Market Overview

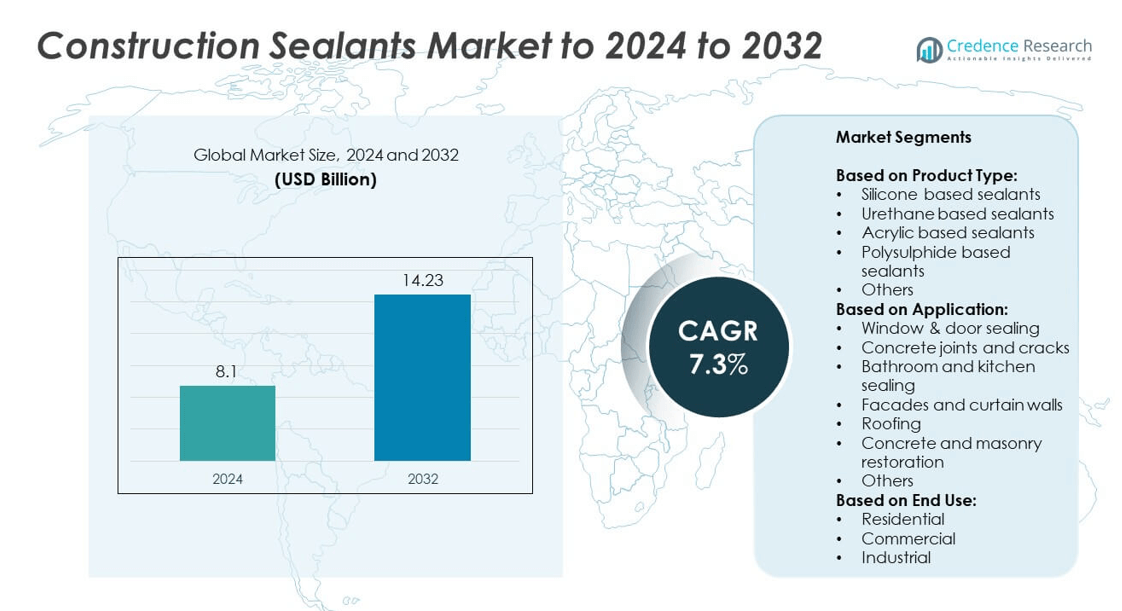

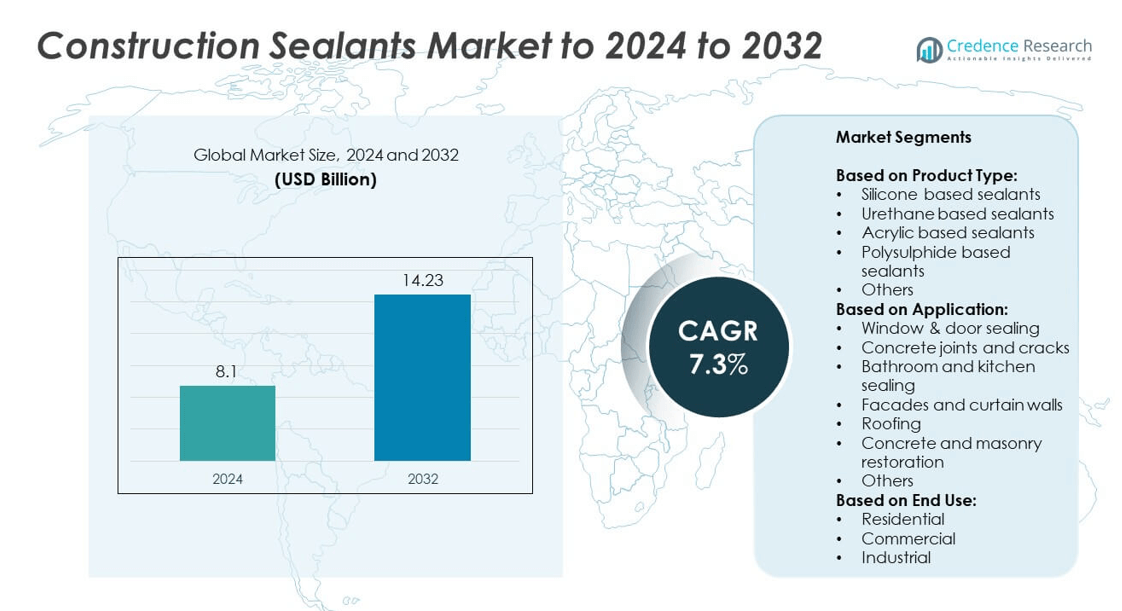

The Construction Sealants Market size was valued at USD 8.1 billion in 2024 and is anticipated to reach USD 14.23 billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Sealants Market Size 2024 |

USD 8.1 billion |

| Construction Sealants Market, CAGR |

7.3% |

| Construction Sealants Market Size 2032 |

USD 14.23 billion |

The construction sealants market is highly competitive, with major players such as Sika AG, Dow Inc., BASF SE, Henkel AG & Co. KGaA, H.B. Fuller Company, Tremco, Arkema S.A., and Wacker Chemie AG leading global operations. These companies dominate through extensive product portfolios, strong R&D capabilities, and strategic expansion across infrastructure and residential sectors. They focus on developing sustainable, low-VOC, and high-performance sealants to meet tightening environmental standards. Regionally, North America leads the market with a 33% share in 2024, driven by robust construction activity, renovation projects, and growing demand for energy-efficient and durable sealing solutions.

Market Insights

- The construction sealants market was valued at USD 8.1 billion in 2024 and is projected to reach USD 14.23 billion by 2032, growing at a CAGR of 7.3%.

- Market growth is driven by rising global infrastructure development, urbanization, and increasing demand for energy-efficient and durable sealing solutions in residential and commercial construction.

- Key trends include the shift toward low-VOC, sustainable, and hybrid polymer sealants that meet environmental regulations and improve long-term performance in high-stress applications.

- The market is competitive, with major companies focusing on innovation, mergers, and product diversification to strengthen their global presence and meet advanced building material standards.

- Regionally, North America leads with a 33% share, followed by Europe at 27% and Asia Pacific at 29%, while silicone-based sealants dominate the product segment with around 36% of total market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Silicone-based sealants dominated the construction sealants market in 2024, accounting for around 36% of the total share. Their strong adhesion, flexibility, and resistance to UV radiation and weathering make them ideal for exterior applications. Silicone sealants are extensively used in glass glazing, curtain walls, and expansion joints due to their long lifespan and thermal stability. Increasing adoption in modern architectural designs and energy-efficient buildings further boosts demand. Urethane and acrylic-based sealants follow closely, supported by cost efficiency and compatibility with concrete and masonry substrates.

- For instance, Dow reports DOWSIL™ 995 meets ASTM C1184 and ASTM C920, plus Federal TT-S-00230C.

By Application

Window and door sealing held the largest market share in 2024, capturing about 31% of total application-based revenue. This segment benefits from growing residential and commercial construction, where sealants ensure air and water tightness, improving energy efficiency. Expanding renovation activities and stricter building envelope standards drive segment growth. Facades and curtain walls also witness rising demand due to increasing use of glass exteriors in urban projects. Silicone and polyurethane sealants dominate these uses because of their high elasticity, durability, and compatibility with various surface materials.

- For instance, Sika specifies that the optimum application temperature for the substrate and sealant of its Sikasil® IG-25 HM Plus product is between 15 °C and 25 °C.

By End Use

The residential sector led the construction sealants market in 2024, representing nearly 42% of the total share. Growth is fueled by rising urban housing development, home renovation projects, and demand for waterproofing and energy-efficient sealing solutions. Government initiatives promoting affordable housing in developing economies further enhance consumption. The commercial segment also expands steadily, driven by construction of high-rise offices and retail complexes. Industrial applications remain essential for infrastructure, factories, and warehouses, emphasizing high-performance sealants with superior chemical and temperature resistance for long-term durability.

Key Growth Drivers

Rising Infrastructure and Construction Activities

The expansion of residential, commercial, and industrial infrastructure globally remains the primary growth driver for the construction sealants market. Rapid urbanization and smart city projects in countries such as India, China, and the U.S. are increasing sealant consumption for glazing, insulation, and joint sealing. Demand for flexible, durable sealants in large-scale public infrastructure projects, such as airports and bridges, continues to grow. This steady rise in construction activity sustains market demand for advanced and weather-resistant sealant formulations.

- For instance, MAPEI operates 106 manufacturing plants across 42 nations.

Increasing Focus on Energy Efficiency and Green Buildings

Growing adoption of energy-efficient building designs is a key driver of sealant demand. Sealants play a crucial role in enhancing thermal insulation and preventing air leakage, reducing building energy use. Governments and developers are promoting green certification programs like LEED, driving the use of low-VOC, silicone, and polyurethane sealants. The preference for sustainable construction materials is further boosted by stricter emission standards and eco-friendly formulations from major sealant manufacturers.

- For instance, 3M’s research and development efforts produce more than 3,500 new patents each year across its wide-ranging portfolio of products, including those applicable to building materials.

Technological Advancements and Product Innovation

Ongoing R&D in hybrid and high-performance sealants enhances durability, adhesion, and resistance to extreme weather. Manufacturers are investing in silane-modified polymers (SMPs) and hybrid systems combining polyurethane and silicone advantages. These innovations enable improved bonding on varied substrates, reducing maintenance costs. Additionally, the growing use of automated application equipment in large-scale construction projects increases efficiency and precision, supporting broader adoption of premium-grade sealants in global markets.

Key Trends and Opportunities

Shift Toward Low-VOC and Sustainable Sealants

The market is witnessing a strong shift toward environmentally friendly sealants with low volatile organic compounds (VOC). Regulatory policies across Europe and North America are pushing manufacturers to develop solvent-free and water-based sealants. This transition aligns with growing awareness of indoor air quality and green construction materials. Companies introducing recyclable packaging and bio-based ingredients are gaining a competitive edge as sustainability becomes a major purchasing factor among architects and contractors.

- For instance, Soudal Fix ALL High Tack declares VOC content < 10 g/L in its statement.

Rising Demand from Renovation and Retrofit Projects

Renovation and refurbishment projects across aging infrastructure are creating steady opportunities for sealant manufacturers. Aging residential and commercial buildings require extensive sealing for windows, facades, and concrete restoration. The demand for crack-repair and waterproofing sealants is increasing in developed regions such as North America and Western Europe. This trend is supported by energy efficiency upgrades and sustainability-driven building modernization initiatives, ensuring continuous market growth beyond new construction.

- For instance, In its 2024 Sustainability Report, H.B. Fuller detailed a closed-loop recycling program in Germany that recovered 435 metric tons of material and reused over 16,500 drums.

Key Challenges

Fluctuating Raw Material Prices

Volatility in the prices of raw materials such as silicone, acrylic, and polyurethane directly impacts production costs. Supply chain disruptions and crude oil price variations influence the availability of chemical feedstocks used in sealant manufacturing. Smaller manufacturers face margin pressures, while large players struggle to balance pricing strategies with profitability. These fluctuations often lead to product price hikes, reducing affordability for cost-sensitive construction projects in developing economies.

Stringent Environmental and Safety Regulations

Tightening global regulations regarding VOC emissions and hazardous chemical content pose significant challenges. Manufacturers must comply with evolving environmental standards, increasing R&D and formulation costs. Non-compliance risks penalties or product bans, especially in regions like the EU and North America. Additionally, frequent updates to safety and labeling requirements extend product approval timelines. Balancing performance with environmental safety remains a major constraint for sealant producers aiming to expand globally.

Regional Analysis

North America

North America held the largest share of around 33% in the global construction sealants market in 2024. The region’s dominance is supported by strong residential and commercial construction, particularly in the United States. High adoption of energy-efficient and sustainable building materials drives demand for low-VOC silicone and polyurethane sealants. Ongoing infrastructure modernization and renovation of aging buildings further boost consumption. Major players such as 3M and Dow focus on product innovation and environmentally compliant formulations to meet green building standards under programs like LEED and Energy Star certifications.

Europe

Europe accounted for approximately 27% of the global construction sealants market in 2024. The region benefits from a mature construction industry with a strong emphasis on sustainability and environmental compliance. Strict regulations under REACH and directives promoting low-emission materials are shaping product development. Demand is particularly high for glazing and facade sealing in modern commercial buildings. Countries such as Germany, France, and the U.K. lead market consumption due to their focus on renovation, insulation, and retrofitting projects aligned with the European Green Deal objectives.

Asia Pacific

Asia Pacific captured about 29% of the total construction sealants market share in 2024. Rapid urbanization, industrial expansion, and infrastructure investments in China, India, and Southeast Asia drive strong growth. Rising demand for affordable housing and government-backed construction initiatives are fueling large-scale adoption of silicone and polyurethane sealants. Growing awareness of building energy efficiency and durability also contributes to regional demand. Local manufacturers expand capacity to meet the growing need for cost-effective, weather-resistant sealants across residential and commercial construction projects.

Latin America

Latin America held nearly 6% of the global construction sealants market in 2024. The region’s growth is driven by recovery in the construction sector, particularly in Brazil and Mexico. Public infrastructure programs, along with expanding residential projects, are spurring demand for sealants used in roofing, concrete joints, and window sealing. Despite economic fluctuations, investment in urban housing and commercial development continues to rise. Manufacturers are increasingly targeting this region with competitively priced products and distribution partnerships to meet the growing construction material requirements.

Middle East & Africa

The Middle East and Africa region accounted for around 5% of the construction sealants market in 2024. Growth is supported by large-scale infrastructure and urban development projects in the Gulf Cooperation Council (GCC) countries. Demand is strong in high-temperature applications, where durable and UV-resistant sealants are essential. The construction of commercial buildings, airports, and housing complexes in Saudi Arabia and the UAE contributes significantly. Africa shows gradual adoption, driven by expanding residential construction and government infrastructure investments across South Africa, Kenya, and Nigeria.

Market Segmentations:

By Product Type:

- Silicone based sealants

- Urethane based sealants

- Acrylic based sealants

- Polysulphide based sealants

- Others

By Application:

- Window & door sealing

- Concrete joints and cracks

- Bathroom and kitchen sealing

- Facades and curtain walls

- Roofing

- Concrete and masonry restoration

- Others

By End Use:

- Residential

- Commercial

- Industrial

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The construction sealants market is characterized by strong competition among major players such as Sika AG, Dow Inc., Tremco, BASF SE, Henkel AG & Co. KGaA, H.B. Fuller Company, Arkema S.A., Bostik, Wacker Chemie AG, 3M Company, Huntsman Corporation, Momentive Performance Materials Inc., MAPEI S.p.A., RPM International Inc., ITW Polymers Sealants, and Avery Dennison Corporation. The market is driven by continuous innovation in hybrid and low-VOC formulations designed to meet stricter environmental standards. Companies focus on expanding their product portfolios to cater to infrastructure, residential, and industrial construction needs. Increasing emphasis on durability, weather resistance, and sustainability fuels R&D investment and technological advancements. Strategic partnerships, acquisitions, and regional expansions remain common approaches to strengthen distribution networks and penetrate emerging markets. The competition is also intensifying with rising demand for smart, automated application technologies and growing adoption of eco-friendly sealing solutions in both developed and developing regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sika AG

- Dow Inc.

- Tremco

- BASF SE

- Henkel AG & Co. KGaA

- B. Fuller Company

- Arkema S.A.

- Bostik (an Arkema subsidiary)

- Wacker Chemie AG

- 3M Company

- Huntsman Corporation

- Momentive Performance Materials Inc.

- MAPEI S.p.A.

- RPM International Inc.

- ITW Polymers Sealants

- Avery Dennison Corporation

Recent Developments

- In May 2023, Sika completed its acquisition of MBCC Group, a significant strategic move that expanded its product portfolio and market presence, especially in concrete admixtures and construction sealants.

- In 2023, Dow launched a new product line of silicone-based sealants and adhesives called DOWSIL PV.

- In 2023, Henkel opened a new 70,000-square-foot Technology Center in Bridgewater, New Jersey. The center was designed to showcase Henkel’s portfolio, including adhesives, sealants, and functional coatings, and to foster collaboration with customers from over 800 industry segments.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The construction sealants market will expand steadily due to global infrastructure growth.

- Demand for energy-efficient and eco-friendly sealants will continue to rise across all regions.

- Silicone and polyurethane sealants will maintain dominance due to superior performance.

- Hybrid sealants combining multiple polymer technologies will gain wider adoption.

- Increasing renovation and retrofit activities will drive consistent product consumption.

- Digital application tools and automated dispensing systems will improve installation efficiency.

- Manufacturers will invest more in low-VOC and bio-based sealant formulations.

- Emerging economies in Asia Pacific will remain key growth hubs for construction activity.

- Stricter environmental and safety standards will shape new product development.

- Strategic partnerships and mergers among global manufacturers will strengthen market competitiveness.