Market overview

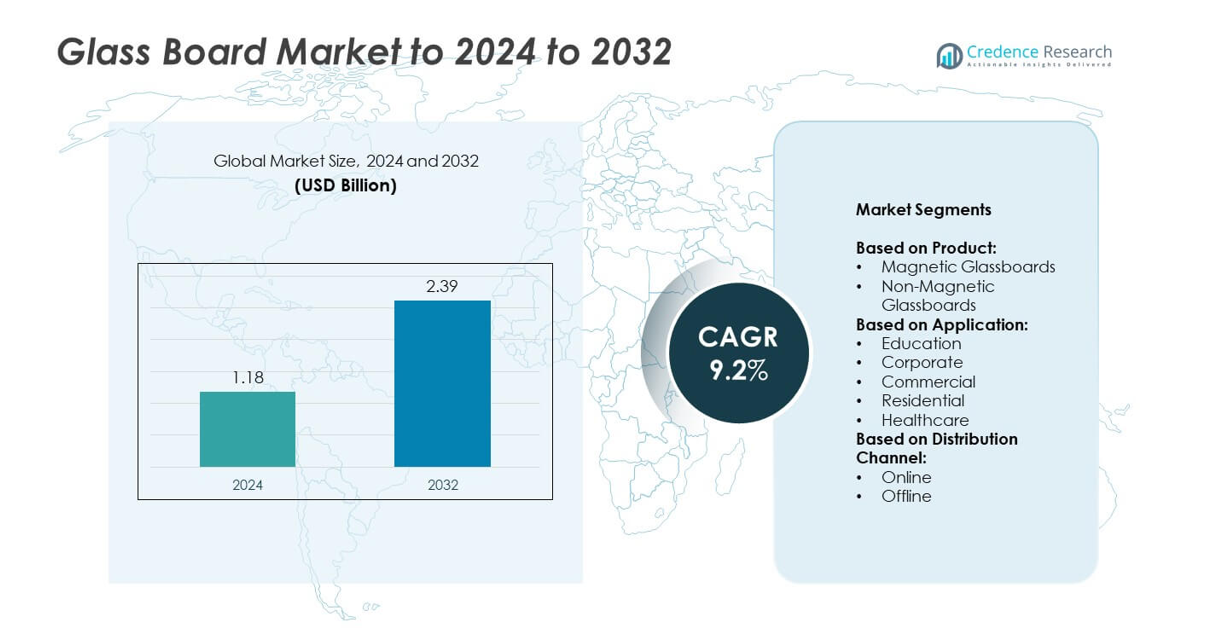

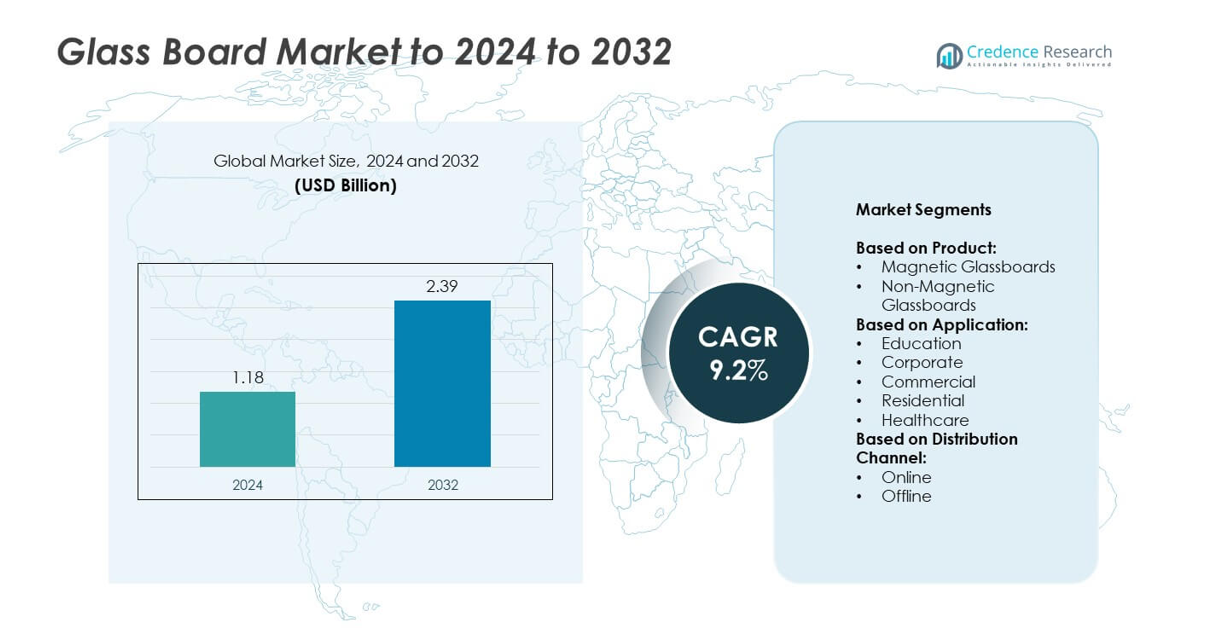

The Glass Board Market size was valued at USD 1.18 billion in 2024 and is anticipated to reach USD 2.39 billion by 2032, at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glass Board Market Size 2024 |

USD 1.18 billion |

| Glass Board Market, CAGR |

9.2% |

| Glass Board Market Size 2032 |

USD 2.39 billion |

The glass board market is driven by prominent players such as Clarus, Fulbright Glass Boards, Esquire, CHAT BOARD A/S, Egan Visual, Saint-Gobain, Casca Glass Boards, Quartet, Claridge, Glass Whiteboard, Krystal Glass Writing Boards Inc., and GMi Companies Inc. These companies focus on product innovation, digital integration, and design flexibility to meet diverse demand across corporate, educational, healthcare, and residential sectors. Regional analysis shows North America leading the market with a 35% share in 2024, supported by high adoption in offices and institutions. Europe followed with 28%, benefiting from sustainability-focused infrastructure upgrades, while Asia Pacific held 25%, emerging as the fastest-growing region due to expanding education and corporate investments.

Market Insights

- The glass board market was valued at USD 1.18 billion in 2024 and is projected to reach USD 2.39 billion by 2032, growing at a CAGR of 9.2%.

- Rising adoption in corporate offices and educational institutions is driving demand, supported by the durability, modern aesthetics, and eco-friendly nature of glassboards compared to traditional boards.

- Integration with digital tools and increasing online sales channels are key trends, with manufacturers focusing on interactive and customizable solutions to meet evolving consumer needs.

- The market is competitive with players emphasizing product innovation, distribution expansion, and partnerships across corporates and institutions, though high initial costs and transportation challenges remain significant restraints.

- Regionally, North America led with 35% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, while Latin America held 7% and Middle East & Africa accounted for 5%; by product, magnetic glassboards dominated with 60% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Magnetic glassboards held the dominant share in the glass board market in 2024, accounting for nearly 60% of total revenue. Their popularity stems from versatility, as they support both writing and attaching documents with magnets, making them highly useful in classrooms and offices. Strong durability and easy maintenance also support their wide adoption across commercial and educational sectors. Non-magnetic glassboards, though smaller in share, are increasingly used in modern interior designs due to sleek aesthetics and lower costs, appealing to residential users seeking functional yet stylish solutions.

- For instance, Legamaster sells magnetic safety-glass boards up to 100×200 cm with a 25-year surface guarantee.

By Application

The corporate sector dominated the glass board market in 2024 with a share exceeding 40%. Rising adoption of glassboards in conference rooms, collaborative spaces, and meeting rooms drives this dominance. Businesses prefer them for their modern design, reusability, and ability to integrate with digital projectors and markers, enhancing workplace efficiency. The education sector follows closely, supported by schools and universities shifting from chalkboards to eco-friendly glassboards. Other applications, including healthcare and residential use, are growing gradually, driven by increasing demand for durable, non-porous writing surfaces that support hygiene standards.

- For instance, Quartet (ACCO Brands) added four new sizes to its InvisaMount line in August 2024, including 3×4, 4×4, 4×6, and 4×8 feet, featuring a 20-year limited warranty and GREENGUARD Gold certification on specific variants.

By Distribution Channel

Offline channels accounted for the largest share in 2024, holding close to 70% of the glass board market. Strong reliance on physical retail outlets, showrooms, and dealer networks ensures greater customer trust and allows buyers to evaluate product quality directly. Offline sales are also supported by bulk orders from schools, corporates, and commercial institutions. Online distribution, while smaller, is rapidly gaining traction due to e-commerce expansion, wider product variety, and competitive pricing. Growing preference for doorstep delivery and digital product demonstrations is expected to push online sales steadily during the forecast period.

Key Growth Drivers

Rising Adoption in Corporate Environments

The corporate sector is a primary growth driver for the glass board market, with rising demand for collaborative tools in offices. Modern workspaces favor glassboards due to their sleek design, easy maintenance, and compatibility with digital technologies. Companies are increasingly replacing traditional boards with glass alternatives for improved aesthetics and long-term durability. Large organizations invest in bulk procurement to equip meeting rooms and training facilities, supporting steady revenue growth. This corporate-driven demand positions workplace modernization as one of the strongest market accelerators.

- For instance, Claridge offers 1/4″ low-iron glass boards with 180+ powder-coat options, suiting corporate specs.

Increasing Adoption in Education Sector

Educational institutions represent a critical growth driver, as schools and universities continue replacing chalkboards and whiteboards with glassboards. Institutions value glassboards for their longer lifespan, resistance to stains, and ease of cleaning. The shift aligns with sustainability goals by reducing frequent replacements. Expanding government funding in digital classrooms and smart learning solutions further boosts adoption. Universities and colleges also leverage glassboards for interactive teaching, group projects, and laboratory spaces, contributing significantly to demand across both developed and emerging regions.

- For instance, Bi-silque specifies 4 mm tempered magnetic glass surfaces designed for extensive classroom use.

Expanding Applications Across Healthcare and Residential Segments

Healthcare and residential applications are emerging as strong growth drivers, broadening the market scope. Hospitals and clinics favor glassboards for their non-porous, hygienic surfaces that support infection control. Residential demand grows due to modern interior designs that combine aesthetics with functionality, as glassboards serve both decorative and practical purposes. Consumers appreciate customizable designs for kitchens, study areas, and home offices. Together, these applications diversify market demand, ensuring adoption beyond corporate and educational segments while strengthening long-term growth opportunities.

Key Trends & Opportunities

Integration with Digital and Smart Solutions

A major trend in the glass board market is the integration of glassboards with smart technologies. Hybrid workplaces and classrooms increasingly use interactive projectors, touch-enabled overlays, and digital pens in combination with glassboards. These enhancements transform traditional boards into collaborative, tech-enabled tools. Companies developing glassboards with digital compatibility are capitalizing on this shift, addressing the rising demand for multifunctional solutions. This trend creates opportunities for innovation and premium product launches, ensuring continued adoption in both developed and developing markets.

- For instance, Clarus supplies Wall2Wall panels up to 72″×144″ per panel for immersive spaces.

E-commerce Expansion Driving Accessibility

Online platforms are creating significant opportunities by broadening product accessibility and improving market reach. E-commerce platforms allow manufacturers to showcase a wide variety of sizes, colors, and designs, appealing to both corporate and residential buyers. Consumers benefit from competitive pricing, easy customization, and doorstep delivery. As purchasing preferences shift online, brands that strengthen their digital sales channels are positioned for strong growth. The trend also favors smaller players who can scale quickly through online visibility, expanding competition and market diversity.

- For instance, Uline’s Magnetic Glass Dry Erase Board, 6 × 4 ft, model H-7181, includes 4 markers, 4 rare-earth magnets, erasing cloth, tray, and mounting hardware.

Key Challenges

High Initial Costs and Price Sensitivity

One of the key challenges for the glass board market is the relatively high upfront cost compared to traditional boards. While durability offsets the investment over time, many small institutions, startups, and residential users hesitate to adopt due to budget constraints. Price-sensitive buyers in emerging economies continue relying on lower-cost whiteboards. This challenge restricts penetration in price-driven segments, requiring manufacturers to balance premium features with cost-effective designs to address affordability concerns without compromising product quality.

Fragility and Transportation Difficulties

Glassboards pose challenges in logistics and installation due to their weight and fragility. Transportation risks increase costs, as boards require careful handling, specialized packaging, and higher insurance expenses. Damage during shipping or installation can discourage bulk purchases from institutions or online buyers. For large corporate or educational orders, delays caused by logistics issues reduce customer satisfaction. Manufacturers face pressure to innovate in lightweight, shatter-resistant materials while also streamlining supply chains to mitigate these barriers and improve large-scale adoption.

Regional Analysis

North America

North America accounted for the largest share of the glass board market in 2024, holding nearly 35%. Strong demand from corporate offices, educational institutions, and healthcare facilities drives regional dominance. The shift toward modern workspaces, combined with rising investment in digital classrooms, fuels adoption. High purchasing power and preference for premium, durable solutions further support market expansion. The United States leads in corporate demand, while Canada contributes significantly through institutional purchases. Established distribution networks and strong online retail penetration also enhance product accessibility, ensuring North America maintains its leading position through the forecast period.

Europe

Europe held around 28% of the global glass board market share in 2024. Growth is driven by strong adoption in corporate and education sectors, particularly in Germany, the UK, and France. Schools and universities are increasingly adopting sustainable solutions, with glassboards replacing traditional chalkboards. Corporate modernization also contributes to rising sales, as businesses prefer advanced collaborative tools. Residential adoption continues to rise in premium housing projects, supporting regional diversity in demand. Strict environmental regulations favor durable, long-lasting products, further boosting market acceptance across Europe and strengthening its position as the second-largest regional contributor.

Asia Pacific

Asia Pacific captured nearly 25% of the global glass board market in 2024, supported by rapid growth in education and corporate infrastructure. China, India, and Japan are key contributors, with rising investments in smart classrooms and digital workplaces. The region benefits from expanding urbanization and increasing disposable incomes, fueling residential demand as well. Growing corporate expansions and multinational presence across India and Southeast Asia also drive adoption. Manufacturers leverage lower production costs to supply competitive pricing, aiding wider penetration. With increasing e-commerce adoption, Asia Pacific is projected to witness the fastest growth throughout the forecast period.

Latin America

Latin America accounted for about 7% of the global glass board market share in 2024. Demand is primarily supported by education sector investments, particularly in Brazil and Mexico, where schools are modernizing infrastructure. Corporate adoption is gradually rising, driven by multinational offices and co-working spaces expanding in urban centers. Residential demand is modest but increasing, especially in premium housing projects. Limited distribution networks and higher product costs pose challenges to broader market growth. However, the growing influence of online retail platforms and rising awareness of durable, eco-friendly products present opportunities for steady expansion in the region.

Middle East and Africa

The Middle East and Africa region held nearly 5% of the global glass board market share in 2024. Demand is mainly concentrated in the corporate and commercial sectors, with adoption supported by new office spaces and urban development projects. Educational institutions in Gulf countries are also investing in modern infrastructure, driving adoption of glassboards. Residential demand remains niche, limited to premium households seeking modern interior solutions. High product costs and limited supply chains restrict wider market penetration. Nonetheless, expanding retail networks and government investments in smart education initiatives are expected to provide growth opportunities in the coming years.

Market Segmentations:

By Product:

- Magnetic Glassboards

- Non-Magnetic Glassboards

By Application:

- Education

- Corporate

- Commercial

- Residential

- Healthcare

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the glass board market features leading companies such as Clarus, Fulbright Glass Boards, Esquire, CHAT BOARD A/S, Egan Visual, Saint-Gobain, Casca Glass Boards, Quartet, Claridge, Glass Whiteboard, Krystal Glass Writing Boards Inc., and GMi Companies Inc. These players collectively drive innovation through product differentiation, modern designs, and enhanced functionality. The market is marked by increasing focus on durable, stain-resistant, and customizable solutions that appeal to both corporate and educational users. Companies are strengthening distribution networks across offline and online channels to expand accessibility. Strategic collaborations with interior designers, corporate offices, and educational institutions further enhance visibility and adoption. Innovation around integrating boards with digital and interactive tools is becoming a major competitive strategy. Rising demand in emerging economies is pushing players to introduce cost-effective variants while maintaining quality. Overall, the market reflects strong rivalry with continuous emphasis on design innovation, durability, and multi-segment applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Clarus

- Fulbright Glass Boards

- Esquire

- CHAT BOARD A/S

- Egan Visual

- Saint-Gobain

- Casca Glass Boards

- Quartet

- Claridge

- Glass Whiteboard

- Krystal Glass Writing Boards Inc.

- GMi Companies Inc.

Recent Developments

- In 2023, Claridge: Featured its premium LCS Porcelain steel markerboards in its 2023 catalog, highlighting stylish, low-profile, and frameless designs. These boards emphasize durability and resistance to ghosting and staining.

- In 2023, Saint-Gobain launched the production of low-carbon glass in India at its Chennai facility.

- In 2022, Quartet introduced its “Brilliance Glass” collection, which features high-contrast glass for superior visibility.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The glass board market will continue expanding with strong adoption in corporate offices.

- Educational institutions will drive demand as schools replace traditional chalkboards and whiteboards.

- Online sales channels will gain momentum with wider product availability and competitive pricing.

- Integration with smart and digital tools will create new growth opportunities.

- Residential adoption will rise as glassboards become part of modern interior design.

- Healthcare facilities will increase usage due to hygienic, non-porous surfaces.

- Manufacturers will focus on lightweight, shatter-resistant materials to reduce fragility concerns.

- Price sensitivity in emerging economies will encourage demand for affordable variants.

- North America and Europe will maintain strong market positions, while Asia Pacific grows fastest.

- Sustainability trends will favor glassboards for their durability and long product lifecycle.