Market Overview:

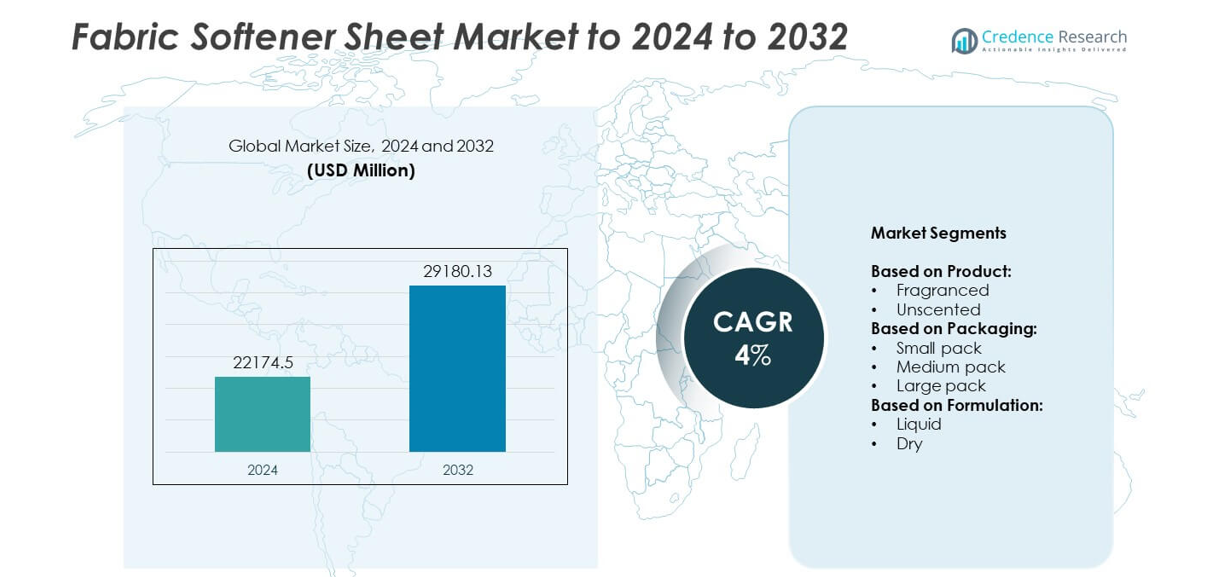

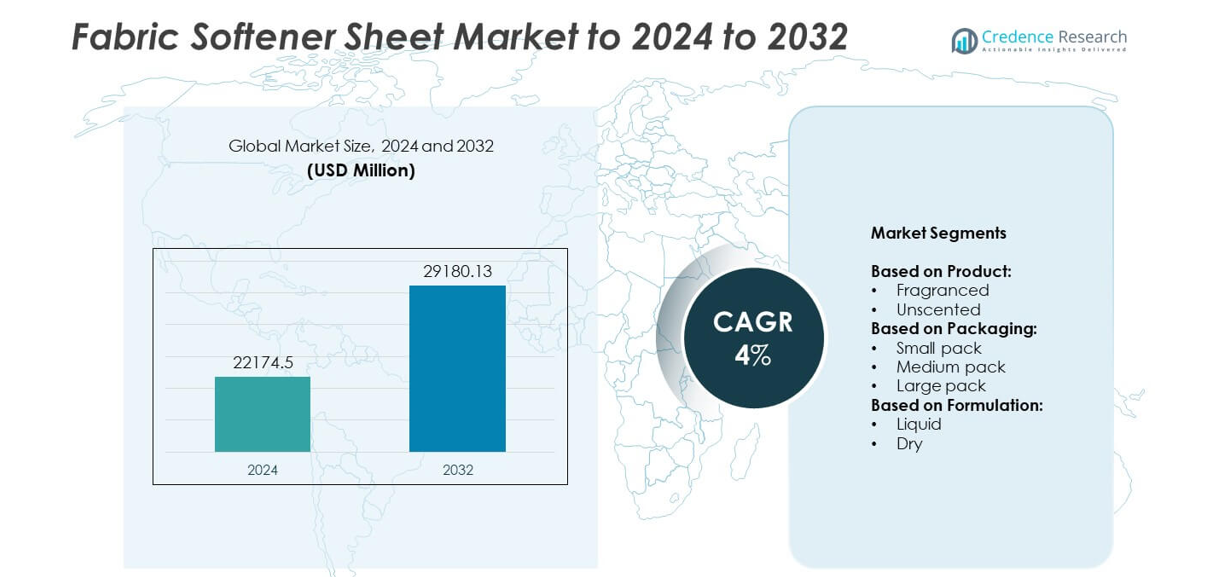

The Fabric Softener Sheet Market size was valued at USD 22,174.5 million in 2024 and is anticipated to reach USD 29,180.13 million by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fabric Softener Sheet Market Size 2024 |

USD 22,174.5 million |

| Fabric Softener Sheet Market, CAGR |

4% |

| Fabric Softener Sheet Market Size 2032 |

USD 29,180.13 million |

The fabric softener sheet market is highly competitive, with leading players such as Procter & Gamble, Henkel AG & Co. KGaA, Unilever, Reckitt Benckiser Group plc, Colgate-Palmolive Company, The Clorox Company, S. C. Johnson & Son, Inc., and Kimberly-Clark Corporation driving market growth through innovation, product diversification, and strong distribution networks. These companies emphasize sustainable and fragranced product lines to meet evolving consumer preferences. Regionally, North America dominated the market in 2024 with a 35% share, supported by high dryer penetration and strong retail infrastructure, while Europe followed with a 28% share driven by eco-friendly product adoption. Asia Pacific accounted for 22%, emerging as the fastest-growing region due to urbanization, rising disposable incomes, and increasing adoption of modern laundry practices.

Market Insights

- The fabric softener sheet market was valued at USD 22,174.5 million in 2024 and is expected to reach USD 29,180.13 million by 2032, growing at a CAGR of 4%.

- Rising household laundry consumption and growing preference for convenient, fragranced laundry products are driving consistent market growth.

- Eco-friendly innovations, biodegradable formulations, and premium fragranced variants are emerging as strong trends influencing consumer choices.

- The market is competitive with global players focusing on sustainable product launches, fragrance diversity, and stronger e-commerce presence to retain market share.

- North America led the market with 35% share in 2024, followed by Europe at 28% and Asia Pacific at 22%, while the fragranced product segment dominated with over 65% share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The fragranced segment dominated the fabric softener sheet market in 2024, capturing over 65% of the share. Consumer preference for pleasant and long-lasting scents drives its strong adoption across households, especially in North America and Europe. Fragranced sheets offer freshness retention and odor control, appealing to families seeking enhanced laundry experiences. Growing product innovations with natural and hypoallergenic scents also strengthen this segment. In contrast, unscented variants hold a smaller share, preferred mainly by consumers with sensitive skin or allergies, reflecting a niche but steadily expanding demand base.

- For instance, Mrs. Meyer’s Clean Day sells scented dryer sheets in 80-count packs (Basil, Honeysuckle, others).

By Packaging

The medium pack segment led the market in 2024 with more than 45% share, as it balances affordability and convenience for regular household use. Medium-sized packs cater to families that require cost-effective laundry solutions without bulk storage concerns. Retail chains and e-commerce platforms have boosted sales through multipack promotions, making this segment a staple choice. Small packs remain popular in emerging markets due to lower price points, while large packs are gaining traction among bulk buyers and institutional users seeking reduced per-sheet costs.

- For instance, Target (up&up) lists 250-count Fresh Linen dryer sheets as an everyday size.

By Formulation

The dry segment accounted for the largest share of over 70% in 2024, owing to its ease of use, long shelf life, and compatibility with modern laundry systems. Dry sheets are lightweight, portable, and convenient for consumers, making them the preferred formulation in developed regions. Their wide availability across supermarkets and online channels also supports their market leadership. Liquid variants, though smaller in share, are expanding due to rising demand in premium categories, where they are promoted for deeper fabric care, enhanced softness, and improved fragrance dispersion in high-capacity laundry loads.

Key Growth Drivers

Rising Household Laundry Consumption

Increasing global demand for laundry products is a key driver of the fabric softener sheet market. Growing urbanization, busy lifestyles, and preference for convenient laundry solutions fuel higher usage of softener sheets. Consumers value ease of use, portability, and added freshness, particularly in regions with high adoption of automatic washing machines. Expanding middle-class households in Asia-Pacific are also contributing to higher penetration rates. This demand growth, supported by changing laundry habits and rising disposable incomes, secures fabric softener sheets as a staple in modern households.

- For instance, in 2023, Whirlpool Corporation operated 55 manufacturing and technology research centers and reported approximately $19 billion in annual sales globally.

Product Innovation and Fragrance Diversity

Innovation in fragrance delivery and sheet composition strongly drives market expansion. Manufacturers are investing in advanced formulations that retain freshness for longer periods and reduce static cling. The introduction of hypoallergenic and eco-friendly fragrances caters to sensitive skin consumers and sustainability-focused buyers. For instance, natural scents with essential oils are gaining popularity in premium product lines. This growing product variety appeals to diverse consumer preferences while reinforcing brand differentiation, making innovation in fragrance profiles a vital factor in sustaining competitive advantage.

- For instance, Costco (Kirkland Signature) sells 2×250 dryer-sheet packs (500 sheets total) with 6.4″×9″ sheet size.

Expansion of Retail and E-commerce Channels

The rapid growth of organized retail and digital platforms has significantly boosted accessibility of fabric softener sheets. Supermarkets and hypermarkets provide extensive product visibility, while e-commerce channels enable consumers to explore a wider range with discounts and subscription options. Online platforms have increased market penetration in emerging economies where retail infrastructure is less developed. Promotional campaigns and bundled offers drive impulse purchases, particularly in medium and small pack sizes. This widespread availability across both offline and online channels enhances product reach, making distribution expansion a core growth driver.

Key Trends & Opportunities

Shift Toward Eco-friendly and Sustainable Products

Sustainability has emerged as a strong trend, shaping consumer choices in fabric softener sheets. Eco-conscious buyers are increasingly demanding biodegradable, non-toxic, and recyclable packaging options. Brands that emphasize reduced environmental impact through plant-based formulations are gaining traction, particularly in Europe and North America. This trend creates opportunities for manufacturers to capture loyalty among green-focused consumers. Companies developing eco-certified products not only expand their appeal but also align with evolving regulatory standards on sustainable household products, positioning themselves for long-term competitive growth in the market.

- For instance, Seventh Generation Fabric Softener Sheets are 97% plant-based and USDA Certified Biobased 97%. They are available in various package counts, including 80-count boxes, and different versions, such as Free & Clear and Fresh Lavender Scent

Premiumization and Scent Customization

Premiumization is creating new opportunities in the fabric softener sheet market. Consumers are willing to pay more for advanced features such as longer-lasting freshness, anti-wrinkle effects, and designer-inspired fragrances. Personalized scent options and subscription models offering curated fragrance assortments are becoming popular, especially among younger urban buyers. This customization trend drives higher customer engagement and repeat purchases. Premium product positioning also enables companies to capture higher margins, while differentiating their offerings in a competitive landscape dominated by established household care brands.

- For instance, Procter & Gamble’s Downy Unstopables scent beads are marketed as an in-wash scent booster designed to provide long-lasting freshness, with the company claiming “up to 12 weeks” of freshness out of storage.

Key Challenges

Rising Competition from Alternatives

A key challenge in the market is increasing competition from alternative fabric care products such as liquid fabric softeners, dryer balls, and eco-friendly sprays. Many of these alternatives claim longer-lasting effects, cost efficiency, or reduced environmental impact, which appeal to sustainability-driven consumers. This competitive pressure forces manufacturers of fabric softener sheets to continuously innovate and justify their value proposition. Without differentiation, fabric softener sheets risk losing share to alternatives that address similar needs with greater environmental or performance-based advantages.

Concerns Over Chemical Safety and Allergies

Chemical formulations in fabric softener sheets raise concerns regarding skin sensitivity and respiratory allergies. Consumers with health-conscious preferences often avoid fragranced products containing synthetic compounds, limiting market adoption in sensitive demographics. Increasing regulatory scrutiny on volatile organic compounds (VOCs) and allergen-causing chemicals further adds compliance costs for manufacturers. Negative publicity regarding potential health risks also challenges brand perception. Addressing these concerns with hypoallergenic, dermatologically tested, and natural ingredient-based sheets will be essential to maintain trust and expand reach among cautious consumer segments.

Regional Analysis

North America

North America held the largest share of the fabric softener sheet market in 2024, accounting for around 35%. High household penetration of dryers and strong consumer preference for fragranced laundry products support demand. The U.S. dominates regional consumption, driven by advanced retail networks, brand loyalty, and frequent product innovations. Rising adoption of eco-friendly and hypoallergenic sheets further boosts market growth. Canada contributes steadily with increasing household use, while Mexico shows growth potential due to expanding middle-class consumers. The region benefits from strong marketing campaigns and premium product launches, reinforcing its leadership in the global market.

Europe

Europe captured nearly 28% of the global fabric softener sheet market in 2024, supported by strong adoption in Western European countries. Consumer preference for sustainable and eco-friendly formulations drives product demand, particularly in Germany, the U.K., and France. Stringent environmental regulations encourage manufacturers to develop biodegradable and recyclable sheet options. Growing demand for premium fragranced variants also supports sales in urban households. Eastern Europe is gradually expanding, driven by rising disposable incomes and retail penetration. The region’s focus on sustainable consumption patterns and regulatory compliance makes it a critical market for innovation-led growth.

Asia Pacific

Asia Pacific accounted for approximately 22% of the fabric softener sheet market in 2024 and is expected to grow rapidly during the forecast period. Rising urbanization, expanding middle-class populations, and increasing adoption of automatic washing machines drive growth across China, Japan, India, and Southeast Asia. Consumers in the region favor affordable medium and small pack sizes, making them dominant in household purchases. International and regional brands are investing in distribution expansion through both modern retail and e-commerce platforms. The growing influence of eco-conscious younger consumers presents opportunities for sustainable product innovation in the market.

Latin America

Latin America held about 8% of the global market share in 2024, with Brazil and Mexico leading regional demand. Urban households increasingly prefer fabric softener sheets for their convenience and affordability. The presence of multinational laundry care brands and growing retail penetration supports steady adoption. Consumers show strong interest in fragranced variants, which dominate sales. Rising disposable incomes and lifestyle changes encourage higher spending on household care products. However, the market faces challenges from price-sensitive buyers in rural areas. E-commerce growth and promotional campaigns are helping to expand fabric softener sheet penetration across the region.

Middle East and Africa

The Middle East and Africa accounted for around 7% of the global market share in 2024, reflecting gradual adoption across urban centers. South Africa, Saudi Arabia, and the UAE represent the largest markets due to higher disposable incomes and preference for premium household care products. Consumers in these countries are adopting fabric softener sheets for their convenience and fragrance appeal. However, limited dryer penetration and reliance on traditional laundry methods restrict growth in several parts of the region. Expanding modern retail formats and rising awareness of premium laundry care are expected to create opportunities for gradual market expansion.

Market Segmentations:

By Product:

By Packaging:

- Small pack

- Medium pack

- Large pack

By Formulation:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fabric softener sheet market is shaped by leading global and regional players, including Kimberly-Clark Corporation, Church & Dwight Co., Inc., Attitude Living Inc., Procter & Gamble (P&G), Mrs. Meyer’s Clean Day, Colgate-Palmolive Company, Unilever, Seventh Generation Inc., Reckitt Benckiser Group plc, The Clorox Company, S. C. Johnson & Son, Inc., Suavitel, Henkel AG & Co. KGaA, Ecover Belgium NV, and GreenShield Organic, LLC. These companies compete on the basis of fragrance innovation, eco-friendly formulations, and sustainable packaging solutions. Product differentiation remains a core strategy, with many brands introducing hypoallergenic and plant-based options to attract health-conscious and environmentally aware consumers. Strong distribution networks across supermarkets, hypermarkets, and e-commerce platforms enhance their reach, while promotional activities and bundled offerings help strengthen brand visibility. Investments in research and development are driving premiumization, with advanced formulations providing longer-lasting freshness and enhanced softness. Strategic acquisitions and partnerships further consolidate market positions in this competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kimberly-Clark Corporation

- Church & Dwight Co., Inc.

- Attitude Living Inc.

- Procter & Gamble (P&G)

- Meyer’s Clean Day

- Colgate-Palmolive Company

- Unilever

- Seventh Generation Inc.

- Reckitt Benckiser Group plc

- The Clorox Company

- C. Johnson & Son, Inc.

- Suavitel

- Henkel AG & Co. KGaA

- Ecover Belgium NV

- GreenShield Organic, LLC

Recent Developments

- In 2024, P&G introduced Tide Evo Tiles, a waterless detergent square, showcasing a commitment to sustainability and waste reduction that influences its broader laundry care strategy.

- In 2023, Unilever launched laundry sheets under its Dirt Is Good (Persil) brand in the UK, following an earlier launch in the Netherlands with the Robijn brand, marking the first time these ultra-convenient, sustainable formats were brought to the mass market

- In 2023, Colgate-Palmolive introduced Soupline Softening Tablets, a water-free fabric softener in tablet form.

Report Coverage

The research report offers an in-depth analysis based on Product, Packaging, Formulation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The fabric softener sheet market will expand steadily with rising global laundry consumption.

- Fragranced sheets will continue dominating due to strong consumer preference for freshness and scent.

- Eco-friendly and biodegradable sheets will gain momentum in developed and regulated markets.

- E-commerce platforms will play a larger role in product accessibility and consumer engagement.

- Premium product lines with longer-lasting fragrance will capture higher-margin opportunities.

- Small and medium pack sizes will remain popular in price-sensitive emerging markets.

- Dry formulations will maintain leadership, while liquid variants grow in niche premium segments.

- North America will retain dominance, while Asia Pacific emerges as the fastest-growing market.

- Competition from alternative fabric care products will drive continuous innovation in sheet formulations.

- Manufacturers will focus on sustainable packaging and allergen-free products to strengthen consumer trust.