Market Overview

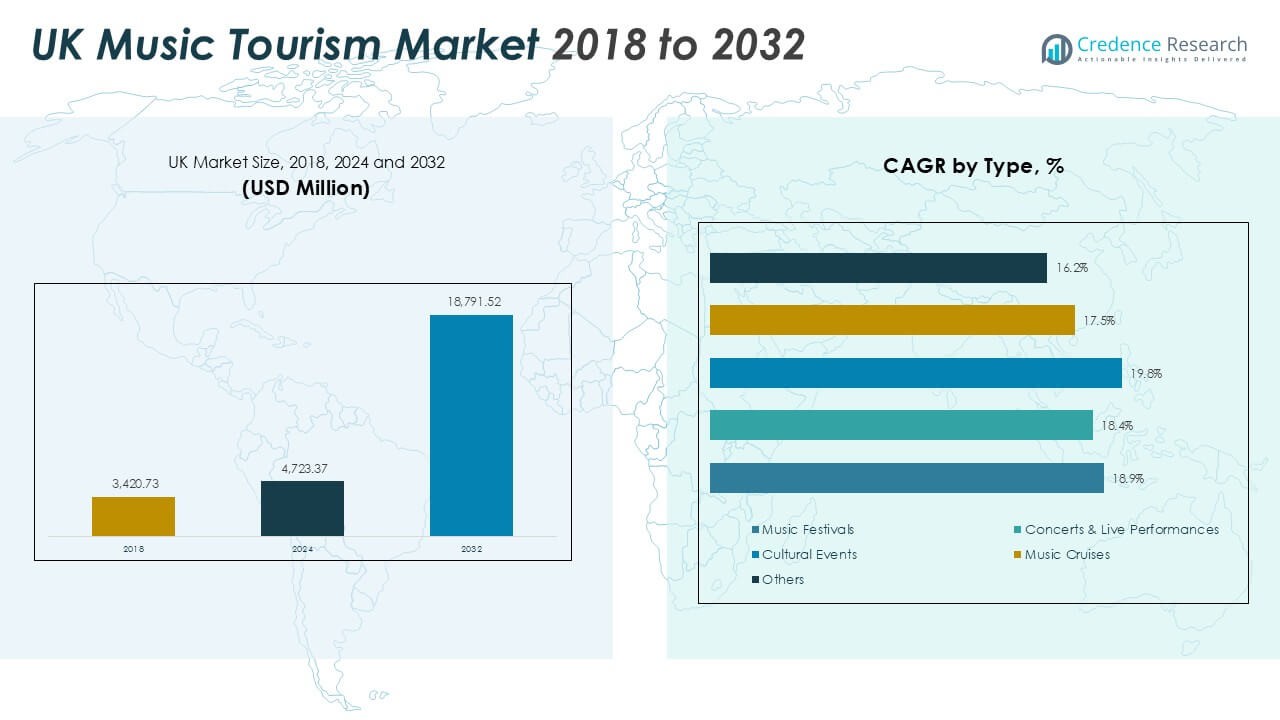

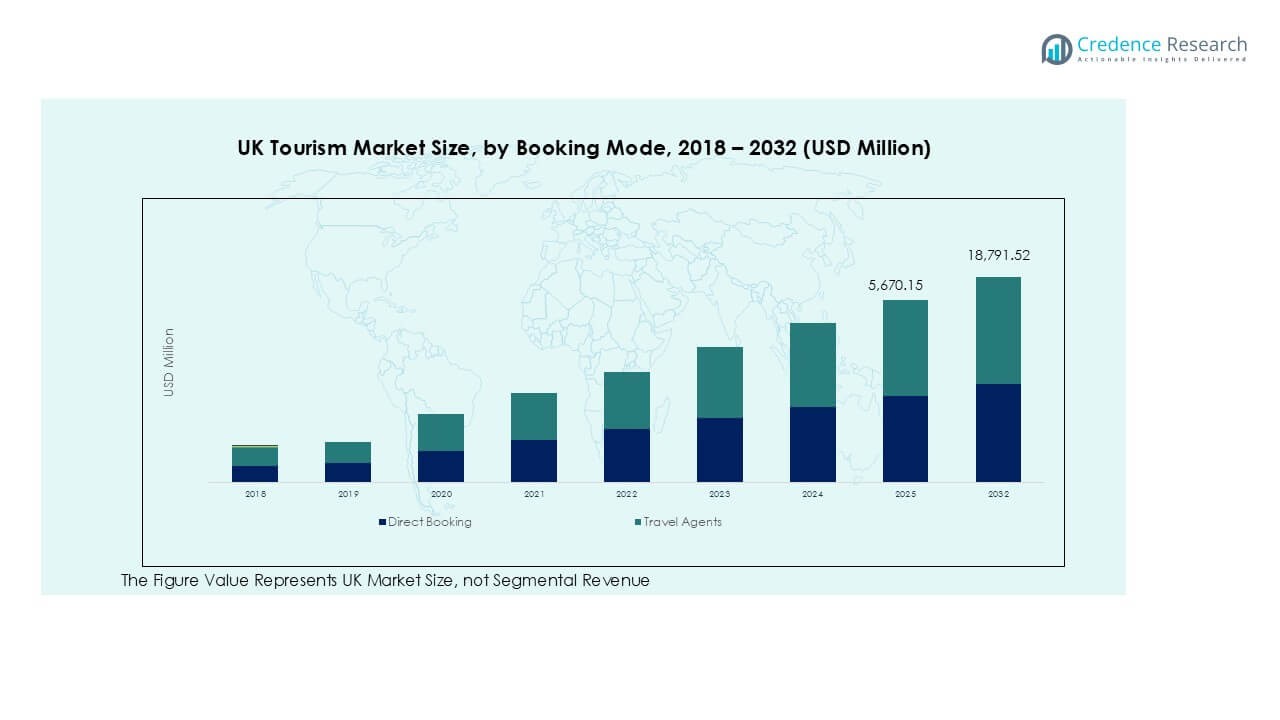

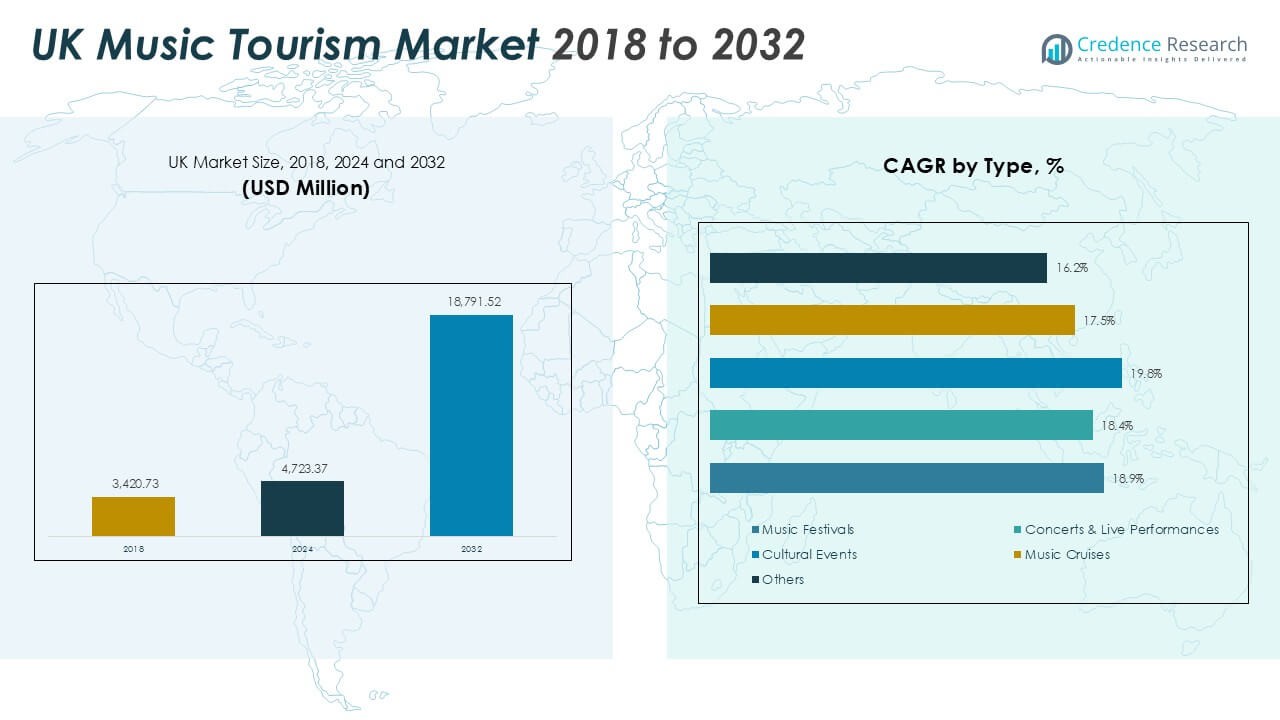

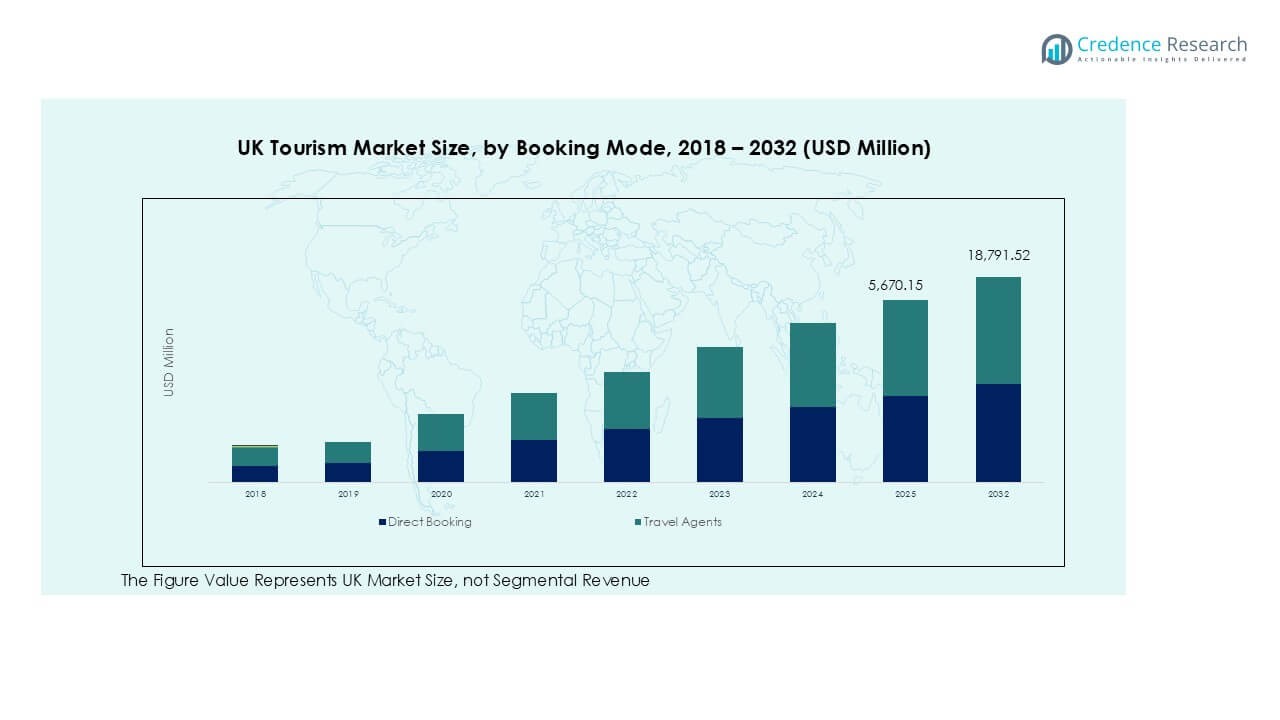

The UK Music Tourism market size was valued at USD 3,420.73 million in 2018, increasing to USD 4,723.37 million in 2024, and is anticipated to reach USD 18,791.52 million by 2032, growing at a CAGR of 18.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Music Tourism Market Size 2024 |

USD 4,723.37 Million |

| UK Music Tourism Market, CAGR |

18.67% |

| UK Music Tourism Market Size 2032 |

USD 18,791.52 Million |

The UK music tourism market is led by major players such as Live Nation UK, AEG Presents, Festival Republic, and SJM Concerts, which collectively command a substantial portion of national event attendance and revenue. These firms dominate through large-scale festivals, global artist partnerships, and advanced digital ticketing platforms. England remains the leading region, accounting for 68% of the total market share in 2024, supported by landmark events like Glastonbury, Wireless, and Creamfields. Scotland follows with 17%, driven by major festivals such as TRNSMT and Celtic Connections. Strong collaboration between organizers and regional tourism bodies continues to enhance event diversity, accessibility, and international appeal.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK music tourism market was valued at USD 4,723.37 million in 2024 and is projected to reach USD 18,791.52 million by 2032, growing at a CAGR of 18.67%.

- Market growth is driven by rising demand for live entertainment, expanding event infrastructure, and strong international tourist participation in major festivals and concerts.

- Key trends include digital ticketing adoption, sustainability-focused festival operations, and the integration of experiential travel packages linking music events with cultural tourism.

- The market is competitive, with leading players such as Live Nation UK, AEG Presents, and Festival Republic dominating through large-scale events and strategic regional partnerships.

- England held the largest regional share of 68% in 2024, followed by Scotland with 17%, while the concerts and live performances segment led the market with a 41% share, reflecting strong audience engagement and consistent event attendance across major cities.

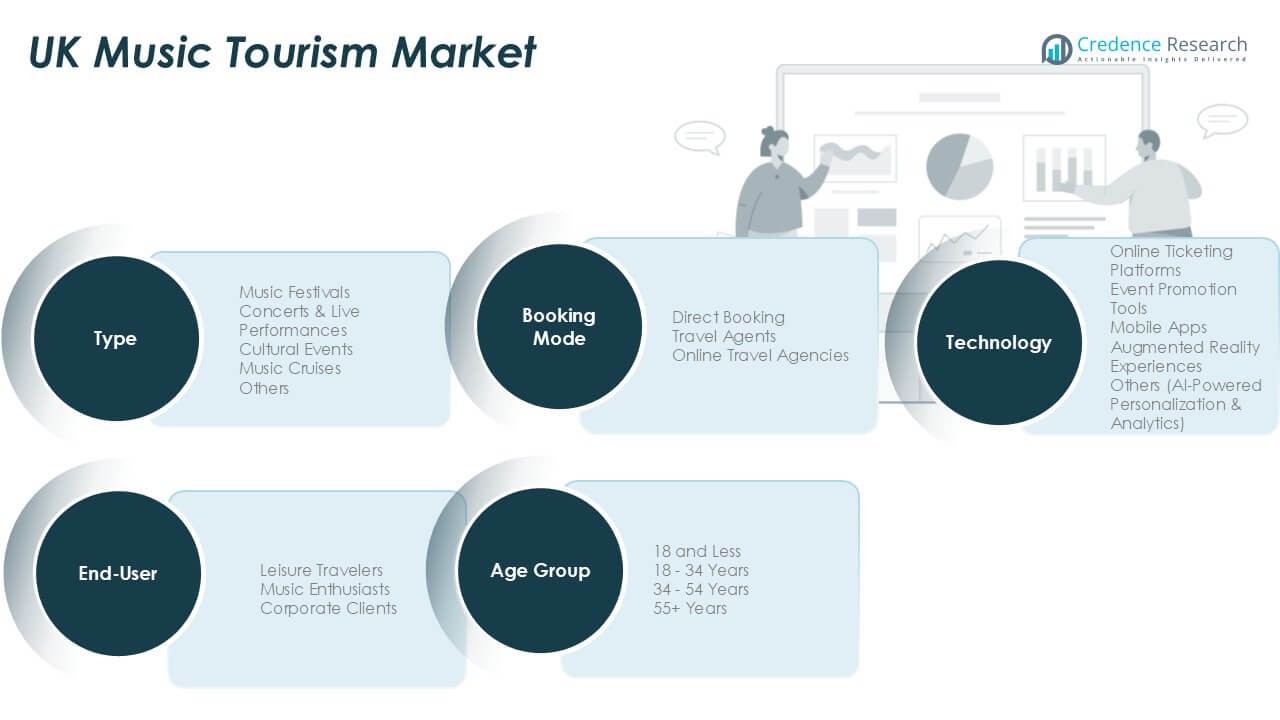

Market Segmentation Analysis:

By Type

The concerts and live performances segment dominated the UK music tourism market in 2024 with a 41% share. The segment’s growth is driven by the strong presence of world-class venues such as The O2 Arena and Wembley Stadium, which host major domestic and international artists. Rising demand for immersive experiences and exclusive live shows continues to attract both local and international tourists. Increased digital marketing by event organizers and the expansion of ticketing platforms have also strengthened attendance across major cities including London, Manchester, and Glasgow.

- For instance, AEG Europe reported that the O2 arena sold over 2.6 million tickets for more than 200 events in 2024, making it the world’s busiest live entertainment arena for another year. The entire O2 complex, including the arena and other attractions, welcomed over 10 million visitors in 2024.

By Age Group

The 18–34 years segment held the largest market share of 46% in 2024, reflecting the strong participation of younger travelers in music tourism. This group values experiential travel and often plans trips around music festivals and live concerts. Social media engagement and influencer-driven event promotion have amplified attendance within this demographic. The growing preference for outdoor and themed festivals, coupled with affordable travel and accommodation packages, continues to support growth. Event organizers increasingly tailor festival environments and merchandise toward youth-oriented audiences.

- For instance, Spotify analytics show that users in younger demographics, particularly the 18-34 age range, are a key audience for festival-related playlist engagement, which demonstrably influences ticket sales and event discovery. For instance, a 2024 Spotify study on major festivals, including Glastonbury in the UK, found that adults aged 25-34 made up the largest share of searches, and playlists see a significant stream increase around festival announcements.

By End-User

Leisure travelers accounted for the highest share of 52% in the UK music tourism market in 2024. These travelers combine entertainment experiences with short vacations, often aligning travel with key events like Glastonbury and the British Summer Time Festival. The segment benefits from strong domestic tourism infrastructure and the integration of cultural itineraries into travel packages. Rising disposable income and the trend toward experience-based travel further enhance participation. Travel agencies and booking platforms increasingly promote bundled packages that include accommodation, transport, and event access, driving higher engagement from leisure-focused visitors.

Key Growth Drivers

Expanding Live Entertainment Infrastructure

The rapid expansion of concert venues and festival grounds across the UK is a major growth driver for the music tourism market. Cities such as London, Manchester, and Glasgow have invested heavily in large-scale event infrastructure, improving capacity and accessibility for domestic and international visitors. The continuous modernization of arenas like The O2 and the construction of regional event spaces have enhanced the nation’s ability to host global artists. Additionally, advancements in transport connectivity, accommodation facilities, and security management have strengthened the visitor experience, encouraging repeat attendance and long-term tourism growth.

- For instance, Co-op Live Arena in Manchester, developed by Oak View Group, opened in 2024 with a capacity of 23,500—making it the UK’s largest indoor venue.

Rising Popularity of Experiential Travel

The shift toward experiential travel, particularly among younger audiences, is driving demand for music-based tourism. Travelers increasingly seek immersive cultural experiences beyond traditional sightseeing, opting to attend concerts, festivals, and music-themed events. Social media exposure and influencer promotions have amplified interest in music destinations such as Liverpool’s Beatles heritage sites and the Glastonbury Festival. Tour operators and hospitality providers are capitalizing on this trend by offering curated packages that include event access, themed tours, and accommodation. The emotional and social value attached to live music experiences continues to shape travel preferences and spending behavior.

- For instance, UK music tourism attracted 1.6 million overseas visitors in 2024, contributing to a record £10 billion for the UK economy. The growth was driven by major events and artists, notably Taylor Swift’s Eras Tour, not by a specific VisitBritain campaign with Warner Music Group.

Supportive Government and Industry Initiatives

Government-backed initiatives promoting creative industries and cultural tourism have strengthened the UK’s position as a global music tourism hub. Programs such as the “Music Export Growth Scheme” and regional funding for event promotion support both artists and local economies. Partnerships between tourism boards, music councils, and private promoters encourage international event marketing and infrastructure investment. The integration of music events into the broader cultural tourism strategy enhances regional visibility and year-round tourism flow. These coordinated efforts contribute to economic diversification while ensuring sustainable development of music tourism across urban and rural areas.

Key Trends & Opportunities

Digital Integration and Smart Event Experiences

Technology-driven event management is reshaping how audiences engage with live music experiences. Digital ticketing platforms, virtual queues, and event apps are improving convenience and safety. Augmented reality and live-streaming features allow remote participation, expanding audience reach beyond physical attendees. The adoption of AI-powered analytics helps organizers understand visitor behavior and customize offerings. This digital evolution presents opportunities for cross-sector collaboration between technology firms, promoters, and travel operators. Enhanced personalization and seamless connectivity are expected to further enrich visitor experiences and support sustained growth in music tourism.

- For instance, Ticketmaster UK has been using AI-driven dynamic pricing tools for several years to optimize event ticket prices and availability based on demand. In 2024, the company was involved in a major data breach that exposed the information of millions of users.

Sustainability and Eco-Friendly Festivals

The growing emphasis on sustainability presents a major opportunity for the UK music tourism market. Festival organizers are adopting eco-friendly measures such as renewable energy sources, plastic-free zones, and carbon offset programs. Events like Glastonbury have pioneered green initiatives that resonate with environmentally conscious travelers. Partnerships with local suppliers and transport providers promote circular economy practices while reducing the carbon footprint of large-scale gatherings. This trend aligns with broader environmental policies and enhances brand reputation for event organizers. Sustainable tourism models are increasingly becoming a competitive advantage in attracting global visitors.

Key Challenges

High Operational Costs and Inflationary Pressure

Rising operational costs remain a significant challenge for the UK music tourism sector. Inflation has increased expenses for venue maintenance, staffing, and logistics, affecting event profitability. Organizers face difficulties balancing ticket affordability with growing production costs, especially amid fluctuating energy prices and supply chain disruptions. Smaller festivals and regional events struggle to maintain margins without external sponsorship or government support. Sustained inflationary pressure may lead to reduced event frequency and scale, limiting accessibility for both domestic and international tourists unless cost-management strategies are adopted.

Seasonal Dependency and Weather Constraints

The seasonal nature of outdoor music festivals creates limitations in revenue consistency across the year. The UK’s unpredictable weather often disrupts event schedules, discouraging attendance and increasing insurance and operational risks. Summer months dominate the festival calendar, resulting in underutilization of venues during off-peak seasons. This dependence on favorable conditions also affects travel and accommodation patterns. Organizers are exploring indoor event alternatives and hybrid formats to reduce weather-related uncertainties. However, achieving balanced year-round tourism flow remains a structural challenge for sustainable market growth.

Regional Analysis

England

England dominated the UK music tourism market in 2024 with a 68% share. The region’s leadership stems from world-renowned music hubs such as London, Manchester, and Liverpool, which host large-scale festivals, arena concerts, and heritage tours. Iconic events like Glastonbury and the British Summer Time Festival attract millions of domestic and international visitors annually. Strong infrastructure, extensive air and rail connectivity, and diverse entertainment options enhance visitor convenience. Additionally, government-backed cultural programs and venue upgrades continue to strengthen England’s global reputation as the epicenter of live music and creative tourism.

Scotland

Scotland accounted for 17% of the UK music tourism market in 2024, supported by a vibrant festival culture and historic music heritage. Major events like TRNSMT, Celtic Connections, and the Edinburgh Festival Fringe drive significant inflows of international visitors. Glasgow’s designation as a UNESCO City of Music further promotes year-round musical engagement. The government’s commitment to promoting cultural tourism and improving event infrastructure has expanded participation. Growing collaboration between local councils and private organizers ensures consistent event quality, helping Scotland position itself as a key northern destination for live music tourism.

Wales

Wales held a 9% share of the UK music tourism market in 2024, driven by a growing portfolio of outdoor festivals and heritage-driven events. Cities like Cardiff and Swansea are investing in live performance venues and artist development initiatives. Popular festivals such as Green Man and Sŵn Festival attract both local audiences and international travelers seeking authentic cultural experiences. The Welsh government’s “Music Tourism Strategy” supports the development of regional music hubs and enhances global visibility. Increasing focus on bilingual music promotion and eco-conscious event operations further differentiates Wales within the national market.

Northern Ireland

Northern Ireland captured a 6% share of the UK music tourism market in 2024, underpinned by rising international interest in Belfast’s growing live music scene. The region hosts notable events such as Belsonic and Stendhal Festival, which showcase both local and international talent. Investment in cultural infrastructure and tourism marketing has improved venue quality and visitor engagement. Belfast’s recognition as a UNESCO City of Music reinforces its cultural identity and strengthens year-round event participation. Continued cross-border tourism collaborations and the promotion of music heritage trails are expected to enhance Northern Ireland’s contribution to market growth.

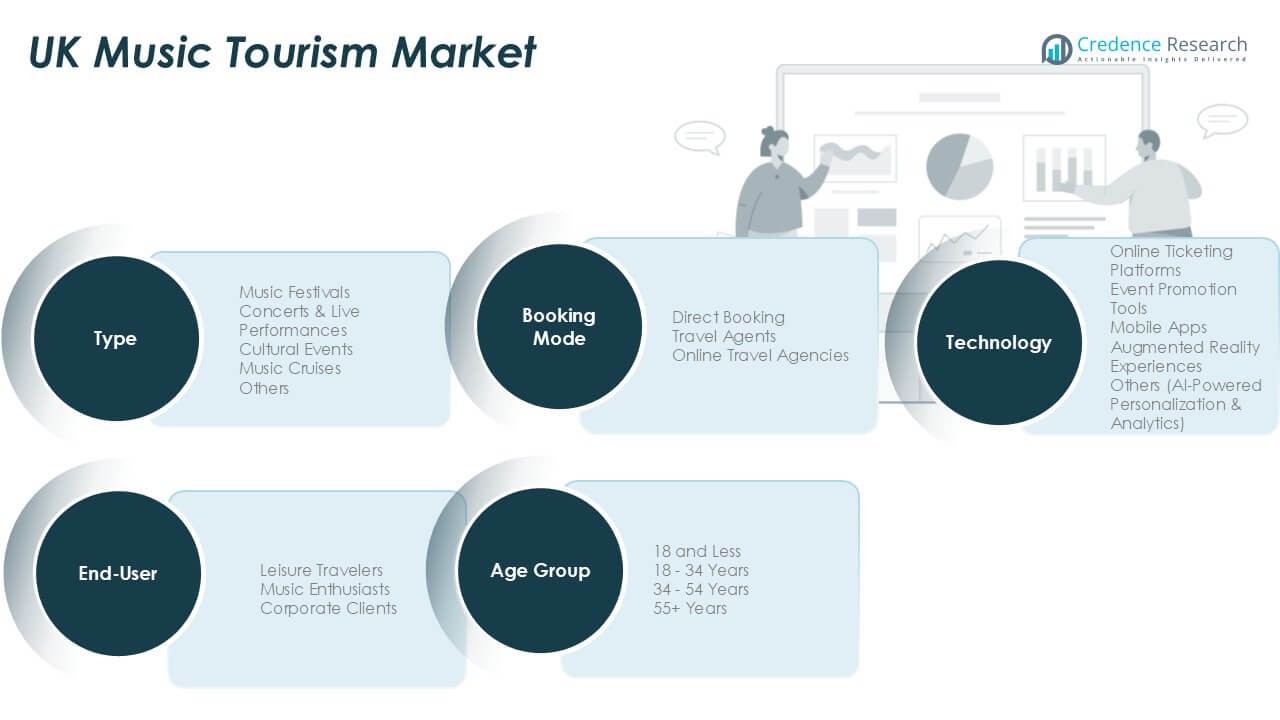

Market Segmentations:

By Type

- Music Festivals

- Concerts & Live Performances

- Cultural Events

- Music Cruises

- Others

By Age Group

- 18 and Less

- 18–34 Years

- 34–54 Years

- 55+ Years

By End-User

- Leisure Travelers

- Music Enthusiasts

- Corporate Clients

By Technology

- Online Ticketing Platforms

- Event Promotion Tools

- Mobile Apps

- Augmented Reality Experiences

- Others (AI-Powered Personalization & Analytics)

By Booking Mode

- Direct Booking

- Travel Agents

- Online Travel Agencies

By Geography

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK music tourism market features a highly competitive landscape dominated by leading event organizers, promoters, and tourism boards. Major players such as Live Nation UK, AEG Presents, and Festival Republic hold significant market presence through large-scale concerts and multi-day festivals. These companies leverage extensive artist networks, digital ticketing platforms, and partnerships with travel agencies to attract both domestic and international visitors. Emerging promoters like Kilimanjaro Live and DF Concerts contribute to market diversity by focusing on regional and genre-specific events. Festivals such as Glastonbury, Wireless, and Creamfields maintain global recognition, strengthening the UK’s cultural appeal. Additionally, organizations like VisitScotland and Tourism Northern Ireland collaborate with event stakeholders to promote destination-based music tourism. The competitive environment emphasizes innovation, sustainability, and digital engagement, with firms increasingly adopting eco-friendly event operations, advanced marketing analytics, and immersive audience experiences to sustain leadership in this rapidly evolving sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Live Nation UK

- AEG Presents UK

- Festival Republic

- SJM Concerts

- Kilimanjaro Live

- DF Concerts

- Crosstown Concerts

- Communion Music

- Broadwick Live

- Vision Nine

- Ticketmaster UK

- Glastonbury Festival

- Wireless Festival

- Creamfields

- TRNSMT Festival

- VisitScotland

- Tourism Northern Ireland

Recent Developments

- In February 2025, Busan Concert Hall launched its official website to provide classical music enthusiasts with a seamless platform for ticket reservations, venue rentals, and academy schedules. Designed with responsive technology, the site ensures accessibility across devices and features a mobile ticketing service for quick entry via barcode scanning. The initiative enhances convenience and enriches the cultural experience for visitors in Busan.

- In August 2024, Brightline launched “The Big Concert Sweepstakes,” offering tickets to Taylor Swift’s sold-out Miami concert on October 20. The prize included two concert tickets, four round-trip Brightline tickets on a special “Tay-keover Sing-Along” train, and exclusive lounge perks. Participants entered by following Brightline on Instagram and signing a rail safety pledge, with the winner announced during Rail Safety Week in late September.

- In May 2024, Live Nation brought back its annual Concert Week promotion, offering USD 25 all-in tickets for over 5,000 shows across North America. Featuring artists like Janet Jackson and 21 Savage, the week-long event made live music more accessible to fans. Tickets, available from May 8 to May 14, could be purchased online without a promo code, allowing fans to enjoy significant savings on select concerts and festivals. The initiative aimed to enhance the summer touring season with budget-friendly options.

Report Coverage

The research report offers an in-depth analysis based on Type, Age Group, End-User, Technology, Booking Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK music tourism market will continue expanding with growing international visitor participation.

- Digital transformation will enhance ticketing, event management, and audience engagement efficiency.

- Sustainability practices will become standard, with festivals adopting renewable energy and waste reduction measures.

- Hybrid and virtual event formats will gain traction to reach broader audiences.

- Government and regional tourism partnerships will strengthen funding for cultural and music initiatives.

- Younger demographics will drive attendance, focusing on experiential and social travel.

- Investments in venue modernization and accessibility will improve visitor experiences.

- Secondary cities will emerge as new music tourism hubs through local event promotion.

- Brand collaborations and sponsorships will increase to enhance festival visibility and scale.

- Data-driven marketing and AI-based audience analytics will shape personalized event offerings and tourism planning.