Market Overview

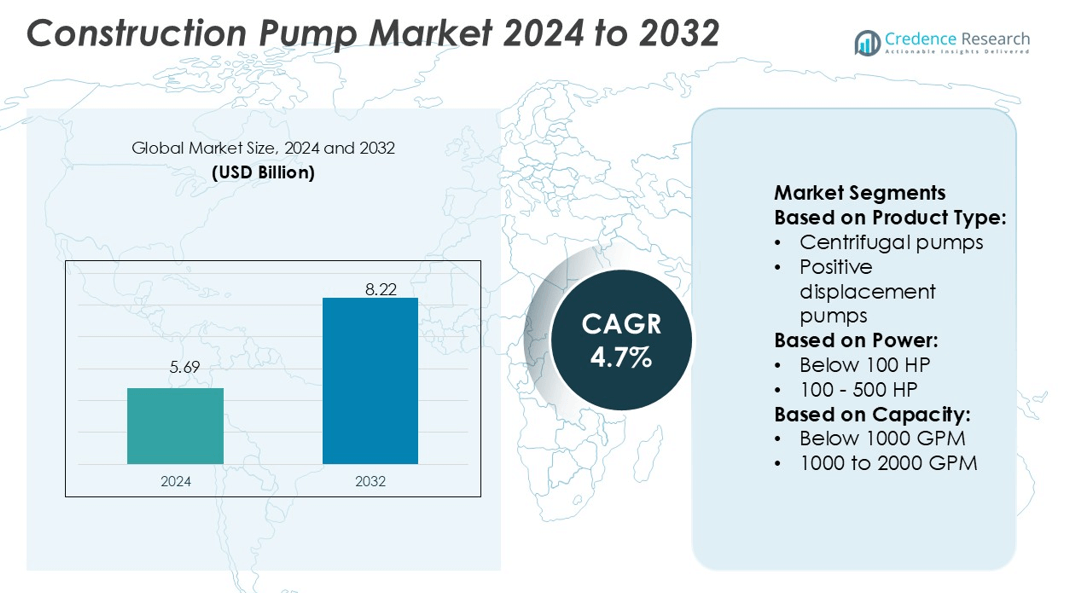

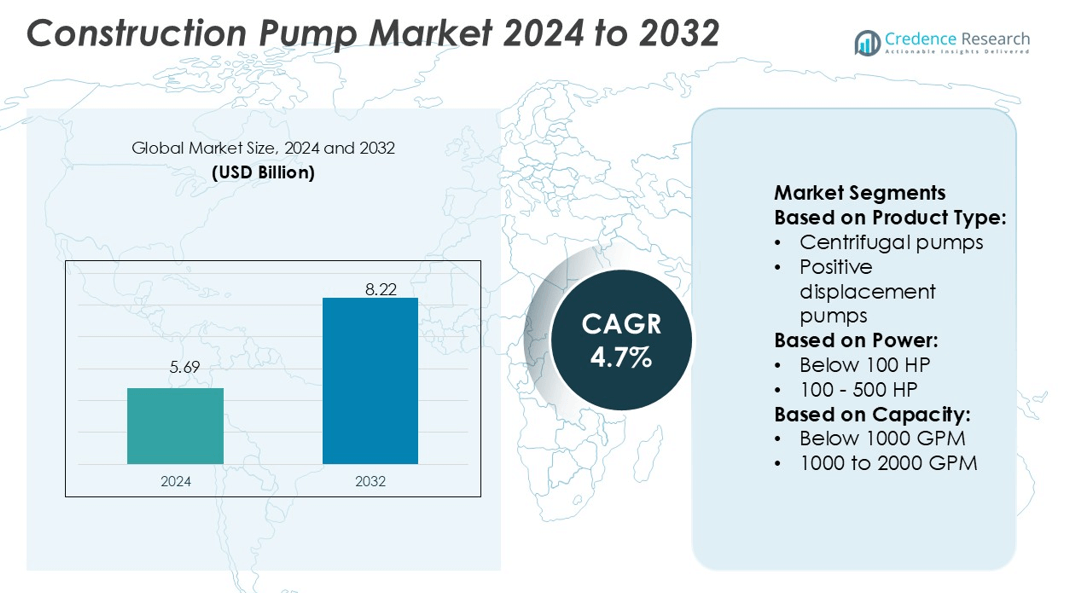

Construction Pump Market size was valued USD 5.69 billion in 2024 and is anticipated to reach USD 8.22 billion by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Pump Market Size 2024 |

USD 5.69 billion |

| Construction Pump Market, CAGR |

4.7% |

| Construction Pump Market Size 2032 |

USD 8.22 billion |

The construction pump market is shaped by strong competition from major players including ITT, Seepex, Atlas Copco, Pentair, Flowserve, BJM Pumps, KSB SE, Grundfos, Ebara, and MDM. These companies focus on product innovation, energy-efficient designs, and digital integration to strengthen their market presence. Many are expanding their rental networks and service offerings to support large-scale construction projects globally. Asia-Pacific leads the market with a 34% share, driven by rapid urbanization, smart city initiatives, and major infrastructure investments. This strong regional dominance, combined with technological advancements from key manufacturers, continues to accelerate market expansion and reinforce competitive positioning worldwide.

Market Insights

- The Construction Pump Market size was valued at USD 5.69 billion in 2024 and is anticipated to reach USD 8.22 billion by 2032, at a CAGR of 4.7%.

- Growing infrastructure development and rapid urbanization are driving strong demand for high-capacity and energy-efficient pumps.

- Asia-Pacific leads the market with a 34% share, supported by smart city projects and large-scale construction activities, while centrifugal pumps dominate the product segment.

- Key players focus on innovation, digital integration, and rental service expansion to strengthen their competitive positions in global markets.

- High maintenance costs and skill shortages act as restraints, but technological advancements and strong regional investment continue to boost overall market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Centrifugal pumps hold the dominant share in the construction pump market due to their high efficiency and versatility. These pumps are widely used in dewatering, concrete pumping, and flood control operations. Their simple design allows easy installation and low maintenance, making them cost-effective for large construction projects. The rising number of infrastructure developments and tunneling activities drives demand for centrifugal pumps. Submersible and diaphragm pumps are also gaining traction for specific applications like groundwater control and chemical handling. However, centrifugal pumps continue to lead due to their robust performance in high-flow conditions.

- For instance, ITT’s Goulds Water Technology centrifugal pump model 3196 is a process pump designed for industrial use across various sectors like chemical, petrochemical, and general industries. It can deliver flow rates up to 1,590 m³/h and handle pressures up to 26 bar.

By Power

Pumps with power below 100 HP lead the market, supported by their use in small to mid-sized construction projects. These pumps are preferred for site drainage, dewatering, and material transfer operations that require moderate flow rates. Their compact size, lower operating cost, and ease of mobility make them a practical choice for contractors. The growing number of residential and commercial construction activities boosts the demand for this power range. In contrast, pumps above 500 HP are used in heavy civil engineering projects but have a smaller market share due to their higher operational cost.

- For instance, SEEPEX’s SCT-AutoAdjust progressive cavity pump is designed with hydraulically adjustable stator clamping, enabling rotor/stator replacement times reduced by up to 85 % relative to conventional designs.

By Capacity

The below 1000 GPM segment dominates the market due to its wide application in general construction works. Pumps in this capacity range are ideal for dewatering basements, trenches, and excavation sites. Their portability, lower power requirement, and flexible operation make them cost-efficient for contractors. Rising investments in housing, urban infrastructure, and road construction projects further increase their usage. Higher-capacity pumps, particularly above 3000 GPM, cater to specialized heavy-duty operations but remain less common because of higher capital and operational expenses.

Key Growth Drivers

Rising Infrastructure Development

Rapid urbanization is driving significant investments in construction projects worldwide. Large-scale infrastructure development, including roads, bridges, and commercial buildings, boosts demand for construction pumps. These pumps support critical operations like dewatering, concrete placement, and fluid transfer. For instance, major metro projects in Asia-Pacific require high-capacity centrifugal pumps to handle water removal efficiently. Government-backed smart city projects also accelerate adoption of advanced pumping systems, enabling contractors to meet strict timelines and safety standards. This strong infrastructure push creates consistent growth opportunities in the market.

- For instance, Atlas Copco’s PAS 150 HF centrifugal pump delivers a maximum flow rate of 510 m³/h and a total head of 51 m, enabling reliable dewatering in harsh construction environments, including large tunnel and metro projects.

Increasing Adoption of Energy-Efficient Pumps

Stringent environmental regulations and rising energy costs are shifting demand toward energy-efficient pumping solutions. Modern pumps with variable frequency drives (VFDs) reduce energy consumption while improving operational precision. Leading manufacturers are launching high-efficiency models with IoT-enabled monitoring to optimize water handling. For example, Grundfos and Xylem introduced smart pump systems that cut energy use by nearly 25%. This growing focus on sustainability helps construction companies lower operating costs and comply with environmental standards, making efficient pumps a preferred choice across projects.

- For instance, Flowserve secured a contract to deliver 5,000 industrial process pumps for TMGcore’s immersion cooling systems, underlining its capability in high-throughput, critical flow control applications.

Expanding Construction Activities in Emerging Economies

Emerging economies such as India, Vietnam, and Brazil are witnessing strong growth in construction investments. Rapid population growth, industrial expansion, and increased government spending drive new commercial and residential projects. Construction pumps are essential in handling high water tables, concrete pumping, and sludge removal at these sites. International developers are also expanding operations in these markets, boosting equipment demand. Infrastructure modernization plans, including housing programs and transport projects, further accelerate pump deployment, positioning these regions as key revenue drivers for manufacturers.

Key Trends & Opportunities

Integration of Smart Pumping Solutions

The integration of IoT and automation is transforming pump operations in the construction sector. Smart pumps enable real-time performance tracking, predictive maintenance, and remote control, reducing downtime and operational costs. Companies are adopting wireless sensors and cloud-based dashboards to monitor flow rates and pressure levels. For example, Sulzer’s smart sensor platform improves equipment life and reliability. The rising demand for connected construction sites creates opportunities for manufacturers offering advanced digital pumping solutions with low maintenance and high efficiency.

- For instance, KSB’s “KSB Guard” system uses sensor units to capture vibration RMS and temperature data, transmitting them every few seconds to the KSB Cloud via MQTT-SN protocol with TLS 1.2 encryption.

Rising Focus on Modular and Portable Pumps

The demand for compact, modular, and portable pumping solutions is increasing as construction sites become more dynamic. These pumps are easy to transport, install, and operate, reducing project delays and labor costs. Manufacturers are focusing on lightweight designs without compromising flow capacity and performance. For instance, Atlas Copco’s mobile submersible pumps are widely used in temporary dewatering projects. Growing use in mining, tunneling, and rapid infrastructure projects enhances their market potential, especially in regions with fast-moving development.

- For instance, Grundfos’s DELTA HCU modular pumping system comes factory-preassembled, pre-wired, and pre-tested. The system uses a CU 352 controller that monitors pump power, pressure, and hydraulics in real time and performs cascade control across up to six pumps.

Surge in Rental Equipment Demand

Construction firms are increasingly opting for pump rentals instead of ownership to minimize capital expenditure. This trend allows contractors to access the latest technologies without long-term commitments. Rental companies offer flexible packages with maintenance support, making operations more cost-efficient. Global rental fleets are also expanding their inventories with energy-efficient models to meet sustainability goals. This rental-driven growth offers strong opportunities for pump manufacturers to partner with fleet operators and expand market reach across multiple construction segments.

Key Challenges

High Maintenance and Operational Costs

Construction pumps require frequent maintenance to handle abrasive materials, sludge, and continuous operation. High wear and tear increase service intervals and replacement part costs. Smaller contractors often struggle with these recurring expenses, which can reduce overall profit margins. Inadequate maintenance also leads to downtime, delaying critical project activities. Although technological improvements help reduce servicing needs, the initial investment in advanced pumps remains a major barrier for cost-sensitive buyers, particularly in developing construction markets.

Lack of Skilled Operators and Technical Awareness

The efficient operation of advanced pumping systems requires skilled operators and proper technical training. Many construction sites, especially in emerging economies, face shortages of trained personnel, leading to improper handling and frequent breakdowns. This skill gap affects pump efficiency, lifespan, and safety. Manufacturers and rental companies are introducing training programs, but adoption remains slow. Without proper technical awareness, the market faces operational inefficiencies and underutilization of advanced pump technologies, limiting their full potential in construction projects.

Regional Analysis

North America

North America holds a 28% market share in the construction pump market. The region benefits from strong investments in infrastructure modernization, commercial construction, and flood control projects. Government funding for smart city and transportation initiatives boosts demand for high-capacity centrifugal and submersible pumps. For example, major infrastructure upgrades across U.S. coastal states drive large-scale dewatering and fluid handling applications. Manufacturers are also focusing on energy-efficient and IoT-enabled solutions to meet strict regulatory standards. The presence of established construction companies and advanced technologies further strengthens market growth across the U.S. and Canada.

Europe

Europe accounts for 22% of the market share, driven by increasing infrastructure renovation and environmental compliance measures. The region emphasizes sustainable construction, leading to higher adoption of energy-efficient pumping systems. Countries like Germany, France, and the U.K. are investing in flood protection, underground tunneling, and metro expansion projects. EU energy regulations also push construction firms to upgrade to smart, low-emission pumps. For example, Germany’s urban water infrastructure projects rely on advanced submersible and vacuum pumps. Strong regulatory support and rapid digital adoption make Europe a key market for high-performance and automated construction pumping solutions.

Asia-Pacific

Asia-Pacific leads the market with a 34% share, supported by rapid urbanization and infrastructure development. Massive investments in transportation, smart cities, and water management projects drive strong pump demand. Countries like China, India, and Vietnam are executing large-scale construction programs, including metro systems, highways, and industrial zones. For example, India’s Smart Cities Mission fuels demand for high-capacity dewatering pumps. Affordable labor and expanding rental markets also accelerate product adoption. Rising construction activities across commercial, residential, and industrial sectors make Asia-Pacific the fastest-growing regional market for both portable and heavy-duty construction pumps.

Latin America

Latin America holds a 6% market share, supported by steady investments in public infrastructure, energy, and mining projects. Brazil and Mexico lead the region, focusing on road construction, water treatment facilities, and renewable energy installations. Frequent flooding and urban expansion increase demand for submersible and diaphragm pumps. For instance, infrastructure programs in Brazil’s urban centers rely on high-capacity dewatering systems to manage water levels. The growing shift toward equipment rentals and modernization of existing systems is improving accessibility. Though the market is emerging, rising government spending creates new opportunities for manufacturers in the region.

Middle East & Africa

The Middle East & Africa region captures 10% of the market share, fueled by strong investments in mega infrastructure and commercial development projects. Countries like Saudi Arabia and the UAE are driving demand through smart city initiatives such as NEOM and Dubai’s urban expansion. Harsh climatic conditions also increase the need for efficient water transfer and dewatering pumps. For example, advanced centrifugal pumps support foundation work in large-scale desert projects. Africa’s focus on housing and transport infrastructure further supports growth. Strategic partnerships with international suppliers are enhancing access to modern pumping technologies across the region.

Market Segmentations:

By Product Type:

- Centrifugal pumps

- Positive displacement pumps

By Power:

- Below 100 HP

- 100 – 500 HP

By Capacity:

- Below 1000 GPM

- 1000 to 2000 GPM

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The construction pump market features strong competition among leading players such as ITT, Seepex, Atlas Copco, Pentair, Flowserve, BJM Pumps, KSB SE, Grundfos, Ebara, and MDM. The construction pump market is highly competitive, characterized by rapid innovation and strong global expansion strategies. Manufacturers are focusing on developing energy-efficient, durable, and smart pumping systems to meet the rising demand from infrastructure and commercial projects. Companies are heavily investing in automation, IoT integration, and remote monitoring to enhance operational reliability and reduce maintenance costs. Strategic partnerships, mergers, and rental service expansions are strengthening market presence and improving customer accessibility. Emphasis on sustainability and compliance with environmental regulations is also driving technological upgrades. This competitive environment fosters continuous product improvement and accelerates adoption across construction applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ITT

- Seepex

- Atlas Copco

- Pentair

- Flowserve

- BJM Pumps

- KSB SE

- Grundfos

- Ebara

- MDM

Recent Developments

- In March 2025, Flowserve Corporation launched the Innomag TB-MAG Dual Drive Pump, the world’s first seal less pump to eliminate leaks, setting a new standard for safety and environmental protection. The Innomag TB-MAG Dual Drive also has an additional layer of corrosion resistance for handling chemicals due to a non-metallic liner which coats the pump internally.

- In November 2024, Ebara has acquired 80% stake in Asanvil SA which is a Brazilian pump sales company with vast sales network in the country. This acquisition has enabled Ebara’s Brazilian subsidiary Ebara Bombas America Do Sul to utilize sales network of Asanvil SA increasing their market share in the country and strengthening their position as a construction pump manufacturer.

- In October 2024, Atlas Copco acquired a British industrial pump distributor Kinder-janes Engineers. This acquisition will allow Atlas Copco to utilize their British sales network and expand in the country with their own pumps. This regional expansion has strengthened their position as top player in the construction pump market.

- In March 2024, Sulzer officially opened an advanced test and assembly facility built alongside its current pump manufacturing facility in Mexico City. The new facility features a 10-meter-deep hydraulics test bed for big pumps, a computerized monitoring system and a dedicated packaging area. Sulzer Mexico’s pump plant enhances production capacity for its range of large pumps in order to respond more adequately to growing demand for infrastructure in the Americas.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Power, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for energy-efficient pumping systems will increase with stricter environmental regulations.

- Smart and connected pumps will see wider adoption across infrastructure projects.

- Rental services will expand as contractors seek cost-effective equipment solutions.

- Rapid urbanization will boost the need for high-capacity construction pumps.

- Automation and remote monitoring will enhance operational efficiency and reduce downtime.

- Technological innovation will focus on lightweight, portable, and modular pump designs.

- Government investments in infrastructure will drive steady market growth.

- Manufacturers will expand their service networks to strengthen aftersales support.

- Integration of IoT platforms will improve predictive maintenance and equipment life.

- Sustainability goals will encourage the use of pumps with lower energy consumption.