Market Overview

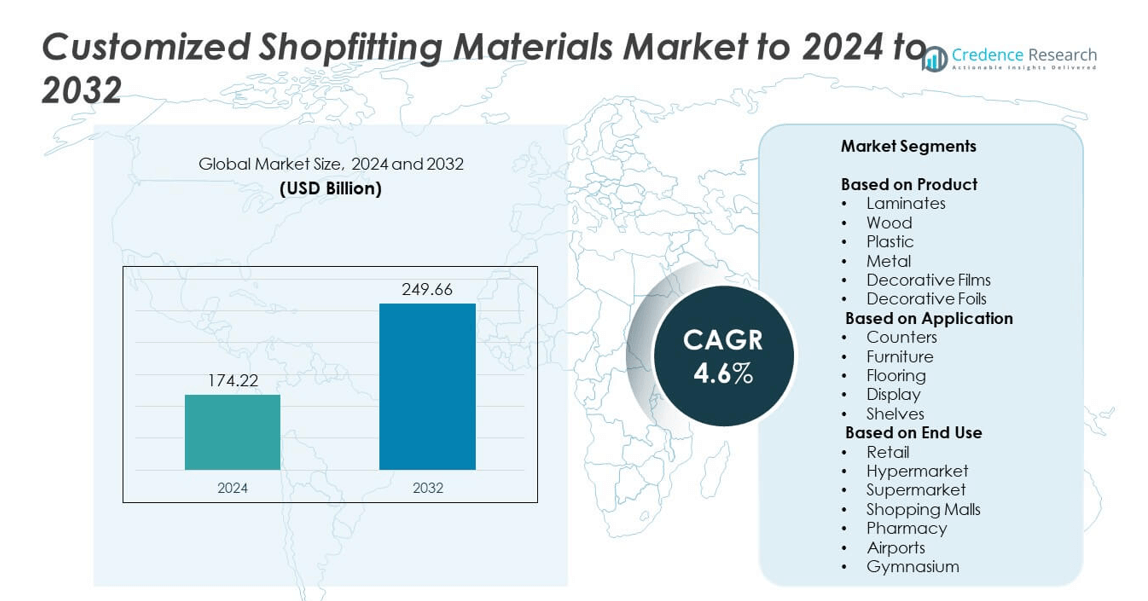

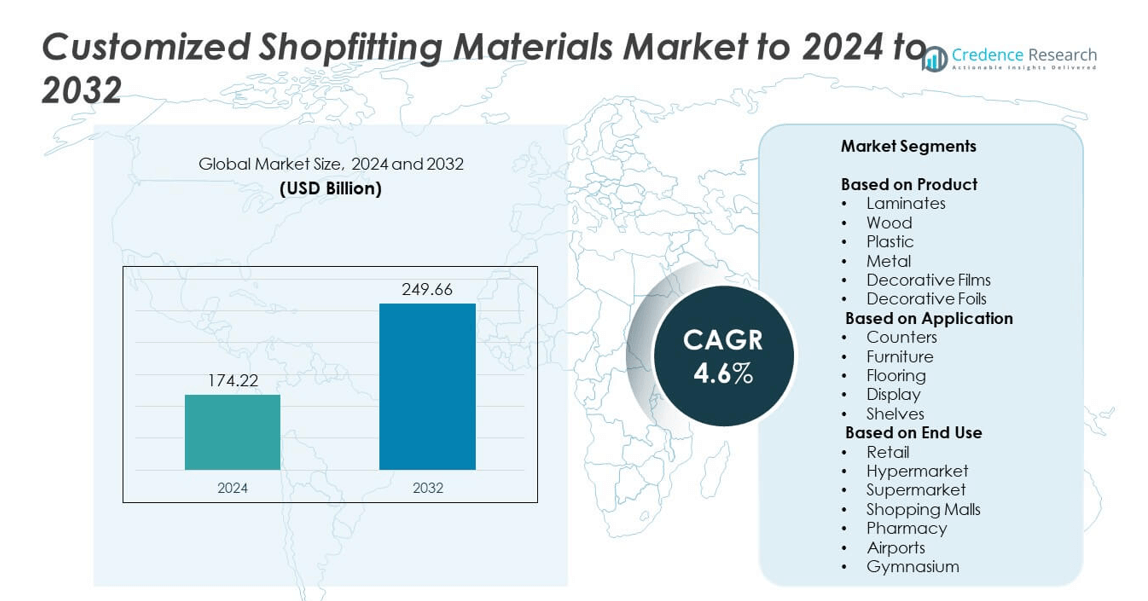

Customized Shopfitting Materials Market size was valued at USD 174.22 billion in 2024 and is anticipated to reach USD 249.66 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Customized Shopfitting Materials Market Size 2024 |

USD 174.22 billion |

| Customized Shopfitting Materials Market, CAGR |

4.6% |

| Customized Shopfitting Materials Market Size 2032 |

USD 249.66 billion |

The customized shopfitting materials market is driven by leading players such as Wilsonart, REHAU Verwaltungszentrale, Shopfitters Greenlam, Madico Decorative Films, Australian Plastic Fabricators, Jacobs Joinery, SURTECO, and Greenlam. These companies focus on sustainable materials, advanced laminates, and high-quality decorative films to meet growing retail design demands. Product innovation, modular fittings, and eco-friendly finishes are key competitive strategies enhancing market growth. North America dominated the global market in 2024 with a 35% share, supported by extensive retail expansion and store remodeling projects, while Europe and Asia-Pacific followed as major growth contributors with strong demand for premium and customizable interior solutions.

Market Insights

- The customized shopfitting materials market was valued at USD 174.22 billion in 2024 and is projected to reach USD 249.66 billion by 2032, growing at a CAGR of 4.6%.

- Rising demand for customized and sustainable shopfitting solutions drives market growth, supported by expansion in retail and commercial spaces.

- Increasing adoption of modular designs, eco-friendly laminates, and digital fabrication trends enhances design flexibility and efficiency.

- The market is moderately consolidated, with key players focusing on material innovation, durable finishes, and sustainability to maintain competitiveness.

- North America led with a 35% share in 2024, followed by Europe at 30% and Asia-Pacific at 26%, while the wood segment held the largest product share at 32%, driven by its strength and natural aesthetics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The wood segment dominated the customized shopfitting materials market in 2024 with a 32% share. Wood remains the preferred choice due to its strength, aesthetic appeal, and adaptability for bespoke retail interiors. Rising demand for sustainable and premium wooden fittings in luxury and mid-range retail spaces supports growth. Manufacturers are introducing engineered wood products with enhanced durability and easy customization. The shift toward eco-friendly materials and the growing trend of natural-themed store designs further boost demand for wood-based shopfitting solutions across global retail environments.

- For instance, Greenlam Industries has installed laminate capacity of 24.5 million sheets per year, supporting large bespoke wood-based retail fit-outs.

By Application

The furniture segment led the market in 2024, accounting for nearly 38% of the share. Customized furniture enhances space efficiency and brand identity, driving adoption among retail stores and shopping complexes. Retailers increasingly prefer modular and flexible designs that optimize space utilization and improve visual merchandising. Rising investments in store remodeling and brand-specific interior designs further contribute to segment dominance. Additionally, the integration of materials like metal frames and decorative foils into furniture structures enhances durability and aesthetic versatility in modern retail outlets.

- For instance, Lozier Corporation operates over 4.3 million sq ft of manufacturing and distribution space across five U.S. states for modular retail furniture and fixtures

By End Use

The retail segment held the largest share of 41% in 2024, leading the customized shopfitting materials market. Retailers prioritize personalized and visually appealing interiors to enhance customer experience and brand differentiation. Expanding retail chains and boutique stores drive consistent demand for customized displays, counters, and shelving systems. The growth of experiential shopping and premium retail spaces further strengthens this segment. Moreover, rising adoption of modular fittings across global retail brands accelerates the use of advanced materials such as laminates, decorative films, and engineered wood for long-lasting, design-oriented installations.

Key Growth Drivers

Rising Demand for Custom Retail Interiors

Growing focus on brand identity and customer engagement fuels the demand for customized shopfitting materials. Retailers are investing in personalized store layouts that reflect brand aesthetics and improve consumer experience. Materials like decorative foils and laminates enable flexibility in design and durability. Expanding retail chains and boutique outlets across emerging markets further accelerate demand for tailored fittings that support modern retail concepts and space optimization.

- For instance, In its 2024 financial year, H&M Group opened 88 new stores but closed 204, resulting in a net reduction of 116 stores. This activity was part of a larger strategy to optimize its store portfolio, which included significant investments in refurbishing existing store interiors.

Sustainability and Eco-friendly Material Adoption

Sustainability has become a key purchasing factor for both retailers and consumers. The adoption of eco-friendly materials such as recycled wood, low-VOC laminates, and biodegradable decorative films is rising rapidly. Manufacturers are innovating with sustainable composites and coatings to meet environmental regulations. This shift aligns with global green building standards, making eco-conscious shopfitting materials a major contributor to market growth across Europe, North America, and Asia-Pacific.

- For instance, Wilsonart reports its HPL uses an average 23% post-consumer recycled content and holds UL GREENGUARD Gold low-emission certification.

Expansion of Retail and Commercial Spaces

Rapid urbanization and the growth of global retail chains drive demand for high-quality shopfitting materials. Malls, hypermarkets, and specialty stores increasingly require durable, aesthetic, and easily customizable fittings. The rise in commercial renovations and retail space modernization projects across developing regions strengthens the market. Additionally, digital retail experiences are influencing physical store layouts, encouraging investments in modular and visually impactful interior materials.

Key Trends and Opportunities

Integration of Digital and Modular Designs

Retailers are adopting modular and digital-integrated shopfitting systems to enhance flexibility and efficiency. Smart fittings allow real-time product display updates and layout adjustments, improving operational convenience. Modular systems also reduce installation time and support cost-effective customization. These advancements help retailers create dynamic spaces that adapt quickly to evolving consumer preferences and seasonal demands.

- For instance, VusionGroup (SES-imagotag) reached a cloud installed base of about 23,000 stores and 135 million ESLs by Q3 2024, enabling rapid, modular pricing updates.

Growing Use of Decorative Films and Foils

The use of decorative films and foils is expanding as retailers seek premium yet affordable finishes. These materials provide versatile aesthetic options with high resistance to wear and easy maintenance. Manufacturers are launching innovative textures and metallic finishes that replicate natural materials. This trend creates new opportunities in luxury retail and commercial spaces, particularly in Europe and the Asia-Pacific regions where design-focused interiors are gaining popularity.

- For instance, 3M DI-NOC offers 800+ architectural film patterns with published interior warranties up to 10 years (series-dependent), supporting fast retail refreshes.

Key Challenges

High Installation and Customization Costs

Customized shopfitting materials often involve high design and installation expenses, limiting adoption among small retailers. The need for precision fabrication and skilled labor further raises costs. Price-sensitive markets, particularly in developing economies, face challenges in balancing aesthetics and affordability. Manufacturers must innovate cost-efficient modular systems and lightweight materials to address this challenge without compromising quality.

Supply Chain and Raw Material Fluctuations

Volatility in raw material prices, especially wood and metal, impacts production stability and profitability. Supply chain disruptions and shipping delays increase lead times for custom projects. The dependence on imported materials and limited availability of sustainable options further strain manufacturers. To overcome this, companies are focusing on localized sourcing and partnerships with eco-certified suppliers to maintain consistency and reduce environmental impact.

Regional Analysis

North America

North America led the customized shopfitting materials market in 2024 with a 35% share. The region’s growth is driven by strong retail expansion, especially among supermarkets and luxury brands. Increasing adoption of sustainable materials such as engineered wood and eco-friendly laminates enhances demand. The presence of established retail chains in the U.S. and Canada further supports market growth. Rising investments in commercial interiors and store remodeling projects continue to strengthen the region’s dominance, with major manufacturers focusing on design innovation and energy-efficient, durable shopfitting solutions.

Europe

Europe accounted for a 30% share of the global market in 2024. The region benefits from the rising demand for premium retail interiors and sustainable materials aligned with EU environmental standards. Retailers increasingly use decorative films and foils to create sophisticated store environments. The strong presence of luxury fashion and lifestyle brands across Germany, France, and Italy boosts material innovation. Additionally, the expansion of shopping malls and refurbishment of historic commercial spaces drive continuous investment in advanced, design-focused shopfitting materials.

Asia-Pacific

Asia-Pacific held a 26% share in 2024, emerging as the fastest-growing regional market. Rapid urbanization, booming retail infrastructure, and expanding supermarket and mall networks in China, India, and Japan drive growth. Local manufacturers are adopting cost-effective production techniques and developing customizable materials to meet growing retail demand. The trend toward modern retail formats, coupled with increased foreign investment in organized retail, accelerates adoption. The region’s focus on aesthetic and space-efficient shopfitting designs further enhances market expansion across diverse commercial sectors.

Latin America

Latin America captured a 6% share of the customized shopfitting materials market in 2024. Growth is supported by the rise of modern retail formats and mall developments in Brazil, Mexico, and Chile. Retailers are increasingly investing in attractive, durable fittings to enhance customer experience. Economic recovery and growing international retail presence encourage material innovation and imports of high-quality laminates and decorative films. The region’s growing focus on sustainable design and cost-effective customization is expected to boost the market over the coming years.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share in 2024. Expanding commercial construction, especially in the UAE, Saudi Arabia, and South Africa, supports steady growth. The rise of luxury shopping destinations and airport retail drives demand for premium materials such as wood and metal fittings. Increasing tourism and hospitality investments further encourage the adoption of customized designs. The region’s growing preference for modern interiors and sustainable decorative finishes creates opportunities for international manufacturers to expand their presence.

Market Segmentations:

By Product

- Laminates

- Wood

- Plastic

- Metal

- Decorative Films

- Decorative Foils

By Application

- Counters

- Furniture

- Flooring

- Display

- Shelves

By End Use

- Retail

- Hypermarket

- Supermarket

- Shopping Malls

- Pharmacy

- Airports

- Gymnasium

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The customized shopfitting materials market features key players such as Wilsonart, REHAU Verwaltungszentrale, Shopfitters Greenlam, Madico Decorative Films, Australian Plastic Fabricators, Jacobs Joinery, SURTECO, and Greenlam. The market is moderately consolidated, with companies focusing on product innovation, sustainable material development, and tailored design solutions. Leading manufacturers emphasize eco-friendly coatings, low-emission laminates, and recyclable decorative films to align with global sustainability standards. Strategic collaborations with architects, retail chains, and interior designers strengthen market positioning and customer reach. Advanced digital fabrication and modular production technologies are being integrated to improve design precision and reduce turnaround time. Companies also invest heavily in R&D to expand material portfolios, enhance durability, and cater to diverse commercial applications. Continuous upgrades in surface finishes, color textures, and moisture resistance contribute to higher product differentiation. Increasing adoption of automated manufacturing and efficient supply chains further supports competitiveness in the global customized shopfitting materials market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Madico Launched SafetyShield® G2 safety and security film system. Announced as a next-gen glass protection upgrade.

- In 2025, Wilsonart: Acquired Virginia Tile’s woodworking products distribution business. Added multi-state branches to its network.

- In 2025, REHAU Verwaltungszentrale (REHAU Group): Released matched edgebands for Kaindl BOARDS Collection 2025. Offer covers ~260 board decors.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising adoption of sustainable and recyclable shopfitting materials will drive long-term market growth.

- Increasing demand for modular and flexible retail fittings will enhance customization opportunities.

- Expansion of global retail chains and boutique stores will boost material consumption.

- Integration of digital and smart shopfitting systems will reshape in-store design strategies.

- Growing preference for lightweight and durable materials will support cost efficiency.

- Development of eco-friendly decorative films and foils will gain strong market traction.

- Rapid urbanization and commercial infrastructure growth will expand retail space investments.

- Manufacturers will focus on localized production to reduce logistics costs and lead times.

- Technological innovation in 3D modeling and fabrication will improve design precision.

- Rising consumer demand for visually appealing store layouts will sustain market expansion.