Market Overview

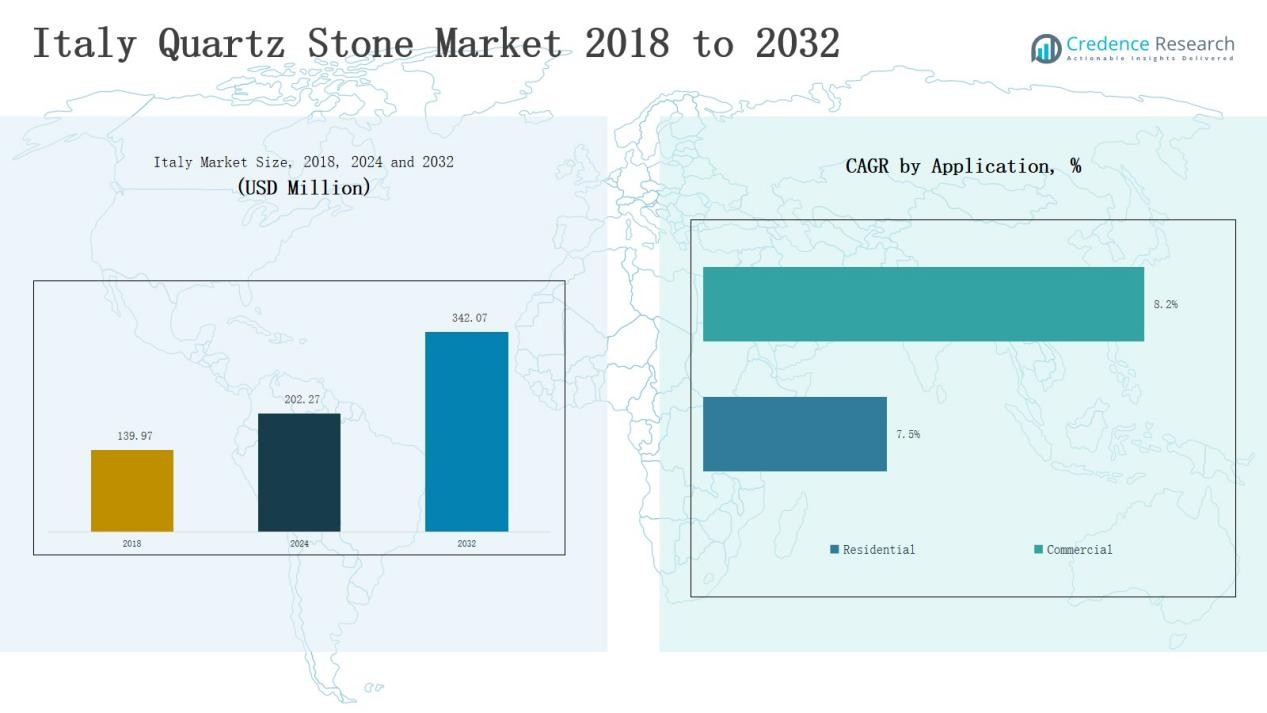

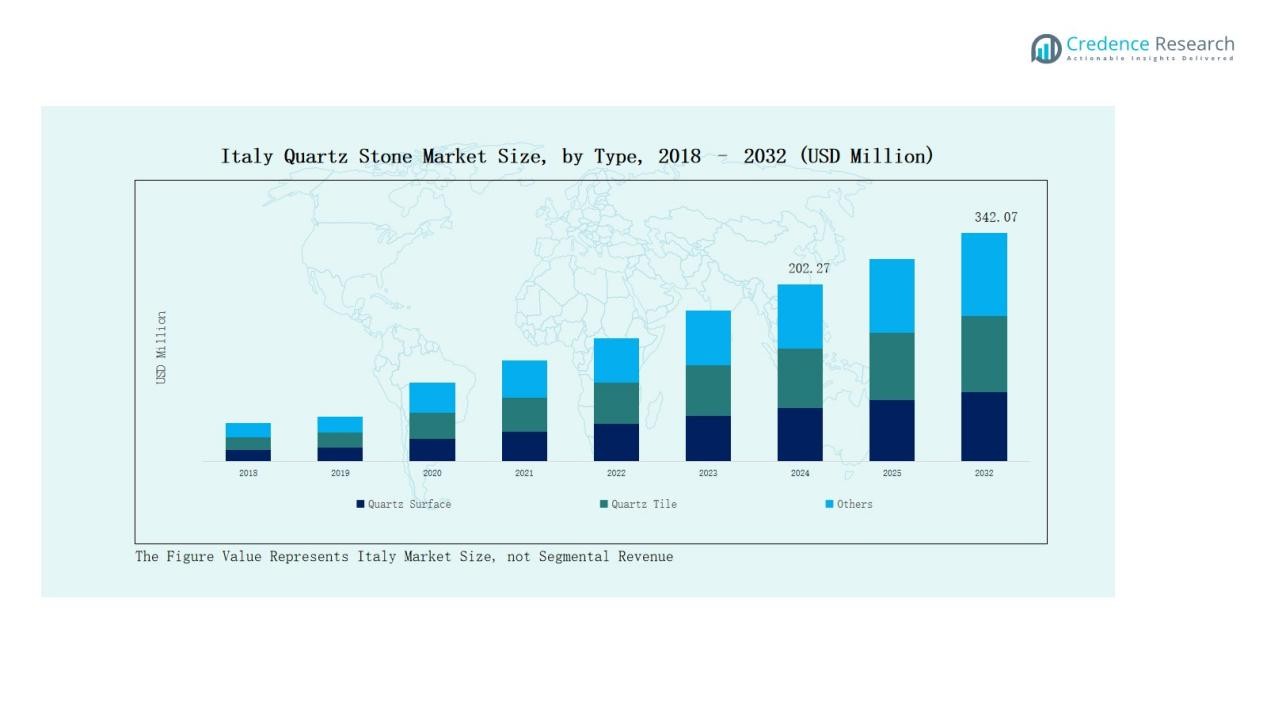

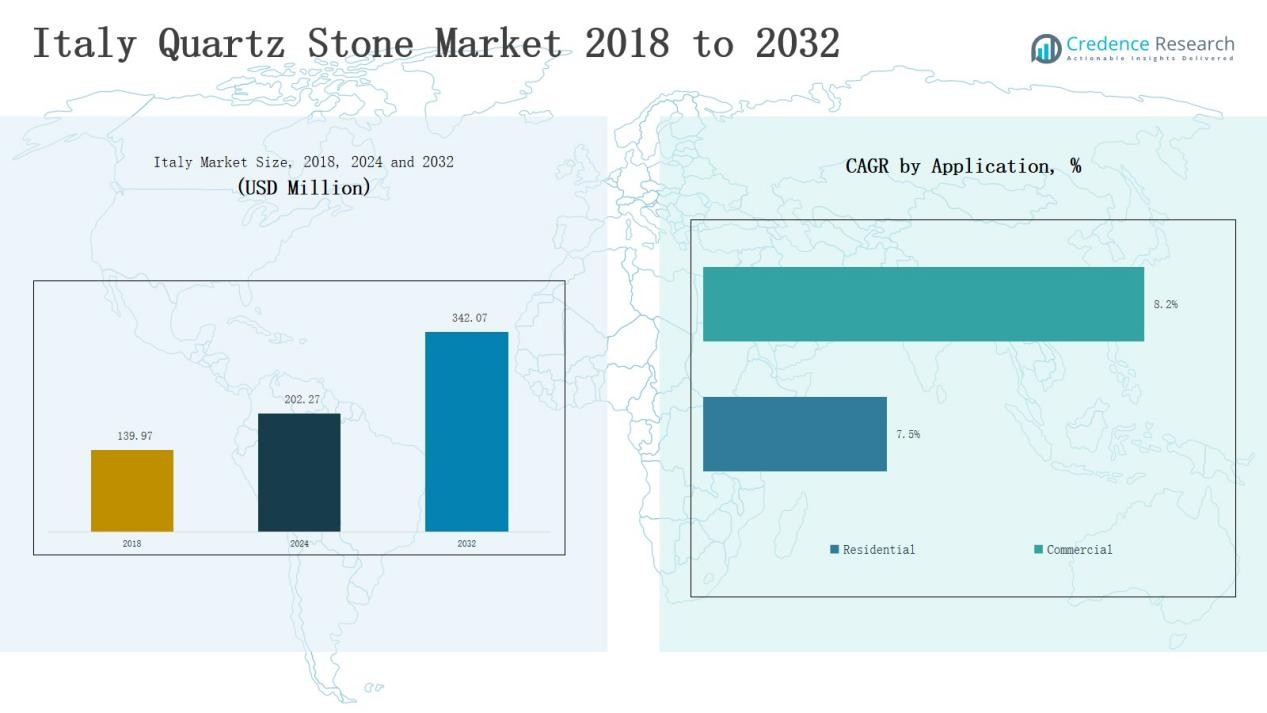

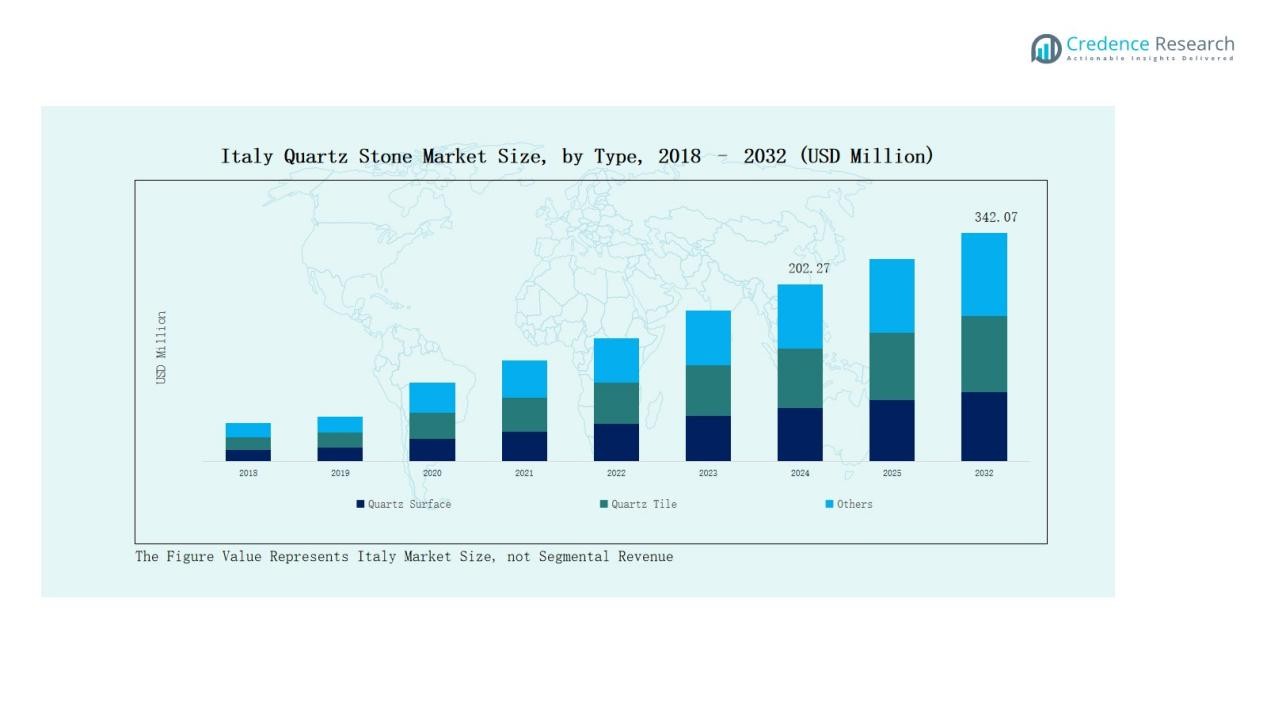

The Italy Quartz Stone Market size was valued at USD 139.97 million in 2018, increased to USD 202.27 million in 2024, and is anticipated to reach USD 342.07 million by 2032, growing at a CAGR of 6.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Quartz Stone Market Size 2024 |

USD 202.27 Million |

| Italy Quartz Stone Market, CAGR |

6.79% |

| Italy Quartz Stone Market Size 2032 |

USD 342.07 Million |

The Italy Quartz Stone Market is led by key players including Stone Italiana S.p.A., Santa Margherita S.p.A., Quarella S.p.A., SEIEFFE S.r.l., and Akemi GmbH, supported by global participants such as Caesarstone Ltd., Cosentino S.A. (Silestone), Cambria Company LLC, Technistone a.s., and Vicostone JSC. These companies focus on product innovation, sustainable production, and advanced surface technologies to meet growing demand in residential and commercial sectors. They emphasize eco-friendly materials, digital texture replication, and customized designs to strengthen market positioning. Northern Italy emerged as the leading region in 2024, accounting for 42% of the total market share, driven by its strong industrial base, luxury interior projects, and concentration of high-end quartz manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Quartz Stone Market was valued at USD 139.97 million in 2018, reached USD 202.27 million in 2024, and is projected to attain USD 342.07 million by 2032, growing at a CAGR of 6.79%.

- Northern Italy led the market with a 42% share in 2024, supported by industrial strength, luxury housing projects, and a concentration of top manufacturers such as Stone Italiana and Quarella.

- The Quartz Surface segment dominated with 59% share in 2024, driven by demand for durable, stain-resistant, and aesthetic materials in modern interiors and kitchen designs.

- The Residential segment accounted for 63% of the market, fueled by rising renovation projects, modular kitchen trends, and the growing appeal of low-maintenance quartz materials.

- The Engineered Quartz segment held 68% of the total share, supported by superior performance, eco-friendly manufacturing, and increasing preference for sustainable, high-quality surfaces in homes and commercial spaces.

Market Segment Insights

By Type:

The Quartz Surface segment dominated the Italy Quartz Stone Market in 2024, accounting for 59% of the total share. Its growth is driven by rising adoption in luxury interiors, kitchen countertops, and high-end flooring applications. Italian consumers prefer quartz surfaces for their durability, stain resistance, and modern aesthetic appeal. Continuous innovations in surface textures and colors further enhance design flexibility, supporting steady demand from residential renovation and premium commercial construction sectors.

- For instance, Quarella S.p.A. offers matte-finish quartz slabs, with finishes such as “honed” and “velvet touch,” which are used in contemporary residential kitchen installations

By Application:

The Residential segment led the Italy Quartz Stone Market in 2024 with a 63% market share. Increasing home renovation projects, urban housing developments, and the popularity of modular kitchens drive segment dominance. Homeowners prefer quartz stone for its long lifespan, minimal maintenance, and superior appearance compared to natural stone. Growth in luxury housing and sustainable architecture trends also boosts adoption, making residential applications the primary contributor to overall market expansion.

- For instance, Stone Italiana is an Italian manufacturer of engineered quartz countertops that emphasizes sustainable practices and uses recycled materials in products like its Cosmolite® range.

By Material Composition:

The Engineered Quartz segment held the largest share of 68% in 2024 within the Italy Quartz Stone Market. Its strong performance stems from superior durability, non-porous nature, and wide design variety compared to natural alternatives. Engineered quartz offers enhanced strength and uniformity, making it ideal for large-scale installations in both homes and commercial buildings. The segment’s growth is further supported by technological advancements and increasing demand for sustainable, low-maintenance construction materials.

Key Growth Drivers

Rising Demand for Luxury Interiors

The Italy Quartz Stone Market is witnessing strong growth due to the increasing demand for luxury interiors in residential and commercial spaces. Italian consumers value elegant design, durability, and low maintenance, which quartz stone provides. The material’s versatility in countertops, flooring, and wall cladding supports upscale architectural projects. Expanding renovation activities and the influence of premium lifestyle trends further fuel adoption, positioning quartz stone as a preferred choice for modern interior applications across Italy.

- For instance, Compac, a Spanish quartz company with global distribution, collaborates with Italian architects to create visually stunning quartz surfaces for statement walls and countertops.

Technological Advancements in Manufacturing

Advanced fabrication technologies have enhanced product quality and performance in the Italy Quartz Stone Market. Manufacturers are adopting automated cutting, surface polishing, and digital texture replication techniques to achieve precision and design consistency. These innovations allow wider customization and improve production efficiency. The integration of eco-friendly processes and recycled materials aligns with Italy’s sustainability goals, supporting both domestic and export demand for engineered quartz products with superior strength and visual appeal.

Growth in Sustainable Construction Projects

Sustainability initiatives across Italy are driving the demand for eco-friendly quartz stone. Builders and consumers increasingly prioritize materials with low environmental impact, long lifespan, and recyclable content. The market benefits from government incentives promoting green construction and energy-efficient buildings. Manufacturers offering low-emission, non-toxic, and recycled quartz surfaces are gaining preference. This shift towards sustainable architecture strengthens the long-term prospects of the Italy Quartz Stone Market across both residential and commercial applications.

- For instance, Stone Italiana integrates recycled minerals such as street sweeping earth and mirror glass in its quartz surfaces, earning LEED credits for eco-friendly sourcing and securing Environmental Product Declarations (EPDs) aligned with ISO 14025 standards.

Key Trends & Opportunities

Rising Preference for Customized Quartz Designs

Customization is emerging as a key trend in the Italy Quartz Stone Market. Consumers seek unique colors, veining patterns, and finishes to match modern interior aesthetics. Manufacturers are leveraging advanced digital printing and 3D surface technology to offer personalized options. The demand for tailor-made quartz surfaces in luxury homes, hotels, and retail spaces presents strong opportunities for local producers to differentiate through design innovation and premium-quality offerings.

- For instance, Santamargherita introduced new, nature-inspired colors and innovative textured surfaces within its engineered quartz and marble product lines, catering to the high-end kitchen and hospitality segments.

Expanding Online and Retail Distribution Networks

The increasing integration of e-commerce and specialized retail channels is creating new growth opportunities. Italian consumers prefer convenient access to premium quartz products with detailed visual catalogs and virtual design previews. Manufacturers are partnering with retail distributors and digital platforms to reach broader audiences. This trend enables small and mid-sized producers to enhance visibility and compete effectively, supporting steady market expansion across Italy’s urban and suburban regions.

- For instance, Quantra Surfaces by Pokarna Limited introduced the Aksara collection in 2025 with ultra-HD printing technology and virtual design previews powered by Italian and Japanese tech, helping the brand reach sophisticated digital buyers.

Key Challenges

High Production and Installation Costs

The Italy Quartz Stone Market faces challenges due to the high costs associated with production and installation. Advanced machinery, imported raw materials, and energy-intensive processes increase overall expenses. These costs often limit affordability for budget-conscious consumers, particularly in mid-scale housing projects. Price competition from ceramic and granite alternatives further intensifies pressure on profit margins, compelling manufacturers to optimize operations and explore cost-effective production technologies.

Environmental and Regulatory Constraints

Stringent environmental regulations pose operational challenges for quartz stone manufacturers in Italy. Compliance with emission standards, waste management norms, and silica dust control increases production complexity. The shift toward greener manufacturing demands heavy investment in sustainable technologies. Small-scale producers often struggle to meet these requirements, resulting in slower adoption. Balancing environmental responsibility with profitability remains a key obstacle for maintaining competitiveness in the domestic and export markets.

Intense Competition from Imported Products

Imported quartz products, especially from Asia, exert strong competitive pressure on local Italian manufacturers. Lower production costs abroad enable foreign suppliers to offer similar quality at reduced prices. This influx affects domestic market share and profitability. Local producers are focusing on design innovation, brand reputation, and quality differentiation to retain customers. Strengthening local sourcing and promoting “Made in Italy” craftsmanship are essential strategies to counter growing import dependency.

Regional Analysis

Northern Italy

The Italy Quartz Stone Market in Northern Italy held the largest regional share of 42% in 2024. The region’s dominance stems from a strong concentration of industrial hubs, luxury interior manufacturers, and advanced construction projects. Milan, Turin, and Bologna lead demand with growing residential renovations and high-end commercial developments. Consumers in this region favor premium quartz surfaces for modern architecture and sustainable design. Leading manufacturers such as Stone Italiana and Quarella maintain significant operations here, benefiting from skilled labor and efficient logistics networks. The region’s strong export capacity further strengthens market growth.

Central Italy

Central Italy accounted for 31% of the total market share in 2024, driven by a mix of tourism-related infrastructure and urban modernization. Cities such as Florence and Rome continue to experience rising adoption of engineered quartz in hotels, offices, and residential projects. The focus on heritage restoration and luxury property upgrades encourages the use of durable, aesthetic quartz materials. The region’s architectural firms favor Italian-made quartz surfaces due to their superior design versatility and environmental compliance. Continuous demand from mid-sized construction firms sustains the market’s stable growth pattern.

Southern Italy

Southern Italy represented 18% of the overall market share in 2024, supported by growing housing investments and coastal property developments. Rising disposable incomes and expansion in hospitality projects are encouraging the use of quartz for interior applications. The market benefits from government housing incentives and modernization efforts in cities like Naples and Bari. Manufacturers are expanding distribution networks to reach local builders and retailers, improving accessibility across smaller towns. Despite moderate growth, Southern Italy remains a key opportunity area for affordable and mid-range quartz products.

Islands (Sicily and Sardinia)

The islands of Sicily and Sardinia captured 9% of the market share in 2024. Market growth is influenced by tourism-driven construction and increasing adoption of decorative quartz in hotels and resorts. The demand for durable, low-maintenance materials aligns with coastal climate conditions. Local distributors and contractors favor lightweight, moisture-resistant quartz products for interior and exterior use. While infrastructure challenges persist, ongoing investment in hospitality and residential projects supports gradual market development. The region’s expanding renovation sector is expected to boost future demand for quartz materials.

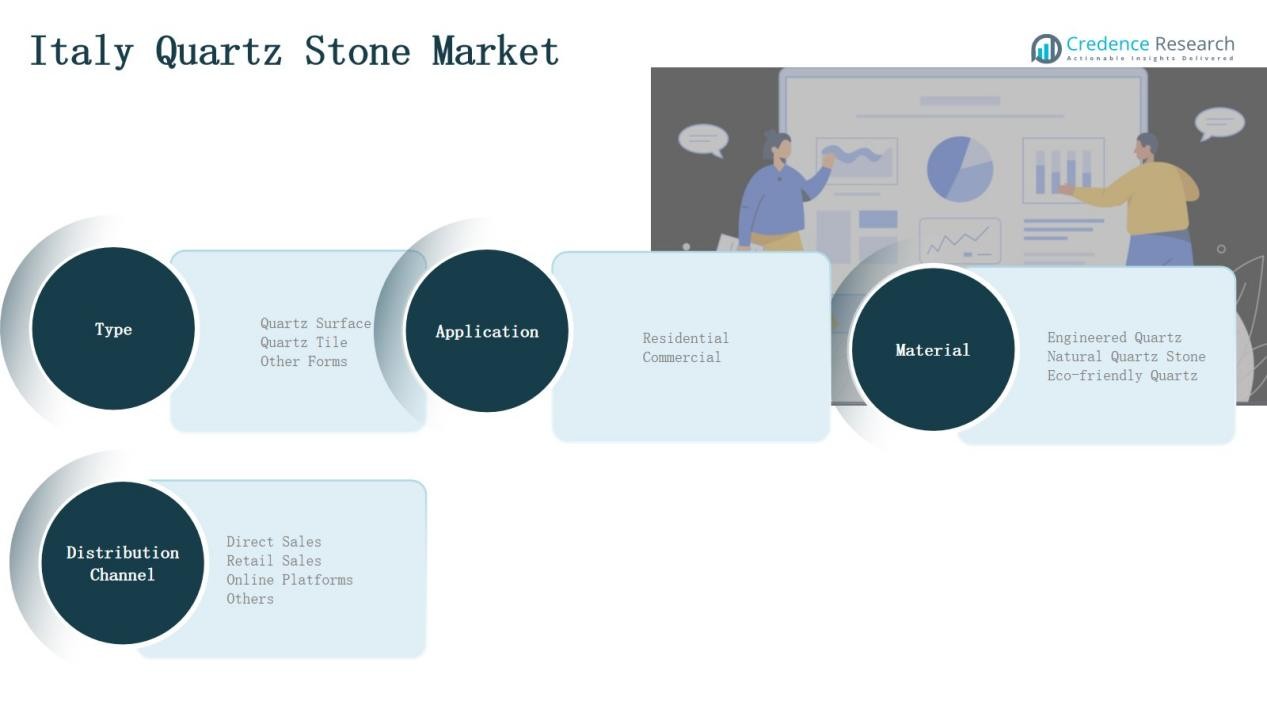

Market Segmentations:

By Type

- Quartz Surface

- Quartz Tile

- Other Forms

By Application

By Material Composition

- Engineered Quartz

- Natural Quartz Stone

- Eco-friendly Quartz

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Platforms

- Others

By Region

- Northern Italy

- Central Italy

- Southern Italy

- Islands

Competitive Landscape

The Italy Quartz Stone Market features a moderately consolidated competitive landscape with several established domestic and international manufacturers. Leading players such as Stone Italiana S.p.A., Santa Margherita S.p.A., Quarella S.p.A., SEIEFFE S.r.l., and Akemi GmbH dominate through strong brand reputation, advanced production capabilities, and innovation in design and sustainability. Competition focuses on product differentiation, surface quality, and customized aesthetics for residential and commercial interiors. Companies invest in automation, eco-friendly manufacturing, and digital texture technologies to strengthen market presence. Partnerships with architects, builders, and distributors expand their customer reach. Global brands like Caesarstone Ltd., Cosentino S.A., and Cambria Company LLC add competitive intensity through premium imported quartz products. Local firms leverage Italy’s design heritage and sustainable production standards to maintain an advantage in high-end applications. Continuous innovation, energy-efficient processing, and material recycling remain key strategies shaping competition across Italy’s growing engineered stone market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Stone Italiana S.p.A.

- Santa Margherita S.p.A.

- Quarella S.p.A.

- SEIEFFE S.r.l.

- Akemi GmbH

- BOPP FilmLtd.

- Cosentino S.A. (Silestone)

- Cambria Company LLC

- Technistone a.s.

- Compac Surfaces

- LG Hausys Ltd. (Hi-MACS/Viatera)

- Hanwha L&C (HanStone Quartz)

- Vicostone JSC

- Dupont de Nemours, Inc. (Corian Quartz)

- Lapitec S.p.A.

Recent Developments

- In February 2024, Biesse S.p.A. acquired GMM Group, a leading stone machinery manufacturer, to expand its capabilities in quartz and engineered stone processing.

- In December 2022, Sibelco Group acquired Bassanetti Group (Italy) to strengthen its southern Europe engineered stone presence.

- In September 2023, Gruppo B&T Quartz launched a vibration-free press & digital decoration line for quartz slabs.

- In September 2024, Aurea Stone introduced a silica-free quartz line (crystalline silica eliminated, full-body aesthetics).

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Composition, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and sustainable quartz materials will continue to increase across housing projects.

- Engineered quartz will maintain its dominance due to durability and design versatility.

- Rising renovation and remodeling activities will strengthen residential segment growth.

- Local manufacturers will focus on automation and advanced fabrication technologies.

- Import competition will drive innovation and product differentiation among Italian producers.

- Eco-friendly quartz production will gain momentum under green building regulations.

- Expansion of retail and online distribution channels will improve product accessibility.

- Collaborations with interior designers and architects will enhance brand visibility.

- Investment in digital surface printing and texture customization will shape future product trends.

- The overall market will move toward high-performance, recyclable, and aesthetically refined quartz solutions.