Market Overview

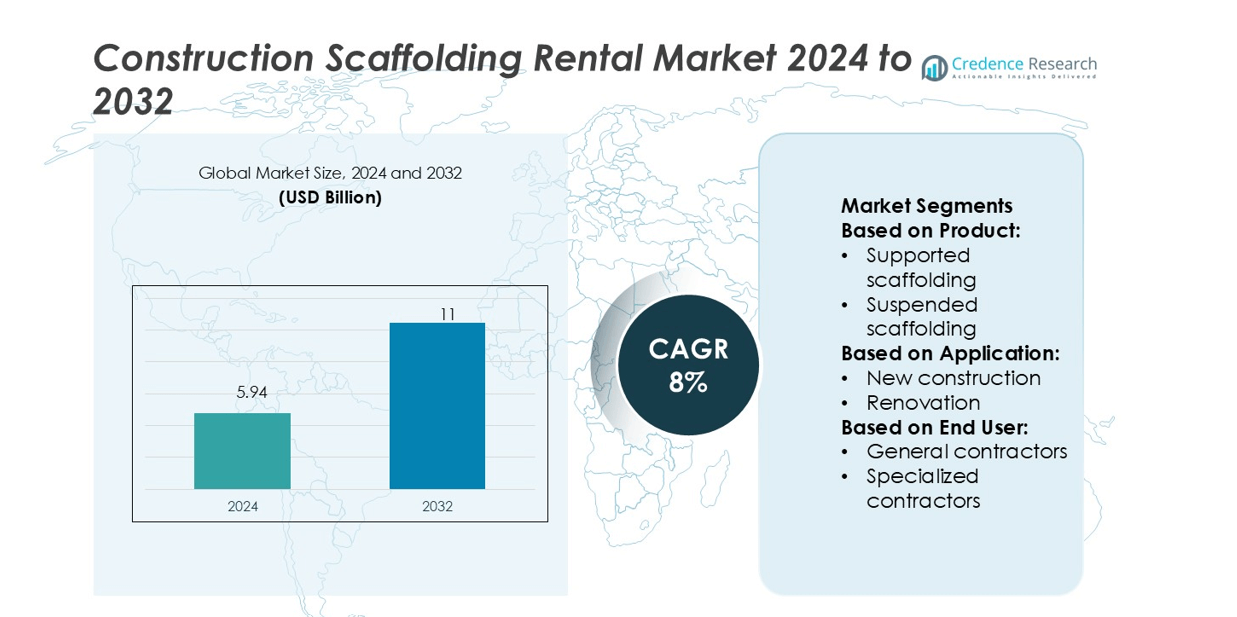

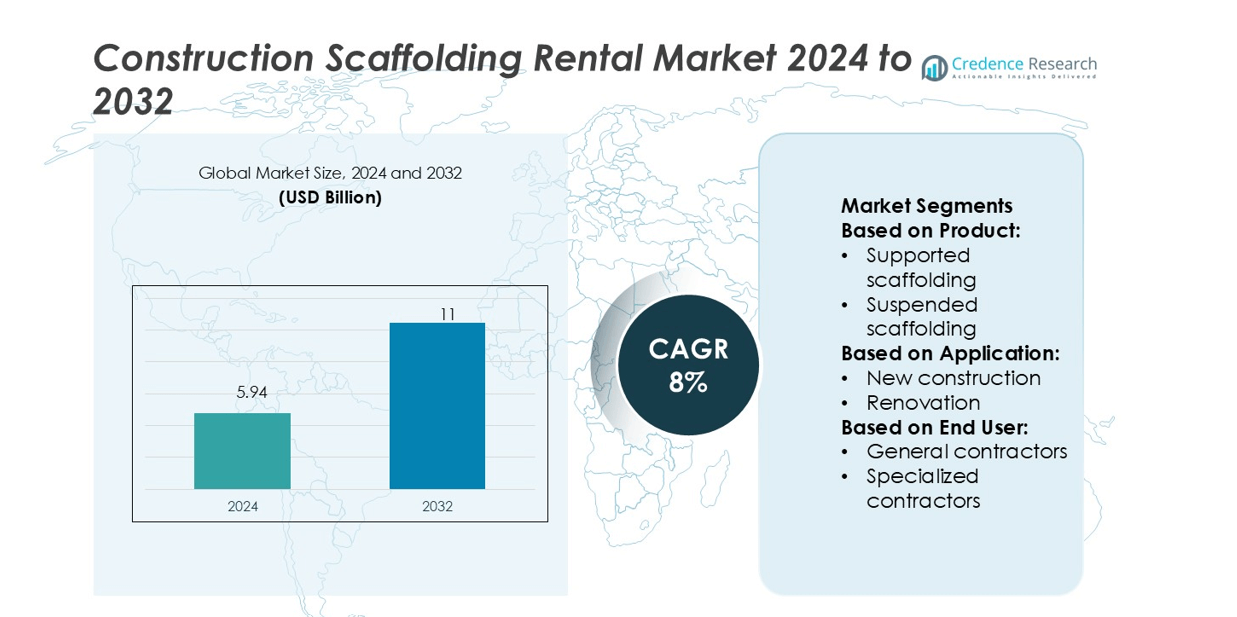

Construction Scaffolding Rental Market size was valued USD 5.94 billion in 2024 and is anticipated to reach USD 11 billion by 2032, at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Scaffolding Rental Market Size 2024 |

USD 5.94 billion |

| Construction Scaffolding Rental Market, CAGR |

8% |

| Construction Scaffolding Rental Market Size 2032 |

USD 11 billion |

The construction scaffolding rental market is highly competitive, with top players including Enigma Industrial Services, PERI GmbH, BrandSafway, United Rentals, Altrad Group, Layher GmbH & Co KG, Ashtead Group Plc, ULMA Construction, Condor S.p.A., and Brock Group. These companies focus on expanding rental fleets, adopting modular systems, and integrating digital solutions to enhance efficiency and safety. Strategic mergers, acquisitions, and technological upgrades strengthen their market positions globally. Asia-Pacific leads the market with a 34% share, driven by rapid urbanization, large-scale infrastructure projects, and smart city developments. The region’s strong construction activity and cost-effective rental adoption position it as the key growth hub for major industry players.

Market Insights

- The Construction Scaffolding Rental Market was valued at USD 5.94 billion in 2024 and is projected to reach USD 11 billion by 2032, growing at a CAGR of 8%.

- Rising infrastructure development, urbanization, and smart city projects are driving strong demand for flexible and cost-efficient scaffolding rental solutions.

- Modular and lightweight scaffolding systems, along with IoT-based monitoring, are shaping market trends and improving safety and operational efficiency.

- The market is highly competitive, with key players expanding rental fleets and adopting digital strategies, though price pressure and operational challenges remain restraints.

- Asia-Pacific holds a 34% market share, leading global growth, while supported scaffolding dominates the product segment due to its widespread use in commercial and infrastructure construction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Supported scaffolding holds the largest market share in the product segment. Its dominance stems from high load capacity, versatility, and wide usage in large commercial projects. General contractors prefer supported scaffolding for stable platforms and ease of assembly, especially in high-rise construction. Suspended scaffolding also sees strong demand for exterior finishing and maintenance work. Rolling scaffolding and mast climbing scaffolding are growing segments due to their mobility and efficiency in façade operations. Other types cater to niche or temporary structures but remain secondary compared to supported systems.

- For instance, BrandSafway’s product literature, some standard WACO® RED box frames weigh as low as 18.7 lb for a 5 ft x 1 ft unit, while larger frames, such as a 5 ft x 6 ft 7 in unit, weigh 48.2 lb.

By Application

New construction represents the dominant sub-segment with the highest market share. The growing number of residential and commercial projects drives this demand. Contractors rely on scaffolding for foundation, façade, and structural work, ensuring safety and workflow efficiency. Renovation projects also account for notable share, especially in urban infrastructure upgrades. Maintenance and demolition applications are expanding as cities adopt stricter safety standards. The increasing use of scaffolding in scheduled maintenance supports steady rental demand, particularly for industrial and public structures.

- For instance, Ascent-200 hydraulic climbing façade system features opening-jaw slab brackets and enables multi-screen climbs with platform heights up to 6.5 m in one lift.

By End-User

General contractors account for the leading share in the end-user segment. Their involvement in large-scale infrastructure and commercial projects drives consistent rental demand. These firms prioritize reliable, cost-effective scaffolding to support structural and finishing works. Specialized contractors use scaffolding for specific tasks such as painting, cladding, or insulation. Government and municipalities support market growth through public infrastructure investments. Event management companies and property management firms represent smaller but rising demand segments, mainly for temporary setups and routine building maintenance.

Key Growth Drivers

Rising Infrastructure Development Activities

Expanding infrastructure development projects strongly drive scaffolding rental demand. Governments are investing heavily in roads, bridges, airports, and commercial buildings. These large-scale projects require flexible and cost-effective access solutions. Rental scaffolding reduces upfront costs and enables quick project mobilization. For instance, smart city and renewable energy projects in Asia and the Middle East are pushing contractors to prefer rentals. The growing emphasis on speed and safety also encourages contractors to adopt professional rental services with advanced scaffolding systems.

- For instance, Layher promoted its Lightweight deck (Steel Deck LW) which reduces component weight by up to 2.2 kg per deck (≈10 %) while preserving full load capacity.

Cost Efficiency and Flexibility for Contractors

Construction companies are shifting toward rentals to reduce capital expenditure. Renting scaffolding eliminates maintenance, storage, and labor training costs. Contractors also gain access to a wider range of modern scaffolding systems for various project types. This flexibility allows firms to scale up or down quickly as needed. For example, short-term projects or seasonal construction work benefit from tailored rental agreements. Such cost-saving advantages support market expansion, especially among small and mid-sized contractors.

- For instance, Ashtead RIDDOR reportable rate in the UK for 2023 was 0.25. The report clarifies that this is a rate per 100,000 hours worked, confirming the specific detail mentioned in the claim.

Stringent Safety and Compliance Standards

Stricter workplace safety regulations increase the need for certified scaffolding equipment. Rental companies provide equipment that complies with local and international safety standards. Regular inspections and maintenance ensure safe working conditions, reducing accident risks on-site. For instance, high-rise construction in Europe and North America often requires advanced modular scaffolding systems. These systems meet strict safety codes and boost operational efficiency. As regulatory enforcement grows, contractors rely more on professional rental services.

Key Trends & Opportunities

Adoption of Modular and Lightweight Scaffolding

The market is witnessing rising adoption of modular and lightweight scaffolding systems. These solutions enhance worker productivity, reduce installation time, and improve site safety. Aluminum and composite materials are gaining preference for their easy handling and durability. For example, high-rise building projects are switching to modular systems to speed up construction cycles. Rental providers offering such advanced solutions are likely to see stronger demand in commercial and residential projects.

- For instance, ULMA’s BRIO ringlock scaffolding uses standards with ring-rosettes every 50 cm, enabling fast modular joins. The system supports façade modules of 0.70 m to 3.00 m width between standards.

Integration of Digital Technologies and Automation

Scaffolding rental providers are increasingly integrating digital tools for inventory tracking and site management. IoT and software solutions help monitor equipment use, ensure timely maintenance, and optimize costs. Automated inspection systems also improve compliance and safety documentation. For instance, rental companies in advanced markets are deploying mobile apps for real-time scaffolding tracking. This trend creates opportunities for smarter rental services with higher efficiency and better project coordination.

- For instance, Evonik deploys around 70 experts in innovation and holds over 300 global patents in that domain. The C4 group claims two-thirds of product sales derive from internally developed technologies.

Growing Demand in Emerging Economies

Emerging economies in Asia-Pacific, Africa, and Latin America offer major growth potential. Rapid urbanization, population growth, and infrastructure investments are boosting construction activity. Rental scaffolding provides a cost-effective solution for contractors in these markets. For example, expanding housing and transportation projects in India and Brazil are creating strong demand. Rental companies expanding their presence in these regions can capture new revenue streams and market share.

Key Challenges

Price Competition and Margin Pressure

The market faces intense competition due to the presence of many regional and local rental providers. Price undercutting often reduces profit margins, making it difficult for smaller players to sustain. Contractors also seek low-cost options, adding pressure on rental rates. For instance, large infrastructure contracts often favor the lowest bidder, pushing companies to reduce prices. Maintaining profitability while ensuring quality and safety remains a critical challenge.

Logistical and Operational Complexities

Managing transportation, storage, and timely delivery of scaffolding equipment is complex. Delays in delivery or installation can disrupt construction timelines and increase project costs. Large projects often require multiple scaffolding configurations, which demand precise planning and coordination. For example, transporting heavy scaffolding systems to remote areas adds extra operational challenges. Rental companies need efficient logistics and skilled staff to maintain service reliability and meet project deadlines.

Regional Analysis

North America

North America holds a 28% share of the construction scaffolding rental market. The region’s growth is fueled by strong demand in commercial and infrastructure projects, including highways, airports, and industrial facilities. The U.S. leads due to extensive urban redevelopment and maintenance work. Strict OSHA safety standards drive the use of certified and modular scaffolding systems. Rental companies in this region emphasize automated inspection and digital inventory management. The rise in high-rise and energy infrastructure projects further boosts equipment rental over ownership, supporting steady market expansion and competitive pricing strategies among established providers.

Europe

Europe accounts for a 24% market share, driven by the region’s focus on sustainable construction and renovation projects. Countries like Germany, the U.K., and France lead the adoption of advanced scaffolding systems to meet stringent safety and environmental regulations. Public infrastructure investments, including railway and urban transit modernization, are expanding rental demand. Modular and lightweight scaffolding is gaining strong traction in urban redevelopment. Strict compliance standards encourage contractors to rent certified solutions instead of purchasing. The growing emphasis on energy-efficient buildings and green infrastructure supports long-term rental demand in both commercial and residential sectors.

Asia-Pacific

Asia-Pacific dominates the market with a 34% share, making it the largest regional segment. Rapid urbanization, smart city programs, and large-scale infrastructure projects are key growth drivers. China, India, and Southeast Asian countries are witnessing a construction boom in residential, commercial, and public sectors. Contractors prefer rentals for cost flexibility and access to modern equipment. Mega infrastructure projects such as highways, metros, and industrial zones accelerate demand. The rising use of modular scaffolding and growing foreign investments in construction sectors strengthen the region’s leadership. Expanding rental networks in emerging cities further supports market growth.

Latin America

Latin America represents a 7% market share, driven by expanding residential and commercial construction. Brazil and Mexico are key contributors, supported by urban development programs and infrastructure investments. The region is seeing a gradual shift from traditional wooden scaffolding to modern modular systems. Rental companies are growing their footprint to meet rising demand in both urban and industrial sectors. Government initiatives to upgrade transportation and energy infrastructure are fueling construction activity. Rental solutions offer flexibility and cost advantages, making them attractive for contractors working on short- to mid-term projects across the region.

Middle East & Africa

The Middle East & Africa holds a 7% share, supported by increasing construction activity in the Gulf Cooperation Council (GCC) countries. Large-scale commercial, hospitality, and infrastructure projects, including smart cities, fuel rental demand. Saudi Arabia and the UAE lead regional adoption due to major investments in transport and tourism infrastructure. Africa is seeing growth from urban development and industrial expansion projects. Contractors prefer rentals to reduce capital spending and meet project-specific safety standards. The adoption of modular and steel scaffolding solutions is rising steadily, improving project efficiency and accelerating deployment timelines.

Market Segmentations:

By Product:

- Supported scaffolding

- Suspended scaffolding

By Application:

- New construction

- Renovation

By End User:

- General contractors

- Specialized contractors

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the construction scaffolding rental market is shaped by Enigma Industrial Services, PERI GmbH, BrandSafway, United Rentals, Altrad Group, Layher GmbH & Co KG, Ashtead Group Plc, ULMA Construction, Condor S.p.A., and Brock Group. The competitive landscape of the construction scaffolding rental market is marked by high service differentiation and strong regional presence. Companies are focusing on expanding rental fleets, improving equipment quality, and integrating digital tools for operational efficiency. Advanced modular and lightweight scaffolding systems are gaining traction due to their ease of installation, enhanced safety, and cost-effectiveness. Many providers are adopting IoT-based monitoring and automated inspection solutions to ensure compliance with stringent safety standards. Strategic collaborations, mergers, and acquisitions are common to strengthen market positioning. The shift toward sustainable and reusable materials is also influencing competitive strategies, supporting long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, ADNOC received unconditional antitrust approval from the European Commission to move forward with its acquisition of Covestro. This acquisition enhances ADNOC’s position in the specialty chemicals sector, particularly in construction chemicals, as Covestro’s product range includes advanced polymer materials utilized in construction applications.

- In June 2024, Herc Rentals has acquired Durante Rentals, a leading equipment rental company with 12 locations across New York, New Jersey, and Connecticut. The integration of Durante Rentals will enhance Herc Rentals’ service offerings and regional reach.

- In April 2024, MAPEI S.p.A. announced the launch of Mapeflex MS 55, a new hybrid adhesive and sealant with high elasticity. This versatile product is suitable for both professional and domestic use, offering benefits such as initial solid tack, compatibility with damp surfaces, and low VOC emissions.

- In March 2024, United Rentals has finalized its acquisition of Yak Access, a leader in the North American matting industry, provides surface protection solutions, primarily serving utility and midstream sectors. The acquisition, funded through a mix of senior unsecured notes and existing resources, is expected to enhance United Rentals’ offerings and growth potential. The company plans to update its 2024 financial outlook to reflect the integration.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for modular and lightweight scaffolding systems will increase across large infrastructure projects.

- Digital tools and IoT-enabled platforms will enhance equipment tracking and safety compliance.

- Rental service providers will expand their networks to capture opportunities in emerging economies.

- Strict safety regulations will push contractors to choose certified rental solutions over ownership.

- Sustainability initiatives will drive the use of recyclable and eco-friendly scaffolding materials.

- Urbanization and smart city developments will create strong rental demand in commercial construction.

- Companies will focus on automation and faster installation methods to reduce labor costs.

- Strategic partnerships and acquisitions will strengthen global and regional market presence.

- Contractors will prefer flexible rental contracts to manage short-term and large-scale projects.

- Continuous innovation in scaffolding design will improve operational efficiency and project timelines.