Market Overview

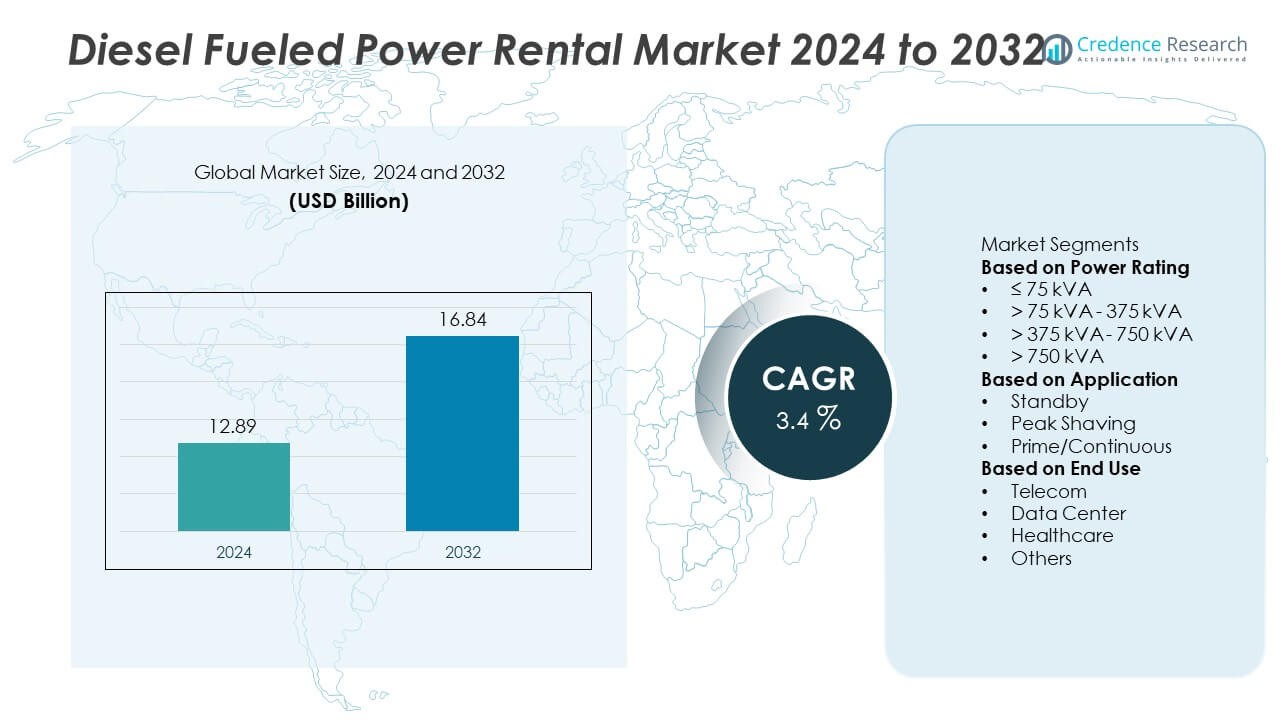

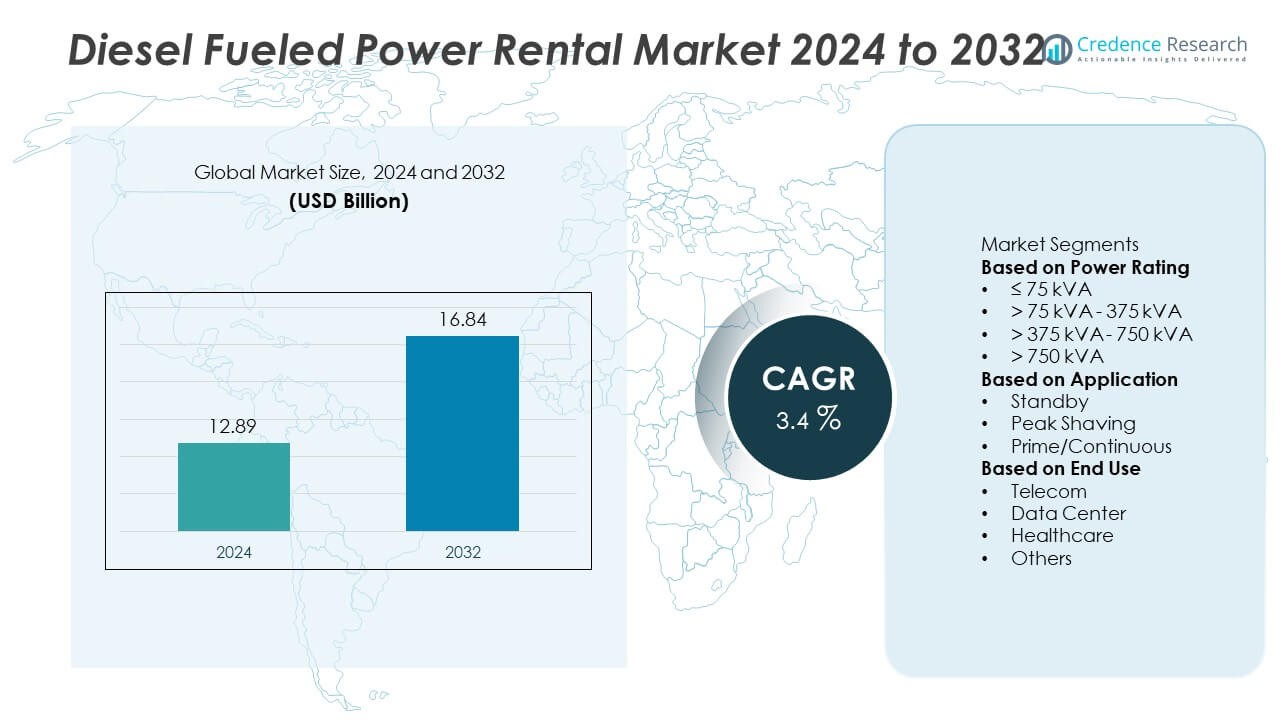

The Diesel Fueled Power Rental Market was valued at USD 12.89 billion in 2024 and is projected to reach USD 16.84 billion by 2032, growing at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Fueled Power Rental Market Size 2024 |

USD 12.89 Billion |

| Diesel Fueled Power Rental Market, CAGR |

3.4% |

| Diesel Fueled Power Rental Market Size 2032 |

USD 16.84 Billion |

The Diesel Fueled Power Rental Market is led by key players such as Aggreko, APR Energy, Ashtead Group, Atlas Copco, Bredenoord, Byrne Equipment Rental, Caterpillar, Cummins, Generac Power Systems, and Herc Rentals. These companies dominate through extensive rental fleets, technological innovation, and strong regional service networks. Asia-Pacific emerged as the leading region in 2024, holding a 36% market share, driven by rapid industrialization, large-scale infrastructure development, and unreliable grid networks. North America followed with 31%, supported by strong demand from construction, data centers, and oil and gas sectors requiring efficient temporary power solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Diesel Fueled Power Rental Market was valued at USD 12.89 billion in 2024 and is projected to reach USD 16.84 billion by 2032, growing at a CAGR of 3.4%.

- Rising demand for temporary and reliable power supply in construction, mining, and industrial operations is driving market growth worldwide.

- The market is witnessing a shift toward hybrid-ready, fuel-efficient, and digitally monitored diesel generator rentals to meet sustainability and performance standards.

- Leading players such as Aggreko, Caterpillar, Cummins, and Atlas Copco are focusing on fleet expansion, remote monitoring systems, and emission-compliant technologies to stay competitive.

- Asia-Pacific led the market with a 36% share, followed by North America at 31% and Europe at 23%; by application, the prime/continuous segment dominated with 46% share, driven by industrial and infrastructure usage.

Market Segmentation Analysis:

By Power Rating

The >375 kVA–750 kVA segment dominated the Diesel Fueled Power Rental Market in 2024, accounting for a 41% market share. Its dominance is driven by widespread adoption across large industrial, commercial, and infrastructure projects that require continuous and stable power. These generators are ideal for high-load operations such as oil exploration, manufacturing, and construction. Rental providers are expanding fleets in this range to meet the growing demand for medium-to-large capacity units that balance cost efficiency with high performance. Their versatility and reliability in both urban and remote sites continue to strengthen segment growth.

- For instance, Cummins Inc. supplies the C700D5 diesel generator with a standby rated output of 706 kVA (565 kW) and a prime power rating of 640 kVA (512 kW) at 1500 rpm. The unit is powered by a VTA28-G5 engine. Its integrated PowerCommand 3.3 control system enables precise synchronization and load management.

By Application

The prime/continuous power segment led the Diesel Fueled Power Rental Market in 2024, capturing a 46% share. The segment’s leadership is attributed to heavy use in remote industrial operations, mining sites, and oil and gas facilities where grid access is limited. These generators provide uninterrupted power for extended periods, supporting mission-critical applications. Rising investments in infrastructure projects and large construction developments are driving demand for long-duration rentals. The growing emphasis on operational continuity and cost-effective solutions is further supporting the adoption of prime and continuous diesel power rental systems.

- For instance, Aggreko operates a fleet of diesel generators globally, including high-capacity Tier 4 Final units in ranges that serve prime and continuous applications. The company uses a modular configuration that allows for scalable deployment, especially for large projects in industries like oil and gas that require reliable, 24/7 power.

By End Use

The data center segment held the largest market share of 34% in the Diesel Fueled Power Rental Market in 2024. Increasing data traffic, cloud computing, and digital transformation initiatives have raised the need for reliable backup power in data centers. Diesel rental generators ensure uninterrupted power during outages and grid fluctuations, safeguarding data integrity and uptime. The expansion of hyperscale data centers in North America, Europe, and Asia-Pacific is accelerating rental demand. Providers are offering scalable, fuel-efficient, and emission-compliant power solutions tailored for modern digital infrastructure operations.

Key Growth Drivers

Rising Demand for Reliable Temporary Power Supply

Growing dependence on continuous power in industrial, commercial, and event sectors is driving the diesel fueled power rental market. Frequent grid failures and increasing energy consumption have encouraged businesses to adopt rental generators as a flexible backup solution. Industries such as construction, telecom, and mining rely on diesel-powered units to maintain operations during outages or remote deployments. The ability to provide quick, portable, and scalable power makes diesel generator rentals essential for ensuring business continuity and operational reliability.

- For instance, Herc Rentals operates a fleet of generators across North America, which are used in a wide range of industries including construction, industrial, and entertainment. The company’s ProControl NextGen telematics system offers real-time insights for fleet management, including diagnostics, utilization data, and alerts.

Expanding Construction and Infrastructure Activities

Ongoing global infrastructure expansion is a major driver for diesel power rentals. Large-scale construction projects, especially in Asia-Pacific and the Middle East, require temporary and mobile power to support equipment and site operations. Diesel generator rentals enable cost-effective, short-term energy access without long-term ownership costs. Governments investing in smart cities, transport, and energy projects are further boosting rental demand. The growing need for uninterrupted power during project execution continues to support market growth.

- For instance, Atlas Copco provides construction-grade diesel generators under its QAS series, including the QAS 625 model with a rated capacity of 500 kW / 625 kVA prime power. The generator features an integrated Power Management System (PMS) that allows up to 32 units to synchronize and distribute load efficiently across large construction sites.

Growth in Data Centers and Telecom Networks

The rapid expansion of data centers and telecom infrastructure has significantly increased demand for diesel rental generators. Data centers require reliable backup systems to ensure seamless uptime and data protection. Similarly, telecom operators use diesel generators for powering base stations in remote and off-grid locations. With the rollout of 5G networks and increased cloud computing usage, the demand for temporary, high-performance diesel power solutions is accelerating, particularly in developing regions with unstable grid connectivity.

Key Trends & Opportunities

Shift Toward Fuel-Efficient and Low-Emission Generators

Environmental regulations and rising fuel costs are driving innovation in cleaner, fuel-efficient diesel power systems. Rental companies are adopting generators equipped with advanced engine technologies, emission control systems, and smart monitoring tools. These upgrades help reduce operational costs while maintaining compliance with emission standards such as Tier 4 and Stage V. The transition toward sustainable diesel solutions presents opportunities for rental providers offering eco-friendly and high-performance equipment for industrial and commercial applications.

- For instance, Caterpillar Inc. introduced its XQ570 Tier 4 Final diesel generator equipped with a Cat C18 ACERT engine that delivers 455 kW of prime power output. The unit’s electronic fuel injection and aftertreatment system, which includes selective catalytic reduction (SCR) for NOx reduction, and a diesel particulate filter (DPF) for particulate matter control, result in improved part-load fuel consumption.

Adoption of Digital Monitoring and Smart Fleet Management

The integration of IoT and telematics technologies is transforming the diesel power rental industry. Digital monitoring systems enable real-time performance tracking, predictive maintenance, and fuel optimization, enhancing operational efficiency. Rental providers are using data-driven insights to improve fleet utilization and customer service. This trend supports greater transparency, faster response times, and reduced downtime for end-users. The growing preference for connected power rental solutions creates opportunities for technologically advanced service providers.

- For instance, Generac Power Systems operates its connected fleet through its telematics platform, which monitors its commercial and industrial rental generators. Each monitored unit transmits data on performance, such as fuel usage, load balance, and engine hours, through network connections.

Key Challenges

Stringent Environmental Regulations

Tightening global emission standards pose a major challenge for diesel generator rental providers. Regulations targeting nitrogen oxide and particulate matter emissions are compelling manufacturers to redesign engines and integrate advanced filtration technologies. Compliance increases production and rental costs, reducing profit margins. Companies must invest in low-emission or hybrid systems to meet sustainability goals. Balancing environmental responsibility with affordability remains a key concern across both developed and emerging markets.

Rising Competition from Alternative Power Sources

The increasing availability of renewable energy and battery storage systems is challenging the growth of diesel-based rentals. Solar hybrid systems and portable battery packs offer cleaner and quieter alternatives for temporary power applications. Businesses aiming to reduce carbon footprints are gradually shifting away from traditional diesel units. To remain competitive, rental providers are expanding into hybrid and energy-efficient solutions while maintaining the reliability and scalability that diesel power rentals offer.

Regional Analysis

North America

North America held a 31% market share in the Diesel Fueled Power Rental Market in 2024. The region’s strong industrial base, frequent weather-related outages, and large-scale infrastructure projects drive consistent demand for rental power solutions. The United States dominates due to widespread use in construction, data centers, and oil and gas operations. Rental companies are expanding fleets with low-emission, Tier 4-compliant diesel generators to meet environmental standards. Increasing investments in renewable–diesel hybrid systems and grid modernization projects are further strengthening the regional market outlook.

Europe

Europe accounted for a 23% market share in the Diesel Fueled Power Rental Market in 2024. The region’s growth is supported by demand from data centers, manufacturing facilities, and construction projects requiring temporary and backup power. Countries such as Germany, the United Kingdom, and France are major contributors, emphasizing compliance with strict EU emission norms. The adoption of hybrid and fuel-efficient rental generators is increasing as companies prioritize sustainability. Ongoing transition toward cleaner energy and rising need for flexible rental solutions across industrial sectors sustain steady market expansion in Europe.

Asia-Pacific

Asia-Pacific dominated the Diesel Fueled Power Rental Market in 2024, capturing a 36% market share. Rapid industrialization, large infrastructure projects, and unstable grid networks are key drivers of growth across China, India, and Southeast Asia. The region’s booming construction and telecom sectors depend heavily on diesel generator rentals to ensure reliable power supply. Rental providers are focusing on high-capacity and fuel-efficient units to serve long-duration operations. Government initiatives promoting rural electrification and continuous energy supply further support market development, positioning Asia-Pacific as the primary growth hub.

Latin America

Latin America captured a 6% market share in the Diesel Fueled Power Rental Market in 2024. Demand is largely driven by mining, oil and gas, and construction activities in Brazil, Mexico, and Chile. Unreliable power infrastructure and frequent grid disruptions encourage the use of rental diesel generators for critical operations. Regional rental companies are investing in modern fleets featuring better fuel economy and remote monitoring technologies. Economic recovery and public infrastructure investments are expected to strengthen the region’s market growth in the coming years, particularly within industrial and commercial sectors.

Middle East & Africa

The Middle East & Africa region held a 4% market share in the Diesel Fueled Power Rental Market in 2024. The market is driven by large oil and gas projects, remote industrial operations, and expanding infrastructure development. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa represent major contributors. Frequent power shortages in parts of Africa further increase dependence on rental diesel generators. The region is witnessing rising adoption of high-capacity, fuel-efficient rental systems that ensure continuous operations, particularly in construction and energy-intensive sectors.

Market Segmentations:

By Power Rating

- ≤ 75 kVA

- > 75 kVA – 375 kVA

- > 375 kVA – 750 kVA

- > 750 kVA

By Application

- Standby

- Peak Shaving

- Prime/Continuous

By End Use

- Telecom

- Data Center

- Healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Diesel Fueled Power Rental Market features major players such as Aggreko, APR Energy, Ashtead Group, Atlas Copco, Bredenoord, Byrne Equipment Rental, Caterpillar, Cummins, Generac Power Systems, and Herc Rentals. These companies dominate through large rental fleets, strong service networks, and advanced diesel generator technologies. Market leaders are focusing on developing fuel-efficient, low-emission, and hybrid-ready systems to meet global sustainability goals. Strategic partnerships, mergers, and regional expansions are key to strengthening their market footprint. Companies are also investing in digital monitoring, remote diagnostics, and predictive maintenance to enhance operational reliability and customer service. Increasing competition from regional providers offering flexible rental packages is intensifying the market landscape, pushing global players to improve fleet diversity and customer-focused power solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Aggreko rolled out a 400 kW Tier 4 Final diesel generator for rental deployment, featuring CO emissions at 0.005 g/kW-hr, NOₓ at 0.103 g/kW-hr, and noise level of 72 dBA.

- In 2025, Aggreko reaffirmed its commitment to carbon reduction via sustainability strategy, including deploying cleaner diesel gensets and greening its rental fleet.

- In May 2024, Aggreko introduced its PowerMX multi-engine generator range (Stage V), combining multiple diesel engines in a modular setup to optimize emissions and fuel efficiency.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily with rising industrial and infrastructure activities.

- Demand for temporary power solutions will increase in construction and mining sectors.

- Hybrid and fuel-efficient diesel generators will gain more market traction.

- Digital monitoring and predictive maintenance systems will become standard in rental fleets.

- Asia-Pacific will remain the largest market due to rapid industrialization and energy demand.

- Rental providers will focus on emission-compliant and low-noise diesel power systems.

- Partnerships between OEMs and rental companies will expand to enhance service coverage.

- Replacement of aging generator fleets will create consistent rental demand.

- Environmental regulations will encourage innovation in cleaner and hybrid power solutions.

- Increased adoption of smart and connected power rental systems will reshape market competition.