Market Overview

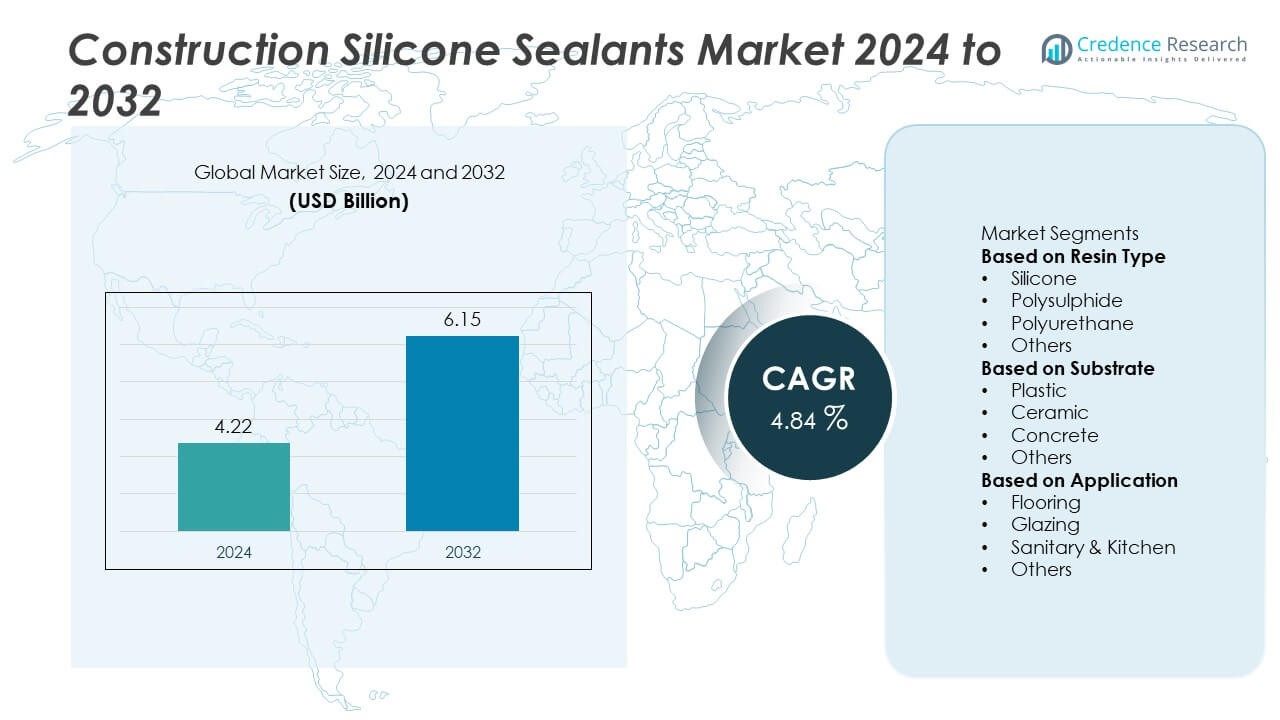

The Construction Silicone Sealants Market was valued at USD 4.22 billion in 2024 and is projected to reach USD 6.15 billion by 2032, growing at a CAGR of 4.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Silicone Sealants Market Size 2024 |

USD 4.22 Billion |

| Construction Silicone Sealants Market, CAGR |

4.84% |

| Construction Silicone Sealants Market Size 2032 |

USD 6.15 Billion |

The construction silicone sealants market is led by key players such as Dow, Henkel Corporation, BASF SE, 3M, H.B. Fuller, Bostik, Mapei, Huntsman International LLC, DAP Products Inc., and KONISHI Chemical Ind Co., Ltd. These companies dominate through advanced product innovation, strong brand presence, and extensive global supply networks. Dow and Henkel lead in developing high-performance sealants for glazing and structural applications, emphasizing durability and sustainability. Regionally, Asia-Pacific held a 39% market share in 2024, driven by large-scale infrastructure projects and expanding residential construction. North America followed with 28%, supported by renovation activities and demand for energy-efficient sealing materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The construction silicone sealants market was valued at USD 4.22 billion in 2024 and is projected to reach USD 6.15 billion by 2032, growing at a CAGR of 4.84% during the forecast period.

- Market growth is driven by rising demand for long-lasting and weather-resistant sealing materials in glazing, flooring, and façade applications within residential and commercial projects.

- Key trends include a shift toward eco-friendly, low-VOC silicone sealants and the adoption of rapid-curing formulations for improved application efficiency and durability.

- The market is competitive, with major players such as Dow, Henkel, BASF SE, and H.B. Fuller emphasizing R&D, sustainable chemistry, and strategic collaborations to enhance global reach.

- Asia-Pacific led with a 39% share in 2024, followed by North America with 28% and Europe with 25%, while the silicone resin segment dominated with 47% share due to its superior elasticity and UV resistance.

Market Segmentation Analysis:

By Resin Type

The silicone segment dominated the construction silicone sealants market in 2024, holding a 56% share. Silicone-based sealants are preferred for their superior flexibility, UV resistance, and long-term adhesion properties across varied substrates. They are extensively used in glass glazing, façades, and expansion joints due to their durability and weatherproof performance. The material’s ability to withstand extreme temperature fluctuations makes it ideal for both indoor and outdoor structural applications. Growing demand for energy-efficient building materials and high-performance sealing solutions continues to strengthen the market position of silicone sealants.

- For instance, Dow introduced its DOWSIL 796 Neutral Silicone Sealant featuring a tensile strength of 1.8 megapascals (MPa) and an elongation at break of 700% (under specific test conditions using 2 mm thick S2 dumb-bells as per ISO 37), providing high elasticity for façade joints.

By Substrate

The concrete substrate segment accounted for 41% of the market share in 2024, driven by its wide use in flooring, facades, and expansion joints. Silicone sealants offer strong adhesion and elasticity when applied to concrete, preventing water ingress and structural cracking. The increasing number of infrastructure and commercial construction projects globally has heightened the use of sealants for concrete protection and maintenance. Their chemical stability and resistance to environmental stressors make them a preferred choice in urban and industrial construction environments.

- For instance, Mapei S.p.A. launched Mapesil AC, a high-performance acetic silicone sealant demonstrating tensile strength of 1.6 MPa and elongation at break of 800%, suitable for long-term watertight sealing on concrete substrates when used with a bonding enhancer.

By Application

The glazing segment held the largest share of 38% in 2024, supported by rising demand for modern glass façades and curtain wall installations in commercial buildings. Silicone sealants are critical in providing airtight and watertight bonds while maintaining structural integrity. Their optical clarity, weather resistance, and compatibility with coated glass surfaces enhance both aesthetic and performance aspects of construction designs. The rapid growth of high-rise and energy-efficient buildings, combined with innovations in architectural glazing, continues to drive the dominance of silicone sealants in this segment.

Key Growth Drivers

Rising Demand for Energy-Efficient and Sustainable Buildings

Growing emphasis on energy-efficient and eco-friendly infrastructure is a major driver for the construction silicone sealants market. Silicone sealants play a vital role in reducing air leakage, improving thermal insulation, and enhancing building envelope performance. Their use in green-certified buildings and modern glazing systems supports sustainability goals. Increasing adoption of low-VOC and environmentally compliant sealants, encouraged by regulations such as LEED and REACH, is driving demand from both residential and commercial construction sectors worldwide.

- For instance, 3M Company developed its 3M Fire Barrier Silicone Sealant 2000+ with a low VOC content of less than 32 grams per liter and a fire resistance rating of up to 4 hours in specific firestop systems, supporting LEED-certified construction projects with high fire safety and low environmental emissions.

Expanding Infrastructure and Urban Development Projects

Rapid urbanization and infrastructure expansion across developing economies are fueling the demand for silicone sealants. These materials are essential in high-performance structural applications, including bridges, airports, and smart city projects. Rising public and private investments in commercial and residential construction increase the need for durable sealing solutions that ensure structural integrity and longevity. The growing use of silicone sealants in renovation and façade restoration projects further supports consistent market growth across global regions.

- For instance, Huntsman offers structural methacrylate adhesives like Araldite 2054-05, which provides a high elongation at break and has excellent resistance to ageing, weathering, and temperatures up to 100°C. This adhesive is suitable for bonding metals, composites, and plastics in dynamic environments.

Increasing Use in High-Performance Glazing and Façade Systems

The surge in demand for advanced glazing and curtain wall systems in modern architecture is significantly driving market expansion. Silicone sealants offer superior adhesion, flexibility, and UV resistance, making them ideal for bonding glass and metal surfaces. Their ability to maintain structural stability under wind loads and temperature variations enhances safety and design versatility. Growing adoption of double-glazed and energy-efficient glass façades in commercial skyscrapers and smart buildings is further boosting consumption across construction markets.

Key Trends & Opportunities

Adoption of Low-VOC and Eco-Friendly Sealants

A growing trend toward sustainable construction is driving demand for low-VOC and solvent-free silicone sealants. Manufacturers are innovating to develop products that comply with environmental standards while maintaining superior performance. These formulations reduce emissions and improve indoor air quality, aligning with global green building initiatives. Increasing consumer awareness and stricter environmental regulations across North America and Europe are accelerating the transition toward eco-friendly sealants. This trend presents strong opportunities for companies focusing on sustainable product development.

- For instance, Henkel Corporation offers the LOCTITE SI 595, a solvent-free silicone sealant that cures on exposure to moisture to form a tough and flexible seal. This general-purpose adhesive and sealant is suitable for applications involving glass, metal, and plastic, and is formulated to withstand extreme temperature cycling, UV light, and ozone, providing long-term performance.

Integration of Smart and Hybrid Sealant Technologies

Technological advancements are leading to the emergence of hybrid silicone sealants that combine the elasticity of silicone with the strength of polyurethane. These hybrid products offer improved adhesion, faster curing, and enhanced resistance to weathering and chemicals. Additionally, smart sealants with self-healing and moisture-reactive properties are gaining attention in advanced construction applications. Such innovations address the industry’s demand for longer-lasting and maintenance-free sealing solutions, opening new avenues for market expansion and product differentiation.

- For instance, Bostik introduced its ISR 70-03 S Hybrid Polymer Sealant achieving tensile strength of approximately 2.6 MPa and elongation at break of approximately 250%, ensuring durable sealing under dynamic industrial movements.

Key Challenges

Fluctuating Raw Material Costs

Volatility in the prices of key raw materials such as silicone polymers and additives poses a major challenge for manufacturers. Supply chain disruptions and dependency on limited suppliers affect production costs and profit margins. Rising energy prices and transportation costs further exacerbate pricing pressure in the construction sealants industry. Manufacturers are investing in localized production and sustainable sourcing strategies to mitigate these fluctuations, but maintaining price stability remains a persistent challenge in the global market.

Stringent Environmental and Performance Regulations

Compliance with environmental, safety, and performance standards adds complexity to product formulation and manufacturing processes. Regulations related to VOC emissions, chemical content, and disposal are becoming increasingly strict, particularly in developed markets. Meeting these requirements often demands costly R&D investments and reformulation of existing products. Additionally, inconsistent regulatory frameworks across regions can delay product approvals and hinder market entry. Companies must balance innovation, compliance, and cost efficiency to remain competitive in the evolving regulatory landscape.

Regional Analysis

North America

North America held a 29% share of the construction silicone sealants market in 2024, driven by growing demand for energy-efficient and sustainable construction materials. The United States leads regional growth due to advanced residential and commercial infrastructure projects and strong adoption of high-performance glazing systems. Strict building codes by organizations such as LEED and Energy Star promote the use of low-VOC silicone sealants. Increasing renovation activities and retrofitting of aging structures are further supporting product demand. Ongoing investment in green building technologies continues to position North America as a key market for silicone sealants.

Europe

Europe accounted for 27% of the construction silicone sealants market in 2024, supported by stringent energy-efficiency regulations and growing adoption of eco-friendly materials. Germany, France, and the United Kingdom are major contributors, driven by rising use of silicone sealants in façade glazing, roofing, and flooring applications. Government-led initiatives promoting carbon-neutral buildings are accelerating product innovation in low-emission formulations. Expanding renovation projects across Western and Central Europe are further boosting consumption. The region’s strong emphasis on sustainability and building performance standards continues to strengthen demand for advanced silicone sealant technologies.

Asia-Pacific

Asia-Pacific dominated the construction silicone sealants market with a 34% share in 2024, fueled by rapid urbanization, industrialization, and infrastructure development in China, India, and Japan. Expanding residential and commercial construction activities are significantly increasing demand for durable and weather-resistant sealants. The rise of smart city projects and energy-efficient skyscrapers is further accelerating adoption. Increasing foreign investment and government initiatives supporting sustainable urban growth enhance regional market expansion. The availability of low-cost raw materials and manufacturing capabilities positions Asia-Pacific as the fastest-growing hub for construction silicone sealant production and consumption globally.

Middle East & Africa

The Middle East & Africa held a 6% share of the construction silicone sealants market in 2024, driven by strong infrastructure development and growing demand for high-performance glazing and waterproofing materials. Countries such as the UAE, Saudi Arabia, and South Africa are leading adoption due to large-scale construction and modernization projects. Harsh climatic conditions and the need for durable sealing solutions further promote silicone-based applications. Government investments in commercial and residential megaprojects, along with expanding tourism infrastructure, are creating consistent growth opportunities across the region’s construction sealant market.

South America

South America captured a 4% share of the construction silicone sealants market in 2024, led by increasing urban development and infrastructure investments across Brazil, Argentina, and Chile. The construction of residential complexes, commercial buildings, and transportation projects is boosting regional demand. Growing focus on energy efficiency and sustainable materials supports the shift toward silicone-based sealants over traditional materials. Economic recovery and expanding industrialization contribute to moderate growth. However, fluctuations in raw material prices and limited local manufacturing capacity pose challenges, prompting reliance on imports from North America and Asia-Pacific suppliers.

Market Segmentations:

By Resin Type

- Silicone

- Polysulphide

- Polyurethane

- Others

By Substrate

- Plastic

- Ceramic

- Concrete

- Others

By Application

- Flooring

- Glazing

- Sanitary & Kitchen

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the construction silicone sealants market includes major players such as Mapei, Huntsman International LLC, 3M, KONISHI Chemical Ind Co., Ltd, BASF SE, DAP Products Inc., H.B. Fuller, Dow, Bostik, and Henkel Corporation. These companies dominate the market through strong R&D capabilities, wide product portfolios, and global distribution networks. Leading manufacturers focus on developing low-VOC, weather-resistant, and high-performance sealants suitable for modern construction materials. Strategic partnerships and acquisitions are strengthening their presence in emerging economies. Continuous innovation in silicone formulations for glazing, façade, and sanitary applications drives market differentiation. Additionally, increasing investment in eco-friendly and energy-efficient sealing technologies helps leading brands align with sustainability regulations and green building standards, ensuring steady long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mapei

- Huntsman International LLC

- 3M

- KONISHI Chemical Ind Co., Ltd

- BASF SE

- DAP Products Inc.

- B. Fuller

- Dow

- Bostik

- Henkel Corporation

Recent Developments

- In August 2025, Bostik (Arkema) introduced VSR 400A, a conductive seam sealant based on SMP chemistry, announced for North American launch at ACCE 2025.

- In July 2025, Henkel reported LOCTITE 55 thread sealant winning two Red Dot Awards 2025 for product and sustainable design (160 m pack).

- In April 2025, DAP Products unveiled its “On-The-Go” line featuring a 100% silicone all-purpose adhesive sealant in a 2.8-fl-oz format for retail channels.

- In March 2023, Dow announced the launch of its DOWSIL PV Product Line, expanding its silicone-based sealants and adhesives specifically for photovoltaic (PV) module assembly.

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Substrate, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising use of silicone sealants in green building projects.

- Increasing demand for high-performance sealants in modern glazing systems will drive growth.

- Adoption of low-VOC and sustainable silicone formulations will gain momentum globally.

- Asia-Pacific will remain the leading region due to rapid construction and infrastructure development.

- Technological advancements will improve UV resistance, flexibility, and thermal stability of sealants.

- Manufacturers will focus on fast-curing products to reduce construction time and labor costs.

- Smart sealing materials with self-healing and weather-adaptive properties will emerge.

- Expansion in prefabricated and modular construction will boost demand for durable sealants.

- Collaborations between chemical firms and construction companies will enhance innovation and market reach.

- Regulations promoting energy-efficient and sustainable materials will continue shaping product development.