Market Overview

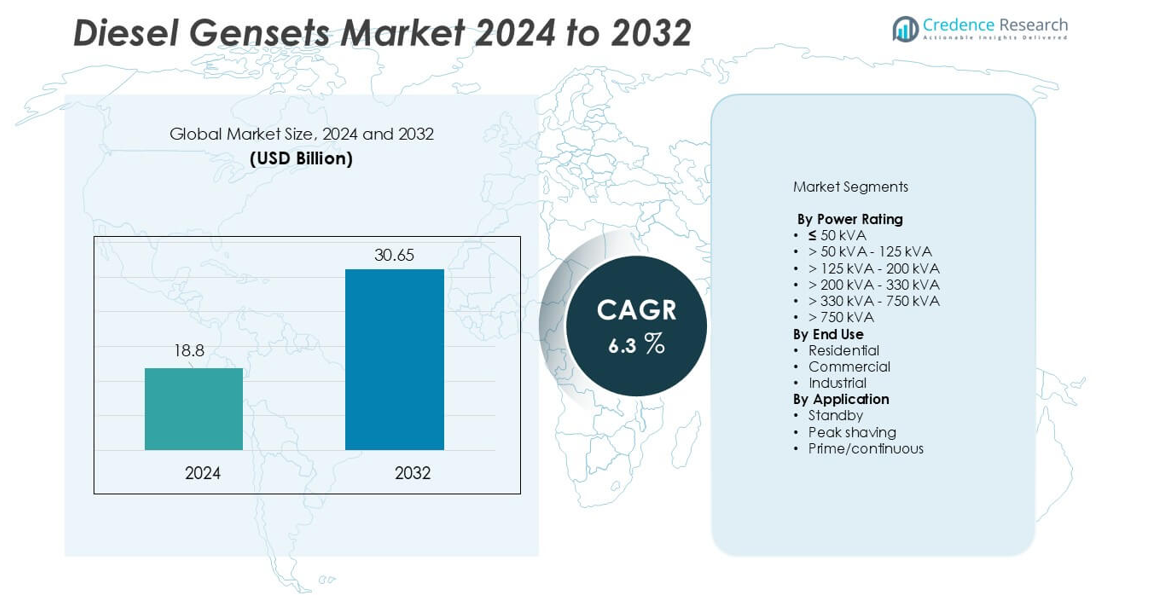

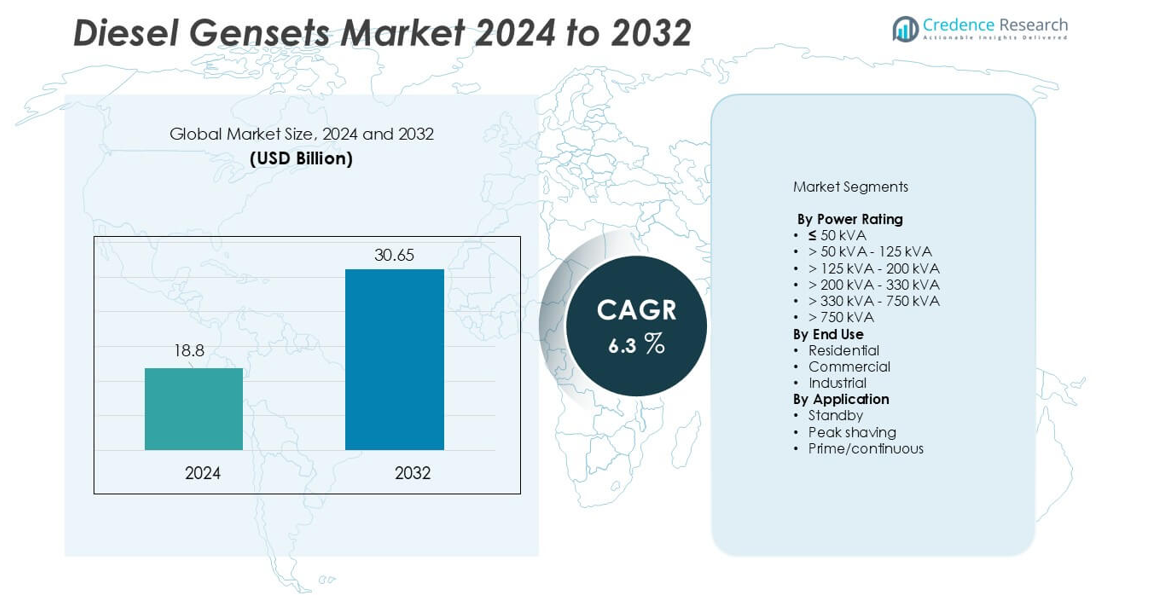

The Diesel Gensets market was valued at USD 18.8 billion in 2024 and is projected to reach USD 30.65 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Gensets Market Size 2024 |

USD 18.8 billion |

| Diesel Gensets Market, CAGR |

6.3% |

| Diesel Gensets Market Size 2032 |

USD 30.65 billion |

The Diesel Gensets market is dominated by key players such as Cummins, Caterpillar, Generac Power Systems, Aggreko, Atlas Copco, FG Wilson, Ashok Leyland, Greaves Cotton Limited, HIMOINSA, Cooper Corp., J C Bamford Excavators, Captiva Energy Solutions, and Deere & Company. These companies lead through technological innovation, robust global distribution networks, and strong after-sales services. Asia-Pacific holds the largest regional share of approximately 40% in 2024, driven by rapid industrialization, construction growth, and increasing power demand across emerging economies such as India and China. North America and Europe collectively account for about 40% of the market, supported by advanced infrastructure, data center expansion, and high standby power needs, while the Middle East & Africa and Latin America regions contribute the remaining 20%, fueled by infrastructure and energy sector investments.

Market Insights

- The Diesel Gensets market was valued at USD 18.8 billion in 2024 and is projected to reach USD 30.65 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

- Rising demand for reliable and uninterrupted power supply across industrial, commercial, and residential sectors is driving market growth, supported by infrastructure development and increasing digitalization in emerging economies.

- Key trends include the adoption of hybrid and smart genset systems, integration of IoT-enabled monitoring, and increasing use of low-emission and fuel-efficient diesel gensets to meet environmental regulations.

- The competitive landscape is dominated by global players such as Cummins, Caterpillar, Generac, Aggreko, Atlas Copco, FG Wilson, Ashok Leyland, and Greaves Cotton, who compete through technology innovation, service networks, and strategic partnerships.

- Regionally, Asia-Pacific leads with 40% market share, followed by North America (22%), Europe (18%), Middle East & Africa (12%), and Latin America (8%), with the >125–200 kVA power rating segment holding the largest share across applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Rating:

The Diesel Gensets market by power rating is dominated by the >125 kVA–200 kVA segment, which holds a significant market share owing to its widespread use across commercial complexes, healthcare facilities, and mid-sized industrial units. These gensets provide an optimal balance between power capacity and operational efficiency, making them ideal for regions with unstable grid supply. The demand for this range is driven by the increasing number of construction projects and data centers requiring reliable backup power. Additionally, technological advancements in fuel efficiency and emission control are further strengthening adoption across emerging economies.

- For instance, Tata Motors’ 125 kVA genset, powered by the 697TCIC engine, delivers a rated power output of 125 kVA at a power factor of 0.8, equating to 100 kW.

By End Use:

Based on end use, the industrial segment leads the Diesel Gensets market, accounting for the largest share due to high power demand in manufacturing, mining, and oil & gas operations. These industries rely heavily on gensets for uninterrupted power during outages and remote operations. Rising industrialization in developing regions and expansion of small-scale production facilities are key growth drivers. Furthermore, industries are increasingly investing in high-capacity diesel gensets to ensure operational continuity, particularly in areas with unreliable grid connectivity.

- For instance, Tata Motors’ gensets, such as the 125 kVA model, are designed for continuous operation and have been tested under high-temperature conditions, proving their reliability and efficiency in demanding industrial environments.

By Application:

In terms of application, the standby power segment dominates the Diesel Gensets market, supported by growing installations in commercial buildings, hospitals, and IT facilities to prevent downtime during power failures. The segment’s growth is fueled by the need for dependable backup systems amid increasing grid instability and urban power outages. Standby gensets are also being integrated with smart monitoring systems for remote diagnostics and maintenance, enhancing their reliability and lifespan. This trend, coupled with government mandates for backup power in critical infrastructure, continues to drive demand globally.

Key Growth Drivers

Rising Demand for Reliable Power Supply

The growing demand for uninterrupted and reliable electricity is a major driver of the diesel gensets market. Rapid urbanization, industrial expansion, and the increasing dependency on electrical and electronic systems across sectors have intensified the need for consistent power backup. Developing economies in Asia, Africa, and Latin America are experiencing frequent grid failures and power deficits, which has accelerated genset adoption. Furthermore, critical infrastructure such as hospitals, data centers, telecom towers, and commercial buildings rely heavily on gensets to ensure business continuity. The resilience and fast start-up capability of diesel gensets make them an indispensable solution for emergency and off-grid applications, thereby driving market growth.

- For instance, Tata Motors’ 125 kVA genset, powered by the 697TCIC engine, delivers a rated power output of 125 kVA at a power factor of 0.8, equating to 100 kW.

Expansion of Industrial and Construction Activities

The expansion of manufacturing, mining, and construction sectors globally is fueling the demand for diesel gensets. Industrial facilities often operate in remote or semi-urban regions with limited grid access, making gensets essential for both primary and backup power supply. The growing number of infrastructure projects—such as smart cities, transportation networks, and industrial parks—requires consistent energy sources to power machinery and equipment. Diesel gensets, known for their robustness, high power output, and mobility, have become the preferred choice for temporary and heavy-duty applications. Additionally, the surge in real estate development and commercial construction in emerging economies further strengthens the market outlook for medium and high-capacity gensets.

- For instance, Tata Motors’ 125 kVA genset, powered by the 697TCIC engine, delivers a rated power output of 125 kVA at a power factor of 0.8, equating to 100 kW.

. Increasing Data Center Investments and Digitalization

The global rise in data center infrastructure is significantly boosting the diesel gensets market. With exponential data generation driven by cloud computing, 5G rollout, and digital transformation, data centers require continuous and stable power to avoid operational disruptions. Diesel gensets serve as critical backup systems that ensure zero downtime and safeguard sensitive IT infrastructure during power interruptions. Major technology firms and colocation service providers are investing in large-scale data centers in regions with unreliable grid networks, further increasing genset installations. The emphasis on redundancy and power reliability, coupled with stringent uptime requirements, continues to position diesel gensets as a vital component in the global digital ecosystem.

Key Trends & Opportunities

Integration of Hybrid and Smart Genset Systems

A key trend shaping the diesel gensets market is the integration of hybrid systems combining diesel generators with renewable energy sources such as solar and wind. This approach helps reduce fuel consumption, emissions, and operational costs while improving efficiency. Smart genset systems featuring IoT-enabled monitoring and predictive maintenance capabilities are gaining traction across industrial and commercial sectors. These solutions allow real-time performance tracking, remote diagnostics, and optimized load management. Manufacturers are increasingly focusing on hybrid configurations and digital control systems to meet regulatory standards and sustainability targets. The growing preference for smart, connected gensets presents lucrative opportunities for innovation and market expansion.

- For instance, Yanmar Energy System installed a total of 3 MW of diesel generator capacity as part of an IoT-enabled hybrid microgrid project in the Sakha Republic, Russia.

Growing Demand from Emerging Economies and Infrastructure Development

Emerging economies present a significant opportunity for diesel genset manufacturers, driven by rapid industrialization and infrastructure growth. Nations in Asia-Pacific, the Middle East, and Africa are heavily investing in construction, telecommunications, and energy projects that require reliable power support. In these regions, inadequate grid infrastructure and frequent outages make diesel gensets indispensable. Moreover, government initiatives to enhance rural electrification and industrial output are expanding market potential. The surge in public infrastructure development, coupled with increasing investments in manufacturing and logistics hubs, provides strong long-term growth opportunities for genset suppliers catering to high-demand and off-grid applications.

Key Challenges

Rising Environmental Concerns and Emission Regulations

Stringent environmental regulations regarding greenhouse gas emissions and air quality are among the major challenges for the diesel gensets market. Diesel engines emit nitrogen oxides (NOx), carbon monoxide (CO), and particulate matter (PM), leading to concerns over pollution and health impacts. Governments worldwide are enforcing strict emission norms and promoting cleaner energy alternatives, such as gas-based or hybrid power systems. Compliance with these standards has increased production costs and pushed manufacturers toward developing low-emission technologies and biofuel-compatible gensets. Although these innovations enhance sustainability, they also raise equipment costs, affecting market competitiveness and adoption rates in cost-sensitive regions.

Fluctuating Diesel Prices and Operational Costs

Volatility in global crude oil prices significantly impacts the operating costs of diesel gensets. Frequent fluctuations in diesel fuel prices increase the total cost of ownership and deter potential users, especially in developing economies where budget constraints are prominent. Moreover, the high maintenance requirements of diesel engines add to operational expenses over time. End users are increasingly evaluating alternative solutions such as gas gensets or renewable hybrid systems to reduce fuel dependency and long-term costs. This shift toward more economical and sustainable power options poses a persistent challenge to the widespread adoption of conventional diesel gensets.

Regional Analysis

North America:

North America holds a substantial share of the global Diesel Gensets market, accounting for over 22% of total revenue in 2024. The region’s dominance is driven by strong demand from data centers, healthcare facilities, and commercial establishments requiring reliable backup power. The United States leads the market, supported by continuous investments in digital infrastructure and the growing need for standby power in industrial operations. Additionally, aging grid infrastructure and increasing instances of power outages across urban and rural areas continue to drive genset adoption, particularly in medium and high-capacity power segments.

Europe:

Europe captures nearly 18% of the global Diesel Gensets market share, propelled by rising demand for emergency power solutions in commercial and residential sectors. The United Kingdom, Germany, and France are leading markets, supported by stringent energy security policies and growing installation of gensets in healthcare and data center facilities. Moreover, the region’s increasing focus on low-emission and hybrid diesel gensets aligns with EU environmental directives. Technological advancements and replacement of aging power backup systems are also driving market growth, particularly across industrial facilities and public infrastructure applications.

Asia-Pacific:

Asia-Pacific dominates the global Diesel Gensets market, accounting for over 40% of the total share in 2024. The region’s growth is primarily driven by rapid urbanization, expanding industrial base, and frequent power outages in countries such as India, China, and Indonesia. Infrastructure development projects, manufacturing expansion, and increasing demand from data centers further strengthen regional market growth. Additionally, government investments in rural electrification and off-grid power generation fuel diesel genset deployment. Rising construction activity and continuous power demand across commercial and residential sectors make Asia-Pacific the most dynamic and fastest-growing market globally.

Middle East & Africa:

The Middle East & Africa region represents around 12% of the global Diesel Gensets market share, supported by extensive use in oil & gas operations, mining, and large-scale infrastructure projects. Countries such as Saudi Arabia, the UAE, and South Africa are major contributors, driven by growing investments in industrial and construction sectors. Limited grid connectivity in remote areas further encourages genset installations. Additionally, frequent power supply interruptions in parts of Africa continue to sustain strong demand for portable and high-capacity gensets, making the region an important growth hub for international manufacturers.

Latin America:

Latin America accounts for approximately 8% of the global Diesel Gensets market, with Brazil, Mexico, and Argentina leading in adoption. The region’s growth is fueled by expanding manufacturing, mining, and commercial activities that demand consistent power backup. Frequent power fluctuations and insufficient grid reliability in several countries further accelerate genset installations. Government infrastructure initiatives and rising urban development also contribute to market expansion. Additionally, the adoption of diesel gensets for rural electrification and industrial applications continues to strengthen the region’s position as an emerging growth market in the global landscape.Top of Form

Market Segmentations:

By Power Rating

- ≤ 50 kVA

- > 50 kVA – 125 kVA

- > 125 kVA – 200 kVA

- > 200 kVA – 330 kVA

- > 330 kVA – 750 kVA

- > 750 kVA

By End Use

- Residential

- Commercial

- Industrial

By Application

- Standby

- Peak shaving

- Prime/continuous

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Diesel Gensets market is characterized by the presence of well-established global manufacturers and agile regional players who compete on product reliability, fuel efficiency, emissions performance, and after-sales support. Leading OEMs such as Cummins, Caterpillar, Generac, Aggreko, Atlas Copco, FG Wilson, Ashok Leyland, Greaves Cotton, HIMOINSA, Cooper Corp., J C Bamford, Captiva Energy Solutions, and Deere & Company emphasize differentiated value through extended warranties, preventive-maintenance contracts, and integrated remote-monitoring solutions. Companies pursue growth via product portfolio expansion, strategic acquisitions, dealer network strengthening, and partnerships with EPC contractors and data-center operators. Price competition remains intense in cost-sensitive regions, while advanced markets prioritize low-emission and hybrid offerings to meet regulatory and sustainability targets. Service availability, spare-parts logistics, and fast commissioning are decisive factors for buyers, prompting vendors to localize manufacturing and invest in digital service platforms. Overall, competition balances scale-driven manufacturing efficiencies with customer-centric services and technological upgrades to capture market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cummins

- Caterpillar

- Generac Power Systems

- Aggreko

- FG Wilson

- Atlas Copco

- Greaves Cotton Limited

- Ashok Leyland

- Cooper Corp.

- HIMOINSA

- J C Bamford Excavators

- Captiva Energy Solutions

- Deere & Company

Recent Developments

- In June 2025, Rolls-Royce committed USD 24 million to establish a new 250,000 square feet Logistics Operations Center in Mankato, Minnesota, aiming to more than double production of its mtu Series 4000 diesel generator sets by 2026. The investment targets surging U.S. data center demand and will also enhance output at its Aiken, South Carolina plant. Moreover, Rolls-Royce highlighted the gensets compatibility with synthetic diesel and HVO fuels, reinforcing its strategic role in mission-critical backup power.

- In April 2025, Generac Holding introduced advanced generator solutions tailored for the data center sector, strengthening its portfolio of diesel, natural gas, and scalable multi-asset energy systems. These offerings are designed to integrate seamlessly with the dynamic needs of hyperscale, colocation, enterprise, and edge data center environments.

- In June 2024, Atlas Copco enhanced its QES diesel gensets series by introducing power nodes ranging from 200 kVA to 500 kVA. The upgraded models underwent extensive testing to withstand harsh weather, featuring a waterproof and corrosion-resistant canopy for durability. Additionally, generators above 250 kVA were designed with synchronization capabilities for parallel operation and load sharing.

- In March 2024, MAHINDRA POWEROL launched its CPCBIV+ emission-compliant diesel genset range at Taj Deccan, Hyderabad, in collaboration with Recon Technologies Pvt Ltd. This new range, with capacities up to 625 KVA, underscores their commitment to delivering advanced, environmentally responsible power solutions.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, End Use, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing industrialization and urbanization will continue to drive demand for diesel gensets globally.

- Rising investments in data centers and digital infrastructure will boost the need for reliable backup power solutions.

- Growing adoption of hybrid diesel-renewable systems will enhance fuel efficiency and reduce emissions.

- Expansion of construction and infrastructure projects in emerging economies will support genset deployment.

- Technological advancements in IoT-enabled monitoring and predictive maintenance will improve operational efficiency.

- Stringent environmental regulations will encourage the development of low-emission and eco-friendly gensets.

- Increasing demand for standby and prime power applications will sustain medium and high-capacity genset sales.

- Integration of smart control systems will offer better load management and operational flexibility.

- Growing rural electrification initiatives in developing regions will open new market opportunities.

- Strategic collaborations, mergers, and regional expansion by key players will strengthen market competitiveness