Market Overview

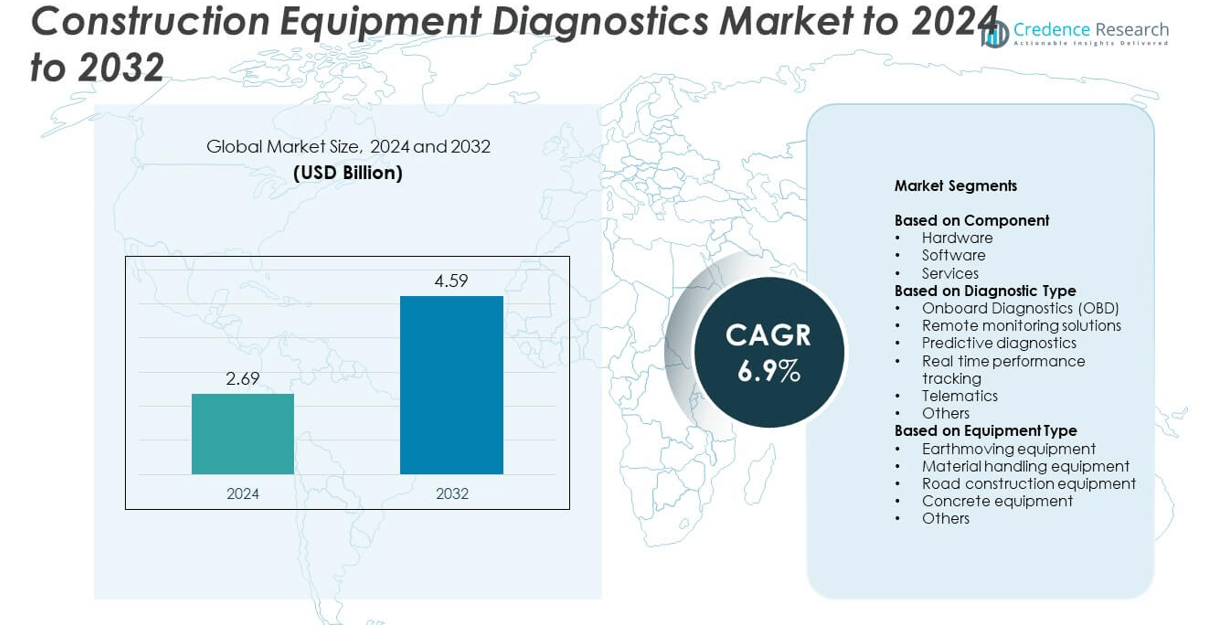

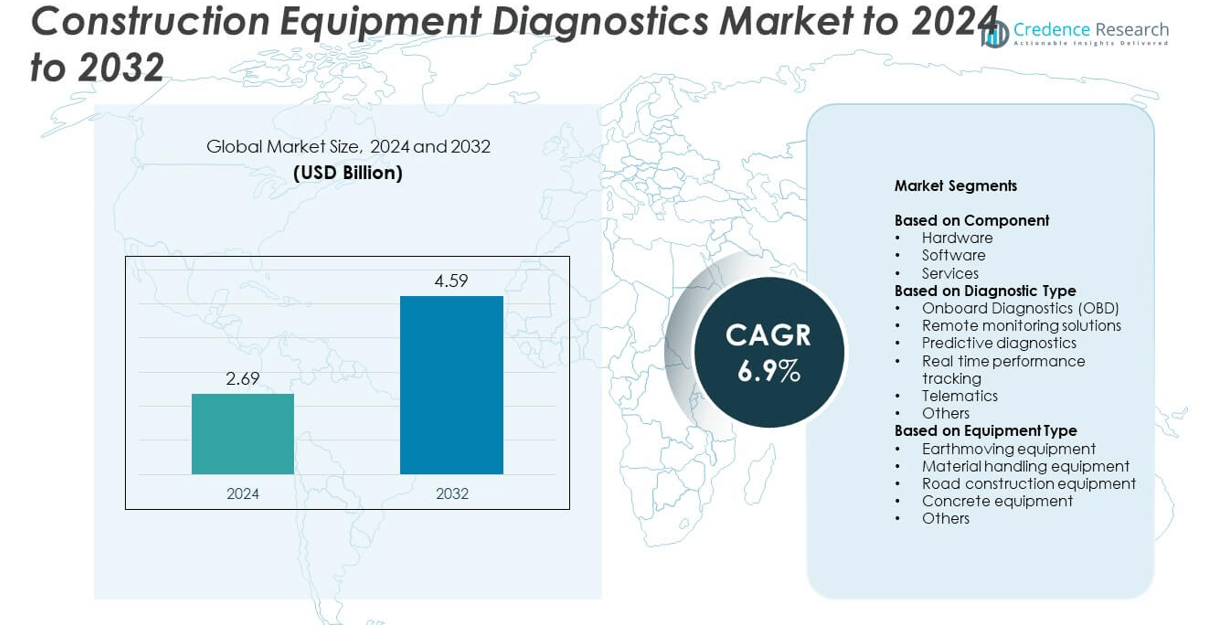

Construction Equipment Diagnostics Market size was valued at USD 2.69 Billion in 2024 and is anticipated to reach USD 4.59 Billion by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Equipment Diagnostics Market Size 2024 |

USD 2.69 Billion |

| Construction Equipment Diagnostics Market ,CAGR |

6.9% |

| Construction Equipment Diagnostics Market Size 2032 |

USD 4.59 Billion |

The Construction Equipment Diagnostics market is led by key players such as Bosch, Komatsu, Launch Tech, Autel, Noregon, Actia, Jaltest, Cando International, iCarsoft Technology, Heavy Diagnostics, Metsim Pro, and GuangZhou GuoLi Engineering Machinery Company Limited. These companies focus on advancing diagnostic technologies through IoT integration, predictive analytics, and telematics-driven monitoring systems to enhance equipment reliability and performance. Strategic collaborations with OEMs and construction fleet operators are strengthening their market positions. Regionally, North America dominated the global market with a 36% share in 2024, followed by Europe at 27% and Asia Pacific at 25%, reflecting strong adoption of connected equipment and data-driven maintenance solutions

.Market Insights

- The Construction Equipment Diagnostics market was valued at USD 2.69 billion in 2024 and is projected to reach USD 4.59 billion by 2032, growing at a CAGR of 6.9%.

- Rising demand for predictive maintenance, telematics integration, and IoT-based monitoring systems is driving market growth across major construction sectors.

- The market is witnessing trends toward cloud-based diagnostics, AI-driven fault detection, and remote monitoring for enhanced operational efficiency.

- Leading companies are investing in advanced sensor technologies and digital platforms, with the hardware segment holding a dominant 46% share in 2024.

- North America led the global market with a 36% share, followed by Europe at 27% and Asia Pacific at 25%, supported by large-scale infrastructure projects and strong regulatory focus on equipment safety and performance compliance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The hardware segment held the dominant share of around 46% in 2024, driven by increasing integration of advanced sensors, control units, and diagnostic modules across heavy equipment. The demand for hardware is supported by the adoption of IoT-enabled devices and onboard control systems that enable real-time monitoring of engine, hydraulic, and transmission performance. Software and services are gaining traction as cloud-based platforms and analytics tools enhance fault detection accuracy, reduce downtime, and enable remote equipment management for construction operators.

- For instance, Caterpillar Remote Flash cuts software-update time by up to 50%.

By Diagnostic Type

Onboard diagnostics (OBD) accounted for the largest share of approximately 39% in 2024, supported by its critical role in equipment health assessment and emission monitoring. OBD systems provide fault codes and performance data that improve maintenance efficiency and compliance with emission norms. Predictive diagnostics and remote monitoring solutions are expanding rapidly, as telematics and AI-driven analytics allow early fault detection, performance benchmarking, and optimized maintenance schedules, significantly reducing unplanned equipment downtime in large construction fleets.

- For instance, in January 2024, Volvo Construction Equipment announced that the number of machines in its Asia region connected to its ActiveCare service had surpassed 1,000 in November 2023.

By Equipment Type

Earthmoving equipment represented the leading category with about 42% market share in 2024, fueled by widespread adoption of diagnostic technologies in excavators, loaders, and bulldozers. The increasing use of connected sensors and automated maintenance alerts in earthmoving machinery enhances operational uptime and reduces repair costs. Material handling and road construction equipment are also witnessing growth as OEMs integrate real-time monitoring and telematics to improve asset utilization and ensure safety compliance across construction projects

Key Growth Drivers

Rising Demand for Predictive Maintenance Solutions

The construction industry is rapidly adopting predictive maintenance systems to enhance equipment uptime and reduce operational costs. Diagnostic solutions leveraging AI and machine learning analyze sensor data to predict component failures before they occur. This proactive approach minimizes repair downtime, extends equipment lifespan, and optimizes fleet management. Growing awareness of maintenance cost efficiency and productivity gains is encouraging equipment manufacturers to integrate predictive diagnostics in heavy machinery.

- For instance, Caterpillar reports 1.5 million+ connected assets using VisionLink in 2025.

Integration of Telematics and IoT Technologies

The increasing use of IoT-enabled diagnostic tools is transforming how construction equipment is monitored and maintained. Telematics systems provide real-time data on machine health, location, and performance metrics, allowing operators to respond quickly to potential issues. OEMs are embedding advanced connectivity modules in equipment to deliver remote fault detection and software updates. This integration enhances operational efficiency and supports the growing trend toward connected and automated construction sites.

- For instance, Volvo Group surpassed 1 million connected customer assets in 2019.

Strict Emission and Safety Regulations

Governments across major markets are enforcing stricter emission and safety regulations for construction equipment. Diagnostic systems help operators ensure compliance by monitoring exhaust emissions, engine performance, and safety parameters. These technologies enable automatic alerts and reporting for regulatory compliance, supporting sustainability goals and reducing penalties. The rising focus on eco-friendly operations and workforce safety continues to accelerate the adoption of advanced diagnostic technologies across the construction industry.

Key Trends & Opportunities

Growth of Cloud-Based and AI-Driven Platforms

Cloud-based diagnostics platforms are gaining traction as they centralize equipment data and enable predictive analytics across fleets. AI algorithms process real-time information from multiple machines, improving fault accuracy and reducing human dependency in maintenance decisions. Equipment manufacturers and rental firms are increasingly using these systems to enhance service quality and asset performance, creating new revenue streams through data-driven maintenance services.

- For instance, Komatsu products achieved a 23% operational CO₂ reduction versus FY2010 by FY2024.

Expansion of Remote and Mobile Diagnostics

The increasing use of remote monitoring and mobile diagnostic apps is redefining equipment maintenance strategies. Operators can now access live diagnostic data and receive alerts through mobile devices, improving response time and flexibility. This trend is particularly strong in large-scale projects where equipment is deployed across remote or multiple sites. The expansion of 5G connectivity and cloud integration further strengthens the opportunity for real-time mobile diagnostics.

- For instance, the telematics system now known as DevelonCONNECT covered more than 80,000 of the company’s machines worldwide by April 2021, and this number has increased since then. Most new machines equipped with the system come with a free 36-month subscription, allowing customers to monitor equipment remotely and optimize fleet management.

Key Challenges

High Implementation and Integration Costs

Adopting advanced diagnostic systems involves significant investment in sensors, software, and data infrastructure. Many small and medium construction firms face challenges in justifying these upfront costs, especially in developing markets. Additionally, integrating new systems with legacy machinery can be complex and time-consuming. These cost barriers slow market adoption despite the long-term benefits of enhanced productivity and reduced downtime.

Data Security and Connectivity Issues

As construction diagnostics become more connected, cybersecurity and data privacy risks are increasing. Unauthorized access to telematics data or cloud platforms can compromise operational safety and financial information. Moreover, inconsistent network coverage in remote construction areas limits real-time monitoring and data transmission reliability. These factors pose significant challenges to the seamless implementation of digital diagnostics across global construction operations.

Regional Analysis

North America

North America held the largest share of 36% in 2024, driven by strong adoption of digital diagnostic systems across the U.S. and Canada. The region benefits from high equipment utilization in large infrastructure and mining projects, combined with strong regulatory emphasis on equipment safety and emission control. OEMs such as Caterpillar and Deere & Company are expanding connected diagnostics platforms to improve fleet uptime and efficiency. The widespread use of telematics, predictive maintenance, and remote monitoring tools continues to boost market penetration across major construction and rental fleets.

Europe

Europe accounted for 27% of the global market in 2024, supported by growing adoption of connected diagnostic technologies in Germany, the U.K., and France. Stringent EU emission norms and sustainability policies are encouraging fleet owners to adopt systems that track performance and compliance in real time. European manufacturers are integrating IoT-based sensors and predictive analytics into machinery to reduce maintenance costs and downtime. The increasing focus on smart construction sites and digital asset management is further propelling the demand for advanced diagnostic solutions across the region.

Asia Pacific

Asia Pacific captured a 25% market share in 2024, fueled by large-scale infrastructure development in China, India, and Southeast Asia. Rapid urbanization and government-backed construction projects are driving demand for advanced equipment diagnostics to improve efficiency and control costs. Regional OEMs are increasingly adopting IoT-enabled telematics and predictive maintenance tools to enhance machinery performance. Expanding smart city initiatives and the adoption of cloud-based diagnostic platforms are strengthening the region’s position as a high-growth market for connected construction equipment systems.

Latin America

Latin America represented 7% of the global market in 2024, with Brazil and Mexico leading adoption. The region is gradually embracing diagnostic technologies to enhance operational efficiency and ensure regulatory compliance in construction projects. Equipment rental companies are investing in remote diagnostic platforms to minimize machine downtime and maintenance expenses. Despite economic fluctuations, the growing demand for reliable machinery monitoring in infrastructure projects is encouraging OEMs and service providers to expand their presence across the region.

Middle East & Africa

The Middle East & Africa accounted for 5% of the global market in 2024, supported by infrastructure investments in Saudi Arabia, the UAE, and South Africa. Construction equipment diagnostics are gaining importance in large-scale projects such as smart cities and industrial zones. Rising government spending on transport, energy, and real estate projects is driving the use of connected machinery and predictive analytics. Increasing awareness of cost-efficient maintenance and safety standards is fostering gradual market growth in both developed and emerging economies of the region.

Market Segmentations:

By Component

- Hardware

- Software

- Services

By Diagnostic Type

- Onboard Diagnostics (OBD)

- Remote monitoring solutions

- Predictive diagnostics

- Real time performance tracking

- Telematics

- Others

By Equipment Type

- Earthmoving equipment

- Material handling equipment

- Road construction equipment

- Concrete equipment

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Construction Equipment Diagnostics market features a competitive landscape led by major players such as Bosch, Komatsu, Launch Tech, Autel, Noregon, Actia, Jaltest, Cando International, iCarsoft Technology, Heavy Diagnostics, Metsim Pro, and GuangZhou GuoLi Engineering Machinery Company Limited. These companies focus on enhancing diagnostic accuracy, equipment uptime, and predictive maintenance capabilities through advanced software integration and sensor-based monitoring systems. Strategic investments in telematics, AI-driven analytics, and cloud connectivity are enabling vendors to deliver faster fault detection and remote diagnostic services. Manufacturers are expanding partnerships with OEMs and rental companies to strengthen aftersales support and fleet management efficiency. Continuous product innovation, integration of real-time monitoring technologies, and regional expansion across emerging construction markets are key strategies shaping competition. The market is witnessing rising emphasis on connected diagnostics and sustainable equipment performance, positioning technologically advanced firms to capture higher market share in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bosch

- Komatsu

- Launch Tech

- Autel

- Noregon

- Actia

- Jaltest

- Cando International

- iCarsoft Technology

- Heavy Diagnostics

- Metsim Pro

- GuangZhou GuoLi Engineering Machinery Company Limited

Recent Developments

- In 2025, Komatsu Showcased new-generation equipment and solutions at the Bauma trade fair, including the PC220LCi-12 hydraulic excavator with advanced 3D construction features.

- In 2025, Actia highlighted its digital ecosystem for industrial machines, which focuses on optimizing the equipment lifecycle.

- In 2024, Autel launched significant software updates for brands like Mahindra in India in July, expanding its diagnostic coverage in that key market.

Report Coverage

The research report offers an in-depth analysis based on Component, Diagnostic Type, Equipment Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth with rising demand for smart and connected machinery.

- Predictive maintenance will become standard practice across large construction fleets.

- Integration of AI and machine learning will enhance fault detection accuracy and efficiency.

- Telematics-based diagnostics will expand rapidly with improved 5G and cloud connectivity.

- OEMs will focus on developing remote and mobile diagnostic platforms for field use.

- Partnerships between software firms and equipment manufacturers will strengthen data-driven maintenance models.

- Adoption will grow among rental companies seeking higher uptime and lower repair costs.

- Regulations on emissions and equipment safety will further accelerate diagnostic technology use.

- Emerging markets in Asia and the Middle East will drive new growth opportunities.

- Increased focus on sustainability and energy-efficient operations will shape future diagnostic innovations.