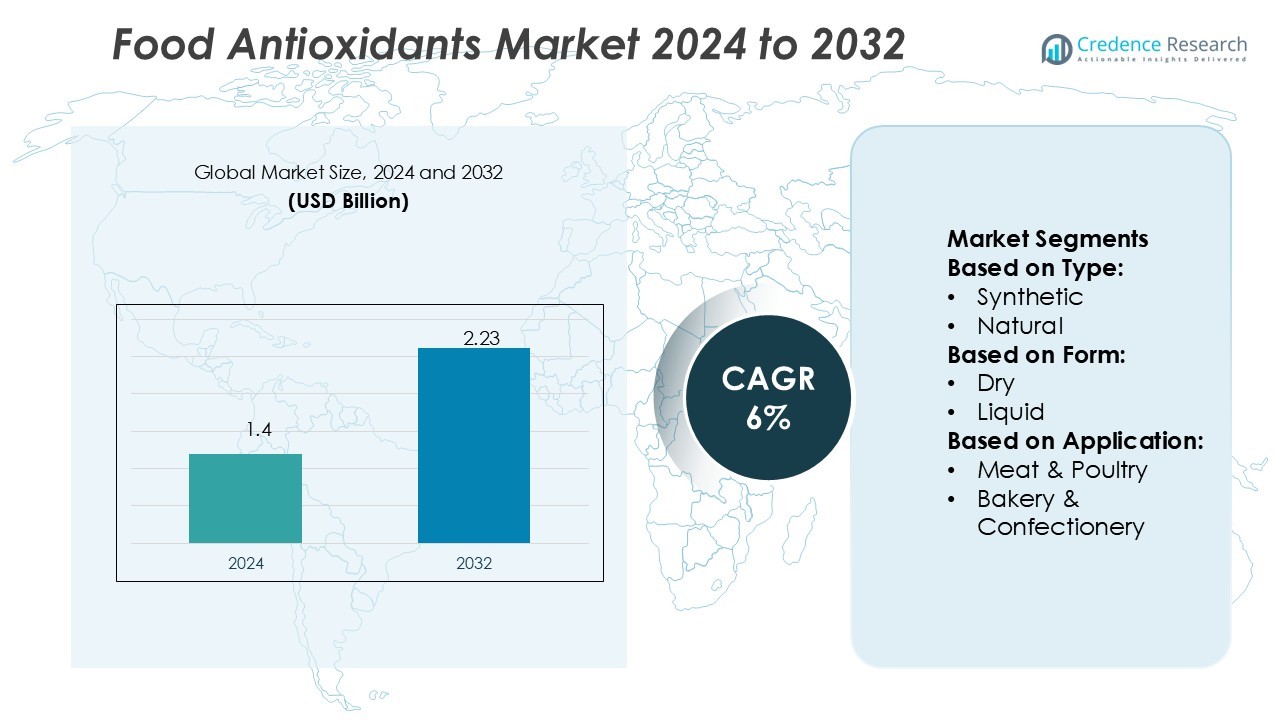

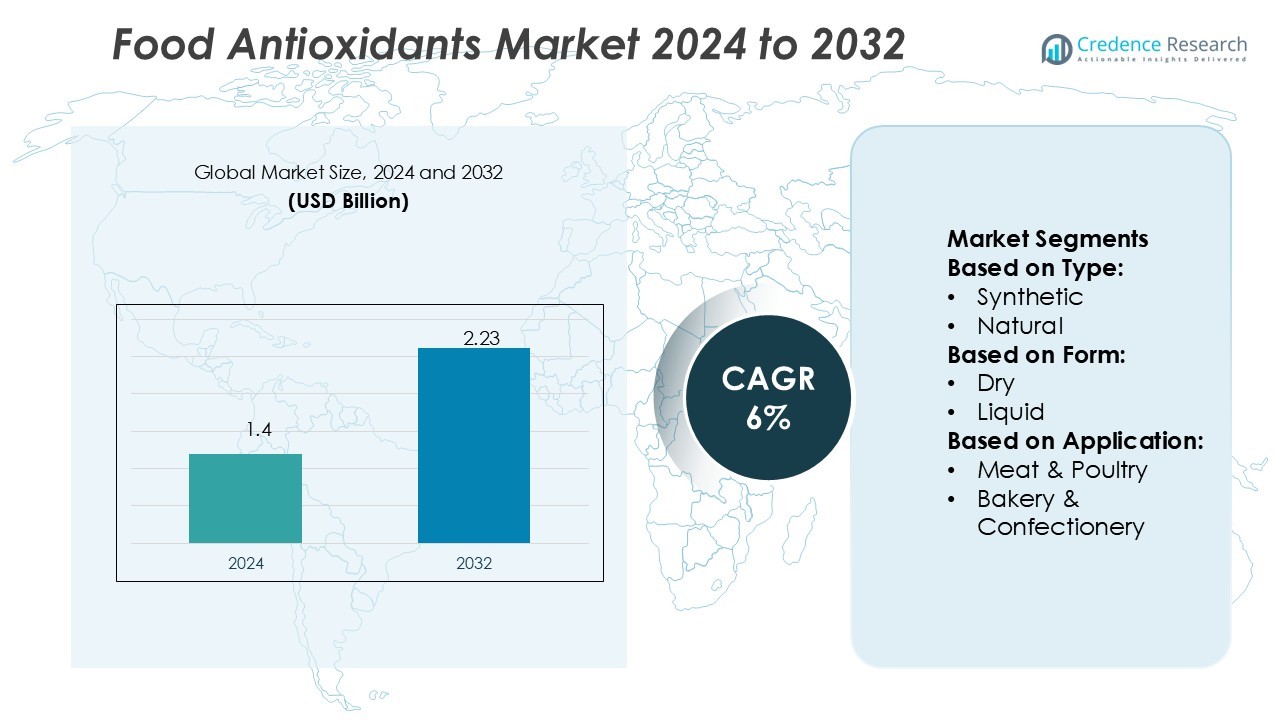

Food Antioxidants Market size was valued USD 1.4 billion in 2024 and is anticipated to reach USD 2.23 billion by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Antioxidants Market Size 2024 |

USD 1.4 Billion |

| Food Antioxidants Market, CAGR |

6% |

| Food Antioxidants Market Size 2032 |

USD 2.23 Billion |

The food antioxidants market is shaped by leading players such as BASF SE, Eastman Chemical Company, Archer Daniels Midland Company (ADM), DuPont, Kemin Industries, Camlin Fine Sciences, Kalsec Inc., Frutarom Ltd, Barentz Group, and 3A Antioixidants. These companies strengthen their positions through innovation in natural antioxidant solutions, strategic mergers, and expanded global distribution networks. Product diversification and compliance with regulatory frameworks remain key strategies to capture consumer demand for safe and sustainable food preservation. Regionally, Asia-Pacific leads the global food antioxidants market with a 35% share in 2024, supported by rapid growth in packaged foods, increasing disposable incomes, and rising adoption of functional ingredients across China, India, and Japan. This strong regional dominance is reinforced by expanding urbanization and higher health awareness among consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The food antioxidants market size was valued at USD 1.4 billion in 2024 and is projected to reach USD 2.23 billion by 2032, registering a CAGR of 6% during the forecast period.

- Rising demand for processed and packaged foods, coupled with increasing consumer preference for natural and clean-label ingredients, drives market growth across key applications such as meat, poultry, bakery, and oils.

- A major trend shaping the market is the shift toward plant-based and natural antioxidants, supported by technological innovations in extraction and formulation that enhance stability and functionality.

- Competitive intensity remains strong with players like BASF SE, Eastman Chemical Company, ADM, DuPont, Kemin Industries, and Camlin Fine Sciences focusing on product diversification, sustainable sourcing, and regulatory compliance to expand global presence.

- Regionally, Asia-Pacific leads with a 35% market share in 2024, while the natural antioxidants segment dominates by type, capturing 58% share due to growing adoption in functional foods and nutraceuticals.

Market Segmentation Analysis:

By Type

The natural antioxidants segment dominates the market, holding 58% share in 2024. This leadership is driven by rising consumer demand for clean-label and plant-based products. Manufacturers are increasingly adopting natural sources such as rosemary extract, tocopherols, and green tea polyphenols to align with health-conscious trends. Strict regulations on synthetic antioxidants like BHA and BHT further accelerate the shift toward natural variants. Growing use in packaged foods, bakery, and meat products enhances adoption, making natural antioxidants the fastest-growing type during the forecast period.

- For instance, BASF also launched Irganox® 1010 BMBcert™ and Irganox® 1076 BMBcert™, the first biomass-balance certified antioxidant additives, reducing cradle-to-gate carbon footprint by up to 60 units versus conventional grades.

By Form

The dry form segment accounts for 65% of the market, leading the food antioxidants industry. Dry antioxidants are widely used due to higher stability, easy storage, and longer shelf life. Their compatibility with powders, mixes, and processed products such as bakery items and snacks drives demand. The dry form is also preferred by manufacturers for cost efficiency and simpler handling in large-scale production. Increasing demand for ready-to-eat foods and functional ingredients continues to strengthen the dominance of the dry antioxidants category across global markets.

- For instance, Frutarom introduced CitrOlive, a patented natural ingredient combining olive and citrus extracts. In a 90-day double-blind trial at Murcia University, subjects taking 500 mg/day showed statistically significant reductions in oxidized LDL and triglyceride biomarkers versus placebo.

By Application

The meat and poultry segment leads the market with a 40% share in 2024. Antioxidants play a crucial role in extending shelf life, preventing rancidity, and preserving freshness in meat products. Rising consumption of processed meat and ready-to-cook poultry products fuels consistent demand. Manufacturers emphasize antioxidant use to meet strict safety standards and reduce food waste. The bakery and confectionery segment follows closely, supported by antioxidants’ role in maintaining flavor, texture, and color stability. Strong demand in emerging economies reinforces meat and poultry as the dominant application segment.

Key Growth Drivers

Rising Demand for Processed and Packaged Foods

The growing consumption of processed and packaged foods worldwide drives demand for food antioxidants. Antioxidants extend shelf life, preserve flavor, and maintain product quality, making them essential in meat, bakery, and snack categories. With rapid urbanization and busy lifestyles, consumers are shifting toward convenient ready-to-eat products. This trend is particularly strong in emerging economies, where rising disposable incomes increase packaged food purchases. As manufacturers expand portfolios to meet evolving preferences, the use of food antioxidants continues to grow, reinforcing their critical role in modern food production.

- For instance, Camlin markets Xtendra antioxidant solutions, successful initiation of commercial production of vanillin (brand name adorr) at the Dahej facility with a capacity of 6,000 metric tons per annum (MTPA).

Shift Toward Natural and Clean-Label Ingredients

Consumers are increasingly favoring natural antioxidants due to health concerns associated with synthetic variants. Clean-label products with plant-derived antioxidants such as rosemary, tocopherols, and green tea extracts are gaining strong momentum. Regulatory restrictions on synthetic additives further accelerate the shift toward natural solutions. Food companies highlight “natural preservation” on product labels to attract health-conscious buyers, especially in developed markets. Rising awareness of preventive health and nutritional transparency reinforces this shift, making natural antioxidants one of the fastest-growing categories and a key growth driver in the global food antioxidants market.

- For instance, ADM introduced new sunflower-sourced, non-GMO natural vitamin E products, including Novatol® Sunflower 5-67 Vitamin E (d-alpha tocopherol) and Novatol® Sunflower Vitamin E Succinate (d-alpha tocopheryl acid succinate).

Expansion of the Functional Food and Nutraceutical Industry

The functional food and nutraceutical sector is expanding rapidly, boosting demand for antioxidants. Consumers increasingly seek foods with added health benefits, such as immune support, anti-aging properties, and disease prevention. Antioxidants are key ingredients in dietary supplements, beverages, and fortified foods targeting wellness-conscious populations. With rising cases of chronic diseases, consumers are turning to preventive nutrition as a daily routine. This expansion offers significant opportunities for antioxidant applications across industries. Growing investments by manufacturers in health-focused product innovation continue to fuel market growth in this segment globally.

Key Trends & Opportunities

Growth in Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and Africa present strong opportunities for food antioxidant manufacturers. Rising urbanization, increasing disposable incomes, and rapid expansion of modern retail drive higher consumption of packaged and processed foods. Local manufacturers are adopting antioxidants to meet international quality and safety standards. Growing investments in cold storage and food supply chains also support market penetration. As consumer awareness of product freshness and food safety rises in these regions, food antioxidants see stronger adoption, making emerging economies vital growth hubs for industry players.

- For instance, 3A Biotech operates on a 10,000 m² production facility and maintains an annual production capacity of 6,000 tonnes across preservatives and antioxidant products.

Technological Innovations in Extraction and Formulation

Advancements in extraction technologies are enabling more efficient production of natural antioxidants. Manufacturers are investing in techniques like supercritical CO₂ extraction and microencapsulation to improve purity, stability, and functionality. These innovations enhance antioxidant effectiveness in diverse food applications, including meat, oils, and bakery products. Improved formulations also support cleaner labeling and longer shelf life without altering taste or texture. With research focused on novel plant-based sources and multifunctional blends, technological progress creates new opportunities for food companies to meet consumer demand and regulatory requirements effectively.

- For instance, DuPont Teijin Films’ Mylar® Harvest Fresh rPET films incorporate up to 50% post-consumer recycled (PCR) content in the base polyester film.These films maintain comparable heat seal, mechanical and optical performance versus virgin material.

Rising Popularity of Plant-Based Diets

The global shift toward plant-based and vegan diets creates new opportunities for natural antioxidants. Plant-derived extracts such as rosemary, acerola, and grape seed are increasingly integrated into food formulations. This aligns with consumer demand for sustainable, ethical, and clean-label food products. Food companies are expanding product portfolios to include plant-based snacks, dairy alternatives, and meat substitutes, all of which require antioxidant use for preservation. The trend not only expands the scope of applications but also positions antioxidants as vital ingredients in supporting the global plant-based movement.

Key Challenges

Regulatory Restrictions on Synthetic Antioxidants

Stringent regulations on synthetic antioxidants such as BHA and BHT limit their usage in many markets. Food safety authorities in Europe and North America enforce strict compliance measures, creating pressure on manufacturers to reformulate products. This adds to production costs and challenges companies reliant on synthetics for affordability and efficiency. While natural antioxidants are a growing alternative, they often come at higher costs and require technical adjustments in formulations. Balancing regulatory compliance and cost-effectiveness remains a major challenge for food manufacturers globally.

Price Volatility of Natural Raw Materials

The cost of natural antioxidants is highly dependent on the availability of raw materials like rosemary, green tea, and citrus extracts. Weather fluctuations, supply chain disruptions, and agricultural yield variations contribute to price volatility. This directly affects production costs for food manufacturers that rely on plant-based antioxidants. Smaller players face higher risks due to limited sourcing capabilities, while global companies struggle with margin pressures. Ensuring stable supply chains and adopting cost-efficient extraction methods remain critical to overcoming this challenge in the food antioxidants market.

Regional Analysis

North America

North America holds a 30% share of the food antioxidants market in 2024, driven by strong demand for processed meat, bakery products, and packaged snacks. Consumers’ preference for convenience foods and strict food safety regulations support antioxidant adoption. The U.S. dominates the regional market due to high consumption of ready-to-eat meals and strong functional food demand. Leading companies invest in natural antioxidant product lines to meet clean-label requirements. Canada and Mexico also contribute to regional growth with rising demand for fortified foods and expanding retail distribution networks.

Europe

Europe accounts for 25% of the global food antioxidants market, supported by stringent regulations on food quality and consumer preference for natural ingredients. Countries such as Germany, the U.K., and France lead adoption, particularly in bakery, confectionery, and meat applications. The region’s strong inclination toward clean-label and sustainable food products drives higher use of natural antioxidants such as tocopherols and rosemary extracts. Increasing innovation in plant-based diets and fortified foods adds further momentum. European manufacturers focus on product reformulation to comply with regulations while meeting consumer expectations for healthier, preservative-free options.

Asia-Pacific

Asia-Pacific dominates the global market with a 35% share in 2024, fueled by rising urbanization, disposable incomes, and rapid growth in the packaged food industry. China, India, and Japan are major contributors, driven by high consumption of processed meat, oils, and bakery items. Growing health awareness boosts demand for natural antioxidants, while expanding retail and e-commerce channels improve accessibility. The increasing penetration of functional foods and nutraceuticals further strengthens regional demand. Asia-Pacific remains the fastest-growing market as multinational and local players invest heavily to capture opportunities across emerging economies.

Latin America

Latin America holds 6% of the food antioxidants market, supported by the rising consumption of packaged and processed foods in Brazil, Mexico, and Argentina. Urban lifestyles and increasing preference for ready-to-eat meals drive demand across bakery, confectionery, and meat segments. The region also witnesses growing use of natural antioxidants as consumers become more health-conscious. Economic development and the expansion of retail infrastructure provide further growth opportunities. However, regulatory differences and cost concerns challenge adoption rates. Despite these hurdles, Latin America presents a growing opportunity for manufacturers targeting middle-income consumer groups.

Middle East & Africa

The Middle East & Africa region represents 4% of the global food antioxidants market, with growth led by the Gulf countries and South Africa. Rising demand for meat and poultry products, combined with growing urbanization, fuels antioxidant use. Increasing imports of processed foods and the expansion of modern retail formats support adoption. The demand for natural antioxidants is gradually increasing as consumers show higher awareness of health and safety. However, economic fluctuations and limited local production capacity pose challenges. Despite this, the region offers long-term opportunities through rising packaged food consumption.

Market Segmentations:

By Type:

By Form:

By Application:

- Meat & Poultry

- Bakery & Confectionery

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the food antioxidants market is shaped by key players including Eastman Chemical Company, BASF SE, Barentz Group, Frutarom Ltd, Kemin Industries, Camlin Fine Sciences, Archer Daniels Midland Company (ADM), DuPont, 3A Antioixidants, and Kalsec Inc. The food antioxidants market is defined by continuous innovation, regulatory compliance, and rising demand for natural solutions. Companies focus on expanding their product portfolios with plant-based and clean-label antioxidants to meet evolving consumer expectations. Strategic investments in research and development enhance product functionality, stability, and shelf-life performance across diverse food applications such as meat, bakery, and oils. Global players strengthen their positions through mergers, acquisitions, and partnerships that expand geographic reach and supply chain capabilities. Regional manufacturers also play a key role by offering cost-effective solutions tailored to local market needs, intensifying overall competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eastman Chemical Company

- BASF SE

- Barentz Group

- Frutarom Ltd

- Kemin Industries

- Camlin Fine Sciences

- Archer Daniels Midland Company (ADM)

- DuPont

- 3A Antioixidants

- Kalsec Inc.

Recent Developments

- In November 2024, Prinova attended Fi Europe, a pivotal event in the nutraceutical and functional food sectors. Recent market research by Prinova highlights key consumer trends, including the growing interest in natural antioxidants. At the event, they showcased innovative products such as functional beverages aimed at enhancing immune health and cognitive performance, along with workout cookies designed for recovery and oxidative stress reduction.

- In September 2024, Growel Group announced a strategic expansion into the growing pet food sector with the launch of its new pet food brand, Carniwel. The company said Carniwel aims to meet the rising demand for premium pet nutrition at affordable prices.

- In May 2024, Kemin Industries submitted a request to the European Commission to allow the use of liquid rosemary extract as an antioxidant feed additive for cats and dogs and has received authorization through Commission Implementing Regulation (EU) 2024/1068.

- In June 2023, Clariant launched AddWorks PKG 158. This is an antioxidant that supports superior color protection and reduction of thermal oxidative degradation of polymer during the melting process. It also comes with high heat stability and helps to enhance the activities of resin after plastic recycling.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see higher demand for natural antioxidants driven by clean-label trends.

- Regulatory pressures will continue to reduce reliance on synthetic antioxidants.

- Emerging markets will provide strong growth opportunities with rising packaged food demand.

- Functional foods and nutraceuticals will expand antioxidant applications across new categories.

- Technological advancements in extraction and formulation will improve product efficiency.

- Plant-based diets will increase the use of botanical antioxidants in food products.

- E-commerce and modern retail will boost accessibility of antioxidant-based products.

- Strategic collaborations and acquisitions will enhance global supply chain strength.

- Rising health awareness will drive innovation in antioxidant blends for diverse uses.

- Sustainability initiatives will push manufacturers toward eco-friendly sourcing and production methods.