Market overview

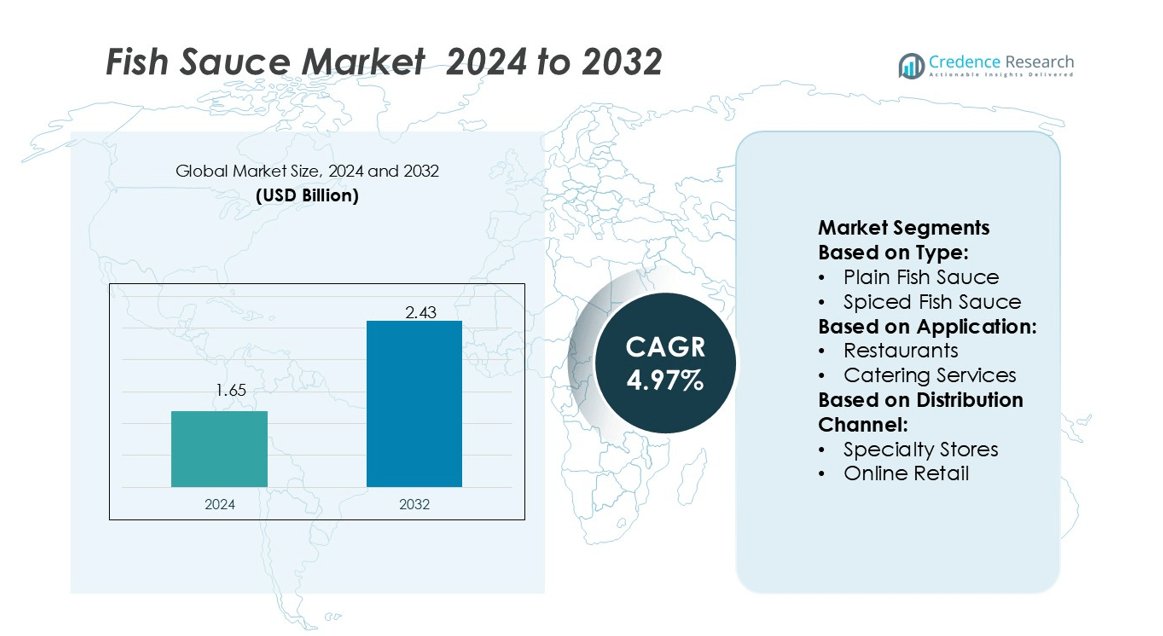

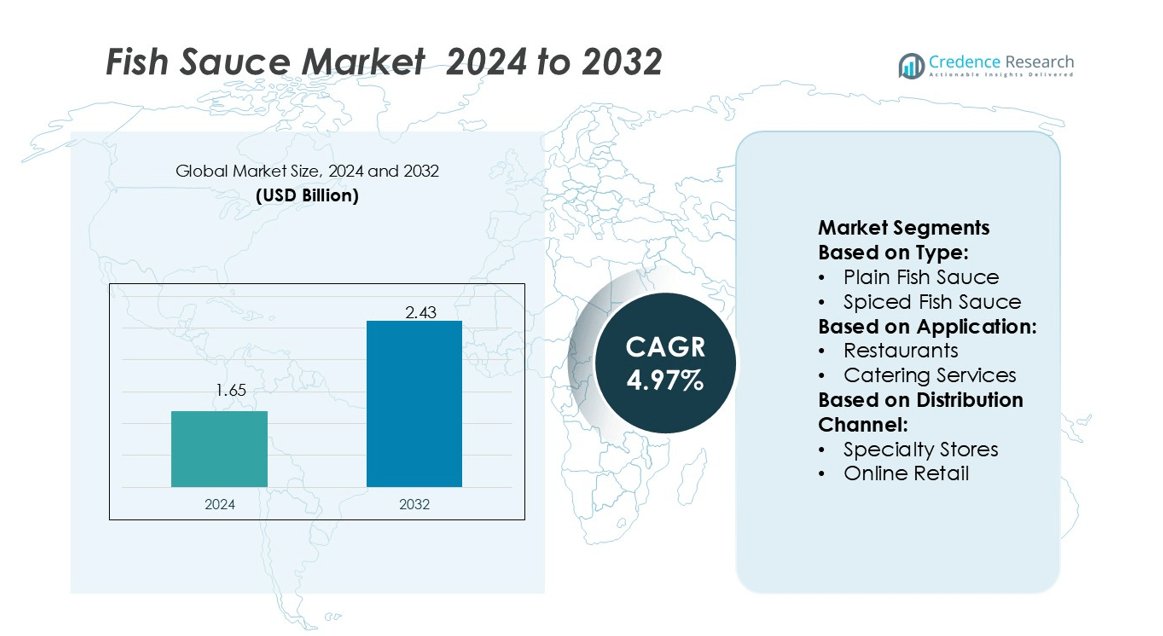

Fish Sauce Market size was valued USD 1.65 billion in 2024 and is anticipated to reach USD 2.43 billion by 2032, at a CAGR of 4.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fish Sauce Market Size 2024 |

USD 1.65 billion |

| Fish Sauce Market, CAGR |

4.97% |

| Fish Sauce Market Size 2032 |

USD 2.43 billion |

The fish sauce market is shaped by top players including Squid Brand, Rayong Fish Sauce, Hung Thanh, TANG SANG HA CO. Ltd, Red Boat, Pichai Fish Sauce, Nestlé, Halcyon Proteins, Thai Preeda Group, and Teo Tak Seng Fish Sauce Factory Co., Ltd. These companies compete through strategies such as product innovation, premium positioning, and expanding distribution networks across global and regional markets. Traditional brands maintain dominance in Asia, while multinational corporations leverage scale and research-driven offerings to strengthen modern retail penetration. Among regions, Asia-Pacific leads the market with a 40% share, supported by strong cultural reliance on fish sauce, rapid urbanization, and growing exports.

Market Insights

- The fish sauce market size was valued at USD 1.65 billion in 2024 and is expected to reach USD 2.43 billion by 2032, registering a CAGR of 4.97% during the forecast period.

- Growth is driven by rising global demand for Asian cuisine, increasing use of fish sauce in processed foods, and consumer preference for natural, traditional condiments.

- Trends include the rise of premium, artisanal, and spiced variants along with the expansion of e-commerce and modern retail channels, which are improving accessibility and visibility worldwide.

- Competition remains fragmented, with traditional producers holding strong regional dominance, while multinational corporations leverage research-based innovation and distribution networks; restraints include reliance on imports and regulatory challenges in global markets.

- Asia-Pacific leads with a 40% regional share due to cultural reliance and urbanization, while Europe holds 22% and North America 19%; the foodservice application segment dominates, accounting for the largest consumption share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Plain fish sauce dominates the market with a 58% share, supported by its widespread use in traditional cooking and processed foods. Consumers value its authentic flavor profile, making it the go-to choice for both household and industrial applications. Spiced variants are gaining momentum due to rising demand for fusion cuisines and convenient flavor enhancers. The “Others” category, including low-sodium and organic versions, is expanding steadily as health-conscious buyers explore alternatives. Growth is mainly driven by strong culinary traditions in Asia and increasing international adoption of Southeast Asian recipes.

- In March 2024, Pelagia announced the acquisition of the UK-based seafood trading firm Ideal Foods Limited. With this, Pelagia plans to develop collaboration and synergy with Ideal Foods to enhance its global supply chain and strengthen its market presence while continuing to innovate and utilize seafood co-products.

By Application

The food service segment leads with a 42% market share, powered by strong demand from restaurants and catering services. Sauces and marinades within industrial applications are also expanding quickly, fueled by rising processed food consumption. Ready-to-eat meals and packaged snacks are adding further momentum as busy lifestyles push convenience-driven choices. Household consumption continues to expand, but its pace lags behind industrial-scale demand. Hotels represent a stable but smaller contributor, driven by premium dining experiences. Market growth is underpinned by rising urbanization, global foodservice expansion, and the popularity of ready-to-use flavor bases.

- For instance, Rayong Fish Sauce operates a manufacturing complex capable of processing up to 600 tons of fish per day, performing fermentation over a 12–18 month period and executing a 5-step filtration system to ensure clarity.

By Distribution Channel

Supermarkets and hypermarkets account for the largest share at 46%, benefiting from high product visibility and bulk purchasing options. Online retail is the fastest-growing sub-segment, fueled by increasing digital adoption and e-commerce penetration in Asia-Pacific and Western markets. Specialty stores play a crucial role in serving niche buyers who seek premium and regional varieties. Convenience stores contribute steadily, particularly in urban areas where quick purchases are common. The “Others” segment, including direct sales and wholesale, supports foodservice operators. Drivers include strong retail infrastructure, rising e-commerce platforms, and consumer preference for both accessibility and variety in purchasing options.

Key Growth Drivers

Rising Global Demand for Asian Cuisine

The growing popularity of Asian cuisines, particularly Thai and Vietnamese dishes, is driving demand for fish sauce worldwide. Consumers increasingly value authentic flavors, and fish sauce remains a key ingredient in soups, marinades, and stir-fried meals. Expansion of Asian restaurants across North America and Europe further supports sales. Additionally, social media and food influencers are boosting awareness of traditional recipes, encouraging trial among new consumers. This cultural diffusion continues to strengthen the fish sauce market’s global penetration and long-term growth potential.

- For instance, Croda reports that hundreds of its Life Sciences product codes and over 1,550 of its Consumer Care codes now include cradle-to-gate carbon footprint data.

Expansion of Processed and Convenience Foods

The processed food industry’s growth significantly drives the fish sauce market, as manufacturers integrate it into sauces, marinades, and ready-to-eat meals. Demand for convenience has accelerated with urbanization, dual-income households, and shifting lifestyles. Fish sauce offers strong umami flavoring, making it ideal for instant noodle brands, meal kits, and packaged snacks. Food companies leverage its versatility to enhance both taste and nutritional value. This application diversity not only boosts volume demand but also secures recurring use across industrial and retail channels globally.

- For instance, BASF invested €2,061 million in research & development, filed 1,159 new patents in one year, and employs approximately 10,000 staff in R&D across the globe—enabling advances in catalysis, digital tools, and material innovations.

E-commerce and Retail Channel Growth

The rapid expansion of e-commerce platforms and modern retail channels is boosting accessibility of fish sauce products. Supermarkets, hypermarkets, and specialty stores provide wide assortments, while online platforms offer convenience and global reach. Consumers in urban areas increasingly purchase fish sauce through digital platforms, supported by doorstep delivery and competitive pricing. Manufacturers also strengthen brand visibility through online promotions and collaborations with food delivery apps. This omnichannel growth strategy expands consumer access, particularly in emerging markets, and accelerates adoption of premium and niche fish sauce varieties.

Key Trends & Opportunities

Shift Toward Premium and Organic Variants

Consumers are showing growing preference for premium, organic, and low-sodium fish sauce options. This trend is fueled by rising health consciousness and demand for clean-label ingredients. Manufacturers are innovating with artisanal production methods, sustainable sourcing, and reduced preservatives to capture health-focused buyers. Premium offerings are especially popular in developed markets where consumers are willing to pay higher prices for authenticity and quality. This trend creates significant opportunities for global players to diversify portfolios and establish niche positioning in competitive retail environments.

- For instance, OLVEA’s operations include an eco-refining plant that uses 100 % renewable electricity at its French sites, and 90 % of its oils are sourced from responsible origins per its CSR report.

Rising Penetration in Western Markets

Western markets are emerging as growth hotspots due to cultural exposure to Asian food. Increased availability of fish sauce in mainstream retail and its inclusion in Western recipes highlight its versatility. Chefs and foodservice operators in the United States and Europe are experimenting with fish sauce as a flavor enhancer in non-traditional dishes. This creates fresh opportunities for suppliers to promote cross-cultural usage. The trend strengthens long-term demand by extending applications beyond traditional Asian cuisine into global food innovation.

- For instance, Omega Protein’s Health & Science Center processes 100 metric tons per day of fish oil, uses automated refining, bleaching, and deodorization steps, and has an on-site lipids lab is accurate.

Key Challenges

Intense Market Competition

The fish sauce market faces strong competition from local and global players offering similar flavoring solutions. In Asia, numerous small-scale producers operate alongside established brands, making differentiation difficult. Low entry barriers allow new entrants to emerge rapidly, intensifying price pressure. Established condiments such as soy sauce or oyster sauce also compete as flavor substitutes. To remain competitive, companies must invest in branding, product innovation, and strong distribution networks. The crowded market landscape remains a key challenge for sustained profitability and market share expansion.

Health and Sustainability Concerns

Growing health awareness poses challenges for fish sauce producers due to concerns over high sodium levels. Excess salt intake is linked to cardiovascular risks, leading some consumers to seek alternatives. Additionally, sustainability concerns about overfishing and raw material sourcing impact brand perception. Regulatory scrutiny on food safety and environmental practices adds further pressure. Companies must adopt eco-friendly fishing methods, transparent sourcing, and reformulated products to address these concerns. Balancing traditional authenticity with healthier, sustainable practices remains a critical challenge for long-term growth.

Regional Analysis

North America

North America holds a 19% share of the fish sauce market, with strong demand in the United States and Canada. The rising popularity of Asian fusion cuisine in restaurants and packaged meals drives consumption. Retail availability in supermarkets, specialty Asian stores, and e-commerce platforms expands household adoption. Health-conscious consumers increasingly prefer clean-label, gluten-free, and spiced varieties, creating new growth opportunities. While North America relies heavily on imports from Asia-Pacific producers, the region continues to witness consistent growth, supported by evolving culinary trends and rising consumer interest in authentic global flavors.

Europe

Europe accounts for 22% of the fish sauce market, supported by the rising popularity of Asian cuisine across major countries like Germany, France, and the UK. Immigrant populations and foodservice establishments drive steady demand, while specialty food retailers ensure availability. E-commerce and gourmet stores expand consumer access to premium and spiced varieties. Health-conscious consumers in Europe are also fueling interest in natural, low-sodium fish sauce products. Despite reliance on imports, Europe remains a significant growth market due to increasing cultural diversity and the integration of Asian condiments into mainstream culinary practices.

Asia-Pacific

Asia-Pacific leads the global fish sauce market with a dominant 40% share, driven by strong cultural and culinary integration in countries such as Vietnam, Thailand, and the Philippines. Fish sauce is a household staple and widely used across foodservice, processed foods, and ready-to-eat meals. Urbanization and rising disposable incomes are boosting packaged sales, while e-commerce expands accessibility. Premium, spiced, and value-added variants appeal to shifting consumer tastes. The region also drives exports to international markets, reinforcing its leadership. Asia-Pacific continues to serve as the growth engine, with consistent demand across both traditional and modern consumption patterns.

Latin America

Latin America captures 10% of the fish sauce market, largely fueled by increasing exposure to Asian cuisines in urban centers. Brazil and Mexico are key markets where Asian restaurants and specialty food stores have expanded consumer access. Growing use of fish sauce in processed sauces and marinades strengthens industrial demand. While household adoption is still limited, rising disposable incomes and cross-cultural culinary trends support future growth. The region remains smaller in scale compared to others, but demand is expanding steadily as international retailers and e-commerce platforms improve distribution networks.

Middle East & Africa

The Middle East & Africa region holds a 9% share of the fish sauce market, with consumption concentrated in multicultural hubs such as the UAE, Saudi Arabia, and South Africa. Expatriate communities and the hospitality sector, including hotels and catering services, are primary demand drivers. Retail penetration is limited, but international supermarkets and e-commerce channels are improving accessibility. While household use remains niche, rising disposable incomes and exposure to global flavors are creating growth potential. The market is import-dependent, but expanding dining diversity and foodservice innovation continue to strengthen its presence in the region.

Market Segmentations:

By Type:

- Plain Fish Sauce

- Spiced Fish Sauce

By Application:

- Restaurants

- Catering Services

By Distribution Channel:

- Specialty Stores

- Online Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fish sauce market is shaped by key players including Squid Brand, Rayong Fish Sauce, Hung Thanh, TANG SANG HA CO. Ltd, Red Boat, Pichai Fish Sauce, Nestlé, Halcyon Proteins, Thai Preeda Group, and Teo Tak Seng Fish Sauce Factory Co., Ltd. The fish sauce market is highly fragmented, with strong participation from both multinational corporations and regional producers. The market is characterized by a balance between traditional manufacturers, which maintain dominance through cultural authenticity and long-standing consumer trust, and premium brands that focus on artisanal methods, natural ingredients, and global exports. Large international companies contribute by leveraging advanced distribution networks, research-driven innovation, and strong retail penetration across modern trade channels. Meanwhile, regional producers emphasize affordability and localized flavors to cater to mass markets, particularly in Asia-Pacific. This combination of global expansion, premium positioning, and localized strategies creates an intensely competitive environment, driving continuous product innovation and wider availability across household, foodservice, and industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Red Boat

- Nestle

- Hung Thanh

- Squid Brand

- Teo Tak Seng Fish Sauce Factory Co., Ltd.

- Halcyon Proteins

- Rayong Fish Sauce

- Thai Preeda Group

- Pichai Fish Sauce

- TANG SANG HA CO. Ltd

Recent Developments

- In August 2024, Vietnamese fish sauce producer SEAGULL Co. Ltd. has exported its first batch of fish sauce products to the United States, including vegan fish sauce.The company offers both traditional and vegan options, with the vegan fish sauce crafted from fragrant fruits, soybeans, and Japanese Shiitake mushrooms.

- In June 2024, GC Rieber VivoMega opened a new omega-3 manufacturing facility in Norway. The plant, which will operate on 100% renewable energy, is expected to double the current output of triglyceride marine omega-3s and vegan algal oils, addressing the rising demand for omega-3 supplements.

- In March 2024, Pelagia announced the acquisition of the UK-based seafood trading firm Ideal Foods Limited. With this, Pelagia plans to develop collaboration and synergy with Ideal Foods to enhance its global supply chain and strengthen its market presence while continuing to innovate and utilize seafood co-products.

- In March 2023, the Nam O fishing village in Da Nang City’s Lien Chieu introduced a new fish sauce named ‘Huong Lang Co’ (Ancient Village Savour) at a Tokyo exhibition. This hand-made fish sauce, crafted by local villagers, was featured at the event, which showcased Da Nang-based fish sauce alongside unique products from 62 Vietnamese provinces and cities

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The fish sauce market will expand steadily as Asian cuisine adoption increases worldwide.

- Rising demand for premium and artisanal products will strengthen global export opportunities.

- Health-conscious consumers will drive growth in natural, low-sodium, and clean-label variants.

- E-commerce channels will play a larger role in retail distribution and consumer reach.

- Foodservice and restaurant sectors will continue to boost bulk demand for authentic flavors.

- Product innovation with spiced and flavored sauces will diversify consumer choices.

- Multinational companies will expand their influence through advanced distribution networks.

- Regional producers will gain share by offering affordable, localized flavor profiles.

- Growing use of fish sauce in processed foods and ready meals will expand industrial applications.

- Market competition will intensify, encouraging continuous innovation and strong brand positioning.