Market Overview

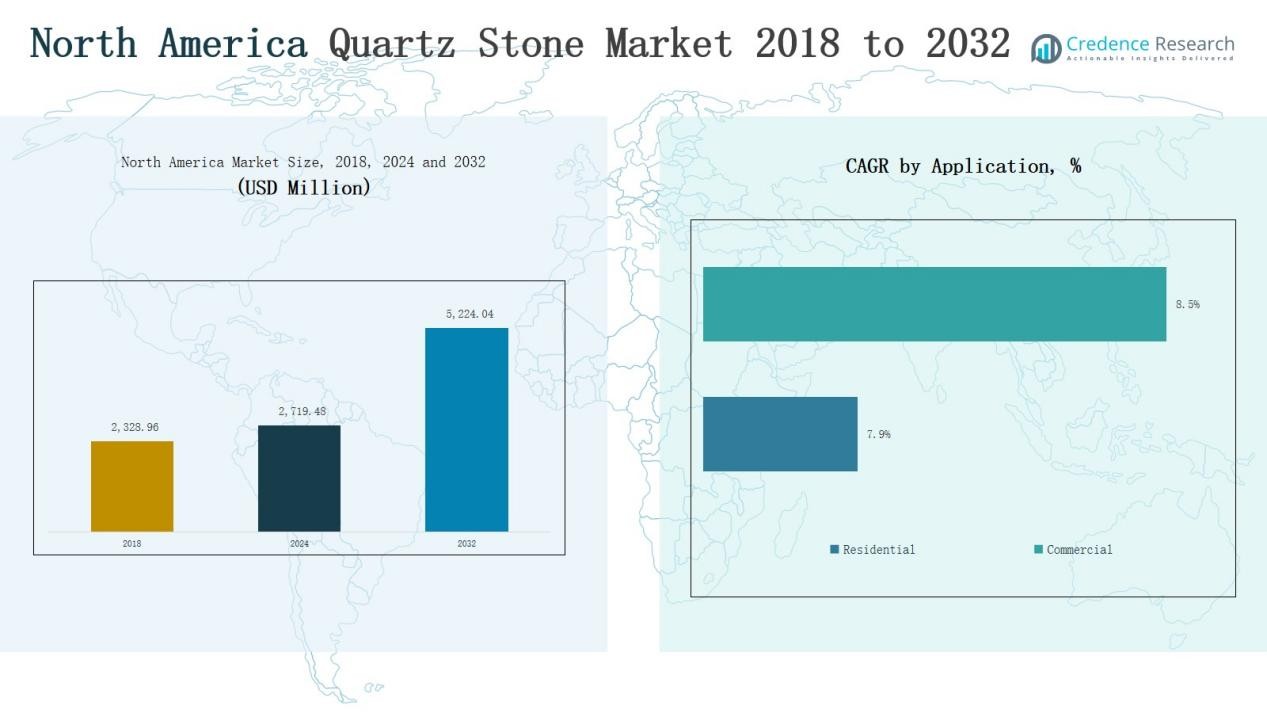

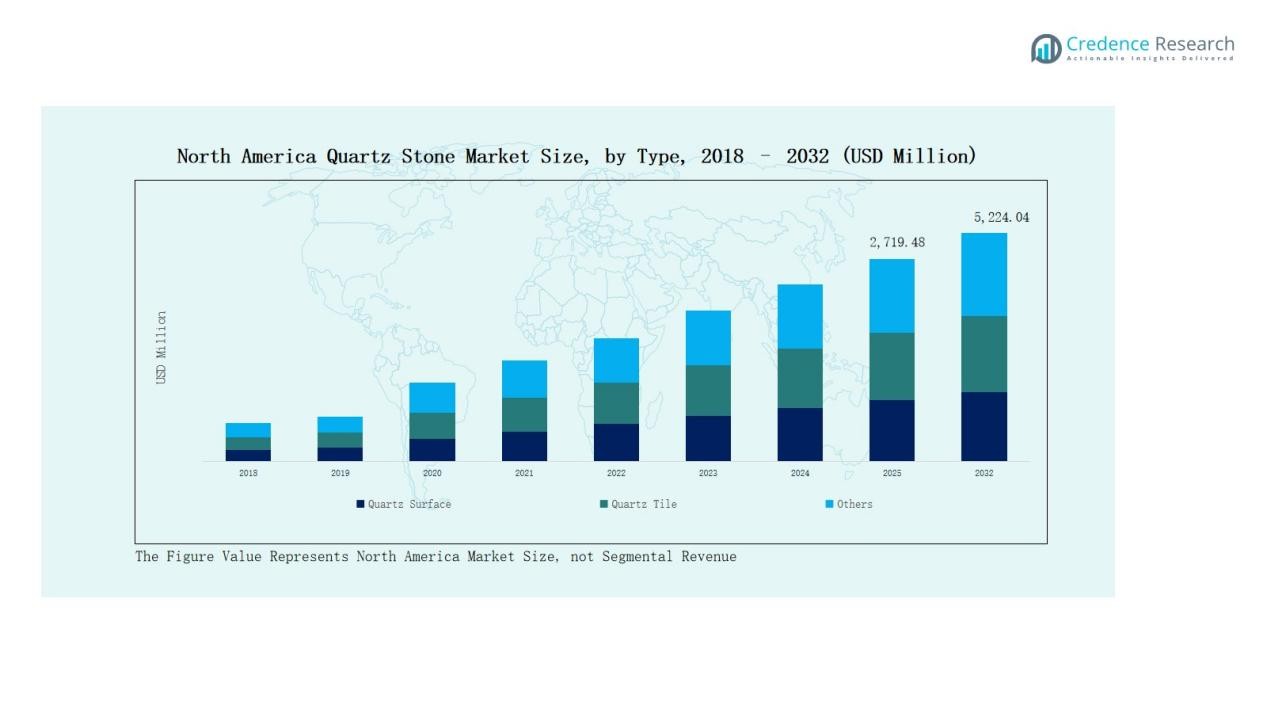

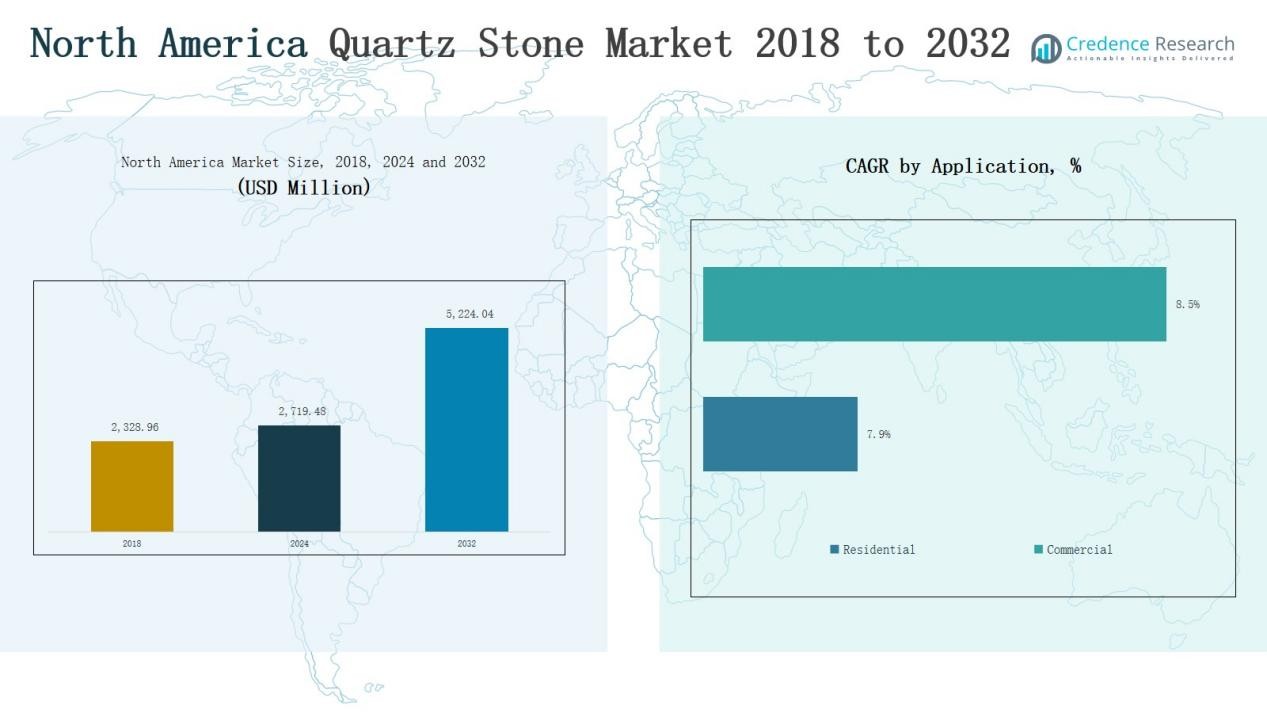

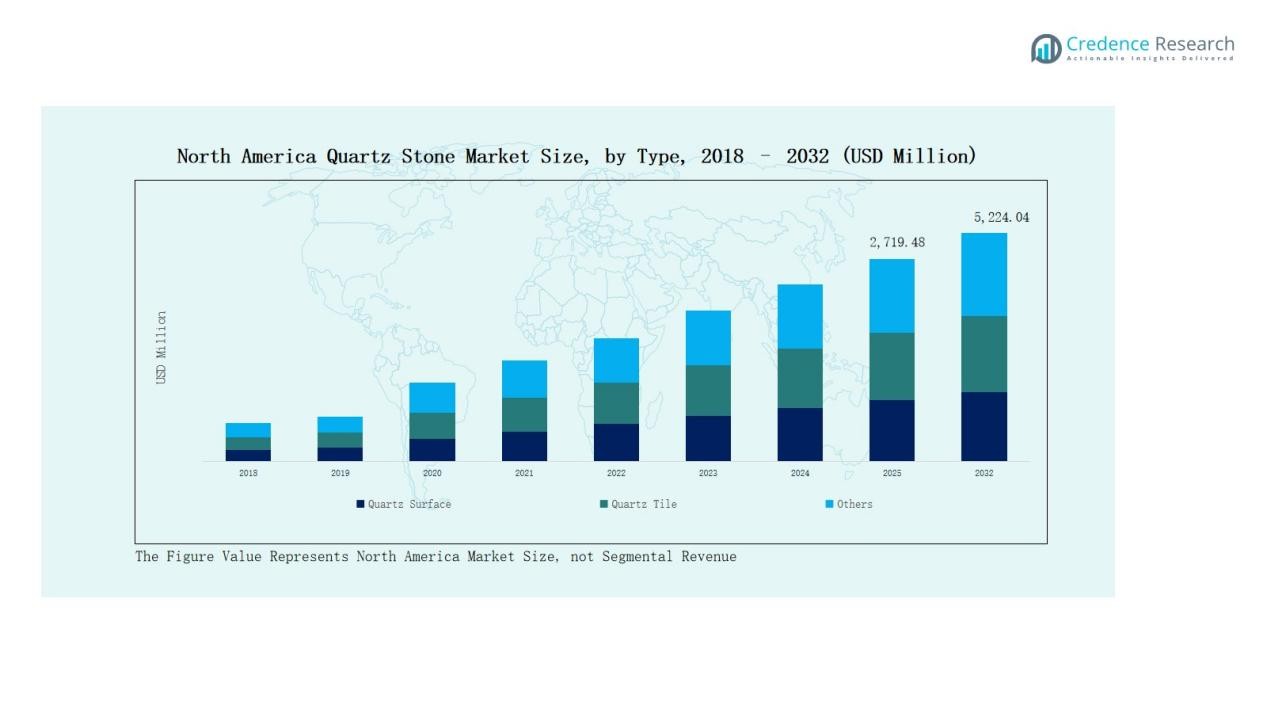

The North America Quartz Stone Market size was valued at USD 2,328.96 million in 2018, increased to USD 2,719.48 million in 2024, and is anticipated to reach USD 5,224.04 million by 2032, growing at a CAGR of 8.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Quartz Stone Market Size 2024 |

USD 2,719.48 Million |

| North America Quartz Stone Market, CAGR |

8.32% |

| North America Quartz Stone Market Size 2032 |

USD 5,224.04 Million |

The North America Quartz Stone Market is led by prominent players such as Caesarstone Ltd., Cambria Company LLC, Hanwha L&C (HanStone Quartz), LG Hausys Ltd., DuPont de Nemours, Inc., Wilsonart LLC, Vicostone JSC, Compac Surfaces, and Cosentino S.A. (Silestone brand). These companies focus on innovation, advanced fabrication technologies, and sustainable production to strengthen their regional presence. Continuous investments in design diversity, recycled material integration, and eco-certified surfaces enhance product competitiveness. The United States remains the leading region, holding 68% of the market share in 2024, driven by strong demand from residential renovation and premium commercial construction projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Quartz Stone Market was valued at USD 2,328.96 million in 2018, increased to USD 2,719.48 million in 2024, and is projected to reach USD 5,224.04 million by 2032, growing at a CAGR of 8.32%.

- The Quartz Surface segment dominated with a 59% share in 2024, driven by demand for durable, stain-resistant, and customizable materials in premium residential and commercial interiors

- The Residential segment held 63% of the market in 2024, supported by strong housing renovation trends, modern kitchen designs, and increasing adoption of eco-conscious interior materials.

- The Engineered Quartz segment led with a 71% share in 2024, favored for its consistent quality, design flexibility, and sustainable manufacturing processes across premium applications.

- The United States led the region with 68% of the market share in 2024, followed by Canada (21%) and Mexico (11%), driven by strong construction activity and rising demand for luxury interiors.

Market Segment Insights

By Type:

The Quartz Surface segment dominated the North America Quartz Stone Market in 2024, accounting for 59% of total revenue. Its growth is driven by rising demand for durable and low-maintenance materials in residential and commercial interiors. Quartz surfaces offer superior stain resistance, aesthetic variety, and easy customization, making them ideal for countertops and flooring. The trend toward premium kitchen designs and sustainable construction continues to strengthen adoption across high-end housing and hospitality projects.

- For instance, Cambria showcased new designs in March 2024, such as Rose Bay at the Kitchen and Bath Industry Show, along with its existing and popular Brittanicca Gold Warm™ quartz, which features intricate veining patterns tailored for luxury kitchen installations.

By Application:

The Residential segment led the North America Quartz Stone Market, representing 63% of total market share in 2024. Strong housing construction, remodeling activities, and preference for luxury home interiors drive this dominance. Homeowners favor quartz for its strength, visual appeal, and ease of maintenance compared to natural stone. Increasing investments in modern kitchen and bathroom renovations further support growth, with rising consumer spending on durable, eco-conscious surfaces boosting long-term residential demand.

- For instance, Cosentino North America launched additional Silestone XM options produced with HybriQ+ technology, made from recycled materials to meet the surging demand for sustainable residential surfaces.

By Material Composition:

The Engineered Quartz segment held the largest share of 71% in the North America Quartz Stone Market in 2024. Engineered quartz’s consistent quality, high durability, and wide design versatility make it the preferred material for interior applications. Manufacturers emphasize advanced fabrication and eco-friendly resins to enhance performance and sustainability. The segment benefits from the expanding use of engineered quartz in premium residential and commercial spaces, supported by technological advancements in surface finishing and color innovation.

Key Growth Drivers

Rising Demand for Premium Interior Materials

The North America Quartz Stone Market benefits from strong consumer preference for luxury and durable interiors. Quartz stone’s non-porous surface, low maintenance, and elegant appearance make it a top choice for modern kitchens and bathrooms. Home renovation and remodeling trends, especially in the U.S. and Canada, continue to expand market opportunities. Developers and homeowners favor quartz over granite and marble for its superior performance, versatility in design, and long-term cost efficiency in high-end applications.

- For instance, Cambria, a family-owned American manufacturer based in Minnesota, produces quartz surfaces with over 140 designs, focusing on durability and artistic mimicry of natural stone, ensuring high-end residential demand across North America.

Expanding Construction and Real Estate Activities

Rapid urbanization and commercial expansion drive quartz stone adoption across residential and commercial sectors. Growth in office spaces, hospitality, and retail construction increases demand for premium surfacing materials. Infrastructure projects emphasizing sustainable design also favor quartz due to its longevity and recyclability. The U.S. construction industry’s consistent rebound and rising per capita income contribute significantly to quartz consumption, positioning it as a preferred material in flooring, countertops, and decorative architectural applications.

- For instance, Wayon Quartz produces high-performance quartz surfaces suitable for high-traffic commercial applications like hotel lobbies and restaurants

Technological Advancements in Manufacturing

Technological progress in engineered quartz production has improved material strength, color precision, and environmental performance. Advanced automation and digital fabrication technologies enable faster processing and customization. Companies use sustainable resins, recycled quartz, and energy-efficient methods to meet eco-certification standards. These innovations enhance surface quality and production efficiency, helping manufacturers achieve higher output with reduced waste. Continuous R&D investment strengthens competitiveness and supports expansion into new aesthetic categories and smart surface applications.

Key Trends & Opportunities

Rising Popularity of Sustainable and Recycled Quartz

Sustainability is a major trend in the North America Quartz Stone Market, with growing adoption of eco-friendly and recycled materials. Consumers increasingly seek surfaces with low environmental impact and certifications like LEED or GREENGUARD. Manufacturers respond by incorporating recycled glass and industrial by-products into quartz slabs. This approach aligns with circular economy principles and strengthens brand positioning among environmentally conscious customers, creating new opportunities in green building and certified construction projects.

- For instance, Quaker’s sustainability initiative, as part of PepsiCo’s pep+ strategy, emphasizes packaging innovation and regenerative agriculture. Quaker has transitioned some porridge pots to paper-based packaging to reduce plastic use and employs science-based crop intelligence to support sustainable oat production.

Growth of Online Retail and Customization Demand

Online platforms are transforming quartz stone distribution, offering consumers and contractors easy access to product catalogs, virtual design tools, and pricing transparency. Digital sales channels enable faster customization, allowing clients to choose patterns, textures, and finishes directly. This trend widens access for small and mid-sized buyers while supporting personalized interior design preferences. The shift toward online retail strengthens market reach and drives demand for innovative quartz solutions tailored to modern aesthetic trends.

- For instance, companies like Fortuna Marmo Granite offer premium quartz slabs online with detailed images, samples, and virtual visualizers that help buyers finalize design choices remotely.

Key Challenges

High Production and Installation Costs

Despite strong demand, high manufacturing and installation costs limit broader adoption of quartz stone. Advanced machinery, imported raw materials, and skilled labor requirements increase pricing compared to traditional surfaces. Transportation and energy expenses also add to overall costs. These factors reduce competitiveness in cost-sensitive markets, especially among mid-range residential projects. Manufacturers face pressure to balance quality with affordability through operational optimization and localized sourcing strategies.

Environmental Concerns in Processing

Quartz stone production involves intensive energy use and resin-based binding materials, raising environmental concerns. Dust emissions during fabrication can pose health and safety risks without proper controls. Regulatory compliance for sustainable production adds operational complexity and cost. Manufacturers are adopting cleaner technologies and closed-loop water systems to reduce impact. Balancing production efficiency with environmental responsibility remains a key challenge in maintaining market reputation and meeting stricter green building standards.

Intense Market Competition and Price Pressure

The market faces strong competition from local and international suppliers offering similar quartz products. Continuous innovation, aggressive pricing, and expanding distribution networks intensify rivalry. Import-driven pricing pressures from Asia further challenge regional manufacturers. Companies must focus on brand differentiation, product quality, and customer service to retain share. Sustaining profit margins while managing material and logistics costs remains a persistent challenge in the highly competitive quartz stone landscape.

Regional Analysis

United States

The United States dominated the North America Quartz Stone Market, holding 68% of the total share in 2024. Strong demand from residential renovation and luxury housing projects drives market expansion. Consumers prefer quartz surfaces for their durability, modern design, and low maintenance. The commercial sector, including hospitality and corporate interiors, also contributes significantly to product adoption. Leading manufacturers such as Cambria, Caesarstone, and Wilsonart have expanded local production to meet growing domestic needs. The market benefits from the rising trend toward eco-friendly, engineered quartz products. Government incentives supporting green building practices further strengthen long-term market potential.

Canada

Canada accounted for 21% of the North America Quartz Stone Market in 2024, driven by the increasing preference for high-quality interior materials. Demand is concentrated in urban centers such as Toronto, Vancouver, and Montreal, where home remodeling and new housing projects are accelerating. Builders and architects favor quartz for its visual appeal and structural resilience under varying climatic conditions. The growing influence of sustainable construction practices supports demand for eco-friendly quartz products. It continues to benefit from a rising middle-class population and strong real estate investment. Expanding distribution through online channels and retail networks enhances consumer accessibility and product visibility.

Mexico

Mexico represented 11% of the North America Quartz Stone Market in 2024, supported by expanding infrastructure and tourism projects. The rise in hotel, resort, and commercial construction increases demand for durable and cost-effective quartz surfaces. Local manufacturers are adopting advanced fabrication technologies to compete with imported products. Growing consumer awareness of quartz’s benefits over natural stones supports its wider adoption in kitchens and bathrooms. It shows steady growth in both residential and hospitality applications, driven by urbanization and rising disposable income. Government support for industrial modernization encourages domestic production and investment in sustainable material development.

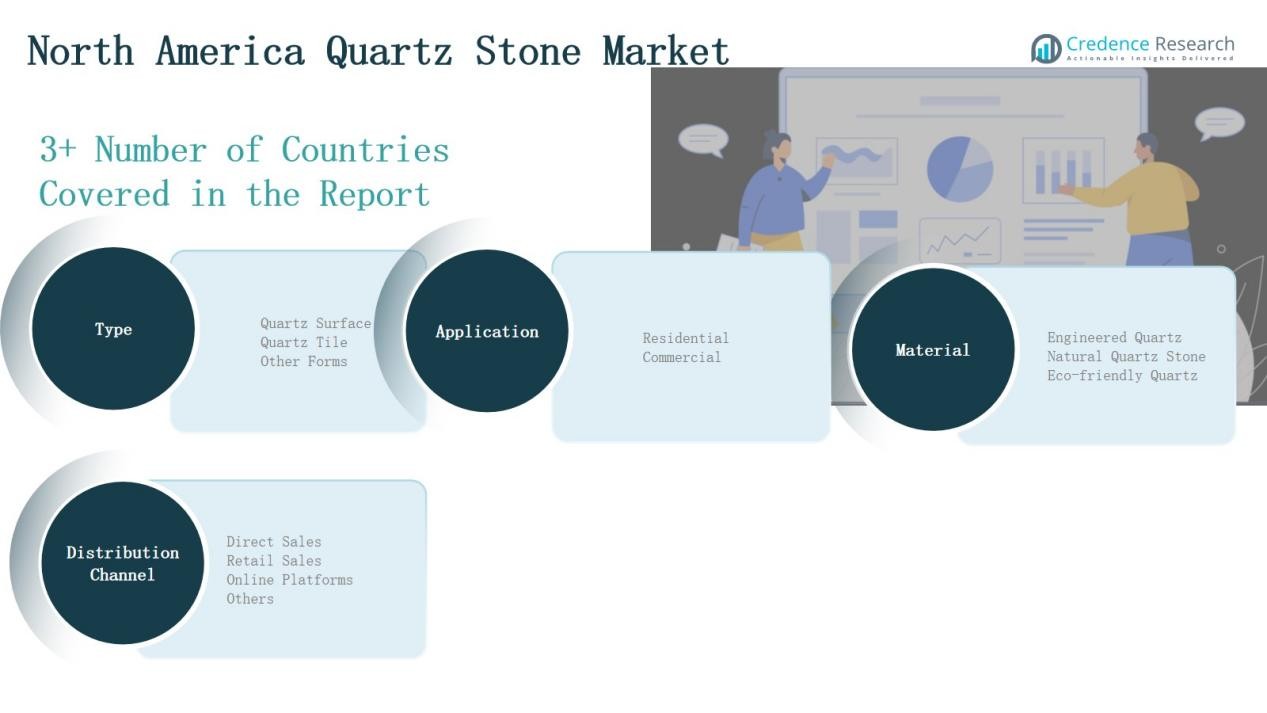

Market Segmentations:

By Type

- Quartz Surface

- Quartz Tile

- Other Forms

By Application

By Material Composition

- Engineered Quartz

- Natural Quartz Stone

- Eco-friendly Quartz

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Platforms

- Others

By Region

Competitive Landscape

The North America Quartz Stone Market is highly competitive, with both regional and international manufacturers vying for market share through innovation and product differentiation. It is characterized by strong brand presence, advanced fabrication technologies, and expanding distribution networks. Leading players such as Caesarstone Ltd., Cambria Company LLC, Hanwha L&C, LG Hausys, DuPont de Nemours, Inc., and Wilsonart LLC focus on producing high-performance quartz surfaces with superior durability, design versatility, and environmental compliance. Companies are investing in automated production, recycled material integration, and digital marketing to strengthen their competitive edge. Strategic partnerships with distributors and interior design firms further enhance visibility and market reach. Price competition from Asian imports challenges regional producers, encouraging innovation in texture, finish, and eco-friendly composition. The market continues to consolidate around technologically advanced and sustainability-driven players capable of addressing shifting consumer preferences in premium residential and commercial surface materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Caesarstone Ltd.

- Hanwha L&C (HanStone Quartz)

- Compac Surfaces

- Vicostone JSC

- Wilsonart LLC

- DuPont de Nemours, Inc.

- LG Hausys Ltd.

- Cambria Company LLC

- Santa Margherita S.p.A.

- Quarella S.p.A.

- Samsung Radianz (Samsung Surface Brand)

- Bitto (Dongguan) Quartz Co., Ltd.

- Technistone a.s.

- Cosentino S.A. (Silestone brand)

Recent Developments

- In April 2025, MSI Surfaces introduced eight new Q Premium Natural Quartz colors during KBIS 2025 in Las Vegas, expanding its design range for residential and commercial interiors.

- In August 2024, Vadara Quartz Surfaces announced four new distribution partnerships across the U.S. East Coast to strengthen its supply network and regional accessibility.

- In May 2025, LOTTE Chemical entered a partnership with EKO Stone to distribute Radianz Quartz products across the U.S. Midwest, aiming to boost its market presence.

- In February 2025, Cambria unveiled four new quartz designs at KBIS 2025, emphasizing refined color tones and enhanced surface durability for luxury interior projects.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Composition, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz surfaces will rise with growing residential renovation activities across major cities.

- Manufacturers will adopt sustainable production methods using recycled and low-emission materials.

- Smart surface technologies and antibacterial coatings will gain higher adoption in premium segments.

- Online retail platforms will play a larger role in product sales and customization options.

- Engineered quartz will continue to dominate due to its durability and design versatility.

- Partnerships between builders, designers, and quartz manufacturers will strengthen market integration.

- Local production capacity will expand to reduce dependence on imported quartz materials.

- Advancements in digital fabrication and automated processing will improve efficiency and quality.

- Eco-friendly product certifications will influence consumer preferences and purchasing decisions.

- Competition will intensify, leading companies to focus on innovation, branding, and sustainability leadership.