Market Overview

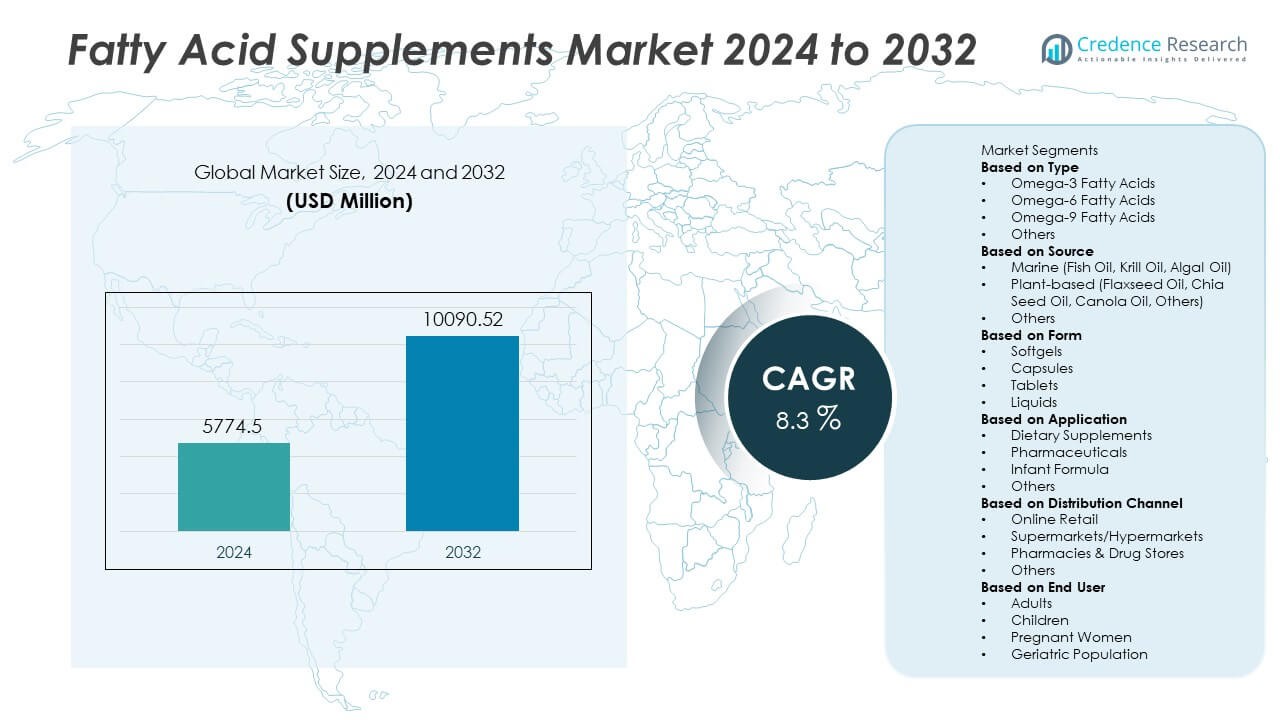

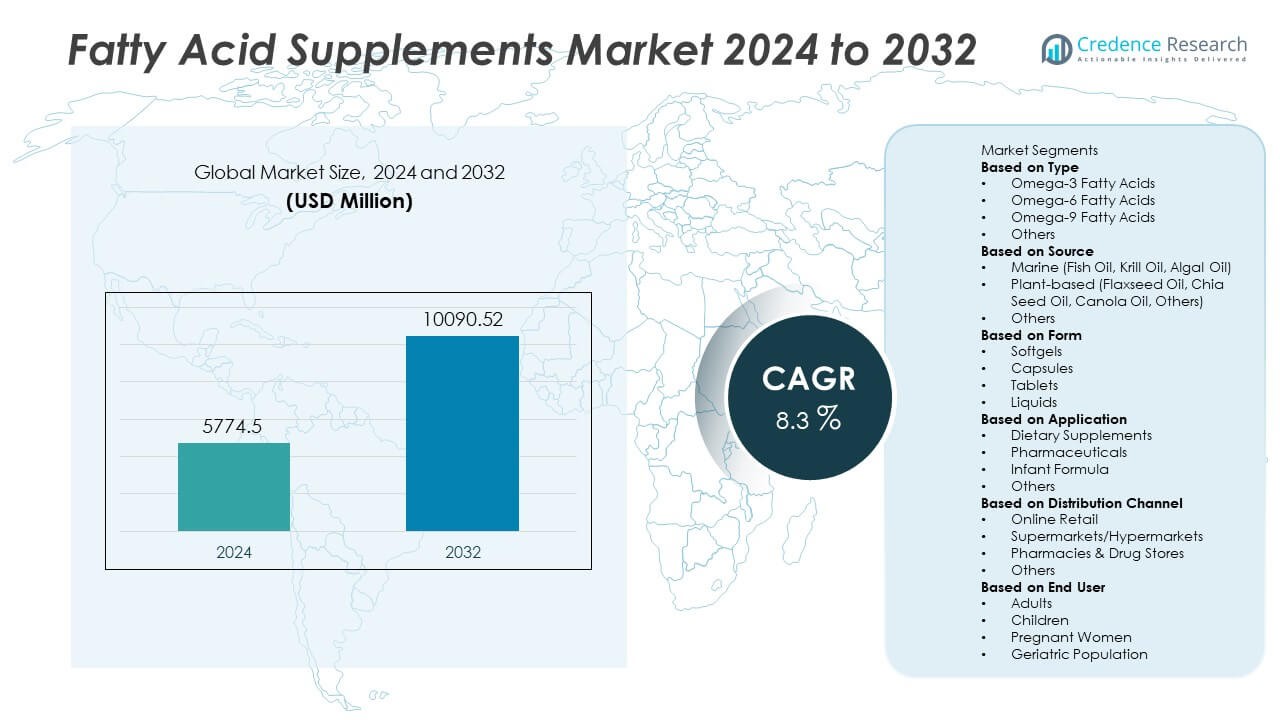

The fatty acid supplements market size was valued at USD 5,774.5 million in 2024 and is projected to reach USD 10,090.52 million by 2032, expanding at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fatty Acid Supplements Market Size 2024 |

USD 5,774.5 Million |

| Fatty Acid Supplements Market, CAGR |

8.3% |

| Fatty Acid Supplements Market Size 2032 |

USD 10,090.52 Million |

The fatty acid supplements market is led by major players including Glaxo Smith Kline plc, Epax AS, Croda Health Care, Koninklijke DSM N.V., BASF SE, Copeinca AS, Arista Industries, EFG Elbe Fetthandel GmbH, Axellus AS, and DMS. These companies focus on marine-based and plant-derived omega fatty acids, investing in sustainable sourcing and clinical-grade formulations to strengthen their global presence. North America dominated the market with 38% share in 2024, supported by high nutraceutical demand and advanced distribution networks. Europe followed with 31% share, driven by regulatory emphasis on health supplements and strong consumer awareness. Asia Pacific accounted for 23%, supported by growing health-conscious populations in China, India, and Japan. Latin America contributed 5%, while the Middle East and Africa together represented 3%, reflecting steady but smaller adoption levels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The fatty acid supplements market was valued at USD 5,774.5 million in 2024 and is projected to reach USD 10,090.52 million by 2032, growing at a CAGR of 8.3%.

- Rising consumer focus on preventive healthcare and the benefits of omega-3 and omega-6 fatty acids are driving demand, with omega-3 holding 46% share in 2024.

- Market trends highlight growing adoption of plant-based sources such as flaxseed and chia seed oils, alongside innovation in sustainable marine oils like algal-based products.

- Competition is shaped by key players including Glaxo Smith Kline, Epax AS, Croda Health Care, and DSM, who focus on sustainable sourcing, clinical research, and expanding product portfolios.

- North America led with 38% share in 2024, followed by Europe at 31% and Asia Pacific at 23%, while Latin America contributed 5% and the Middle East & Africa together accounted for 3%, reflecting steady but region-specific adoption.

Market Segmentation Analysis:

By Type

The omega-3 fatty acids segment dominated the fatty acid supplements market in 2024, holding 58% share. This dominance is driven by rising awareness of their cardiovascular, cognitive, and anti-inflammatory benefits. Demand is further supported by increasing consumption of fish oil and algal oil-based supplements, which cater to both traditional and vegetarian consumers. Omega-6 and omega-9 fatty acids hold smaller shares, largely used for metabolic and skin health, while the “others” category includes niche blends. The strong clinical evidence supporting omega-3 health benefits keeps this segment at the forefront of market growth.

- For instance, Epax AS produces more than 1,000 metric tons of high-concentrate omega-3 fatty acids annually, supplying EPA and DHA ingredients for cardiovascular health supplements worldwide.

By Source

Marine-based sources led the market in 2024 with 62% share, supported by high reliance on fish oil, krill oil, and algal oil for omega-3 production. Fish oil remains the most widely consumed due to its high EPA and DHA concentration, which are critical for cardiovascular and neurological health. Algal oil is gaining traction among vegetarian and vegan consumers, expanding adoption in nutraceuticals. Plant-based sources, such as flaxseed and chia seed oils, accounted for 30% share, offering sustainable and allergen-free alternatives. Marine dominance continues due to widespread clinical validation and availability.

- For instance, Corporación Pesquera Inca S.A.C., now owned by Cooke Inc., processes anchovies annually in Peru, producing fish oil rich in EPA and DHA for the global nutraceutical and animal feed sectors.

By Form

Softgels represented the largest form segment in 2024, accounting for 55% of the fatty acid supplements market. Their dominance stems from ease of consumption, better shelf stability, and effective encapsulation of fish and algal oils. Capsules and tablets together contributed around 30% share, serving consumers seeking standardized dosing and portability. Liquid formulations, with 15% share, are increasingly adopted in infant nutrition and senior care due to ease of ingestion and rapid absorption. The preference for softgels, combined with product innovation and flavored options, reinforces their position as the leading delivery format.

Key Growth Drivers

Rising Health Awareness and Preventive Healthcare

The fatty acid supplements market is strongly driven by growing consumer awareness of preventive healthcare. Increasing cases of cardiovascular disease, obesity, and cognitive decline are pushing consumers to adopt supplements rich in omega-3 fatty acids. Governments and healthcare organizations promote dietary supplementation to address nutritional gaps. This shift toward proactive wellness, combined with rising disposable incomes, fuels higher supplement consumption across demographics. The trend aligns with consumer preference for natural, science-backed solutions to maintain long-term health and reduce medical risks.

- For instance, GlaxoSmithKline’s Lovaza prescription omega-3 treatment generated hundreds of millions in U.S. sales before generics entered the market in 2013. Its FDA-approved use is for treating very high triglyceride levels, and it was never officially approved as a means of reducing the risk of heart attack or stroke.

Expansion of Plant-Based and Vegan Alternatives

Growing demand for plant-based products is a major driver of fatty acid supplements adoption. With a rise in vegan and vegetarian populations, plant-derived sources such as flaxseed, chia seed, and algal oil are gaining traction. Algal oil, in particular, provides a sustainable and vegan-friendly alternative to fish oil, appealing to eco-conscious consumers. Manufacturers are investing in clean-label and allergen-free formulations to meet this rising demand. The shift toward plant-based supplements expands market reach and ensures inclusivity for diverse dietary preferences.

- For instance, DSM’s life’sOMEGA algal oil portfolio delivers up to 500 mg of EPA and DHA per softgel, supplying both vegetarian and vegan consumers worldwide.

Aging Population and Nutritional Needs

The global aging population significantly boosts demand for fatty acid supplements. Older adults face higher risks of cardiovascular disease, arthritis, cognitive decline, and inflammatory conditions, making omega-3 and omega-6 supplements essential in daily diets. Supplementation is widely recommended to maintain joint health, memory, and heart function. With populations over 60 years expanding rapidly, particularly in Asia Pacific and Europe, manufacturers are targeting senior-specific formulations. This demographic shift ensures sustained demand, reinforcing fatty acid supplements as critical products in elderly healthcare and nutrition.

Key Trends and Opportunities

Growing Adoption of Functional Foods and Beverages

Fatty acids are increasingly incorporated into functional foods and beverages such as fortified dairy, juices, and bakery items. This trend allows consumers to intake supplements without relying solely on capsules or softgels. Food companies are partnering with supplement manufacturers to develop enriched products targeting heart and brain health. Rising demand for convenient, on-the-go nutrition supports this integration. The functional foods trend creates opportunities to expand beyond traditional supplement markets and reach wider consumer groups, particularly millennials and busy professionals.

- For instance, Koninklijke DSM supplies algal-based omega-3 ingredients used in more than 100 global fortified food and beverage brands, delivering EPA/DHA levels exceeding 300 mg per serving in dairy and juice applications.

Technological Advancements in Delivery Formats

Innovations in delivery formats are opening new opportunities for market growth. Companies are developing microencapsulation techniques, chewable gummies, flavored liquids, and time-release capsules to enhance bioavailability and consumer appeal. These advancements address issues like fishy aftertaste and improve compliance among children and seniors. Personalized nutrition technologies, such as DNA-based supplement recommendations, are also gaining attention. By offering diverse, consumer-friendly formats, manufacturers expand accessibility and strengthen brand differentiation in an increasingly competitive market.

- For instance, BASF offers highly concentrated omega-3 ingredients for pharmaceutical and nutritional applications, which are used by its customers in various finished products like softgels.

Key Challenges

High Costs and Supply Chain Constraints

One of the primary challenges in the fatty acid supplements market is the high cost of raw materials, particularly fish and algal oils. Overfishing, fluctuating marine yields, and sustainability concerns impact availability and pricing. Production and quality control for plant-based alternatives also add costs, limiting affordability for price-sensitive consumers. These supply chain challenges pose risks to consistent product availability, impacting overall market growth.

Regulatory and Quality Compliance Issues

The market faces strict regulatory requirements concerning product quality, safety, and labeling. Variations in international standards complicate compliance for manufacturers operating across multiple regions. Concerns about product adulteration, misleading claims, and inconsistent dosage accuracy affect consumer trust. Regulatory crackdowns on false marketing and health claims add additional compliance costs. Meeting these rigorous standards while maintaining affordability remains a critical challenge for industry players.

Regional Analysis

North America

North America dominated the fatty acid supplements market in 2024 with 35% share. The region’s growth is fueled by rising demand for omega-3 supplements, driven by high prevalence of cardiovascular diseases and obesity. The U.S. leads consumption, supported by strong healthcare awareness, government recommendations, and a wide range of fortified foods. Canada also contributes significantly, with growing preference for plant-based and algal oil supplements due to sustainability concerns. Increasing focus on preventive healthcare, high purchasing power, and the presence of global supplement manufacturers strengthen North America’s leadership in the fatty acid supplements market.

Europe

accounted for 29% share of the fatty acid supplements market in 2024, supported by rising awareness of nutrition and preventive health. Countries such as Germany, the United Kingdom, and France lead the market with strong demand for omega-3 and omega-6 supplements. Strict EU regulations promoting clean-label and sustainable formulations encourage adoption of plant-based and eco-friendly products. The region’s aging population drives higher consumption of supplements for cardiovascular and cognitive health. Additionally, expansion of fortified foods and beverages creates strong growth opportunities, positioning Europe as a leading hub for fatty acid supplement innovation.

Asia Pacific

Asia Pacific held 25% share of the fatty acid supplements market in 2024, emerging as the fastest-growing region. China, Japan, and India are key contributors, with rising disposable incomes and growing awareness of lifestyle-related diseases boosting supplement adoption. The region benefits from high demand for both marine-based oils and plant-derived alternatives, particularly algal and flaxseed oils. Rapid urbanization and increased health-consciousness among younger populations support expansion. Japan and South Korea lead in functional food integration, while India’s growing nutraceutical industry adds momentum. Asia Pacific’s scale and diverse consumer base make it a major growth engine for the market.

Latin America

Latin America captured 6% share of the fatty acid supplements market in 2024, led by Brazil and Mexico. Growing health awareness, urbanization, and rising prevalence of cardiovascular conditions are driving demand for omega-3 and plant-based supplements. Brazil’s expanding nutraceutical and dietary supplement industries strengthen regional growth, while Mexico shows steady adoption through fortified foods. Limited consumer awareness and affordability challenges still restrict wider penetration, but increasing availability through e-commerce platforms is enhancing access. Government initiatives promoting health and wellness further support expansion, positioning Latin America as a steadily growing market for fatty acid supplements.

Middle East and Africa

The Middle East and Africa together accounted for 5% share of the fatty acid supplements market in 2024, reflecting early-stage adoption but rising potential. The Gulf countries, particularly Saudi Arabia and the United Arab Emirates, are driving growth with strong demand for premium supplements targeting cardiovascular and general health. South Africa leads adoption in Africa, supported by rising urban health awareness and growing middle-class consumption. Limited affordability and distribution infrastructure remain challenges, but government-led nutrition initiatives and expanding retail channels are improving accessibility. The region is expected to witness gradual growth in supplement adoption.

Market Segmentations:

By Type

- Omega-3 Fatty Acids

- Omega-6 Fatty Acids

- Omega-9 Fatty Acids

- Others

By Source

- Marine (Fish Oil, Krill Oil, Algal Oil)

- Plant-based (Flaxseed Oil, Chia Seed Oil, Canola Oil, Others)

- Others

By Form

- Softgels

- Capsules

- Tablets

- Liquids

By Application

- Dietary Supplements

- Pharmaceuticals

- Infant Formula

- Others

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Pharmacies & Drug Stores

- Others

By End User

- Adults

- Children

- Pregnant Women

- Geriatric Population

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the fatty acid supplements market is shaped by leading players including Glaxo Smith Kline plc, Epax AS, Croda Health Care, Arista Industries, EFG Elbe Fetthandel GmbH, Koninklijke DSM N.V., Copeinca AS, Axellus AS, DMS, and BASF SE. These companies focus on expanding product portfolios through high-quality omega-3, omega-6, and plant-based fatty acid supplements targeting both nutraceutical and pharmaceutical applications. Strategies include heavy investment in research and development, particularly in sustainable sourcing such as algal oils, and advanced processing technologies that enhance bioavailability. Global players like BASF SE and DSM dominate with large-scale manufacturing and distribution networks, while specialized firms such as Epax AS and Croda Health Care strengthen their position through premium, clinical-grade formulations. Growing demand for clean-label, plant-based, and fortified supplements is driving innovation, pushing companies to differentiate through certifications, partnerships, and acquisitions. The competitive environment remains intense, with sustainability and product efficacy acting as key factors for market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Glaxo Smith Kline plc

- Epax AS

- Croda Health Care

- Arista Industries

- EFG Elbe Fetthandel GmbH

- Koninklijke DSM N.V.

- Copeinca AS

- Axellus AS

- DMS

- BASF SE

Recent Developments

- In September 2025, BASF completed the sale of its Food & Health Performance Ingredients business, including its omega-3 ingredient operations and associated assets (300 employees, Illertissen manufacturing) to LDC.

- In April 2025, DSM (dsm-firmenich) showcased its Healthy Longevity platform at Vitafoods Europe, combining its life’sOMEGA portfolio with anti-aging and cellular health research.

- In 2025, Croda International (Croda Health Care arm) introduced new concentrated omega-3 formulations with improved bioavailability for infant nutrition and clinical applications.

- In July 2024, DSM introduced its 3C process technology, capable of producing omega-3 concentrates with up to 85% EPA + DHA, customizable for different application needs.

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Form, Application, Distribution Channel, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fatty acid supplements will rise with increasing awareness of cardiovascular health benefits.

- Omega-3 supplements will continue leading the market due to strong clinical validation.

- Plant-based fatty acid sources will grow as consumer preference shifts toward vegan options.

- Algal oil supplements will gain traction as a sustainable marine alternative.

- North America and Europe will remain key markets, while Asia Pacific shows fastest growth.

- E-commerce distribution will expand, making supplements more accessible to consumers.

- Personalized nutrition trends will drive tailored fatty acid supplement formulations.

- Clinical research linking fatty acids to brain and eye health will boost adoption.

- Regulatory support for clean-label and eco-friendly products will shape innovation.

- Strategic collaborations between supplement companies and healthcare providers will strengthen market reach.