Market Overview

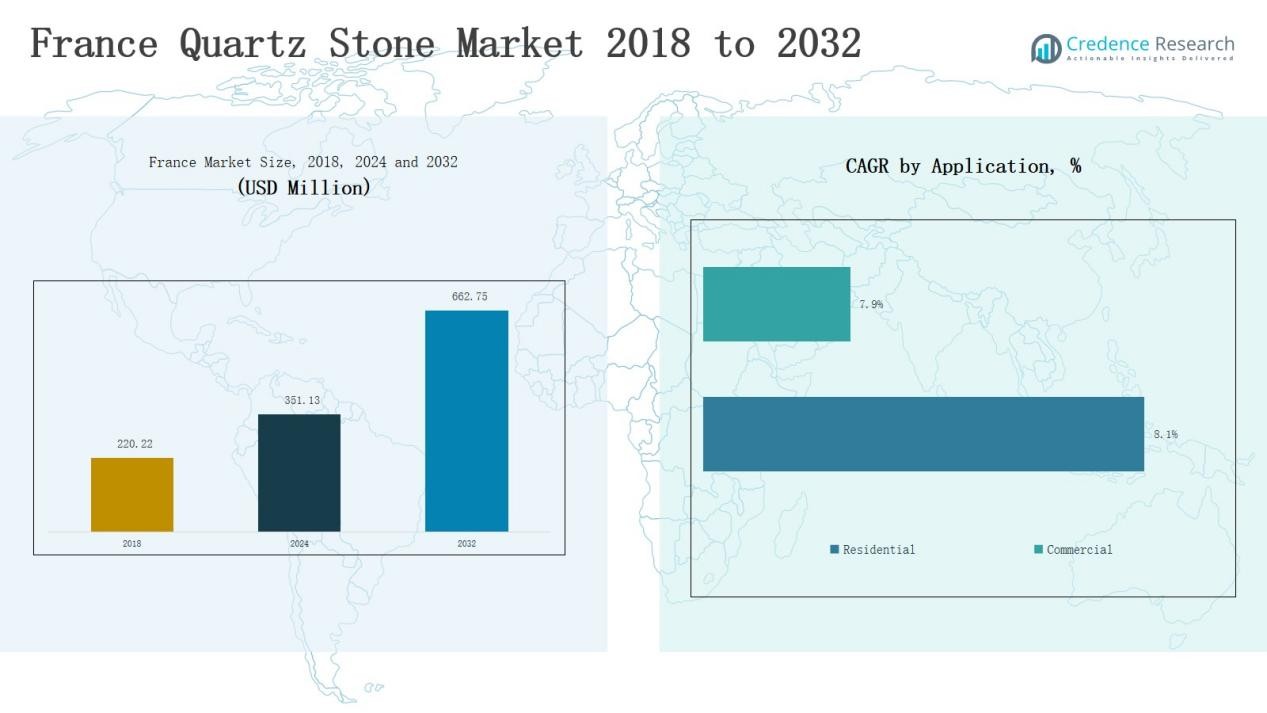

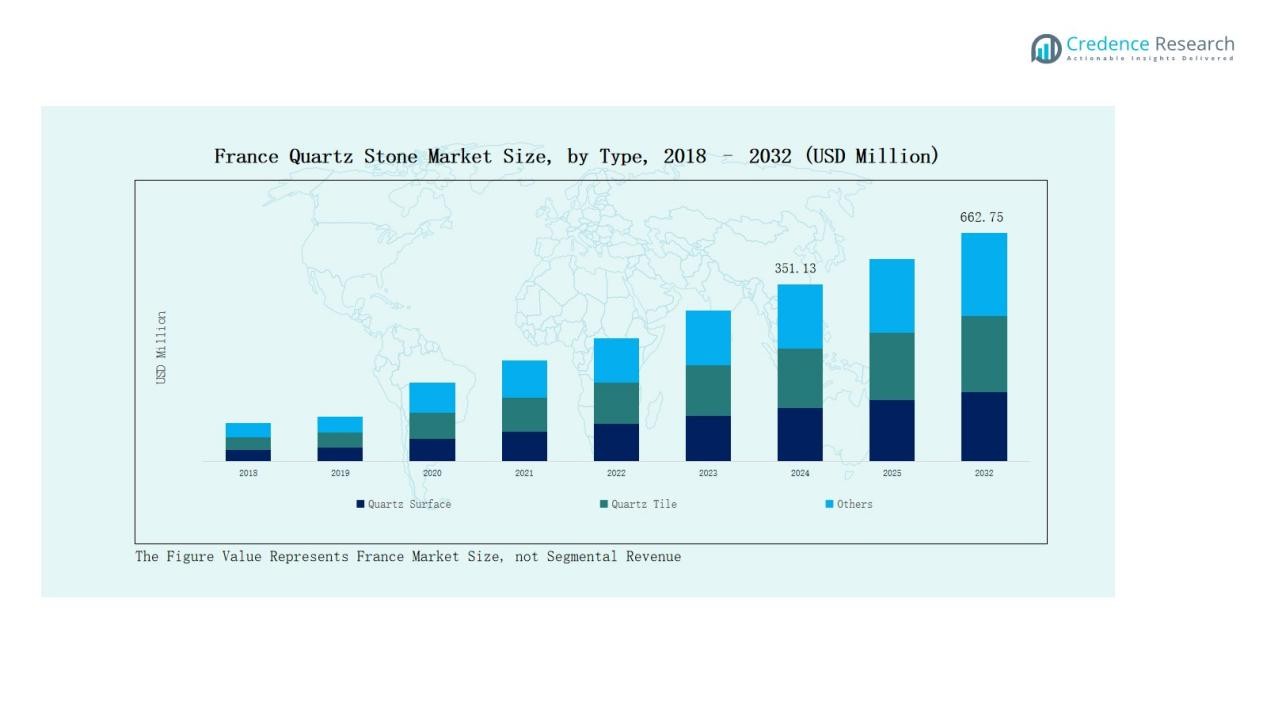

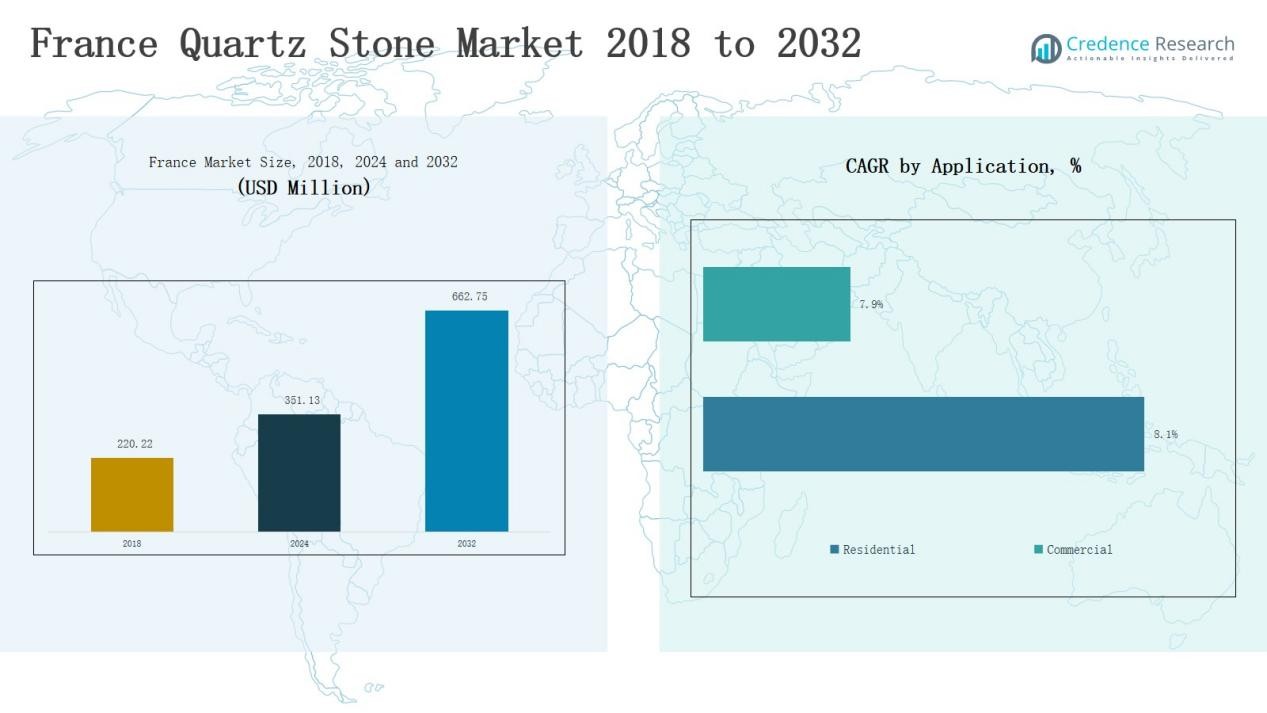

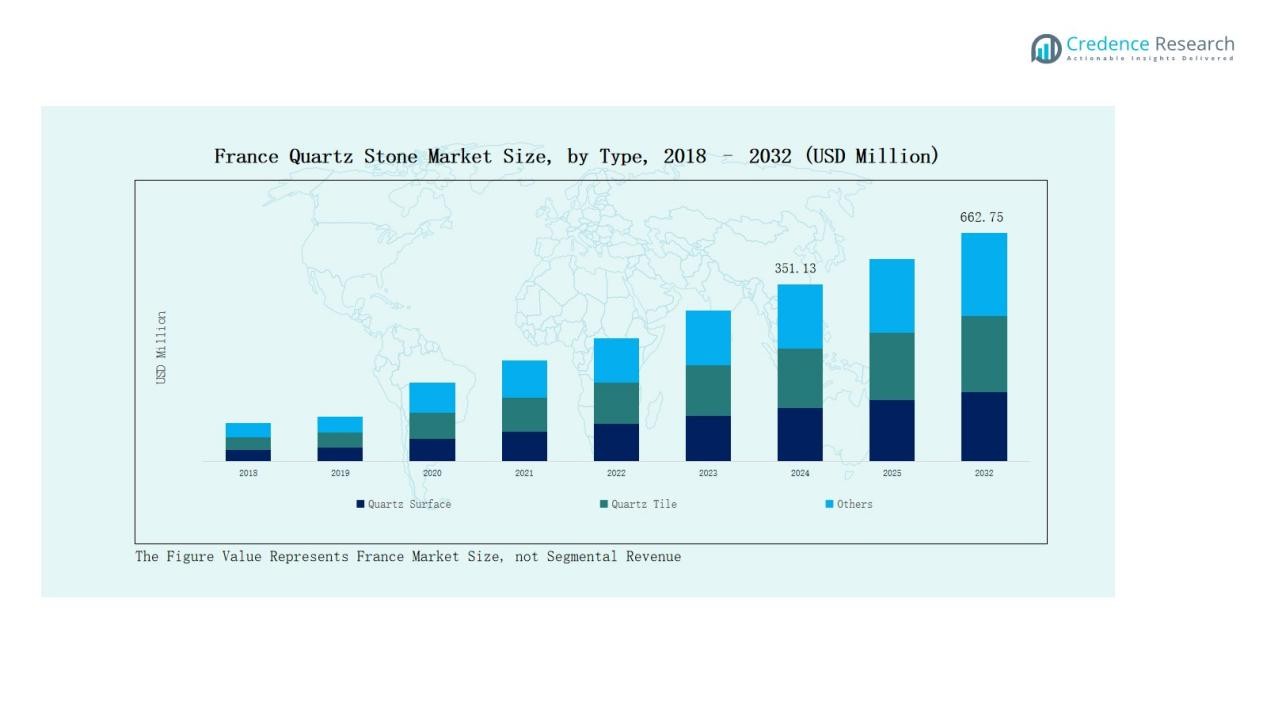

The France Quartz Stone Market size was valued at USD 220.22 million in 2018, increased to USD 351.13 million in 2024, and is anticipated to reach USD 662.75 million by 2032, growing at a CAGR of 8.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Quartz Stone Market Size 2024 |

USD 351.13 Million |

| France Quartz Stone Market, CAGR |

8.26% |

| France Quartz Stone Market Size 2032 |

USD 662.75 Million |

The France Quartz Stone Market features strong competition among key players including Saint-Gobain, Caesarstone, Silestone (Cosentino), Compac Quartz, Cambria, Radianz (Samsung Surface Brand), Stone Italiana, and Vikcomposite GmbH. These companies lead through advanced manufacturing technologies, diverse product portfolios, and a focus on sustainable, high-performance surfaces. They emphasize engineered quartz designed for superior durability, aesthetic versatility, and eco-friendly applications across residential and commercial sectors. The Île-de-France region emerged as the leading regional market in 2024, commanding 36% of the total share, driven by luxury construction, urban renovation projects, and strong consumer demand for premium quartz interiors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Quartz Stone Market was valued at USD 220.22 million in 2018, reached USD 351.13 million in 2024, and is projected to hit USD 662.75 million by 2032, growing at a CAGR of 8.26%.

- Key players such as Saint-Gobain, Caesarstone, Silestone (Cosentino), Compac Quartz, Cambria, Radianz, Stone Italiana, and Vikcomposite GmbH lead through advanced manufacturing, sustainability, and premium surface design.

- The Quartz Surface segment dominated with a 61% share in 2024, driven by demand for durable, low-maintenance, and visually appealing materials in kitchens, flooring, and wall applications.

- The Residential segment held a 68% share in 2024, supported by growing home renovations, luxury housing developments, and increasing adoption of modern, eco-friendly interiors.

- Île-de-France led the regional landscape with a 36% share in 2024, followed by Auvergne–Rhône–Alpes at 22% and Provence–Alpes–Côte d’Azur at 18%, reflecting strong urban construction and design innovation.

Market Segment Insights

By Type:

The Quartz Surface segment dominated the France Quartz Stone Market in 2024, accounting for 61% of the total share. Its leadership stems from strong demand in kitchen countertops, flooring, and wall cladding applications. Consumers favor engineered quartz surfaces for their durability, low maintenance, and design versatility. The segment’s growth is further supported by increasing renovation projects and premium home installations, where aesthetic appeal and resistance to stains or scratches remain key purchase drivers.

- For instance, Silestone by Cosentino launched its HybriQ+ technology surfaces in France, blending recycled materials with enhanced performance properties to meet the growing demand for eco-efficient and stain-resistant countertops.

By Application:

The Residential segment held a leading 68% market share in the France Quartz Stone Market in 2024. Rising home renovation activities, modern kitchen upgrades, and growing consumer preference for stylish and long-lasting interiors boosted adoption. Urban housing developments and custom home projects continue to favor quartz surfaces over natural stones due to superior performance and ease of maintenance. The trend toward luxury interior design and eco-friendly materials further strengthens residential demand.

- For instance, Cosentino Group expanded its Silestone Ethereal collection across France, targeting high-end residential kitchens with enhanced color depth and recycled content.

By Material Composition:

The Engineered Quartz segment captured the largest 72% market share in the France Quartz Stone Market in 2024. Its dominance is driven by superior strength, uniform texture, and an extensive range of color options that appeal to designers and homeowners. Engineered quartz offers consistent quality and higher resistance to stains and heat compared to natural alternatives. The increasing shift toward sustainable, non-porous, and low-maintenance surfaces continues to drive the material’s widespread adoption across both residential and commercial spaces.

Key Growth Drivers

Rising Residential Renovation and Remodeling Projects

The France Quartz Stone Market benefits from a surge in home renovation and remodeling activities. Consumers are increasingly investing in premium materials that combine aesthetics and durability. Quartz stone’s resistance to stains, scratches, and heat makes it a preferred choice for modern kitchens and bathrooms. Growing urbanization and higher disposable incomes further stimulate demand for stylish interiors, supporting steady replacement of traditional marble and granite surfaces with engineered quartz alternatives in residential applications.

- For instance, COMPAC France introduced a new heat- and scratch-resistant quartz collection in mid-2025, specifically targeting home improvement projects where stylish, low-maintenance materials are preferred.

Expansion of Sustainable and Eco-Friendly Construction

Sustainability initiatives in France strongly influence quartz stone demand. Builders and consumers now prioritize eco-friendly and recyclable materials that meet green building standards. Manufacturers are responding with low-emission engineered quartz and recycled content composites to reduce environmental impact. Government incentives and LEED-certified projects further encourage adoption of sustainable surfaces. The growing focus on carbon-neutral construction practices positions quartz stone as a material of choice in environmentally conscious architectural and interior applications.

- For instance, Saint-Gobain Quartz has developed low-emission engineered quartz products incorporating recycled content to reduce environmental impact.

Growth of Commercial Infrastructure and Hospitality Sector

France’s expanding commercial sector, including hotels, offices, and retail spaces, fuels demand for durable and visually appealing surface materials. Quartz stone’s versatility, uniform finish, and minimal maintenance requirements make it ideal for high-traffic areas. Increasing investments in tourism infrastructure and modern commercial projects amplify its usage. Developers prefer quartz for its long service life and resistance to wear, aligning with the trend toward cost-efficient yet luxurious design solutions in commercial interiors.

Key Trends & Opportunities

Integration of Advanced Surface Technologies

Technological advancements in manufacturing are reshaping the France Quartz Stone Market. Digital templating, resin optimization, and precision cutting technologies enhance product consistency and design versatility. Companies now offer antibacterial, heat-resistant, and scratch-proof surfaces tailored for modern living spaces. Innovations such as 3D printing and nanocoatings improve product performance and lifespan, offering differentiation in a competitive market. This technological evolution opens opportunities for customized, high-performance quartz solutions that cater to evolving architectural needs.

- For instance, Caesarstone’s Metropolitan collection uses a cutting-edge process to create surfaces with a concrete-like feel, offering scratch-resistant finishes that support both aesthetic and sustainable performance goals in customized architectural applications.

Increasing Popularity of Minimalist and Luxury Interiors

A growing preference for minimalist, elegant interiors drives demand for quartz surfaces in France. Designers and homeowners favor subtle colors, seamless finishes, and matte textures that complement contemporary aesthetics. The luxury housing segment, in particular, embraces quartz stone for its modern appeal and resilience. Expanding urban housing projects and designer collaborations further promote the use of quartz in countertops, walls, and flooring. This trend creates strong growth opportunities for premium, design-oriented quartz product lines.

- For instance, Goldtop Quartz supplies premium quartz slabs for urban apartments and luxury hotels, reinforcing the trend of quartz in upscale interiors.

Key Challenges

High Production and Installation Costs

Quartz stone production involves expensive raw materials, advanced machinery, and precision engineering, increasing overall costs. Import dependencies for resins and quartz granules further add to price fluctuations. Installation also requires skilled labor, raising project expenses for consumers and contractors. These cost-related challenges often limit adoption among budget-conscious buyers, especially in mid-tier construction projects. Manufacturers must focus on optimizing production efficiency and sourcing strategies to maintain competitiveness without compromising quality or performance.

Competition from Substitute Materials

The market faces rising competition from alternative surface materials such as granite, porcelain slabs, and solid surfaces. These substitutes offer comparable aesthetics and functionality at lower prices. Continuous innovation in ceramics and laminates further challenges quartz’s market position. Consumers seeking affordable renovation options often choose these alternatives. To sustain market share, quartz manufacturers need to emphasize superior durability, low maintenance, and long-term value, coupled with targeted marketing and product differentiation strategies.

Environmental and Regulatory Compliance Issues

Strict environmental regulations and emission standards pose challenges for quartz stone producers in France. Manufacturing processes involving resins and energy-intensive operations face scrutiny over carbon emissions and waste management. Compliance with EU sustainability frameworks and certifications adds complexity and cost to operations. Companies must invest in cleaner technologies and sustainable raw materials to meet regulatory expectations. While this increases short-term expenses, it remains essential for maintaining market access and long-term environmental credibility.

Regional Analysis

Île-de-France

Île-de-France dominated the France Quartz Stone Market in 2024, accounting for 36% of the total share. The region’s leadership stems from its concentration of premium residential developments, modern commercial complexes, and luxury interior design projects. Strong demand for high-quality quartz countertops and flooring materials is driven by rising renovation activity in Paris and surrounding metropolitan areas. It benefits from a well-developed construction network and strong purchasing power among urban consumers. The presence of architectural firms and design studios further strengthens adoption of engineered quartz in upscale applications.

Auvergne–Rhône–Alpes

Auvergne–Rhône–Alpes held 22% of the market share in 2024, supported by its industrial and residential expansion. The region’s growing real estate sector and focus on sustainable housing projects enhance demand for eco-friendly quartz surfaces. It benefits from a robust distribution network and access to material suppliers catering to construction and remodeling sectors. High adoption among mid-range residential customers and hospitality projects reflects its balanced demand profile. The rise of home improvement initiatives in cities such as Lyon and Grenoble continues to support steady sales growth.

Provence–Alpes–Côte d’Azur

Provence–Alpes–Côte d’Azur accounted for 18% of the total market in 2024, driven by increasing luxury housing and tourism infrastructure investments. The region’s preference for elegant and low-maintenance interiors supports strong quartz stone adoption in villas, hotels, and resorts. It shows a consistent shift toward sustainable and design-focused quartz solutions suited for coastal conditions. High exposure to international design trends also fuels demand for customized quartz slabs. The concentration of high-income households reinforces its market presence in the southern corridor.

Nouvelle–Aquitaine

Nouvelle–Aquitaine represented 14% of the France Quartz Stone Market in 2024, supported by growing urbanization and residential modernization. The regional construction sector emphasizes durable and aesthetic materials suitable for coastal and inland climates. It benefits from strong trade activity and expanding retail distribution networks. Rising awareness of quartz’s longevity and low maintenance drives replacement of traditional stones. Ongoing urban development projects in Bordeaux and surrounding cities enhance demand across residential and small commercial applications.

Other Regions (Occitanie, Hauts-de-France, Grand Est, Others)

Other regions collectively captured 10% of the total market share in 2024. These areas demonstrate emerging potential driven by regional housing growth and increasing retail presence of global brands. It shows gradual adoption among small builders and design professionals seeking durable surface materials. Expanding renovation activities and government housing initiatives contribute to moderate but consistent demand. Market penetration remains lower compared to metropolitan areas but shows upward momentum supported by local distributor expansion.

Market Segmentations:

By Type

- Quartz Surface

- Quartz Tile

- Other Forms

By Application

By Material Composition

- Engineered Quartz

- Natural Quartz Stone

- Eco-friendly Quartz

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Platforms

- Others

By Region

- Île-de-France

- Auvergne–Rhône–Alpes

- Provence–Alpes–Côte d’Azur

- Nouvelle–Aquitaine

- Other Regions

Competitive Landscape

The France Quartz Stone Market is moderately consolidated, with competition driven by design innovation, material quality, and sustainable production. Key players such as Saint-Gobain, Caesarstone, Silestone (Cosentino), Compac Quartz, Cambria, Radianz (Samsung Surface Brand), Stone Italiana, and Vikcomposite GmbH dominate through strong brand positioning and advanced manufacturing capabilities. Companies emphasize engineered quartz with superior durability, varied textures, and eco-friendly formulations to meet growing demand in residential and commercial projects. It focuses on expanding product portfolios through customized patterns and digital manufacturing technologies. Strategic initiatives such as capacity expansion, regional distribution partnerships, and investments in low-emission production lines strengthen competitive advantage. The rising influence of e-commerce platforms and design collaborations also enhances visibility and market reach. Continuous innovation in recycling processes and premium surface finishes supports differentiation, while local players compete through cost efficiency and specialized product offerings tailored to regional consumer preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Saint-Gobain

- Cambria

- Compac Quartz

- Caesarstone

- Silestone (Cosentino)

- Radianz (Samsung Surface Brand)

- Stone Italiana

- Vikcomposite GmbH

Recent Developments

- In October 2025, Cosentino launched its new Éclos® brand, featuring mineral surfaces with zero crystalline silica and high recycled content.

- In September 2025, Caesarstone launched its new Icon series, featuring silica-free quartz surfaces aimed at enhancing safety and sustainability.

- In 2025, Cosentino introduced Inlayr® design technology to enhance the aesthetic and sustainability features of its latest surface collections.

- In September 2025, MSI launched seven new Q Quartz colors with bold veining and fresh hues for the European market.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Composition, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for engineered quartz surfaces will continue to rise in residential renovation projects.

- Manufacturers will focus on developing eco-friendly and recyclable quartz formulations.

- Digital design and automated fabrication technologies will enhance production efficiency.

- Luxury housing and hospitality sectors will drive preference for premium quartz finishes.

- Online distribution platforms will expand market accessibility across urban and semi-urban areas.

- Collaboration between designers and material producers will promote customized surface solutions.

- Sustainable construction regulations will encourage adoption of low-emission quartz products.

- Integration of smart coating technologies will improve durability and surface protection.

- Local players will invest in regional production units to reduce import dependency.

- Increasing consumer awareness of design aesthetics will strengthen the demand for high-quality quartz interiors.