Market Overview:

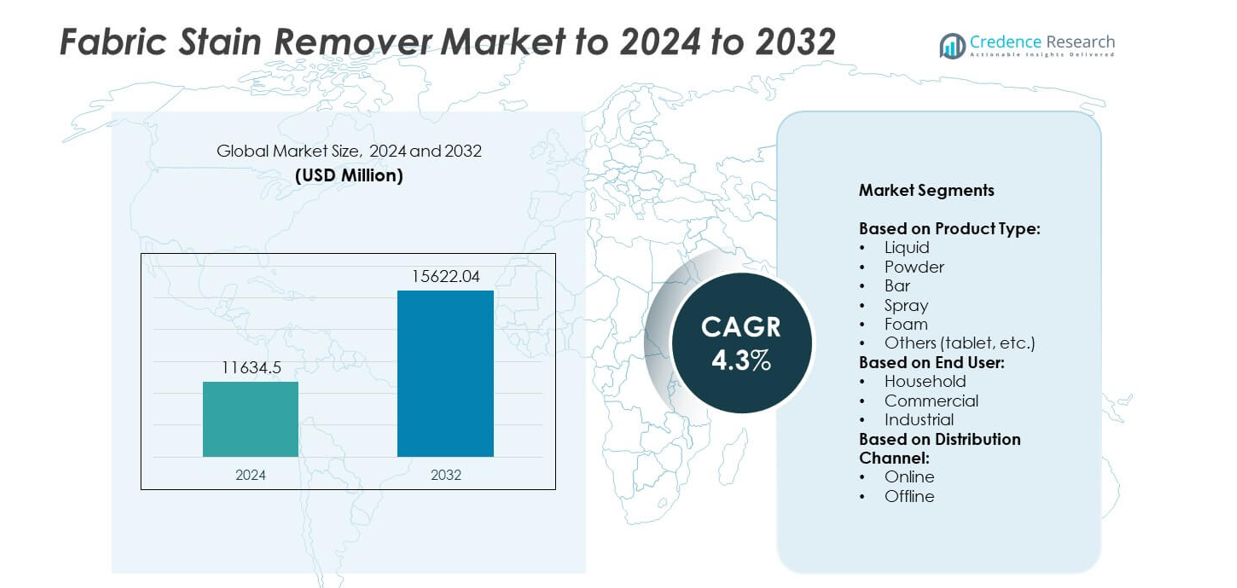

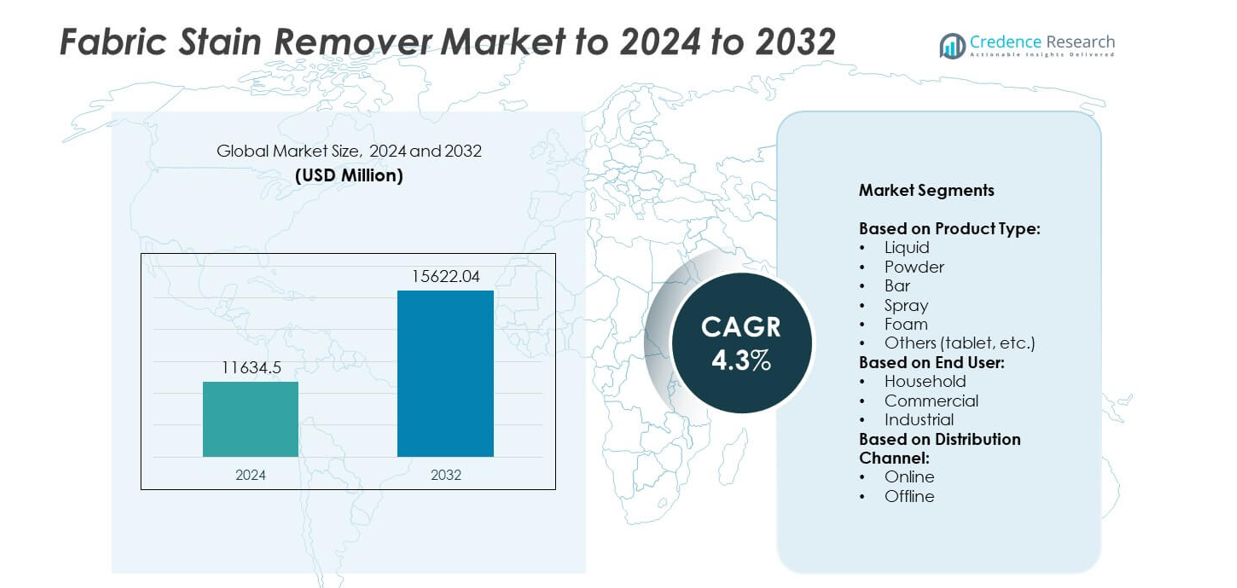

Fabric Stain Remover Market size was valued USD 11,634.5 million in 2024 and is anticipated to reach USD 15,622.04 million by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fabric Stain Remover Market Size 2024 |

USD 11,634.5 million |

| Fabric Stain Remover Market, CAGR |

4.3% |

| Fabric Stain Remover Market Size 2032 |

USD 15,622.04 million |

The fabric stain remover market is highly competitive, with leading players including Dr Beckmann, Amway, Buncha Farmers, Reckitt Benckiser, Attitude, The Clorox Company, Unilever, Biokleen, C. Johnson, Church & Dwight, Henkel, Bio-Tex, ACE Gentle, Bissell, and Procter & Gamble. These companies focus on product innovation, eco-friendly formulations, and strong retail and online distribution networks to strengthen their market presence. Regional performance highlights North America as the leading market in 2024, capturing 32% share, driven by high household demand and advanced retail penetration. Europe followed with 27% share, supported by regulatory push for sustainable products, while Asia Pacific accounted for 24%, emerging as the fastest-growing region due to rising disposable incomes and expanding urban populations.

Market Insights

- The fabric stain remover market was valued at USD 11,634.5 million in 2024 and is projected to reach USD 15,622.04 million by 2032, growing at a CAGR of 4.3%.

- Rising household demand for convenient solutions such as liquid and spray formats is fueling growth, with households accounting for over 60% of end-user share in 2024.

- Key trends include the shift toward eco-friendly, biodegradable formulations and rapid growth in online retailing, particularly in urban markets.

- The competitive landscape is defined by global and regional players focusing on product innovation, sustainable solutions, and aggressive marketing to strengthen brand presence.

- Regionally, North America led with 32% share in 2024, followed by Europe at 27% and Asia Pacific at 24%, while Latin America and the Middle East & Africa together accounted for 17%, highlighting strong growth potential in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The liquid segment dominated the fabric stain remover market in 2024, accounting for over 40% of the total share. Its leadership is driven by ease of application, quick dissolving capability, and strong penetration into fibers, making it the most preferred choice among consumers. Powder variants follow closely, supported by affordability and effectiveness in bulk washing, while sprays and foams are gaining popularity for spot treatments and portability. Bars and tablets remain niche, mainly serving cost-conscious or travel-focused buyers. Growing demand for convenient, multipurpose cleaners continues to strengthen the liquid format’s dominance.

- For instance, Walmart operates more than 10,750 stores and clubs across 19 countries, supporting strong offline availability.

By End User

Households represented the largest end-user segment in 2024, holding more than 60% of the market share. The dominance is fueled by rising consumer focus on hygiene, frequent laundry use, and increasing disposable incomes that boost demand for premium stain removers. Commercial users, including laundromats, hospitality, and cleaning services, also show strong adoption due to bulk requirements. Industrial demand is comparatively smaller but growing, driven by the textile and healthcare sectors where stain management is critical. Household preference for easy-to-use liquid and spray products keeps this segment at the forefront.

- For instance, Procter & Gamble recalled approximately 8.2 million bags of detergent pods in the U.S., manufactured between September 2023 and February 2024, due to a packaging defect.

By Distribution Channel

Offline channels led the fabric stain remover market in 2024 with over 65% market share. Supermarkets, hypermarkets, and retail stores dominate distribution, offering strong brand visibility and consumer trust through physical availability. Promotional campaigns, bundled offers, and established supply chains further strengthen this segment’s position. Online channels are expanding rapidly, supported by e-commerce penetration, subscription services, and consumer preference for doorstep delivery. Growth is especially strong in urban areas where digital adoption is high. Despite online growth, offline stores continue to lead due to immediate product access and broader consumer reach.

Key Growth Drivers

Rising Household Demand for Convenient Solutions

The growing need for effective and easy-to-use cleaning products is the primary driver of the fabric stain remover market. Households prefer liquid and spray-based solutions due to their convenience and ability to handle multiple types of stains quickly. Increasing disposable income, coupled with consumer awareness of hygiene and fabric care, further fuels product demand. Expanding urban populations and busier lifestyles reinforce the preference for ready-to-use stain removers, making this the key growth driver of the market during the forecast period.

- For instance, Diversey serves over 85,000 customers in 80+ countries, reflecting broad commercial adoption.

Expansion of Commercial and Hospitality Sectors

The commercial and hospitality sectors are boosting market growth with consistent bulk requirements for fabric care. Hotels, restaurants, and laundromats rely on large quantities of stain removers to maintain cleanliness and quality standards. The rise of professional laundry services and hospitality industry expansion in urban areas strengthens demand. As consumer expectations for hygiene rise, these industries continue to invest in effective stain removal solutions, positioning commercial end-use as a major growth enabler in the market.

- For instance, Ecolab has reported internal tests from 2021 showing its Liquid Laundry Built Detergent achieved 22–49% higher stain removal for specific soil types compared to Tide 2X, and its programs help commercial laundries target rewash rates within the 3–5% industry average.

Innovation in Product Formulations

Innovation in eco-friendly and multifunctional stain removers is driving significant market expansion. Manufacturers are introducing biodegradable and chemical-free solutions to cater to sustainability-conscious consumers. Additionally, advancements in enzyme-based formulations enhance stain removal efficiency across different fabric types without damaging materials. Multipurpose products that combine stain removal with fabric softening or fragrance boost consumer adoption. These innovations not only differentiate brands but also increase customer loyalty, reinforcing growth opportunities in competitive markets where innovation directly impacts purchasing behavior.

Key Trends & Opportunities

Growth of Online Retailing

The rapid expansion of online distribution presents a strong opportunity for market players. E-commerce platforms provide consumers with easy access to a wide range of stain removers, supported by promotional offers and subscription models. Online sales also enable brands to target younger, tech-savvy demographics who value convenience. Global e-commerce penetration in emerging markets further accelerates this trend. As digital platforms grow in trust and reach, online retailing becomes a key trend shaping future distribution strategies for stain remover companies worldwide.

- For instance, Church & Dwight said online made up 21.4% of 2024 consumer sales, evidencing strong e-commerce traction.

Sustainability and Eco-Friendly Products

Eco-conscious consumers are pushing manufacturers toward developing sustainable stain remover solutions. Bio-based, non-toxic, and recyclable packaging options are gaining traction across developed and emerging regions. Brands emphasizing eco-label certifications and green product claims attract environmentally aware customers. This trend aligns with stricter environmental regulations that encourage the adoption of chemical-free cleaning solutions. Companies investing in sustainable innovation not only gain a competitive edge but also build long-term loyalty among consumers, making sustainability a vital opportunity in the market.

- For instance, Seventh Generation launched a new ultra-concentrated laundry detergent line with its EasyDose bottles, which use 60% less plastic and are 75% lighter than its standard 100 fl oz bottles.

Key Challenges

Intense Market Competition

The market faces strong competitive pressures from established brands and local manufacturers. Price wars, aggressive promotions, and frequent product launches make differentiation difficult. Consumers often switch between brands based on discounts and availability, creating challenges for long-term loyalty. Global leaders must continuously innovate to maintain an edge, while smaller players struggle with scaling operations. This intense competition limits profit margins and increases the need for significant investments in marketing, product development, and distribution networks to remain competitive.

Health and Environmental Concerns

Concerns about chemical ingredients in stain removers present a growing challenge for the industry. Certain formulations contain harsh substances that may cause skin irritation or environmental harm when disposed of improperly. Rising consumer awareness of these risks is pressuring companies to reformulate products with safer, eco-friendly alternatives. Compliance with tightening regulations adds further complexity and costs to production. Manufacturers unable to adapt face reputational risks and reduced market share, making health and environmental issues a critical barrier to sustained growth.

Regional Analysis

North America

North America held the largest share of the fabric stain remover market in 2024, accounting for around 32%. Growth is driven by high household consumption, strong preference for premium cleaning products, and advanced retail infrastructure. The U.S. leads due to rising demand for liquid and spray formulations, supported by innovations in eco-friendly solutions. Canada contributes with increasing adoption of sustainable and biodegradable products. The region benefits from a strong presence of global brands, high consumer awareness, and consistent demand from the hospitality sector. Continued innovation and marketing investments sustain North America’s leadership in this market.

Europe

Europe accounted for approximately 27% of the market share in 2024, with strong demand for eco-friendly and bio-based fabric stain removers. Stringent environmental regulations and consumer preference for sustainable products drive innovation and adoption across the region. Germany, the UK, and France lead the market due to advanced retail penetration and high awareness of chemical-free products. The presence of established multinational players also ensures strong product availability. Growth is further supported by rising e-commerce sales and demand from the hospitality sector. Europe remains a key region emphasizing sustainability and regulatory compliance in product development.

Asia Pacific

Asia Pacific captured around 24% of the fabric stain remover market in 2024, emerging as one of the fastest-growing regions. Growth is fueled by rising disposable incomes, urbanization, and increasing household laundry demand across China, India, and Southeast Asia. Expanding middle-class populations with growing awareness of hygiene boost consumption. Regional players are also entering the market with affordable and localized formulations, driving competition. Online sales channels are expanding rapidly, particularly in urban areas. The region’s rapid adoption of convenient and affordable stain remover products ensures its strong growth trajectory through the forecast period.

Latin America

Latin America accounted for nearly 10% of the global fabric stain remover market share in 2024. Brazil and Mexico dominate the region due to high population density, growing laundry care habits, and strong retail distribution. Household consumption is the key driver, supported by rising demand for cost-effective powder and liquid stain removers. Growth in commercial laundry services and hospitality also contributes to regional adoption. However, economic volatility and price sensitivity influence consumer choices. Despite challenges, expanding e-commerce platforms and increasing awareness of hygiene continue to create opportunities for market expansion across Latin America.

Middle East and Africa

The Middle East and Africa represented about 7% of the fabric stain remover market share in 2024. Rising urbanization, growing disposable incomes, and increasing awareness of hygiene practices are driving demand. South Africa and the Gulf Cooperation Council countries are leading markets due to higher household consumption and expanding retail presence. Demand for liquid and powder formats is particularly strong, with sprays gaining traction among younger consumers. However, limited product affordability and infrastructure constraints challenge growth in certain areas. Expanding modern retail channels and rising hospitality investments are expected to create growth opportunities in the region.

Market Segmentations:

By Product Type:

- Liquid

- Powder

- Bar

- Spray

- Foam

- Others (tablet, etc.)

By End User:

- Household

- Commercial

- Industrial

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The fabric stain remover market is shaped by leading companies such as Dr Beckmann, Amway, Buncha Farmers, Reckitt Benckiser, Attitude, The Clorox Company, Unilever, Biokleen, C. Johnson, Church & Dwight, Henkel, Bio-Tex, ACE Gentle, Bissell, and Procter & Gamble. Competition is intense, with global and regional players focusing on expanding product portfolios, enhancing formulations, and investing in eco-friendly innovations. Brands emphasize sustainability, offering biodegradable and enzyme-based products to meet growing consumer demand for safe and effective solutions. Distribution strength across both offline and online channels is a major differentiator, as companies leverage supermarkets, specialty stores, and digital platforms to reach wider audiences. Aggressive marketing, frequent product launches, and strategic collaborations also define the competitive dynamics, ensuring strong market visibility. The landscape is further influenced by continuous investment in research and development, where companies seek to create multipurpose products that address diverse stain types while aligning with stricter regulatory standards worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dr Beckmann

- Amway

- Buncha Farmers

- Reckitt Benckiser

- Attitude

- The Clorox Company

- Unilever

- Biokleen

- Johnson

- Church & Dwight

- Henkel

- Bio-Tex

- ACE Gentle

- Bissell

- Procter & Gamble

Recent Developments

- In 2024, Clorox continued to offer its popular Clorox 2 for Colors stain remover and laundry additive, emphasizing its effectiveness in brightening colors while removing stains.

- In 2024, Henkel Launched a new line of Persil stain removers in Europe with deep-cleaning enzymes.

- In 2022, Unilever Uganda introduced a new & improved OMO hand cleansing powder, which is inexpensive, convenient, and consumer friendly. It provides unparalleled stain removal with a pleasant scent and illuminated clothing.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The fabric stain remover market will continue to grow steadily with consistent household demand.

- Liquid and spray formats will maintain dominance due to convenience and quick application.

- Eco-friendly and biodegradable formulations will gain stronger adoption across developed and emerging regions.

- Online sales channels will expand rapidly, supported by digital platforms and subscription models.

- Commercial and hospitality sectors will drive bulk demand for effective stain removal solutions.

- Innovation in multifunctional products will boost consumer preference and brand loyalty.

- Regulatory compliance will shape product development toward safer and sustainable solutions.

- Intense competition will push companies to invest more in marketing and product innovation.

- Emerging markets in Asia Pacific and Latin America will witness faster consumption growth.

- Increasing focus on hygiene and fabric care will ensure long-term demand sustainability.