Market Overview

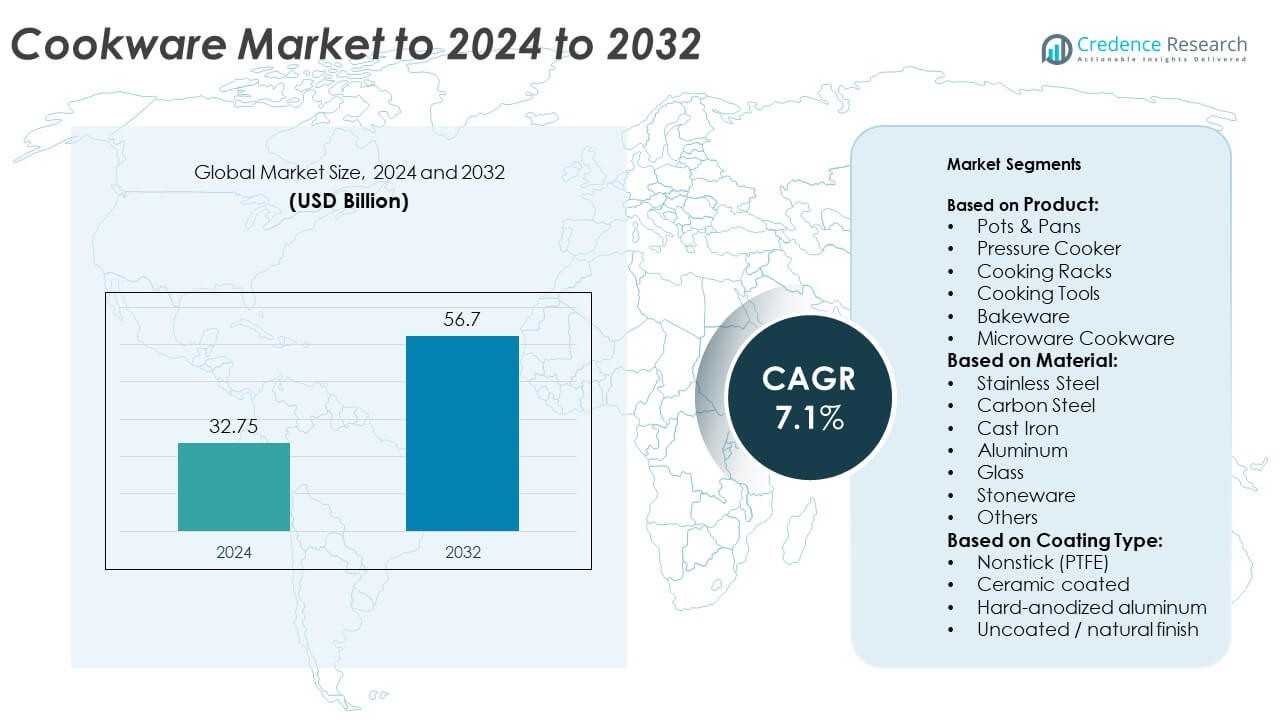

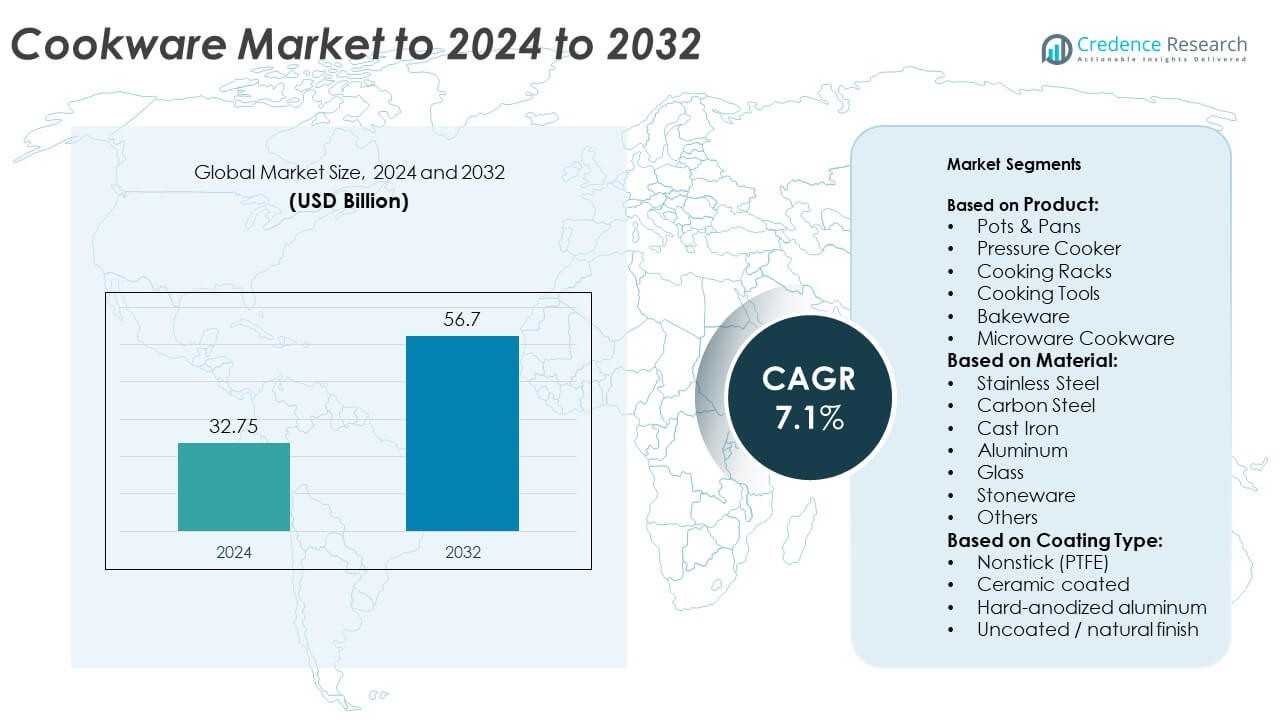

Cookware Market size was valued at USD 32.75 billion in 2024 and is anticipated to reach USD 56.7 billion by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cookware Market Size 2024 |

USD 32.75 Billion |

| Cookware Market, CAGR |

7.1% |

| Cookware Market Size 2032 |

USD 56.7 Billion |

The cookware market is led by major companies such as Meyer Corporation, TTK Prestige Ltd., Hawkins Cookers Limited, Werhahn Group, Fissler, SCANPAN, The Vollrath Co., L.L.C., Groupe SEB, Newell Brands Inc., Tramontina, and Target. These players focus on innovation, sustainable materials, and premium product ranges to strengthen their global presence. Continuous investment in digital retail, eco-friendly coatings, and product durability enhances competitiveness. Regionally, North America dominated the market in 2024 with a 34% share, driven by high consumer spending and modern kitchen adoption, followed by Europe with 28% and Asia Pacific with 27%, reflecting rising disposable incomes and lifestyle modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cookware market was valued at USD 32.75 billion in 2024 and is projected to reach USD 56.7 billion by 2032, growing at a CAGR of 7.1%.

- Rising home cooking trends, increasing disposable incomes, and demand for nonstick and eco-friendly cookware are driving market growth.

- The market is witnessing strong trends toward smart cookware, sustainable materials, and online retail expansion across all consumer segments.

- Leading players focus on product innovation, premium quality, and strategic partnerships to strengthen brand presence, while competition from low-cost imports poses a restraint.

- North America led with a 34% share in 2024, followed by Europe at 28% and Asia Pacific at 27%, while the pots and pans segment dominated product demand with a 42% share globally.

Market Segmentation Analysis:

By Product

Pots & Pans dominated the cookware market in 2024, accounting for around 42% of the total share. Their dominance stems from high consumer demand for versatile cooking tools suited to daily use in households and foodservice applications. Increasing preference for induction-compatible and dishwasher-safe pans has strengthened this segment. Growth in modular kitchen trends and the popularity of multi-functional cookware also support steady expansion. Meanwhile, bakeware and microware cookware segments are gaining momentum due to rising interest in home baking and quick cooking solutions.

- For instance, Lodge Cast Iron, which operates two foundries in South Pittsburg, Tennessee, has increased its annual production capacity to 100 million pounds of cast iron.

By Material

Stainless Steel led the market in 2024 with a share of approximately 38%. Its widespread adoption is driven by durability, corrosion resistance, and ease of maintenance. Consumers favor stainless steel due to its non-reactive nature and compatibility with induction stoves. Aluminum and cast iron materials also show strong growth, driven by affordability and superior heat retention properties. The ongoing innovation in lightweight steel alloys and premium finishes continues to expand this segment’s appeal across both household and commercial kitchens.

- For instance, Nordic Ware’s Bundt pan became widely popular after a “Tunnel of Fudge” cake baked in the pan won second place in the 1966 Pillsbury Bake-Off. The resulting surge in demand prompted Nordic Ware to switch to a 24-hour production schedule.

By Coating Type

Nonstick (PTFE) cookware captured the largest market share of about 47% in 2024. The convenience of low-oil cooking and easy cleaning has made PTFE-coated cookware highly preferred among consumers. Rising health awareness and the growing adoption of modern cooking methods support segment growth. Ceramic-coated and hard-anodized aluminum variants are also gaining traction as eco-friendly and durable alternatives. The uncoated or natural finish category appeals to traditional users who prefer chemical-free surfaces, ensuring steady niche demand within the overall cookware market.

Key Growth Drivers

Rising Home Cooking and Lifestyle Shifts

The growing trend of home cooking and healthier eating habits has significantly boosted cookware demand. Consumers are investing in premium and multi-functional cookware to enhance cooking efficiency and convenience. Urbanization and increasing disposable income have further accelerated household spending on kitchen essentials. The post-pandemic rise in home-based culinary activities continues to drive long-term market growth, especially in emerging economies.

- For instance, Chemours specifies PTFE service temperatures up to 260 °C, with useful properties down to −240 °C.

Expansion of E-commerce and Brand Diversification

E-commerce has become a major growth engine for cookware sales. Online platforms enable consumers to compare products, access discounts, and explore diverse international brands. Cookware companies are leveraging digital marketing and direct-to-consumer models to strengthen their global reach. The introduction of exclusive online collections and easy return policies has increased consumer trust and accelerated product adoption worldwide.

- For instance, HelloFresh reported 2024 revenue of about €7.66 billion and AEBITDA of about €399.4 million.

Innovation in Material and Coating Technologies

Advancements in nonstick coatings, induction-compatible designs, and lightweight materials are transforming cookware performance. Manufacturers are introducing ceramic and hard-anodized aluminum coatings for better durability and safety. The growing preference for eco-friendly and toxin-free cookware is fueling innovation in surface technology. These product improvements enhance energy efficiency and cooking convenience, making innovation a key competitive differentiator.

Key Trends & Opportunities

Demand for Sustainable and Eco-friendly Cookware

Rising environmental awareness is encouraging consumers to choose cookware made from recyclable and non-toxic materials. Companies are focusing on sustainable aluminum, ceramic coatings, and plastic-free packaging to meet green regulations. This shift offers opportunities for brands that invest in circular production and eco-certification. The growing alignment of cookware manufacturing with global sustainability standards presents significant expansion potential.

- For instance, TTK Prestige runs around 680 stores across 375 towns and plans a ~30% store increase over four years.

Growth of Smart and Connected Cookware

The adoption of smart cookware integrated with sensors and IoT connectivity is increasing. These products offer temperature control, cooking guidance, and energy efficiency, appealing to tech-savvy users. Manufacturers are collaborating with appliance brands to develop connected cooking ecosystems. As smart kitchens become mainstream, the demand for intelligent cookware solutions will continue to grow across urban households.

- For instance, GE Appliances’ Café ranges quantify guidance temps, like 425 °F for scallops and 325 °F for eggs, standardizing sensor-driven cooking.

Key Challenges

Rising Raw Material and Production Costs

Volatile prices of stainless steel, aluminum, and coating materials pose major challenges for manufacturers. Increased logistics and energy costs further pressure profit margins. Companies face difficulties maintaining affordability without compromising quality. Managing cost structures while ensuring supply chain stability has become critical for sustaining competitiveness in the cookware market.

Competition from Low-cost and Counterfeit Products

The market faces increasing competition from low-cost imports and counterfeit products, particularly in developing regions. These alternatives often compromise on quality and safety, impacting brand trust. Established manufacturers are struggling to maintain market share amid aggressive pricing strategies by local players. Strengthening brand authenticity and implementing stricter distribution controls are essential to overcome this challenge.

Regional Analysis

North America

North America dominated the cookware market in 2024, accounting for nearly 34% of the total share. High consumer spending power, modern kitchen upgrades, and the popularity of premium nonstick and stainless-steel cookware drive strong regional demand. The U.S. leads with widespread adoption of smart and eco-friendly cookware solutions. Growing preference for sustainable materials and online retail expansion by key brands further strengthen market growth. Continuous innovation in product design and functionality keeps North America a major contributor to global revenue.

Europe

Europe held around 28% of the global cookware market share in 2024, driven by strong culinary traditions and demand for high-quality kitchenware. Germany, France, and Italy lead the market with established cookware brands emphasizing durability and design aesthetics. Rising awareness of sustainable manufacturing practices and non-toxic coatings supports regional growth. The increasing adoption of induction-compatible cookware and energy-efficient designs continues to expand the market. European consumers’ preference for long-lasting, eco-friendly cookware maintains the region’s significant market position.

Asia Pacific

Asia Pacific accounted for about 27% of the global market share in 2024 and is projected to record the fastest growth. Expanding urban populations, growing middle-class income, and evolving cooking habits drive cookware demand. China, India, and Japan dominate consumption due to rapid lifestyle modernization and rising kitchenware replacement rates. Manufacturers are focusing on affordable yet innovative cookware solutions to serve diverse regional needs. Increasing e-commerce penetration and consumer preference for multifunctional cookware further enhance market potential across Asia Pacific.

Latin America

Latin America captured nearly 7% of the global cookware market in 2024, supported by improving living standards and growing urbanization. Brazil and Mexico are the leading contributors due to rising household spending on modern cookware. The region is witnessing increased adoption of aluminum and nonstick cookware driven by affordability and convenience. Expanding retail channels and local production facilities are helping reduce import dependency. Despite economic fluctuations, rising consumer awareness and growing middle-income populations continue to support steady market expansion in Latin America.

Middle East & Africa

The Middle East & Africa region held approximately 4% of the cookware market share in 2024. Market growth is driven by rising residential construction, hotel expansions, and modern kitchen adoption. Countries like the UAE, Saudi Arabia, and South Africa are leading consumers due to higher disposable incomes and increasing interest in international cuisine. Local brands are introducing affordable cookware alternatives, while global players target premium segments. Although still emerging, the region’s demand for energy-efficient and durable cookware continues to rise steadily.

Market Segmentations:

By Product:

- Pots & Pans

- Pressure Cooker

- Cooking Racks

- Cooking Tools

- Bakeware

- Microware Cookware

By Material:

- Stainless Steel

- Carbon Steel

- Cast Iron

- Aluminum

- Glass

- Stoneware

- Others

By Coating Type:

- Nonstick (PTFE)

- Ceramic coated

- Hard-anodized aluminum

- Uncoated / natural finish

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cookware market is highly competitive, with major players such as Meyer Corporation, TTK Prestige Ltd., Hawkins Cookers Limited, Werhahn Group, Fissler, SCANPAN, The Vollrath Co., L.L.C., Groupe SEB, Newell Brands Inc., Tramontina, and Target leading global operations. These companies compete through innovation, product diversification, and expansion into emerging markets. Manufacturers emphasize premium quality, eco-friendly coatings, and ergonomic designs to meet evolving consumer preferences. Strategic initiatives such as mergers, acquisitions, and partnerships strengthen market presence and brand loyalty. Increasing investments in digital marketing, e-commerce, and direct-to-consumer channels help companies reach wider audiences. Firms are also focusing on sustainable production, recyclable materials, and advanced technologies such as induction-ready and nonstick cookware to enhance product appeal. Continuous research and development efforts remain central to maintaining competitiveness and addressing the growing demand for high-performance, energy-efficient cookware solutions across both residential and commercial segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Meyer Corporation

- TTK Prestige Ltd.

- Hawkins Cookers Limited

- Werhahn Group

- Fissler

- SCANPAN

- The Vollrath Co., L.L.C.

- Groupe SEB

- Newell Brands Inc.

- Tramontina

- Target

Recent Developments

- In 2025, Groupe SEB announced the acquisition of La Brigade de Buyer, which includes cookware and cutlery brands like De Buyer, Sabatier, and 32 Dumas.

- In 2025, Meyer Corporation Announced plans to expand into the mass cookware category in India, including pressure cookers, open cookware, and serving essentials. Will launch new products in cast iron, tri-ply, and nonstick cookware and introduce globally acclaimed cookware brands in India.

- In 2025, TTK Prestige Ltd. commissioned additional production capacity for Triply cookware at its Karjan, Gujarat facility.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Coating Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cookware market will continue expanding with rising global home cooking trends.

- Demand for sustainable and recyclable cookware materials will increase steadily.

- Smart and connected cookware adoption will grow in urban households.

- Nonstick and ceramic-coated cookware will maintain strong consumer preference.

- Manufacturers will focus on lightweight, induction-compatible, and energy-efficient designs.

- E-commerce will remain a major sales channel for global cookware brands.

- Innovation in eco-friendly coatings will drive product differentiation.

- Premium and multi-functional cookware will gain popularity among millennials.

- Asia Pacific will emerge as the fastest-growing regional market.

- Brand collaborations and digital marketing will shape competitive strategies globally.