Market Overview

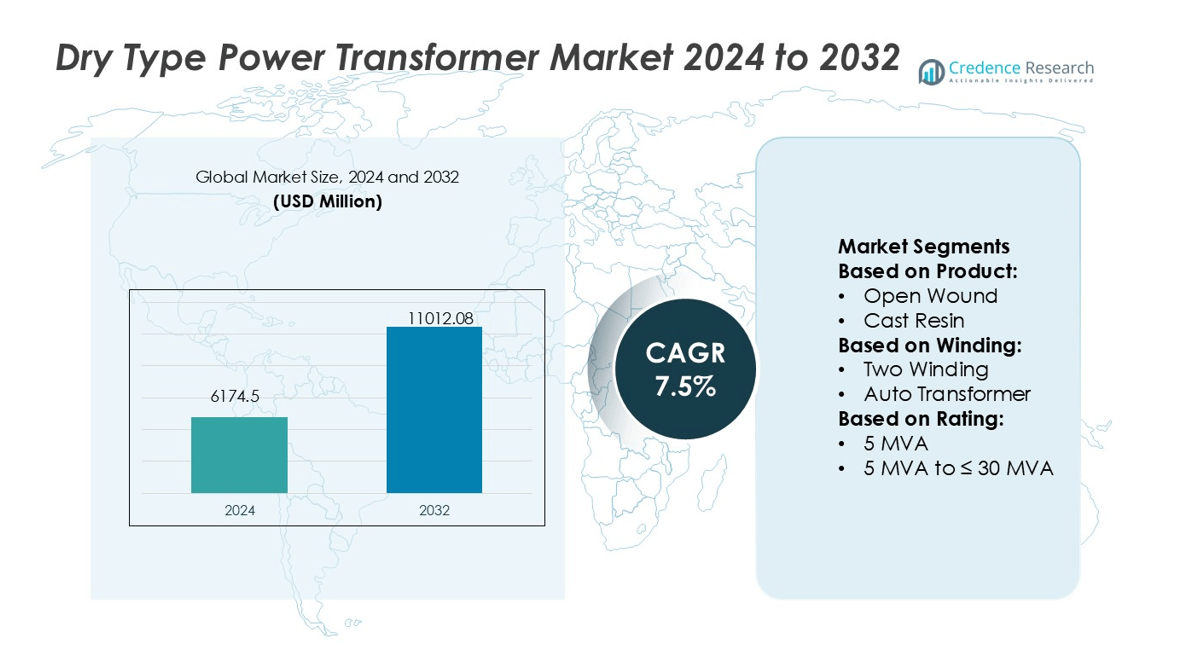

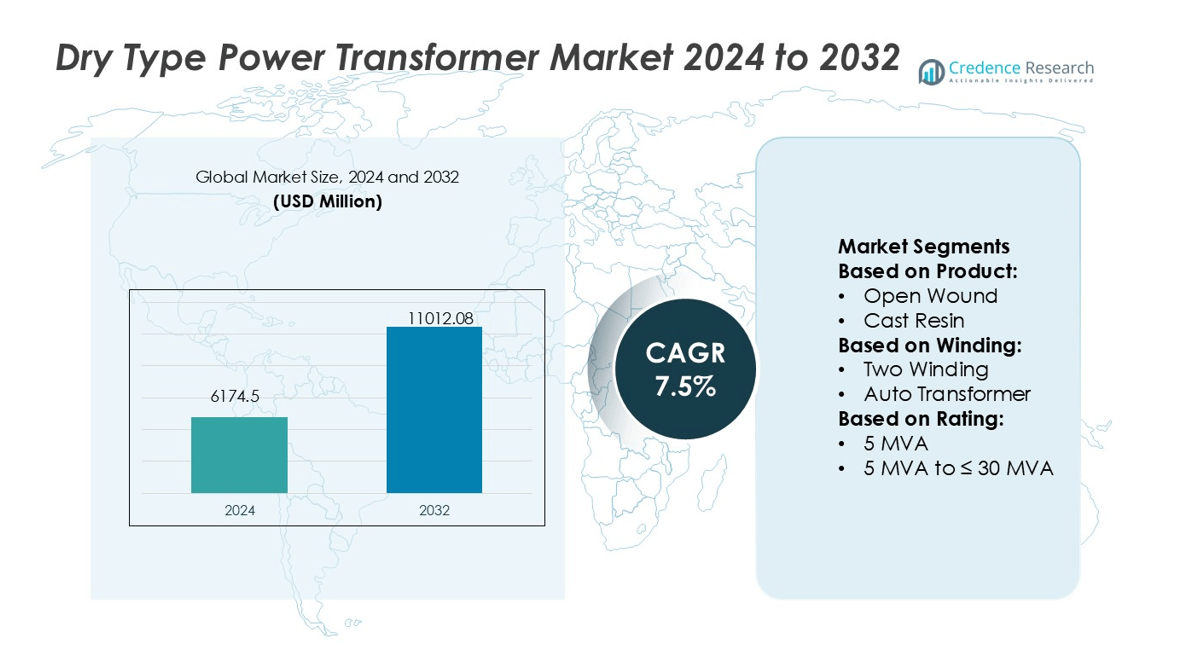

Dry Type Power Transformer Market size was valued USD 6174.5 million in 2024 and is anticipated to reach USD 11012.08 million by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry Type Power Transformer Market Size 2024 |

USD 6174.5 million |

| Dry Type Power Transformer Market, CAGR |

7.5% |

| Dry Type Power Transformer Market Size 2032 |

USD 11012.08 million |

The Dry Type Power Transformer Market is driven by key players such as ABB, Schneider Electric, Hitachi Energy Ltd., General Electric, Eaton, CG Power & Industrial Solutions Ltd., Crompton Greaves Consumer Electricals Limited, Bharat Heavy Electricals Limited (BHEL), Kirloskar Electric Company Limited, and Easun Reyrolle Limited. These companies emphasize technological advancement, digital monitoring integration, and eco-efficient transformer designs to enhance grid reliability and operational safety. Strategic partnerships with utilities and industrial clients further strengthen their market positions through customized energy solutions and sustainable manufacturing practices. Asia-Pacific leads the global market with a 34% share, supported by rapid industrialization, expansion of smart grid infrastructure, and significant government investments in renewable energy and power distribution systems, making it the most dynamic region in this industry.

Market Insights

- The Dry Type Power Transformer Market was valued at USD 6174.5 million in 2024 and is projected to reach USD 11012.08 million by 2032, growing at a CAGR of 7.5%.

- Market growth is driven by rising demand for energy-efficient transformers, digital monitoring integration, and expansion of industrial and renewable energy infrastructures.

- A key trend includes the adoption of smart and eco-efficient transformers equipped with IoT-based performance tracking and predictive maintenance systems.

- Competitive strategies focus on R&D investments, sustainable manufacturing, and partnerships between manufacturers and utilities to meet modern grid reliability needs.

- Asia-Pacific dominates the global market with a 34% share, followed by North America and Europe, driven by urbanization and renewable projects, while the cast resin segment holds the largest product share due to enhanced safety and insulation efficiency across commercial and industrial power applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Cast Resin segment holds the dominant share of 46% in the Dry Type Power Transformer Market in 2024. Cast resin transformers are preferred for their high dielectric strength, fire safety, and moisture resistance, making them ideal for indoor and renewable energy installations. Manufacturers focus on improving epoxy formulations for enhanced heat dissipation and mechanical durability. The growing use in commercial buildings, metro rail projects, and wind energy substations supports demand. Technological developments, such as vacuum casting automation and partial discharge-free performance, strengthen the segment’s market leadership across Asia-Pacific and Europe.

- For instance, Hitachi Energy’s Resibloc® dry-type transformer series utilizes a vacuum cast coil process and meets a partial discharge level of below 10 picocoulombs, ensuring high long-term insulation reliability.

By Winding

The Two Winding segment accounts for 71% of the total market share in 2024. These transformers are extensively used in industrial, commercial, and utility applications for voltage isolation and efficient power regulation. The segment’s dominance is driven by the rise in renewable integration projects and industrial modernization initiatives. Manufacturers such as ABB and Hitachi Energy develop digital-ready models with temperature sensors and load monitoring features. Their reliability, easy maintenance, and flexible design for multiple voltage levels enhance adoption in medium- and high-voltage distribution systems globally.

- For instance, Eaton’s catalog for medium-voltage dry-type transformers explicitly states that three-phase units are available in ratings from 112.5 kVA up to 32,000 kVA.

By Rating

The >5 MVA to ≤30 MVA category leads with 58% market share in 2024. This segment benefits from widespread deployment in industrial plants, renewable energy grids, and data centers. Its dominance is fueled by the growing need for high-capacity transformers supporting stable power distribution and grid resilience. Advancements in resin encapsulation and smart monitoring technologies enhance performance efficiency. Increasing infrastructure investments in emerging economies and the transition toward energy-efficient, low-emission power systems further boost adoption, solidifying the segment’s position in both utility and commercial applications.

Key Growth Drivers

Expansion of Smart Grid Infrastructure

The rapid modernization of power distribution systems drives strong demand for dry type power transformers. Governments and utilities are investing heavily in smart grid technologies to improve reliability and energy efficiency. These transformers, being oil-free, offer safer indoor installations and require minimal maintenance. For instance, Schneider Electric and ABB integrate smart sensors into dry type units for real-time monitoring and fault detection. The need for grid automation and decentralized energy management continues to make dry type transformers a critical component in modern power networks.

- For instance, BHEL manufactures dry-type transformers that feature copper windings encapsulated in class-F epoxy resin via a vacuum casting process. These transformers are typically equipped with temperature monitoring systems that use embedded RTD PT100 sensors to detect winding hot-spot temperatures.

Rising Focus on Fire and Environmental Safety

Safety regulations are pushing industries to adopt eco-friendly, flame-resistant electrical equipment. Dry type transformers eliminate the risk of oil leaks or explosions, making them ideal for hospitals, commercial buildings, and underground substations. Manufacturers like Hitachi Energy and Eaton develop advanced insulation systems to enhance fire resistance while improving cooling performance. These systems meet global safety standards such as UL and IEC, promoting broader adoption. The market growth aligns with industries’ increasing emphasis on sustainable and low-emission infrastructure solutions.

- For instance, Kirloskar Electric Company Limited (KEC) offers cast-resin dry-type transformers up to 10,000 kVA at 33 kV class in its Special Transformers line.Their distribution transformers cover 160 kVA to 2,500 kVA up to 33 kV with designs compliant with IS:2026 / IEC:76 standards.

Urbanization and Industrial Electrification

The growing need for reliable power in urban and industrial sectors accelerates market expansion. Rapid industrialization in Asia-Pacific, coupled with expanding metro and rail projects, drives higher transformer installations. Dry type transformers are favored for their compact size, quiet operation, and environmental compatibility. Companies such as CG Power & Industrial Solutions and Bharat Heavy Electricals Limited (BHEL) supply large-capacity units to smart city and manufacturing projects. These developments highlight the market’s role in supporting sustainable electrification and efficient energy distribution across emerging economies.

Key Trends & Opportunities

Integration of Digital Monitoring Systems

Digitalization is transforming transformer maintenance and operations. Manufacturers now embed IoT-based sensors and cloud analytics to enable predictive diagnostics. For example, General Electric offers monitoring platforms that analyze thermal and load data to prevent failures. This trend supports higher reliability and longer service life. The combination of AI-driven monitoring and remote control capabilities provides utilities with real-time visibility, enhancing grid stability and reducing downtime costs across large networks.

- For instance, General Electric (GE Vernova / GE Grid Solutions) markets its MS 3000 transformer monitoring system, which integrates data from over 10 sensor types (temperature, load, bushing, cooling, partial discharge, etc.).

Adoption in Renewable Energy Infrastructure

Dry type transformers are increasingly deployed in wind, solar, and hybrid renewable energy systems. Their compact, maintenance-free design suits challenging environments like offshore and desert installations. ABB and Siemens Energy have developed medium-voltage dry type transformers optimized for variable renewable input. These transformers ensure efficient voltage regulation and grid stability. The global shift toward decarbonization and renewable integration continues to expand opportunities in distributed generation and energy storage projects.

Customization and Modular Design Innovations

Manufacturers are focusing on modular and customizable dry type transformers to meet diverse project needs. Modular units reduce installation time, ease transport, and enhance scalability in both commercial and industrial facilities. Schneider Electric and Kirloskar Electric Company develop modular systems suitable for rapid deployment in data centers and manufacturing sites. This flexibility offers cost efficiency and adaptability, making modular designs an emerging opportunity for manufacturers catering to varied end-user demands.

- For instance, CG Power & Industrial Solutions Ltd. manufactures dry-type cast resin transformers in the range of 100 kVA to 10 MVA for voltages up to 36 kV, meeting standards IS 11171 and IEC 60076-11.

Key Challenges

High Initial Cost and Limited Power Rating

Dry type transformers are more expensive to manufacture than oil-filled units due to specialized insulation and resin systems. Their power handling capacity is also limited, making them less suitable for high-voltage transmission applications. This restricts large-scale adoption, especially in cost-sensitive markets. Despite reduced maintenance expenses over time, the upfront capital investment remains a key barrier for utilities and industrial users transitioning from conventional transformer technologies.

Cooling Efficiency and Space Constraints

Maintaining optimal cooling remains a challenge, particularly in environments with high ambient temperatures. Dry type transformers depend on air cooling, which may be less efficient than oil-based systems. Large installations often require additional ventilation or forced air systems, increasing operational complexity. Space limitations in industrial or commercial setups further complicate thermal management. Manufacturers are addressing this challenge by enhancing resin materials and introducing advanced cooling ducts, yet widespread adoption still faces performance limitations in extreme conditions.

Regional Analysis

North America

North America holds a 31% share in the Dry Type Power Transformer Market in 2024. The region’s growth is driven by investments in renewable integration, grid modernization, and industrial expansion. The United States leads due to large-scale replacement of aging infrastructure and adoption of eco-friendly dry transformers. Canada supports growth through its clean energy initiatives and industrial upgrades. Strict efficiency standards and smart grid projects further stimulate market demand. Key players such as ABB, Eaton, and General Electric strengthen their presence through advanced monitoring systems and digitalization of transformer operations across industrial and utility applications.

Europe

Europe accounts for a 28% share of the global Dry Type Power Transformer Market in 2024. The region benefits from strong environmental policies promoting low-emission and energy-efficient equipment. Germany, France, and the United Kingdom lead the market, supported by renewable grid expansion and industrial automation. The European Union’s strict eco-design directives encourage adoption of cast resin transformers. Manufacturers like Schneider Electric and Siemens focus on product innovation and digital integration. Ongoing electrification of railways, urban infrastructure, and data centers sustains demand, positioning Europe as a key hub for sustainable transformer technologies and production advancements.

Asia-Pacific

Asia-Pacific dominates the global Dry Type Power Transformer Market with a 34% share in 2024. Rapid urbanization, expanding manufacturing bases, and rising energy consumption in China, India, and Japan drive market growth. Governments invest heavily in smart grid development, industrial electrification, and renewable energy integration. Leading regional manufacturers, including Hitachi Energy, Hyundai Electric, and CG Power, focus on high-capacity, low-loss transformers. Increasing infrastructure spending and industrial park developments across Southeast Asia fuel additional growth. The region’s growing focus on sustainable distribution networks positions Asia-Pacific as the primary growth engine for dry type power transformers globally.

Latin America

Latin America holds a 4% share in the Dry Type Power Transformer Market in 2024. Market growth is supported by infrastructure modernization and renewable energy projects in Brazil, Mexico, and Chile. Governments prioritize grid reliability and energy efficiency to meet rising power demands. Key players expand their regional presence through partnerships and localized manufacturing. The shift toward decentralized energy systems and renewable-based power plants boosts adoption of dry type transformers. While investment pace varies across nations, steady demand from industrial and utility sectors positions Latin America as an emerging market with long-term potential.

Middle East & Africa

The Middle East & Africa region represents a 3% share of the global Dry Type Power Transformer Market in 2024. Market expansion is driven by ongoing power sector reforms, renewable energy projects, and smart city initiatives. Countries such as Saudi Arabia, the UAE, and South Africa lead investments in grid upgrades and industrial power distribution. Dry type transformers gain traction for their safety and low maintenance advantages in arid conditions. Global manufacturers collaborate with regional utilities to deliver energy-efficient solutions. Increasing urbanization and industrialization continue to create steady demand for modern, eco-friendly transformer systems.

Market Segmentations:

By Product:

By Winding:

- Two Winding

- Auto Transformer

By Rating:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the Dry Type Power Transformer Market features leading players such as Hitachi Energy Ltd., Crompton Greaves Consumer Electricals Limited, Eaton, Bharat Heavy Electricals Limited (BHEL), Kirloskar Electric Company Limited, General Electric, Easun Reyrolle Limited, CG Power & Industrial Solutions Ltd., Schneider Electric, and ABB.The Dry Type Power Transformer Market is characterized by strong competition driven by innovation, efficiency, and sustainability. Companies in this market focus on developing advanced insulation systems, improved cooling technologies, and eco-friendly designs to meet modern energy standards. The growing adoption of smart and IoT-enabled transformers enhances real-time monitoring, predictive maintenance, and grid reliability. Digital integration, along with energy-efficient and compact designs, remains a key competitive factor among manufacturers. Local production initiatives and government-backed projects also strengthen regional supply capabilities. Strategic partnerships, continuous R&D investment, and a focus on renewable integration are shaping the market’s future direction and fostering steady global expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hitachi Energy Ltd.

- Crompton Greaves Consumer Electricals Limited

- Eaton

- Bharat Heavy Electricals Limited (BHEL)

- Kirloskar Electric Company Limited

- General Electric

- Easun Reyrolle Limited

- CG Power & Industrial Solutions Ltd.

- Schneider Electric

- ABB

Recent Developments

- In July 2025, power transformers utilizing advanced natural ester insulating fluids. These transformers offer enhanced thermal stability and safety features, supporting sustainable grid upgrades and reducing environmental impact across the utility and industrial sectors.

- In October 2024, TMC Transformers USA Inc., a manufacturer specializing in dry-type transformers, announced plans to invest over to establish a new manufacturing facility in Waynesboro, Georgia. This expansion is projected to create at least 110 jobs in Burke County over the next five years.

- In January 2024, GE Vernova and IHI Corporation have initiated the next phase of their collaboration to develop a gas turbine combustion system capable of burning 100% ammonia, potentially transforming natural gas fired electricity generation.

- In November 2023, Hitachi Energy introduced a groundbreaking dry-type transformer capable of withstanding 100 kV/550 kV Basic Impulse Level (BIL). This innovation enhances the U.S. dry-type transformer market by offering virtually maintenance-free transformers that comply with international standards, including ISO 9001

Report Coverage

The research report offers an in-depth analysis based on Product, Winding, Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand due to increasing demand for energy-efficient and low-maintenance transformers.

- Smart monitoring systems will become standard for real-time performance and predictive maintenance.

- Adoption of dry type transformers in renewable energy projects will accelerate.

- Governments will promote eco-friendly transformer technologies through supportive policies.

- Compact and modular transformer designs will gain traction in urban power networks.

- Growing industrial automation will drive the need for reliable dry type power solutions.

- Manufacturers will focus on sustainable materials to reduce carbon emissions.

- Digital twin technology will enhance performance analysis and lifecycle management.

- Rising investments in smart grid infrastructure will create significant growth opportunities.

- Partnerships between utilities and manufacturers will strengthen product innovation and deployment.